UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 (Amendment No.)

Filed

by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary

Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive

Proxy Statement |

| ☐ | Definitive

Additional Materials |

| ☐ | Soliciting

Material Pursuant to Section 240.14a-12 |

Quantum

Corporation

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee

paid previously with preliminary materials. |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Preliminary Proxy Statement

Subject to Completion

2024

A

Message from our Chairman and CEO

Dear Quantum Shareholders,

I sincerely

believe in being transparent, so I want to acknowledge that our fiscal year 2024 was not one that any of us expected. We didn’t

plan to spend much of the year being off file with our financial statements, and thus unable to share the details and positive

impacts of our concentrated work to bolster our balance sheet, improve our operating results, increase our execution efficiencies,

and focus on our mission to deliver unique solutions for AI workflows and unstructured data across our customers’ entire

data lifecycle.

Now that we have reported on our financial performance, I am truly excited to speak with you about Quantum’s deep capabilities

to succeed in the AI era. Our end-to-end software and hardware platforms deploy AI solutions to tag, catalog, and index your

data, making it easy to find, recall, and reuse. Thousands of customers rely on our solutions to leverage their unique data

to fuel AI, inform decisions, innovate new products, and improve people’s lives.

Our award-winning Quantum MyriadTM all-flash file and object storage platform and ActiveScaleTM multi-tiered, extremely durable

software and hardware solutions are well positioned to leverage vastly multiplying AI-driven data workflows and analysis.

Our ScalarTM tape libraries continue to operate as backbone infrastructure for the world’s largest hyperscalers and

public cloud providers. Our customers don’t just store data with our products, they entertain the world, build homes

and communities, secure borders, and save lives. I couldn’t be prouder of what we have helped them achieve, and am awed

by the possibilities of how we can help solve our customers’ toughest challenges as we move further into fiscal year

2025, and beyond.

I hope you can feel my enthusiasm for

what lies ahead, and join me in it. I look forward to speaking with you in more detail soon.

Jamie

| |

|

|

| |

|

|

| |

|

|

James

J. Lerner

President and Chief Executive Officer

Chairman of the Board

|

|

|

©

2024 Quantum Corporation | | 3 |

Notice of Annual

Meeting of Shareholders

|

|

|

|

| |

|

|

|

| June

20, 2024 |

August

15, 2024 |

8:30a.m.

Pacific Time |

http://www.viewproxy.com/QMCO/2024 |

| Record

Date |

Annual

Meeting Date |

Annual

Meeting Time |

Virtual

Meeting |

| |

|

|

(you

must preregister in order to attend) |

Quantum Corporation (Quantum or the Company)

invites you to attend our 2024 annual meeting of shareholders (Annual Meeting) on Thursday, August 15, 2024, beginning promptly

at 8:30a.m. Pacific Time. At the meeting, we will consider and vote on the following proposals:

|

|

|

|

|

|

|

| Elect

Directors |

Approve

Reverse Stock Split |

Amend

the 2023 Long-Term

Incentive Plan |

Amend

the Employee Stock

Purchase Plan |

Non-Binding

Advisory

Vote

on Executive

Compensation |

Ratify

Grant Thornton LLP as

Independent Auditors |

Other

Matters

Properly Raised |

Only shareholders of record at the

close of business on June 20, 2024 (the Record Date), or their valid proxy holders, may vote at the meeting. Our Board of Directors

(Board) recommends you vote “FOR” each of the nominees in Proposal 1, and “FOR” Proposals 2, 3, 4, 5, and

6.

|

©

2024 Quantum Corporation | | 4 |

Important Notice Regarding the Availability

of Proxy Materials

Our 2024 proxy statement,

including more complete descriptions of proposals and Board candidates, is set forth on the following pages. This information is

also available at http://www.viewproxy.com/QMCO/2024.

In order to increase efficiency and reduce

the environmental impact of the proxy process, shareholders will not automatically receive paper copies of our proxy

statement and annual report. We will instead send a Notice of Internet Availability (Notice) with instructions for accessing

the proxy materials and voting online. The notice will also provide information about how shareholders may obtain paper

copies of proxy materials if hard copies are preferred. Our Notice is first being mailed on or about July 2, 2024 to all

shareholders entitled to vote at the Annual Meeting.

Quantum knows of no other matters to be

submitted at the Annual Meeting. As Corporate Secretary, I must receive any shareholder proposals intended for

consideration at the Annual Meeting within the timeframes, and including the required information, specified in our Bylaws

and required by the rules of the Securities and Exchange Commission (SEC). If any other matters properly come before the

Annual Meeting, the persons named in the form of proxy will vote the shares they represent as the Board may recommend.

By Order of the Board of Directors,

Brian E. Cabrera

Senior Vice President, Chief Administrative

Officer, Chief Legal and Compliance Officer, and Corporate Secretary

[date]

|

©

2024 Quantum Corporation | | 5 |

Table of Contents

BOARD

OF DIRECTORS AND COMMITTEES

| Director Biographies |

8 |

| Board Meetings and Independence |

18 |

| Board Committees and Leadership

Structure |

19 |

| Director Candidate Evaluation |

23 |

| |

|

CORPORATE

GOVERNANCE |

|

| Ethics and

Compliance |

26 |

| Environmental, Social, and Governance

Oversight |

27 |

| Board Role in Risk Oversight and

Board Evaluation |

28 |

| Stock Ownership Guidelines |

29 |

| Non-Employee Director Compensation |

30 |

| |

|

|

PROPOSALS

|

|

| Proposal 1:

Election of Directors |

34 |

| Proposal 2: Approval of Reverse

Stock Split |

35 |

| Proposal 3: Amendment to the 2023

Long-Term Incentive Plan |

45 |

| Proposal 4: Amendment to the Employee

Stock Purchase Plan |

56 |

| Proposal 5: Non-Binding Advisory

Vote on Executive Compensation |

60 |

| Proposal 6: Ratification of Appointment of Independent Registered Public Accounting Firm |

61 |

| Other Proposals |

63 |

|

COMPENSATION DISCUSSION AND ANALYSIS |

|

| Fiscal 2024

Executive Compensation Highlights |

65 |

| Executive Compensation Philosophy

and Competitive Positioning |

66 |

| Compensation Elements |

68 |

| Perquisites and Other Benefits |

74 |

| Executive Compensation Process

and Decision Making |

76 |

| Compensation Governance Best Practices |

77 |

| Change of Control Severance Policy

and Employment and Severance Agreements |

80 |

| Tax and Accounting Considerations

and Risks Related to Compensation Policies and Practices |

81 |

| |

|

|

FISCAL

2024 COMPENSATION TABLES

|

|

| Fiscal

2024 Summary Compensation Table |

83 |

| Fiscal

2024 Grants of Plan-Based Awards |

84 |

| Outstanding Equity Awards at Fiscal

2024 Year End |

85 |

| Fiscal

2023 Options Exercised and Stock Vested |

88 |

| Potential Payments upon Termination

or Change of Control for Fiscal 2024 |

89 |

| Equity Compensation Plan Information |

91 |

| CEO Pay Ratio and Security Ownership

of Certain Beneficial Owners and Management |

92 |

| Pay Versus Performance |

95 |

|

BOARD

COMMITTEE REPORTS AND RELATED INFORMATION |

|

| Compensation

Committee Report |

100 |

| Draft Report of the Audit Committee of the Board of Directors |

101 |

| Independent Registered Public

Accounting Firm |

102 |

| Related Party Transactions |

103 |

| |

|

|

INFORMATION

CONCERNING SOLICITATION, VOTING, AND COMMUNICATION |

|

| General

Information, Notice and Access, Record Date and Outstanding Shares, and Voting Procedures |

106 |

| Householding, Solicitation, and

Communicating with the Company |

109 |

| Shareholder Proposals for Our

2025 Annual Meeting |

110 |

EXHIBITS

| A: |

Certificate

of Amendment to the Amended and Restated Certificate of Incorporation |

112 |

| B: |

2023

Long-Term Incentive Plan |

114 |

| C: |

Employee Stock Purchase Plan |

122 |

| |

|

|

| PROXY CARD |

127 |

|

©

2024 Quantum Corporation | | 6 |

|

©

2024 Quantum Corporation | | 7 |

Director Biographies

n4329pre14aimg

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

James

J. Lerner

President and Chief Executive Officer

Chairman of the Board |

Marc

E. Rothman

Chair,

Audit Committee

INDEPENDENT |

Yue

Zhou (Emily) White

Board Member

INDEPENDENT |

Christopher

D.

Neumeyer

Chair,

Corporate Governance

and Nominating Committee

INDEPENDENT |

Donald

J. Jaworski

Chair,

Leadership and

Compensation Committee

INDEPENDENT |

Hugues

Meyrath

Chair,

Technology Advisory

Committee

INDEPENDENT |

Todd

W. Arden

Board Member

INDEPENDENT |

John

T. Tracy

Board Member

INDEPENDENT |

The key roles for our Board include,

but are not limited to:

| • | Selecting and evaluating the Company’s Chief Executive Officer

(CEO). |

| • | Reviewing and approving the CEO’s objectives and compensation.

|

| • | Overseeing CEO succession planning. |

| • | Advising the CEO and management on the Company’s fundamental

strategies and approving the annual operating plan. |

| • | Approving acquisitions, divestitures, important organizational changes,

and other significant corporate actions. |

Mr. Lerner currently presides as the

Chairman of the Board and Mr. Rothman serves as Lead Independent Director.

For the April 1 – September 12, 2023

portion of the fiscal year ended March 31, 2024 (Fiscal 2024), Ms. Rebecca J. Jacoby served on the Board as the Chair of our

Leadership and Compensation Committee. Ms. Jacoby did not stand for re-election at our 2023 shareholder meeting.

Each of our directors, excluding Marc E. Rothman,

have been nominated for election at the Annual Meeting. Mr. Rothman does not have any disagreements with the Board or Quantum

management team on any matter relating to the Company’s operations, policies, or practices. The Board expects to appoint

a new Lead Independent Director and Audit Committee Chair following the Annual Meeting.

There are no familial relationships

between any directors or executive officers of the Company.

|

©

2024 Quantum Corporation | | 8 |

Mr.

Lerner has served as our President and Chief Executive Officer since July 2018. He

was appointed to the Board at that time and named Chairman in August 2018.

Some

of Quantum’s key accomplishments during Mr. Lerner’s tenure include:

| ● | Furthering

its transition from one-time hardware sales to a recurring software revenue model; |

| ● | Launching

more than 20 new products, including Quantum MyriadTM, an all-flash file and

object storage platform, and acquiring additional software and hardware features, products,

and business that introduced incremental performance capabilities; and |

| ● | Driving

the Company’s opportunities and position in the AI market. |

Mr.

Lerner previously served in senior leadership positions at Pivot3 Inc., a smart infrastructure solutions company. He held the

roles of Vice President and Chief Operating Officer from March 2017 to June 2018 and Chief Revenue Officer from November 2016

to March 2017. Prior to Pivot3, from March 2014 to August 2015, he served as President of Cloud Systems and Solutions at Seagate

Technology Public Limited Company, a publicly-traded data storage company.

Before

working at Seagate, Mr. Lerner served in various executive roles at Cisco Systems, Inc., a publicly-traded networking hardware

and software manufacturing company, including as Senior Vice President and General Manager of the Cloud & Systems Management

Technology Group. Prior to beginning his career as a technology company executive, he was a Senior Consultant at Andersen Consulting,

a financial advisory and consulting firm.

From

2011 to 2022, Mr. Lerner served on the Board of Trustees (including serving as Chair) of Astia, a global not-for-profit organization

built on a community of men and women dedicated to the success of women-led, high-growth ventures.

Mr.

Lerner earned a Bachelor of Arts in Quantitative Economics and Decision Sciences from the University of California, San Diego.

We

believe Mr. Lerner’s extensive history in our industry and unstructured data, his deep understanding of our business given

his role as our Chief Executive Officer, and executive-level experience at several publicly-traded companies qualifies him to

serve on our Board.

Mr.

Lerner does not sit on any Board committees.

|

©

2024 Quantum Corporation | | 9 |

| |

|

| |

| James

J. Lerner |

| President

and Chief Executive Officer |

| Age:

54 |

| |

| |

| |

| DIRECTOR |

| NOMINEE |

| |

|

| Chair |

| Board

of Directors |

| |

| |

| |

| |

| |

| |

| |

Ms.

White was elected to our Board in September 2021.

She

has served as Vice President of Enterprise Data and Analytics at NIKE, Inc., a public company that manufactures and sells athletic

apparel, since April 2020. Prior to NIKE, from February 2017 to April 2020, Ms. White served as Vice President of Enterprise Data

Engineering at Synchrony Financial, a publicly-traded consumer financial services company.

Ms.

White previously held multiple positions at General Electric entities. From November 2013 to June 2015, she served as Data Science

Director and Global Commercial IT Director at General Electric Healthcare, a company that manufactures and distributes medical

imaging modalities. From May 2007 to October 2013, she was Global Enterprise Resource Director and Senior Global Business Intelligence

Program Manager for General Electric Transportation, a company that manufactures equipment for energy generation industries.

Ms.

White’s education includes a:

| ● | Bachelor

of Science degree in Accounting and Finance from Shengyang Polytechnic University; |

| ● | Master

of Business Administration degree from Huron University; |

| ● | Master

of Applied Mathematics degree in Computer Science at the University of Central Oklahoma; and |

| ● | Certificate

in Health Economics & Outcomes Research from the University of Washington. |

We

believe Ms. White’s extensive senior management experience, particularly in data science and analytics, brings valuable

perspective to our Board and to the oversight of these functions within Quantum.

|

©

2024 Quantum Corporation | | 10 |

| |

|

| |

| Yue

Zhou (Emily) White |

| Age:

52 |

| |

| |

| |

| INDEPENDENT |

| DIRECTOR |

| NOMINEE |

| |

| |

|

| Member |

| Corporate Governance and Nominating Committee |

| |

| |

| |

| |

| |

| |

| |

Mr.

Neumeyer was elected to our Board in August 2022 and previously served as a non-voting Board observer since 2016.

He

is an executive vice president and portfolio manager at Pacific Investment Management Company, LLC (PIMCO), a global investment

management firm that provides investment solutions to companies, educational institutions, foundations, and endowments across

the world. Since joining PIMCO in January 2010, Mr. Neumeyer has held multiple roles and is currently responsible for identifying,

originating, and structuring corporate investments across the capital structure in a variety of industries for various PIMCO-managed

investment funds.

Mr.

Neumeyer’s previous experience includes:

| ● | Various

positions at The Blackstone Group, a leading global investment business from April 2004 to May 2009. |

| ● | Work

in the investment banking division of Credit Suisse First Boston, a global investment bank, from July 2002 to April 2004. |

Mr.

Neumeyer earned a Bachelor of Science degree in business from Indiana University and is a CFA® charterholder.

We

believe Mr. Neumeyer is qualified to serve on the Board due to his financial expertise. In addition, we have found that his ability

to convey shareholder interests to boards and management teams brings valuable shareholder perspectives to our Board oversight

and decision-making processes.

|

©

2024 Quantum Corporation | | 11 |

| |

|

| |

| Christopher D. Neumeyer |

| Age: 43 |

| |

| |

| |

| INDEPENDENT |

| DIRECTOR |

| NOMINEE |

| |

| |

|

| Chair |

| Corporate Governance and Nominating Committee |

| |

|

| Member |

| Leadership and Compensation Committee |

| |

| |

| |

Mr.

Jaworski was appointed to our Board in November 2022.

Mr.

Jaworski is President and Chief Operating Officer of Lacuna Technologies, Inc., a leader in software that helps municipalities

to operationalize digital infrastructure and manage transportation, since March 2021. Mr. Jaworski leads execution and is focused

on delivering value to Lacuna’s customers. Prior to joining Lacuna, from January 2015 to March 2020, he was CEO of SwiftStack,

Inc., an open-source cloud data management company focused on large scale data applications, which was acquired by NVIDIA Corporation,

a publicly-traded multinational technology company, in March 2020.

Mr.

Jaworski previously served as:

| ● | Senior

Vice President and General Manager of the core platform business at NetApp, Inc. from August 2010 through January 2012, where

the team focused on the transition to scale-out systems. |

| ● | Senior

Vice President Product at Brocade Communications Systems, Inc. |

| ● | General

Manager of the Enterprise Security business unit at Nokia Corporation. |

In

addition, Mr. Jaworski’s early career included management positions at Sun Microsystems, Inc. and Amdahl Corporation. He

has been an advisor and board member for a number of early-stage companies.

Mr.

Jaworski received a B.S. in Computer Science from Bowling Green State University and an MBA from Santa Clara University.

We

believe Mr. Jaworski brings strength to our Board through his broad and deep technology and product development and marketing

experience.

|

©

2024 Quantum Corporation | | 12 |

| |

|

| |

| Donald J. Jaworski |

| Age: 65 |

| |

| INDEPENDENT |

| DIRECTOR |

| NOMINEE |

| |

| |

|

| Chair |

| Leadership and Compensation Committee |

| |

|

| Member |

| Audit Committee |

| Technology Advisory Committee |

| |

| |

Mr.

Meyrath was appointed to our Board in November 2022.

Mr.

Meyrath has developed an extensive background in various leadership roles at global technology companies, most notably in the

networking and data storage segments. Most recently, from January 2017 to December 2021, he served as Chief Product Officer of

ServiceChannel Holdings Inc., a provider of SaaS-based multi-site solutions, which was acquired by Fortive Corporation, a publicly-traded

provider of connected workflow solutions, in 2021.

From

January 2014 to January 2017, Mr. Meyrath was Vice President at Dell Technologies Capital, a venture capital arm of Dell Technologies

that invests in enterprise and cloud infrastructure, where he was responsible for driving venture funding, mergers and acquisitions,

and other advisory roles for a diverse set of portfolio companies. He also held the role of Vice President of Product Management

and Business Development for Dell EMC’s Backup and Recovery Services, which offers data protection and business continuity

products.

Mr.

Meyrath’s experience also includes executive roles at:

| ● | Brocade

Communications Systems, Inc. |

| ● | Strategic

Business Systems, Inc. |

He

was previously a Quantum employee from January 2002 to September 2003.

We

believe Mr. Meyrath’s extensive work in product portfolio and technology development, and in particular his experience with

data storage technologies, provides valuable experience and perspective to our Board.

|

©

2024 Quantum Corporation | | 13 |

| |

|

| |

| Hugues Meyrath |

| Age: 54 |

| |

| INDEPENDENT |

| DIRECTOR |

| NOMINEE |

| |

| |

|

| Chair |

| Technology Advisory Committee |

| |

|

| Member |

| Audit Committee |

| |

| |

| |

Todd

W. Arden was appointed to our Board in June 2024.

Mr.

Arden brings a long-term foundation in capital management and private equity business development. Most recently, he held the

Senior Managing Director and Co-Chief Credit Officer position at Black Diamond Capital Management LLC, an alternative asset management

firm, from January 2016 until March 2020.

From

October 2012 to November 2014, Mr. Arden served as Chief Investment Officer – Octagon Credit Opportunities at CCMP Capital

Advisors, LP, an American private equity investment firm. He was previously a Managing Director at TPG Angelo Gordon (formerly

Angelo Gordon & Co. LP), a global alternative investment manager from March 2000 to June 2012. Prior to that, he held roles

as:

| ● | Senior

Research Analyst at AIG Global Investment Corporation. |

| ● | Senior

Equity Analyst at Troubh Partners LP. |

| ● | Manager

in the Financial Consulting Services practice at Arthur Anderson & Co., New York. |

Mr.

Arden received a Bachelor of Arts degree in Economics from Northwestern University and a Masters in Business Administration from

Columbia University’s Graduate School of Business. He is a Chartered Financial Analyst.

We

believe Mr. Arden’s expertise in capital structures and debt management brings important experience to our Board. Mr. Arden

does not sit on any Board committees.

|

©

2024 Quantum Corporation | | 14 |

| |

|

| |

| Todd W. Arden |

| Age:

57 |

| |

| INDEPENDENT |

| DIRECTOR |

| NOMINEE |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

We

expect to appoint John R. Tracy to our Board immediately after filing our Form 10-K for Fiscal 2024.

Mr. Tracy has an extensive background in public company financial planning and operations. Most recently, he served as Executive

Vice President and Chief Financial Officer at Verifone Systems, Inc., a payment system company, from February 2019 until April

2024. Prior to that, from November 2017 to November 2019, Mr. Tracy served as Senior Director at Pine Hill Group, an accounting

and transaction advisory firm.

From July 2015 to October 2016, Mr. Tracy held the

position of Senior Vice President of Finance for TiVo Inc. (formerly Rovi), a streaming entertainment content delivery

service. Prior to that, he was Vice President of Finance and Chief Financial Officer for TE Connectivity Inc., a

publicly-traded electronics connector and sensor manufacturer, from June 2013 to June 2015. He also served as Vice President

and Corporate Controller at ConvaTec, a publicly-traded medical products and technology company, from October 2012 to June

2013.

Mr. Tracy also held various senior finance roles at Motorola Inc. and its subsidiaries.

Mr. Tracy received a Bachelor of Science degree in Accounting from Rider University and a Masters of Science in Taxation from

Fairleigh Dickinson University.

We believe Mr. Tracy’s financial expertise, including

his experience as a public company chief financial officer, will make him a valuable member of our Board.

|

©

2024 Quantum Corporation | | 15 |

| |

|

| |

| John R. Tracy |

| Age:

59 |

| |

| INDEPENDENT |

| DIRECTOR |

| NOMINEE |

| |

| |

|

| Member |

| Audit Committee |

| |

| |

| |

| |

| |

| |

| |

Marc

E. Rothman has served as a member of our Board since May 2017.

He

has been Senior Vice President and Chief Financial Officer at BMC Software, Inc. (BMC), a company that develops, delivers, and

services IT operations management software, since October 2020.

Before

joining BMC, Mr. Rothman served as Executive Vice President and Chief Financial Officer of Verifone Systems, Inc., a multinational

company providing technology for electronic payment transactions from 2013 to July 2020. Prior to Verifone, Mr. Rothman served

in various capacities, including as Senior Vice President and Chief Financial Officer at Motorola Mobility, Inc., a consumer electronics

and telecommunications company, from 2000 to 2012.

From

1995 to 2000, Mr. Rothman served in multiple leadership finance roles at General Instrument Corporation, which developed integrated

and interactive broadband access solutions, including as Vice President and Corporate Controller.

From

1987 through 1995, he was with Deloitte & Touche LLP, a professional services company.

Mr.

Rothman graduated with a bachelor’s degree in Business from Stockton University (formerly Richard Stockton College) with

Distinction and is a Certified Public Accountant in California (inactive).

We

believe that Mr. Rothman possesses specific attributes that qualify him to serve as a member of the Board, including his executive

leadership experience and deep financial expertise in:

| ● | Corporate

finance, accounting, and treasury; |

| ● | Restructuring,

mergers, and acquisitions; and |

|

©

2024 Quantum Corporation | | 16 |

| |

|

| |

| Marc E. Rothman |

| Age: 59 |

| |

| INDEPENDENT |

| |

| |

|

| Lead Independent Director |

| |

|

| Chair |

| Audit Committee |

| |

|

| Member |

| Corporate

Governance and Nominating Committee |

| Leadership

and Compensation Committee |

| |

|

©

2024 Quantum Corporation | | 17 |

Board

Meetings and Independence

Board

Meeting Attendance

The

Board met a total of 19 times in Fiscal 2024. All Board members during Fiscal 2024 attended at least 75% of the Board and Committee

meetings for which they were eligible to attend, which is the expectation outlined in our Corporate Governance Principles. Each

of the directors nominated for election at our 2023 annual meeting of shareholders attended that meeting.

Director

Independence

The

Board has determined that all current members other than Mr. Lerner are independent directors as defined under the rules of the

Nasdaq Stock Market LLC (Nasdaq). In addition to the listing standards and the SEC’s independence requirements, we are subject

to additional independence criteria as defined in the April 2019 Stipulation of Settlement we executed upon settlement of the

In re Quantum Corp. Derivative Litigation shareholder derivative action.

This

additional independence criteria requires that independent directors:

| • | Have

not received, during the current calendar year or any of the three immediately preceding

calendar years, direct or indirect remuneration (other than de minimis remuneration less

than $5,000) resulting from service as our significant supplier or customer, or as an

advisor, consultant, or legal counsel to Quantum or a member of our senior management

team; and |

| • | Are

not employed by a private or public company at which any of our executive officers serves

as a director. |

We

also exceed Nasdaq listing standards by requiring approximately 75% of our Board to be comprised of independent directors.

Our

independent directors meet in executive session, without employee directors, at least as often as each regularly scheduled quarterly

Board meeting. The independent directors are also empowered to request reporting from any employee during the executive session,

including audit and compliance personnel.

Leadership

Structure

Quantum’s

Board is committed to strong, independent Board leadership and oversight of management’s performance. The Board believes

it should determine whether the CEO should also serve as Board Chair. The Board determines the Chair assignment, from time to

time and in its business judgment after considering relevant factors, including Quantum’s needs and our shareholders’

best interests. Following a thorough evaluation, the Board has determined that Mr. Lerner should continue to serve as both Chairman

and CEO. The Board believes this structure promotes aligning strategic development and execution, effectively implementing strategic

initiatives, and exercising accountability for the Company’s performance. The Chair focuses on effectively leading and managing

the Board. The Board has appointed a Lead Independent Director to help provide robust, independent Board leadership. The roles

and responsibilities of the Chair and Lead Independent Director are described in more detail in our Corporate Governance Principles

available on the investor relations section of our website at www.investors.quantum.com.

|

©

2024 Quantum Corporation | | 18 |

Board

Committees and Leadership Structure

Board

Demographics and Committees

Key

demographics for our current Board members are:

|

|

|

| |

|

|

Independent

Committee

Chairs

(100%) |

Independent

Directors(85.7%) |

Female

or Ethnically

Diverse

Directors(14.3%) |

| |

|

|

|

3 |

54 |

| |

|

|

Aggregate

Meeting

Attendance

(96%) |

Average

Tenure

(Years) |

Average

Age

(Years) |

|

©

2024 Quantum Corporation | | 19 |

|

©

2024 Quantum Corporation | | 20 |

| 1Each of our standing committees is governed by a written charter, available on the investor relations section of our website at www.investors.quantum.com.

Copies of the charters may be requested from Quantum’s Corporate Secretary at 224 Airport Parkway, Suite 550, San Jose, California, 95110. |

|

©

2024 Quantum Corporation | | 21 |

| |

|

|

| |

|

|

| |

|

|

| |

CHAIR

RESPONSIBILITIES

•

Planning and organizing Board activities, including meeting agendas, frequency, content, and conduct.

•

Ensuring, along with the Corporate Governance and Nominating Committee, that the Board’s work processes

effectively enable the Board to exercise oversight and due diligence in fulfilling its mandate, including for the oversight of

Company strategy and risk.

•

Promoting effective communication among directors between Board meetings.

•

Working with committee chairs to ensure committees perform effectively and apprise the Board of actions

taken.

•

Ensuring that the Board’s action items are tracked and appropriately resolved.

•

Encouraging an environment that facilitates all directors expressing their views on key Board matters.

LEAD

INDEPENDENT DIRECTOR RESPONSIBILITIES

•

Presiding at any Board meeting the Chair does not attend, including executive sessions of only independent directors.

•

Calling meetings of non-management directors and providing appropriate executive session feedback to the

CEO and management.

•

Serving as a liaison and facilitator between the independent directors and CEO.

•

Advising the Chair regarding Board meeting agendas, frequency, content, and conduct.

•

Collaborating with Board committees, including the Corporate Governance and Nominating Committee, on appointing

members and chairs.

|

|

| |

|

|

| |

|

|

| |

|

|

|

©

2024 Quantum Corporation | | 22 |

Director

Candidate Evaluation

The

Corporate Governance and Nominating Committee is responsible for identifying, evaluating, recruiting, and recommending qualified

director candidates to our Board. The Board nominates directors for election at each annual shareholder meeting and appoints new

Board members at other times determined to be appropriate. Directors are not permitted to serve on the Board for more than ten

years.

General

and Specific Considerations

The

Board’s evaluation process will generally consider a candidate’s:

| • | High

integrity and character. |

| • | Qualifications

that will increase Board effectiveness. |

| • | Diverse

personal characteristics, thinking, and backgrounds. |

| • | Other

requirements as may be set forth by applicable rules, such as financial expertise for

audit committee members. |

The

Board will also more specifically weigh:

| • | Its

current size, composition, and performance and oversight requirements. |

| • | Previous

experience serving on public company boards or senior management teams. |

| • | Independence

determinations under all applicable rules, including Nasdaq and SEC. |

| • | Whether

the candidate possesses knowledge, experience, skills, and diversity to enhance the Board’s

ability to manage and direct the Company’s affairs and business. |

| • | Key

personal characteristics including strategic thinking, objectivity, independent judgment,

integrity, intellect, and the courage to speak out and actively participate in meetings. |

| • | Knowledge

of and familiarity with information technology. |

| • | The

absence of conflicts of interest with Quantum’s business. |

| • | A

willingness to devote significant time in effectively carrying out duties and responsibilities,

including committing to attend at least six Board meetings per year, sit on at least

one committee, and serve on the Board for an extended period of time. |

| • | Other

factors the Corporate Governance and Nominating Committee may consider appropriate. |

Identifying

and Evaluating Director Nominees

The

Corporate Governance and Nominating Committee uses the following procedures to identify and evaluate potential director nominees:

| • | Regularly

reviewing the Board’s size, composition, and collective performance, in addition

to individual member performance and qualifications. |

| • | Determining

whether to retain or terminate any third-party search firm used to identify director

candidates, including approving the fees paid. |

|

©

2024 Quantum Corporation | | 23 |

| • | Reviewing

qualifications of any properly identified, recommended, or nominated candidate. The committee’s

review, in its discretion, may consider only the information provided to it or include

discussions with third parties familiar with the candidate, candidate interviews, or

other actions the committee deems proper. |

| • | Evaluating

each candidate according to the General and Specific Considerations previously outlined. |

| • | Recommending

a slate of director nominees to be approved by the Board. |

| • | Endeavoring

to promptly notify director candidates of its decision regarding whether to nominate

a candidate for Board election. |

The

Board has not historically maintained a formal diversity policy for its members. However, in evaluating the Board’s composition,

the Board and Corporate Governance and Nominating Committee consider diversity of:

|

|

|

|

|

| |

|

|

|

|

| Knowledge |

Culture |

Race |

Gender |

Age |

The

Board believes that directors with a diverse range of perspectives, skills, and experiences enable it to more effectively oversee

all aspects of Quantum’s business. The Board considers underrepresented populations when seeking candidates for future nomination

to the Board, and seeks to include women and members of underrepresented groups in each nominee candidate pool.

Shareholder

Recommendations

The

Corporate Governance and Nominating Committee’s policy is to consider shareholder recommendations for Board candidates.

A shareholder must submit a written recommendation for a Board candidate to the attention of Quantum Corporation, Attn: Corporate

Secretary, 224 Airport Parkway, Suite 550, San Jose, CA 95110.

Submissions

must include:

| • | Candidate

name and contact information. |

| • | Detailed

biographical data and relevant qualifications, including references. |

| • | Descriptions

of any relationships between the candidate and Quantum. |

| • | The

shareholder’s statement in support of the candidate. |

| • | The

candidate’s written indication of his or her willingness to serve if elected. |

| • | Other

nominee information that our Bylaws and applicable SEC regulations require to be disclosed. |

Shareholder

Nominees

Shareholders

may also nominate director candidates for election to the Board. A shareholder that desires to nominate a candidate directly for

election must meet the deadlines and other requirements set forth in our Bylaws1 and SEC rules and regulations (see

Shareholder Proposals for Our 2025 Annual Meeting for more information).

The

Corporate Governance and Nominating Committee may require any prospective nominee to furnish other information it reasonably desires

to determine the nominee’s independence or eligibility to serve as a director.

| 1Our

Bylaws are available on the investor relations section of our website at www.investors.quantum.com and

as an exhibit to our annual report on Form 10-K. |

|

©

2024 Quantum Corporation | | 24 |

|

©

2024 Quantum Corporation | | 25 |

Ethics

and Compliance

We

conduct business ethically, honestly, and in compliance with all applicable laws and regulations. Our path through complex AI

and unstructured data environments presents new opportunities and as well as new challenges. Our code of conduct is meant to help

us successfully navigate this new landscape by enabling effective business processes, relationships, and solutions.

The

code applies to anyone conducting business on behalf of Quantum or its subsidiaries, including all directors, officers, and employees,

and defines expectations in each of the following key areas:

The

Board most recently revised the code in February 2024, and it was distributed to all employees in both English and local languages

the following month.

We

maintain an internal ethics committee comprised of leaders from our finance, internal audit, human resources, and legal teams.

The committee supports the Chief Administrative Officer’s oversight of our compliance program and provides appropriate assistance

in reviewing, investigating, and responding to reported concerns. We have also implemented a whistleblower policy and encourage

reporting of ethics and compliance concerns, including by providing a confidential and anonymous third-party reporting hotline.

Concerns

that may relate to material accounting or auditing matters are communicated promptly to our Audit Committee.

Waivers

of the code’s applicability to a Quantum director or executive officer may only be granted by our Board or its committees and

must be timely disclosed as required by applicable law.

The

code of conduct is available on the investor relations section of our website at www.investors.quantum.com.

Copies of the code may be requested from Quantum’s Corporate Secretary at 224 Airport Parkway, Suite 550, San Jose, California,

95110.

|

©

2024 Quantum Corporation | | 26 |

Environmental,

Social, and Governance Oversight

Our

environmental, social, and governance (ESG) sustainability philosophy is deeply ingrained in our core values. We view environmental

stewardship as an essential component of our long-term business strategy but recognize that the path to environmental excellence

is continuous and evolving. We are committed to adapting, innovating, and leading in this vital endeavor, fully cognizant that

our actions today will shape the world of tomorrow.

To

that end, in Fiscal 2024 we invested significant time and resources in improving our carbon footprint data, including by calculating

product-specific footprints and estimating employee commute impacts. Our Carbon Disclosure Project score continued to keep pace

with worldwide and industry-specific benchmarks.

The

Corporate Governance and Nominating Committee oversees our ESG initiatives and policies, including communicating with stakeholders.

Integral in that is our human capital management strategy, which includes:

|

|

|

|

|

|

| |

|

|

|

|

|

| Recruiting |

Retention |

Career

Development |

Performance

Management |

Rewards

and

Recognition |

Succession

Planning |

We

also conducted a culture survey in Fiscal 2024, finding that respondents generally have strong relationships with their managers,

which they value and find to be one of the best aspects of working at Quantum.

| 1Calculations

assume 1 unit in service for 12 hours per day over a 5-year life span, in a controlled environment.

Actual user results may vary. |

|

©

2024 Quantum Corporation | | 27 |

Board

Role in Risk Oversight and Board Evaluation

Quantum

faces a wide spectrum of financial, strategic, operational, and regulatory risks. The Audit Committee is primarily responsible

for overseeing the Company’s management of those risks and providing appropriate updates to the Board. The Audit Committee

guides our risk identification, assessment, and management policies and procedures, including discussions of our major risk exposures,

associated risk mitigation activities, and risk management practices implemented throughout the Company. It also actively monitors

the Company’s product and information technology cybersecurity risks and mitigation procedures.

The

Board’s other committees also oversee risks associated with their respective areas of responsibility, including:

| • | The

Leadership and Compensation Committee’s review of compensation practices risks. |

| • | The

Corporate Governance and Nominating Committee’s guidance regarding compliance risks. |

The

committees update the Board regarding their risk oversight practices through regular reporting and discussion.

While

the Board is responsible for risk oversight, risk management accountability lies with our management team. Quantum’s enterprise

risk management practices and formal risk assessments are led by our internal audit team, which periodically reports status to

the Audit Committee or Board, where appropriate. Our functional teams apply other appropriate risk assessment and mitigation techniques,

with the relevant management representatives updating the Board as needed.

Our

Board, committees, and individual directors perform annual self-evaluations in accordance with our corporate governance principles.

The evaluations ensure our Board is strategic, productive, and effective, and contributes to long-term shareholder value. As part

of the evaluation process, the Board, Mr. Lerner, and Mr. Cabrera hold ongoing discussions regarding Board and committee composition,

effectiveness, and decision-making, as well as individual director performance.

|

©

2024 Quantum Corporation | | 28 |

Stock

Ownership Guidelines

We

annually review our stock ownership guidelines for our CEO, directors, and other officers. We compare our guidelines with those

of peer group companies and consider ISS ownership governance best practices. Our Board believes that best aligning with shareholder

interests requires our directors to hold common stock amounts on the larger end of our peer group and the ISS guidelines.

In

Fiscal 2024, our Board determined it would continue the following stock ownership guidelines, which were last increased in 2020:

|

|

|

| |

|

|

| Directors |

CEO |

CFO |

| 5x Annual Retainer |

3x Annual Base Salary |

2x Annual Base Salary |

Our policy does not include vested and unvested outstanding stock options, unvested restricted stock and restricted stock units,

and unearned performance stock and performance stock units in share ownership. Eligible stock ownership includes the following

elements:

| • | Shares

purchased on the open market or through the 2022 rights offering. |

| • | Shares

acquired by exercising stock options or under our Employee Stock Purchase Plan. |

| • | Vested

restricted stock and restricted stock units. |

| • | Stock

beneficially owned in a trust. |

| • | Stock

held by a spouse or minor children. |

Compliance

with our stock ownership guidelines is due on the later of five years from:

| • | The

date an individual first became eligible for our stock ownership guidelines; or |

If

the dollar value of required holdings increases due to base salary or director cash compensation increases, stock ownership must

also be increased within five years. We measure compliance with these guidelines at the end of each fiscal year. At the end of

Fiscal 2024, all included positions were on track to meet their stock ownership guidelines.

|

©

2024 Quantum Corporation | | 29 |

Non-Employee

Director Compensation

The

Board and Leadership and Compensation Committee (Committee) determine the amount and form of non-employee director compensation.

Management provides information and recommendations regarding competitive market practices, target compensation levels, and compensation

program design. The Committee also retains an independent compensation consultant to provide analysis and advice regarding:

| • | Specific

compensation recommendations. |

| • | The

market competitiveness of our compensation program, including current compensation trends

and developments. |

| • | Benchmarking

against peer group and technology industry practices. |

While

the Committee carefully considers the information and recommendations it receives, the Board maintains ultimate authority for

decisions relating to non-employee director compensation. Mr. Lerner is the only Quantum employee on the Board and receives no

additional compensation for his Board service.

The

Committee generally conducts a comprehensive periodic review of the Company’s compensation program, most recently in Fiscal

2023. Quantum engaged Compensia as its independent compensation consultant to complete an independent review, which compared the

Company’s compensation program, design, and practices to those of our peer group. Our current non-employee director compensation

program elements are listed in the chart to the right.

In

Fiscal 2024, given the Company’s listing price and potential dilution impacts, the Board voted to delay its refresh equity

grant. As a result, no Board members other than Mr. Lerner received equity grants in Fiscal 2024. Board members did not receive

any incremental cash compensation to offset the delayed equity grant.

|

©

2024 Quantum Corporation | | 30 |

We

have executed change of control agreements with each of our non-employee directors other than Mr. Arden. The agreements provide

for automatic accelerated vesting of equity-based awards if the director’s service with the Company ends within 12 months

following a change of control (other than for termination due to death or disability).

We allow our non-employee directors to defer some or all of their cash fees, which defers federal and state income taxes.

Plan participants direct the deemed investment of their deferred accounts among a preselected group of investment funds which

excludes Quantum’s common stock. The deemed investment accounts mirror the investment options available under Quantum’s

401(k) Savings Plan. Plan participants’ deferred accounts are credited with interest based on their selected deemed

investments. During Fiscal 2024, no non-employee directors elected to participate in the deferred compensation plan.

Compensation Committee Interlocks and Insider

Participation

Mr. Jaworski, Mr. Neumeyer, and Mr. Rothman currently

comprise the Leadership and Compensation Committee of our Board of Directors. None is currently, nor has been at any time since

Quantum was formed, an officer or employee of the Company or any of its subsidiaries. Likewise, no Committee member has entered

into any transactions in which they will have a direct or indirect material interest adverse to the Company. No interlocking relationships

exist between any Board or Committee members and any other company’s board or compensation committee members, nor have they

previously existed.

|

©

2024 Quantum Corporation | | 31 |

|

©

2024 Quantum Corporation | | 32 |

Proposals

|

©

2024 Quantum Corporation | | 33 |

Proposal

1

Election

of Directors

Quantum

has nominated seven directors to

be elected to the Board at the Annual Meeting, to serve until the 2025 annual meeting or until their successors are duly qualified

and elected. The Corporate Governance and Nominating Committee recommended all nominees and the Board nominated all for election.

The

nominees are:

|

|

|

| |

|

|

| James

J. Lerner |

Yue

Zhou (Emily) White |

Christopher

D. Neumeyer |

|

|

|

|

| |

|

|

|

Donald J. Jaworski

|

Hugues Meyrath

|

Todd W. Arden

|

John R. Tracy

|

Required

Vote

This

is an uncontested election requiring a majority of votes cast. A majority of votes cast means that

the number of shares voted for a director exceeds the number of votes cast against the director. Abstentions will not be counted

for or against a nominee. If a director nominee does not receive a majority of votes cast, he or she will not be elected. See

Information Concerning Solicitation, Voting, and Communication for more information about majority voting.

Each

shareholder voting on Proposal 1 may cumulate their votes as described in Information Concerning Solicitation, Voting, and

Communication.

|

©

2024 Quantum Corporation | | 34 |

Proposal

2

Approval

of Reverse Stock Split

The

Board has adopted and recommends that shareholders approve an amendment (the Amendment) to the Company’s amended and restated

certificate of incorporation (the Restated Certificate) to effect a reverse stock split of our common stock by combining issued

shares of common stock into a lesser number of issued shares of common stock at a ratio ranging from 1 share-for-5 shares up

to a ratio of 1 share-for-20 shares, with the exact ratio to be selected by the Board and set forth in a public announcement (the

Reverse Stock Split). If the Amendment is approved by shareholders, the Reverse Stock Split may be effected at any time prior

to August 15, 2025. The Board may alternatively elect, in its sole discretion, to abandon such proposed Amendment and not effect

the Reverse Stock Split authorized by shareholders. Upon the effectiveness of the Amendment effecting the Reverse Stock Split,

the issued shares of our common stock will be combined into a lesser number of shares such that one share of our common stock

will be issued for a specified number of shares in accordance with the ratio for the Reverse Stock Split. The Reverse Stock Split

is not intended as, and will not have the effect of, a “going private transaction” covered by Rule 13e-3 promulgated

under the Exchange Act.

The

form of the proposed certificate of amendment to the Company’s Restated Certificate to effect the Reverse Stock Split is

attached hereto as Exhibit

A (the Certificate of Amendment).

The Certificate of Amendment that will be filed to effect the Reverse Stock Split will include the Reverse Stock Split ratio fixed

by the Board, within the range approved by our shareholders. If Proposal 2 is approved by our shareholders and the Board elects

to effect the Reverse Stock Split, the Certificate of Amendment may be filed with the Secretary of State of the State of Delaware

at any time prior to August 15, 2025, and the Reverse Stock Split and will become effective upon such filing or on the effective

date and time specified in the Certificate of Amendment (the Effective Time).

If

the Proposal 2 is approved by our shareholders, the board of directors would have the sole discretion to effect the Reverse Stock

Split at any time prior to August 15, 2025, and to fix the specific ratio for the Reverse Stock Split, provided that the ratio

would be not less than 1-for-5 and not more than 1-for-20. We believe that enabling our board of directors to fix the specific

ratio of the Reverse Stock Split within the stated range will provide us with the flexibility to implement the split in a manner

designed to maximize the anticipated benefits to the Company and our shareholders, as described below. The determination of the

ratio of the Reverse Stock Split will be based on a number of factors, described further below under Criteria to be Used for Decision

to Apply the Reverse Stock Split.

Reverse

Stock Split

The

primary purpose for effecting the Reverse Stock Split is to increase the per share trading price of our common stock so as to:

| • | maintain

the listing of our common stock on the Nasdaq Global Market and avoid a delisting of

our common stock from Nasdaq in the future on the basis of the Minimum Bid Price Requirement

(as defined below); and |

| • | broaden

the pool of investors that may be interested in investing in the Company by attracting

new investors who are prohibited from or prefer not to invest in shares that trade at

lower share prices. |

|

©

2024 Quantum Corporation | |

35 |

While

the number of authorized shares of our common stock will not change as a result of the Reverse Stock Split, it will cause the

number of issued and outstanding shares of our common stock to be reduced in accordance with the selected exchange ratio and will

therefore have the effect of increasing the authorized common stock available for future issuance.

In

evaluating the Reverse Stock Split, the Board has taken, and will take, into consideration negative factors associated with reverse

stock splits. These factors include:

| • | Negative

perceptions of reverse stock splits held by many shareholders, investors, analysts and

other stock market participants; |

| • | Reduced

number of shares of common stock potentially adversely affecting the liquidity of our

common stock; |

| • | A

decrease in our market capitalization following implementation of a reverse stock

split (recognized based on the experience of other companies that have effective

reverse stock splits); and |

| • | The

fact that the stock price of some companies that have effected reverse stock splits has

subsequently declined back to pre-reverse stock split levels. |

In

recommending approval of the Reverse Stock Split, the Board determined that these potential negative factors were significantly

outweighed by the potential benefits.

Criteria

to be Used for Decision to Apply the Reverse Stock Split

If

the stockholders approve the Reverse Stock Split, the Board will be authorized to proceed with the Reverse Stock Split, although

it may determine not to effect a Reverse Stock Split. The exact ratio of the Reverse Stock Split, within the 1-for-5 to 1-for-20

range, would be determined by the Board and set forth in a public announcement. In determining whether to proceed with the Reverse

Stock Split and setting the ratio for it, the Board expects to consider, among other things, factors such as:

| • | Nasdaq’s

minimum price per share requirements; |

| • | The

historical trading prices and trading volume of our common stock; |

| • | The

expected stability of the per share price of our common stock following the Reverse Stock

Split; |

| • | The

number of shares of our common stock that would be outstanding following the Reverse

Stock Split; |

| • | The

then-prevailing and expected trading prices and trading volume of our common stock and

the anticipated impact of the Reverse Stock Split on the trading market for our common

stock; |

| • | Our

market capitalization before and after the Reverse Stock Split; |

| • | The

anticipated impact of a particular ratio on our ability to reduce administrative and

transactional costs; and |

| • | Prevailing

general market and economic conditions. |

We

believe that granting our board of directors the authority to set the ratio for the Reverse Stock Split is essential because it

allows us to take these factors into consideration and to react to changing market conditions.

|

©

2024 Quantum Corporation | |

36 |

Reasons

for the Reverse Stock Split

The

Board is seeking authority to effect the Reverse Stock Split with the primary intent of increasing the price of our common stock

in order to meet the price criteria for continued listing on Nasdaq. Our common stock is publicly traded and listed on Nasdaq

under the symbol “QMCO.” The Board believes that, in addition to increasing the price of our common stock to meet

the price criteria for continued listing on Nasdaq, the Reverse Stock Split would also make our common stock more attractive to

a broader range of institutional and other investors. Accordingly, for these and other reasons discussed below, we believe that

effecting the Reverse Stock Split is in the Company’s and our shareholders’ best interests.

On

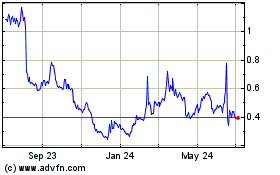

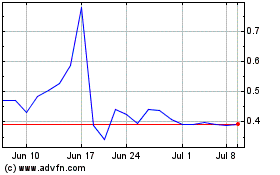

September 20, 2023, we received written notice from Nasdaq notifying us that we are not in compliance with the minimum bid price

requirements set forth in Nasdaq listing rule 5450(a)(1) for continued listing on Nasdaq (the Minimum Bid Price Requirement).

Nasdaq listing rule 5450(a)(1) requires that listed securities maintain a minimum closing bid price of $1.00 per share, and Nasdaq

listing rule 5810(c)(3)(A) provides that a failure to meet the minimum closing bid price requirement exists if the deficiency

continues for a period of 30 consecutive business days. Based on the closing bid price of the Company’s common stock for

the 30 consecutive business days prior to the date of the written notice, the Company did not meet the Minimum Bid Price Requirement.

In accordance with Nasdaq listing rule 5810(c)(3)(A), we were provided with a period of 180 calendar days to regain compliance

with the Minimum Bid Price Requirement. To regain compliance, the closing bid price of our common stock must have been at least

$1.00 per share for a minimum of 10 consecutive business days at any time prior to March 18, 2024.

On

March 19, 2024, we received a notice from Nasdaq that we did not meet the Minimum Bid Price Requirement and our common stock would

be scheduled for delisting at the opening of business on March 28, 2024, unless the Company timely requested a hearing before

the Nasdaq Hearings Panel (the Panel). On March 21, 2024, we timely requested a hearing before the Panel to appeal the delist

determination. On the same day, we received written notice from Nasdaq that the delisting action would be stayed until April 5,

2024, and on April 4, 2024, we requested that the stay of delisting be extended until the Panel issued a final decision on the

matter. On April 10, 2024, we received written notice from Nasdaq that the Panel granted our request to extend the stay of suspension

pending the hearing on May 14, 2024 and the issuance of a final Panel decision.

On

May 14, 2024, Messrs. Lerner, Gianella, Cabrera, and Ms. Nash met with the Panel to discuss our plan to regain compliance with

the Minimum Bid Price Requirement. On June 6, 2024, the Panel notified us that it had granted an extension of time for the Company

to regain Minimum Bid Price Requirement compliance, now due on or before September 16, 2024.

We

may regain compliance with the Minimum Bid Price Requirement if the bid price of our common stock closes at $1.00 per share or

more for a minimum of 10 consecutive business days at any time prior to September 16, 2024.

|

©

2024 Quantum Corporation | |

37 |

In

the event we are delisted from Nasdaq, the only established trading market for our common stock would be eliminated and our common

stock may then trade on the OTC Bulletin Board or other small trading markets. As a result, investors would likely find it more

difficult to trade, or to obtain accurate price quotations for, our common stock. Delisting would likely also reduce the visibility,

liquidity and value of our common stock, including as a result of reduced institutional investor interest in the Company, and

may increase the volatility of our common stock. Delisting could also cause a loss of confidence of customers, suppliers, potential

industry partners, lenders and employees, which could further harm our business and our future prospects. We believe that effecting

the Reverse Stock Split may help us avoid delisting from Nasdaq and any resulting consequences.

In

addition, the board of directors believes that an expected increased stock price could encourage investor interest and improve

the marketability of our common stock to a broader range of investors. In particular, because of the trading volatility often

associated with low-priced stocks, many brokerage firms and institutional investors have internal policies and practices that

either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced

stocks. Additionally, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock

price than commissions on higher-priced stocks, the current share price of our common stock may result in an investor paying transaction

costs that represent a higher percentage of total share value than would be the case if our share price were higher. The Board

believes that the higher share price that may result from the Reverse Stock Split could enable brokerage firms and institutional

investors with such policies and practices to invest in our common stock.

Although

we expect that the Reverse Stock Split will result in an increase in the market price of our common stock, it may not result in

a long-term increase in the market price of our common stock, which would be dependent on many factors, including general economic,

market and industry conditions, our business and other factors detailed from time to time in the reports we file with the Securities

and Exchange Commission.

Certain

Risks Associated with the Reverse Stock Split

There

can be no assurance that the total market capitalization of our common stock after the implementation of the Reverse Stock Split

will be equal to or greater than the total market capitalization before it, or that the per share market price of our common stock

following the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our issued common stock

in connection with it. Also, we cannot assure you that the Reverse Stock Split would lead to a sustained increase in the trading

price of our common stock, or that the trading price of our common stock will remain above the Minimum Bid Price Requirement.

The trading price of our common stock may change due to a variety of other factors, including our ability to successfully accomplish

our business goals, market conditions and the market perception of our business. You should also keep in mind that the implementation

of the Reverse Stock Split does not have an effect on the actual or intrinsic value of our business or a stockholder’s proportional

ownership in the Company (subject to the treatment of fractional shares). However, should the overall value of our common stock

decline after the proposed Reverse Stock Split, then the actual or intrinsic value of the shares of our common stock held by you

will also proportionately decrease as a result of the overall decline in value.

|

©

2024 Quantum Corporation | |

38 |

While

the Board believes that a higher stock price may help generate investor interest, there can be no assurance that the Reverse Stock

Split will result in a per-share market price that will attract institutional investors or that such share price will satisfy

the investing guidelines of institutional investors.

If

the Amendment is approved and effected, the total number of authorized shares of common stock will not be reduced in accordance

with the Reverse Stock Split ratio, but rather, the number of outstanding shares of common stock will be reduced in proportion

to the selected exchange ratio. Thus, the Reverse Stock Split would have the effect of increasing the number of shares of common

stock authorized and available for issuance, relative to the number of issued and outstanding shares of our common stock. Any

additional common stock authorized as a result of the Reverse Stock Split will be available for issuance by the Board for raising

additional capital, acquisitions, stock dividends or other corporate purposes, and any such issuances may be dilutive to current

stockholders.

While

the Board has proposed the Reverse Stock Split to bring the price of our common stock back above $1.00 per share in order to meet

the requirements for the continued listing of our common stock on Nasdaq, there is no guarantee that the price of our common stock

will not decrease in the future, or that our common stock will remain in compliance with Nasdaq listing standards.

Additionally,

there can be no guarantee that the closing bid price of our common stock will remain at or above $1.00 for 10 consecutive trading

days, whether following the Reverse Stock Split or otherwise, which is required to cure our current Nasdaq listing standard deficiency.

Effect

of the Reverse Stock Split

If

the Reverse Stock Split is approved by our shareholders and the Board elects to effect it, the number of issued shares of common

stock will be reduced in proportion to the ratio of the split chosen by the board of directors. As of the effective time of the

Reverse Stock Split, we would also adjust and proportionately decrease the number of shares of our common stock reserved for issuance

upon exercise of, and adjust and proportionately increase the exercise price of, all options and warrants and other rights to

acquire our common stock. In addition, as of the effective time of the Reverse Stock Split, we would adjust and proportionately

decrease the total number of shares of our common stock that may be the subject of the future grants under our stock plans.

The

Reverse Stock Split would be effected simultaneously for all issued shares of our common stock. The Reverse Stock Split would

affect all of our shareholders uniformly and would not change any shareholder’s percentage ownership interest in the Company,

except to the extent that the Reverse Stock Split results in any of our shareholders owning fractional shares. As a result of

the Reverse Stock Split, there will be a reduction of the number of shares of our issued common stock, resulting in an increase

in the number of shares of common stock authorized and available for issuance, relative to the number of issued and outstanding

shares of our common stock.

The

Reverse Stock Split is not intended to modify the rights of existing shareholders in any material respect. Voting rights and other

rights and preferences of the holders of common stock will not be affected by the Reverse Stock Split (other than as a result

of the treatment of fractional shares). Common stock issued pursuant to the Reverse Stock Split will remain fully paid and nonassessable,

and the par value per share of common stock will remain $0.01.

|

©

2024 Quantum Corporation | |

39 |

If

the Reverse Stock Split is effected, we intend to treat the shares of common stock held by beneficial owners in “street

name” through a broker, bank or other nominee in the same manner as shareholders whose shares are registered in their own

names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their customers holding common

stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered

shareholders for processing the Reverse Stock Split. If you hold shares of common stock with a broker, bank, or other nominee

and have any questions in this regard, you are encouraged to contact that resource for assistance.

If

the Board does not implement the Reverse Stock Split prior to August 15, 2025, the authority granted in this proposal to implement

the Reverse Stock Split would terminate.

Interested

Parties

Our

directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth in this proposal,

except to the extent of their ownership in shares of our common stock and securities convertible or exercisable for our common

stock. In that case, such shares and securities would be subject to the same proportionate adjustment in accordance with the terms

of the Reverse Stock Split as all other outstanding shares of our common stock and securities convertible into or exercisable

for our common stock.

|

©

2024 Quantum Corporation | | 40 |

Procedure

for Effecting the Amendment

If

the Amendment is approved by our shareholders and the Board elects to effect the Reverse Stock Split, it would take effect upon

the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware or on the effective date and time

specified in the Certificate of Amendment. The exact timing of the filing of the Certificate of Amendment and the effectiveness

of the Reverse Stock Split will be determined by the Board based on its evaluation as to when such action will be the most advantageous

to us and our shareholders, but it will not occur after August 15, 2025. In addition, the Board reserves the right, notwithstanding

shareholder approval and without further action by our shareholders, to abandon the Amendment (and therefore the Reverse Stock

Split) if, at any time prior to the filing of the Certificate of Amendment with the Secretary of State of the State of Delaware,

the Board, in its sole discretion, determines that it is no longer in the best interest of the Company our shareholders to proceed.

Beginning

at the effective time of the Reverse Stock Split, your pre-split shares will be deemed for all corporate purposes to evidence

ownership of post-split shares. We expect that our transfer agent will act as exchange agent for purposes of implementing the

exchange of stock.

After

the effective time of the Reverse Stock Split, our common stock will have a new Committee on Uniform Securities Identification

Procedures (CUSIP) number, which is a number used to identify our equity securities.

Holders

of common stock may hold some or all of their common stock electronically in book-entry form under the direct registration system

for securities. These shareholders will not have stock certificates evidencing their ownership. They are, however, provided with

a statement reflecting the number of shares of common stock registered in their accounts. If you hold registered common stock

in book-entry form, you do not need to take any action to receive your post-split shares.

Holders

of common stock that have certificated shares may be asked to surrender to the exchange agent certificate(s) representing pre-split

shares in exchange for certificate(s) representing post-split shares, in accordance with the procedures to be set forth in a letter

of transmittal. No new certificates will be issued to a shareholder until such shareholder has surrendered prior certificate(s)

together with the properly completed and executed letter of transmittal to the exchange agent.

STOCKHOLDERS

WHO HOLD CERTIFICATES SHOULD NOT DESTROY ANY STOCK CERTIFICATES AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL REQUESTED TO DO SO.

Fractional

Shares

No

fractional shares will be issued in connection with the Reverse Stock Split. Instead, shareholders who otherwise would be entitled