- Net sales increased by 19% to $32.8

million for the third quarter, and by 21% to $94.0 million

year-to-date

- Year over year Income from

operations improved by 132% to $0.8 million in the third quarter of

2018

- Backlog of $70.1 million as of

October 31, 2018 increased by 50%, or $23.4 million, since January

31, 2018

- Finalized new $18 million credit

facility

Perma-Pipe International Holdings, Inc. (NASDAQ: PPIH) announced

today financial results for the third quarter and year-to-date

ended October 31, 2018.

President and CEO David Mansfield commented, “While third

quarter revenues of $32.8 million were consistent with those

achieved in the second quarter, income from operations increased by

121% over the same periods. The improvement in gross profit

reflects the impact of our initiatives which resulted in an

increase to 21% versus 12% in the same quarter last year. On a year

to date basis versus the same period last year, revenue grew $16.2

million or 21%, while income from operations improved by $8.7

million. This increase in operating performance was achieved

despite the adverse impact on our revenues caused by

customer-driven delays to project schedules in the Middle East.

“We are also pleased to see that the continued focus on growing

our leak detection business generated significantly improved

results during the quarter,” Mr. Mansfield continued.

“Backlog has continued to grow and now stands at more than $70

million, an increase of 50% since the beginning of the year. This

level of backlog is a record for the Company and is driven by

increases in all areas combined with the aforementioned project

delays in the Middle East.

“As previously announced, during this quarter we entered into a

new $18 million credit facility with PNC Bank that will provide

enhanced liquidity to our North American operations,” added Mr.

Mansfield.

“Overall, we continue to see encouraging results from our

strategies to return the Company to profitability and we believe we

are continuing to make progress toward achieving this objective,”

concluded Mr. Mansfield.

Third Quarter 2018 Results

Net sales increased 19% to $32.8 million in the

current quarter, from $27.5 million in the prior year quarter.

Higher revenues resulted from increased sales in North America.

Gross profit increased to 21%, or $6.9 million of net

sales, in the current quarter from 12%, or $3.3 million of net

sales, in the prior year quarter. This 107% improvement was

due to increased volumes and improved margins, which are a result

of strategic initiative improvements.

General and administrative expenses were slightly lower at

$4.2 million in the current quarter, compared to $4.3 million

in the prior year quarter. Selling expenses were

$1.6 million in the current quarter, compared to

$1.3 million in the prior quarter. This increase is due to

commissions related to increased sales.

Net interest expense increased to $0.3 million in the

current quarter, from $0.2 million in the prior-year quarter

due to higher borrowings and higher effective interest rates, both

domestic and foreign.

Year-to-Date 2018 Results

Net sales increased 21% to $94.0 million in the current

year-to-date, from $77.9 million in the prior year

year-to-date. Higher revenues resulted from increased sales in all

geographic regions.

Gross profit increased to 18%, or $17.0 million of

sales, in the current year-to-date from 10%, or $8.2 million

of sales, in the prior year year-to-date. This improvement was due

to increased volumes and improved margins.

General and administrative expenses decreased by 2% to

$12.2 million in the current year-to-date, from $12.5 million in

the prior year year-to-date. In the prior year year-to-date,

the Company recognized foreign exchange losses on the payback of an

intercompany loan extended to a foreign subsidiary.

Selling expenses increased by 2% to $4.0 million in

the current year-to-date from $3.9 million the prior year

year-to-date. Current year expenses included higher commissions

related to increased sales.

Net interest expense increased to $0.8 million in the current

year-to-date, from $0.5 million in the prior year year-to-date

due to higher borrowings and higher effective interest rates, both

domestic and foreign.

Percentages set forth above in this press release have been

rounded to the nearest percentage point, and may not exactly

correspond to the comparative data presented.

Perma-Pipe International Holdings, Inc.

Perma-Pipe International Holdings is a global leader in

pre-insulated piping and leak detection systems for oil and gas

gathering, district heating and cooling, and other applications. It

uses its extensive engineering and fabrication expertise to develop

piping solutions that solve complex challenges regarding the safe

and efficient transportation of many types of liquids. In total,

Perma-Pipe has operations at seven locations in five countries.

Forward-Looking Statements

Certain statements and other information contained in this press

release that can be identified by the use of forward-looking

terminology constitute “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended

(“Exchange Act”), and are subject to the safe harbors created

thereby, including, without limitation, statements regarding the

expected future performance and operations of the Company. These

statements should be considered as subject to the many risks and

uncertainties that exist in the Company's operations and business

environment. Such risks and uncertainties include, but are not

limited to, the following: (i) the Company’s ability to

effectively execute its strategic plan and achieve profitability

and positive cash flows; (ii) the impacts of global economic

weakness and volatility; (iii) fluctuations in steel prices

and the Company’s ability to offset increases in steel prices

through price increases in its products; (iv) the timing of

orders for the Company’s products; (v) decreases in United

States government spending on projects using the Company’s

products, and challenges to the Company’s non-government customers’

liquidity and access to capital funds; (vi) the Company’s

ability to successfully negotiate progress-billing arrangements for

its large contracts; (vii) fluctuations in crude oil and

natural gas prices risks and uncertainties related to the Company’s

international business operations; (viii) the Company’s

ability to repay its debt, and renew expiring international credit

facilities; (ix) aggressive pricing by existing competitors

and the entrance of new competitors in the markets in which the

Company operates; (x) the Company’s ability to purchase raw

materials at favorable prices and to maintain beneficial

relationships with its suppliers; (xi) the Company’s ability

to manufacture products free of latent defects and to recover from

suppliers who may provide defective materials to the Company;

(xii) reductions or cancellations of orders included in the

Company’s backlog; (xiii) the Company’s ability to attract and

retain senior management and key personnel; (xiv) the

Company’s ability to achieve the expected benefits of its growth

initiatives; (xv) reversals of previously recorded revenue and

profits resulting from inaccurate estimates made in connection with

the Company’s percentage-of-completion revenue recognition;

(xvi) the Company’s failure to establish and maintain

effective internal control over financial reporting; and

(xvii) the impact of cybersecurity threats on the Company’s

information technology systems. Shareholders, potential investors

and other readers are urged to consider these factors carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. The

forward-looking statements made herein are made only as of the date

of this press release and we undertake no obligation to publicly

update any forward-looking statements, whether as a result of new

information, future events or otherwise. More detailed information

about factors that may affect our performance may be found in our

filings with the Securities and Exchange Commission, which are

available at https://www.sec.gov and under the Investor Center

section of our website (http://investors.permapipe.com).

Perma-Pipe’s Form 10-Q for the period ended October

31, 2018 will be accessible at www.sec.gov and www.permapipe.com. For more information, visit the

Company's website.

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share data)

Three Months Ended October 31, Nine Months

Ended October 31, 2018 2017

2018 2017 Net sales $ 32,806 $ 27,498 $

94,020 $ 77,851 Cost of sales 25,923

24,178 77,019

69,688 Gross profit 6,883 3,320 17,001 8,163

Operating expenses General and administrative expenses 4,247 4,314

12,153 12,456 Selling expenses 1,554

1,297 4,017 3,920

Total operating expenses 5,801 5,611 16,170 16,376

Income/(loss) from operations 1,082

(2,291 ) 831 (8,213 ) Interest expense, net 280

193 830

507 Income/(loss) from operations before income taxes

802 (2,484 ) 1 (8,720 ) Income tax expense/(benefit) 934 808

1,525 (241 )

Net loss $

(132 ) $ (3,292 ) $ (1,524 ) $ (8,479 )

Weighted average common shares outstanding Basic and diluted 7,877

7,714 7,806 7,668 Loss per share Basic and diluted (0.02 )

(0.43 ) (0.20 ) (1.11 )

See accompanying notes to consolidated

financial statements.

Note: Earnings per share calculations

could be impacted by rounding.

PERMA-PIPE INTERNATIONAL HOLDINGS, INC.

AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(unaudited)

(In thousands except per share data)

October 31,

2018 January 31, 2018 ASSETS

Unaudited Current assets Cash and cash equivalents $

9,582 $ 7,084 Restricted cash 2,536 1,237 Trade accounts

receivable, less allowance for doubtful accounts of $480 at October

31, 2018 and $469 at January 31, 2018 32,280 32,936 Inventories,

net 14,330 16,856 Prepaid expenses and other current assets 3,345

2,703 Contract assets 2,357 1,502

Total current assets 64,430 62,318 Property, plant

and equipment, net of accumulated depreciation 31,020 34,509

Other assets Deferred tax assets - long-term 45 391 Goodwill

2,269 2,423 Other assets 5,966 4,943

Total other assets 8,280

7,757

Total assets $ 103,730 $ 104,584

LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities Trade accounts payable $ 9,788 $ 14,186 Accrued

compensation and payroll taxes 1,893 1,580 Commissions and

management incentives payable 1,789 787 Revolving line of credit

13,662 7,273 Current maturities of long-term debt 1,046 753

Customers' deposits 4,028 5,236 Outside commissions payable 2,194

1,800 Contract liability 1,599 1,967 Other accrued liabilities

3,491 4,259 Income taxes payable 1,348

1,339

Total current liabilities 40,838 39,180

Long-term liabilities Long-term debt, less current

maturities 6,892 7,728 Deferred compensation liabilities 3,504

4,098 Deferred tax liabilities - long-term 1,149 1,242 Other

long-term liabilities 534 524

Total long-term liabilities 12,079

13,592

Stockholders' equity Common stock, $.01

par value, authorized 50,000 shares; 7,877 issued and outstanding

at October 31, 2018 and 7,717 issued and outstanding at January 31,

2018 79 77 Additional paid-in capital 58,365 56,304 Accumulated

deficit (4,627 ) (3,103 ) Accumulated other comprehensive loss

(3,004 ) (1,466 )

Total stockholders'

equity 50,813 51,812

Total liabilities and stockholders' equity $ 103,730

$ 104,584

See accompanying notes to consolidated

financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181211005170/en/

Perma-Pipe International Holdings, Inc.David

Mansfield, President and CEO

Perma-Pipe Investor Relations(847)

929-1200investor@permapipe.com

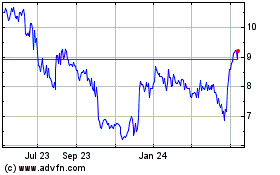

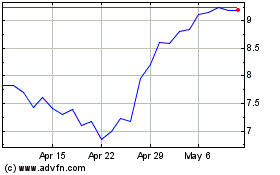

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Perma Pipe (NASDAQ:PPIH)

Historical Stock Chart

From Apr 2023 to Apr 2024