11th Straight Quarter of YOY Revenue Growth TEL-AVIV, Israel, July

24 /PRNewswire-FirstCall/ -- RADCOM Ltd. (RADCOM)

(NASDAQ:RDCMNASDAQ:andNASDAQ:TASE:NASDAQ:RDCM) today announced

financial results for the second quarter and six months ended June

30, 2006. Financial Results for the Second Quarter Revenues for the

second quarter of 2006 were $5.7 million, an increase of 18%

compared with $4.8 million for the second quarter of 2005,

representing the Company's 11th straight quarter of year-over-year

revenue growth, and an increase of 12% compared with the $5.1

million recorded in the first quarter of 2006. Gross margin for the

second quarter of 2006 increased to 70% compared with 68% for the

parallel period of 2005 as well as for the first quarter of 2006.

On the basis of U.S. generally accepted accounted principles

(GAAP), the Company recorded net income for the second quarter of

2006 of $208,000, or $0.01 per ordinary share (basic and diluted).

Net income for the quarter included a non-cash share-based

compensation expense of $105,000 taken in respect of the Company's

mandatory adoption of Statement of Financial Accounting Standards

No. 123 (revised 2004), "Share-Based Payment" ("SFAS 123R"). SFAS

123R requires that companies recognize the fair value of

share-based incentives as compensation. The Company is also

presenting its results on a non-GAAP basis excluding share-based

compensation to provide investors and management with insight into

RADCOM's underlying operating results. On such non-GAAP basis,

RADCOM's net income for the second quarter of 2006 was $313,000, or

$0.02 per Share, an increase of 204% compared with $103,000, or

$0.01 per ordinary share (basic and diluted), for the second

quarter of 2005, which did not include share-based compensation.

Financial Results for the First Half Revenues for the first six

months of 2006 rose by 9% to $10.8 million compared to $9.9 million

for the first half of 2005. Gross margin for the first half of 2006

was 69%, a slight rise compared to 68% for the parallel period of

2005. On the basis of U.S. generally accepted accounted principles

(GAAP), the Company recorded net income of $89,000, or $0.01 per

ordinary share (basic and diluted) for the first half of 2006. Net

income for the six-month period included non-cash share-based

compensation expense of $233,000 taken in respect of SFAS 123R, as

explained above. The Company has also presented its results on a

non-GAAP basis excluding share-based compensation to provide

investors and management with insight into RADCOM's underlying

operating results. On such non-GAAP basis, RADCOM's net income for

the first six months of 2006 was $322,000, or $0.02 per share. Net

income for the first six months of 2005, which did not include

share-based compensation, was $237,000, or $0.02 per share.

Comments of Management Commenting on the news, Mr. Arnon

Toussia-Cohen, President and CEO, said, "The second quarter was

another period of revenue growth, profitability and strategic

progress for RADCOM. Our revenues fell marginally short of our

original projections due to accounting policies relating to a

multiple element agreement that prevented the recognition of

revenues associated with an order shipped during the second

quarter. Nevertheless, we were able to post our eleventh straight

quarter of year-over-year revenue growth and a 12% sequential

increase in sales, achieving another solidly profitable quarter for

RADCOM." Mr. Toussia-Cohen continued, "We are very pleased by the

overall development of our business in line with our plan for

building the company to the next level. The rising pace of global

3G deployments continues to drive demand for our 3G service

monitoring solutions, as demonstrated by the follow-on orders that

we continue to receive from cellular operators in North America,

Europe and Australia. In addition, we are seeing a rise in Omni-Q

demand from wireline operators as they ramp up their VoIP and other

converged network deployments." Mr. Toussia-Cohen concluded, "Taken

as a whole, we are optimistic regarding the future and believe that

market trends are working in our favor. We are on track for

achieving a stronger second half of the year and continue working

to build the Company to the next level." Guidance The following

statement is forward-looking in nature, and actual results may

differ materially. See below under "Risks Regarding Forward Looking

Statements". Given the reliance of the Company's performance for

any specific quarter on the timing of a relatively small number of

relatively large orders, the Company's quarterly results of

operations are subject to fluctuations. Nonetheless, management

projects that the Company's revenues for the third quarter of 2006

will range between $6.7 million and $7.1 million, and that its

revenues for the second half of the year will be significantly

improved compared with those of the first half of the year.

Conference Call Information RADCOM's management will hold an

interactive conference call today, July 24th, at 9:00 AM EDT (16:00

Israel Time) to discuss the results and to answer investor

questions. To participate, please call 1-877-209-0397 from the

U.S., or +1-612-332-0819 from international locations,

approximately five minutes before the call is scheduled to begin. A

replay of the call will be available from 10:45 AM Eastern Time on

July 24th until midnight July 31st. To access the replay, please

call 1-800-475-6701 from the U.S., or +1-320-365-3844 from

international locations, and use the access code 836284. The

conference call can also be accessed online at

http://www.radcom.com/. Non-GAAP Information Certain non-GAAP

financial measures are included in this press release. These

non-GAAP financial measures are provided to enhance the user's

overall understanding of our financial performance. By excluding

non-cash equity based compensation that has been expensed in

accordance with SFAS 123R, our non-GAAP results provide information

to both management and investors that is useful in assessing

RADCOM's core operating performance and in evaluating and comparing

our results of operations on a consistent basis from period to

period. These non-GAAP financial measures are also used by

management to evaluate financial results and to plan and forecast

future periods. The presentation of this additional information is

not meant to be considered a substitute for the corresponding

financial measures prepared in accordance with generally accepted

accounting principles. RADCOM develops, manufactures, markets and

supports innovative network test and service monitoring solutions

for communications service providers and equipment vendors. The

company specializes in Next Generation Cellular as well as Voice,

Data and Video over IP networks. Its solutions are used in the

development and installation of network equipment and in the

maintenance of operational networks. The company's products

facilitate fault management, network service performance monitoring

and analysis, troubleshooting and pre-mediation. RADCOM's shares

are listed on both the Nasdaq Global Market and the Tel Aviv Stock

Exchange under the symbol RDCM. For more information, please visit

http://www.radcom.com/. Risks Regarding Forward Looking Statements

Certain statements made herein that use the words "estimate,"

"project," "intend," "expect", "believe" and similar expressions

are intended to identify forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements involve known and unknown risks

and uncertainties which could cause the actual results, performance

or achievements of the Company to be materially different from

those which may be expressed or implied by such statements,

including, among others, changes in general economic and business

conditions and specifically, decline in demand to the Company's

products, inability to timely develop and introduce new

technologies, products and applications and loss of market share

and pressure on prices resulting from competition. For additional

information regarding these and other risks and uncertainties

associated with the Company's business, reference is made to the

Company's reports filed from time to time with the Securities and

Exchange Commission. The Company does not undertake to update

forward-looking statements. RADCOM Ltd. Consolidated Statements of

Operations (1000's of U.S. dollars, except per share data) Three

months ended Six months ended June 30, June 30, 2006(a) 2005

2006(b) 2005 (unaudited) (unaudited) (unaudited) (unaudited) Sales

$ 5,701 $ 4,837 $ 10,781 $ 9,854 Cost of sales 1,704 1,571 3,319

3,192 Gross profit 3,997 3,266 7,462 6,662 Research and

development, gross 1,620 1,416 3,183 2,831 Less - royalty-bearing

participation 554 489 1,004 884 Research and development, net 1,066

927 2,179 1,947 Sales and marketing 2,374 1,870 4,473 3,736 General

and administrative 475 422 945 833 Total operating expenses 3,915

3,219 7,597 6,516 Operating income (loss) 82 47 (135) 146 Financing

income, net 126 56 224 91 Net income 208 103 89 237 Basic net

earnings per ordinary share $ 0.01 $ 0.01 $ 0.01 $ 0.02 Diluted net

earnings per ordinary share $ 0.01 $ 0.01 $ 0.01 $ 0.02 Weighted

average number of ordinary shares used in computing basic net

earnings per ordinary share 16,074,528 14,792,288 15,661,349

14,540,644 Weighted average number of ordinary shares used in

computing diluted net earnings per ordinary share 16,591,986

16,069,930 16,748,398 16,152,875 Note a: The Company's results for

the second quarter of 2006 according to U.S. GAAP include non-cash

share-based compensation expense of $105,000 allocated as follows:

$3,000 to cost of sales, $25,000 to research and development,

$48,000 to sales and marketing and $29,000 to general and

administrative. Note b: The Company's results for the six months of

2006 according to U.S. GAAP include non-cash share-based

compensation expense of $233,000 allocated as follows: $6,000 to

cost of sales, $52,000 to research and development, $91,000 to

sales and marketing and $84,000 to general and administrative.

RADCOM Ltd. Consolidated Balance Sheets (1000's of U.S. dollars) As

of As of June 30, December 31, 2006 2005 (unaudited) (unaudited)

Current Assets Cash and cash equivalents 11,682 10,520 Trade

receivables, net 8,437 7,856 Inventories 2,364 1,938 Other current

assets 951 380 Total Current Assets 23,434 20,694 Assets held for

severance benefits 2,075 1,863 Property and equipment, net 1,400

1,233 Total Assets 26,909 23,790 Liabilities and Shareholders'

Equity Current Liabilities Trade payables 2,262 2,148 Current

deferred revenue 1,735 1,545 Other payables and accrued expenses

4,010 4,014 Total Current Liabilities 8,007 7,707 Long-Term

Liabilities Long-term deferred revenue 1,229 1,161 Liability for

employees' severance pay benefits 2,727 2,437 Total Long-Term

Liabilities 3,956 3,598 Total Liabilities 11,963 11,305

Shareholders' Equity Share capital 118 107 Additional paid-in

capital 46,974 44,613 Accumulated deficit (32,146) (32,235) Total

Shareholders' Equity 14,946 12,485 Total Liabilities and

Shareholders' Equity 26,909 23,790 Contact: Jonathan Burgin CFO

+(972)-3-645-5004 DATASOURCE: RADCOM Ltd. CONTACT: Contact:

Jonathan Burgin, CFO, +(972)-3-645-5004,

Copyright

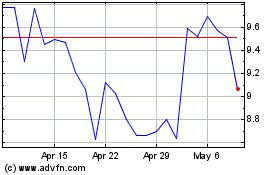

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Sep 2024 to Oct 2024

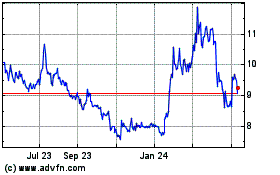

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Oct 2023 to Oct 2024