false

0001616262

0001616262

2023-10-11

2023-10-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 11, 2023

Rocky Mountain Chocolate Factory, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36865

|

|

47-1535633

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

265 Turner Drive

Durango, Colorado 81303

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code: (970) 259-0554

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities Registered Pursuant To Section 12(b) Of The Act:

| Title of each class |

Trading Symbol |

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

RMCF |

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 11, 2023, Rocky Mountain Chocolate Factory, Inc. (the “Company”) issued a press release reporting its results of operations for the three and six months ended August 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information contained in this current report on Form 8-K, including Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed incorporated by reference into any other filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language included in such filing, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| |

Exhibit No. |

Description

|

| |

|

|

| |

99.1

|

|

| |

|

|

| |

104

|

Cover Page Interactive Data File (embedded with the Inline XBRL document)

|

*Furnished herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC. |

| |

|

|

| |

|

|

| Date: October 12, 2023 |

By: |

/s/ Allen Arroyo |

| |

|

Allen Arroyo, Chief Financial Officer |

| |

|

|

| |

|

|

Exhibit 99.1

ROCKY MOUNTAIN CHOCOLATE FACTORY REPORTS FISCAL SECOND QUARTER 2024 FINANCIAL RESULTS

- Company Continues to Execute Across its Three Strategic Pillars, Reveals Transformational Brand Refresh, and Anticipates Acceleration of eCommerce and Specialty Retail Revenues for the Holidays -

- Company to Host Conference Call Tomorrow at 8:30 a.m. ET -

DURANGO, Colo., October 11, 2023 (GLOBE NEWSWIRE) -- Rocky Mountain Chocolate Factory Inc. (Nasdaq: RMCF) (the “Company”, “we”, “RMC”, or “Rocky Mountain Chocolate”), an international franchisor and producer of premium chocolates and other confectionery products including gourmet caramel apples, is reporting financial and operating results for its second quarter ended August 31, 2023. The Company will host a conference call tomorrow at 8:30 a.m. Eastern time to discuss the results.

“We continue to execute against the pillars of our Strategic Transformation Plan to establish Rocky Mountain Chocolate as America’s preferred premium chocolate company,” said Rob Sarlls, CEO of RMC. “The initiatives we have implemented this fiscal year are expected to generate material revenue growth in the quarters ahead as we enter the holiday season. During the fiscal second quarter, we removed several impediments that held back our eCommerce business and we are now fulfilling orders with trusted third-party service providers. These providers have favorable geographic locations that can reach consumers within 48 hours—a capability we lacked in Durango. We also eliminated customer shipping charges and have begun to utilize more effective ad spend. When coupled with purchase orders in-hand from our specialty retail partners, we expect the combination of eCommerce and specialty retail sales in fiscal 2H’24 to exceed the sales from these channels for all of fiscal 2023.

“With respect to efficiency gains during the quarter, to ‘do more with less’ we reduced our driver fleet by 33% while maintaining consistent pound volume shipped from our Durango facility, which is a direct result of our logistic optimization efforts. We also calibrated our employee compensation structure to reduce turnover in the short-term and help establish a long-term foundation for accelerated product throughput. Notwithstanding recent increases in base pay for our processing team, we experienced a 16% reduction in labor salaries per pound produced versus fiscal Q1’24.

“To ‘simplify and focus’ our operations, during the quarter we completed the implementation of a streamlined franchisee royalty structure and volume-based discount program. This new royalty structure and discount program will incentivize our highest-performing franchisees to become multi-unit operators, while empowering them to deliver even more sales of Rocky Mountain Chocolate products. Lastly, we continue to make progress towards our 25% SKU reduction target, as we work to sunset underperforming chocolate SKUs and increase production of our most popular items.

“To ‘amplify and elevate’ our brand, last month we unveiled a transformational brand refresh during our 2023 Annual National Franchisee Convention, which achieved record attendance. This brand refresh provides a streamlined, and highly recognizable, trade name and logo that builds upon our rich history of bringing the Rocky Mountain experience to customers since 1981. Further, to reaffirm our commitment to proactive engagement with shareholders and prospective investors, we participated in our first investor conference in nearly a decade during the quarter, inaugurating our re-engagement with the investor community under the new leadership team. This active participation also amplifies the reach of our message about the plans for the future of Rocky Mountain Chocolate.

“As we look to the remainder of fiscal 2024, we are well on our way towards laying the foundation of our multi-year plan for Rocky Mountain Chocolate, and we expect to continue seeing tangible results to our growth and profitability as we progress through the periods ahead.”

Fiscal Q2 2024 Financial Results vs. Year-Ago Quarter

| |

●

|

Total revenue of $6.6 million in the second quarter of 2024 was approximately unchanged compared to $6.6 million in the second quarter of 2023. During the quarter, the Company benefitted from the reopening of the Corpus Christi store in July, which mostly offset lower shipments of product related to the planned exit of two out-of-network customers earlier this year.

|

| |

●

|

Total product and retail gross profit was $0.4 million in the second quarter of 2024 compared to $1.2 million in the second quarter of 2023, with gross margin of 7.6% compared to 23.3%. The decrease was primarily due to lower production volume and higher costs related to wages and inflation as the Company resolved a labor shortage. This was partially offset by higher retail gross margins primarily attributable to better cost management and higher basket sizes at the Durango company-owned store.

|

| |

●

|

Total operating expenses decreased 16% to $7.6 million in the second quarter of 2024 compared to $9.0 million in the second quarter of 2023. The improvement was primarily due to lower professional fees associated with the contested solicitation of proxies in the prior year, as well as lower costs related to employee severance and relocation. This was partially offset by increased franchise and personnel costs.

|

| |

●

|

Net loss from continuing operations decreased 68% to $1.0 million or $(0.16) per share in the second quarter of 2024, compared to a net loss from continuing operations of $3.2 million or $(0.51) per share in in the second quarter of 2023.

|

| |

●

|

Adjusted EBITDA (a non-GAAP measure defined below) was $(0.6) million in the second quarter of 2024 compared to $0.7 million in the second quarter of 2023. The year-ago period benefitted from a $2.8 million add-back related to professional fees associated with the contested solicitation of proxies, as well as costs associated with employee severance and relocation.

|

Conference Call Information

The Company will conduct a conference call on October 12, 2023 at 8:30 a.m. Eastern time to discuss its financial results. A question-and-answer session will follow management’s opening remarks. The conference call details are as follows:

Date: Thursday, October 12, 2023

Time: 8:30 a.m. Eastern time

Dial-in registration link: here

Live webcast registration link: here

Please dial into the conference call 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact the Company’s investor relations team at RMCF@elevate-ir.com.

The conference call will also be broadcast live and available for replay in the investor relations section of the Company’s website at https://ir.rmcf.com/.

Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements, which are prepared and presented in accordance with GAAP, Rocky Mountain Chocolate provides investors with certain non-GAAP financial measures, such as adjusted EBITDA. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

Adjusted EBITDA, a non-GAAP financial measure, is computed by adding depreciation and amortization, stock-based compensation expenses, costs associated with non-recurring expenses (which include costs associated with proxy contests and related matters, costs associated with the departure of executive officers, costs recognized to retain new executive officers, event specific inventory disposal costs, and gains and losses associated with long-lived asset sales and impairment) to GAAP income (loss) from operations.

This non-GAAP financial measure may have limitations as an analytical tool, and this measure should not be considered in isolation or as a substitute for analysis of results as reported under GAAP. Management uses adjusted EBITDA because it believes that adjusted EBITDA provides additional analytical information on the nature of ongoing operations excluding expenses not expected to recur in future periods, non-cash charges and variations in the effective tax rate among periods. Management believes that adjusted EBITDA is useful to investors because it provides a measure of operating performance and its ability to generate cash that is unaffected by non-cash accounting measures and non-recurring expenses. However, due to these limitations, management uses adjusted EBITDA as a measure of performance only in conjunction with GAAP measures of performance such as income from operations and net income. Reconciliations of this non-GAAP measure to its most comparable GAAP measure are included at the end of this press release.

About Rocky Mountain Chocolate Factory, Inc.

Rocky Mountain Chocolate Factory, Inc. (dba “Rocky Mountain Chocolate”) is an international franchiser of premium chocolate and confection stores, and a producer of an extensive line of premium chocolates and other confectionery products, including gourmet caramel apples. Rocky Mountain Chocolate was named one of America’s Best on Newsweek's list of "America's Best Retailers 2023" in the chocolate and candy stores category. The Company is headquartered in Durango, Colorado. Its subsidiaries, franchisees and licensees currently operate over 260 Rocky Mountain Chocolate stores across the United States, with several international locations. The Company's common stock is listed on the Nasdaq Global Market under the symbol "RMCF."

Forward-Looking Statements

This press release includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements involve various risks and uncertainties. The statements, other than statements of historical fact, included in this press release are forward-looking statements. Many of the forward-looking statements contained in this document may be identified by the use of forward-looking words such as "will," "intend," "believe," "expect," "anticipate," "should," "plan," "estimate," "potential," or similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future - including statements expressing general views about future operating results - are forward-looking statements. Management of the Company believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date of this press release. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause our Company’s actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to: inflationary impacts, changes in the confectionery business environment, seasonality, consumer interest in our products, receptiveness of our products internationally, consumer and retail trends, costs and availability of raw materials, competition, the success of our co-branding strategy, the success of international expansion efforts and the effect of government regulations. For a detailed discussion of the risks and uncertainties that may cause our actual results to differ from the forward-looking statements contained herein, please see the section entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, each filed with the Securities and Exchange Commission.

Investor Contact

Sean Mansouri, CFA

Elevate IR

720-330-2829

RMCF@elevate-ir.com

STORE INFORMATION

| |

|

New stores opened during

|

|

|

|

|

|

| |

|

the three months ended

|

|

|

Stores open as of

|

|

| |

|

August 31, 2023

|

|

|

August 31, 2023

|

|

|

United States

|

|

|

|

|

|

|

|

|

|

Rocky Mountain Chocolate Factory

|

|

|

|

|

|

|

|

|

|

Franchise Stores

|

|

|

1 |

|

|

|

150 |

|

|

Company-Owned Stores

|

|

|

1 |

|

|

|

2 |

|

|

Co-brand Stores

|

|

|

1 |

|

|

|

113 |

|

|

International License Stores

|

|

|

0 |

|

|

|

4 |

|

|

Total

|

|

|

3 |

|

|

|

269 |

|

SELECTED BALANCE SHEET DATA

(in thousands)

(unaudited)

| |

|

August 31, 2023

|

|

|

February 28, 2023

|

|

|

Current Assets

|

|

$ |

10,102 |

|

|

$ |

11,205 |

|

|

Total Assets

|

|

|

20,535 |

|

|

|

21,987 |

|

|

Current Liabilities

|

|

|

5,582 |

|

|

|

5,010 |

|

|

Total Liabilities

|

|

|

7,663 |

|

|

|

7,617 |

|

|

Stockholder's Equity

|

|

$ |

12,872 |

|

|

$ |

14,370 |

|

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

| |

|

Three Months Ended August 31,

|

|

|

Three Months Ended August 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

$ |

4,707 |

|

|

$ |

4,808 |

|

|

|

71.8 |

% |

|

|

73.3 |

% |

|

Royalty and marketing fees

|

|

|

1,501 |

|

|

|

1,441 |

|

|

|

22.9 |

% |

|

|

22.0 |

% |

|

Franchise fees

|

|

|

41 |

|

|

|

45 |

|

|

|

0.6 |

% |

|

|

0.7 |

% |

|

Retail sales

|

|

|

309 |

|

|

|

264 |

|

|

|

4.7 |

% |

|

|

4.0 |

% |

|

Total Revenues

|

|

|

6,558 |

|

|

|

6,558 |

|

|

|

100.0 |

% |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

4,633 |

|

|

|

3,890 |

|

|

|

70.6 |

% |

|

|

59.3 |

% |

|

Franchise costs

|

|

|

613 |

|

|

|

449 |

|

|

|

9.3 |

% |

|

|

6.8 |

% |

|

Sales and marketing

|

|

|

442 |

|

|

|

428 |

|

|

|

6.7 |

% |

|

|

6.5 |

% |

|

General and administrative

|

|

|

1,687 |

|

|

|

4,037 |

|

|

|

25.7 |

% |

|

|

61.6 |

% |

|

Retail operating

|

|

|

162 |

|

|

|

151 |

|

|

|

2.5 |

% |

|

|

2.3 |

% |

|

Depreciation and amortization, exclusive of depreciation and amortization expense of $183 and $160 included in cost of sales, respectively

|

|

|

32 |

|

|

|

29 |

|

|

|

0.5 |

% |

|

|

0.4 |

% |

|

Total Costs and Expenses

|

|

|

7,569 |

|

|

|

8,984 |

|

|

|

115.4 |

% |

|

|

137.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

(1,011 |

) |

|

|

(2,426 |

) |

|

|

-15.4 |

% |

|

|

-37.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(6 |

) |

|

|

- |

|

|

|

-0.1 |

% |

|

|

0.0 |

% |

|

Interest income

|

|

|

18 |

|

|

|

5 |

|

|

|

0.3 |

% |

|

|

0.1 |

% |

|

Other Income, net

|

|

|

12 |

|

|

|

5 |

|

|

|

0.2 |

% |

|

|

0.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

(999 |

) |

|

|

(2,421 |

) |

|

|

-15.2 |

% |

|

|

-36.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

- |

|

|

|

731 |

|

|

|

0.0 |

% |

|

|

11.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations

|

|

|

(999 |

) |

|

|

(3,152 |

) |

|

|

-15.2 |

% |

|

|

-48.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from discontinued operations, net of tax

|

|

|

- |

|

|

|

(489 |

) |

|

|

|

|

|

|

|

|

|

Gain on disposal of discontinued operations, net of tax

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Net income (loss) from discontinued operations, net of tax

|

|

|

- |

|

|

|

(489 |

) |

|

|

|

|

|

|

|

|

|

Consolidated Net (Loss) Earnings

|

|

|

(999 |

) |

|

|

(3,641 |

) |

|

|

|

|

|

|

|

|

|

Basic Earnings (loss) Per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

$ |

(0.16 |

) |

|

$ |

(0.51 |

) |

|

|

|

|

|

|

|

|

|

Earnings (loss) from discontinued operations

|

|

$ |

- |

|

|

$ |

(0.08 |

) |

|

|

|

|

|

|

|

|

|

Net Earnings

|

|

$ |

(0.16 |

) |

|

$ |

(0.59 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings (loss) Per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

$ |

(0.16 |

) |

|

$ |

(0.51 |

) |

|

|

|

|

|

|

|

|

|

Earnings (loss) from discontinued operations

|

|

$ |

- |

|

|

$ |

(0.08 |

) |

|

|

|

|

|

|

|

|

|

Net Earnings

|

|

$ |

(0.16 |

) |

|

$ |

(0.59 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding

|

|

|

6,293,078 |

|

|

|

6,215,186 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilutive Effect of Employee Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Awards

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Outstanding,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assuming Dilution

|

|

|

6,293,078 |

|

|

|

6,215,186 |

|

|

|

|

|

|

|

|

|

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(unaudited)

| |

|

Six Months Ended August 31,

|

|

|

Six Months Ended August 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales

|

|

$ |

9,531 |

|

|

$ |

9,966 |

|

|

|

73.3 |

% |

|

|

74.0 |

% |

|

Royalty and marketing fees

|

|

|

2,876 |

|

|

|

2,881 |

|

|

|

22.1 |

% |

|

|

21.4 |

% |

|

Franchise fees

|

|

|

86 |

|

|

|

99 |

|

|

|

0.7 |

% |

|

|

0.7 |

% |

|

Retail sales

|

|

|

501 |

|

|

|

514 |

|

|

|

3.9 |

% |

|

|

3.8 |

% |

|

Total Revenues

|

|

|

12,994 |

|

|

|

13,460 |

|

|

|

100.0 |

% |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales

|

|

|

9,391 |

|

|

|

8,416 |

|

|

|

72.3 |

% |

|

|

62.5 |

% |

|

Franchise costs

|

|

|

1,293 |

|

|

|

868 |

|

|

|

10.0 |

% |

|

|

6.4 |

% |

|

Sales and marketing

|

|

|

915 |

|

|

|

909 |

|

|

|

7.0 |

% |

|

|

6.8 |

% |

|

General and administrative

|

|

|

3,619 |

|

|

|

5,643 |

|

|

|

27.9 |

% |

|

|

41.9 |

% |

|

Retail operating

|

|

|

265 |

|

|

|

309 |

|

|

|

2.0 |

% |

|

|

2.3 |

% |

|

Depreciation and amortization, exclusive of depreciation and amortization expense of $354 and $320 included in cost of sales, respectively

|

|

|

63 |

|

|

|

58 |

|

|

|

0.5 |

% |

|

|

0.4 |

% |

|

Total Costs and Expenses

|

|

|

15,546 |

|

|

|

16,203 |

|

|

|

119.6 |

% |

|

|

120.4 |

% |

| |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

(2,552 |

) |

|

|

(2,743 |

) |

|

|

-19.6 |

% |

|

|

-20.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(12 |

) |

|

|

- |

|

|

|

-0.1 |

% |

|

|

0.0 |

% |

|

Interest income

|

|

|

38 |

|

|

|

7 |

|

|

|

0.3 |

% |

|

|

0.1 |

% |

|

Other Income, net

|

|

|

26 |

|

|

|

7 |

|

|

|

0.2 |

% |

|

|

0.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes

|

|

|

(2,526 |

) |

|

|

(2,736 |

) |

|

|

-19.4 |

% |

|

|

-20.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

- |

|

|

|

702 |

|

|

|

0.0 |

% |

|

|

5.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations

|

|

|

(2,526 |

) |

|

|

(3,438 |

) |

|

|

-19.4 |

% |

|

|

-25.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings from discontinued operations, net of tax

|

|

|

69 |

|

|

|

(318 |

) |

|

|

|

|

|

|

|

|

|

Gain on disposal of discontinued operations, net of tax

|

|

|

635 |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

Net income (loss) from discontinued operations, net of tax

|

|

|

704 |

|

|

|

(318 |

) |

|

|

|

|

|

|

|

|

|

Consolidated Net (Loss) Earnings

|

|

|

(1,822 |

) |

|

|

(3,756 |

) |

|

|

|

|

|

|

|

|

|

Basic Earnings (loss) Per Common

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

$ |

(0.40 |

) |

|

$ |

(0.55 |

) |

|

|

|

|

|

|

|

|

|

Earnings (loss) from discontinued operations

|

|

$ |

0.11 |

|

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

Net Earnings

|

|

$ |

(0.29 |

) |

|

$ |

(0.60 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings (loss) Per Common Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations

|

|

$ |

(0.40 |

) |

|

$ |

(0.55 |

) |

|

|

|

|

|

|

|

|

|

Earnings (loss) from discontinued operations

|

|

$ |

0.11 |

|

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

|

|

Net Earnings

|

|

$ |

(0.29 |

) |

|

$ |

(0.60 |

) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common Shares Outstanding

|

|

|

6,284,846 |

|

|

|

6,211,815 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dilutive Effect of Employee Stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Awards

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted Average Common

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Outstanding,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assuming Dilution

|

|

|

6,284,846 |

|

|

|

6,211,815 |

|

|

|

|

|

|

|

|

|

GAAP RECONCILIATION

ADJUSTED EBITDA

(in thousands)

(unaudited)

| |

|

Three Months Ended August 31,

|

|

|

| |

|

2023

|

|

|

2022

|

|

Change

|

|

GAAP: Income from Operations

|

|

$ |

(1,011 |

) |

|

$ |

(2,426 |

) |

n/m

|

|

Depreciation and Amortization

|

|

|

215 |

|

|

|

189 |

|

|

|

Stock-Based Compensation Expense

|

|

|

123 |

|

|

|

149 |

|

|

|

Costs associated with non-recurring expenses (1)

|

|

|

68 |

|

|

|

2,792 |

|

|

|

Non-GAAP, adjusted EBITDA

|

|

$ |

(605 |

) |

|

$ |

704 |

|

n/m

|

| |

|

Six Months Ended August 31,

|

|

|

| |

|

2023

|

|

|

2022

|

|

Change

|

|

GAAP: Income (loss) from Operations

|

|

$ |

(2,552 |

) |

|

$ |

(2,743 |

) |

n/m

|

|

Depreciation and Amortization

|

|

|

417 |

|

|

|

378 |

|

|

|

Stock-Based Compensation Expense

|

|

|

325 |

|

|

|

281 |

|

|

|

Costs associated with non-recurring expenses (1)

|

|

|

441 |

|

|

|

3,449 |

|

|

|

Non-GAAP, adjusted EBITDA

|

|

$ |

(1,369 |

) |

|

$ |

1,365 |

|

n/m

|

(1) Non-recurring expenses include costs associated with the departure of the former Senior Vice President – Franchise Development, the retention of a new Chief Executive Officer, staff relocation and severance costs associated with hiring and separations, costs associated with a stockholder’s contested solicitation of proxies and non-recurring gains or losses on the sale of long-lived assets.

v3.23.3

Document And Entity Information

|

Oct. 11, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Rocky Mountain Chocolate Factory, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 11, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36865

|

| Entity, Tax Identification Number |

47-1535633

|

| Entity, Address, Address Line One |

265 Turner Drive

|

| Entity, Address, City or Town |

Durango

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

81303

|

| City Area Code |

970

|

| Local Phone Number |

259-0554

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

RMCF

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001616262

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

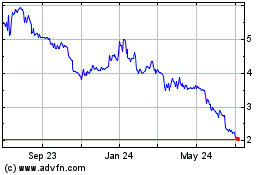

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rocky Mountain Chocolate... (NASDAQ:RMCF)

Historical Stock Chart

From Apr 2023 to Apr 2024