Current Report Filing (8-k)

November 10 2021 - 4:17PM

Edgar (US Regulatory)

false 0001673772 0001673772 2021-11-09 2021-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2021

RAPT Therapeutics, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38997

|

|

47-3313701

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

561 Eccles Avenue

South San Francisco, CA

|

|

94080

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(650) 489-9000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

RAPT

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 2.02

|

Results of Operations and Financial Condition

|

On November 10, 2021, RAPT Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2021. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this current report shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information contained in this Item 2.02 and in the press release furnished as Exhibit 99.1 to this current report shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On November 9, 2021 (the “Appointment Time”), upon the recommendation of the Nominating and Corporate Governance Committee of the Board of Directors (the “Board”) of RAPT Therapeutics, Inc. (the “Company”), the Board appointed Lori Lyons-Williams as a member of the Board, filling a vacant Board seat and with an initial term expiring at the Company’s 2024 annual meeting of stockholders, and until her successor is duly elected and qualified, or until her earlier death, resignation or removal. In connection with her appointment to the Board, Ms. Lyons-Williams was appointed to serve as a member of the Compensation Committee of the Board (the “Compensation Committee”) and the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) effective as of the Appointment Time.

There are no arrangements or understandings between Ms. Lyons-Williams and any other persons pursuant to which she was selected as a director of the Company. The Board has determined that Ms. Lyons-Williams is independent under the Company’s corporate governance guidelines, applicable U.S. Securities and Exchange Commission requirements and Nasdaq listing standards. There is no transaction involving Ms. Lyons-Williams that requires disclosure under Item 404(a) of Regulation S-K.

Ms. Lyons-Williams will participate in the Company’s Non-Employee Director Compensation Policy (the “Policy”), which is described in the Company’s definitive proxy statement for the 2020 Annual Meeting of Stockholders, filed with the Securities and Exchange Commission on April 29, 2020. Under the Policy, Ms. Lyons-Williams will receive an annual retainer of $35,000 for her service on the Board, an additional $5,000 annual retainer for service as a member of the Compensation Committee and an additional $4,000 annual retainer for service as a member of the Nominating Committee with payment pro-rated for any partial period of service. In addition, upon her appointment, Ms. Lyons-Williams received an option to purchase 22,500 shares of the Company’s Common Stock, which will vest in a series of three successive equal annual installments over the three-year period measured from the date of grant, subject to Ms. Lyons-Williams’s continuous service as a member of the Board through each applicable vesting date.

The Company also entered into the Company’s standard form of indemnification agreement with Ms. Lyons-Williams. The indemnification agreement provides, among other things, that the Company will indemnify Ms. Lyons-Williams for certain expenses which she may be required to pay in connection with certain claims to which she may be made a party by reason of her position as a director of the Company, and otherwise to the fullest extent permitted under Delaware law and the Company’s Amended and Restated Bylaws. The form of indemnification agreement was previously filed as Exhibit 10.8 to the Company’s Registration Statement on Form S-1 (No. 333-232572), as amended, as filed on July 22, 2019, and is incorporated herein by reference.

|

ITEM 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

RAPT Therapeutics, Inc.

|

|

|

|

|

|

|

Dated: November 10 2021

|

|

|

|

By:

|

|

/s/ Rodney Young

|

|

|

|

|

|

|

|

Rodney Young

|

|

|

|

|

|

|

|

Chief Financial Officer

|

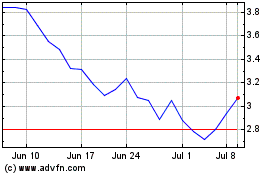

RAPT Therapeutics (NASDAQ:RAPT)

Historical Stock Chart

From Mar 2024 to Apr 2024

RAPT Therapeutics (NASDAQ:RAPT)

Historical Stock Chart

From Apr 2023 to Apr 2024