false

0001774170

0001774170

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): November 9, 2023

POWERFLEET,

INC.

(Exact

Name of Registrant as Specified in its Charter)

| Delaware |

|

001-39080 |

|

83-4366463 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 123

Tice Boulevard, Woodcliff

Lake, New

Jersey |

|

07677 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code (201) 996-9000

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☒ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

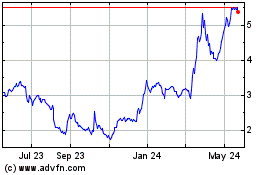

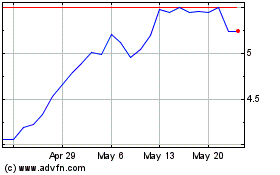

| Common

Stock, par value $0.01 per share |

|

PWFL |

|

The

Nasdaq Global Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

November 9, 2023, PowerFleet, Inc. (the “Registrant”) issued a press release regarding financial results for the fiscal quarter

ended September 30, 2023. A copy of the press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item

7.01. Regulation FD Disclosure.

As

previously announced, the Registrant will hold a conference call on November 9, 2023 at 8:30 a.m. Eastern time (5:30 a.m. Pacific time)

to discuss the financial results for the fiscal quarter ended September 30, 2023. During the call, management will also discuss the previously

announced business combination with MiX Telematics Limited (“MiX Telematics”). A copy of the prepared remarks for the conference

call is being furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The

information in this report is being furnished pursuant to Items 2.02 and 7.01 of Form 8-K. In accordance with General Instruction B.2.

of Form 8-K, the information in this report, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as may be expressly set forth

by specific reference in such a filing.

Cautionary

Note Regarding Forward-Looking Statements

This

report, including Exhibits 99.1 and 99.2 furnished herewith, contains forward-looking statements within the meaning of federal securities

laws. Forward-looking statements include statements with respect to the Registrant’s beliefs, plans, goals, objectives, expectations,

anticipations, assumptions, estimates, intentions, and future performance, and involve known and unknown risks, uncertainties and other

factors, which may be beyond the Registrant’s control, and which may cause its actual results, performance or achievements to be

materially different from future results, performance or achievements expressed or implied by such forward-looking statements. All statements

other than statements of historical fact are statements that could be forward-looking statements. For example, forward-looking statements

include statements regarding: the proposed transaction with MiX Telematics; prospects for additional customers; potential contract values;

market forecasts; projections of earnings, revenues, synergies, accretion or other financial information; emerging new products; and

plans, strategies and objectives of management for future operations, including growing revenue, controlling operating costs, increasing

production volumes and expanding business with core customers. The risks and uncertainties referred to above include, but are not limited

to, future economic and business conditions, the ability to recognize the anticipated benefits of the proposed transaction with MiX Telematics,

the loss of key customers or reduction in the purchase of products by any such customers, the failure of the market for the Registrant’s

products to continue to develop, the inability to protect the Registrant’s intellectual property, the inability to manage growth,

the effects of competition from a variety of local, regional, national and other providers of wireless solutions, risks related to the

proposed transaction with MiX Telematics and other risks detailed from time to time in the Registrant’s filings with the Securities

and Exchange Commission (the “SEC”), including the Registrant’s most recent annual report on Form 10-K. These risks

could cause actual results to differ materially from those expressed in any forward-looking statements made by, or on behalf of, the

Registrant. Unless otherwise required by applicable law, the Registrant assumes no obligation to update any forward-looking statements,

and expressly disclaims any obligation to do so, whether as a result of new information, future events or otherwise.

Additional

Information and Where to Find It

In

connection with the proposed transaction with MiX Telematics, the Registrant and MiX Telematics intend to file with the SEC a registration

statement on Form S-4 that will include a joint proxy statement of the Registrant and MiX Telematics and a prospectus of the Registrant.

Additionally,

MiX Telematics intends to prepare a scheme circular for MiX Telematics shareholders in accordance with the South African Companies Act

and the listings requirements of the Johannesburg Stock Exchange with respect to a shareholder meeting at which MiX Telematics shareholders

will be asked to vote on the proposed transaction. The scheme circular will be issued to MiX Telematics shareholders together with the

joint proxy statement/prospectus. Any holder of MiX Telematics ordinary shares through an intermediary such as a broker/dealer or clearing

agency or MiX Telematics American Depositary Shares should consult with their intermediary or The Bank of New York Mellon, the depositary

for the MiX Telematics American Depositary Shares, as applicable, about how to obtain information on the MiX Telematics shareholder meeting.

After

the Registrant’s registration statement on Form S-4 has been filed and declared effective by the SEC, the Registrant will send

a definitive proxy statement/prospectus to its stockholders entitled to vote at the meeting relating to the proposed transaction, and

MiX Telematics will send the scheme circular, together with the definitive proxy statement/prospectus, to its shareholders entitled to

vote at the meeting relating to the proposed transaction. The Registrant and MiX Telematics may file other relevant materials with the

SEC in connection with the proposed transaction. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT ON FORM S-4,

JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN),

THE SCHEME CIRCULAR AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and shareholders will be able to obtain free

copies of these documents (if and when available) and other documents containing important information about the Registrant and MiX Telematics

once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. The Registrant and MiX Telematics

will make available copies of materials they file with, or furnish to, the SEC free of charge at https://ir.powerfleet.com and

https://investor.mixtelematics.com, respectively.

No

Offer or Solicitation

This

report shall not constitute an offer to buy or sell any securities, or the solicitation of an offer to buy or sell any securities, nor

shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants

in the Solicitation

The

Registrant, MiX Telematics and their respective directors, executive officers and certain employees and other persons may be deemed to

be participants in the solicitation of proxies from the Registrant’s stockholders and MiX Telematics’ shareholders in connection

with the proposed transaction. Securityholders may obtain information regarding the names, affiliations and interests of the Registrant’s

directors and executive officers in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with

the SEC on March 31, 2023, its amended Annual Report on Form 10-K/A for the year ended December 31, 2022, which was filed with the SEC

on May 1, 2023, and its definitive proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on June

21, 2023. Securityholders may obtain information regarding the names, affiliations and interests of MiX Telematics’ directors and

executive officers in its Annual Report on Form 10-K for the year ended March 31, 2023, which was filed with the SEC on June 22, 2023,

and its definitive proxy statement for its 2023 annual general meeting of shareholders, which was filed with the SEC on July 28, 2023.

Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the joint proxy statement/prospectus, the scheme circular and other relevant materials

to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the joint proxy

statement/prospectus and the scheme circular carefully when they become available before making any voting or investment decisions. You

may obtain free copies of these documents from the Registrant or MiX Telematics using the sources indicated above.

Item

9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

POWERFLEET, INC. |

| |

|

|

| |

By: |

/s/

David Wilson |

| |

Name: |

David Wilson |

| |

Title: |

Chief Financial

Officer |

| |

|

|

| Date: November 9, 2023 |

|

|

Exhibit

99.1

Powerfleet

Reports Third Quarter and Nine Month 2023 Financial Results

Q3

2023 total revenue increased 7% sequentially to $34.2 million, marking the highest revenue performance in four quarters

Company’s

SaaS-centric business model transformation continues at pace with high-margin service revenue increasing 11% in Q3 2023 and 14% for the

year to date compared to prior year periods (constant currency)

AEBITDA

increased threefold following the execution of annualized $4 million cost reduction measures to absorb AI and data science talent acquired

with the Movingdots transaction

North

America total business grew 12% year over year in the quarter leading to service revenue YTD growth of15%, reflecting the adoption of

the Unity data platform for new and existing customers

Previously

announced transformative business combination with MiX Telematics expected to double revenue and provide the foundation for future Rule

of 40 financial performance

WOODCLIFF

LAKE, NJ – November 9, 2023 – Powerfleet, Inc. (Nasdaq: PWFL), reported results for the third quarter and nine

months ended September 30, 2023.

THIRD

QUARTER 2023 FINANCIAL AND OPERATIONAL HIGHLIGHTS

| |

● |

Business returned to topline growth with revenue of $34.2 million, up 7% sequentially with the increase of new sales centered on

Unity and safety led solutions outstripping the shuttering low value and non-core business. |

| |

|

|

| |

● |

Service revenue increased 11% year-over-year (constant currency) to $21.0 million, or 62% of total revenue, demonstrating the company’s

transformation to a SaaS centric business model. |

| |

|

|

| |

● |

Product revenue increased 19% sequentially and product gross margin expanded to 33% from 22% in the prior quarter, showcasing the

company’s strategy to pivot selling high-margin products that drive enduring SaaS revenue. |

| |

|

|

| |

● |

Total North American business revenue increased 12% year-over-year, with service revenue growing by15% year to date fueled by Unity

data platform success. |

| |

|

|

| |

● |

Adjusted EBITDA totaled $2.0 million; three times higher than Q2 2023 following cost reduction activities of $4 million per year

absorbing the incremental operating expenses from the Q1 2023 Movingdots acquisition. |

| |

|

|

| |

● |

Subscriber count increased 8% year-over-year, totaling 707,342 at quarter end. |

MANAGEMENT

COMMENTARY

“These

highly satisfying quarterly results underscore remarkable execution by our global team and are particularly impressive as they were

achieved during our pursuit and signing of a transformative business combination with MiX Telematics,” said Powerfleet CEO

Steve Towe.

“Business

expansion continues to be led by North America with total revenue increasing by an impressive 12% in the quarter and 15% for the

first nine months of the year. This performance provides compelling proof points of the adoption of our Unity data integration

platform and its potential to drive meaningful recurring SaaS revenues and best-in-class net dollar retention. The

success of our Powerfleet business model transformation, shifting focus from devices to the Unity SaaS platform, was always expected

to be evident in quarters rather than months. We made bold strategic choices to close out non-core and low-margin product lines

while strengthening the pipeline of SaaS-centric offerings to enable high quality revenue growth. I am delighted to share

that we have now moved past the expected inflection point with our Q3 results posting a 7% sequential increase in total revenue, and

the highest revenue performance in four quarters.”

“Our

announced combination with MiX is a game changer and meets multiple strategic objectives for the company, deepening our opportunity to

create meaningfully increased shareholder value while simultaneously addressing the current balance sheet overhang. We are excited about

the business combination and the momentum we are building and look forward to sharing more about our future vision for shareholder value

creation, the integration strategy, growth drivers, go-to-market approach, technology roadmap, and financial targets for the combined

business during our Investor Day.”

David

Wilson, Powerfleet CFO, added: “We are successfully executing our strategic priorities to build a high-value business focused

on high-quality, recurring SaaS revenue. Our Q3 performance is a clear testament to our transformation, both financially and operationally.

Notably, our rapid execution of strategic measures, including a $4 million cost-cutting initiative for Movingdots, directly led to a

threefold increase in adjusted EBITDA.”

KEY

THIRD QUARTER 2023 FINANCIAL RESULTS

Total

revenue was $34.2 million, compared to $34.3 million in the same year-ago period, an increase of 5% on a constant currency basis with

$2.0 million of low value product revenue actively shed from the business and replaced with high margin service revenue which increased

by 11% on a constant currency basis.

Gross

profit margin of 50.1%, was in line with the prior year period with improved product margins offset by the commencement of depreciation

expense for the Unity platform.

Operating

expenses were $20.4 million compared to $18.4 million in the same year-ago period. Current year operating expenses included $1.4

million in one-time rationalization and deal costs related to the announced business combination with Mix Telematics; and $1.2 million

in Movingdots’ run rate expense.

Net

loss attributable to common stockholders totaled $(5.0) million, or $(0.14) per basic and diluted share (based on 35.7 million weighted

average shares outstanding) while adjusted EBITDA, a non-GAAP metric, totaled $2.0 million. See the section below titled “Non-GAAP

Financial Measures” for more information about adjusted EBITDA and its reconciliation to GAAP net income (loss).

Powerfleet

had $19.6 million in cash and cash equivalents and a working capital position of $34.5 million at quarter-end.

INVESTOR

CONFERENCE CALL

Powerfleet

management will discuss these results and business outlook on a conference call today (Thursday, November 9, 2023) at 8:30 a.m. Eastern

time (5:30 a.m. Pacific time).

Powerfleet

management will host the presentation, followed by a question-and-answer session.

Toll

Free: 888-506-0062

International:

973-528-0011

Participant

Access Code: 531533

Webcast:

https://www.webcaster4.com/Webcast/Page/2467/49375

The

conference call will be available for replay here and via the investor section of the company’s website at ir.powerfleet.com.

If

you have any difficulty connecting with the conference call, please contact Powerfleet’s investor relations team at 949-574-3860.

INVESTOR

DAY

As

previously announced, Powerfleet and MiX Telematics are hosting a joint Investor Day for financial analysts and institutional investors

on Thursday, November 16 at The InterContinental New York Barclay hotel in New York, NY.

Powerfleet

and MiX Telematics leadership teams will share the strategic rationale and expected benefits for the previously announced business combination,

which will create one of the largest mobile asset Internet of Things (IoT) Software-as-a-Service (SaaS) providers in the world. Senior

leaders from the Powerfleet and MiX organizations will present the vision, integration strategy, growth drivers, go-to-market approach,

Unity platform and AI roadmap, customer success stories, and financial targets for the combined business, followed by a live Q&A.

In-person

attendance is by invitation only. For those who would like to attend the event in-person, please contact respectively Powerfleet’s

investor relations team at PWFL@gateway-grp.com or MiX’s investor relations team at MiXT@gatewayir.com.

A

live webcast will be available on the investor

relations section of each company’s website. A replay of the webcast will be available shortly after the event concludes.

NON-GAAP

FINANCIAL MEASURES

To

supplement its financial statements presented in accordance with Generally Accepted Accounting Principles (GAAP), Powerfleet provides

certain non-GAAP measures of financial performance. These non-GAAP measures include adjusted EBITDA and total revenue and service revenue

excluding foreign exchange effect. Reference to these non-GAAP measures should be considered in addition to results prepared under current

accounting standards, but are not a substitute for, or superior to, GAAP results. These non-GAAP measures are provided to enhance investors’

overall understanding of Powerfleet’s current financial performance. Specifically, Powerfleet believes the non-GAAP measures provide

useful information to both management and investors by excluding certain expenses, gains and losses and fluctuations in currency rates

that may not be indicative of its core operating results and business outlook. These non-GAAP measures are not measures of financial

performance or liquidity under GAAP and, accordingly, should not be considered as an alternative to net income or cash flow from operating

activities as an indicator of operating performance or liquidity. Because Powerfleet’s method for calculating the non-GAAP measures

may differ from other companies’ methods, the non-GAAP measures may not be comparable to similarly titled measures reported by

other companies. Reconciliation of all non-GAAP measures included in this press release to the nearest GAAP measures can be found in

the financial tables included in this press release.

POWERFLEET,

INC. AND SUBSIDIARIES

RECONCILIATION

OF GAAP TO ADJUSTED EBITDA FINANCIAL MEASURES

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net loss attributable to common stockholders | |

$ | (3,535,000 | ) | |

$ | (4,969,000 | ) | |

$ | (8,994,000 | ) | |

$ | (5,749,000 | ) |

| Non-controlling interest | |

| 1,000 | | |

| - | | |

| 3,000 | | |

| 3,000 | |

| Preferred stock dividend and accretion | |

| 1,235,000 | | |

| 1,295,000 | | |

| 3,647,000 | | |

| 3,867,000 | |

| Interest (income) expense, net | |

| 502,000 | | |

| 560,000 | | |

| 1,493,000 | | |

| 1,534,000 | |

| Other (income) expense, net | |

| 0 | | |

| 5,000 | | |

| (1,000 | ) | |

| 4,000 | |

| Income tax (benefit) expense | |

| 770,000 | | |

| 262,000 | | |

| 107,000 | | |

| 698,000 | |

| Depreciation and amortization | |

| 2,019,000 | | |

| 2,409,000 | | |

| 6,152,000 | | |

| 6,926,000 | |

| Stock-based compensation | |

| 1,070,000 | | |

| 1,100,000 | | |

| 3,156,000 | | |

| 2,785,000 | |

| Foreign currency translation | |

| 731,000 | | |

| (72,000 | ) | |

| (959,000 | ) | |

| (1,014,000 | ) |

| Severance related expenses | |

| 486,000 | | |

| 142,000 | | |

| 1,332,000 | | |

| 701,000 | |

| Gain on Bargain purchase - Movingdots | |

| - | | |

| - | | |

| - | | |

| (7,517,000 | ) |

| Acquisition Related Expenses | |

| - | | |

| 1,232,000 | | |

| - | | |

| 1,772,000 | |

| Adjusted EBITDA | |

$ | 3,279,000 | | |

$ | 1,964,000 | | |

$ | 5,936,000 | | |

$ | 4,010,000 | |

ABOUT

POWERFLEET

Powerfleet

(Nasdaq: PWFL; TASE: PWFL) is a global leader of internet of things (IoT) software-as-a-service (SaaS) solutions that optimize the performance

of mobile assets and resources to unify business operations. Our data science insights and advanced modular software solutions help drive

digital transformation through our customers’ and partners’ ecosystems to help save lives, time, and money. We help connect

companies, enabling customers and their customers to realize more effective strategies and results. Powerfleet’s tenured and talented

team is at the heart of our approach to partnership and tangible success. The company is headquartered in Woodcliff Lake, New Jersey,

with our Pointer Innovation Center (PIC) in Israel and field offices around the globe. For more information, please visit www.powerfleet.com.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

press release contains forward-looking statements within the meaning of federal securities laws. Forward-looking statements include statements

with respect to Powerfleet’s beliefs, plans, goals, objectives, expectations, anticipations, assumptions, estimates, intentions,

and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond Powerfleet’s

control, and which may cause its actual results, performance or achievements to be materially different from future results, performance

or achievements expressed or implied by such forward-looking statements. All statements other than statements of historical fact are

statements that could be forward-looking statements. For example, forward-looking statements include statements regarding the proposed

transaction with MiX Telematics; prospects for additional customers; potential contract values; market forecasts; projections of earnings,

revenues, synergies, accretion, or other financial information; emerging new products; and plans, strategies, and objectives of management

for future operations, including growing revenue, controlling operating costs, increasing production volumes, and expanding business

with core customers. The risks and uncertainties referred to above include, but are not limited to, future economic and business conditions,

the ability to recognize the anticipated benefits of the proposed transaction with MiX Telematics, the loss of key customers or reduction

in the purchase of products by any such customers, the failure of the market for Powerfleet’s products to continue to develop,

the inability to protect Powerfleet’s intellectual property, the inability to manage growth, the effects of competition from a

variety of local, regional, national and other providers of wireless solutions, risks related to the proposed transaction with MiX Telematics

and other risks detailed from time to time in Powerfleet’s filings with the Securities and Exchange Commission (the “SEC”),

including Powerfleet’s most recent annual report on Form 10-K. These risks could cause actual results to differ materially from

those expressed in any forward-looking statements made by, or on behalf of, Powerfleet. Unless otherwise required by applicable law,

Powerfleet assumes no obligation to update the information contained in this press release, and expressly disclaims any obligation to

do so, whether a result of new information, future events, or otherwise.

ADDITIONAL

INFORMATION AND WHERE TO FIND IT

In

connection with the proposed transaction with MiX, Powerfleet intends to file with the SEC a registration statement on Form S-4 that

will include a joint proxy statement of Powerfleet and MiX and a prospectus of Powerfleet. Furthermore, Powerfleet intends to procure

a secondary inward listing on the Johannesburg Stock Exchange to accommodate existing and future South African Shareholders.

Additionally,

MiX intends to prepare a scheme circular for MiX shareholders in accordance with the Companies Act of South Africa (including the Companies

Act Regulations, 2011 thereunder) and the JSE’s listings requirements with respect to a shareholder meeting at which MiX shareholders

will be asked to vote on the proposed transaction. The scheme circular will be issued to MiX shareholders together with the proxy statement/prospectus.

If you hold MiX ordinary shares through an intermediary such as a broker/dealer or clearing agency, or if you hold MiX ADSs, you should

consult with your intermediary or The Bank of New York Mellon, the depositary for the MiX ADSs, as applicable, about how to obtain information

on the MiX shareholder meeting.

After

Powerfleet’s registration statement has been filed and declared effective by the SEC, Powerfleet will send the definitive proxy

statement/prospectus to Powerfleet stockholders entitled to vote at the meeting relating to the proposed transaction, and MiX will send

the scheme circular, together with the definitive proxy statement/prospectus, to MiX shareholders entitled to vote at the meeting relating

to the proposed transaction. MiX and Powerfleet may file other relevant materials with the SEC in connection with the proposed transaction.

INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE THEREIN), THE SCHEME CIRCULAR AND OTHER DOCUMENTS THAT MAY BE FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and shareholders will be able to obtain free copies of these documents (if and when available) and other documents

containing important information about Powerfleet and MiX once such documents are filed with the SEC through the website maintained by

the SEC at www.sec.gov. Powerfleet or MiX make available copies of materials they file with, or furnish to, the SEC free of charge at

https://ir.powerfleet.com and http://investor.mixtelematics.com, respectively.

NO

OFFER OR SOLICITATION

This

communication shall not constitute an offer to buy or sell any securities, or the solicitation of an offer to buy or sell any securities,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

PARTICIPANTS

IN THE SOLICITATION

Powerfleet,

MiX and their respective directors, executive officers and certain employees and other persons may be deemed to be participants in the

solicitation of proxies from the shareholders of Powerfleet and MiX in connection with the proposed transaction. Securityholders may

obtain information regarding the names, affiliations and interests of Powerfleet’s directors and executive officers in its Annual

Report on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 31, 2023, its amended Annual Report

on Form 10-K/A for the year ended December 31, 2022, which was filed with the SEC on May 1, 2023, and its definitive proxy statement

for its 2023 annual meeting of stockholders, which was filed with the SEC on June 21, 2023. Securityholders may obtain information regarding

the names, affiliations and interests of MiX’s directors and executive officers in its Annual Report on Form 10-K for the year

ended March 31, 2023, which was filed with the SEC on June 22, 2023, and its definitive proxy statement for its 2023 annual general meeting

of shareholders, which was filed with the SEC on July 28, 2023. Other information regarding the participants in the proxy solicitations

and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus

and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors

should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

You may obtain free copies of these documents from Powerfleet or MiX using the sources indicated above.

Powerfleet

Investor Contact

Matt

Glover

Gateway

Group, Inc.

PWFL@gatewayir.com

(949)

574-3860

Powerfleet

Media Contact

Andrea

Hayton

Powerfleet,

Inc.

ahayton@powerfleet.com

(610)

401-1999

POWERFLEET,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

September 30, | | |

September 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | | |

(Unaudited) | |

| Revenue: | |

| | | |

| | | |

| | | |

| | |

| Products | |

$ | 14,021,000 | | |

$ | 13,147,000 | | |

$ | 43,231,000 | | |

$ | 36,563,000 | |

| Services | |

| 20,267,000 | | |

| 21,048,000 | | |

| 58,812,000 | | |

| 62,521,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Revenues | |

| 34,288,000 | | |

| 34,195,000 | | |

| 102,043,000 | | |

| 99,084,000 | |

| Cost of revenue: | |

| | | |

| | | |

| | | |

| | |

| Cost of products | |

| 9,839,000 | | |

| 8,843,000 | | |

| 33,152,000 | | |

| 26,394,000 | |

| Cost of services | |

| 7,268,000 | | |

| 8,237,000 | | |

| 21,081,000 | | |

| 22,923,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total cost of revenues: | |

| 17,107,000 | | |

| 17,080,000 | | |

| 54,233,000 | | |

| 49,317,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

| 17,181,000 | | |

| 17,115,000 | | |

| 47,810,000 | | |

| 49,767,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 16,664,000 | | |

| 17,988,000 | | |

| 47,393,000 | | |

| 51,763,000 | |

| Research and development expenses | |

| 1,735,000 | | |

| 2,384,000 | | |

| 6,965,000 | | |

| 6,285,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 18,399,000 | | |

| 20,372,000 | | |

| 54,358,000 | | |

| 58,048,000 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (1,218,000 | ) | |

| (3,257,000 | ) | |

| (6,548,000 | ) | |

| (8,281,000 | ) |

| Interest income | |

| 20,000 | | |

| 23,000 | | |

| 48,000 | | |

| 69,000 | |

| Interest expense | |

| (522,000 | ) | |

| (583,000 | ) | |

| (1,541,000 | ) | |

| (1,603,000 | ) |

| Gain on Bargain purchase - Movingdots | |

| - | | |

| - | | |

| - | | |

| 7,517,000 | |

| Foreign currency translation of debt | |

| 191,000 | | |

| 429,000 | | |

| 2,803,000 | | |

| 1,139,000 | |

| Other (expense) income, net | |

| - | | |

| (24,000 | ) | |

| 1,000 | | |

| (22,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income before income taxes | |

| (1,529,000 | ) | |

| (3,412,000 | ) | |

| (5,237,000 | ) | |

| (1,181,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit (expense) | |

| (770,000 | ) | |

| (262,000 | ) | |

| (107,000 | ) | |

| (698,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income before non-controlling interest | |

| (2,299,000 | ) | |

| (3,674,000 | ) | |

| (5,344,000 | ) | |

| (1,879,000 | ) |

| Non-controlling interest | |

| (1,000 | ) | |

| - | | |

| (3,000 | ) | |

| (3,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income | |

| (2,300,000 | ) | |

| (3,674,000 | ) | |

| (5,347,000 | ) | |

| (1,882,000 | ) |

| Accretion of preferred stock | |

| (168,000 | ) | |

| (167,000 | ) | |

| (504,000 | ) | |

| (503,000 | ) |

| Preferred stock dividend | |

| (1,067,000 | ) | |

| (1,128,000 | ) | |

| (3,143,000 | ) | |

| (3,364,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income attributable to common stockholders | |

$ | (3,535,000 | ) | |

$ | (4,969,000 | ) | |

$ | (8,994,000 | ) | |

$ | (5,749,000 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income per share - basic | |

$ | (0.10 | ) | |

$ | (0.14 | ) | |

$ | (0.25 | ) | |

$ | (0.16 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) / income per share - diluted | |

$ | (0.10 | ) | |

$ | (0.14 | ) | |

$ | (0.25 | ) | |

$ | (0.16 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average common shares outstanding - basic | |

| 35,406,000 | | |

| 35,653,000 | | |

| 35,375,000 | | |

| 35,602,000 | |

| Weighted average common shares outstanding - diluted | |

| 35,406,000 | | |

| 35,653,000 | | |

| 35,375,000 | | |

| 35,602,000 | |

POWERFLEET,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEET DATA

| | |

As of | |

| | |

December 31, 2022 | | |

September 30, 2023 | |

| | |

| | |

(Unaudited) | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 17,680,000 | | |

$ | 19,297,000 | |

| Restricted cash | |

| 309,000 | | |

| 310,000 | |

| Accounts receivable, net | |

| 32,493,000 | | |

| 33,606,000 | |

| Inventory, net | |

| 22,272,000 | | |

| 21,055,000 | |

| Deferred costs - current | |

| 762,000 | | |

| 191,000 | |

| Prepaid expenses and other current assets | |

| 7,709,000 | | |

| 8,721,000 | |

| Total current assets | |

| 81,225,000 | | |

| 83,180,000 | |

| | |

| | | |

| | |

| Fixed assets, net | |

| 9,249,000 | | |

| 10,222,000 | |

| Goodwill | |

| 83,487,000 | | |

| 83,487,000 | |

| Intangible assets, net | |

| 22,908,000 | | |

| 21,157,000 | |

| Right of use asset | |

| 7,820,000 | | |

| 6,490,000 | |

| Severance payable fund | |

| 3,760,000 | | |

| 3,427,000 | |

| Deferred tax asset | |

| 3,225,000 | | |

| 1,915,000 | |

| Other assets | |

| 5,761,000 | | |

| 6,228,000 | |

| Total assets | |

$ | 217,435,000 | | |

$ | 216,106,000 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term bank debt and current maturities of long-term debt | |

$ | 10,312,000 | | |

$ | 12,137,000 | |

| Accounts payable and accrued expenses | |

| 26,598,000 | | |

| 28,109,000 | |

| Deferred revenue - current | |

| 6,363,000 | | |

| 6,101,000 | |

| Lease liability - current | |

| 2,441,000 | | |

| 2,286,000 | |

| Total current liabilities | |

| 45,714,000 | | |

| 48,633,000 | |

| | |

| | | |

| | |

| Long-term debt, less current maturities | |

| 11,403,000 | | |

| 9,617,000 | |

| Deferred revenue - less current portion | |

| 4,390,000 | | |

| 4,804,000 | |

| Lease liability - less current portion | |

| 5,628,000 | | |

| 4,415,000 | |

| Accrued severance payable | |

| 4,365,000 | | |

| 4,142,000 | |

| Deferred tax liability | |

| 4,919,000 | | |

| 4,283,000 | |

| Other long-term liabilities | |

| 636,000 | | |

| 649,000 | |

| | |

| | | |

| | |

| Total liabilities | |

| 77,055,000 | | |

| 76,543,000 | |

| | |

| | | |

| | |

| MEZZANINE EQUITY | |

| | | |

| | |

| Convertible redeemable Preferred stock: Series A | |

| 57,565,000 | | |

| 59,176,000 | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Total Powerfleet, Inc. stockholders’ equity | |

| 82,737,000 | | |

| 80,324,000 | |

| Non-controlling interest | |

| 78,000 | | |

| 63,000 | |

| Total equity | |

| 82,815,000 | | |

| 80,387,000 | |

| Total liabilities and stockholders’ equity | |

$ | 217,435,000 | | |

$ | 216,106,000 | |

POWERFLEET,

INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOW DATA

| | |

Nine Months Ended September 30, | |

| | |

2022 | | |

2023 | |

| | |

| | |

(Unaudited) | |

| Cash flows from operating activities (net of net assets acquired): | |

| | | |

| | |

| Net (loss) / income | |

$ | (5,347,000 | ) | |

$ | (1,882,000 | ) |

| Adjustments to reconcile net loss to cash (used in) provided by operating activities: | |

| | | |

| | |

| Non-controlling interest | |

| 3,000 | | |

| 3,000 | |

| Gain on bargain purchase | |

| - | | |

| (7,517,000 | ) |

| Inventory reserve | |

| 177,000 | | |

| 619,000 | |

| Stock based compensation expense | |

| 3,156,000 | | |

| 2,785,000 | |

| Depreciation and amortization | |

| 6,152,000 | | |

| 6,926,000 | |

| Right-of-use assets, non-cash lease expense | |

| 2,071,000 | | |

| 1,900,000 | |

| Bad debt expense | |

| 102,000 | | |

| 1,161,000 | |

| Deferred taxes | |

| 107,000 | | |

| 674,000 | |

| Other non-cash items | |

| 660,000 | | |

| 172,000 | |

| Changes in: | |

| | | |

| | |

| Operating assets and liabilities | |

| (8,795,000 | ) | |

| (5,073,000 | ) |

| | |

| | | |

| | |

| Net cash (used in) provided by operating activities | |

| (1,714,000 | ) | |

| (232,000 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Acquisitions, net of cash assumed | |

| - | | |

| 8,722,000 | |

| Purchase of investment | |

| - | | |

| (100,000 | ) |

| Capitalized software development costs | |

| - | | |

| (2,727,000 | ) |

| Capital expenditures | |

| (4,001,000 | ) | |

| (2,626,000 | ) |

| | |

| | | |

| | |

| Net cash (used in) investing activities | |

| (4,001,000 | ) | |

| 3,269,000 | |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Payment of preferred stock dividend | |

| - | | |

| (2,257,000 | ) |

| Repayment of long-term debt | |

| (4,279,000 | ) | |

| (3,986,000 | ) |

| Short-term bank debt, net | |

| 3,949,000 | | |

| 4,995,000 | |

| Purchase of treasury stock upon vesting of restricted stock | |

| (193,000 | ) | |

| (138,000 | ) |

| Proceeds from exercise of stock options | |

| - | | |

| 37,000 | |

| | |

| | | |

| | |

| Net cash (used in) provided by financing activities | |

| (523,000 | ) | |

| (1,349,000 | ) |

| | |

| | | |

| | |

| Effect of foreign exchange rate changes on cash and cash equivalents | |

| (3,510,000 | ) | |

| (70,000 | ) |

| Net increase in cash, cash equivalents and restricted cash | |

| (9,748,000 | ) | |

| 1,618,000 | |

| Cash, cash equivalents and restricted cash - beginning of period | |

| 26,760,000 | | |

| 17,989,000 | |

| | |

| | | |

| | |

| Cash, cash equivalents and restricted cash - end of period | |

$ | 17,012,000 | | |

$ | 19,607,000 | |

CONSTANT

CURRENCY

Constant

currency information has been presented to illustrate the impact of changes in currency rates on the company’s results. The constant

currency information has been determined by adjusting the current financial reporting period results to the prior period average exchange

rates, determined as the average of the monthly exchange rates applicable to the period. The measurement has been performed for each

of the company’s currencies. The constant currency growth percentage has been calculated by utilizing the constant currency results

compared to the prior period results.

The

constant currency information represents non-GAAP information. The company believes this provides a useful basis to measure the performance

of its business as it removes distortion from the effects of foreign currency movements during the period; however, this information

should be considered as supplemental in nature and should not be considered in isolation or as a substitute for the related financial

information prepared in accordance with GAAP. See the section above titled “Non-GAAP Financial Measures” for more information.

Due

to a portion of the company’s customers who are invoiced in non-U.S. Dollar denominated currencies, the company also calculates

subscription revenue growth rate on a constant currency basis, thereby removing the effect of currency fluctuation on results of operations.

| | |

Three Months Ended Sept 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Service Revenue: | |

| | | |

| | | |

| | | |

| | |

| Service Revenue as reported | |

$ | 20,267 | | |

$ | 21,048 | | |

$ | 781 | | |

| 3.9 | % |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 1,470 | | |

$ | 1,470 | | |

| | |

| Service revenue on a constant currency basis | |

$ | 20,267 | | |

$ | 22,518 | | |

$ | 2,251 | | |

| 11.1 | % |

| | |

Three Months Ended Sept 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Product Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product Revenue as reported | |

$ | 14,021 | | |

$ | 13,147 | | |

$ | (874 | ) | |

| (6.2 | %) |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 154 | | |

$ | 154 | | |

| | |

| Product revenue on a constant currency basis | |

$ | 14,021 | | |

$ | 13,301 | | |

$ | (720 | ) | |

| (5.1 | %) |

| | |

Three Months Ended Sept 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Total Revenue: | |

| | | |

| | | |

| | | |

| | |

| Total Revenue as reported | |

$ | 34,288 | | |

$ | 34,195 | | |

$ | (93 | ) | |

| (0.3 | %) |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 1,624 | | |

$ | 1,624 | | |

| | |

| Total revenue on a constant currency basis | |

$ | 34,288 | | |

$ | 35,819 | | |

$ | 1,531 | | |

| 4.5 | % |

| | |

Nine Months Ended September 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Service Revenue: | |

| | | |

| | | |

| | | |

| | |

| Service Revenue as reported | |

$ | 58,812 | | |

$ | 62,521 | | |

$ | 3,709 | | |

| 6.3 | % |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 4,420 | | |

$ | 4,420 | | |

| | |

| Service revenue on a constant currency basis | |

$ | 58,812 | | |

$ | 66,941 | | |

$ | 8,129 | | |

| 13.8 | % |

| | |

| | | |

| | | |

| | | |

| | |

| | |

Nine Months Ended September 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Product Revenue: | |

| | | |

| | | |

| | | |

| | |

| Product Revenue as reported | |

$ | 43,231 | | |

$ | 36,563 | | |

$ | (6,668 | ) | |

| (15.4 | %) |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 348 | | |

$ | 348 | | |

| | |

| Product revenue on a constant currency basis | |

$ | 43,231 | | |

$ | 36,911 | | |

$ | (6,320 | ) | |

| (14.6 | %) |

| | |

Nine Months Ended September 30, | | |

Year Over Year Change | |

| ($ in Thousands) | |

2022 | | |

2023 | | |

$ | | |

% | |

| | |

| | |

| | |

| | |

| |

| Total Revenue: | |

| | | |

| | | |

| | | |

| | |

| Total Revenue as reported | |

$ | 102,043 | | |

$ | 99,084 | | |

$ | (2,959 | ) | |

| (2.9 | %) |

| Conversion impact of U.S. Dollar | |

| | | |

$ | 4,768 | | |

$ | 4,768 | | |

| | |

| Total revenue on a constant currency basis | |

$ | 102,043 | | |

$ | 103,852 | | |

$ | 1,809 | | |

| 1.8 | % |

Exhibit

99.2

Powerfleet

Q3 2023 Conference Call Script

Thursday,

November 9, 2023 at 8:30 a.m. Eastern time

Steve

Towe – CEO

Good

morning, everyone, and thank you for being here today.

In

today’s call, I will share an update on our Q3 performance, as well as spending some time reviewing progress on the strategic pillars

of the business.

Turning

first to our Q3 performance, we are delighted to report a strong set of Q3 financial results. Our commitment to evolve into a high-quality

SaaS business, required us to take brave decisions to manage existing revenues in ways where our success would become clearer in quarters

rather than months. In essence, we have been executing a private equity style transformative playbook in the public market.

Central

to this strategy, is building a pipeline of strategic product sales that pulls through sticky high margin SaaS revenue, while shedding

non-core and non-profitable product business. We have been clear that executing this transition would result in revenues coming down

through early to mid-2023 before reaching an inflection point where higher product revenue would begin flowing through the P&L in

second half 2023.

I’m

pleased to report this inflection point is now evident in our numbers. Our Q3 total revenue performance was our best result in four quarters.

Total revenue increased by 7% sequentially, Q3 product revenue increased quarter over quarter by an impressive 19% at a much-improved

gross margin. At the same time our service revenue increased by 11% on a constant currency basis year over year.

Looking

at adjusted EBTIDA we made a commitment that we would take the necessary steps to absorb the cost and cash burn of our investment in

engineering talent following our Q1 Movingdots acquisition. Clear success here is evident in our Q3 numbers with sequential adjusted

EBITDA increasing threefold to $2 million.

David

will dive into more details on our financial performance shortly.

I

view the quarterly earnings cycle as an opportunity to provide an overview of strategic and operational changes in the business and as

a regular opportunity for our stakeholders to evaluate whether we are achieving the objectives we set for the revised business strategy,

following my appointment in January 2022.

The

overriding reason I took the helm at Powerfleet was a conviction that it provided a starting foundation to build a word class business

and ultimately create a highly valued and appreciated SaaS asset in the industry.

To

realize this vision, it was essential to execute a substantial transformation plan at pace. To succeed, we took aggressive and decisive

actions designed to enable Powerfleet to have a credible shot at being at the forefront of the data led SaaS revolution of the industry

in the years to come. This remains a bold and ambitious mission for Powerfleet, our investors, and now our partners from MiX Telematics.

Trust

is a key currency in successfully navigating this kind of transition and is built by following through on your commitments. A common

mantra for those of you who have joined me on this journey, is the commitment of the Powerfleet team to “say what we do and do

what we say.”

To

demonstrate that these words have substance, I’ll now share proof points from the revolutionary change program focusing on the

three major areas we knew we would need to significantly transform in the first two years of my tenure: First Scale; second Technology;

and third the shape and health of our P&L and Balance Sheet.

Looking

at scale, we are not here to be an “also ran” in this industry, we’re here to secure a place at the very top table.

I’m convinced that there will be four or five consolidated global players that will dominate the space over time, and we very much

intend to be one of them.

To

get there, we need the depth of resources to invest at the level the market demands; and have breadth of data led solution capability

to feed, refine and evolve best-in-class AI engines, earning the right to be a mission critical provider, in an integrated fashion, for

an energized customer base.

With

the announcement of the MiX combination, both organizations have taken a massive step towards securing the necessary scale. Anticipated

achievements of the transaction to support the combined strategy include:

| |

● |

Annual

revenue increasing from ~$135M to ~$280M.

|

| |

|

|

| |

● |

Adjusted

EBITDA increasing from $7M to $39M. |

| |

|

|

| |

● |

The

number of subscribers on our platforms increasing from 700K to 1.8 million. |

| |

|

|

| |

● |

The

engineering team growing from 90 to over 230 colleagues. |

| |

|

|

| |

● |

Enterprise

customers growing from 3,500 to more than 7,500. |

Now

onto Technology, where the Unity AI and data platform strategy has been validated by customers and industry analysts alike. It was also

pivotal to MiX’s decision to combine forces with Powerfleet. Joss and his team have produced a successful and incredibly well-run

business that’s been steeped in the industry for over 25-years. The fact they believe wholeheartedly that the Unity vision is the

right one to take a leading position in our fast-evolving industry, is a compelling validation for the unique Unity data highway and

integrated ecosystem.

Another

proud achievement this year remains the Q1 acquisition of Movingdots, which secured some unique IP in the Insurance space, alongside

a sizable team of data scientists and AI experts with deep domain knowledge. We believe that the combined engineering teams and datasets

of Powerfleet and MiX will provide the strategic pillars for us to be a technological and market leader in the rapidly emerging Artificial

Intelligence of things, or AIOT, space, driven through the Unity platform.

Now

onto the Evolution of our P&L and Balance Sheet

I

shared at the start of this call our progress against our strategy to evolve the P&L to successfully build a pipeline of strategic

product sales that pulls through sticky high margin SaaS revenue, while shedding non-core and non-profitable product business, and that

we have reached the inflection point in our strong Q3 performance. I’d like to add some more color on the strategic evolution of

our P&L and Balance Sheet.

Looking

at the geographic distribution of revenue, we have been very clear that we would directly address the mindshare and hidden cost drag

of our subscale businesses in Brazil, Argentina and South Africa. At a single stroke, our announced combination with MiX enables us to

retain and scale these books of business, particularly in South Africa, which will combine with MiX’s powerful local operation,

and Brazil where we reach critical mass on a combined basis.

With

regards to the balance sheet, the MiX combination provides an elegant and shareholder friendly pathway to meet our commitment to address

the challenging Abry preferred instrument.

Based

on any measure these are major accomplishments across all three areas and this is a testament to the ability of the team to deliver compelling

results against ambitious targets.

As

I approach my two-year anniversary, I’m proud to say that the prospects and the strategic potential of the business are transformed.

The right chess pieces are now in the place for the next phase of our journey; a phase that is centered on realizing significant enterprise

value for our shareholders.

Ahead

of sharing insights and thoughts on this, I’ll ask David to walk you through our third quarter results in detail. David?

David

Wilson – CFO

Thanks,

Steve, and good morning, everyone.

Continuing

the spirit of transparency and accountability, I’ll firstly provide an update on the key strategic priorities that I called out

on our prior call before providing additional insight on the numbers.

Strategic

priority number one is to accelerate our business transformation while living within the limits of our current balance sheet. Our October

10th MiX merger announcement is a game changer while the realized results from our cut to cover activities for Movingdots,

with adjusted EBITDA trebling sequentially, demonstrates a team that can execute decisively and at pace.

While

these initiatives are major wins they naturally created some headwind in our short-term financial results with $1.4 million in one-time

transaction and rationalization expenses incurred in the quarter.

Priority

number two is to improve the underlying operating leverage of our business by implementing a common and scalable software platform across

all geographies.

The

central tenet of this initiative is the roll out of a global ERP system and, as I’m sure you can appreciate, our business combination

with MiX significantly increases the scale of this endeavor and presented us with alternative pathways. Based on an initial review,

we concluded that the most expeditious option to get the entire global business on single ERP instance is to standardize on MiX’s

Dynamics 365 solution that is actively being rolled out.

A

global ERP is of critical importance for both realizing millions of dollars in spend efficiencies and building out a rich set of SaaS

metrics that provide proof points on the durability of revenue and operating leverage inherent in our business model. ERP is a major

workstream for integration planning and execution and we will continue to provide regular insights and updates on future calls.

Now

onto our financial performance for the quarter.

Starting

with revenue where the underlying quality is radically improved versus the prior year. While Total revenue for the quarter ended September

30, 2023, of $34.2 million was in line with last year, approximately $2 million of low value product revenue has actively been shed from

the business and replaced with high margin service revenue, up 4% on an absolute basis and over 11% on a constant currency basis. Additionally,

our product sales are increasingly high-margin; differentiated; and centered on pulling through sticky SaaS revenue. Success here is

evident in sequential performance where product margins increased from 22% to over 30%.

Total

gross profit margin for the quarter of 50% was in line with the prior year. Product gross margin of 33% benefited from $0.4M of out of

period import duty recovery. On an adjusted basis product gross margin was 30%. Meanwhile Service gross margin of 61% was hindered by

$0.4M in out of period infrastructure expense and $0.3M in Unity depreciation expense. Adjusting for these items, service gross margin

was in line with the 64% posted in the prior year.

Onto

operating expenses which increased by $2.0 million to $20.4 million compared to the same year-ago period with the current year impacted

by one time deal and rationalization costs of $1.4 million.

Net

loss attributable to common stockholders totaled $5.0 million, or $(0.14) per basic and diluted share and adjusted EBITDA was $2.0 million,

three times higher than the prior quarter following cut to cover activities for Movingdots.

Our

balance sheet remained strong at quarter-end, with $19.6 million in cash and cash equivalents and a working capital position of $34.5

million.

Looking

to the future, we recognize that the macro environment poses certain challenges in specific markets and regions. Specifically, the ongoing

conflict in Israel has, understandably, brought about temporary fluctuations in product demand and foreign currency challenges.

It

is worthy to note that over 80% of our book of business in the Israel is recurring subscription revenue that is centered on transportation

safety and security, an essential versus discretionary need.

Most

importantly, I’m relieved to report that despite the horrific ongoing events and related strain to all those impacted, our Israeli

team members are currently safe, and our facilities remain unaffected. While we continue to closely monitor the situation, this assurance

of safety is paramount. We have also enacted our Business Continuity Plan to ensure we have redundant capabilities for the services our

Israeli team provides to our global business particularly around Supply Chain and Distribution.

That

concludes my remarks. Steve?

Steve

Towe – CEO

Thanks,

David.

Our

Q3 financial results are a testament to the exceptional execution by our global team. These on-plan results are particularly impressive

when you take into consideration they were achieved in the midst of an immense effort to sign our transformative business combination

with MiX.

Moving

back to the overall view of the business, we continue to gain strong traction. This is especially true as we witness the resounding success

of Unity, our safety-driven industrial solutions, and our connected car offerings.

In

Q3 we are delighted to announce new logo wins in North America with the likes of Valvoline, Summit Construction and Development, Oi Glass,

and CMC, and major account expansion projects with the likes of NACPC, Brinks, General Motors, Georgia Pacific and Femsa.

From

a market development perspective, Safety remains at the heart of what we do. Here are some examples we achieved in Q3:

| |

● |

Powerfleet

expanded its existing relationship with Mitsubishi Logisnext America (MLA), the fourth largest forklift manufacturer in the world.

We signed a white-label agreement, creating a competitive advantage for MLA and an additional revenue stream for Powerfleet. |

| |

|

|

| |

● |

The

U.S. Department of Transportation launched an initiative and subsequent campaign to reduce the rising number of serious injuries

and deaths on America’s highways, roads, and streets. After an extensive review process, Powerfleet and our Unity platform

was selected as a partner to join the U.S. Department of Transportation effort to improve road safety. |

| |

|

|

| |

● |

ABI

Research, a leading analyst in the IoT industry released a competitive report that compared vendors of video safety solutions to

provide a third party assessment and ranking. After a full assessment process - which included innovation criteria like solution

options, user experience, and use cases - Powerfleet was named a Top Innovator, ranked in the top 5 in the world. |

To

close off our prepared remarks, I’ll now set expectations on what the combined Powerfleet and MiX team is committed to deliver

over the coming quarters, in a similar fashion to the initial commitments I made for the business at the beginning of 2022.

Delivery

will be across the following three vectors: Technology; Financial performance; and realizing Shareholder value.

Starting

with Technology.

We

will continue to strengthen and broaden the capabilities of Unity and demonstrate this is a true software platform capable of expanding

wallet share with our existing customers as well as acting as a powerful magnet for new ones. Unity is on the path to become a platform

and ecosystem that in the future will go well beyond traditional telematics. Scaling our device agnostic and data ingestion capabilities,

harnessing our AI led insights for customers and providing flexibility on how they consume those insights, whether through our advanced

applications or other integration points positions Unity as a true data highway and ecosystem hub for broader IoT use cases.

Looking

at Financial Performance we expect to deliver accelerated revenue growth:

| |

● |

We

expect to realize readily available revenue synergies from the MiX combination sourced from compelling cross sell and upsell opportunities

through the combined complementary product portfolios. Powerfleet’s solutions will also benefit from the global reach of MiX’s

120 indirect channel partners. |

| |

|

|

| |

● |

Expect

Unity to be an engine driving a steady quarterly climb of net dollar retention to best in class levels as: |

| |

○ |

the

device agnostic capabilities of Unity expands

the set of revenue generating subscribers well beyond those we directly supply; |

| |

|

|

| |

○ |

our

value-added modules and integration points provide

significant headroom on the amount of revenue we can generate per subscriber; and |

| |

|

|

| |

○ |

our

solutions become increasingly sticky as the

value of the data that we provide reaches well beyond the underlying asset owner in organizations. |

| |

● |

Expect

rapidly expanding adjusted EBITDA. The opportunities coming out of the combination are both substantial and readily accessible and

we expect adjusted EBITDA to more than double from a trailing twelve months starting point. |

| |

|

|

| |

● |

Expect

best in class Rule of 40 financial performance within two years of close. |

Now

onto Shareholder Value Creation where we expect to take major strides in recalibrating the way Powerfleet is viewed and valued

by the market. Areas of focus include:

.

| |

● |

the

MiX combination provides size and scale that

will enable us to attract a much broader set of investors; |

| |

|

|

| |

● |

the

steady release of Unity AIOT powered offerings

will enable us to break away from the market’s traditional view of telematics providers; |

| |

|

|

| |

● |

the

roll out our global ERP for the combined company

will allow us to report an increasingly rich set of SaaS metrics which will provide clarity and transparency on the quality and durability

of our recurring revenue book of business with a specific focus on net dollar retention; and finally |

| |

|

|

| |

● |

securing

an enterprise value that is underpinned by a

Rule of 40 revenue multiple. |

We

clearly now have a compelling short to mid-term value proposition to present to the markets and as a result we will be intensifying our

Investor outreach.

This

starts next week where the Joint Powerfleet and MiX team will attend the Roth investor conference in mid-town Manhattan on November 15th;

we will host our joint investor day with MiX at The InterContinental New York Barclay Hotel in Mid-Town Manhattan at 2pm ET on November

16th; David will be joining the MiX team at the Raymond James TMT conference In New York on December 5th; and finally

we plan to execute an investor roadshow early in the new year. We look forward to seeing as many of you as possible at these events.

I’ll

now turn it back over to the operator for Q&A. Operator?

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e