As

filed with the Securities and Exchange Commission on August 10, 2023

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-8

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

POWERFLEET,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

83-4366463 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification Number) |

123

Tice Boulevard

Woodcliff

Lake, New Jersey 07677

(Address,

including zip code, of principal executive offices)

Stock

Option inducement awards

POWERFLEET,

INC. 2018 Incentive Plan

(Full

title of the plan)

David

Wilson

Chief

Financial Officer

PowerFleet,

Inc.

123

Tice Boulevard

Woodcliff

Lake, New Jersey 07677

(201)

996-9000

(Name,

address and telephone number, including area code, of agent for service)

With

a copy to:

| Honghui

S. Yu, Esq. |

| Olshan

Frome Wolosky LLP |

| 1325

Avenue of the Americas |

| 15th

Floor |

| New

York, New York 10019 |

| Telephone:

(212) 451-2300 |

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

Accelerated

filer ☒ |

| Non-accelerated

filer ☐

| Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY

NOTE

This

Registration Statement on Form S-8 is being filed by PowerFleet, Inc. (the “Company”) for the purpose of registering (i)

an aggregate of 405,000 shares of the Company’s common stock, par value $0.01 (“Common Stock”), issuable pursuant to

Stock Option Inducement Award Agreements providing for inducement grants to David Wilson, the Company’s Chief Financial Officer,

in accordance with the inducement grant exception under Rule 5635(c)(4) of the Nasdaq Listing Rules and (ii) an additional 1,000,000

shares of Common Stock under the Company’s 2018 Incentive Plan, as amended. Each of the Company’s Registration Statements

on Form S-8 (File Nos. 333-234079 and 333-258715) filed with the Securities and Exchange Commission (the “SEC”) on October

3, 2019 and August 11, 2021, respectively, is incorporated by reference herein.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

The

documents containing the information required by Item 1 and Item 2 of Part I of Form S-8 will be sent or given to employees as specified

by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). Such documents need not be filed with

the SEC either as part of this registration statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities

Act. These documents and the documents incorporated by reference in the registration statement pursuant to Item 3 of Part II of Form

S-8, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART

II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The

following documents previously filed by the Company with the SEC under the Securities Act and the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), are incorporated herein by reference (other than any such documents or portions thereof that

are furnished under Item 2.02 or Item 7.01 of Form 8-K, unless otherwise indicated therein, including any exhibits included with such

Items):

| |

● |

Our

Annual Report on Form 10-K for the fiscal year ended December 31, 2022 filed with the SEC on March 31, 2023, as amended by the Form

10-K/A filed with the SEC on May 1, 2023; |

| |

|

|

| |

● |

Our

Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2023 filed with the SEC on May

10, 2023 and the fiscal quarter ended June 30, 2023 filed with the SEC on August

10, 2023; |

| |

|

|

| |

● |

Our

Current Reports on Form 8-K filed with the SEC on January 4, 2023 (as amended by the Form 8-K/A filed with the SEC on January 6, 2023), March 9, 2023, April 7, 2023 and July 26, 2023; and |

| |

|

|

| |

● |

The

description of the common stock of the Company contained in our Registration Statement on Form S-4 (File No. 333-231725), or any

registration statement or report subsequently filed under the Exchange Act for the purpose of updating such description. |

All

documents filed by the Company pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act subsequent to the date of this Registration

Statement (other than any such documents or portions thereof that are furnished under Item 2.02 or Item 7.01 of Form 8-K, unless otherwise

indicated therein, including any exhibits included with such Items), prior to the filing of a post-effective amendment to this Registration

Statement which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold,

shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such

documents.

Any

statement contained in this Registration Statement or in a document incorporated or deemed to be incorporated by reference herein shall

be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained or incorporated

by reference herein or in any subsequently filed document that is deemed to be incorporated by reference herein modifies or supersedes

such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute

a part of this Registration Statement.

Item

4. Description of Securities

Not

applicable.

Item

5. Interests of Named Experts and Counsel

Not

applicable.

Item

6. Indemnification of Directors and Officers

Section

145 of the Delaware General Corporation Law (the “DGCL”) provides that a corporation may indemnify directors and officers

as well as other employees and individuals against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement

in connection with specified actions, suits or proceedings, whether civil, criminal, administrative or investigative (other than an action

by or in the right of the corporation – a “derivative action”), if they acted in good faith and in a manner they reasonably

believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal actions or proceedings, had

no reasonable cause to believe their conduct was unlawful. A similar standard is applicable in the case of derivative actions, except

that indemnification only extends to expenses (including attorneys’ fees) actually and reasonably incurred in connection with the

defense or settlement of such action, and the DGCL requires court approval before there can be any indemnification where the person seeking

indemnification has been found liable to the corporation. The DGCL provides that it is not exclusive of other rights to indemnification

that may be granted by a corporation’s bylaws, disinterested director vote, stockholder vote, agreement or otherwise.

Pursuant

to the terms of the Company’s Amended and Restated Certificate of Incorporation (the “Charter”), the Company has agreed

to indemnify its current and former directors and officers (and the current and former directors and officers of its subsidiaries) against

liability and loss suffered and expenses (including reasonable attorneys’ fees) reasonably incurred in connection with any claim

made against such director or officer or any actual or threatened action, suit or proceeding in which such director or officer may be

involved by reason of being or having been a director or officer of the Company or its subsidiaries, or, while serving as a director

or officer of the Company or its subsidiaries, of serving or having served at the Company’s request as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise.

The

Charter provides that expenses (including attorneys’ fees) incurred by such persons in defending any action, suit or proceeding

shall be paid in advance of the final disposition of such action, suit or proceeding, provided that, to the extent required by law, such

advancement of expenses shall be made only upon receipt of an undertaking by or on behalf of such person to repay such amount if it is

ultimately determined that such person is not entitled to be so indemnified.

The

Charter also provides that the Company may indemnify its current and former employees and agents and may advance expenses to such employees

and agents on such terms and conditions as may be approved by the board of directors.

Section

102(b)(7) of the DGCL permits a provision in the certificate of incorporation of each corporation organized thereunder, such as the Company,

eliminating or limiting, with certain exceptions, the personal liability of a director to the corporation or its stockholders for monetary

damages for breach of fiduciary duty as a director. The Charter eliminates the liability of directors to the extent permitted by the

DGCL.

The

Company has also entered into indemnification agreements with members of its board of directors and officers (the “Indemnification

Agreement”). The Indemnification Agreement, subject to limitations contained therein, will obligate the Company to maintain director

and officer insurance if reasonably available, and to indemnify the indemnitee, to the fullest extent permitted by applicable law, for

certain expenses, including attorneys’ fees, judgments, penalties, fines and settlement amounts actually and reasonably incurred

by him or her in any threatened, pending or completed action, suit, claim, investigation, inquiry, administrative hearing, arbitration

or other proceeding arising out of his or her services as a director or officer. Subject to certain limitations, the Indemnification

Agreement provides for the advancement of expenses incurred by the indemnitee, and the repayment to the Company of the amounts advanced

to the extent that it is ultimately determined that the indemnitee is not entitled to be indemnified by the Company. The Indemnification

Agreement also creates certain rights in favor of the Company, including the right to assume the defense of claims and to consent to

settlements. The Indemnification Agreement does not exclude any other rights to indemnification or advancement of expenses to which the

indemnitee may be entitled under applicable law or the Charter or by any other agreement, a vote of stockholders or disinterested directors,

or otherwise.

The

Company carries directors’ and officers’ liability insurance that covers certain liabilities and expenses of its directors

and officers.

The

foregoing summaries are qualified in their entirety by the terms and provisions of such arrangements.

Item 7. Exemption From Registration Claimed

Not

applicable.

Item

8. Exhibits

Item

9. Undertakings.

(a)

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth

in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total

dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b) if, in the aggregate, the

changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Registration Fee” table in this effective Registration Statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement

or any material change to such information in this Registration Statement;

provided,

however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to section 13 or section 15(d)

of the Exchange Act that are incorporated by reference in this Registration Statement.

(2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be

a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed

to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

(b)

The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of

the registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an

employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this

Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h)

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the SEC

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that

a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Woodcliff Lake, State of New Jersey on August 9, 2023.

| |

POWERFLEET,

INC. |

| |

|

|

| |

By: |

/s/

David Wilson |

| |

Name: |

David

Wilson |

| |

Title: |

Chief

Financial Officer |

POWER

OF ATTORNEY

KNOW

ALL MEN BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Steve Towe and David Wilson as his

true and lawful attorney-in-fact, each acting alone, with full power of substitution and resubstitution for him and in his name, place

and stead, in any and all capacities, to sign any and all amendments, including post-effective amendments, to this Registration Statement,

and to file the same, with exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission,

hereby ratifying and confirming all that said attorneys-in-fact or their substitutes, each acting alone, may lawfully do or cause to

be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, this Registration Statement has been signed below by the following persons in the

capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Steve Towe |

|

Chief

Executive Officer and Director

|

|

August

9, 2023 |

| Steve

Towe |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

David Wilson |

|

Chief

Financial Officer

|

|

August

9, 2023 |

| David

Wilson |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Anders Bjork |

|

Director |

|

August

9, 2023 |

| Anders

Bjork |

|

|

|

|

| |

|

|

|

|

| /s/

Michael Brodsky |

|

Director

and Chairman of the Board |

|

August

9, 2023 |

| Michael

Brodsky |

|

|

|

|

| |

|

|

|

|

| /s/

Michael Casey |

|

Director

|

|

August

9, 2023 |

| Michael

Casey |

|

|

|

|

| |

|

|

|

|

| /s/

Charles Frumberg |

|

Director |

|

August

9, 2023 |

| Charles

Frumberg |

|

|

|

|

| |

|

|

|

|

| /s/

Elchanan Maoz |

|

Director |

|

August

9, 2023 |

| Elchanan

Maoz |

|

|

|

|

| |

|

|

|

|

| /s/

Medhini Srinivasan |

|

Director |

|

August

9, 2023 |

| Medhini

Srinivasan |

|

|

|

|

Exhibit

5.1

August

9, 2023

PowerFleet,

Inc.

123

Tice Boulevard

Woodcliff

Lake, New Jersey 07677

| |

Re: |

Registration

Statement on Form S-8 |

Ladies

and Gentlemen:

We

have acted as counsel to PowerFleet, Inc., a Delaware corporation (the “Company”), in connection with the filing with the

Securities and Exchange Commission (the “Commission”) of the Company’s Registration Statement on Form S-8 (the “Registration

Statement”) relating to the registration of (i) an aggregate of 405,000 shares (the “Inducement Shares”) of the Company’s

common stock, par value $0.01 per share (“Common Stock”), issuable pursuant to Stock Option Inducement Award Agreements providing

for inducement stock option grants between the Company and David Wilson, the Company’s Chief Financial Officer (the “Award

Agreements”), which were entered into in connection with Mr. Wilson’s entering into employment with the Company in accordance

with the inducement grant exception under Rule 5635(c)(4) of the Nasdaq Listing Rules, and (ii) 1,000,000 shares (the “Plan Shares”)

of Common Stock issuable pursuant to the terms of and in the manner set forth in the Company’s 2018 Incentive Plan, as amended

(the “Plan”).

This

opinion letter is being delivered at the request of the Company and in accordance with the requirements of Item 601(b)(5) of Regulation

S-K promulgated under the Securities Act of 1933, as amended (the “Securities Act”).

We

advise you that we have examined executed originals or copies certified or otherwise identified to our satisfaction of (i) the Registration

Statement, (ii) the Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws, each as amended

to date, (iii) the Award Agreements, (iv) the Plan and (v) corporate proceedings of the Company, and such other documents, instruments

and certificates of officers and representatives of the Company and of public officials, and we have made such examination of law, as

we have deemed necessary or appropriate for purposes of the opinion expressed below.

We

have assumed for purposes of rendering the opinion set forth herein, without any verification by us, the genuineness of all signatures,

the legal capacity of all natural persons to execute and deliver documents, the authenticity and completeness of documents submitted

to us as originals and the completeness and conformity with authentic original documents of all documents submitted to us as copies,

and that all documents, books and records made available to us by the Company are accurate and complete.

August

9, 2023

Page

2

On

the basis of the foregoing and in reliance thereon and subject to the assumptions, qualifications and limitations set forth herein, we

advise you that in our opinion, (i) the Inducement Shares have been duly authorized and, when issued and paid for pursuant to the terms

of and in the manner set forth in the Award Agreements, will be validly issued, fully paid and non-assessable, and (ii) the Plan Shares

have been duly authorized and, when issued and paid for pursuant to the terms of and in the manner set forth in the Plan, will be validly

issued, fully paid and non-assessable.

We

are members of the Bar of the State of New York. We express no opinion as to the effect of any laws other than the laws of the State

of New York, the General Corporation Law of the State of Delaware and the federal laws of the United States of America, each as in effect

on the date hereof.

This

opinion speaks only at and as of its date and is based solely on the facts and circumstances known to us at and as of such date. We assume

no obligation to revise or supplement this opinion to reflect any facts or circumstances that may hereafter come to our attention or

any changes in fact or law that may hereafter occur.

We

hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby concede

that our firm is within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations

of the Commission thereunder.

| |

Very

truly yours, |

| |

|

| |

/s/ Olshan Frome Wolosky LLP |

| |

|

| |

OLSHAN

FROME WOLOSKY LLP |

Exhibit

23.1

Consent

of Independent Registered Public Accounting Firm

We

consent to the incorporation by reference in the Registration Statement on Form S-8 pertaining to the Stock Option Inducement Awards

of PowerFleet, Inc. and the PowerFleet, Inc. 2018 Incentive Plan, as amended, of our reports, dated March 31, 2023, with respect to the

consolidated financial statements of PowerFleet, Inc. and the effectiveness of internal control over financial reporting of PowerFleet,

Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2022, filed with the Securities and Exchange Commission.

| /s/

Ernst & Young LLP |

|

| |

|

| Iselin,

New Jersey |

|

| August

9, 2023 |

|

Exhibit

99.1

POWERFLEET,

INC. STOCK OPTION INDUCEMENT AWARD AGREEMENT

THIS

STOCK OPTION INDUCEMENT AWARD AGREEMENT (the “Grant Agreement”) is made and entered into by and between PowerFleet,

Inc., a Delaware Corporation (the “Company”) and the following individual:

| Name: |

David

Wilson (the “Optionee”) |

The

Optionee is granted an option to purchase Common Stock of the Company (this “Option”), subject in all events to the

terms and conditions of this Grant Agreement, as follows:

| A. |

DATE

OF GRANT: January 4, 2023 |

| |

|

| B. |

TYPE(S)

OF OPTION: |

☐

Nonstatutory Stock Option. |

| |

|

|

| |

|

☐

Incentive Stock Option. |

To

the extent designated as an Incentive Stock Option (“ISO”), this Option is intended to qualify as an Incentive Stock

Option under Section 422 of the Code. However, notwithstanding such designation, if the Optionee becomes eligible in any given year to

exercise ISOs for Shares having a Fair Market Value in excess of $100,000, those Options representing the excess shall be treated as

Nonstatutory Stock Options (“NSOs”). In the previous sentence, “ISOs” include ISOs granted under any plan

of the Company or any Parent or any Subsidiary. For the purpose of deciding which Options apply to Shares that “exceed” the

$100,000 limit, ISOs shall be taken into account in the same order as granted. The Fair Market Value of the Shares shall be determined

as of the time the Option with respect to such Shares is granted. Optionee hereby acknowledges that there is no assurance that the Option

will, in fact, be treated as an Incentive Stock Option under Section 422 of the Code.

| C. |

TOTAL

SHARES OF COMMON STOCK COVERED BY THIS OPTION: |

| |

[___________]

Shares, as follows: |

|

| |

|

|

| |

Number

Granted as Incentive Stock Options: |

______________ |

| |

|

|

| |

Number

Granted as Nonstatutory Stock Options: |

______________ |

| D. |

EXERCISE

PRICE OF OPTION: $3.00 per Share (the “Exercise Price”). |

| |

|

| E. |

EXPIRATION

DATE: January 4, 2033 |

F. VESTING SCHEDULE: This Option will vest [25% annually on each of the first, second, third and fourth anniversaries of the Date

of Grant/in full if the volume weighted average price of the Common Stock during a consecutive 60 trading day period reaches $12.00 per

share]. Except as otherwise provided in this Grant Agreement, any vested portion of this Option (to the extent not previously exercised)

may be exercised, in whole or in part, with respect to the Shares at any time on or after the Date of Grant (or such earlier date and

with respect to such number of Shares as may apply pursuant to the terms of any severance (or other) agreement between the Optionee and

the Company providing for accelerated vesting in certain events), or, if earlier, upon consummation of a Change in Control as provided

(and defined) in the Plan.

Notwithstanding

the foregoing, this Option may not be exercised with respect to any Shares on or after the earlier of (1) the date the Option terminates

and is canceled in accordance with this Grant Agreement and (2) the Expiration Date.

G. INDUCEMENT

AWARD: This Option is made and granted as a stand-alone award, separate and apart from, and outside of, the PowerFleet, Inc. 2018

Incentive Plan (the “Plan”) and shall not constitute an award granted under or pursuant to the Plan.

The grant of this Option is intended to constitute an “employment inducement grant” under Rule 5635(c)(4) of the Nasdaq Listing

Rules. However, except as otherwise expressly stated herein, this option is governed by terms and conditions identical to those of the

Plan, which are incorporated herein by reference. In the event of any conflict between the terms and conditions of this Grant Agreement

and the terms and conditions of the Plan, the terms and conditions of this Grant Agreement shall govern. Capitalized terms used herein

and not otherwise defined shall have the meaning set forth in the Plan.

H. EXERCISE

OF OPTION FOLLOWING TERMINATION OF SERVICE: This Option may be exercised for up to 90 days after the Optionee ceases to be a Service

Provider, except that if such cessation results from the death or Disability of the Optionee, this Option may be exercised for up to

365 days after the Optionee ceases to be a Service Provider. In no event shall this Option be exercised later than the Expiration Date

as provided above and in no event shall this Option be exercised for more Shares than the Shares which otherwise have vested as of the

date of cessation of status as a Service Provider. Notwithstanding the foregoing, if the Optionee’s service or employment with

the Company terminates for Cause, the Option shall not be exercisable following the effective date of such termination of service or

employment.

I. METHOD

OF EXERCISE. This Option is exercisable by delivery of an exercise notice in the form attached as Exhibit A (the “Exercise

Notice”) which shall state the election to exercise the Option, the number of Shares with respect to which the Option is being

exercised (the “Exercised Shares”), and such other representations and agreements as may be required by the Company

pursuant to the provisions of the Plan. The Exercise Notice shall be completed by the Optionee and delivered to the Administrator. The

Exercise Notice shall be accompanied by payment of the aggregate Exercise Price for the Exercised Shares. This Option shall be deemed

to be exercised upon receipt by the Company of the fully executed Exercise Notice accompanied by the aggregate Exercise Price. Notwithstanding

the foregoing, no Exercised Shares shall be issued unless such exercise and issuance complies with the requirements relating to the administration

of stock option plans and other applicable equity plans under U.S. state corporate laws, U.S. federal and state securities laws, the

Code, any stock exchange or quotation system on which the Common Stock is listed or quoted, and the applicable laws of any foreign country

or jurisdiction where stock grants or other applicable equity grants are made under the Plan; assuming such compliance, for income tax

purposes the Exercised Shares shall be considered transferred to the Optionee on the date the Option is exercised with respect to such

Shares.

J. METHOD

OF PAYMENT. Payment of the aggregate Exercise Price shall be by any of the following, or a combination thereof:

| |

1. |

cash; |

| |

|

|

| |

2. |

check;

or |

| |

|

|

| |

3. |

such

other form of consideration as the Administrator shall determine in its discretion, provided that such form of consideration is permitted

by the Plan and by applicable law. |

Upon

exercise of the Option by the Optionee and prior to the delivery of such Exercised Shares, the Company shall have the right to require

the Optionee to remit to the Company cash in an amount sufficient to satisfy applicable Federal and state tax withholding requirements.

K. TAX CONSEQUENCES OF OPTION. Some of the federal income tax consequences relating to the grant and exercise of this Option, as

of the date of this Option, are set forth below. THE FOLLOWING DESCRIPTION OF FEDERAL INCOME TAX CONSEQUENCES IS NECESSARILY INCOMPLETE

(AS THE TAX LAWS AND REGULATIONS ARE SUBJECT TO CHANGE), AND ASSUMES THAT THE EXERCISE PRICE OF THIS OPTION IS NO LESS THAN THE FAIR

MARKET VALUE OF THE COMMON STOCK UNDERLYING THE OPTION AT THE DATE OF GRANT. MOREOVER, THIS SUMMARY ONLY ADDRESSES THE FEDERAL INCOME

TAX CONSEQUENCES UNDER THE LAWS OF THE UNITED STATES, AND DOES NOT ADDRESS WHETHER AND HOW THE TAX LAWS OF ANY OTHER JURISDICTION MAY

APPLY TO THIS OPTION OR TO THE OPTIONEE. ACCORDINGLY, THE OPTIONEE SHOULD CONSULT A TAX ADVISER BEFORE EXERCISING THIS OPTION OR DISPOSING

OF ANY EXERCISED SHARES.

| |

1. |

Grant

of the Option. The grant of an Option generally will not result in the imposition of a tax under the federal income tax laws. |

| |

2. |

Exercising

the Option. |

(a) Nonstatutory Stock Option (“NSO”). The Optionee may incur regular federal income tax liability upon exercise

of a NSO. The Optionee will be treated as having received compensation income (taxable at ordinary income tax rates) equal to the excess,

if any, of the Fair Market Value of the Exercised Shares on the date of exercise over their aggregate Exercise Price. If the Optionee

is an Employee or a former Employee, the Company will be required to withhold from his or her compensation or collect from the Optionee

and pay to the applicable taxing authorities an amount in cash equal to a specified percentage of this compensation income at the time

of exercise, and may refuse to honor the exercise and refuse to deliver Shares if such withholding amounts are not delivered at the time

of exercise.

(b) Incentive

Stock Option (“ISO”). If this Option qualifies as an ISO, the Optionee will have no regular federal income

tax liability upon its exercise, although the excess, if any, of the Fair Market Value of the Exercised Shares on the date of

exercise over their aggregate Exercise Price will be treated as an adjustment to alternative minimum taxable income for federal tax

purposes and may subject the Optionee to alternative minimum tax in the year of exercise. In the event that the Optionee ceases to

be an Employee but remains a Service Provider, any Incentive Stock Option of the Optionee that remains unexercised shall cease to

qualify as an Incentive Stock Option and will be treated for tax purposes as a Nonstatutory Stock Option on the date three (3)

months and one (1) day following such change of status.

| |

3. |

Disposition

of Shares. |

(a) NSO. If the Optionee holds NSO Shares for at least one year, any gain realized on disposition of the Shares will be treated as

long-term capital gain for federal income tax purposes.

(b) ISO. If the Optionee holds ISO Shares for at least one year after exercise and two years after the grant date, any gain realized

on disposition of the Shares will be treated as long-term capital gain for federal income tax purposes. If the Optionee disposes of ISO

Shares within one year after exercise or within two years after the grant date, any gain realized on such disposition will be treated

as compensation income (taxable at ordinary income rates) to the extent of the excess, if any, of the lesser of (A) the difference between

the Fair Market Value of the Shares acquired on the date of exercise and the aggregate Exercise Price, or (B) the difference between

the sale price of such Shares and the aggregate Exercise Price. Any additional gain will be taxed as short-term or long-term capital

gain, depending on the period that the ISO Shares were held.

(c) Notice of Disqualifying Disposition of ISO Shares. If the Optionee sells or otherwise disposes of any of the Shares acquired pursuant

to an ISO on or before the later of (i) two years after the grant date, or (ii) one year after the exercise date, the Optionee shall

promptly notify the Company in writing of such disposition. The Optionee agrees that he or she may be subject to income tax withholding

by the Company on the compensation income recognized from such early disposition of ISO Shares by payment in cash or out of the current

earnings paid to the Optionee.

L. NON-TRANSFERABILITY OF OPTION. Unless otherwise consented to in advance in writing by the Administrator, this Option may not be

transferred in any manner otherwise than by will or by the laws of descent or distribution and may be exercised during the lifetime of

the Optionee only by the Optionee. The terms of the Plan and this Grant Agreement shall be binding upon the executors, administrators,

heirs, successors and assigns of the Optionee.

M. SECURITIES MATTERS. All Shares and Exercised Shares shall be subject to the restrictions on sale, encumbrance and other disposition

provided by Federal or state law. As a condition precedent to the Optionee’s acquisition of Exercised Shares, the Company may require

that the Optionee submit a letter to the Company stating that such Shares are being acquired for investment and not with a view to the

distribution thereof. The Company shall not be obligated to sell or issue any Shares or Exercised Shares pursuant to this Grant Agreement

unless, on the date of sale and issuance thereof, such Shares are either registered under the Securities Act of 1933, as amended, and

all applicable state securities laws, or are exempt from registration thereunder. Any such Shares acquired by the Optionee may bear a

restrictive legend summarizing any restrictions on transferability applicable thereto, including those imposed by Federal and state securities

laws. Notwithstanding anything to the contrary contained herein, in the event that the Company at any time ceases to be eligible to use

Form S-8, or any then effective Form S-8 (or successor form) ceases to be effective for any reason, the Company shall have no obligation

or liability to sell or issue any Shares or Exercised Shares pursuant to this Grant Agreement unless and until such eligibility or effectiveness

is restored.

N. OTHER PLANS. No amounts of income received by the Optionee pursuant to this Grant Agreement shall be considered compensation for

purposes of any pension or retirement plan, insurance plan or any other employee benefit plan of the Company or its subsidiaries, unless

otherwise provided in such plan.

O. NO GUARANTEE OF CONTINUED SERVICE. THE OPTIONEE ACKNOWLEDGES AND AGREES THAT THE VESTING OF SHARES PURSUANT TO THE VESTING SCHEDULE HEREOF

IS EARNED ONLY BY CONTINUING EMPLOYMENT WITH THE COMPANY (AND NOT THROUGH THE ACT OF BEING HIRED, BEING GRANTED AN OPTION OR PURCHASING

SHARES HEREUNDER). THE OPTIONEE FURTHER ACKNOWLEDGES AND AGREES THAT THIS GRANT AGREEMENT, THE TRANSACTIONS CONTEMPLATED HEREUNDER AND

THE VESTING SCHEDULE SET FORTH HEREIN DO NOT CONSTITUTE AN EXPRESS OR IMPLIED PROMISE OF CONTINUED EMPLOYMENT FOR THE VESTING PERIOD,

FOR ANY PERIOD, OR AT ALL, AND SHALL NOT INTERFERE WITH THE OPTIONEE’S RIGHT OR THE COMPANY’S RIGHT TO TERMINATE THE EMPLOYMENT

RELATIONSHIP AT ANY TIME, WITH OR WITHOUT CAUSE.

P. ENTIRE AGREEMENT; GOVERNING LAW. The Plan is incorporated herein by reference. The Plan and this Grant Agreement constitute the

entire agreement of the parties with respect to the subject matter hereof and supersede in their entirety all prior undertakings and

agreements of the Company and the Optionee with respect to the subject matter hereof, and may not be modified adversely to the Optionee’s

interest except by means of a writing signed by the Company and Optionee. This Grant Agreement is governed by the internal substantive

laws, but not the choice of law rules, of the State of Delaware.

By

your signature and the signature of the Company’s representative below, you and the Company agree that this Option is granted under

and governed by the terms and conditions of the Plan and this Grant Agreement. The Optionee has reviewed the Plan and this Grant Agreement

in their entirety, has had an opportunity to obtain the advice of counsel prior to executing this Grant Agreement and fully understands

all provisions of the Plan and this Grant Agreement. The Optionee hereby agrees to accept as binding, conclusive and final all decisions

or interpretations of the Administrator upon any questions relating to the Plan and this Grant Agreement. The Optionee further agrees

to notify the Company upon any change in the residence address indicated herein.

| OPTIONEE |

|

POWERFLEET, INC. |

| |

|

|

|

|

| |

|

By: |

|

| |

|

|

|

|

| David Wilson |

|

Steve Towe/Chief Executive Officer |

| Print Name |

|

Print Name/Title |

| |

|

|

|

|

| Date: |

|

|

Date: |

|

Nothing

contained herein concerning certain federal income tax considerations is intended or written to be used, and cannot be used, for the

purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing, or recommending to another

party any transactions or tax-related matters addressed herein.

EXHIBIT

A

POWERFLEET, INC.

EXERCISE NOTICE

PowerFleet,

Inc.

123

Tice Boulevard, Suite 101

Woodcliff

Lake, NJ 07677

Attention:

1. Exercise of Option. Effective as of today, _____, 20__, the undersigned (“Purchaser”) hereby elects to purchase _____

shares (the “Shares”) of the Common Stock of PowerFleet, Inc. (the “Company”) under and pursuant to the PowerFleet,

Inc. 2018 Incentive Plan (the “Plan”) and the Stock Option Inducement Award Agreement dated January 4, 2023 (the

“Option Agreement”). The purchase price for the Shares shall be $3.00, as required by the Option Agreement.

2. Delivery of Payment. Purchaser herewith delivers to the Company the full purchase price for the Shares.

3. Representations of Purchaser. Purchaser acknowledges that Purchaser has received, read and understood the Plan and the Option

Agreement and agrees to abide by and be bound by their terms and conditions. Unless the Company is a public corporation which has registered

the shares issuable under the Plan under the Securities Act of 1933, the Purchaser confirms the representations set forth below:

The

Purchaser is acquiring the Shares for his/her own account and the Shares were acquired by him/her for the purpose of investment and not

with a view to distribution or resale thereof in violation of the Securities Act of 1933 (the “Securities Act”). The Purchaser

agrees not to resell or otherwise dispose of all or any part of the Shares purchased by him/her except as permitted by law, including,

without limitation, any regulations under the Securities Act and other applicable securities laws. The Purchaser is able to bear the

economic risk of this investment including a complete loss of the investment.

4. Rights as Shareholder. Until the issuance (as evidenced by the appropriate entry on the books of the Company or of a duly authorized

transfer agent of the Company) of the Shares, no right to vote or receive dividends or any other rights as a shareholder shall exist

with respect to the Shares covered by the Option, notwithstanding the exercise of the Option. The Shares so acquired shall be issued

to the Optionee as soon as practicable after exercise of the Option. No adjustment will be made for a dividend or other right for which

the record date is prior to the date of issuance, except as provided in the Plan.

5. Tax Consultation. Purchaser understands that Purchaser may suffer adverse tax consequences as a result of Purchaser’s purchase

or disposition of the Shares. Purchaser represents that Purchaser has consulted with any tax consultants Purchaser deems advisable in

connection with the purchase or disposition of the Shares and that Purchaser is not relying on the Company for any tax advice.

6. Entire Agreement; Governing Law. The Plan and Option Agreement are incorporated herein by reference. This Agreement, the Plan

and the Option Agreement constitute the entire agreement of the parties with respect to the subject matter hereof and supersede in their

entirety all prior undertakings and agreements of the Company and the Purchaser with respect to the subject matter hereof, and may not

be modified adversely to the Purchaser’s interest except by means of a writing signed by the Company and Purchaser. This agreement

is governed by the internal substantive laws, but not the choice of law rules, of the State of Delaware.

| Submitted

by: |

|

Accepted

by: |

| |

|

|

| PURCHASER |

|

POWERFLEET,

INC. |

| |

|

|

|

|

| |

|

By: |

|

| |

|

|

|

|

| |

|

|

| Print

Name |

|

Print

Name/Title |

| |

|

|

|

|

| Date: |

|

|

Date: |

|

Exhibit

107

Calculation

of Filing Fee Table

Form

S-8

(Form

Type)

PowerFleet,

Inc.

(Exact

Name of Registrant as Specified in its Charter)

Table

1: Newly Registered Securities

| Security Type | |

Security Class Title | |

Fee Calculation Rule | | |

Amount Registered | | |

Proposed Maximum Offering Price Per Share | | |

Maximum Aggregate Offering Price | | |

Fee Rate | | |

Amount of

Registration Fee | |

| Equity | |

Common Stock, par value $0.01 per share | |

| 457(h) | | |

| 405,000 | (1) | |

$ | 3.00 | (2) | |

$ | 1,215,000 | (2) | |

| 0.0001102 | | |

$ | 134 | |

| Equity | |

Common Stock, par value $0.01 per share | |

| 457(c) and 457(h) | | |

| 1,000,000 | (3) | |

$ | 2.26 | (4) | |

| 2,260,000 | (4) | |

| 0.0001102 | | |

$ | 249 | |

| Total Offering Amounts | |

| | | |

$ | 3,475,000 | | |

| | | |

$ | 383 | |

| Total Fee Offsets | | |

| | | |

| | | |

| — | |

| Net Fee Due | |

| | | |

| | | |

$ | 383 | |

| (1) |

Represents

shares of common stock, par value $0.01 per share (“Common Stock”), of PowerFleet, Inc., a Delaware corporation (the

“Company”), issuable upon the exercise of options to purchase an aggregate of 405,000 shares of Common Stock (the “Options”)

awarded to David Wilson, the Chief Financial Officer of the Company, as an inducement material to Mr. Wilson’s entering into

employment with the Company, in accordance with the inducement grant exception under Rule 5635(c)(4) of the Nasdaq Listing Rules.

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement

also covers such additional shares of Common Stock that may become issuable in respect of the shares identified in the above table

by reason of any stock split, stock dividend, recapitalization or other similar transaction that results in an increase in the number

of outstanding shares of Common Stock. |

| |

|

| (2) |

Estimated

solely for the purposes of calculating the registration fee pursuant to Rule 457(h) under the Securities Act, based on the exercise

price of the Options. |

| |

|

| (3) |

Represents

shares of Common Stock issuable pursuant to the Company’s 2018 Incentive Plan, as amended (the “2018 Plan”). Pursuant

to Rule 416(a) under the Securities Act, this Registration Statement also covers such additional shares of Common Stock that may

become issuable under the 2018 Plan by reason of any stock split, stock dividend, recapitalization or other similar transaction that

results in an increase in the number of outstanding shares of Common Stock. |

| |

|

| (4) |

Estimated

solely for the purposes of calculating the registration fee pursuant to Rule 457(c) and 457(h) under the Securities Act, based on

the average of the high and low prices of the Common Stock as reported on The Nasdaq Global Market on August 9, 2023. |

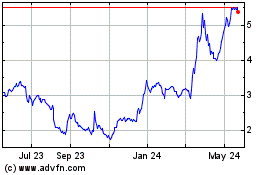

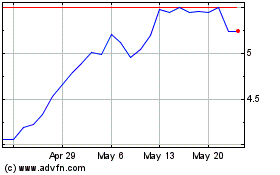

PowerFleet (NASDAQ:PWFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

PowerFleet (NASDAQ:PWFL)

Historical Stock Chart

From Apr 2023 to Apr 2024