UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-40786

Sigma Lithium

Corporation

(Translation of registrant's name into English)

2200 HSBC Building

885 West Georgia Street

Vancouver, British Columbia

V6C 3E8

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other

Commission filing on EDGAR.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

Sigma Lithium Corporation |

| |

|

(Registrant) |

| Date: November 1, 2023 |

|

|

| |

|

Ana Cristina Cabral Gardner |

| |

|

Chief Executive Officer |

Exhibit 99.1

SIGMA

LITHIUM ANNOUNCES A POTENTIAL INCREASE OF ITS MINERAL RESOURCE ESTIMATE TO OVER 110MT, AMONGST LARGEST SCALE GLOBALLY

MINERAL RESOURCE

EXPLORATION PROGRAM UPDATE

| • | Sigma

announces positive results from its Exploration Program of Phase 4. |

| o | Expected to represent an approximate

25% potential increase of mineral resource estimate of Sigma Lithium to 110 million tonnes,

placing it amongst the largest scale lithium companies globally. |

| • | The

Company expects to further increase mineral resource resulting from an Accelerated Plan to

drill a Phase 5 and beyond. |

| o | Exploration programs to date have identified

up to 20Mt of potential additional mineral resource in a spodumene bearing pegmatite, which

could represent a potential Phase 5. |

| • | Accelerated

Plan is expected to unlock significant further potential increase to the Company mineral

resource, with additional exploration drilling of the following targets: |

| o | Remaining five former artisanal mines

within Sigma Lithium’s mineral concessions. |

| o | Another 57 out of the 200 mapped pegmatites

within the Company’s mineral concessions. |

SAO PAULO, BRAZIL – (November 1,

2023) – Sigma Lithium Corporation (“Sigma Lithium” or the “Company”) (NASDAQ: SGML,

BVMF: S2GM34, TSXV: SGML), a leading global lithium producer dedicated to powering the next generation of electric vehicles with

carbon neutral, responsibly sourced chemical grade lithium concentrate, is pleased to provide an update on its exploration program to

date, conducted in close coordination with SGS Canada, including initial mineral resource potential for Phase 4 (“Exploration Program”)

and plans for acceleration of the Exploration Program (“Accelerated Plan”).

The Company expects the results of the

Exploration Program could represent an increase of its total mineral resource estimate to 110 Mt:

| o | The Company increased the exploration

potential of Phase 4 to approximately 26 to 30Mt, with ore body extensions continuing to

the east, based on the drilling results received to date (Table 1 below). |

| o | This is a significant 25% potential increase

to the Grota do Cirilo mineral resource estimate, delivering further consistent high grade

assay results which are to be incorporated into an updated NI 43-101 compliant technical

report expected to be released in Q4 2023. |

Please refer to

the Company’s National Instrument 43-101 technical report titled "Grota do Cirilo Lithium Project Araçuaí and

Itinga Regions, Minas Gerais, Brazil, Amended and Restated Technical Report" issued June 12, 2023 (“Technical Report”),

filed on SEDAR and available on the Company’s website.

| o | The Technical Report has a mineral resource

estimate comprised of 77.0 Mt of measured and indicated mineral resources grading at 1.43%

Li2O and 8.6 Mt of inferred mineral resources grading at 1.43% Li2O. |

Ana Cabral, CEO commented: “The

incredible success of our exploration campaign establishes Sigma Lithium as one of the largest lithium companies globally. Sigma is a

current large-scale and low-cost producer but also has mineral resource estimates to potentially surpass 110 million tonnes of open pit

deposits. This scale underscores our strategic relevance to become the foundation of global supply chains that will deliver the decarbonization

of EV batteries.

“We consistently execute and

deliver and by unlocking the NI 43-101 compliant mineral resource potential of the former artisanal mines in our mineral concessions,

we are validating and closing the gap between the large scale of mineral resources registered within our mineral concessions in our regulatory

body, ANM in Brazil and the NI 43-101.” She concluded.

| | 1 |  |

Significant Further Potential to

Increase Mineral Resource

The results to date indicate that a

further potential increase to the Company’s mineral resource is expected to be delivered consistently over time from the following

exploration drilling campaigns in an Accelerated Plan:

| • | Remaining

five former artisanal mines within Sigma Lithium’s mineral concessions to define the

volumes and grades. |

| • | Additional

57 pegmatites (out of the approximately 200 pegmatites mapped) within the Company’s

mineral concessions. |

Phase 4 Exploration Program Update

Phase 4 was centered

on the Murial South and Lavra do Meio deposits. Both could be mined as an open pit, if warranted and economically viable based on a Feasibility

Study.

| • | The

Exploration Program has significantly increased the size of Murial and Lavra do Meio deposits

to potentially 23 to 26 Mt. |

| • | The

Company validated additional pegmatites: Maxixe and Tamboril, further increasing the total

mineral resource potential. |

Phase 4 strike extends up to 2.3 km

along strike north-south, and the deposits remain open to both the east and west.

| • | Phase

4 is in very close proximity to Phase 3 (north of it) and initial drilling indicated potential

connectivity of certain pegmatites (as per the Figures 1 and 2 below); and |

| • | Intersecting

high quality spodumene crystals and persistent spodumene-rich zones (Table 1 below). |

The maiden resource statements for Murial

South and Lavra do Meio were published in January 2019, and this is the first update to both resources since 2019. The maiden resource

for Murial South was 5.6Mt @ 1.14% Li2O M&I with an additional 0.7Mt @ 1.06% Li2O, while Lavra do Meio was

2.3Mt @ 1.09% Li2O M&I, with an additional 0.3Mt @ 0.87% Li2O.

Table 1:

Phase 4 Pegmatites Exploration Potential At Various Cut-Off Grades(1)

| Exploration Zones | |

2019 M&I | | |

2019 Inferred | | |

Lower Range

Tonnage (Mt) | | |

Upper Range

Tonnage (Mt) | |

| Murial South | |

| 5.6 | | |

| 0.7 | | |

| 18 | | |

| 20 | |

| Lavra do Meio | |

| 2.3 | | |

| 0.3 | | |

| 5 | | |

| 6 | |

| Tamboril and Maxixe | |

| - | | |

| - | | |

| 3 | | |

| 4 | |

| Total | |

| 7.9 | | |

| 1.0 | | |

| 26 | | |

| 30 | |

Note

1: The potential quantity and grade of the lithium mineralization for Murial South, Lavra Do Maio, Maxixe and Tamboril are conceptual

in nature, there has been insufficient exploration to estimate Mineral Resources and it is uncertain if exploration will confirm the

target ranges.

The company is

highly encouraged with the initial assay results from the Tamboril and Maxixe deposits that suggest that the mineralization encountered

is directly related to the Phase 3 mine and confirms that Phase 3 and Phase 4 are a continuous mineralization.

Further assay results

for the completed holes at Maxixe and Tamboril are pending and will be released once received to produce an updated Mineral Resource

Estimate.

Phase 5 and Accelerated Plan

As part of the Exploration Program,

Sigma Lithium has also identified additional pegmatites that could potentially yield up to 20 Mt of incremental mineral resource in a

potential Phase 5.

The Company is conducting significant

exploration RC drilling, trench work and sampling, in 57 mineralized pegmatites (out of the 200 pegmatites mapped within the Company’s

mineral concessions). The Exploration Program defined the surface area and the weathered mineralogy for these 57 pegmatites. The Accelerated

Plan will include drilling exploratory core diamond drill holes into each of these targets.

| | 2 |  |

The Company increased its exploration

efforts in an Accelerated Program: a total of 8 core diamond drills currently operating in the Grota do Cirilo region with 20,000m planned

for the next 7 weeks. The current drilling priority is to confirm and further extend the size of the pegmatite swarm at the Phase 4 area.

Iran Zan, MAIG,

co-Head of Geology and co-General Manager, “Our Phase 4 is the result of the hard work and relentless commitment of Sigma’s

geology team over the last year. The results derived from these months of drilling activities are impressive, confirming the projections

for Phase 4. The exploration campaign provided an understanding of the connectivity of the pegmatites in the area between Phase 3 and

Phase 4. The ore bodies show consistent strike and depth with intercepts, grades, and coarse spodumene crystal quality. We are very optimistic

about the 2.3 km long strike of Phase 4 and its depth of approximately 300 meters, which is still open to the east.”

Current Mineral Resource and Phase

1, 2 and 3 Results

The Amended and Restated Technical Report

from June 12, 2023 shows a Consolidated Mineral Resource on the Grota do Cirilo property of 77Mt of Measured and Indicated Resources

at a grade of 1.43% Li2O and Inferred Resources of 8.6Mt also at a grade of 1.43% Li2O (Table 2).

Tables 3, 4 and 5 show the contribution

to the Consolidated Resource from Phases 1, 2 and 3.

Please refer to the Company’s

National Instrument 43-101 technical report titled "Grota do Cirilo Lithium Project Araçuaí and Itinga Regions, Minas

Gerais, Brazil, Amended and Restated Technical Report" issued June 12, 2023, for further information on the Mineral Resource

statements.

Table 2: Grota do Cirilo Consolidated

Mineral Resource June 2023

| Cut-Off Grade (% Li2O) | | |

Category | |

Tonnes (Mt) | | |

(% Li2O) | |

| | 0.5 | % | |

Measured | |

| 37.1 | | |

| 1.43 | % |

| | 0.5 | % | |

Indicated | |

| 39.9 | | |

| 1.43 | % |

| | 0.5 | % | |

Measured & Indicated | |

| 77.0 | | |

| 1.43 | % |

| | 0.5 | % | |

Inferred | |

| 8.6 | | |

| 1.43 | % |

Table 3: Phase 1 Mineral Resource

Estimate

| CUT-OFF

GRADE (% LI2O) | | |

CATEGORY | |

TONNES

(MT) | | |

(%

LI2O) | |

| | 0.5 | % | |

Measured | |

| 10.2 | | |

| 1.59 | |

| | 0.5 | % | |

Indicated | |

| 7.2 | | |

| 1.49 | |

| | 0.5 | % | |

Measured & Indicated | |

| 17.4 | | |

| 1.55 | |

| | 0.5 | % | |

Inferred | |

| 3.8 | | |

| 1.58 | |

| | 3 |  |

Table 4: Phase 2 Mineral Resource

Estimate

| CUT-OFF

GRADE (% LI2O) | | |

CATEGORY | |

TONNES

(MT) | | |

(%

LI2O) | |

| | 0.5 | % | |

Measured | |

| 18.7 | | |

| 1.41 | |

| | 0.5 | % | |

Indicated | |

| 6.3 | | |

| 1.30 | |

| | 0.5 | % | |

Measured & Indicated | |

| 25.1 | | |

| 1.38 | |

| | 0.5 | % | |

Inferred | |

| 3.8 | | |

| 1.39 | |

Table 5: Phase 3 Mineral Resource

Estimate

| CUT-OFF

GRADE (% LI2O) | | |

CATEGORY | |

TONNES

(MT) | | |

(%

LI2O) | |

| | 0.5 | % | |

Measured | |

| 2.4 | | |

| 1.56 | |

| | 0.5 | % | |

Indicated | |

| 24.3 | | |

| 1.48 | |

| | 0.5 | % | |

Measured & Indicated | |

| 26.7 | | |

| 1.49 | |

Detailed Phase 4 Exploration Program

Sigma Lithium's

Phase 4 deposits are in the Cirilo Grota region, in the same continuous mineralization line to the Phase 2 and Phase 3 deposits. The

Phase 4 pegmatite dikes run parallel to those defined at the Phases 2 and 3 deposits. Drill testing to date has confirmed that the Phase

4 pegmatites extend to at least 400 m below surface.

Drilling results

from the Maxixe and Tamboril deposits have confirmed the presence of spodumene crystals with assay results confirming substantial intersections

of strong lithium mineralization. Significant results include the following highlight drilling intercepts:

| o | DH –

MAX - 03 1.40% Li2O over 26.0m, including 2.34% Li2O over 9.07 m |

| o | DH - TAM

– 10 1.00 % Li2O over 7.03 m, including 1.23% Li2O over 3.00 m |

| o | DH –

LDM – 04 1.79% Li2O over 27.61 m, including 3.26% Li2O over 10.00 m |

| o | DH –

LDM – 05 1.31% Li2O over 31.85 m, including 1.81% Li2O over 11.29 m |

| o | DH

– LDM – 14 1.17% Li2O over 22.83 m, including 2.02% Li2O over 7.81 m |

| | 4 |  |

Figure 1: Phase 4 Deposit Drilling

Shows Dense Pegmatite Proximity

Figure 2: Murial South Cross Section with

Mineralized Intercepts

| | 5 |  |

Table 6: Phase 4 Intercept Results

| BHID | | |

From (m) | | |

To (m) | | |

Length (m) | | |

Grade

(Li2O%) | |

| DH-MUR-021 | | |

| 163 | | |

| 198 | | |

| 35 | | |

| 1,39 | |

| DH-MUR-027 | | |

| 151 | | |

| 177 | | |

| 26 | | |

| 1,78 | |

| DH-MUR-031 | | |

| 142 | | |

| 171 | | |

| 29 | | |

| 1,57 | |

| DH-MUR-033 | | |

| 170 | | |

| 192 | | |

| 22 | | |

| 1,32 | |

| DH-MUR-034 | | |

| 180 | | |

| 223 | | |

| 43 | | |

| 1,47 | |

| DH-MUR-034 | | |

| 234 | | |

| 244 | | |

| 9 | | |

| 1,79 | |

| DH-MUR-039 | | |

| 225 | | |

| 245 | | |

| 20 | | |

| 1,38 | |

| DH-MUR-055 | | |

| 174 | | |

| 190 | | |

| 16 | | |

| 1,22 | |

| DH-MUR-060 | | |

| 114 | | |

| 122 | | |

| 8 | | |

| 1,6 | |

| DH-MUR-091 | | |

| 284 | | |

| 295 | | |

| 11 | | |

| 1,28 | |

| DH-MUR-112 | | |

| 251 | | |

| 285 | | |

| 34 | | |

| 1,62 | |

| DH-MUR-114 | | |

| 194 | | |

| 218 | | |

| 24 | | |

| 1,7 | |

| DH-MUR-132 | | |

| 213 | | |

| 227 | | |

| 15 | | |

| 1,44 | |

| DH-MUR-206 | | |

| 214 | | |

| 246 | | |

| 32 | | |

| 1,27 | |

| DH-MUR-184 | | |

| 145 | | |

| 150 | | |

| 6 | | |

| 1,19 | |

QUALITY

ASSURANCE AND CONTROL

Diamond drilling

samples were collected and sent to the SGS-Geossol laboratory. All diamond drilling core samples submitted for assay were saw cut with

one-half supplied for assay and one-half archived for reference. The physical preparation follows the steps: drying, crushing of 75%

to 3mm, homogenization, splitting of Jones, and pulverization of 100g in a Tungsten carbide pan until 150 meshes with 95% of passing

pulp. In 5% of the samples, the control of particle size and loss of mass is carried out in the crushing and pulverization stages (QCgranul

and QCloss of mass). The analytical method adopted was ICP90A, carrying out the sodium peroxide (Na2O2) fusion and ICP AES. Samples with

the content of Li2O% > 3.225 (over-limit for ICP90A) were reanalyzed by ICP90Q, consisting of sodium peroxide (Na2O2) fusion in concentrates

(ICP AES).

Sampling was carried

out following strict QA/QC procedures. Certified reference materials (standards) were inserted into the sample stream. Blanks AMIS0577,

AMIS0484, and AMIS0865 were submitted at a rate of 1 per 29 samples and introduced preferentially at upper or lower contacts of the main

pegmatitic intercepts. Standards AMIS0341, AMIS0342, AMIS0565, and AMIS0408 were inserted at the same rate as blanks, mostly within the

pegmatite intervals. In addition, QC controls were added preferably in pegmatite samples with a satisfactory content of Li2O%, enough

to make a fair comparison between the original samples and controls. Coarse and pulp duplicates were injected at a rate of 1 per 40 samples,

while the check samples were at a rate of 1 per 20 samples. All check samples were dispatched to a second laboratory analysis and sent

to ALS in Vancouver. The ALS results were compared with the SGS-Geosol results to verify the reliability of the primary laboratory results.

QUALIFIED

PERSONS

The technical and

scientific information related to mineral resource estimates in this news release has been reviewed and approved by Marc-Antoine Laporte

P.Geo., M.Sc., of SGS. Mr. Laporte is a Qualified Person as defined by National Instrument 43-101 and is independent of Sigma Lithium.

The mining and

mineral reserve estimates in this news release have been reviewed and approved by Porfirio Cabaleiro Rodriguez P.Eng, Mining Engineer

of GE21 Consultoria Mineral Brazil. Mr. Rodriguez is a Qualified Person as defined by National Instrument 43-101 and is independent

of Sigma Lithium.

The technical information

in this news release, including statements regarding geology and potential mineral resources, has been elaborated by Iran Zan MAIG (Membership

number 7566), Director of Geology and exploration department of Sigma Lithium, Mr Iran Zan is a Qualified Person internal of Sigma Lithium

corporation.

| | 6 |  |

ABOUT

SIGMA LITHIUM

Sigma Lithium (NASDAQ:

SGML, TSXV: SGML, BVMF: S2GM34) is a leading global lithium producer dedicated to powering

the next generation of electric vehicle batteries with carbon neutral, socially and environmentally sustainable chemical-grade lithium

concentrate.

Sigma Lithium has

been at the forefront of environmental and social sustainability in the EV battery materials supply chain for six years and it is currently

producing Triple Zero Green Lithium from its Grota do Cirilo Project in Brazil. Phase 1 of the project is expected to produce 270,000

tonnes of Triple Zero Green Lithium annually (36,700 LCE annually). If it is determined to proceed after completion of an ongoing feasibility

study, Phase 2 & 3 of the project are expected to increase production to 766,000 tonnes annually (or 104,200 LCE annually).

The project produces Triple Zero Green Lithium in its state-of-the-art Greentech lithium plant that uses 100% renewable energy, 100%

recycled water and 100% dry-stacked tailings.

Please refer to

the Company’s National Instrument 43-101 technical report titled "Grota do Cirilo Lithium Project Araçuaí and

Itinga Regions, Minas Gerais, Brazil, Amended and Restated Technical Report" issued June 12, 2023, which was prepared for Sigma

Lithium by Homero Delboni Jr., MAusIMM, Promon Engenharia; Marc-Antoine Laporte, P.Geo, SGS Canada Inc; Jarrett Quinn, P.Eng., Primero

Group Americas; Porfirio Cabaleiro Rodriguez, (MEng), FAIG, GE21 Consultoria Mineral; and Noel O'Brien, B.E., MBA, F AusIMM (the “Updated

Technical Report”). The Updated Technical Report is filed on SEDAR and is also available on the Company’s website.

For more information

about Sigma Lithium, visit https://www.sigmalithiumresources.com/

FOR

ADDITIONAL INFORMATION PLEASE CONTACT

Jamie Flegg, Director, Business

Development

+1 (647) 706-1087

jamie.flegg@sigmalithium.com.br

Daniel Abdo, Director, Investor

Relations

+55 11 2985-0089

daniel.abdo@sigmalithium.com.br

Sigma

Lithium

|

Sigma

Lithium |

|

@sigmalithium |

|

@SigmaLithium |

| | 7 |  |

FORWARD-LOOKING

STATEMENTS

This news release

includes certain "forward-looking information" under applicable Canadian and U.S. securities legislation, including but not

limited to statements relating to timing and costs related to the general business and operational outlook of the Company, the environmental

footprint of tailings and positive ecosystem impact relating thereto, donation and upcycling of tailings, timing and quantities relating

to tailings and Green Lithium, achievements and projections relating to the Zero Tailings strategy, achievement of ramp-up volumes, production

estimates and the operational status of the Grota do Cirilo Project, and other forward-looking information. All statements that address

future plans, activities, events, estimates, expectations or developments that the Company believes, expects or anticipates will or may

occur is forward-looking information, including statements regarding the potential development of mineral resources and mineral reserves

which may or may not occur. Forward-looking information contained herein is based on certain assumptions regarding, among other things:

general economic and political conditions; the stable and supportive legislative, regulatory and community environment in Brazil; demand

for lithium, including that such demand is supported by growth in the electric vehicle market; the Company’s market position and

future financial and operating performance; the Company’s estimates of mineral resources and mineral reserves, including whether

mineral resources will ever be developed into mineral reserves; and the Company’s ability to operate its mineral projects including

that the Company will not experience any materials or equipment shortages, any labour or service provider outages or delays or any technical

issues. Although management believes that the assumptions and expectations reflected in the forward-looking information are reasonable,

there can be no assurance that these assumptions and expectations will prove to be correct. Forward-looking information inherently involves

and is subject to risks and uncertainties, including but not limited to that the market prices for lithium may not remain at current

levels; and the market for electric vehicles and other large format batteries currently has limited market share and no assurances can

be given for the rate at which this market will develop, if at all, which could affect the success of the Company and its ability to

develop lithium operations. There can be no assurance that such statements will prove to be accurate, as actual results and future events

could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking

information. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether because of

new information, future events or otherwise, except as required by law. For more information on the risks, uncertainties and assumptions

that could cause our actual results to differ from current expectations, please refer to the current annual information form of the Company

and other public filings available under the Company’s profile at www.sedar.com.

Neither the

TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this news release.

| | 8 |  |

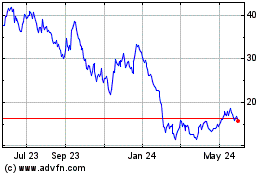

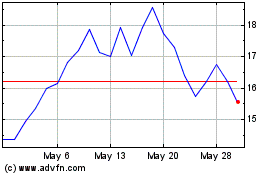

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From Apr 2024 to May 2024

Sigma Lithium (NASDAQ:SGML)

Historical Stock Chart

From May 2023 to May 2024