Current Report Filing (8-k)

February 22 2021 - 6:04AM

Edgar (US Regulatory)

0001093691

false

0001093691

2021-02-18

2021-02-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 18, 2021

Plug Power Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

1-34392

|

|

22-3672377

|

|

(State or other jurisdiction

|

|

(Commission File

|

|

(IRS Employer

|

|

of incorporation)

|

|

Number)

|

|

Identification No.)

|

968 Albany Shaker Road,

Latham, New York

|

|

12110

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (518) 782-7700

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

¨ Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

PLUG

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 18, 2021, the Board of Directors (the “Board”)

of Plug Power Inc. (the “Company”) appointed Kimberly A. Harriman as a director and as a member of the Audit Committee

of the Board, effective immediately. Ms. Harriman has been designated as a Class III director to serve until the Company's 2023

Annual Meeting of Stockholders or until her successor has been duly elected and qualified, or until her earlier death, removal

or resignation. The Board has determined that Ms. Harriman is an independent director as defined in the NASDAQ Stock Market listing

standards and applicable Securities and Exchange Commission rules and regulations.

Ms. Harriman is the Vice President, State Government Relations

and Public Affairs, of Avangrid, Inc., an NYSE-listed energy provider operating in 24 states. Prior to joining Avangrid, from 2016

to December 2020, Ms. Harriman served as Senior Vice President, Public and Regulatory Affairs, for New York Power Authority, the

largest public utility in the United States. Previously Ms. Harriman was General Counsel for the New York State Department of Public

Service from 2014 to July 2016. Ms. Harriman holds a J.D. from Albany Law School of Union University and a B.A. in Political Science

from Siena College.

For her service as a non-employee director, Ms. Harriman

will be compensated in accordance with the Company’s Non-Employee Director Compensation Plan (the “Plan”).

In accordance with the Plan, upon her appointment as a director, the Company granted Ms. Harriman options to purchase 4,479

shares of the Company’s common stock with an exercise price per share equal to the closing price of the Company’s

common stock on the NASDAQ Capital Market on the date of grant. The options become fully vested on the first anniversary of

the grant date, subject to Ms. Harriman’s continued service on the Board. Under the Plan, Ms. Harriman will receive an

annual retainer of $60,000 for service as a director and $15,000 for service on the Audit Committee. In addition, pursuant to

the Plan, Ms. Harriman will receive an annual equity grant comprised of (i) a non-qualified stock option for a number of

shares of common stock equal to $112,500 divided by the closing price of the common stock on the grant date, and (ii) a

number of shares of restricted common stock equal to $112,500 divided by the closing price of the common stock on the grant

date. The stock option will have an exercise price equal to the fair market value of the common stock on the grant date and

will vest fully on the first anniversary of the grant date. The restricted common stock will vest fully on the first

anniversary of the grant date. In connection with her appointment to the Board, the Company and Ms. Harriman entered into the

Company’s standard indemnification agreement for non-employee directors.

There are no arrangements or understandings between Ms. Harriman

and any other person pursuant to which she was elected as a director. There are no transactions in which Ms. Harriman has an interest

requiring disclosure under Item 404(a) of Regulation S-K.

Item 7.01 Regulation FD Disclosure.

On February 22,

2021, the Company issued a press release with respect to Ms. Harriman’s appointment to the Board. A copy of the press release

is furnished herewith as Exhibit 99.1.

The

information included in this Item 7.01 and Exhibit 99.1 of this Current Report are not deemed to be “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall

this item and Exhibit 99.1 be incorporated by reference into the Company’s filings under the Securities Act of 1933, as

amended, or the Exchange Act, except as expressly set forth by specific reference in such future filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Plug Power Inc.

|

|

|

|

|

|

Date: February 22, 2021

|

By:

|

/s/ Paul Middleton

|

|

|

|

Name: Paul Middleton

|

|

|

|

Title: Chief Financial Officer

|

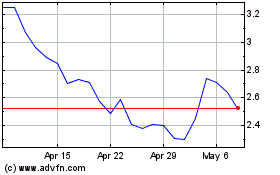

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Mar 2024 to Apr 2024

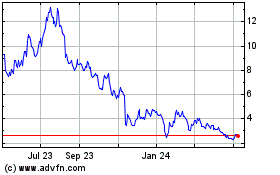

Plug Power (NASDAQ:PLUG)

Historical Stock Chart

From Apr 2023 to Apr 2024