Qualcomm Sales Jump on iPhone, 5G Demand Surge -- 2nd Update

February 03 2021 - 6:31PM

Dow Jones News

By Asa Fitch

Qualcomm Inc. parlayed the global 5G rollout and Apple Inc.'s

inclusion of its chips in the latest iPhone models into an earnings

jump that failed to satisfy investors betting phone-chip sales

would be even higher.

The mobile-phone chip maker on Wednesday said its quarterly

sales rose 62% from the year-ago period to $8.24 billion. Net

income for the first quarter of the company's financial year more

than doubled to $2.46 billion.

The company narrowly missed Wall Street's sales expectations of

$8.27 billion, but beat the bottom line protection of net income of

$2.09 billion, according to analysts surveyed by FactSet.

Sales of chips for phones came in slightly below investor

expectations that had been supercharged by Apple's strong earnings

a week ago. Qualcomm's stock fell more than 8% in after-hours

trading.

Qualcomm's results were healthy, but investors had been hoping

for a home-run performance, said Stacy Rasgon, an analyst at

Bernstein Research.

Qualcomm's outlook for the current quarter of sales between $7.2

billion and $8 billion also topped Wall Street forecasts.

The chip business is really growing like crazy," Chief Executive

Steve Mollenkopf said. "It's all the things we've been talking

about -- growth in content and growth in devices that's significant

sequentially and year over year."

Qualcomm is undergoing a leadership transition. Mr. Mollenkopf

plans to retire this summer, to be succeeded by current company

President Cristiano Amon.

Qualcomm is split into two divisions, one that focuses on making

chips and another that profits from licensing Qualcomm's patented

technologies to others. Revenue in the licensing business rose 18%

in the quarter, while sales were 81% higher in the chip

business.

The company also saw strong growth in newer parts of its chip

business. While it made $4.22 billion on chips for handsets, it

also surpassed $1 billion in quarterly sales for the first time for

chips that go into internet-of-things devices and dedicated

circuitry that handles communications with cell towers.

Qualcomm, Mr. Mollenkopf said, may also benefit from U.S.

restrictions on trade with Chinese telecommunications company

Huawei Technologies Co. Those moves have redirected demand toward

other phones that Qualcomm can sell its chips into.

"Huawei shedding so much share provides a big opportunity for us

to grow, " Mr. Mollenkopf said. "The addressable market has grown,

so that'll start to be a bit of a tailwind for us as we get supply

and have the ability to go after it."

But Qualcomm is also grappling with a broader problem affecting

the chip industry: supply shortages. Those may limit Qualcomm's

ability to fully capitalize on strong demand for phones and other

devices, especially as the broader economy rebounds from the

pandemic downturn with the rollout of vaccines.

Qualcomm relies on contract manufacturers to make its chips, and

the company could sell more if they could have more made, Mr.

Mollenkopf said, adding that the company, like others in the

industry, is trying to figure out how to resolve the bottleneck.

"Demand is far exceeding supply right now, which is something I

think is going to be normalized over the next several quarters," he

said.

Write to Asa Fitch at asa.fitch@wsj.com

(END) Dow Jones Newswires

February 03, 2021 18:16 ET (23:16 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

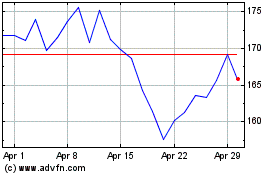

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Apr 2023 to Apr 2024