UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16

or 15d-16

under the Securities Exchange

Act of 1934

For the month of January

2024

Commission file number: 001-41334

RAIL VISION LTD.

(Translation of registrant’s

name into English)

15 Ha’Tidhar

St

Ra’anana, 4366517

Israel

(Address of principal

executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

☒ Form 40-F ☐

CONTENTS

Execution of Credit Facility Agreement and Issuance

of Warrant

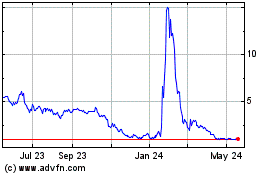

On January 9, 2024, Rail Vision

Ltd. (the “Company”) entered into a Facility Agreement (the “Facility Agreement”) for a $6 million credit facility

(the “Credit Facility”) and an additional amount up to $3 million, subject to certain conditions (the “Additional Loans”)

with a global investment firm (the “Lender”).

The Credit Facility, which has

an initial term of 10 months, will accrue interest at a rate of 8% per annum, and the first payment of $1.5 million was drawn down upon

execution of the Facility Agreement and the remaining amount may be drawn down in eight equal installments as of March 7, 2024.

After the Credit Facility

is exhausted, the Company may draw down the Additional Loans in an aggregate amount up to $3 million. The Additional Loans include two

initial installments of up to $750,000, and two additional installments of up to $750,000, the latter of which are subject to certain conditions. The Additional Loans will accrue interest at a rate of 12% per annum.

In the event that the Company

enters into an alternate credit facility on more favorable terms, the Lender’s funding obligations under the Credit Facility shall

decrease with respect to the amount actually received by the Company under such alternate credit facility. The Lender’s financing

obligations shall terminate in the event the Company draws down $7.5 million or more pursuant to an alternate credit facility or closes

one or more equity financing transaction in an aggregate amount of at least $5 million.

Until the Company closes one or

more equity financing transactions in an aggregate amount of at least $5 million (including the conversion of the Credit Facility), it

has the right to convert an amount of up to $1.5 million out of the outstanding loan (including accrued interest) into ordinary shares

of the Company, in connection with and in the framework of a financing transaction of the Company on the date that follows the date upon

which the Company notifies the Lender of such financing transaction, which conversion will occur upon the same terms. In addition, the

loan, together with accrued interest, must be repaid at a rate of 30% of the gross proceeds of any equity financing transactions consummated

by the Company during the term of the Credit Facility, which meet a minimum threshold aggregate amount (initially, $5,000,000 and increasing

by an additional $500,000 for each month during the term) until the loan is repaid in full. The repayment of the Credit Facility shall

be on the last day of each calendar month during which the sources for repayment specified above were actually received by the Company.

The loan may be prepaid early without any penalty.

As part of the Facility Agreement,

the Company issued a warrant (the “Warrant”) to the Lender to purchase 2,419,354 ordinary shares of the Company representing

an aggregate exercise amount of $7.5 million, with a per share exercise price of $3.10, subject to certain adjustments and certain anti-dilution

protection, representing a 150% premium of the closing share price of the Company’s ordinary shares on January 5, 2024. The Warrant will be exercisable

upon issuance and will have a term of 5 years from the date of issuance.

The Company undertook to

file a registration statement with the Securities Exchange Commission to register the resale by the Lender of the ordinary shares

underlying the Credit Facility and the Warrant. The securities described herein have not been registered under the Securities Act of

1933, as amended, and may not be sold in the United States absent registration or an applicable exemption from the registration

requirements. This Report of Foreign Private Issuer on Form

6-K (this “Report”) shall not constitute an offer to sell or the solicitation to buy nor shall there be any sale of the

ordinary shares or warrants in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or jurisdiction.

As a condition to the Credit Facility,

each of Shmuel Donnerstein, Inbal Kreiss and Keren Aslan have tendered their resignations from the Company’s board of directors

(the “Board”), and the Board has appointed Amitay Weiss and Hila Kiron-Revach to the Board, to serve until the Company’s

next annual general meeting of shareholders. The following are brief biographies of each of Mr. Weiss and Ms. Kiron-Revach, based upon

information furnished by each director.

Amitay Weiss, Director

Mr. Amitay Weiss has served

as the chairman of the board of directors of Scisparc Ltd. (Nasdaq: SPRC) since January 2022, has been a member of the board of directors

of Scisparc Ltd. since August 2020, and has previously served as the Chief Executive Officer of Scisparc Ltd. from August 2020 to January

2022. Mr. Weiss currently also serves as chairman of the board of directors of AutoMax Motors Ltd. (TASE: AMX.TA) Save Foods, Inc. (Nasdaq:

SVFD) and ParaZero Technologies Ltd. (Nasdaq: PRZO). Additionally, Mr. Weiss serves as a director of Jeffs’ Brands Ltd. (Nasdaq:

JFBR), Clearmind Medicine Inc. (Nasdaq: CMND), Maris Tech Ltd. (Nasdaq: MTEK) and as an external director of Cofix Group Ltd. (TASE: CFCS).

In 2016, Mr. Weiss founded Amitay Weiss Management Ltd. and now serves as its chief executive officer. From 2001 until 2015, Mr. Weiss

served as vice president of business marketing & development and in various other positions at Bank Poalei Agudat Israel Ltd. from

the First International Bank of Israel group. Mr. Weiss holds a B.A. in economics from New England College, an M.B.A. in business administration

from Ono Academic College in Israel, an Israeli branch of University of Manchester and an LL.B. from the Ono Academic College.

Hila Kiron-Revach, Director

Ms.

Hila Kiron-Revach has served as a member of the board of directors of Geffen Biomed Ltd. since 2014 and has been a member of the board

of directors of Zmiha Investment House Ltd. since 2021. In 2021, Ms. Kiron-Revach served as a professional advisor to the chairman of

the board of directors and acting secretary of Eilat Ashkelon Pipeline Company. From 2015 until 2021, Ms. Kiron-Revach served as a senior

professional advisor to ministers in the Israeli government, including the minister of foreign affairs and minister of transportation.

From 2012 until 2015, Ms. Kiron-Revach served as CEO of Hamil 38 – the Israeli Center for National Master Plan to Strengthen Existing

Building in the Face of Earthquakes, Tama 38 Ltd. and as an attorney at Tabakman & Co. Law Firm. In 2007, Ms. Kiron-Revach founded

Eliya – AB and served as its chief executive officer until 2010. Ms. Kiron-Revach hold an LL.B. from the Netanya Academic College

and is a licensed attorney in Israel.

On

January 9, 2024, the Company issued a press release titled “Rail Vision Secures $6 Million Credit Facility,” a copy

of which is furnished as Exhibit 99.3 hereto. Copies of the Facility Agreement and the Warrant

are filed as Exhibits 99.1 and 99.2, respectively, to this Report and are incorporated by reference herein. The foregoing summaries

of such documents are subject to, and qualified in their entirety by reference to, such exhibits.

This Report is

incorporated by reference into the Company’s Registration Statements on Form F-3 (File

Nos. 333-271068 and 333-272933) and Form S-8 (Registration No. 333-265968), filed with the Securities and Exchange

Commission, to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or

reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

| |

Rail Vision Ltd. |

| |

|

| Date: January 9, 2024 |

By: |

/s/ Ofer Naveh |

| |

|

Name: |

Ofer Naveh |

| |

|

Title: |

Chief Financial Officer |

3

Exhibit 99.1

FACILITY AGREEMENT

THIS FACILITY

AGREEMENT is made as of January 9, 2024 (the “Agreement Date”) between L.I.A.

Pure Capital Ltd., company no. 514408715 (the “Lender”) and Rail Vision Ltd., company no. 515441541

(the “Borrower” or the “Company”) (the Borrower together with the Lender, the

“Parties” and individually “Party”).

| WHEREAS, | the Borrower is a publicly traded company; and |

| WHEREAS, | the Borrower desires to receive funding in the amounts representing

the First Drawdown Amount (as defined below) immediately upon the Effective Date (as defined below), the Remaining Drawdown Amounts (as

defined below) in eight (8) separate installments commencing on the sixty (60) day anniversary of the Effective Date, four additional

installments of USD Seven Hundred and Fifty Thousand (USD 750,000) commencing upon the Loan End Date (as defined below), until such time

that the Borrower completes a Five Million Fundraise (as defined below), all in accordance with and subject to the terms and conditions

of this Agreement (the “Purpose”); and |

| WHEREAS, | the Parties wish to set forth in this Agreement the terms and

conditions of the Loan (as defined below) and to determine their mutual rights and obligations. |

Now,

Therefore, the parties hereto hereby agree as follows:

| 1. | Preamble and Definitions |

| 1.1. | The Preamble to this Agreement and all Schedules hereto shall

constitute an integral part of this Agreement. |

| 1.2. | In this Agreement, including the Schedules hereto, the following

terms shall have the meanings set out opposite them below: |

| “Actual Loan Amount” |

– |

| Means the amount of the Funding actually extended by

the Lender to the Borrower. |

| | |

|

| |

| | “Agreement” |

– |

| Means this Agreement and all its Exhibits and Schedules. |

| | |

|

| |

| | “Availability Period” |

– |

| Means the period commencing on the Effective Date and ending ten (10) months after

as may be extended pursuant to Clause 4.3. |

| | |

|

| |

| | “Business Day” |

– |

| Means a day (other than a Friday, Saturday and an official holiday) on which banks

are generally open for business in Israel. |

| | |

|

| |

| | “Drawdown” |

– |

| Means a drawdown of a Loan in accordance with Clause 4(A) below; or of the Additional

Loan in accordance with Clause 4(B) below; or of the Cost- Reduction Loan in accordance with Clause 4(C) below. |

| | |

|

| |

| | “Effective Date” |

– |

| Means the date the First Drawdown is drawn. |

| | |

|

| |

| | “Five Million Fundraise” |

– |

| Means the completion by the Company of equity investment(s) in the Company (in one

or more rounds, including by means of warrant(s)/option(s) cash exercise, to be consummated following the Effective

Date) totaling an aggregate amount of Five Million US Dollars (USD 5,000,000). |

| | “Funding” |

– |

| Means the Loan, Additional Loan, and Cost- Reduction Loan. |

| | |

|

| |

| | “Grace Period” |

– |

| Means a period until the Company completes a Five Million Fundraise; provided, however,

that this period shall not exceed thirty-six (36) months following the Effective Date. |

| | |

|

| |

| | “Interest” |

– |

| Means the applicable annual interest rate underlying the Funding: (i) on the Loan

- 8% per annum; (ii) on the Additional Loan and on the Cost-Reduction Loan – 12% per annum. |

| | |

|

| |

| | “Loan” |

– |

| Means a principal amount that shall not exceed Six Million US Dollars (USD 6,000,000),

of which the First Draw shall be drawn down on the Effective Date, followed by eight (8) Drawdowns as described in

Clause 4(A) below. |

| | |

|

| |

| | “Additional Loan” |

– |

| Means a principal amount that shall not exceed One Million and Five Hundred Thousand

US Dollars (USD 1,500,000), which may be utilized by the Borrower in Drawdowns subject to the terms and as described

in 3Clause 4(B) below. |

| | |

|

| |

| | “Cost-Reduction Loan” |

– |

| Means a principal amount that shall not exceed One Million and Five Hundred Thousand

US Dollars (USD 1,500,000), which may be utilized by the Borrower in Drawdowns subject to the terms and as described

in Clause 4(C) below. |

| | |

|

| |

| | “One Million Fundraise” |

– |

| Means the completion by the Company of equity investment(s) in the Company (in one

or more rounds to be consummated following the Effective Date) in excess of One Million US Dollars (USD 1,000,000). |

| | |

|

| |

| | “Ongoing Expenses” |

- |

| Means the monthly expenses of the Borrower incurred in its ordinary course of its

business but excluding one-time expenses and/or equipment purchases which are classified for accounting as “Inventory”. |

In this Agreement, unless the contrary

intention appears, a reference to:

| 1.3.1. | a Section, Clause, a Sub-clause or a Schedule is a reference to a section, clause or sub-clause of, or

a schedule to, this Agreement; |

| 1.3.2. | a Party or any other person/entity includes its successors in title, permitted assignees and permitted

transferees; |

| 1.3.3. | the headings in this Agreement do not affect its interpretation; and |

| 1.3.4. | any dispute of interpretation in relation to any clause set forth in the Agreement

shall be interpreted in accordance with and in the context of the Purpose. |

| 2. | Representations and Warranties of the Borrower |

The Borrower hereby represents, covenants

and warrants to the Lender as follows:

| 2.1. | The Borrower is a company duly organized, validly existing under the laws of the

State of Israel. |

| 2.2. | The Borrower has the corporate power to enter into, perform and deliver, and has

taken all necessary actions to authorize the entry into, performance and delivery of, the Agreement and all its Exhibits and Schedules,

and to carry on its business as now being conducted. |

| 2.3. | The entry into this Agreement by the Borrower does not conflict with: (i) any Applicable

Law; (b) the Articles of Association of the Company or any of its other constitutional documents; or (iii) subject to Clause 14.3 any

agreement which it is a party or under which it is bound. |

| 2.4. | No consent, approval, order or authorization of any third party, or registration,

qualification, designation, declaration or filing with governmental authority is required on the part of the Borrower in connection with

the consummation of the transactions contemplated by this Agreement. |

| 2.5. | The authorized share capital of Borrower consists of (i) 12,500,000 ordinary shares,

par value NIS 0.08, of which 2,998,278 shares are issued and outstanding as of the Signing Date. Except as disclosed in the Company Reports

or as detailed in the disclosure schedule attached as Schedule 2 hereto (“Disclosure Schedule”): (i)

there are no outstanding bonds, debentures, notes or other indebtedness or other securities of Borrower having the right to vote (or convertible

into, or exchangeable for, securities having the right to vote) on any matters on which shareholders of Borrower; (ii) there are no outstanding

securities, options, warrants, calls, rights, commitments, agreements, arrangements or undertakings of any kind to which Borrower is a

party or by which it is bound obligating Borrower to issue, deliver or sell, or cause to be issued, delivered or sold, additional ordinary

shares of Borrower or other equity or voting securities of Borrower or obligating Borrower to issue, grant, extend or enter into any such

security, option, warrant, call, right, commitment, agreement, arrangement or undertaking; (iii) there are no outstanding contractual

obligations, commitments, understandings or arrangements of Borrower to repurchase, redeem or otherwise acquire or make any payment in

respect of any ordinary shares of Borrower or any other securities of Borrower; (iv) there are no agreements or arrangements pursuant

to which Borrower is or could be required to register Borrower’s ordinary shares or other securities under the Securities Act (as

defined below) or other agreements or arrangements with or among any holders of Borrower or with respect to any securities of Borrower;

and (v) the issuance of the Shares

(as defined below) will not trigger any anti-dilution rights of any existing securities of Borrower. Except as disclosed in the Company

Reports, as of the Effective Date, there will be no rights, subscriptions, warrants, options, conversion rights, or agreements of any

kind outstanding to purchase from Borrower, or otherwise require Borrower to issue, any shares of share capital of Borrower or securities

or obligations of any kind convertible into or exchangeable for any ordinary shares of Borrower. |

| 2.6. | Since January 1, 2021, Borrower has filed all forms, reports and documents with

the Securities and Exchange Commission (the “SEC”) that have been required to be filed by it under applicable laws

prior to the date hereof (all such forms, reports and documents, together with all documents filed or furnished on a voluntary basis and

all exhibits and schedules thereto, the “Company Reports”). As of its filing date (or, if amended or superseded by

a filing prior to the date of this Agreement, on the date of such amended or superseded filing), (i) each Company Report complied as to

form in all material respects with the applicable requirements of the Securities Act, the Exchange Act, and/or the Sarbanes-Oxley Act,

as the case may be, each as in effect on the date such Company Report was filed, and (ii) each Company Report did not contain any untrue

statement of a material fact or omit to state any material fact necessary in order to make the statements made therein, in the light of

the circumstances under which they were made, not misleading. To the knowledge of the Borrower, none of the Company Reports is the subject

of ongoing SEC review or investigation. The financial statements included in the Company Reports comply in all material respects with

the applicable accounting requirements and the rules and regulations of the Commission with respect thereto as in effect at the time of

filing. The financial statements included in the Company Reports have been prepared in accordance with generally accepted accounting principles

in the United States applied on a consistent basis (“GAAP”), and fairly represent the financial position of Borrower

and as of and for the dates thereof and the results of operations and cash flows for the periods then ended, subject, in the case of unaudited

statements, to normal, year-end audit adjustments and the omission of certain footnotes. Except as set forth in the Company Reports, Borrower

has no liabilities or obligations of any nature (whether accrued, absolute, contingent or otherwise) required by GAAP to be set forth

on a balance sheet of Borrower or in the notes thereto. |

| 2.7. | Since January 1, 2021, and except as disclosed in its Company Reports or Disclosure

Schedule, (i) Borrower has not incurred any liabilities or obligations, indirect, or contingent, or entered into any oral or written agreement

or other transaction which exceeds US$100,000; (ii) Borrower has not paid or declared any dividends or other distributions with respect

to its share capital, or redeemed or purchased or otherwise acquired any of its ordinary shares and Borrower is not in default in the

payment of principal or interest on any outstanding debt obligations, except as set forth herein; (iii) Borrower has not initiated any

compensation arrangement or agreement with any executive officer; (iv) there has not been any change in the ordinary shares of Borrower;

and (v) there has not been any other event which has caused, or is likely to cause, a material adverse effect on Borrower. |

| 2.8. | Other then as disclosed in its Company Reports or Disclosure Schedule, there is

no action, suit, claim, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory

organization or body pending against or, to the knowledge of Borrower, threatened against Borrower. Borrower is not subject to any order,

writ, judgment, injunction, decree or award of any court or any governmental authority. |

| 2.9. | Borrower has not been advised, nor does Borrower have reason to believe, that it

is not conducting its business in compliance with all applicable laws, rules and regulations of the jurisdictions in which it is conducting

its business. |

| 2.10. | Borrower has filed all necessary federal, state and foreign income and franchise

tax returns, and the equivalent thereof with the respective organs in the State of Israel, and has paid or accrued all taxes

shown as due thereon, and Borrower has no knowledge of a tax deficiency which has been or might be asserted or threatened against it. |

| 2.11. | The Shares (as defined below), when issued (if applicable), will conform in all

material respects to the descriptions of Borrower’s ordinary shares contained in the Company Reports and other filings with the

SEC. |

| 2.12. | Borrower has disclosure controls and procedures (as defined in Rule 13a-15 under

the Securities Exchange Act of 1934, as amended) that are designed to ensure that material information relating to Borrower is made known

to Borrower’s principal executive officer and Borrower’s principal financial officer or persons performing similar functions. |

| 2.13. | All disclosure provided to Lender regarding Borrower, its business and the transactions

contemplated hereby, including the exhibits to this Agreement, furnished by Borrower with respect to the representations and warranties

made herein are true and correct with respect to such representations and warranties and do not contain any untrue statement of a material

fact or omit to state any material fact necessary in order to make the statements made therein, in light of the circumstances under which

they were made, not misleading. |

| 2.14. | This Agreement has been duly executed and delivered by and constitutes a valid and

binding obligation of Borrower, enforceable in accordance with its terms. |

| 3. | Representations and Warranties of the Lender |

The Lender hereby represents, covenants

and warrants to the Borrower as follows:

| 3.1. | The Lender, and any additional persons and/or entities that may provide funds under

this Agreement solely by and through the Lender (the “Additional Persons”), is an “Accredited Investor”

as such term is defined in Rule 501 of Regulation D promulgated under the Securities Act of 1933, as amended (the “Securities

Act”), and to support its classification as an Accredited Investor, Lender shall sign and deliver to Borrower the declaration

in the form attached hereto as Schedule 3. |

(A) The

Borrower shall (i) draw down the First Drawdown Amount on the execution date of this Agreement, and (ii) thereafter shall be

entitled, at its discretion, to utilize the remainder of the Loan or any portion thereof during the Availability Period in up to

eight (8) Drawdowns, as follows:

| 4.1. | The first Drawdown in the amount of USD One Million and Five Hundred Thousand US

Dollars (USD 1,500,000) (the “First Drawdown Amount”) shall be drawn by the Borrower upon the execution hereof (the

“First Drawdown”). The First Drawdown Amount will be deposited directly by the Lender into the Company’s bank

account detailed in Schedule 4.1 hereto and the Lender shall deliver to the Borrower a wire confirmation thereof upon the

Effective Date. Without derogating from Lender’s responsibilities under this Agreement, including for avoidance of doubt its obligation

to provide the First Drawdown Amount it is agreed that a sum of USD Four Hundred Eighty Thousand (USD 480,000) from the First Drawdown

Amount shall be provided by M.R.M. Merhavit Holding and Management Ltd on behalf of the Lender. |

| 4.2. | Each of the additional eight (8) Drawdowns in the amount of up to USD Five Hundred

and Sixty-Two Thousand, Five Hundred (USD 562,500) each (the “Remaining Drawdown

Amount(s)”) may be drawn down on the seventh (7th) day of each calendar month commencing on March 7, 2024 during the Availability

Period (the “Remaining Drawdown Payment Date(s)”). It is hereby agreed that failure to meet the Remaining Drawdown

Amounts, if Borrower elects to draw, upon the Remaining Drawdown Payment Date(s) shall be considered as a material breach of this Agreement. |

| 4.3. | Notwithstanding, if during the Availability Period, the Borrower completes a One

Million Fundraise, the Lender shall defer payment of the applicable Remaining Drawdown Amount, in an amount equal to the amount raised

by the Company in the One Million Fundraise (the “Deferred Drawdown”) such that the Lender shall not deliver payment

of the Deferred Drawdown on the original Remaining Drawdown Payment Date, and such amount shall instead be delivered thirty (30) days

following payment of the final Drawdown under the Remaining Drawdown Amounts (in other words, and for the avoidance of any doubt, the

Deferred Drawdown shall be the final Remaining Drawdown Amount delivered by the Lender to the Borrower; if the One Million Fundraise was

USD One Million One Hundred and Twenty Five Thousand (USD 1.125 Million) then such number will represent the Deferred Drawdown and will

delivered to the Borrower as the “last in line”). In such case, within three (3) Business Days from the closing date of the

One Million Fundraise (for the avoidance of doubt, such closing date will be the closing date of the financing transaction that results

in the Borrower meeting the One Million Fundraise), the Borrower shall return the checks underlying the Deferred Drawdown and the Lender

shall deliver to the Borrower new check(s) dated to the new drawdown dates. |

(B) After

the Borrower has drawn down the entire Loan (the “Loan End Date”), the Borrower shall be entitled to draw down the

Additional Loan in two separate installments on each of the thirty (30) day and sixty (60) day anniversary of the Loan End Date (such

that the Borrower may draw down up to USD Seven Hundred and Fifty Thousand Dollars (USD 750,000) on the thirty (30) day anniversary of

the Loan End Date and up to USD Seven Hundred and Fifty Thousand Dollars (USD 750,000) on the sixty (60) day anniversary of the Loan End

Date), and if not drawn down within the foregoing schedule then the availability of the Additional Loan will expire, by way of notifying

the Lender in writing of its wish to exercise such right and call the Lender to wire such amount to Borrower’s bank account the

details of which shall be provided by Borrower (and verified by phone by Lender) within seven (7) days as of such notice. Failure to extend

the amounts of the Additional Loan, if Borrower elects to draw, pursuant to this Clause shall be considered as a material breach of this

Agreement.

(C) If

following the Loan End Date, the Borrower implements a cost reduction plan whereby the Borrower’s Ongoing Expenses will not

exceed USD Five Hundred and Fifty Thousand (USD 550,000), as shall be confirmed by a certificate in the form attached as Schedule

4.3(c) hereto executed by the Borrower’s Chief Executive Officer and Chief Financial officer, Borrower shall be

entitled to draw down the Cost-Reduction Loan in two separate monthly installments on each of the thirty (30) day and sixty (60) day

anniversaries of the Loan End Date (such that the Borrower may draw down up to USD Seven Hundred and Fifty Thousand Dollars (USD

750,000 ) on the thirty (30) day anniversary of the Loan End Date and up to USD Seven Hundred and Fifty Thousand Dollars (USD

750,000) on the sixty (60) day anniversary of the Loan End Date), and if not drawn down within the foregoing schedule then the

availability of the Cost-Reduction Loan will expire, by way of notifying the Lender in writing of its wish to exercise such right

and call the Lender to wire such amount to Borrower’s bank account the details of which shall be provided by Borrower (and

verified by delivery of wire confirmation by Lender) within 7 days as of such notice. Failure to extend the amounts of the Cost

Reduction Loan, if Borrower elects to draw, pursuant to this Clause shall be considered as a material breach of this Agreement.

| 5.1. | Lender shall, upon the Agreement Date, deposit with the Borrower eight (8) checks

dated as of the Remaining Drawdown Payment Dates, as per Clause 4(A)4.2 above, each in the amount of the Remaining Drawdown Amounts, which

the Borrower shall have the right to deposit in its bank account and the Lender warrants and undertakes the checks will be honored by

the bank and allow for cash payment by Lender (and receipt by Borrower) of such portions of the Loan on their applicable due dates. In

the event that the Lender defaults payment of the Loan, and does not remedy such default within three (3) business days of such default,

including on paying any Remaining Drawdown Amount on such date according to the Remaining Drawdown Payment Dates, then without derogating

from any other remedy available to the Borrower pursuant to this Agreement and applicable law an amount of USD One Million and Five Hundred

Thousand US Dollars (USD 1,500,000) shall be deducted from the outstanding Actual Loan Amount as agreed upon penalty. |

| 5.2. | Notwithstanding anything herein to the contrary, in the event that the Borrower

receives and accepts an offer for a new credit facility with commercial terms more favorable than the terms provided herein (the “Alternate

Credit Facility”), as shall be determined by the Borrower’s board of directors at its sole discretion at the time such

Alternate Credit Facility is proposed (the “Board”), Lender’s Funding obligations to extend the aggregated amounts

under the Agreement will decrease only with respect to the amount actually received by the Company under the Alternate Credit Facility

and the Lender shall have the right to request repayment of the Actual Loan Amount (using such funds actually received under the Alternate

Credit Facility). It is hereby clarified that accepting an Alternate Credit Facility by the Company shall not release Lender’s obligation

to extend the remaining Funds going forward and shall only decrease the aggregate Funding obligation taken as a whole (i.e., if the Company

receives USD Two Million (USD 2,000,000) pursuant to the Alternate Credit Facility during the Availability Period than the Lender’s

funding obligation under the Loan, in aggregate, shall be reduced to USD Four Million (USD 4,000,000)). It is further agreed that in any

event the Lender shall remain liable to provide any amounts which were not actually received due to the Alternate Credit Facility as result

of failure of the alternate creditor. Subject to the signing of the Alternate Credit Facility, the Borrower shall have the right to convert

pursuant to Clause 11. |

| 5.3. | Notwithstanding anything herein to the contrary, if the Borrower shall complete a Five Million

Fundraise, or, the Company draws down US$7,500,000 or more under the Alternate Credit Facility, then in each case: (a) (1) no

further Drawdown can be made thereafter, and the Lender shall be discharged of all obligations under this Agreement (other than the

obligations that survive the termination of this Agreement under Clause 17.8), including termination of the requirement to make

available any funds contemplated under the Funding, from that moment on, and (2) any checks not deposited (as contemplated in Clause

5.1) shall be returned by Borrower to Lender as soon as possible; and (b) Lender’s obligation under Clause 5.2 shall

terminate. |

| 6.1. | Subject to Cluse 11 below, interest accrued on the Actual Loan Amount up to and

as of the Five Million Raise shall be paid by the Borrower to the Lender immediately following the completion of the Five Million Fundraise,

as detailed and adjusted in Clause 7 below. For clarity, during the Grace Period, the Borrower shall not be obligated to repay either

the principal amount of the Loan or the Interest. |

| 6.2. | Interest shall be calculated on a daily basis in accordance with the number of

days which have actually elapsed until payment thereof, divided by 365. Any sum under the Funding shall bear Interest from the date it

had been utilized to the Borrower. |

Following the Effective Date and

without derogating from Borrower’s right to convert as detailed in Clause 11 below, the Borrower shall repay the Actual Loan Amount

and any Interest accrued thereon outstanding on the date thereof by way of repayment to the Lender of 30% of the aggregate amount of any

equity financing transaction(s) completed (in one or more transactions) consummated after the Effective Date resulting in the receipt

of USD Five Million (USD 5,000,000) provided however that solely for the purpose of repayment such amount will increase in each month

as of March 31, 2024 and through the Availability Period by additional USD Five Hundred Thousand (USD 500,000, i.e. upon April 30, 2024

the repayment trigger shall be aggregate equity financing of USD Five Million Five Hundred Thousand (USD 5,500,000)). The Actual Loan

Amount and any Interest accrued thereon shall be continually repaid to the Lender upon the closing of each such financing transaction

at a rate of 30% of the aggregate gross proceeds of each such transaction until the Loan is repaid in full. The repayment of the Actual

Loan Amount shall be on the last day of each calendar month during which the sources for repayment specified above were actually received

by the Company.

| 8.1. | Any tax consequences arising from the grant or repayment of the Funding, shall

be borne solely by the Lender. Borrower is allowed to withhold tax at source from any repayment it shall pay to the Lender pursuant to

applicable law, unless Borrower has provided it with a valid tax exemption issued by the Israeli Tax Authority providing otherwise. |

| 8.2. | The Borrower shall pay VAT, where applicable, on any payment paid by it against

an applicable tax invoice. |

The Borrower shall be entitled

to voluntary prepay the Actual Loan Amount and the Interest in whole or in part, prior to their applicable due dates without the prior

written approval of the Lender. In such case Borrower shall give the Lender at least three (3) days’ prior written notice of the

prepayment which shall specify the: (i) date upon which the prepayment is to be made, and (ii) the amount to be prepaid as aforesaid.

The outstanding debt under the

Funding shall be subordinate to any other debt of the Borrower until the Borrower has raised USD Five Million in the aggregate (in one

or more transactions) following the Effective Date.

The Borrower has the right, per

its discretion, to convert an amount of up to USD One Million and Five Hundred Thousand (USD 1,500,000) out of the outstanding Actual

Loan Amount as well as the Interest accrued thereon into ordinary shares of the Borrower, in connection with and in the framework of a

financing transaction of the Borrower on the date that follows the date upon which the Borrower notifies the Lender of such financing

transaction, which conversion will occur upon the same terms (same price per share or unit, and in the event of units, pursuant to such

terms agreed upon with the participating investors in such transaction, i.e., registration rights at the same time and scope) as the foregoing

financing transaction; and Lender undertakes to execute the required transaction documents to effect the foregoing if so chosen by the

Borrower. For avoidance of doubt, the amount so converted shall be taken into account as part of the Five Million Fundraise or as part

of a financing pursuant to Clause 7 above. Borrower right to convert as stipulated above shall be limited to the USD Five Million Fundraise,

including the converted amount, and shall expire thereafter (i.e. if Borrower completes a USD Four Million (USD 4,000,000) fundraise than

Borrower may convert up to USD One Million (USD 1,000,000).

| 12.1. | Concurrently with the execution hereof and in consideration of Lenders obligations

herein, the Borrower shall issue the Lender the warrant, in the form attached hereto as Annex 0, representing an aggregate

Exercise Price (as defined in the Warrant) of USD Seven Million and Five Hundred Thousand (USD 7,500,000) (the “Warrant”). |

| 12.2. | In the event of an adjustment(s) to the Exercise Price of the Warrant pursuant to

Section 2(a) of the Warrant following a Dilutive Issuance (as defined in the Warrant), then the Company shall issue to the Lender an additional

warrant (the “Additional Warrant”) in substantially the same form as the Warrant to purchase such number of ordinary

shares of the Company so that the aggregate exercise price payable under the Warrant and the Additional Warrant, after taking into account

the decrease in the Exercise Price (as defined in the Warrant), shall be equal to the aggregate Exercise Price under the Warrant immediately

prior to the date of such Dilutive Issuance. |

| 13.1. | The Parties further acknowledge and are aware that the ordinary shares issuable

upon the conversion of the Loan or upon the exercise of the Warrant or the Additional Warrant (collectively, the “Shares”),

may only be disposed of in compliance with respective U.S. state and U.S. federal securities laws. In connection with any transfer of

Shares other than pursuant to an effective registration statement, the Borrower may require the transferor thereof to provide to the Borrower

an opinion of counsel selected by the transferor and reasonably acceptable to the Borrower, the form and substance of which opinion shall

be reasonably satisfactory to the Borrower, to the effect that such transfer does not require registration of such transferred Shares

under the Securities Act. |

| 13.2. | The Lender agrees to the imprinting, so long as required by this Section 13.2,

of a legend on any such Shares (issuable upon conversion of the Loan or exercise of the Warrant) in the following form: |

[NEITHER

THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE

SECURITIES ARE EXERCISABLE HAVE BEEN] [THE SECURITIES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN] REGISTERED UNDER THE SECURITIES

ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED FOR SALE, SOLD, TRANSFERRED OR

ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES ACT OF 1933, AS

AMENDED, OR (B) AN OPINION OF COUNSEL SELECTED BY THE HOLDER, IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT REQUIRED

UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES

MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.

| 13.3. | Certificates evidencing the Shares shall not contain any legend (including the

legend set forth in Section 13.2 hereof): (i) while a registration statement covering the resale of such security is effective under the

Securities Act, (ii) following any sale of such Shares pursuant to Rule 144, (iii) if Shares are eligible for sale under Rule 144, without

the requirement for the Borrower to be in compliance with the current public information required under Rule 144 as to such Shares and

without volume or manner-of-sale restrictions, or (iv) if such legend is not required under applicable requirements of the Securities

Act (including judicial interpretations and pronouncements issued by the staff of the Commission). The Borrower shall cause its counsel

to issue a legal opinion to the transfer agent of the Borrower promptly after the respective effective date of the transfer if required

by the transfer agent to effect the removal of the legend hereunder. |

| 13.4. | The Lender agrees with the Borrower that the Lender will sell any Shares pursuant

to either the registration requirements of the Securities Act, including any applicable prospectus delivery requirements, or an exemption

therefrom, and that if Shares are sold pursuant to a registration statement, they will be sold in compliance with the plan of distribution

set forth therein, and acknowledges that the removal of the restrictive legend from certificates representing the Shares as set forth

in this Section 13 is predicated upon the Company’s reliance upon this understanding |

| 14.1. | Lender undertakes not to take, on or before December 31, 2024, any action, directly

or indirectly in contravention of the Company’s business and operations as conducted as of the Effective Date. |

| 14.2. | Until December 31, 2024, Lender will use commercially reasonable efforts to allow

the Borrower to have sufficient capital to finance its operations (i.e., to execute purchase orders received by the Borrower) during the

Availability Period, by way of equity or debt financing instruments providing for funding beyond the Funding specified herein above; provided

that the Lender receive a written statement executed by the Chief Executive Officer of the Borrower thereby affirming the Company’s

inability to finance its then current operations. |

| 14.3. | Lender confirms it is familiar with the terms of the engagement letter between the

Company and A.G.P./Alliance Global Partners (“AGP”) and the waiver provided to the Company by AGP on December 26, 2023,

attached hereto as Schedule 14.3, and undertakes to comply with the terms of this Agreement, with such waiver. |

| 14.4. | Within 45 days from the Effective Date, the Company shall file a registration statement

with the SEC to register the resale of the Shares by the Lender, or any Shares issuable to the Lender pursuant to an adjustment(s) set

forth in the Warrant or Shares issuable pursuant to the Additional Warrant, so as to permit the public resale thereof (the “Resale

Registration Statement”). However, if the Company files another resale registration statement with the SEC prior to such

date, the Company shall use reasonable best efforts to register the resale of the Shares together with such other registration statement.

The Company will use its reasonable efforts to ensure that such Resale Registration Statement is declared effective by the SEC within

ninety (90) days of the filing thereof. The Company will ensure that all Shares issuable to the Lender are covered by the Resale Registration

Statement and to the extent necessary file with, and cause to be decelerated effective by, the SEC, additional registration statements,

to register any Shares not covered by the Resale Registration Statement, which such registration statements shall be filed no later than

45 days following the event triggering the increase of the number of Shares issuable to the Lender. |

| 14.5. | If following the Effective Date, a strategic investor both (a) invests no less than

USD Thirty Million (USD 30 million) in the Company; and (b) exceeds 50.01% of the Company’s share capital as a result of, then immediately

upon signing of such transaction, the Lender shall notify the strategic investor and offer to transfer, without consideration, 50% of

Lender’s outstanding Warrants as of signing date of the foregoing strategic investment to that strategic investor, which transfer

will take place immediately following the closing of such transaction. The Lender shall commence good faith discussions with the strategic

investor in order to facilitate the transfer of the Warrants as detailed herein. |

| 15. | Conditions of the Lender |

The obligations of the Lender under

this Agreement, including payment of the First Drawdown Amount, shall be subject to the satisfaction at or prior to the Effective Date

of the following:

| (i) | Upon the Effective Date, the Board shall consist of up to seven (7) members, including

Oz Adler and Yossi Daskal, in their respective capacities as external directors (as such term is defined under the Israeli Companies Law,

5759-1999), (ii) one representative of Foresight Autonomous Holdings Ltd., (iii) two representatives of Knorr-Bremse, and (iv) two new

directors - Amitay Weiss and Hila Kiron- Revach, (the “New Directors”). It is hereby agreed that at least one of the

foregoing New Directors shall meet the qualifications of Independent Director (as such term is defined under Nasdaq’s listing rules). |

| (ii) | Each of Shmuel Donnerstein, Inbal Kreiss and Keren Aslan (the “Outgoing

Directors”) shall tender their resignations, in the form attached hereto as Annex B, which resignation letters

shall be dated as of the Effective Date, and the Company shall take any required action to consummate the effectiveness of such resignations. |

| (iii) | The Board shall appoint the New Directors such that the effectiveness of their

appointments to the Board shall enter into effective immediately upon the resignation of the Outgoing Directors. |

In

the event following the Effective Date until the termination of this Agreement, Knorr- Bremse utilizes its right under Article 39(a)

of the Company’s articles of association to appoint additional directors to the Board (increasing the number of its

representatives on the Board to be higher than 2 members), then the Company shall immediately act to appoint by a resolution of the

Board the same number of additional directors, as shall be nominated by the Lender.

The mutual confidentiality agreement

attached as Annex C herein shall govern the confidentiality obligations of the Parties.

| 17.1. | Governing Law; Jurisdiction. The laws of the State of Israel, irrespective

of its conflicts of law principles, shall govern the validity of this Agreement, the construction of its terms, and the interpretation

and enforcement of the rights and duties of the parties hereto. The appropriate courts in Tel-Aviv – Jaffa, Israel shall have exclusive

jurisdiction over any dispute or claim in connection with this Agreement and no other court shall have jurisdiction over any such matter. |

| 17.2. | Assignment; Binding Upon Successors and Assigns. |

The Lender and

the Borrower may not assign any of their rights under this Agreement.

If any provision of this Agreement,

or the application thereof, shall for any reason and to any extent be invalid or unenforceable, then the remainder of this Agreement and

the application of such provision to other persons or circumstances shall be interpreted so as reasonably to effect the intent of the

parties hereto. The Parties further agree to replace such void or unenforceable provision of this Agreement with a valid and enforceable

provision that shall achieve, to the extent possible, the economic, business and other purposes of the void or unenforceable provision.

| 17.4. | Counterparts; Scanned Signatures |

This Agreement may be executed

in any number of counterparts, each of which shall be an original as regards any Party whose signature appears thereon and all of which

together shall constitute one and the same instrument. This Agreement may be executed and delivered by one Party hereto to the other Party

hereto by e-mail transmission of a photocopy of the original signature page hereto, and upon receipt of such e-mail transmission will

be deemed to have the same effect as if the original signature had been delivered to the other parties.

| 17.5. | Amendments; Expenses |

Any term or provision of this

Agreement may be amended mutually in writing by the Parties. Each Party shall bear its own expenses in connection with the execution and

performance of this Agreement.

A waiver by a Party of any breach

or default by the other Party shall not be deemed to constitute a waiver of any other default or any succeeding breach or default. The

failure of a Party to enforce any of the provisions hereof shall not be construed to be a waiver of the right of that Party thereafter

to enforce such provisions.

All

notices and other communications required or permitted under this Agreement shall be in writing and shall be either hand delivered in

person, sent by e-mail, sent by certified or registered mail, postage pre-paid, or sent by express courier service. Such notices and

other communications shall be effective upon receipt if hand delivered, if sent by e-mail – one (1) Business Day following transmission,

seven (7) Business Days after mailing if sent by mail, and one (1) Business Day after dispatch if sent by express courier, to the following

addresses, or such other addresses as any party may notify the other party in accordance with this Clause 17.7: if to Borrower:

Rail Vision Ltd., 15 Ha’Tidhar St., Raanana, Israel, Attention: Shahar Hania, E-mail: shahar@railvision.io; if to Lender: L.I.A.

Pure Capital Ltd., 20 Wallenberg Raul, Tel Aviv, Israel, Attention: Kfir Zilberman, E-mail: kfir@shremzilberman.com.

All obligations, covenants and

rights of the Parties hereunder shall terminate and expire upon repayment in full of the amounts to be repaid herein, except for the confidentiality

obligations of the Parties hereunder, the applicable undertakings of the Lender pursuant to Clause 14.1 – 14.3 and 14.5 which shall

survive the termination of this Agreement in accordance with their respective terms.

This Agreement, the annexes and

schedules hereto, constitute the entire understanding and agreement of the Parties with respect to the subject matter hereof and supersede

all prior and contemporaneous agreements or understandings, inducements or conditions, express or implied, written or oral, between the

Parties with respect hereto, including without limitation to the memorandum of understanding executed between the Parties on December

21, 2023.

[Signature page follows]

IN WITNESS WHEREOF, this Agreement

has been executed by the duly authorized representative of each Party as of the date first stated above.

| L.I.A. Pure Capital Ltd. |

|

Rail Vision Ltd. |

| |

|

|

| By: |

/s/ Kfir Zilberman |

|

By: |

/s/ Shahar Hania |

| Name: |

Kfir Zilberman

| |

|

/s/ Ofer Naveh |

| Title: |

CEO |

|

Name: |

Shahar Hania & Ofer Naveh |

| |

|

Title: |

CEO & CFO |

14

Exhibit

99.2

NEITHER

THE ISSUANCE AND SALE OF THE SECURITIES REPRESENTED BY THIS CERTIFICATE NOR THE SECURITIES INTO WHICH THESE SECURITIES ARE EXERCISABLE

HAVE BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED, OR APPLICABLE STATE SECURITIES LAWS. THE SECURITIES MAY NOT BE OFFERED

FOR SALE, SOLD, TRANSFERRED OR ASSIGNED (I) IN THE ABSENCE OF (A) AN EFFECTIVE REGISTRATION STATEMENT FOR THE SECURITIES UNDER THE SECURITIES

ACT OF 1933, AS AMENDED, OR (B) AN OPINION OF COUNSEL SELECTED BY THE HOLDER, IN A GENERALLY ACCEPTABLE FORM, THAT REGISTRATION IS NOT

REQUIRED UNDER SAID ACT OR (II) UNLESS SOLD PURSUANT TO RULE 144 OR RULE 144A UNDER SAID ACT. NOTWITHSTANDING THE FOREGOING, THE SECURITIES

MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN ACCOUNT OR OTHER LOAN OR FINANCING ARRANGEMENT SECURED BY THE SECURITIES.

RAIL

VISION LTD.

Warrant

To Purchase Ordinary Shares

Warrant

No.: 1

Number

of Ordinary Shares: 2,419,355

Date

of Issuance: January 8, 2024 (“Issuance Date”)

Rail

Vision Ltd, an Israeli company (the “Company”), hereby certifies that, for good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, L.I.A. PURE CAPITAL LTD., the registered

holder hereof or its permitted assigns (the “Holder”), is entitled, subject to the terms set forth below, to purchase

from the Company, at the Exercise Price (as defined below) then in effect, at any time or times on or after the date hereof, but not

after 11:59 p.m., New York time, on the Expiration Date, (as defined below), 2,419,355 fully paid nonassessable Ordinary Shares, subject

to adjustment as provided herein (the “Warrant Shares”). Except as otherwise defined herein, capitalized terms in this

Warrant to Purchase Ordinary Shares (including any Warrants to Purchase Ordinary Shares issued in exchange, transfer or replacement hereof,

this “Warrant”), shall have the meanings set forth in Section 17. This Warrant is issued pursuant to Section 12 of that

certain Credit Facility Agreement, dated as of January 7, 2024 (the “Agreement Date”), by and among the Company and

the Holder (the “Agreement”). Capitalized terms used herein and not otherwise defined shall have the definitions ascribed

to such terms in the Agreement.

1.

EXERCISE OF WARRANT.

(a)

Mechanics of Exercise. Subject to the terms and conditions hereof (including, without limitation, the limitations set forth in

Section 1(f)), this Warrant may be exercised by the Holder at any time or times on or after the Issuance Date, in whole or in part, by

(i) delivery of a written notice, in the form attached hereto as Exhibit A (the “Exercise Notice”), of the

Holder’s election to exercise this Warrant and (ii) (A) payment to the Company of an amount equal to the applicable Exercise Price

multiplied by the number of Warrant Shares as to which this Warrant is being exercised (the “Aggregate Exercise Price”)

in cash by wire transfer of immediately available funds or (B) by notifying the Company that this Warrant is being exercised pursuant

to a Cashless Exercise (as defined in Section 1(d)). The Holder shall not be required to deliver the original Warrant in order to effect

an exercise hereunder. Execution and delivery of the Exercise Notice with respect to less than all of the Warrant Shares shall have the

same effect as cancellation of the original Warrant and issuance of a new Warrant evidencing the right to purchase the remaining number

of Warrant Shares. On or before the first (1st) Trading Day following the date on which the Company has received the Exercise

Notice, the Company shall transmit by electronic mail an acknowledgment of confirmation of receipt of the Exercise Notice to the Holder

and the Company’s transfer agent (the “Transfer Agent”). On or before the earlier of (i) the second (2nd)

Trading Day and (ii) the number of Trading Days comprising the Standard Settlement Period, in each case, following the date on which

the Holder delivers the Exercise Notice to the Company, so long as the Holder delivers the Aggregate Exercise Price (or notice of a Cashless

Exercise) on or prior to the Trading Day following the date on which the Company has received the Exercise Notice (the “Share

Delivery Date”) (provided that if the Aggregate Exercise Price has not been delivered by such date, the Share Delivery Date

shall be one (1) Trading Day after the Aggregate Exercise Price (or notice of a Cashless Exercise) is delivered), the Company shall (X)

provided that the Transfer Agent is participating in The Depository Trust Company (“DTC”) Fast Automated Securities

Transfer Program and (A) the Warrant Shares are subject to an effective resale registration statement in favor of the Holder or (B) if

exercised via Cashless Exercise, at a time when Rule 144 would be available for resale of the Warrant Shares by the Holder, credit such

aggregate number of Warrant Shares to which the Holder is entitled pursuant to such exercise to the Holder’s or its designee’s balance

account with DTC through its Deposit / Withdrawal At Custodian system, or (Y) if the Transfer Agent is not participating in the DTC Fast

Automated Securities Transfer Program or (A) the Warrant Shares are not subject to an effective resale registration statement in favor

of the Holder and (B) if exercised via Cashless Exercise, at a time when Rule 144 would not be available for resale of the Warrant Shares

by the Holder, deliver to the Holder, book entry statements evidencing the Warrant Shares, for the number of Warrant Shares to which

the Holder is entitled pursuant to such exercise. The Company shall be responsible for all fees and expenses of the Transfer Agent and

all fees and expenses with respect to the issuance of Warrant Shares via DTC, if any. Upon delivery of the Exercise Notice, the Holder

shall be deemed for all corporate purposes to have become the holder of record of the Warrant Shares with respect to which this Warrant

has been exercised, irrespective of the date such Warrant Shares are credited to the Holder’s DTC account or the date of delivery of

the book entry statements evidencing such Warrant Shares, as the case may be. If this Warrant is submitted in connection with any exercise

pursuant to this Section 1(a) and the number of Warrant Shares represented by this Warrant submitted for exercise is greater than the

number of Warrant Shares being acquired upon an exercise, then the Company shall as soon as practicable and in no event later than three

(3) Trading Days after any exercise and at its own expense, issue a new Warrant (in accordance with Section 7(d)) representing the right

to purchase the number of Warrant Shares issuable immediately prior to such exercise under this Warrant, less the number of Warrant Shares

with respect to which this Warrant is exercised. No fractional Warrant Shares are to be issued upon the exercise of this Warrant, but

rather the number of Warrant Shares to be issued shall be rounded up to the nearest whole number. The Company shall pay any and all taxes

which may be payable with respect to the issuance and delivery of Warrant Shares upon exercise of this Warrant. The Company’s obligations

to issue and deliver Warrant Shares in accordance with the terms and subject to the conditions hereof are absolute and unconditional,

irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect to any provision hereof,

the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation

or termination.

(b)

Exercise Price. For purposes of this Warrant, “Exercise Price” means $3.1 per share, subject to adjustment as

provided herein.

(c)

Company’s Failure to Timely Deliver Securities. If the Company shall fail to cause its transfer agent to transmit to the Holder

on or prior to the Share Delivery Date, Warrant Shares pursuant to an exercise notice delivered by the Holder and if after such date

the Holder is required by its broker to purchase (in an open market transaction or otherwise) or the Holder’s brokerage firm otherwise

purchases, Ordinary Shares to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving

upon such exercise (a “Buy-In”), then the Company shall (a) pay in cash to the Holder the amount, if any, by which

(x) the Holder’s total purchase price (including brokerage commissions, if any) for the Ordinary Shares so purchased exceeds (y)

the amount obtained by multiplying (1) the number of Warrant Shares that the Company was required to deliver to the Holder in connection

with the exercise at issue times (2) the price at which the sell order giving rise to such purchase obligation was executed, and (b)

at the option of the Holder, either reinstate the portion of the Warrant and equivalent number of Warrant Shares for which such exercise

was not honored (in which case such exercise shall be deemed rescinded) or deliver to the Holder the number of Ordinary Shares that would

have been issued had the Company timely complied with its exercise and delivery obligations hereunder. For example, if the Holder purchases

Ordinary Shares having a total purchase price of $11,000 to cover a Buy-In with respect to an attempted exercise of Ordinary Shares with

an aggregate sale price giving rise to such purchase obligation of $10,000, under clause (a) of the immediately preceding sentence the

Company shall be required to pay the Holder $1,000. The Holder shall provide the Company written notice indicating the amounts payable

to the Holder in respect of the Buy-In and evidence of the amount of such loss. Nothing herein shall limit the Holder’s right to pursue

any other remedies available to it hereunder, at law or in equity, including, without limitation, a decree of specific performance and/or

injunctive relief with respect to the Company’s failure to timely deliver Ordinary Shares upon the exercise of this Warrant as required

pursuant to the terms hereof.

(d)

Cashless Exercise. While this Warrant is outstanding, the Company will use its best efforts to maintain the effectiveness of the

Registration Statement. Notwithstanding anything contained herein to the contrary, if the Registration Statement covering the resale

of the Warrant Shares is not available for the resale of such Warrant Shares, the Holder may, in its sole discretion, exercise this Warrant

in whole or in part and, in lieu of making the cash payment otherwise contemplated to be made to the Company upon such exercise in payment

of the Aggregate Exercise Price, elect instead to receive upon such exercise the “Net Number” of Ordinary Shares determined

according to the following formula (a “Cashless Exercise”):

| |

Net

Number = |

(A x B) - (A x C) |

|

| |

|

B |

|

For

purposes of the foregoing formula:

A= the total number of shares with respect to which this Warrant is then being exercised.

B= as applicable: (i) the Weighted Average Price of the Ordinary Shares on the Trading Day immediately preceding the date of the applicable

Exercise Notice if such Exercise Notice is (1) both executed and delivered pursuant to Section 1(a) hereof on a day that is not a Trading

Day or (2) both executed and delivered pursuant to Section 1(a) hereof on a Trading Day prior to the opening of “regular trading

hours” (as defined in Rule 600(b) of Regulation NMS promulgated under the federal securities laws) on such Trading Day, (ii) the

Weighted Average Price of the Ordinary Shares on the Trading Day immediately preceding the date of the applicable Exercise Notice if

such Exercise Notice is executed during “regular trading hours” on a Trading Day and is delivered within two (2) hours thereafter

(including until two (2) hours after the close of “regular trading hours” on a Trading Day) pursuant to Section 1(a) hereof

or (iii) the Weighted Average Price of the Ordinary Shares on the date of the applicable Exercise Notice if the date of such Exercise

Notice is a Trading Day and such Exercise Notice is both executed and delivered pursuant to Section 1(a) hereof after the close of “regular

trading hours” on such Trading Day;

C= the Exercise Price then in effect for the applicable Warrant Shares at the time of such exercise.

If

Ordinary Shares are issued pursuant to this Section 1(d), the Company hereby acknowledges and agrees that the Warrant Shares issued in

a Cashless Exercise shall be deemed to have been acquired by the Holder, and the holding period for the Warrant Shares shall be deemed

to have commenced, on the date this Warrant was originally issued pursuant to the Securities Purchase Agreement. The Company agrees not

to take any position contrary to this Section 1(d).

(e)

Disputes. In the case of a dispute as to the determination of the Exercise Price or the arithmetic calculation of the Warrant

Shares, the Company shall promptly issue to the Holder the number of Warrant Shares that are not disputed and resolve such dispute in

accordance with Section 12.

(f)

Beneficial Ownership Limitations on Exercises. Notwithstanding anything to the contrary contained herein, the Company shall not

effect the exercise of any portion of this Warrant, and the Holder shall not have the right to exercise any portion of this Warrant,

pursuant to the terms and conditions of this Warrant to the extent that after giving effect to such exercise, the Holder together with

the other Attribution Parties collectively would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the

number of Ordinary Shares outstanding immediately after giving effect to such exercise. For purposes of the foregoing sentence, the aggregate

number of Ordinary Shares beneficially owned by the Holder and the other Attribution Parties shall include the number of Ordinary Shares

held by the Holder and all other Attribution Parties plus the number of Ordinary Shares issuable upon exercise of this Warrant with respect

to which the determination of such sentence is being made, but shall exclude the number of Ordinary Shares which would be issuable upon

(A) exercise of the remaining, unexercised portion of this Warrant beneficially owned by the Holder or any of the other Attribution Parties

and (B) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company beneficially owned by

the Holder or any other Attribution Party subject to a limitation on conversion or exercise analogous to the limitation contained in

this Section 1(f). For purposes of this Section 1(f), beneficial ownership shall be calculated in accordance with Section 13(d) of the

Securities Exchange Act of 1934, as amended (the “1934 Act”). For purposes of this Warrant, in determining the number

of outstanding Ordinary Shares the Holder may acquire upon the exercise of this Warrant without exceeding the Maximum Percentage, the

Holder may rely on the number of outstanding Ordinary Shares as reflected in (x) the Company’s most recent Annual Report on Form 20-F,

Report of Foreign Private Issuer on Form 6-K or other public filing with the Securities and Exchange Commission (the “SEC”),

as the case may be, (y) a more recent public announcement by the Company or (3) any other written notice by the Company or the Transfer

Agent setting forth the number of Ordinary Shares outstanding (the “Reported Outstanding Share Number”). If the Company

receives an Exercise Notice from the Holder at a time when the actual number of outstanding Ordinary Shares is less than the Reported

Outstanding Share Number, the Company shall (i) notify the Holder in writing of the number of Ordinary Shares then outstanding and, to

the extent that such Exercise Notice would otherwise cause the Holder’s beneficial ownership, as determined pursuant to this Section

1(f), to exceed the Maximum Percentage, the Holder must notify the Company of a reduced number of Warrant Shares to be purchased pursuant

to such Exercise Notice (the number of shares by which such purchase is reduced, the “Reduction Shares”) and (ii) as

soon as reasonably practicable, the Company shall return to the Holder any exercise price paid by the Holder for the Reduction Shares.

For any reason at any time, upon the written or oral request of the Holder, the Company shall within one (1) Trading Day confirm orally

and in writing or by electronic mail to the Holder the number of Ordinary Shares then outstanding. In any case, the number of outstanding

Ordinary Shares shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant,

by the Holder and any other Attribution Party since the date as of which the Reported Outstanding Share Number was reported. In the event

that the issuance of Ordinary Shares to the Holder upon exercise of this Warrant results in the Holder and the other Attribution Parties

being deemed to beneficially own, in the aggregate, more than the Maximum Percentage of the number of outstanding Ordinary Shares (as

determined under Section 13(d) of the 1934 Act) (the number of shares so issued by which the Holder’s and the other Attribution Parties’

aggregate beneficial ownership exceeds the Maximum Percentage, the “Excess Shares”), then the Holder shall not have

the power to vote or to transfer the Excess Shares and such Excess Shares shall be held in abeyance for the Holder until such time or

times, as its right thereto would not result in the Holder and its other Attribution Parties exceeding the Maximum Percentage, at which

time or times the Holder shall be delivered such shares to the extent as if there had been no such limitation. For purposes of clarity,

the Ordinary Shares issuable pursuant to the terms of this Warrant in excess of the Maximum Percentage shall not be deemed to be beneficially

owned by the Holder for any purpose including for purposes of Section 13(d) or Rule 16a-1(a)(1) of the 1934 Act. No

prior inability to exercise this Warrant pursuant to this paragraph shall have any effect on the applicability of the provisions

of this paragraph with respect to any subsequent determination of exercisability. The provisions of this paragraph shall be construed

and implemented in a manner otherwise than in strict conformity with the terms of this Section 1(f) to the extent necessary to correct

this paragraph or any portion of this paragraph which may be defective or inconsistent with the intended beneficial ownership limitation

contained in this Section 1(f) or to make changes or supplements necessary or desirable to properly give effect to such limitation, and,

in addition, with the intention that Sections 274 and 328 to the Israeli Companies Law, 1999, shall not apply to any of the transactions

contemplated under this Warrant. The limitation contained in this paragraph may not be waived and shall apply to a successor holder of

this Warrant.

(g)

Insufficient Authorized Shares. If at any time while this Warrant remains outstanding the Company does not have a sufficient number

of authorized and unreserved Ordinary Shares to satisfy its obligation to reserve for issuance upon exercise of this Warrant at least

a number of Ordinary Shares equal to 100% of the number of Ordinary Shares as shall from time to time be necessary to effect the exercise

of all of this Warrant then outstanding without regard to any limitation on exercise included herein (the “Required Reserve Amount”

and the failure to have such sufficient number of authorized and unreserved Ordinary Shares, an “Authorized Share Failure”),

then the Company shall immediately take all action necessary to increase the Company’s authorized Ordinary Shares to an amount sufficient

to allow the Company to reserve the Required Reserve Amount for this Warrant then outstanding. Without limiting the generality of the

foregoing sentence, as soon as practicable after the date of the occurrence of an Authorized Share Failure, but in no event later than

sixty (60) days after the occurrence of such Authorized Share Failure, the Company shall hold a meeting of its shareholders for the approval

of an increase in the number of authorized Ordinary Shares. In connection with such meeting, the Company shall provide each shareholder

with a proxy statement and shall use its best efforts to solicit its shareholders’ approval of such increase in authorized Ordinary Shares

and to cause its board of directors to recommend to the shareholders that they approve such proposal. Notwithstanding the foregoing,

if any such time of an Authorized Share Failure, the Company is able to obtain the approval of holders of a majority of the ordinary

shares voting at a general meeting to approve the increase in the number of authorized Ordinary Shares, the Company may satisfy this

obligation by obtaining such approval. In the event that upon any exercise of this Warrant, the Company does not have sufficient authorized

shares to deliver in satisfaction of such exercise, then unless the Holder elects to void such attempted exercise, the Holder may require

the Company to pay to the Holder within three (3) Trading Days of the applicable exercise, cash in an amount equal to the product of

(i) the quotient determined by dividing (x) the number of Warrant Shares that the Company is unable to deliver pursuant to this Section

1(g), by (y) the total number of Warrant Shares issuable upon exercise of this Warrant (without regard to any limitations or restrictions

on exercise of this Warrant) and (ii) the Black Scholes Value; provided, that (x) references to “the day immediately following the

public announcement of the applicable Fundamental Transaction” in the definition of “Black Scholes Value” shall instead

refer to “the date the Holder exercises this Warrant and the Company cannot deliver the required number of Warrant Shares because

of an Authorized Share Failure” and (y) clause (iii) of the definition of “Black Scholes Value” shall instead refer to

“the underlying price per share used in such calculation shall be the highest Weighted Average Price during the period beginning

on the date of the applicable date of exercise and the date that the Company makes the applicable cash payment.”

2.

ADJUSTMENT OF EXERCISE PRICE AND NUMBER OF WARRANT SHARES. The Exercise Price and the number of Warrant Shares shall be adjusted

from time to time as follows:

(a)

Adjustment Upon Issuance of Ordinary Shares. If and whenever on or after the Agreement Date, the Company issues or sells, or in

accordance with this Section 2 is deemed to have issued or sold, any Ordinary Shares (including the issuance or sale of Ordinary Shares

owned or held by or for the account of the Company, but excluding Ordinary Shares deemed to have been issued or sold by the Company in

connection with any Excluded Securities) for a consideration per share (the “New Issuance Price”) less than a price

(the “Applicable Price”) equal to the Exercise Price in effect immediately prior to such issue or sale or deemed issuance

or sale (the foregoing a “Dilutive Issuance”), then immediately after and subject to the consummation of such Dilutive

Issuance, the Exercise Price then in effect shall be reduced to an amount equal to the New Issuance Price. For purposes of determining

the adjusted Exercise Price under this Section 2(a), the following shall be applicable:

(i)

Issuance of Options. If the Company in any manner grants or sells any Options and the lowest price per share for which one Ordinary

Share is issuable upon the exercise of any such Option or upon conversion, exercise or exchange of any Convertible Securities issuable

upon exercise of any such Option is less than the Applicable Price, then such Ordinary Share shall be deemed to be outstanding and to

have been issued and sold by the Company at the time of the granting or sale of such Option for such price per share. For purposes of

this Section 2(a)(i), the “lowest price per share for which one Ordinary Share is issuable upon the exercise of any such Option

or upon conversion, exercise or exchange of any Convertible Securities issuable upon exercise of any such Option” shall be equal

to the sum of the lowest amounts of consideration (if any) received or receivable by the Company with respect to any one Ordinary Share,

upon exercise of the Option and upon conversion, exercise or exchange of any Convertible Security issuable upon exercise of such Option