false

0001649904

0001649904

2024-01-04

2024-01-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 4, 2024

RHYTHM PHARMACEUTICALS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-38223 |

|

46-2159271 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

222 Berkeley Street

12th Floor

Boston, MA 02116

(Address of principal executive offices)

(Zip Code)

Registrant’s telephone number, including

area code: (857) 264-4280

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, $0.001 par value per share |

RYTM |

The Nasdaq Stock Market LLC (Nasdaq Global Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On January 4, 2024 (the “Effective Date”),

Rhythm Pharmaceuticals, Inc., a Delaware corporation (the “Company,” “we” and “our”), entered

into a License Agreement (the “License Agreement”) and Share Issuance Agreement (the “Share Issuance Agreement”)

with LG Chem, Ltd., a corporation organized and existing under the laws of the Republic of Korea (“LGC”).

Under the terms of the License Agreement, the Company will obtain worldwide rights to exploit LGC’s proprietary compound LB54640 and will assume sponsorship of two ongoing LGC Phase 2 studies designed

to evaluate safety, tolerability, pharmacokinetics and weight loss efficacy of LB54640. The SIGNAL trial is a randomized, placebo-controlled,

double-blind study designed to enroll and evaluate approximately 28 patients with acquired hypothalamic obesity. Participants will receive

one of three doses of LB54640 by oral administration once daily for up to 52 weeks, and the primary endpoint of the study is the change

from baseline in body mass index after 14 weeks of treatment. The open-label, single-arm, 16-week ROUTE trial is designed to enroll five

patients with POMC or LEPR deficiency obesity.

The Company has agreed to pay LGC a $40 million in cash and issue shares

of its common stock, par value of $0.001, with an aggregate value of $20 million (the “Shares”) within fifteen business days

from the Effective Date. The Shares will be issued at a per share price equal to the ten-day volume weighted average closing price for

the Company’s common stock, calculated as of the trading day immediately prior to January 4, 2024. The Company has also agreed to

make a $40 million payment in cash 18 months after the Effective Date.

In addition, under the terms of the License Agreement, the

Company has agreed to pay LGC up to $205 million in cash upon achieving various regulatory and sales milestones based on net sales

of LB54640. In addition and subject to the completion of Phase 2 development of LB54640, the Company has agreed to pay LGC

royalties of between low to mid single digit percent of net revenues from its MC4R portfolio, including LB54640,

commencing in 2029 and dependent upon achievement of various regulatory and indication approvals, and subject to customary deductions and anti-stacking.

The Company and LGC have made customary representations and warranties

in the License Agreement and have agreed to certain other customary covenants, including confidentiality, cooperation, and indemnity provisions.

The Share Issuance Agreement contains customary

representations and warranties by the Company and LGC, and the issuance of the Shares is subject to certain customary closing conditions.

The foregoing descriptions of the License

Agreement and Share Issuance Agreement are only a summary of their respective material terms and do not purport to be complete.

| Item 3.02. | Unregistered Sales of Equity Securities. |

The information included in Item 1.01 above

regarding the Share Issuance Agreement is incorporated by reference under this Item 3.02. The Shares will be issued in reliance upon an

exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), contained in

Section 4(a)(2) of the Securities Act. LGC has represented that they are acquiring the securities for investment only and not

with a view towards, or for resale in connection with, the public sale or distribution thereof, and appropriate legends have been or will

be affixed to the securities.

In

light of the License Agreement, the Company is providing the following update to its cash guidance. Based on its current operating

plans, the Company expects that its existing cash, cash equivalents and short-term investments, taking into account a total of $80 million

in cash payments to LGC as fixed consideration pursuant to the License Agreement, as well as the incremental clinical development costs

associated with the two Phase 2 studies that the Company will assume following the transfer of study sponsorship, will be sufficient to

fund its operating expenses and capital expenditure requirements into the second half of 2025.

Forward-Looking Statements

This Current Report on Form 8-K contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in

this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements,

including without limitation statements regarding the regarding the potential, safety, efficacy, and regulatory and clinical

progress of setmelanotide and LB54640, the potential timing, payments due, and benefits of the global licensing agreement for

LB54640 including with respect to the consummation of the transaction, expectations regarding the design, enrollment, or outcome of

clinical trials of LB54640, the ability to reach any net sales or revenue milestones, obtaining regulatory approvals in connection

with the global licensing agreement, the price per Share to be paid by the Company pursuant to the Share Issuance Agreement and the

sufficiency of the Company’s existing cash, cash equivalents and short-term investments to fund its current or future

operating plans. Statements using word such as “expect”, “anticipate”, “believe”,

“may”, “will”, “aim” and similar terms are also forward-looking statements. Such statements are

subject to numerous risks and uncertainties, including, but not limited to, risks relating to the Company’s liquidity and

expenses, the Company’s ability to enroll patients in clinical trials, the design and outcome of clinical trials, the ability

to achieve necessary regulatory approvals, risks associated with data analysis and reporting, failure to identify and develop

additional product candidates, unfavorable pricing regulations, third-party reimbursement practices or healthcare reform

initiatives, risks associated with the laws and regulations governing our international operations and the costs of any related

compliance programs, the impact of competition, risks relating to product liability lawsuits, inability to maintain collaborations,

or the failure of these collaborations, the Company’s reliance on third parties, risks relating to intellectual property, the

Company’s ability to hire and retain necessary personnel, the impact of the COVID-19 pandemic and general economic conditions

on the Company’s business and operations, including its preclinical studies, clinical trials and commercialization prospects,

failure to realize the anticipated benefits of the Company’s acquisition of Xinvento B.V. or significant integration

difficulties related to the acquisition, and the other important factors discussed under the caption “Risk Factors” in

the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 and its other filings with the Securities

and Exchange Commission. Except as required by law, the Company undertakes no obligations to make any revisions to the

forward-looking statements contained in this release or to update them to reflect events or circumstances occurring after the date

of this release, whether as a result of new information, future developments or otherwise.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

RHYTHM PHARMACEUTICALS, INC. |

| |

|

|

| Date: January 4, 2024 |

By: |

/s/ Hunter Smith |

| |

|

Hunter Smith |

| |

|

Chief Financial Officer |

v3.23.4

Cover

|

Jan. 04, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 04, 2024

|

| Entity File Number |

001-38223

|

| Entity Registrant Name |

RHYTHM PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001649904

|

| Entity Tax Identification Number |

46-2159271

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

222 Berkeley Street

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02116

|

| City Area Code |

857

|

| Local Phone Number |

264-4280

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

RYTM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

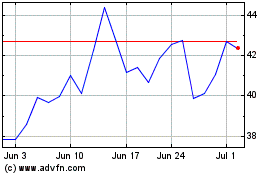

Rhythm Pharmaceuticals (NASDAQ:RYTM)

Historical Stock Chart

From Apr 2024 to May 2024

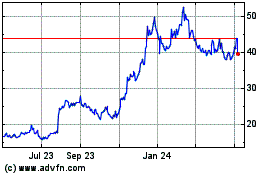

Rhythm Pharmaceuticals (NASDAQ:RYTM)

Historical Stock Chart

From May 2023 to May 2024