0001115055FALSE00011150552023-10-172023-10-170001115055us-gaap:CommonClassAMember2023-10-172023-10-170001115055us-gaap:NoncumulativePreferredStockMember2023-10-172023-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 17, 2023

| | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| Tennessee | 000-31225 | 62-1812853 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

150 Third Avenue South, Suite 900, Nashville, Tennessee 37201

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (615) 744-3700

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Exchange on which Registered |

| Common Stock par value $1.00 | | PNFP | | The Nasdaq Stock Market LLC |

| Depositary Shares (each representing a 1/40th interest in a share of 6.75% Fixed-Rate Non-Cumulative Perpetual Preferred Stock, Series B) | | PNFPP | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

This Current Report on Form 8-K is being furnished to disclose the press release issued by Pinnacle Financial Partners, Inc., a Tennessee corporation (the "Company"), on October 17, 2023. The press release, which is furnished as Exhibit 99.1 hereto pursuant to Item 2.02 of Form 8-K, announced the Company's results of operations for the three and nine months ended September 30, 2023.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PINNACLE FINANCIAL PARTNERS, INC.

| | | | | | | | |

| | By: | /s/Harold R. Carpenter |

| | Name: | Harold R. Carpenter |

| | Title: | Executive Vice President and |

| | | Chief Financial Officer |

Date: October 17, 2023

FOR IMMEDIATE RELEASE

| | | | | | | | |

| MEDIA CONTACT: | Joe Bass, 615-743-8219 |

| FINANCIAL CONTACT: | Harold Carpenter, 615-744-3742 |

| WEBSITE: | www.pnfp.com |

PNFP REPORTS 3Q23 DILUTED EPS OF $1.69, DILUTED EPS OF $1.79 EXCLUDING INVESTMENT LOSSES

3Q23 annualized linked-quarter, end-of-period loans and core deposits grew 10.1%

NASHVILLE, TN, Oct. 17, 2023 - Pinnacle Financial Partners, Inc. (Nasdaq/NGS: PNFP) reported net income per diluted common share of $1.69 for the quarter ended Sept. 30, 2023, compared to net income per diluted common share of $1.91 for the quarter ended Sept. 30, 2022, a decrease of 11.5 percent. Net income per diluted common share was $5.99 for the nine months ended Sept. 30, 2023, compared to $5.42 for the nine months ended Sept. 30, 2022, an increase of approximately 10.5 percent.

| | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2023 | June 30, 2023 | September 30, 2022 | | September 30, 2023 | September 30, 2022 |

| Diluted earnings per common share | $ | 1.69 | | $ | 2.54 | | $ | 1.91 | | | $ | 5.99 | | $ | 5.42 | |

| Adjustments: | | | | | | |

| Investment losses on sales of securities, net | 0.13 | | 0.13 | | — | | | 0.26 | | — | |

| Gain on sale of fixed assets as a result of sale-leaseback transaction | — | | (1.13) | | — | | | (1.13) | | — | |

| Tax effect of above noted adjustments | (0.03) | | 0.25 | | — | | | 0.22 | | — | |

| Diluted earnings per common share after adjustments | $ | 1.79 | | $ | 1.79 | | $ | 1.91 | | | $ | 5.34 | | $ | 5.42 | |

After considering the adjustments noted in the table above for the three months ended Sept. 30, 2023 and 2022, net income per diluted common share was $1.79, compared to $1.91 for the three months ended Sept. 30, 2022. Net income per diluted common share adjusted for the items noted in the table above was $5.34 for the nine months ended Sept. 30, 2023, compared to $5.42 for the nine months ended Sept. 30, 2022.

"Despite a volatile economic backdrop, our firm continues to benefit from our unmatched ability to attract talent and create raving clients that refuse to leave us," said M. Terry Turner, Pinnacle's president and chief executive officer. "We continued to deliver outsized growth to our already strong client deposit base, with our core deposits increasing by 10.1 percent annualized this quarter. The 2023 FDIC summary of deposits reflects significant market share growth over 2022 in all our major markets, validating both the exportability of our model and the sustainability of our outsized growth by taking market share from our larger, more vulnerable competitors.

"Additionally, during the quarter we continued to avoid certain asset classes and reduced our exposure in loan segments with elevated risks and expect that to continue for the next few quarters. Against that backdrop, we are also pleased that overall loan growth during the third quarter of 2023 was $790 million, or 10.1 percent linked-quarter annualized.

"We also added 29 revenue producers during the third quarter. Going forward, I have asked our line leadership to accelerate their efforts to recruit the best relationship bankers in our markets in order to seize on the vulnerabilities that exist at many of our larger competitors. It is this ability to attract market-leading revenue producers that enables us to continue compounding earnings and growing tangible book value more reliably than peers, even in a very challenging operating environment. Historically, our operating leverage has compared favorably to our peers; however, given the outsized number of non-revenue support hires we

have invested in over the last few years, I would now expect our focus on recruiting more revenue producers to yield an even stronger operating leverage advantage for us as we move into 2024."

BALANCE SHEET GROWTH AND LIQUIDITY:

Total assets at Sept. 30, 2023 were $47.5 billion, an increase of approximately $6.5 billion from Sept. 30, 2022 and $647.8 million from June 30, 2023, reflecting a year-over-year increase of 15.9 percent and a linked-quarter annualized increase of 5.5 percent, respectively. A further analysis of select balance sheet trends follows:

| | | | | | | | | | | | | | | | | |

| Balances at | Linked-Quarter

Annualized

% Change | Balances at | Year-over-Year

% Change |

| (dollars in thousands) | Sept. 30, 2023 | June 30, 2023 | Sept. 30, 2022 |

| Loans | $ | 31,943,284 | | $ | 31,153,290 | | 10.1% | $ | 27,711,694 | | 15.3% |

| Securities | 6,882,276 | 6,623,457 | 15.6% | 6,481,018 | 6.2% |

| Other interest-earning assets | 3,512,452 | | 4,001,844 | | (48.9)% | 2,225,435 | | 57.8% |

| Total interest-earning assets | $ | 42,338,012 | | $ | 41,778,591 | | 5.4% | $ | 36,418,147 | | 16.3% |

| | | | | |

| Core deposits: | | | | | |

| Noninterest-bearing deposits | $ | 8,324,325 | | $ | 8,436,799 | | (5.3)% | $ | 10,567,873 | | (21.2)% |

Interest-bearing core deposits(1) | 25,282,458 | 24,343,968 | 15.4% | 20,180,944 | | 25.3% |

Noncore deposits and other funding(2) | 7,420,341 | 7,731,082 | (16.1)% | 4,444,868 | | 66.9% |

| Total funding | $ | 41,027,124 | | $ | 40,511,849 | | 5.1% | $ | 35,193,685 | | 16.6% |

(1): Interest-bearing core deposits are interest-bearing deposits, money market accounts, time deposits less than $250,000 including reciprocating time and money market deposits.

(2): Noncore deposits and other funding consists of time deposits greater than $250,000, securities sold under agreements to repurchase, public funds, brokered deposits, FHLB advances and subordinated debt.

•Approximately 54 percent of third quarter 2023 loan growth was related to commercial and industrial and owner-occupied commercial real estate categories, two segments the firm intends to continue to emphasize for the remainder of 2023 and 2024.

•During the quarter ended Sept. 30, 2023, the firm acquired $583.6 million in floating rate US treasuries offset by the sale of $129.7 million in other investment securities, premium amortization and market value adjustments.

•On-balance sheet liquidity, defined as cash and cash equivalents plus unpledged securities, remained strong, totaling $7.4 billion as of Sept. 30, 2023, representing a $381 million decrease from the on-balance sheet liquidity level of $7.8 billion as of June 30, 2023.

"As we entered the third quarter, we expected three important deposit related trends to materialize for our firm," Turner said. "First, we believed that we would continue to grow our core deposit base more rapidly than peers. Our core deposits increased by 10.1 percent linked-quarter annualized in the third quarter, which we believe is exceptional in this environment. Second, we also believed the rate of decrease in noninterest bearing deposits should begin to subside, which it has. Demand deposit contraction in the third quarter was only $112.5 million, compared to $581.6 million and $794.3 million in the second and first quarters of 2023, respectively. And third, we expected the rate of increase in our overall deposit costs would lessen, which it did, having increased by 40 basis points in the third quarter, compared to 49 basis points and 63 basis points in the second and first quarters,

respectively. We are pleased to see these three critical trends improve during the third quarter and are optimistic about continued improvement as we enter the fourth quarter of 2023."

PRE-TAX, PRE-PROVISION NET REVENUE (PPNR) GROWTH:

Pre-tax, pre-provision net revenues (PPNR) for the three and nine months ended Sept. 30, 2023 were $194.8 million and $662.4 million, respectively, a decrease of 7.8 percent and an increase of 17.1 percent, respectively, from the $211.3 million and $565.7 million, respectively, recognized in the three and nine months ended Sept. 30, 2022.

| | | | | | | | | | | | | | | | | | | | |

| Three months ended | Nine months ended |

| Sept. 30, | Sept. 30, |

| (dollars in thousands) | 2023 | 2022 | % change | 2023 | 2022 | % change |

| Revenues: | | | | | | |

| Net interest income | $ | 317,242 | | $ | 305,784 | | 3.7 | % | $ | 944,866 | | $ | 809,833 | | 16.7 | % |

| Noninterest income | 90,797 | | 104,805 | | (13.4) | % | 354,165 | | 333,803 | | 6.1 | % |

| Total revenues | 408,039 | | 410,589 | | (0.6) | % | 1,299,031 | | 1,143,636 | | 13.6 | % |

| Noninterest expense | 213,233 | | 199,253 | | 7.0 | % | 636,601 | | 577,952 | | 10.1 | % |

| Pre-tax, pre-provision net revenue (PPNR) | 194,806 | | 211,336 | | (7.8) | % | 662,430 | | 565,684 | | 17.1 | % |

| Adjustments: | | | | | | |

| Investment losses (gains) on sales of securities, net | 9,727 | | (217) | | NM | 19,688 | | (156) | | NM |

| Gain on the sale of fixed assets as a result of sale leaseback | — | | — | | NM | (85,692) | | — | | NM |

| | | | | | |

| | | | | | |

| ORE expense (benefit) | 33 | | (90) | | NM | 190 | | 101 | | 88.1 | % |

| Adjusted PPNR | $ | 204,566 | | $ | 211,029 | | (3.1) | % | $ | 596,616 | | $ | 565,629 | | 5.5 | % |

•Revenue per fully diluted common share was $5.35 for the third quarter of 2023, compared to $6.43 for the second quarter of 2023 and $5.40 for the third quarter of 2022, a decline of 0.9 percent year-over-year. Excluding net losses on sales of investment securities and ORE expense, revenue per fully diluted share for the third quarter of 2023 was $5.49.

•Net interest income for the quarter ended Sept. 30, 2023 was $317.2 million, compared to $315.4 million for the second quarter of 2023 and $305.8 million for the third quarter of 2022, a year-over-year growth rate of 3.7 percent.

•Noninterest income for the quarter ended Sept. 30, 2023 was $90.8 million, compared to $173.8 million for the second quarter of 2023 and $104.8 million for the third quarter of 2022, a year-over-year decrease of 13.4 percent.

◦Gain on the sale of fixed assets was $87,000 for the quarter ended Sept. 30, 2023, compared to $85.7 million and $227,000, respectively, for the quarters ended June 30, 2023 and Sept. 30, 2022. The quarter ended June 30, 2023 included a gain on the sale of fixed assets as a result of the sale-leaseback transaction completed in the second quarter of 2023 of $85.7 million.

◦Net losses on the sale of investment securities were $9.7 million for the quarter ended Sept. 30, 2023, compared to $10.0 million in net losses for the quarter ended June 30, 2023 and $217,000 in net gains for the quarter ended Sept. 30, 2022.

◦Wealth management revenues, which include investment, trust and insurance services, were $22.8 million for the third quarter of 2023, compared to $24.1 million for the second quarter of 2023 and $19.4 million for the third quarter of 2022, a year-over-year increase of 17.3 percent.

◦During the third quarter of 2023, mortgage loans sold resulted in a $2.0 million net gain, compared to $1.6 million in the second quarter of 2023 and $1.1 million in the third quarter of 2022.

◦Income from the firm's investment in BHG was $25.0 million for the third quarter 2023, compared to $26.9 million for the second quarter of 2023 and $41.3 million for the third quarter of 2022, a year-over-year decline of 39.6 percent. The firm estimated that BHG's overall impact to Pinnacle's earnings for the first nine months of 2023 amounted to $0.52, down from $1.09 for the comparable period in 2022, in each case, after considering reasonable funding costs to support the investment. BHG's impact on Pinnacle's earnings declined from 20.2 percent of Pinnacle's 2022 total diluted earnings per common share to 8.6 percent of Pinnacle's 2023 total diluted earnings per share.

▪BHG's loan originations decreased to $1.0 billion in the third quarter 2023 compared to $1.1 billion in the second quarter of 2023 and $1.2 billion in the third quarter of 2022.

▪Loans sold to BHG's community bank partners were approximately $435 million in the third quarter 2023 compared to approximately $523 million in the second quarter of 2023 and $555 million in the third quarter of 2022. BHG also sold $564 million in loans to private investors during the third quarter of 2022 compared to $557 million in the second quarter of 2023 and $452 million in the third quarter of 2022.

▪BHG increased its reserves for on-balance sheet loan losses to $213.5 million, or 6.44 percent of loans held for investment at Sept. 30, 2023, compared to 5.99 percent at June 30, 2023. BHG decreased its accrual for losses attributable to loan substitutions and prepayments for loans previously sold through its community bank auction platform to $350.3 million, or 5.46 percent of the loans that have been previously sold and were unpaid, at Sept. 30, 2023 compared to 5.87 percent at June 30, 2023.

•Noninterest expense for the quarter ended Sept. 30, 2023 was $213.2 million, compared to $211.6 million in the second quarter of 2023 and $199.3 million in the third quarter of 2022, reflecting a year-over-year increase of 7.0 percent.

◦Salaries and employee benefits were $130.3 million in the third quarter of 2023, compared to $132.4 million in the second quarter of 2023 and $129.9 million in the third quarter of 2022, reflecting a slight year-over-year increase. The reduction in salaries and employee benefits expense on a linked-quarter basis was primarily due to the year-over-year decrease in the costs related to the firm's annual cash and equity incentive plans. Offsetting this decrease in part was the impact of an increase in full-time equivalent associates, to 3,329.5 at Sept. 30, 2023 from 3,184.5 at Sept. 30, 2022, a year-over-year increase of 4.6 percent.

◦Equipment and occupancy costs were $36.9 million in the third quarter of 2023, compared to $33.7 million in the second quarter of 2023 and $27.9 million in the third quarter of 2022, reflecting a year-over-year increase of 32.3 percent. Contributing to the year-over-year increase is the impact of the sale leaseback transaction completed in the second quarter of 2023.

◦Noninterest expense categories, other than those specifically noted above, were $46.0 million in the third quarter of 2023, compared to $45.5 million in the second quarter of 2023 and $41.5 million in the third quarter of 2022, reflecting a year-over-year increase of 10.9 percent.

"To grow net interest income in this environment on a linked-quarter basis is a great achievement," said Harold R. Carpenter, Pinnacle's chief financial officer. "The net reduction in fee income in the third quarter of 2023 compared to the second quarter was largely attributable to the $85.7 million gain on sale of fixed assets recognized in connection with a sale-leaseback transaction during the prior quarter.

"BHG had a stronger quarter than we originally anticipated. Even though their pipelines remain strong and credit costs improved during the quarter, our 2023 outlook for BHG remains essentially unchanged at this time. Thus, we believe BHG's fourth quarter results will not be as strong as the last two quarters. Excluding the impact of BHG, the sale-leaseback transaction in the second quarter and the bond losses experienced in the second and third quarters, third quarter fee income increased slightly over the second quarter."

SOUNDNESS AND PROFITABILITY:

| | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Nine months ended |

| September 30, 2023 | June 30, 2023 | September 30, 2022 | | September 30, 2023 | September 30, 2022 |

| Net interest margin | 3.06 | % | 3.20 | % | 3.47 | % | | 3.22 | % | 3.18 | % |

| Efficiency ratio | 52.26 | % | 43.26 | % | 48.53 | % | | 49.01 | % | 50.54 | % |

| Return on average assets | 1.08 | % | 1.71 | % | 1.42 | % | | 1.35 | % | 1.40 | % |

| | | | | | |

| Return on average tangible common equity (TCE) | 13.43 | % | 21.06 | % | 17.40 | % | | 16.62 | % | 16.89 | % |

|

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | |

| As of | |

| September 30, 2023 | June 30, 2023 | September 30, 2022 | |

| Shareholders' equity to total assets | 12.3 | % | 12.5 | % | 13.0 | % | |

| Average loan to deposit ratio | 82.80 | % | 84.94 | % | 81.61 | % | |

| Uninsured/uncollateralized deposits to total deposits | 28.89 | % | 28.31 | % | 39.71 | % | |

| Tangible common equity to tangible assets | 8.2 | % | 8.3 | % | 8.3 | % | |

| Book value per common share | $ | 73.23 | | $ | 73.32 | | $ | 67.07 | | |

| Tangible book value per common share | $ | 48.78 | | $ | 48.85 | | $ | 42.44 | | |

Annualized net loan charge-offs to avg. loans (1) | 0.23 | % | 0.13 | % | 0.16 | % | |

| Nonperforming assets to total loans, ORE and other nonperforming assets (NPAs) | 0.14 | % | 0.15 | % | 0.15 | % | |

Classified asset ratio (Pinnacle Bank) (2) | 4.60 | % | 3.30 | % | 2.60 | % | |

| Allowance for credit losses (ACL) to total loans | 1.08 | % | 1.08 | % | 1.04 | % | |

(1): Annualized net loan charge-offs to average loans ratios are computed by annualizing quarterly net loan charge-offs and dividing the result by average loans for the quarter.

(2): Classified assets as a percentage of Tier 1 capital plus allowance for credit losses.

•Net interest margin was 3.06 percent for the third quarter of 2023, compared to 3.20 percent for the second quarter of 2023 and 3.47 percent for the third quarter of 2022. Net interest margin increased to 3.22 percent for the nine months ended Sept. 30, 2023, compared to 3.18 percent for the nine months ended Sept. 30, 2022.

•Provision for credit losses was $26.8 million in the third quarter of 2023, compared to $31.7 million in the second quarter of 2023 and $27.5 million in the third quarter of 2022. Net charge-offs were $18.1 million for the quarter ended Sept. 30, 2023, compared to $9.8 million for the quarter ended June 30, 2023 and $11.0 million for the quarter ended Sept. 30, 2022. Annualized net charge-offs for the third quarter of 2023 were 0.23 percent.

•Nonperforming assets were $46.0 million at Sept. 30, 2023, compared to $47.4 million at June 30, 2023 and $41.9 million at Sept. 30, 2022, up 9.7 percent over the same quarter last year. The ratio of the allowance for credit losses to nonperforming loans at Sept. 30, 2023 was 806.0 percent, compared to 762.0 percent at June 30, 2023 and 844.5 percent at Sept. 30, 2022.

•Classified assets were $218.9 million at Sept. 30, 2023, compared to $153.9 million at June 30, 2023 and $107.9 at Sept. 30, 2022, up more than 100 percent over the same quarter last year.

"Although our net interest margin declined on a linked-quarter basis by approximately 14 basis points, we are pleased that the size of the decline was lower than what we experienced over the last several quarters," Carpenter said. "Increased deposit pricing and the continued reduction in our noninterest-bearing deposit account balances were again the primary contributors to our decreased net interest margin.

"Our investment securities portfolio, including both the held-to-maturity and available-for-sale portfolios, continues to perform well for us. Approximately 35 percent of our available-for-sale securities portfolio is effectively indexed to floating rates, which we consider to be a meaningful advantage. Despite this advantage, the impact of increased market interest rates on investment securities caused our accumulated other comprehensive loss to increase by $127 million this quarter, contributing to a slight decline in our tangible book value per share from $48.85 at June 30, 2023 to $48.78 at Sept. 30, 2023.

"Lastly, net charge-offs increased this quarter primarily due to a single loan acquired through our syndication platform. At June 30, 2023, we had placed this loan on nonperforming status and allocated approximately 50 percent of the loan to our allowance for credit losses. We were notified during the third quarter by the lead syndication bank that the borrower filed for bankruptcy protection, which prompted us to charge off substantially all of this loan, or $9.5 million, during the third quarter.

"Nevertheless, our asset quality metrics such as past due loans, classified assets and nonperforming loans continue to perform at historically low levels. Our strong credit culture, as well as operating in some of the best markets in the U.S., enable our portfolio to continue performing at peer-leading levels of classified and nonperforming loans."

BOARD OF DIRECTORS DECLARES DIVIDENDS

On Oct. 17, 2023, Pinnacle Financial's Board of Directors approved a quarterly cash dividend of $0.22 per common share to be paid on Nov. 24, 2023 to common shareholders of record as of the close of business on Nov. 3, 2023. Additionally, the Board of Directors approved a quarterly cash dividend of approximately $3.8 million, or $16.88 per share (or $0.422 per depositary share), on Pinnacle Financial's 6.75 percent Series B Non-Cumulative Perpetual Preferred Stock payable on Dec. 1, 2023 to shareholders of record at the close of business on Nov. 16, 2023. The amount and timing of any future dividend payments to both preferred and common shareholders will be subject to the approval of Pinnacle's Board of Directors.

WEBCAST AND CONFERENCE CALL INFORMATION

Pinnacle will host a webcast and conference call at 8:30 a.m. CDT on Oct. 18, 2023, to discuss third quarter 2023 results and other matters. To access the call for audio only, please call 1-877-209-7255. For the presentation and streaming audio, please access the webcast on the investor relations page of Pinnacle's website at www.pnfp.com.

For those unable to participate in the webcast, it will be archived on the investor relations page of Pinnacle's website at www.pnfp.com for 90 days following the presentation.

Pinnacle Financial Partners provides a full range of banking, investment, trust, mortgage and insurance products and services designed for businesses and their owners and individuals interested in a comprehensive relationship with their financial institution. The firm is the No. 1 bank in the Nashville-Murfreesboro-Franklin MSA according to 2023 deposit data from the FDIC, is listed by Forbes among the top 25 banks in the nation and earned a spot on the 2022 list of 100 Best Companies to Work For® in the U.S., its sixth consecutive appearance. Pinnacle was also listed in Fortune magazine as the second best company to work for in the U.S. for women. American Banker recognized Pinnacle as one of America’s Best Banks to Work For nine years in a row and No. 1 among banks with more than $11 billion in assets in 2021.

Pinnacle owns a 49 percent interest in Bankers Healthcare Group (BHG), which provides innovative, hassle-free financial solutions to healthcare practitioners and other professionals. Great Place to Work and FORTUNE ranked BHG No. 4 on its 2021 list of Best Workplaces in New York State in the small/medium business category.

The firm began operations in a single location in downtown Nashville, TN in October 2000 and has since grown to approximately $47.5 billion in assets as of Sept. 30, 2023. As the second-largest bank holding company in Tennessee, Pinnacle operates in 17 primarily urban markets and their surrounding communities.

Additional information concerning Pinnacle, which is included in the Nasdaq Financial-100 Index, can be accessed at www.pnfp.com.

###

Forward-Looking Statements

All statements, other than statements of historical fact, included in this press release, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. The words "expect," "anticipate," "intend," "may," "should," "plan," "believe," "seek," "estimate" and similar expressions are intended to identify such forward-looking statements, but other statements not based on historical information may also be considered forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from the statements, including, but not limited to: (i) deterioration in the financial condition of borrowers of Pinnacle Bank and its subsidiaries or BHG, including as a result of the negative impact of inflationary pressures on our and BHG's customers and their businesses, resulting in significant increases in loan losses and provisions for those losses and, in the case of BHG, substitutions; (ii) fluctuations or differences in interest rates on loans or deposits from those that Pinnacle Financial is modeling or anticipating, including as a result of Pinnacle Bank's inability to better match deposit rates with the changes in the short-term rate environment, or that affect the yield curve; (iii) the sale of investment securities in a loss position before their value recovers, including as a result of asset liability management strategies or in response to liquidity needs; (iv) adverse conditions in the national or local economies including in Pinnacle Financial's markets throughout Tennessee, North Carolina, South Carolina, Georgia, Alabama, Virginia and Kentucky, particularly in commercial and residential real estate markets; (v) the inability of Pinnacle Financial, or entities in which it has significant investments, like BHG, to maintain the long-term historical growth rate of its, or such entities', loan portfolio; (vi) the ability to grow and retain low-cost core deposits and retain large, uninsured deposits, including during times when Pinnacle Bank is seeking to limit the rates it pays on deposits or uncertainty exists in the financial services sector; (vii) changes in loan underwriting, credit review or loss reserve policies associated with economic conditions, examination conclusions, or regulatory developments; (viii) effectiveness of Pinnacle Financial's asset management activities in improving, resolving or liquidating lower-quality assets; (ix) the impact of competition with other financial institutions, including pricing pressures and the resulting impact on Pinnacle Financial’s results, including as a result of the negative impact to net interest margin from rising deposit and other funding costs; (x) the results of regulatory examinations; (xi) BHG's ability to profitably grow its business and successfully execute on its business plans; (xii) risks of expansion into new geographic or product markets; (xiii) any matter that would cause Pinnacle Financial to conclude that there was impairment of any asset, including goodwill or other intangible assets; (xiv) the ineffectiveness of Pinnacle Bank's hedging strategies, or the unexpected counterparty failure or hedge failure of the underlying hedges; (xv) reduced ability to attract additional financial advisors (or failure of such advisors to cause their clients to switch to Pinnacle Bank), to retain financial advisors (including as a result of the competitive environment for associates) or otherwise to attract customers from other financial institutions; (xvi) deterioration in the valuation of other real estate owned and increased expenses associated therewith; (xvii) inability to comply with regulatory capital requirements, including those resulting from changes to capital calculation methodologies, required capital maintenance levels or regulatory requests or directives, particularly if Pinnacle Bank's level of applicable commercial real estate loans were to exceed percentage levels of total capital in guidelines recommended by its regulators; (xviii) approval of the declaration of any dividend by Pinnacle Financial's board of directors; (xix) the vulnerability of Pinnacle Bank's network and online banking portals, and the systems of parties with whom Pinnacle Bank contracts, to unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and other security breaches; (xx) the possibility of increased compliance and operational costs as a result of increased regulatory oversight (including by the Consumer Financial Protection Bureau), including oversight of companies in which Pinnacle Financial or Pinnacle Bank have significant investments, like BHG, and the development of additional banking products for Pinnacle Bank's corporate and consumer clients; (xi) Pinnacle Financial's ability to identify potential candidates for, consummate, and achieve synergies from, potential future acquisitions; (xii) difficulties and delays in integrating acquired businesses or fully realizing costs savings and other benefits from acquisitions; (xxiii) the risks associated with Pinnacle Bank being a minority investor in BHG, including the risk that the owners of a majority of the equity interests in BHG decide to sell the company or all or a portion of their ownership interests in BHG (triggering a similar sale by Pinnacle Bank); (xxiv) changes in state and federal legislation, regulations or policies applicable to banks and other financial service providers, like BHG, including regulatory or legislative developments; (xxv) fluctuations in the valuations of Pinnacle Financial's

equity investments and the ultimate success of such investments; (xxvi) the availability of and access to capital; (xxvii) adverse results (including costs, fines, reputational harm, inability to obtain necessary approvals and/or other negative effects) from current or future litigation, regulatory examinations or other legal and/or regulatory actions; and (xxviii) general competitive, economic, political and market conditions. Additional factors which could affect the forward looking statements can be found in Pinnacle Financial's Annual Report on Form 10-K for the year ended December 31, 2022, and subsequently filed Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC and available on the SEC's website at http://www.sec.gov. Pinnacle Financial disclaims any obligation to update or revise any forward-looking statements contained in this press release, which speak only as of the date hereof, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Matters

This release contains certain non-GAAP financial measures, including, without limitation, total revenues, net income to common shareholders, earnings per diluted common share, revenue per diluted common share, PPNR, efficiency ratio, noninterest expense, noninterest income and the ratio of noninterest expense to average assets, excluding in certain instances the impact of expenses related to other real estate owned, gains or losses on sale of investment securities, gains associated with the sale-leaseback transaction completed in the second quarter of 2023 and other matters for the accounting periods presented. This release may also contain certain other non-GAAP capital ratios and performance measures that exclude the impact of goodwill and core deposit intangibles associated with Pinnacle Financial's acquisitions of BNC, Avenue Bank, Magna Bank, CapitalMark Bank & Trust, Mid-America Bancshares, Inc., Cavalry Bancorp, Inc. and other acquisitions which collectively are less material to the non-GAAP measure as well as the impact of Pinnacle Financial's Series B Preferred Stock. The presentation of the non-GAAP financial information is not intended to be considered in isolation or as a substitute for any measure prepared in accordance with GAAP. Because non-GAAP financial measures presented in this release are not measurements determined in accordance with GAAP and are susceptible to varying calculations, these non-GAAP financial measures, as presented, may not be comparable to other similarly titled measures presented by other companies.

Pinnacle Financial believes that these non-GAAP financial measures facilitate making period-to-period comparisons and are meaningful indications of its operating performance. In addition, because intangible assets such as goodwill and the core deposit intangible, and the other items excluded each vary extensively from company to company, Pinnacle Financial believes that the presentation of this information allows investors to more easily compare Pinnacle Financial's results to the results of other companies. Pinnacle Financial's management utilizes this non-GAAP financial information to compare Pinnacle Financial's operating performance for 2023 versus certain periods in 2022 and to internally prepared projections.

| | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES |

| CONSOLIDATED BALANCE SHEETS – UNAUDITED |

| | | |

| (dollars in thousands, except for share and per share data) | September 30, 2023 | December 31, 2022 | September 30, 2022 |

| ASSETS | | | |

| Cash and noninterest-bearing due from banks | $ | 279,652 | | $ | 268,649 | | $ | 168,010 | |

| Restricted cash | 17,356 | | 31,447 | | 18,636 | |

| Interest-bearing due from banks | 2,855,094 | | 877,286 | | 1,616,878 | |

| | | |

| Cash and cash equivalents | 3,152,102 | | 1,177,382 | | 1,803,524 | |

| Securities purchased with agreement to resell | 500,000 | | 513,276 | | 528,999 | |

| Securities available-for-sale, at fair value | 3,863,697 | | 3,558,870 | | 3,542,601 | |

| Securities held-to-maturity (fair value of $2.6 billion, $2.7 billion, and $2.5 billion, net of allowance for credit losses of $1.7 million, $1.6 million, and $1.6 million at Sept. 30, 2023, Dec. 31, 2022, and Sept. 30, 2022, respectively) | 3,018,579 | | 3,079,050 | | 2,938,417 | |

| Consumer loans held-for-sale | 119,489 | | 42,237 | | 45,509 | |

| Commercial loans held-for-sale | 20,513 | | 21,093 | | 15,413 | |

| Loans | 31,943,284 | | 29,041,605 | | 27,711,694 | |

| Less allowance for credit losses | (346,192) | | (300,665) | | (288,088) | |

| Loans, net | 31,597,092 | | 28,740,940 | | 27,423,606 | |

| Premises and equipment, net | 252,669 | | 327,885 | | 320,273 | |

| Equity method investment | 480,996 | | 443,185 | | 425,892 | |

| Accrued interest receivable | 177,390 | | 161,182 | | 110,170 | |

| Goodwill | 1,846,973 | | 1,846,973 | | 1,846,466 | |

| Core deposits and other intangible assets | 29,216 | | 34,555 | | 35,666 | |

| Other real estate owned | 2,555 | | 7,952 | | 7,787 | |

| Other assets | 2,462,519 | | 2,015,441 | | 1,955,795 | |

| Total assets | $ | 47,523,790 | | $ | 41,970,021 | | $ | 41,000,118 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Deposits: | | | |

| Noninterest-bearing | $ | 8,324,325 | | $ | 9,812,744 | | $ | 10,567,873 | |

| Interest-bearing | 10,852,086 | | 7,884,605 | | 7,549,510 | |

| Savings and money market accounts | 14,306,359 | | 13,774,534 | | 12,712,809 | |

| Time | 4,813,039 | | 3,489,355 | | 2,859,857 | |

| Total deposits | 38,295,809 | | 34,961,238 | | 33,690,049 | |

| Securities sold under agreements to repurchase | 195,999 | | 194,910 | | 190,554 | |

| Federal Home Loan Bank advances | 2,110,598 | | 464,436 | | 889,248 | |

| Subordinated debt and other borrowings | 424,718 | | 424,055 | | 423,834 | |

| Accrued interest payable | 67,442 | | 19,478 | | 10,202 | |

| Other liabilities | 591,583 | | 386,512 | | 454,119 | |

| Total liabilities | 41,686,149 | | 36,450,629 | | 35,658,006 | |

| Preferred stock, no par value, 10.0 million shares authorized; 225,000 shares non-cumulative perpetual preferred stock, Series B, liquidation preference $225.0 million, issued and outstanding at Sept. 30, 2023, Dec. 31, 2022, and Sept. 30, 2022, respectively | 217,126 | | 217,126 | | 217,126 | |

| Common stock, par value $1.00; 180.0 million shares authorized; 76.8 million, 76.5 million and 76.4 million shares issued and outstanding at Sept. 30, 2023, Dec. 31, 2022, and Sept. 30, 2022, respectively | 76,753 | | 76,454 | | 76,413 | |

| Additional paid-in capital | 3,097,702 | | 3,074,867 | | 3,066,527 | |

| Retained earnings | 2,745,934 | | 2,341,706 | | 2,224,736 | |

| Accumulated other comprehensive loss, net of taxes | (299,874) | | (190,761) | | (242,690) | |

| Total shareholders' equity | 5,837,641 | | 5,519,392 | | 5,342,112 | |

| Total liabilities and shareholders' equity | $ | 47,523,790 | | $ | 41,970,021 | | $ | 41,000,118 | |

| This information is preliminary and based on company data available at the time of the presentation. |

| | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF INCOME – UNAUDITED |

| (dollars in thousands, except for share and per share data) | Three months ended | Nine months ended |

| | September 30, 2023 | June 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| Interest income: | | | | | |

| Loans, including fees | $ | 508,963 | | $ | 478,896 | | $ | 315,935 | | $ | 1,419,761 | | $ | 795,164 | |

| Securities | | | | | |

| Taxable | 36,525 | | 31,967 | | 18,204 | | 97,850 | | 41,977 | |

| Tax-exempt | 24,185 | | 24,603 | | 21,408 | | 72,590 | | 58,752 | |

| Federal funds sold and other | 57,621 | | 39,773 | | 16,217 | | 118,371 | | 26,864 | |

| Total interest income | 627,294 | | 575,239 | | 371,764 | | 1,708,572 | | 922,757 | |

| Interest expense: | | | | | |

| Deposits | 280,305 | | 228,668 | | 55,189 | | 685,562 | | 83,620 | |

| Securities sold under agreements to repurchase | 1,071 | | 783 | | 182 | | 2,449 | | 320 | |

| FHLB advances and other borrowings | 28,676 | | 30,395 | | 10,609 | | 75,695 | | 28,984 | |

| Total interest expense | 310,052 | | 259,846 | | 65,980 | | 763,706 | | 112,924 | |

| Net interest income | 317,242 | | 315,393 | | 305,784 | | 944,866 | | 809,833 | |

| Provision for credit losses | 26,826 | | 31,689 | | 27,493 | | 77,282 | | 43,120 | |

| Net interest income after provision for credit losses | 290,416 | | 283,704 | | 278,291 | | 867,584 | | 766,713 | |

| Noninterest income: | | | | | |

| Service charges on deposit accounts | 12,665 | | 12,180 | | 10,906 | | 36,563 | | 33,552 | |

| Investment services | 13,253 | | 14,174 | | 10,780 | | 39,022 | | 34,676 | |

| Insurance sales commissions | 2,882 | | 3,252 | | 2,928 | | 10,598 | | 9,518 | |

| Gains on mortgage loans sold, net | 2,012 | | 1,567 | | 1,117 | | 5,632 | | 7,333 | |

| Investment losses (gains) on sales, net | (9,727) | | (9,961) | | 217 | | (19,688) | | 156 | |

| Trust fees | 6,640 | | 6,627 | | 5,706 | | 19,696 | | 17,744 | |

| Income from equity method investment | 24,967 | | 26,924 | | 41,341 | | 70,970 | | 124,461 | |

| Gain on sale of fixed assets | 87 | | 85,724 | | 227 | | 85,946 | | 425 | |

| Other noninterest income | 38,018 | | 33,352 | | 31,583 | | 105,426 | | 105,938 | |

| Total noninterest income | 90,797 | | 173,839 | | 104,805 | | 354,165 | | 333,803 | |

| Noninterest expense: | | | | | |

| Salaries and employee benefits | 130,344 | | 132,443 | | 129,910 | | 398,495 | | 378,373 | |

| Equipment and occupancy | 36,900 | | 33,706 | | 27,886 | | 100,959 | | 80,343 | |

| Other real estate, net | 33 | | 58 | | (90) | | 190 | | 101 | |

| Marketing and other business development | 5,479 | | 5,664 | | 4,958 | | 17,085 | | 13,494 | |

| Postage and supplies | 2,621 | | 2,863 | | 2,795 | | 8,303 | | 7,486 | |

| Amortization of intangibles | 1,765 | | 1,780 | | 1,951 | | 5,339 | | 5,873 | |

| | | | | |

| Other noninterest expense | 36,091 | | 35,127 | | 31,843 | | 106,230 | | 92,282 | |

| Total noninterest expense | 213,233 | | 211,641 | | 199,253 | | 636,601 | | 577,952 | |

| Income before income taxes | 167,980 | | 245,902 | | 183,843 | | 585,148 | | 522,564 | |

| Income tax expense | 35,377 | | 48,603 | | 35,185 | | 117,975 | | 99,669 | |

| Net income | 132,603 | | 197,299 | | 148,658 | | 467,173 | | 422,895 | |

| Preferred stock dividends | (3,798) | | (3,798) | | (3,798) | | (11,394) | | (11,394) | |

| Net income available to common shareholders | $ | 128,805 | | $ | 193,501 | | $ | 144,860 | | $ | 455,779 | | $ | 411,501 | |

| Per share information: | | | | | |

| Basic net income per common share | $ | 1.69 | | $ | 2.55 | | $ | 1.91 | | $ | 6.00 | | $ | 5.43 | |

| Diluted net income per common share | $ | 1.69 | | $ | 2.54 | | $ | 1.91 | | $ | 5.99 | | $ | 5.42 | |

| Weighted average common shares outstanding: | | | | | |

| Basic | 76,044,182 | | 76,030,081 | | 75,761,930 | | 75,998,965 | | 75,723,129 | |

| Diluted | 76,201,916 | | 76,090,321 | | 75,979,056 | | 76,102,622 | | 75,945,469 | |

This information is preliminary and based on company data available at the time of the presentation.

PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (dollars and shares in thousands) | Preferred

Stock

Amount | Common Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comp. Income (Loss), net | Total Shareholders' Equity |

| | Shares | Amounts |

| Balance at December 31, 2021 | $ | 217,126 | | 76,143 | | $ | 76,143 | | $ | 3,045,802 | | $ | 1,864,350 | | $ | 107,186 | | $ | 5,310,607 | |

| Exercise of employee common stock options & related tax benefits | — | | 14 | | 14 | | 264 | | — | | — | | 278 | |

| Preferred dividends paid ($50.64 per share) | — | | — | | — | | — | | (11,394) | | — | | (11,394) | |

| Common dividends paid ($0.66 per share) | — | | — | | — | | — | | (51,115) | | | (51,115) | |

| Issuance of restricted common shares, net of forfeitures | — | | 207 | | 207 | | (169) | | — | | — | | 38 | |

| Restricted shares withheld for taxes & related tax benefits | — | | (46) | | (46) | | (4,657) | | — | | — | | (4,703) | |

| Issuance of common stock pursuant to restricted stock unit (RSU) and performance stock unit (PSU) agreements, net of shares withheld for taxes & related tax benefits | — | | 95 | | 95 | | (5,595) | | — | | — | | (5,500) | |

| Compensation expense for restricted shares & performance stock units | — | | — | | — | | 30,882 | | — | | — | | 30,882 | |

| Net income | — | | — | | — | | — | | 422,895 | | — | | 422,895 | |

| Other comprehensive loss | — | | — | | — | | — | | — | | (349,876) | | (349,876) | |

| Balance at Sept. 30, 2022 | $ | 217,126 | | 76,413 | | $ | 76,413 | | $ | 3,066,527 | | $ | 2,224,736 | | $ | (242,690) | | $ | 5,342,112 | |

| | | | | | | |

| Balance at December 31, 2022 | $ | 217,126 | | 76,454 | | $ | 76,454 | | $ | 3,074,867 | | $ | 2,341,706 | | $ | (190,761) | | $ | 5,519,392 | |

| Exercise of employee common stock options & related tax benefits | — | | 40 | | 40 | | 931 | | — | | — | | 971 | |

| Preferred dividends paid ($50.64 per share) | — | | — | | — | | — | | (11,394) | | — | | (11,394) | |

| Common dividends paid ($0.66 per share) | — | | — | | — | | — | | (51,551) | | — | | (51,551) | |

| Issuance of restricted common shares, net of forfeitures | — | | 219 | | 219 | | (219) | | — | | — | | — | |

| Restricted shares withheld for taxes & related tax benefits | — | | (53) | | (53) | | (3,712) | | — | | — | | (3,765) | |

| Issuance of common stock pursuant to RSU and PSU agreements, net of shares withheld for taxes & related tax benefits | — | | 93 | | 93 | | (3,738) | | — | | — | | (3,645) | |

| Compensation expense for restricted shares & performance stock units | — | | — | | — | | 29,573 | | — | | — | | 29,573 | |

| Net income | — | | — | | — | | — | | 467,173 | | — | | 467,173 | |

| Other comprehensive loss | — | | — | | — | | — | | — | | (109,113) | | (109,113) | |

| Balance at Sept. 30, 2023 | $ | 217,126 | | 76,753 | | $ | 76,753 | | $ | 3,097,702 | | $ | 2,745,934 | | $ | (299,874) | | $ | 5,837,641 | |

| | | | | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES |

| SELECTED QUARTERLY FINANCIAL DATA – UNAUDITED |

| | | | | | |

| (dollars in thousands) | September | June | March | December | September | June |

| 2023 | 2023 | 2023 | 2022 | 2022 | 2022 |

| Balance sheet data, at quarter end: | | | | | | |

| Commercial and industrial loans | $ | 11,307,611 | | 10,983,911 | | 10,723,327 | | 10,241,362 | | 9,748,994 | | 9,295,808 | |

| Commercial real estate - owner occupied loans | 3,944,616 | | 3,845,359 | | 3,686,796 | | 3,587,257 | | 3,426,271 | | 3,243,018 | |

| Commercial real estate - investment loans | 5,957,426 | | 5,682,652 | | 5,556,484 | | 5,277,454 | | 5,122,127 | | 4,909,598 | |

| Commercial real estate - multifamily and other loans | 1,490,184 | | 1,488,236 | | 1,331,249 | | 1,265,165 | | 1,042,854 | | 951,998 | |

| Consumer real estate - mortgage loans | 4,768,780 | | 4,692,673 | | 4,531,285 | | 4,435,046 | | 4,271,913 | | 4,047,051 | |

| Construction and land development loans | 3,942,143 | | 3,904,774 | | 3,909,024 | | 3,679,498 | | 3,548,970 | | 3,386,866 | |

| Consumer and other loans | 532,524 | | 555,685 | | 559,706 | | 555,823 | | 550,565 | | 498,757 | |

| Total loans | 31,943,284 | | 31,153,290 | | 30,297,871 | | 29,041,605 | | 27,711,694 | | 26,333,096 | |

| Allowance for credit losses | (346,192) | | (337,459) | | (313,841) | | (300,665) | | (288,088) | | (272,483) | |

| Securities | 6,882,276 | | 6,623,457 | | 6,878,831 | | 6,637,920 | | 6,481,018 | | 6,553,893 | |

| Total assets | 47,523,790 | | 46,875,982 | | 45,119,587 | | 41,970,021 | | 41,000,118 | | 40,121,292 | |

| Noninterest-bearing deposits | 8,324,325 | | 8,436,799 | | 9,018,439 | | 9,812,744 | | 10,567,873 | | 11,058,198 | |

| Total deposits | 38,295,809 | | 37,722,661 | | 36,178,553 | | 34,961,238 | | 33,690,049 | | 32,595,303 | |

| Securities sold under agreements to repurchase | 195,999 | | 163,774 | | 149,777 | | 194,910 | | 190,554 | | 199,585 | |

| FHLB advances | 2,110,598 | | 2,200,917 | | 2,166,508 | | 464,436 | | 889,248 | | 1,289,059 | |

| Subordinated debt and other borrowings | 424,718 | | 424,497 | | 424,276 | | 424,055 | | 423,834 | | 423,614 | |

| Total shareholders' equity | 5,837,641 | | 5,843,759 | | 5,684,128 | | 5,519,392 | | 5,342,112 | | 5,315,239 | |

| Balance sheet data, quarterly averages: | | | | | | |

| Total loans | $ | 31,529,854 | | 30,882,205 | | 29,633,640 | | 28,402,197 | | 27,021,031 | | 25,397,389 | |

| Securities | 6,801,285 | | 6,722,247 | | 6,765,126 | | 6,537,262 | | 6,542,026 | | 6,446,774 | |

| Federal funds sold and other | 4,292,956 | | 3,350,705 | | 2,100,757 | | 1,828,588 | | 2,600,978 | | 2,837,679 | |

| Total earning assets | 42,624,095 | | 40,955,157 | | 38,499,523 | | 36,768,047 | | 36,164,035 | | 34,681,842 | |

| Total assets | 47,266,199 | | 45,411,961 | | 42,983,854 | | 41,324,251 | | 40,464,649 | | 38,780,786 | |

| Noninterest-bearing deposits | 8,515,733 | | 8,599,781 | | 9,332,317 | | 10,486,233 | | 10,926,069 | | 10,803,439 | |

| Total deposits | 38,078,665 | | 36,355,859 | | 35,291,775 | | 34,177,281 | | 33,108,415 | | 31,484,100 | |

| Securities sold under agreements to repurchase | 184,681 | | 162,429 | | 219,082 | | 199,610 | | 215,646 | | 216,846 | |

| FHLB advances | 2,132,638 | | 2,352,045 | | 1,130,356 | | 701,813 | | 1,010,865 | | 1,095,531 | |

| Subordinated debt and other borrowings | 426,855 | | 426,712 | | 426,564 | | 427,503 | | 426,267 | | 427,191 | |

| Total shareholders' equity | 5,898,196 | | 5,782,239 | | 5,605,604 | | 5,433,274 | | 5,403,244 | | 5,316,219 | |

| Statement of operations data, for the three months ended: |

| Interest income | $ | 627,294 | | 575,239 | | 506,039 | | 451,178 | | 371,764 | | 292,376 | |

| Interest expense | 310,052 | | 259,846 | | 193,808 | | 131,718 | | 65,980 | | 27,802 | |

| Net interest income | 317,242 | | 315,393 | | 312,231 | | 319,460 | | 305,784 | | 264,574 | |

| Provision for credit losses | 26,826 | | 31,689 | | 18,767 | | 24,805 | | 27,493 | | 12,907 | |

| Net interest income after provision for credit losses | 290,416 | | 283,704 | | 293,464 | | 294,655 | | 278,291 | | 251,667 | |

| Noninterest income | 90,797 | | 173,839 | | 89,529 | | 82,321 | | 104,805 | | 125,502 | |

| Noninterest expense | 213,233 | | 211,641 | | 211,727 | | 202,047 | | 199,253 | | 196,038 | |

| Income before income taxes | 167,980 | | 245,902 | | 171,266 | | 174,929 | | 183,843 | | 181,131 | |

| Income tax expense | 35,377 | | 48,603 | | 33,995 | | 37,082 | | 35,185 | | 36,004 | |

| Net income | 132,603 | | 197,299 | | 137,271 | | 137,847 | | 148,658 | | 145,127 | |

| Preferred stock dividends | (3,798) | | (3,798) | | (3,798) | | (3,798) | | (3,798) | | (3,798) | |

| Net income available to common shareholders | $ | 128,805 | | 193,501 | | 133,473 | | 134,049 | | 144,860 | | 141,329 | |

| Profitability and other ratios: | | | | | | |

Return on avg. assets (1) | 1.08 | % | 1.71 | % | 1.26 | % | 1.29 | % | 1.42 | % | 1.46 | % |

Return on avg. equity (1) | 8.66 | % | 13.42 | % | 9.66 | % | 9.79 | % | 10.64 | % | 10.66 | % |

Return on avg. common equity (1) | 9.00 | % | 13.95 | % | 10.05 | % | 10.20 | % | 11.08 | % | 11.12 | % |

Return on avg. tangible common equity (1) | 13.43 | % | 21.06 | % | 15.43 | % | 15.95 | % | 17.40 | % | 17.62 | % |

Common stock dividend payout ratio (14) | 11.35 | % | 11.04 | % | 12.07 | % | 12.26 | % | 12.34 | % | 12.63 | % |

Net interest margin (2) | 3.06 | % | 3.20 | % | 3.40 | % | 3.60 | % | 3.47 | % | 3.17 | % |

Noninterest income to total revenue (3) | 22.25 | % | 35.53 | % | 22.28 | % | 20.49 | % | 25.53 | % | 32.17 | % |

Noninterest income to avg. assets (1) | 0.76 | % | 1.54 | % | 0.84 | % | 0.79 | % | 1.03 | % | 1.30 | % |

Noninterest exp. to avg. assets (1) | 1.79 | % | 1.87 | % | 2.00 | % | 1.94 | % | 1.95 | % | 2.03 | % |

Efficiency ratio (4) | 52.26 | % | 43.26 | % | 52.70 | % | 50.29 | % | 48.53 | % | 50.26 | % |

Avg. loans to avg. deposits | 82.80 | % | 84.94 | % | 83.97 | % | 83.10 | % | 81.61 | % | 80.67 | % |

Securities to total assets | 14.48 | % | 14.13 | % | 15.25 | % | 15.82 | % | 15.81 | % | 16.34 | % |

| This information is preliminary and based on company data available at the time of the presentation. |

| | | | | | | | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES |

| ANALYSIS OF INTEREST INCOME AND EXPENSE, RATES AND YIELDS-UNAUDITED |

| | | |

| (dollars in thousands) | Three months ended | | Three months ended |

| September 30, 2023 | | September 30, 2022 |

| | Average Balances | Interest | Rates/ Yields | | Average Balances | Interest | Rates/ Yields |

| Interest-earning assets | | | | | | | |

Loans (1) (2) | $ | 31,529,854 | | $ | 508,963 | | 6.50 | % | | $ | 27,021,031 | | $ | 315,935 | | 4.73 | % |

| Securities | | | | | | | |

| Taxable | 3,542,383 | | 36,525 | | 4.09 | % | | 3,436,460 | | 18,204 | | 2.10 | % |

Tax-exempt (2) | 3,258,902 | | 24,185 | | 3.51 | % | | 3,105,566 | | 21,408 | | 3.28 | % |

| Interest-bearing due from banks | 3,553,640 | | 51,109 | | 5.71 | % | | 1,491,338 | | 8,666 | | 2.31 | % |

| Resell agreements | 503,153 | | 3,258 | | 2.57 | % | | 920,786 | | 5,616 | | 2.42 | % |

| Federal funds sold | — | | — | | — | % | | — | | — | | — | % |

| Other | 236,163 | | 3,254 | | 5.47 | % | | 188,854 | | 1,935 | | 4.06 | % |

| Total interest-earning assets | 42,624,095 | | $ | 627,294 | | 5.95 | % | | 36,164,035 | | $ | 371,764 | | 4.20 | % |

| Nonearning assets | | | | | | | |

| Intangible assets | 1,877,340 | | | | | 1,883,350 | | | |

| Other nonearning assets | 2,764,764 | | | | | 2,417,264 | | | |

| Total assets | $ | 47,266,199 | | | | | $ | 40,464,649 | | | |

| | | | | | | |

| Interest-bearing liabilities | | | | | | | |

| Interest-bearing deposits: | | | | | | | |

| Interest checking | 10,414,869 | | 98,974 | | 3.77 | % | | 6,763,990 | | 18,008 | | 1.06 | % |

| Savings and money market | 14,131,277 | | 128,453 | | 3.61 | % | | 12,765,435 | | 29,347 | | 0.91 | % |

| Time | 5,016,786 | | 52,878 | | 4.18 | % | | 2,652,921 | | 7,834 | | 1.17 | % |

| Total interest-bearing deposits | 29,562,932 | | 280,305 | | 3.76 | % | | 22,182,346 | | 55,189 | | 0.99 | % |

| Securities sold under agreements to repurchase | 184,681 | | 1,071 | | 2.30 | % | | 215,646 | | 182 | | 0.34 | % |

| Federal Home Loan Bank advances | 2,132,638 | | 22,710 | | 4.22 | % | | 1,010,865 | | 5,762 | | 2.26 | % |

| Subordinated debt and other borrowings | 426,855 | | 5,966 | | 5.54 | % | | 426,267 | | 4,847 | | 4.51 | % |

| Total interest-bearing liabilities | 32,307,106 | | 310,052 | | 3.81 | % | | 23,835,124 | | 65,980 | | 1.10 | % |

| Noninterest-bearing deposits | 8,515,733 | | — | | — | | | 10,926,069 | | — | | — | |

| Total deposits and interest-bearing liabilities | 40,822,839 | | $ | 310,052 | | 3.01 | % | | 34,761,193 | | $ | 65,980 | | 0.75 | % |

| Other liabilities | 545,164 | | | | | 300,212 | | | |

| Shareholders' equity | 5,898,196 | | | | | 5,403,244 | | | |

| Total liabilities and shareholders' equity | $ | 47,266,199 | | | | | $ | 40,464,649 | | | |

Net interest income | | $ | 317,242 | | | | | $ | 305,784 | | |

Net interest spread (3) | | | 2.14 | % | | | | 3.10 | % |

Net interest margin (4) | | | 3.06 | % | | | | 3.47 | % |

| | | | | | | |

| (1) Average balances of nonperforming loans are included in the above amounts. |

| (2) Yields computed on tax-exempt instruments on a tax equivalent basis and included $12.0 million of taxable equivalent income for the three months ended September 30, 2023 compared to $10.8 million for the three months ended September 30, 2022. The tax-exempt benefit has been reduced by the projected impact of tax-exempt income that will be disallowed pursuant to IRS Regulations as of and for the then current period presented. |

| (3) Yields realized on interest-bearing assets less the rates paid on interest-bearing liabilities. The net interest spread calculation excludes the impact of demand deposits. Had the impact of demand deposits been included, the net interest spread for the three months ended September 30, 2023 would have been 2.94% compared to a net interest spread of 3.44% for the three months ended September 30, 2022. |

| (4) Net interest margin is the result of annualized net interest income calculated on a tax equivalent basis divided by average interest-earning assets for the period. |

| | |

| This information is preliminary and based on company data available at the time of the presentation. | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES |

| ANALYSIS OF INTEREST INCOME AND EXPENSE, RATES AND YIELDS-UNAUDITED |

| | | |

| (dollars in thousands) | Nine months ended | | Nine months ended |

| September 30, 2023 | | September 30, 2022 |

| | Average Balances | Interest | Rates/ Yields | | Average Balances | Interest | Rates/ Yields |

| Interest-earning assets | | | | | | | |

Loans (1) (2) | $ | 30,688,846 | | $ | 1,419,761 | | 6.27 | % | | $ | 25,433,939 | | $ | 795,164 | | 4.27 | % |

| Securities | | | | | | | |

| Taxable | 3,482,068 | | 97,850 | | 3.76 | % | | 3,400,046 | | 41,977 | | 1.65 | % |

Tax-exempt (2) | 3,280,951 | | 72,590 | | 3.53 | % | | 2,978,901 | | 58,752 | | 3.18 | % |

| Interest-bearing due from banks | 2,522,300 | | 100,275 | | 5.32 | % | | 2,050,401 | | 12,580 | | 0.82 | % |

| Resell agreements | 508,467 | | 9,960 | | 2.62 | % | | 1,175,119 | | 10,674 | | 1.21 | % |

| Federal funds sold | — | | — | | — | % | | — | | — | | — | % |

| Other | 225,402 | | 8,136 | | 4.83 | % | | 179,293 | | 3,610 | | 2.69 | % |

| Total interest-earning assets | 40,708,034 | | $ | 1,708,572 | | 5.72 | % | | 35,217,699 | | $ | 922,757 | | 3.61 | % |

| Nonearning assets | | | | | | | |

| Intangible assets | 1,879,100 | | | | | 1,876,614 | | | |

| Other nonearning assets | 2,649,291 | | | | | 2,206,600 | | | |

| Total assets | $ | 45,236,425 | | | | | $ | 39,300,913 | | | |

| | | | | | | |

| Interest-bearing liabilities | | | | | | | |

| Interest-bearing deposits: | | | | | | | |

| Interest checking | 9,199,603 | | 227,263 | | 3.30 | % | | 6,560,068 | | 26,741 | | 0.54 | % |

| Savings and money market | 14,063,699 | | 335,997 | | 3.19 | % | | 12,479,841 | | 43,542 | | 0.47 | % |

| Time | 4,509,386 | | 122,302 | | 3.63 | % | | 2,272,063 | | 13,337 | | 0.78 | % |

| Total interest-bearing deposits | 27,772,688 | | 685,562 | | 3.30 | % | | 21,311,972 | | 83,620 | | 0.52 | % |

| Securities sold under agreements to repurchase | 188,605 | | 2,449 | | 1.74 | % | | 204,251 | | 320 | | 0.21 | % |

| Federal Home Loan Bank advances | 1,875,351 | | 58,284 | | 4.16 | % | | 998,828 | | 15,467 | | 2.07 | % |

| Subordinated debt and other borrowings | 426,711 | | 17,411 | | 5.46 | % | | 431,681 | | 13,517 | | 4.19 | % |

| Total interest-bearing liabilities | 30,263,355 | | 763,706 | | 3.37 | % | | 22,946,732 | | 112,924 | | 0.66 | % |

| Noninterest-bearing deposits | 8,812,953 | | — | | — | | | 10,737,610 | | — | | — | |

| Total deposits and interest-bearing liabilities | 39,076,308 | | $ | 763,706 | | 2.61 | % | | 33,684,342 | | $ | 112,924 | | 0.45 | % |

| Other liabilities | 396,965 | | | | | 266,018 | | | |

| Shareholders' equity | 5,763,152 | | | | | 5,350,553 | | | |

| Total liabilities and shareholders' equity | $ | 45,236,425 | | | | | $ | 39,300,913 | | | |

Net interest income | | $ | 944,866 | | | | | $ | 809,833 | | |

Net interest spread (3) | | | 2.35 | % | | | | 2.95 | % |

Net interest margin (4) | | | 3.22 | % | | | | 3.18 | % |

| | | | | | | |

| (1) Average balances of nonperforming loans are included in the above amounts. |

| (2) Yields computed on tax-exempt instruments on a tax equivalent basis and included $34.1 million of taxable equivalent income for the nine months ended September 30, 2023 compared to $28.8 million for the nine months ended September 30, 2022. The tax-exempt benefit has been reduced by the projected impact of tax-exempt income that will be disallowed pursuant to IRS Regulations as of and for the then current period presented. |

| (3) Yields realized on interest-bearing assets less the rates paid on interest-bearing liabilities. The net interest spread calculation excludes the impact of demand deposits. Had the impact of demand deposits been included, the net interest spread for the nine months ended September 30, 2023 would have been 3.11% compared to a net interest spread of 3.16% for the nine months ended September 30, 2022. |

| (4) Net interest margin is the result of annualized net interest income calculated on a tax equivalent basis divided by average interest-earning assets for the period. |

|

| This information is preliminary and based on company data available at the time of the presentation. |

| | | | | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES |

| SELECTED QUARTERLY FINANCIAL DATA – UNAUDITED |

| | | | | | |

| (dollars in thousands) | September | June | March | December | September | June |

| 2023 | 2023 | 2023 | 2022 | 2022 | 2022 |

| Asset quality information and ratios: | | | | | | |

| Nonperforming assets: | | | | | | |

| Nonaccrual loans | $ | 42,950 | | 44,289 | | 36,988 | | 38,116 | | 34,115 | | 15,459 | |

ORE and other nonperforming assets (NPAs) | 3,019 | | 3,105 | | 7,802 | | 7,952 | | 7,787 | | 8,237 | |

| Total nonperforming assets | $ | 45,969 | | 47,394 | | 44,790 | | 46,068 | | 41,902 | | 23,696 | |

| Past due loans over 90 days and still accruing interest | $ | 4,969 | | 5,257 | | 5,284 | | 4,406 | | 6,757 | | 3,840 | |

| | | | | | |

| Accruing purchase credit deteriorated loans | $ | 7,010 | | 7,415 | | 7,684 | | 8,060 | | 8,759 | | 9,194 | |

| Net loan charge-offs | $ | 18,093 | | 9,771 | | 7,291 | | 11,729 | | 10,983 | | 877 | |

| Allowance for credit losses to nonaccrual loans | 806.0 | % | 762.0 | % | 848.5 | % | 788.8 | % | 844.5 | % | 1,762.6 | % |

| As a percentage of total loans: | | | | | | |

| Past due accruing loans over 30 days | 0.16 | % | 0.14 | % | 0.14 | % | 0.15 | % | 0.13 | % | 0.11 | % |

Potential problem loans | 0.42 | % | 0.32 | % | 0.22 | % | 0.19 | % | 0.21 | % | 0.32 | % |

| Allowance for credit losses | 1.08 | % | 1.08 | % | 1.04 | % | 1.04 | % | 1.04 | % | 1.03 | % |

| Nonperforming assets to total loans, ORE and other NPAs | 0.14 | % | 0.15 | % | 0.15 | % | 0.16 | % | 0.15 | % | 0.09 | % |

| | | | | | |

Classified asset ratio (Pinnacle Bank) (6) | 4.6 | % | 3.3 | % | 2.7 | % | 2.4 | % | 2.6 | % | 2.9 | % |

Annualized net loan charge-offs to avg. loans (5) | 0.23 | % | 0.13 | % | 0.10 | % | 0.17 | % | 0.16 | % | 0.01 | % |

| | | | | | |

| Interest rates and yields: | | | | | | |

| Loans | 6.50 | % | 6.30 | % | 6.00 | % | 5.54 | % | 4.73 | % | 4.07 | % |

| Securities | 3.81 | % | 3.66 | % | 3.47 | % | 3.19 | % | 2.66 | % | 2.29 | % |

| Total earning assets | 5.95 | % | 5.74 | % | 5.45 | % | 5.02 | % | 4.20 | % | 3.49 | % |

| Total deposits, including non-interest bearing | 2.92 | % | 2.52 | % | 2.03 | % | 1.40 | % | 0.66 | % | 0.23 | % |

| Securities sold under agreements to repurchase | 2.30 | % | 1.93 | % | 1.10 | % | 0.94 | % | 0.34 | % | 0.15 | % |

| FHLB advances | 4.22 | % | 4.20 | % | 3.94 | % | 3.04 | % | 2.26 | % | 1.92 | % |

| Subordinated debt and other borrowings | 5.54 | % | 5.44 | % | 5.38 | % | 4.98 | % | 4.51 | % | 4.04 | % |

| Total deposits and interest-bearing liabilities | 3.01 | % | 2.65 | % | 2.12 | % | 1.47 | % | 0.75 | % | 0.34 | % |

| | | | | | |

Capital and other ratios (6): | | | | | | |

| Pinnacle Financial ratios: | | | | | | |

| Shareholders' equity to total assets | 12.3 | % | 12.5 | % | 12.6 | % | 13.2 | % | 13.0 | % | 13.2 | % |

| Common equity Tier one | 10.3 | % | 10.2 | % | 9.9 | % | 10.0 | % | 10.0 | % | 10.2 | % |

| Tier one risk-based | 10.9 | % | 10.8 | % | 10.5 | % | 10.5 | % | 10.7 | % | 10.9 | % |

| Total risk-based | 12.8 | % | 12.7 | % | 12.4 | % | 12.4 | % | 12.6 | % | 12.9 | % |

| Leverage | 9.4 | % | 9.5 | % | 9.6 | % | 9.7 | % | 9.7 | % | 9.8 | % |

| Tangible common equity to tangible assets | 8.2 | % | 8.3 | % | 8.3 | % | 8.5 | % | 8.3 | % | 8.4 | % |

| Pinnacle Bank ratios: | | | | | | |

| Common equity Tier one | 11.2 | % | 11.1 | % | 10.8 | % | 10.9 | % | 11.1 | % | 11.0 | % |

| Tier one risk-based | 11.2 | % | 11.1 | % | 10.8 | % | 10.9 | % | 11.1 | % | 11.0 | % |

| Total risk-based | 12.0 | % | 11.9 | % | 11.6 | % | 11.6 | % | 11.8 | % | 11.7 | % |

| Leverage | 9.7 | % | 9.8 | % | 9.9 | % | 10.1 | % | 10.1 | % | 9.9 | % |

Construction and land development loans as a percentage of total capital (17) | 83.1 | % | 84.5 | % | 88.5 | % | 85.9 | % | 85.4 | % | 87.4 | % |

Non-owner occupied commercial real estate and multi-family as a percentage of total capital (17) | 256.4 | % | 256.7 | % | 261.1 | % | 249.6 | % | 244.0 | % | 250.2 | % |

| | | | | | |

| This information is preliminary and based on company data available at the time of the presentation. |

| | | | | | | | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES |

| SELECTED QUARTERLY FINANCIAL DATA – UNAUDITED |

| | | | | | | |

| (dollars in thousands, except per share data) | | September | June | March | December | September | June |

| 2023 | 2023 | 2023 | 2022 | 2022 | 2022 |

| | | | | | | |

| Per share data: | | | | | | | |

| Earnings per common share – basic | $ | 1.69 | | 2.55 | | 1.76 | | 1.77 | | 1.91 | | 1.87 | |

| Earnings per common share - basic, excluding non-GAAP adjustments | $ | 1.79 | | 1.80 | | 1.76 | | 1.77 | | 1.91 | | 1.87 | |

| Earnings per common share – diluted | $ | 1.69 | | 2.54 | | 1.76 | | 1.76 | | 1.91 | | 1.86 | |

| Earnings per common share - diluted, excluding non-GAAP adjustments | $ | 1.79 | | 1.79 | | 1.76 | | 1.76 | | 1.91 | | 1.86 | |

| Common dividends per share | $ | 0.22 | | 0.22 | | 0.22 | | 0.22 | | 0.22 | | 0.22 | |

Book value per common share at quarter end (7) | $ | 73.23 | | 73.32 | | 71.24 | | 69.35 | | 67.07 | | 66.74 | |

Tangible book value per common share at quarter end (7) | $ | 48.78 | | 48.85 | | 46.75 | | 44.74 | | 42.44 | | 42.08 | |

| Revenue per diluted common share | $ | 5.35 | | 6.43 | | 5.28 | | 5.27 | | 5.40 | | 5.14 | |

| Revenue per diluted common share, excluding non-GAAP adjustments | $ | 5.48 | | 5.43 | | 5.28 | | 5.27 | | 5.40 | | 5.14 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Investor information: | | | | | | | |

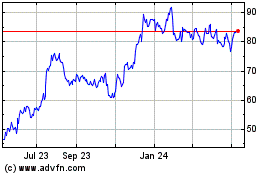

| Closing sales price of common stock on last trading day of quarter | $ | 67.04 | | 56.65 | | 55.16 | | 73.40 | | 81.10 | | 72.31 | |

| High closing sales price of common stock during quarter | $ | 75.95 | | 57.93 | | 82.79 | | 87.81 | | 87.66 | | 91.42 | |

| Low closing sales price of common stock during quarter | $ | 56.41 | | 46.17 | | 52.51 | | 70.74 | | 68.68 | | 68.56 | |

| | | | | | | |

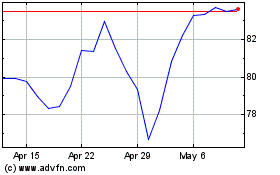

| Closing sales price of depositary shares on last trading day of quarter | $ | 22.70 | | 23.75 | | 24.15 | | 25.35 | | 25.33 | | 25.19 | |

| High closing sales price of depositary shares during quarter | $ | 23.85 | | 24.90 | | 25.71 | | 25.60 | | 26.23 | | 26.44 | |

| Low closing sales price of depositary shares during quarter | $ | 21.54 | | 19.95 | | 20.77 | | 23.11 | | 24.76 | | 24.75 | |

| | | | | | | |

| Other information: | | | | | | | |

| Residential mortgage loan sales: | | | | | | | |

| Gross loans sold | $ | 198,247 | | 192,948 | | 120,146 | | 134,514 | | 181,139 | | 239,736 | |

Gross fees (8) | $ | 4,350 | | 4,133 | | 2,795 | | 3,149 | | 3,189 | | 6,523 | |

| Gross fees as a percentage of loans originated | | 2.19 | % | 2.14 | % | 2.33 | % | 2.34 | % | 1.76 | % | 2.72 | % |

| Net gain (loss) on residential mortgage loans sold | $ | 2,012 | | 1,567 | | 2,053 | | (65) | | 1,117 | | 2,150 | |

Investment gains (losses) on sales of securities, net (13) | $ | (9,727) | | (9,961) | | — | | — | | 217 | | — | |

Brokerage account assets, at quarter end (9) | $ | 9,041,716 | | 9,007,230 | | 8,634,339 | | 8,049,125 | | 7,220,405 | | 6,761,480 | |

| Trust account managed assets, at quarter end | $ | 5,047,128 | | 5,084,592 | | 4,855,951 | | 4,560,752 | | 4,162,639 | | 4,207,406 | |

Core deposits (10) | $ | 33,606,783 | | 32,780,767 | | 32,054,111 | | 31,301,077 | | 30,748,817 | | 30,011,444 | |

Core deposits to total funding (10) | | 81.9 | % | 80.9 | % | 82.4 | % | 86.8 | % | 87.4 | % | 87.0 | % |

| Risk-weighted assets | $ | 39,527,086 | | 38,853,588 | | 38,117,659 | | 36,216,901 | | 35,281,315 | | 33,366,074 | |

| Number of offices | | 128 | | 127 | | 126 | | 123 | | 120 | | 119 | |

| Total core deposits per office | $ | 262,553 | | 258,116 | | 254,398 | | 254,480 | | 256,240 | | 252,197 | |

| Total assets per full-time equivalent employee | $ | 14,274 | | 14,166 | | 13,750 | | 12,948 | | 12,875 | | 13,052 | |

| Annualized revenues per full-time equivalent employee | $ | 486.2 | | 593.0 | | 496.5 | | 491.8 | | 511.5 | | 509.0 | |

| Annualized expenses per full-time equivalent employee | $ | 254.1 | | 256.5 | | 261.7 | | 247.3 | | 248.2 | | 255.8 | |

| Number of employees (full-time equivalent) | | 3,329.5 | | 3,309.0 | | 3,281.5 | | 3,241.5 | | 3,184.5 | | 3,074.0 | |

Associate retention rate (11) | | 93.6 | % | 94.1 | % | 93.8 | % | 93.8 | % | 93.6 | % | 93.3 | % |

| | | | | | | |

| This information is preliminary and based on company data available at the time of the presentation. |

| | | | | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES | | | |

| RECONCILIATION OF NON-GAAP SELECTED QUARTERLY FINANCIAL DATA – UNAUDITED | | | |

| Three months ended | | Nine months ended |

(dollars in thousands, except per share data) | September | June | September | | September | September |

| 2023 | 2023 | 2022 | | 2023 | 2022 |

| | | | | | |

| Net interest income | $ | 317,242 | 315,393 | 305,784 | | 944,866 | 809,833 |

| | | | | | |

| Noninterest income | 90,797 | 173,839 | 104,805 | | 354,165 | 333,803 |

| Total revenues | 408,039 | 489,232 | 410,589 | | 1,299,031 | 1,143,636 |

| Less: Investment losses (gains) on sales of securities, net | 9,727 | 9,961 | (217) | | 19,688 | (156) |

| Gain on sale of fixed assets as a result of sale-leaseback transaction | — | (85,692) | — | | (85,692) | — |

| Total revenues excluding the impact of adjustments noted above | $ | 417,766 | 413,501 | 410,372 | | 1,233,027 | 1,143,480 |

| | | | | | |

| Noninterest expense | $ | 213,233 | 211,641 | 199,253 | | 636,601 | 577,952 |

| Less: ORE expense (benefit) | 33 | 58 | (90) | | 190 | 101 |

| | | | | | |

| | | | | | |

| | | | | | |

| Noninterest expense excluding the impact of adjustments noted above | $ | 213,200 | 211,583 | 199,343 | | 636,411 | 577,851 |

| | | | | | |

| Pre-tax income | $ | 167,980 | 245,902 | 183,843 | | 585,148 | 522,564 |

| Provision for credit losses | 26,826 | 31,689 | 27,493 | | 77,282 | 43,120 |

| Pre-tax pre-provision net revenue | 194,806 | 277,591 | 211,336 | | 662,430 | 565,684 |

| Less: Adjustments noted above | 9,760 | (75,673) | (307) | | (65,814) | (55) |

Adjusted pre-tax pre-provision net revenue (12) | $ | 204,566 | 201,918 | 211,029 | | 596,616 | 565,629 |

| | | | | | |

| Noninterest income | $ | 90,797 | 173,839 | 104,805 | | 354,165 | 333,803 |

| Less: Adjustments noted above | 9,727 | (75,731) | (217) | | (66,004) | (156) |

| Noninterest income excluding the impact of adjustments noted above | $ | 100,524 | 98,108 | 104,588 | | 288,161 | 333,647 |

| | | | | | |

Efficiency ratio (4) | 52.26 | % | 43.26 | % | 48.53 | % | | 49.01 | % | 50.54 | % |

| Adjustments noted above | (1.23) | % | 7.91 | % | 0.05 | % | | 2.60 | % | (0.01) | % |

Efficiency ratio excluding adjustments noted above (4) | 51.03 | % | 51.17 | % | 48.58 | % | | 51.61 | % | 50.53 | % |

| | | | | | |

| Total average assets | $ | 47,266,199 | 45,411,961 | 40,464,649 | | 45,236,425 | 39,300,913 |

| | | | | | |

Noninterest income to average assets (1) | 0.76 | % | 1.54 | % | 1.03 | % | | 1.05 | % | 1.14 | % |

| Less: Adjustments noted above | 0.08 | % | (0.67) | % | — | % | | (0.20) | % | — | % |

Noninterest income (excluding adjustments noted above) to average assets (1) | 0.84 | % | 0.87 | % | 1.03 | % | | 0.85 | % | 1.14 | % |

| | | | | | |

Noninterest expense to average assets (1) | 1.79 | % | 1.87 | % | 1.95 | % | | 1.88 | % | 1.97 | % |

| Adjustments as noted above | — | % | — | % | — | % | | — | % | — | % |

Noninterest expense (excluding adjustments noted above) to average assets (1) | 1.79 | % | 1.87 | % | 1.95 | % | | 1.88 | % | 1.97 | % |

| | | | | | |

| This information is preliminary and based on company data available at the time of the presentation. |

| | | | | | | | | | | | | | | | | | | | | | |

| PINNACLE FINANCIAL PARTNERS, INC. AND SUBSIDIARIES | | | |

| RECONCILIATION OF NON-GAAP SELECTED QUARTERLY FINANCIAL DATA – UNAUDITED | | | |

| Three months ended | |

| (dollars in thousands, except per share data) | September | June | March | December | September | June | | |

| 2023 | 2023 | 2023 | 2022 | 2022 | 2022 | | |

| Net income available to common shareholders | $ | 128,805 | | 193,501 | | 133,473 | | 134,049 | | 144,860 | | 141,329 | | | |

| | | | | | | | |

| Investment (gains) losses on sales of securities, net | 9,727 | | 9,961 | | — | | — | | (217) | | — | | | |

| Gain on sale of fixed assets as a result of sale-leaseback transaction | — | | (85,692) | | — | | — | | — | | — | | | |

| | | | | | | | |

| | | | | | | | |

| ORE expense (benefit) | 33 | | 58 | | 99 | | 179 | | (90) | | 86 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Tax effect on adjustments noted above (16) | (2,440) | | 18,918 | | (25) | | (47) | | 80 | | (22) | | | |

| Net income available to common shareholders excluding adjustments noted above | $ | 136,125 | | 136,746 | | 133,547 | | 134,181 | | 144,633 | | 141,393 | | | |

| | | | | | | | |

| Basic earnings per common share | $ | 1.69 | | 2.55 | | 1.76 | | 1.77 | | 1.91 | | 1.87 | | | |

| | | | | | | | |

| Adjustment due to investment (gains) losses on sales of securities, net | 0.13 | | 0.13 | | — | | — | | — | | — | | | |

| Adjustment due to gain on sale of fixed assets as a result of sale-leaseback transaction | — | | (1.13) | | — | | — | | — | | — | | | |

| | | | | | | | |

| | | | | | | | |

| Adjustment due to ORE expense (benefit) | — | | — | | — | | — | | — | | — | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Adjustment due to tax effect on adjustments noted above (16) | (0.03) | | 0.25 | | — | | — | | — | | — | | | |

| Basic earnings per common share excluding adjustments noted above | $ | 1.79 | | 1.80 | | 1.76 | | 1.77 | | 1.91 | | 1.87 | | | |

| | | | | | | | |

| Diluted earnings per common share | $ | 1.69 | | 2.54 | | 1.76 | | 1.76 | | 1.91 | | 1.86 | | | |

| | | | | | | | |

| Adjustment due to investment (gains) losses on sales of securities, net | 0.13 | | 0.13 | | — | | — | | — | | — | | | |

| Adjustment due to gain on sale of fixed assets as a result of sale-leaseback transaction | — | | (1.13) | | — | | — | | — | | — | | | |

| | | | | | | | |

| | | | | | | | |

| Adjustment due to ORE expense (benefit) | — | | — | | — | | — | | — | | — | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |