The Lind Securities were issued pursuant to that

certain purchase agreement between us and Lind, dated February 2, 2023 (the “Purchase Agreement”). See “The Lind

Transaction” for a description of the agreement and “Selling Stockholder” for additional information regarding Lind.

The prices at which Lind sells the Shares will be determined by the prevailing market price for the shares or in negotiated transactions.

We are not offering any shares of our common

stock for sale under this prospectus. We are registering the offer and resale of the Shares to satisfy contractual obligations owed by

us to the selling stockholder pursuant to the Purchase Agreement and documents ancillary thereto. Our registration of the Shares covered

by this prospectus does not mean that the selling stockholder will offer or sell any of the Shares. Any of the Shares subject to resale

hereunder will have been issued by us and acquired by the selling stockholder prior to any resale of such Shares pursuant to this prospectus.

No underwriter or other person has been engaged to facilitate the sale of the Shares in this offering. The selling stockholder will pay

or assume discounts, commissions, fees of underwriters, selling brokers, dealer managers or similar expenses, if any, incurred for the

sale of the Shares.

We will not receive any proceeds from the resale

of the Shares by the selling stockholder pursuant to this prospectus. However, we will receive proceeds from the exercise of the Warrant

if the selling stockholder exercises the Warrant for cash.

The selling stockholder, or its permitted transferees

or other successors-in-interest, may offer the Shares from time to time through public or private transactions at prevailing market prices,

at prices related to prevailing market prices or at privately negotiated prices. We provide additional information about how the selling

stockholder may sell the Shares in the section entitled “Plan of Distribution” on page 14 in this prospectus.

While we will not receive any proceeds from the

sale of our common stock by the selling stockholder in the offering described in this prospectus, we may receive up to $3.25 per share

upon the cash exercise of the Warrant. Upon the exercise of the Warrant for all 800,000 Warrant Shares by payment of cash, however, we

will receive aggregate gross proceeds of approximately $2.6 million. However, we cannot predict when and in what amounts or if the Warrant

will be exercised, and it is possible that the Warrant may expire and never be exercised, in which case we would not receive any cash

proceeds.

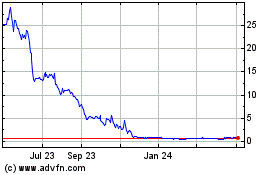

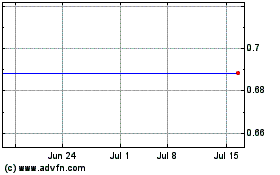

Our common stock is listed on the Nasdaq Capital

Market under the symbol “PXMD.” On May 10, 2023, the last reported sale price of our common stock on the Nasdaq Capital

Market was $1.56 per share.

We are an “emerging growth company”

as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public

company reporting requirements for this prospectus and future filings.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form S-1 that we filed with the SEC. The selling stockholder may offer, sell or distribute all or a portion of the shares of

our common stock hereby registered publicly or through private transactions at prevailing market prices or at negotiated prices, from

time to time in one or more offerings as described in this prospectus. We will not receive any of the proceeds from such sales of our

common stock. We will bear all costs, expenses and fees in connection with the registration of these securities, including with regard

to compliance with state securities or “blue sky” laws. The selling stockholder will bear all commissions and discounts,

if any, attributable to its sale of our common stock hereby registered. See “Plan of Distribution.”

We may also file a prospectus supplement or post-effective

amendment to the registration statement of which this prospectus forms a part that may contain material information relating to these

offerings. The prospectus supplement or post-effective amendment may also add, update or change information contained in this prospectus

with respect to that offering. If there is any inconsistency between the information in, or incorporated by reference in, this prospectus

and the applicable prospectus supplement or post-effective amendment, you should rely on the prospectus supplement or post-effective

amendment, as applicable. Before purchasing any securities, you should carefully read this prospectus, any post-effective amendment,

and any applicable prospectus supplement, and information incorporated by reference therein, together with the additional information

described in the “Where You Can Find More Information” section of this prospectus.

Neither we nor the selling stockholder have authorized

anyone to provide you with any information or to make any representations other than those contained in this prospectus, any post-effective

amendment, or any applicable prospectus supplement prepared by or on behalf of us or to which we have referred you. We and the selling

stockholder take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may

give you. We and the selling stockholder will not make an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing or incorporated by reference in this prospectus, any post-effective

amendment and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover. Our business,

financial condition, results of operations and prospects may have changed since those dates. This prospectus and the information incorporated

by reference herein contains, and any post-effective amendment or any prospectus supplement may contain, market data and industry statistics

and forecasts that are based on independent industry publications and other publicly available information. Although we believe these

sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this

information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus,

any post-effective amendment or any prospectus supplement may involve estimates, assumptions and other risks and uncertainties and are

subject to change based on various factors, including those discussed in the “Risk Factors” section of this prospectus and

similar sections of other documents that are incorporated by reference herein, any post-effective amendment and the applicable prospectus

supplement. Accordingly, investors should not place undue reliance on this information.

INDUSTRY

AND MARKET DATA

This prospectus contains estimates, projections

and other information concerning our industry, our business, and the markets for our product candidates, including data regarding market

research, estimates and forecasts prepared by our management. Information that is based on estimates, forecasts, projections, market

research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from

events and circumstances that are assumed in this information.

Unless otherwise expressly stated, we obtained

this industry, business, market and other data from reports, research surveys, studies and similar data prepared by market research firms

and other third parties, industry, medical and general publications, government data and similar sources. In some cases, we do not expressly

refer to the sources from which this data is derived. In that regard, when we refer to one or more sources of this type of data in any

paragraph, you should assume that other data of this type appearing in the same paragraph is derived from the same sources, unless otherwise

expressly stated or the context otherwise requires.

PROSPECTUS SUMMARY

This summary highlights certain information

contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before purchasing

our common stock. The words “PaxMedica,” “us,” “we,” the “Company” and any variants thereof

used in this prospectus refer to PaxMedica, Inc. Investing in our common stock is speculative and involves a high degree of risk.

You should carefully consider the risks and uncertainties described herein, together with all of the other information in this prospectus

or incorporated by reference herein, including our financial statements and related notes, before investing in our common stock. If any

of the risks described, or incorporated by reference, herein materialize, our business, financial condition, operating results and prospects

could be materially and adversely affected. In that event, the price of our common stock could decline, and you could lose part or all

of your investment. Our expectations for our future performance may change after the date of this prospectus and there is no guarantee

that such expectations will prove to be accurate.

Overview

We are a clinical stage biopharmaceutical company

focusing on the development of anti-purinergic drug therapies (“APT”) for the treatment of disorders with intractable neurologic

symptoms, ranging from neurodevelopmental disorders, including autism spectrum disorder (“ASD”), to Myalgic Encephalomyelitis/Chronic

Fatigue Syndrome (“ME/CFS”), a debilitating physical and cognitive disorder believed to be viral in origin and now with rising

incidence globally due to the long term effects of SARS-CoV-2 (“COVID-19”). APTs have been shown to block the effects of

excess production and extracellular receptor activity of adenosine triphosphate (“ATP”), which acts as both the main energy

molecule in all living cells and a peripheral and central nervous system neurotransmitter via receptors that are found throughout the

nervous system. Excess purinergic signaling can offset homeostasis and trigger immune responses that result in localized and systemic

increases in inflammatory chemokines and cytokines, ultimately stimulating ATP production. APTs may also impact immunologic and inflammatory

mechanisms that may be causing or exacerbating symptoms in these seemingly unrelated disorders, which may be caused in part by similar

mechanisms of ATP overproduction.

One of our primary points of focus is currently

the development and testing of our lead program, PAX-101, an intravenous formulation of suramin, in the treatment of ASD and the advancement

of the clinical understanding of using that agent against other disorders such as ME/CFS and Long COVID-19 Syndrome (“LCS”),

a clinical diagnosis in individuals who have been previously infected with COVID-19. In February 2021, we announced positive topline

data from our Phase 2 dose-ranging clinical trial evaluating PAX-101 (commonly known as intravenous suramin) for the treatment of the

core symptoms of ASD, as described in more detail below. We also intend to submit data to support a New Drug Application (an “NDA”)

for PAX-101 under the Tropical Disease Priority Voucher Program of the U.S. Food and Drug Administration (the “FDA”) for

the treatment of Human African Trypanosomiasis, a fatal parasitic infection commonly known as African sleeping sickness (“HAT”),

leveraging suramin’s historical use in treating HAT outside of the United States. We have exclusively licensed clinical data from

certain academic or international government institutions to potentially accelerate PAX-101’s development plans in the United States

through this regulatory program and seek approval in the United States for the treatment of East African HAT (as defined below) as early

as 2024. We are also pursuing the development of next generation APT product development candidates for neurodevelopmental indications.

These candidates include PAX-102, our proprietary intranasal formulation of suramin, as well as other new chemical entities that are

more targeted and selective antagonists of particular purine receptor subtypes. We believe our lead drug candidate (suramin), if approved

by the FDA, may be a significant advancement in the treatment of ASD and a potentially useful treatment for ME/CFS and LCS.

Corporate Information

We were formed as a Delaware limited liability

company under the name Purinix Pharmaceuticals LLC (“Purinix”) on April 5, 2018. On April 15, 2020, we converted

into a Delaware corporation and changed our name to PaxMedica, Inc. Our offices are located at 303 South Broadway, Suite 125,

Tarrytown, NY 10591, and our telephone number is (914) 987-2876. Our website is www.paxmedica.com. Information contained in, or accessible

through, our website does not constitute part of this prospectus or registration statement and inclusions of our website address in this

prospectus or registration statement are inactive textual references only.

“PaxMedica” and our other common

law trademarks, service marks or trade names appearing herein are the property of PaxMedica, Inc. We do not intend the use or display

of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other

companies.

Our Status as an Emerging

Growth Company

The Jumpstart Our Business Startups Act (the

“JOBS Act”), was enacted in April 2012 with the intention of encouraging capital formation in the United States and

reducing the regulatory burden on newly public companies that qualify as “emerging growth companies.” We are an emerging

growth company within the meaning of the JOBS Act. As an emerging growth company, we may take advantage of certain exemptions from various

public reporting requirements, including the requirement that our internal control over financial reporting be audited by our independent

registered public accounting firm pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, certain requirements related to the

disclosure of executive compensation in this prospectus and in our periodic reports and proxy statements, and the requirement that we

hold a nonbinding advisory vote on executive compensation and any golden parachute payments. We may take advantage of these exemptions

until we are no longer an emerging growth company.

We will remain an emerging growth company until

the earliest to occur of (1) the last day of the fiscal year in which we have $1.235 billion or more in annual revenue; (2) the

date we qualify as a “large accelerated filer,” with at least $700 million of equity securities held by non-affiliates; (3) the

date on which we have issued, in any three-year period, more than $1.0 billion in non-convertible debt securities; or (4) the last

day of the fiscal year ending after the fifth anniversary of our initial public offering.

For certain risks related to our status as an

emerging growth company, see “Risk Factors — Risks Related to Our Common Stock and this Offering — We are

an ‘emerging growth company’ and as a result of the reduced disclosure and governance requirements applicable to emerging

growth companies, our common stock may be less attractive to investors” in our most recent Annual Report on Form 10-K.

THE OFFERING

The following summary contains basic information

about this offering and our common stock and is not intended to be complete. It does not contain all of the information that may be important

to you. For a more complete understanding of our common stock, please refer to the section of this prospectus titled “Description

of Capital Stock.”

| Common

stock offered by the Selling Stockholder |

|

Up to 3,391,549 shares of our common stock, consisting

of (i) up to 2,591,549 shares of common stock (the “Convertible Note Shares”) issuable upon the conversion or repayment

of a secured, 18-month, interest free convertible promissory note in the principal amount of $3,680,000 issued to the selling stockholder

(the “Note”); and (ii) 800,000 shares of common stock (the “Warrant Shares” and, together with the Convertible

Note Shares and the Warrant Shares, the “Shares”) issuable upon exercise of a common stock purchase warrant (the “Warrant”

and, together with the Note, the “Lind Securities”). |

| |

|

|

| Common

stock outstanding immediately after this offering(1) |

|

15,427,141 shares, assuming the sale of 3,391,549 Shares. |

| |

|

|

| Use

of proceeds |

|

We will receive no proceeds from the sale of Shares of common

stock by Lind in this offering. We will receive proceeds in the event that the Warrant is exercised at the exercise price per share

for cash, which will result in gross proceeds of approximately $2.6 million. Any proceeds that we receive from the exercise of the

Warrant may be used to partially repay the Note, and the remainder of the net proceeds will be used for general working capital purposes.

See the section of this prospectus titled “Use of Proceeds” for additional information. |

| |

|

|

| Nasdaq

Capital Market symbol |

|

“PXMD” |

| |

|

|

| Risk

Factors |

|

Investing in our common stock is speculative and involves

a high degree of risk. See “Risk Factors” beginning on page 4, other information appearing elsewhere in

this prospectus and in the documents incorporated by reference herein for a discussion of factors you should carefully consider before

deciding whether to invest in our common stock. Additional risks and uncertainties not presently known to us or that we currently

deem to be immaterial may also impair our business and operations. |

| (1) | The number of shares of our common stock outstanding after this offering

is based on the number of shares outstanding as of December 31, 2022, and excludes: |

| · | 142,088 shares of our common

stock issuable upon the exercise of the 2020 Warrants to purchase shares of common stock

at an exercise price equal to $3.00 per share; |

| · | 867,943 shares of common stock

issuable upon the conversion of our outstanding Series X Preferred Stock; |

| · | 1,877,582 shares of our common

stock reserved for issuance upon settlement of restricted stock units granted as of December 31,

2022 pursuant to the PaxMedica Inc. Amended and Restated 2020 Omnibus Equity Incentive Plan

(the “2020 Plan”); |

| · | 607,418 shares of our common stock available for issuance under

the 2020 Plan; |

| · | 108,181 shares of our common stock issuable upon the exercise of

the Underwriter Warrants to purchase shares of common stock at an exercise price of $6.88

per share; |

| · | 195,140 shares of our common stock issuable upon exercise of the

2022 Warrants at an exercise price equal to $4.20 per share; |

| · | 142,000 shares of our common stock issuable upon the exercise of

the Representative’s Warrants (as defined below) issued in January and March 2023

to purchase shares of common stock at an exercise price equal to $3.00 per share and $3.50

per share, respectively; and |

| · | up to $20,000,000 of shares

of our common stock issuable to Lincoln Park from time to time under the Lincoln Park Purchase

Agreement (as defined below), of which 13,102,199 shares of our common stock have been registered

for resale on a Registration Statement on Form S-1 (File No. 333-268882), initially

filed with the Securities and Exchange Commission (the “Commission”) on December 19,

2022 and declared effective on December 27, 2022 (the “Lincoln Park Registration

Statement”). |

RISK FACTORS

An investment in

our common stock is speculative, illiquid and involves a high degree of risk including the risk of a loss of your entire investment.

We have identified a number of these factors under the heading “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2022, as updated by our subsequently filed Quarterly Reports on Form 10-Q,

each of which are incorporated by reference in this prospectus, as well as in other information included or incorporated by reference

in this prospectus and any prospectus supplement. We have also identified certain risks related to this offering, which are listed below.

You should carefully consider the risks and uncertainties and the other information contained in this prospectus. The risks identified

are not the only ones facing us. Additional unanticipated or unknown risks and uncertainties may exist that could also adversely affect

our business, operations and financial condition in ways that are unknown to us or unpredictable. If any of the risks actually materialize,

our business, financial condition and/or operations could suffer. In such event, the trading price of our common stock could decline,

and you could lose all or a substantial portion of your investment. See the section of this prospectus titled “Where You Can Find

More Information.”

Risks Related to This Offering

The selling stockholder

may choose to sell the shares at prices below the current market price.

The selling stockholder is

not restricted as to the prices at which they may sell or otherwise dispose of the Shares covered by this prospectus. Sales or other

dispositions of the Shares below the then-current market prices could adversely affect the market price of our common stock.

Neither we nor the selling

stockholder has authorized any other party to provide you with information concerning us or this offering.

You should carefully evaluate

all of the information in this prospectus, including the documents incorporated by reference herein. We may receive media coverage regarding

our Company, including coverage that is not directly attributable to statements made by our officers, that incorrectly reports on statements

made by our officers or employees, or that is misleading as a result of omitting information provided by us, our officers or employees.

Neither we nor the selling stockholder has authorized any other party to provide you with information concerning us or this offering,

and recipients should not rely on this information.

We will have broad discretion

as to the proceeds that we receive from the cash exercise by any holder of the Warrant, and we may not use the proceeds effectively.

We will not receive any of

the proceeds from the sale of the Shares by the selling stockholders pursuant to this prospectus. We may receive up to approximate $2.6

million in aggregate gross proceeds from cash exercises of the Warrant, based on the per share exercise price of the Warrant, and to

the extent that we receive such proceeds, subject to any obligation to pay a portion of such proceeds to repay any amounts outstanding

under the Note, we intend to use the net proceeds from cash exercises of the Warrant to further our product development activities and

for working capital and general corporate purposes. Our management will have broad discretion in the application of such proceeds, including

for any of the purposes described in the section entitled “Use of Proceeds,” and we could spend the proceeds from the sale

of Warrant Shares to Lind in ways our stockholders may not agree with or that do not yield a favorable return, if at all. You will not

have the opportunity, as part of your investment decision, to assess whether such proceeds are being used in a manner agreeable to you.

You will be relying on the judgment of our management concerning these uses and you will not have the opportunity, as part of your investment

decision, to assess whether the proceeds are being used appropriately. The failure of our management to apply these funds effectively

could result in unfavorable returns and uncertainty about our prospects, each of which could cause the price of our common stock to decline.

You may experience future

dilution as a result of issuance of the Shares, future equity offerings by us and other issuances of our common stock or other securities.

In addition, the issuance of the Shares and future equity offerings and other issuances of our common stock or other securities may adversely

affect our common stock price.

The Shares sold in the offering

will be freely tradable without restriction or further registration under the Securities Act of 1933, as amended (the “Securities

Act”). As a result, a substantial number of shares of our common stock may be sold in the public market following this offering.

If there are significantly more shares of our common stock offered for sale than buyers are willing to purchase, then the market price

of our common stock may decline to a market price at which buyers are willing to purchase the offered common stock and sellers remain

willing to sell our common stock. The issuance of the Shares or any future sales of a substantial number of shares of our common stock

in the public market, or the perception that such sales may occur, could also adversely affect the price of our common stock. We cannot

predict the effect, if any, that market sales of those shares of common stock or the availability of those shares for sale will have

on the market price of our common stock.

In addition, in order to raise

additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable

for our common stock at prices that may not be the same as the price per share as prior issuances of common stock. We may not be able

to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share previously

paid by investors, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders.

The price per share at which we sell additional shares of our common stock or securities convertible into common stock in future transactions

may be higher or lower than the prices per share per share. In addition, the exercise price of the Warrant for the Warrant Shares may

be or greater than the price per share previously paid by certain investors. You will incur dilution upon exercise of any outstanding

stock options, warrants or upon the issuance of shares of common stock under our stock incentive programs. In addition, the issuance

of the Shares and any future sales of a substantial number of shares of our common stock in the public market, or the perception that

such sales may occur, could adversely affect the price of our common stock. We cannot predict the effect, if any, that market sales of

those shares of common stock or the availability of those shares for sale will have on the market price of our common stock.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated

by reference in this prospectus contain forward-looking statements. The words “believe,” “may,” “will,”

potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,”

“would,” “project,” “plan,” “expect” and similar expressions that convey uncertainty

of future events or outcomes are intended to identify forward-looking statements. These forward-looking statements include, but are not

limited to, statements concerning the following:

| · | our

lack of operating history; |

| · | the

expectation that we will incur significant operating losses for the foreseeable future and

will need significant additional capital, including through future sales and issuances of

equity securities which could also result in substantial dilution to our stockholders; |

| · | our

current and future capital requirements to support our development and commercialization

efforts for our product candidates and our ability to satisfy our capital needs; |

| · | our

dependence on our product candidates, which are still in preclinical or early stages of clinical

development; |

| · | our,

or our third-party manufacturers’, ability to manufacture cGMP batches of our product

candidates as required for pre-clinical and clinical trials and, subsequently, our ability

to manufacture commercial quantities of our product candidates; |

| · | whether

we will be successful in obtaining a priority review voucher, or PRV, for PAX-101 and the

commercial value to be realized from any such PRV, if any; |

| · | our

relationship with TardiMed, an affiliated entity that provides office space and important

administrative services to us, as well as our ability to attract and retain key executives

and medical and scientific personnel; |

| · | our

ability to complete required clinical trials for our product candidates and obtain approval

from the FDA or other regulatory agencies in different jurisdictions; |

| · | our

lack of a sales and marketing organization and our ability to commercialize our product candidates

if we obtain regulatory approval; |

| · | our

dependence on third parties to manufacture our product candidates; |

| · | our

reliance on third-party CROs to conduct our clinical trials; |

| · | our

ability to obtain, maintain or protect the validity of our intellectual property, including

our granted or potential future patents; |

| · | our

ability to internally develop new inventions and intellectual property; |

| · | interpretations

of current laws and the passages of future laws; |

| · | acceptance

of our business model by investors; |

| · | adverse

developments affecting the financial services industry; |

| · | the

accuracy of our estimates regarding expenses and capital requirements; and |

| · | our

ability to adequately support organizational and business growth. |

These forward-looking statements are subject

to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” and under similar headings

in our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K

incorporated by reference herein and elsewhere in this prospectus or incorporated by reference herein. Moreover, we operate in a very

competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for us to predict all risks,

nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual

results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties

and assumptions, the forward- looking events and circumstances discussed in this prospectus or incorporated by reference herein may not

occur and actual results could differ materially and adversely from those anticipated or implied in our forward-looking statements.

You should not rely upon forward-looking statements

as predictions of future events. Although we believe that the expectations reflected in our forward-looking statements are reasonable,

we cannot guarantee that the future results, levels of activity, performance or events and circumstances described in the forward-looking

statements will be achieved or will occur. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness

of any forward-looking statements. We undertake no obligation to update publicly any forward-looking statements for any reason after

the date of this prospectus to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this prospectus, the documents

incorporated by reference herein and the documents that we reference in this prospectus and have filed with the Commission as exhibits

to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity,

performance and events and circumstances may be materially different from what we expect.

USE OF PROCEEDS

All shares of our common stock offered by this

prospectus are being registered for the account of the selling stockholder and we will not receive any proceeds from the sale of these

shares by the selling stockholders. However, we did receive $3,680,000 upon the issuance of the Note to the selling stockholder, and

we may receive up to approximately $2.6 million in aggregate gross proceeds from the cash exercise of the Warrant, based on the per share

exercise price of the Warrant.

We may use a portion of the net proceeds from

any cash exercises of the Warrant to partially repay the Note, and the remainder of the net proceeds, if any, to advance our development

programs and for general corporate purposes, which may include the acquisition of companies or businesses, working capital, clinical

trial expenditures and capital expenditures. The Note is interest free and has a maturity date of August 6, 2024. The proceeds from

the sale of the Note are for general working capital.

Our expected use of net proceeds from this offering

represents our intentions based on our present plans and business conditions, which could change as our plans and business conditions

evolve. The amounts and timing of our actual expenditures will depend on numerous factors, including our development timeline, costs

associated with drug development, the impact of the COVID-19 pandemic, and any unforeseen cash needs and other factors described under

“Risk Factors” in this prospectus and incorporated by reference from our most recent Annual Report on Form 10-K and

any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, as well as the amount of cash used in our operations.

We may find it necessary or advisable to use the net proceeds for other purposes, and we will have broad discretion in the application

of the net proceeds.

DILUTION

The issuance of the Convertible Note Shares and

the Warrant Shares pursuant to the Purchase Agreement will have a dilutive impact on our stockholders. In addition, in the event we elect

to make any portion of the monthly payments of the outstanding principal amount of the Note with Convertible Note Shares, which amount

we may issue may further increase as the VWAP (as defined in the Purchase Agreement) of our common stock during the 20-day period prior

to the applicable payment date decreases, the greater the dilution to our existing shareholders.

Our net tangible book value represents total

tangible assets less total liabilities divided by the number of shares of common stock outstanding on December 31, 2022. As of December 31,

2022, we had a historical net tangible book value of $0.1 million, or $0.01 per share of common stock.

After giving effect to (i) the sale of 3,391,549

Shares to Lind pursuant to the Purchase Agreement and assuming gross proceeds of approximately $2.6 million from the exercise of the

Warrant and (ii) deducting estimated offering expenses of $0.7 million payable by us, our pro forma net tangible book value as of

December 31, 2022, would have been approximately $5.7 million, or $0.37 per share. This represents an immediate increase in net

tangible book value of $0.36 per share to existing stockholders and an immediate dilution of $1.48 per share to new investors.

The following table illustrates this dilution

on a per share basis:

| Assumed

offering price per Share(1) | |

$ | 1.85 | |

| Historical net tangible book value

per share of common stock at December 31, 2022 | |

$ | 0.01 | |

| Increase in net

tangible book value per share of common stock attributable to this offering | |

$ | 0.36 | |

| Pro forma net tangible

book value per share of common stock after this offering | |

$ | 0.37 | |

| Dilution per share

of common stock to new investors in this offering | |

$ | 1.48 | |

(1) The assumed offering price per Share

is based on gross proceeds of $6.28 million from (i) the issuance of the Note in the Principal Amount (as defined below) and (ii) gross

proceeds of approximately $2.6 million upon the exercise of the Warrant for all of the Warrant Shares, divided by the number of Shares

being registered by this registration statement.

The calculations above are based on 12,035,592

shares of our common stock outstanding as of December 31, 2022 and exclude:

| · | 142,088 shares of our common

stock issuable upon the exercise of the 2020 Warrants to purchase shares of common stock

at an exercise price equal to $3.00 per share; |

| · | 867,943 shares of common

stock issuable upon the conversion of our outstanding Series X Preferred Stock; |

| · | 1,877,582 shares of our

common stock reserved for issuance upon settlement of restricted stock units granted as of

December 31, 2022 pursuant to the 2020 Plan; |

| · | 607,418 shares of our common stock available for issuance under

the 2020 Plan; |

| · | 108,181 shares of our common stock issuable upon the exercise

of the Underwriter Warrants to purchase shares of common stock at an exercise price of $6.88

per share; |

| · | 195,140 shares of our common stock issuable upon exercise of

the 2022 Warrants at an exercise price equal to $4.20 per share; |

| · | 142,000 shares of our common stock issuable upon the exercise

of the Representative’s Warrants issued in January and March 2023 to purchase

shares of common stock at an exercise price equal to $3.00 per share and $3.50 per share,

respectively; and |

| · | up to $20,000,000 of shares

of our common stock issuable to Lincoln Park from time to time under the Lincoln Park Purchase

Agreement, of which 13,102,199 shares of our common stock have been registered for resale

on the Lincoln Park Registration Statement. |

The discussion of dilution assumes no exercise

of warrants, convertible notes or other potentially dilutive securities, other than the Warrant and the Note. The exercise of potentially

dilutive securities having an exercise price less than the offering price would increase the dilutive effect to new investors.

In addition, we may choose to raise additional

capital due to market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating

plans. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the issuance of these

securities could result in further dilution to our stockholders.

SELLING STOCKHOLDER

Unless the context otherwise requires, as used

in this prospectus, “selling stockholder” refers to the selling stockholder named in this prospectus, or certain transferees,

assignees or other successors-in-interest that may receive our securities from the selling stockholder.

We have prepared this prospectus to allow the

selling stockholder to sell or otherwise dispose of, from time to time, up to 3,391,549 shares of our common stock, which are comprised

of (i) up to 2,591,549 Convertible Note Shares issuable upon the conversion or repayment of the Note and (ii) 800,000 Warrant

Shares issuable upon exercise of the Warrant. See “Prospectus Summary – The Offering” starting on page 2 of this prospectus for a description of the private transactions in which we issued the Lind Securities. Except for the beneficial

ownership of our securities, neither the selling stockholder nor any persons who have control over the selling stockholder have had any

material relationship with us within the past three years.

The table below lists the selling stockholder

and other information regarding the ownership of our shares of common stock by the selling stockholder.

The second column lists the number of shares

of common stock owned by the selling stockholder, based on its ownership of the shares of common stock and securities convertible or

exercisable into shares of common stock, as of December 31, 2022, assuming exercise or conversion, as applicable, of the securities

exercisable or convertible into shares of common stock held by the selling stockholder on that date, if applicable, without regard to

any limitations on conversions or exercises.

The following table provides, as of December 31,

2022, information regarding the selling stockholder and the shares of common stock that it may offer and sell from time to time under

this prospectus. The percentage of ownership in the table below is based on 12,035,592 shares of common stock outstanding as of December 31,

2022. The table is prepared based on information supplied to us by the selling stockholder, and reflects its holdings as of December 31,

2022. Neither Lind nor any of its affiliates has held a position or office, or had any other material relationship, with us or any of

our predecessors or affiliates. Beneficial ownership is determined in accordance with Section 13(d) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), and Rule 13d-3 thereunder.

| | |

Shares

Beneficially

Owned Prior to

Offering(1) | | |

Maximum

Number of

Shares to be

Offered | | |

Shares

Beneficially Owned After

Offering(2) | |

| Name of Selling Stockholders | |

Number | | |

Percentage | | |

| | |

Number | | |

Percentage | |

| Lind

Global Fund II LP (3) | |

| 632,118 | | |

| 4.99 | % | |

| 3,391,549 | | |

| 0 | | |

| 0 | % |

| |

(1) |

Lind may not

convert or exercise, as applicable, any portion of the Lind Securities to the extent such conversion or exercise would cause Lind,

together with its affiliates, to beneficially own a number of shares of common stock which would exceed 4.99% of our then outstanding

common stock (or 9.99% of our then outstanding common stock to the extent Lind, together with its affiliates, beneficially owns in

excess of 4.99% of shares of our then common stock at the time of such conversion (each such limitation, a “Beneficial

Ownership Limitation”)). Due to the Beneficial Ownership Limitation, prior to the offering, Lind’s beneficial ownership

of our shares of common stock includes up to 632,118 Convertible Note Shares and/or Warrant Shares issuable in accordance with the

terms of the Purchase Agreement and excludes up to 2,759,431 Convertible Note Shares and/or Warrant Shares. |

| |

|

|

| |

(2) |

Assumes the selling stockholder sells all of the Shares, although the selling stockholder is under no obligation to sell any

Shares at this time. |

| |

|

|

| |

(3) |

The securities are directly

owned by Lind. Jeff Easton is the Managing Member of The Lind Partners, LLC, which is the Investment Manager of Lind, and in such

capacity has the right to vote and dispose of the securities held by such entities. Mr. Easton disclaims beneficial ownership

over the securities listed except to the extent of his pecuniary interest therein. The address for Lind is 444 Madison Avenue, 41st

Floor, New York, NY 10022. |

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with

respect to the beneficial ownership of our common stock, as of March 27, 2023 by:

| |

· |

each person or group of affiliated persons known by

us to beneficially own more than 5% of our common stock; |

| |

· |

each of our named executive officers; |

| |

· |

each of our directors; and |

| |

· |

all of our executive officers and directors as a group. |

The number of shares beneficially owned by each

stockholder is determined under rules issued by the SEC. Under these rules, a person is deemed to be a “beneficial”

owner of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct

the disposition of such security. Except as indicated in the footnotes below, we believe, based on the information furnished to us, that

the individuals and entities named in the table below have sole voting and investment power with respect to all shares of common stock

beneficially owned by them, subject to any applicable community property laws.

Percentage ownership of our common stock is based

on 13,555,392 shares of our common stock outstanding on March 27, 2023. Unless noted otherwise, the address of all listed stockholders

is 303 South Broadway, Suite 125, Tarrytown, New York, 10591.

| | |

Number

of

Shares

Beneficially

Owned (#)(2) | | |

Percentage

of

Shares

Beneficially

Owned (%)(3) | |

| Name of Beneficial Owner | |

| | | |

| | |

| 5% Stockholders | |

| | | |

| | |

| TardiMed Sciences, LLC(4) | |

| 7,336,745 | | |

| 54.1 | % |

| Blue Cane Partners, LLC(5) | |

| 1,193,339 | | |

| 8.8 | % |

| Amar Foundation(6) | |

| 1,193,339 | | |

| 8.8 | % |

| Directors and Executive Officers | |

| | | |

| | |

| Howard J. Weisman | |

| 157,623 | | |

| 1.2 | % |

| Stephen D. Sheldon(7) | |

| 33,799 | | |

| 0.2 | % |

| Michael Derby(8) | |

| 7,430,769 | | |

| 54.8 | % |

| Zachary Rome | |

| 58,046 | | |

| 0.4 | % |

| Karen LaRochelle | |

| 11,444 | | |

| 0.1 | % |

| John F. Coelho | |

| 36,264 | | |

| 0.3 | % |

| Charles J. Casamento | |

| - | | |

| 0.0 | % |

| All executive officers and directors as a group (7 individuals) | |

| 7,727,945 | | |

| 57.1 | % |

| |

(1) |

The address of TardiMed and of each officer and director

is 303 South Broadway, Suite 125 Tarrytown, NY 10591. |

| |

(2) |

We have determined beneficial ownership in accordance

with Rule 13d-3 under the Exchange Act, which is generally determined by voting power and/or dispositive power with respect

to securities. Unless otherwise noted, the shares of common stock listed above are owned as of the date of this prospectus, and are

owned of record by each individual named as beneficial owner and such individual has sole voting and dispositive power with respect

to the shares of common stock owned by each of them, unless otherwise noted. |

| |

(3) |

Percentage ownership is based on 13,555,392 shares

of common stock issued and outstanding as of March 27, 2023. RSUs that vest within 60 days of this proxy statement are deemed

to be beneficially owned by the persons holding those RSUs for the purpose of computing percentage ownership of that person, but

are not treated as outstanding for the purpose of computing any other person’s ownership percentage. |

| |

(4) |

Michael Derby is the Managing Partner of TardiMed and

has sole voting and dispositive control over the shares of our common stock held by TardiMed. As a result, Mr. Derby may be

deemed to beneficially own the shares of our common stock held by TardiMed. |

| |

(5) |

The number of shares of common stock beneficially owned

by Blue Cane Partners, LLC includes 18,339 shares of common stock issuable upon conversion of Series X Preferred Stock and excludes

137,718 shares of common stock as a result of beneficial ownership limitation provisions contained in certain of their security instruments.

Craig Kesselman is a member of Blue Cane Partners, LLC and has voting and dispositive control over the shares of our common stock

held by Blue Cane Partners, LLC. The address of Blue Cane Partners, LLC is 3411 Silverside Road Tatnal Building #104, Wilmington,

DE 19810. |

| |

(6) |

The number of shares of common stock beneficially owned

by Amar Foundation includes 18,339 shares of our common stock issuable upon conversion of Series X Preferred Stock and excludes

711,422 shares of our common stock issuable upon conversion of Series X Preferred Stock as a result of beneficial ownership

limitation provisions contained therein. Vinod Khosla has voting and dispositive control over the shares of our common stock held

by Amar Foundation. The address of Amar Foundation is 1760 The Alameda, Suite 300, San Jose, CA 95126. |

| |

(7) |

Consists of 15,000 shares owned by Mr. Sheldon

and 18,799 shares held by The Sheldon Family Trust. |

| |

(8) |

Consists of 94,024 shares owned by Mr. Derby and

7,336,745 held by TardiMed, of which Mr. Derby is the Managing Partner. |

DESCRIPTION

OF CAPITAL STOCK

The following is a summary of all material characteristics

of our capital stock as set forth in our Certificate of Incorporation, as amended (the “Certificate of Incorporation”) and

bylaws, as amended and restated (the “Bylaws”). The summary does not purport to be complete and is qualified in its entirety

by reference to our Certificate of Incorporation and Bylaws, each of which is incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and the applicable provisions of Delaware law.

Authorized Capitalization

Our Certificate of Incorporation authorizes us

to issue up to 210,000,000 shares of capital consisting of 200,000,000 shares of common stock with a par value of $0.0001 per share and

10,000,000 shares of preferred stock with a par value of $0.0001 per share. As of December 31, 2022, we had 12,035,592 shares of

common stock, par value $0.0001 per share, issued and outstanding. In addition, as of December 31, 2022, we had 1,877,582 shares

of our common stock reserved for issuance upon settlement of restricted stock units granted pursuant to the 2020 Plan.

Common Stock

Holders of our common stock are entitled to such

dividends as may be declared by our board of directors out of funds legally available for such purpose. The shares of common stock are

neither redeemable nor convertible. Holders of common stock have no preemptive or subscription rights to purchase any of our securities.

Each holder of our common stock is entitled to

one vote for each such share outstanding in the holder’s name. No holder of common stock is entitled to cumulate votes in voting

for directors.

In the event of our liquidation, dissolution

or winding up, the holders of our common stock are entitled to receive pro rata our assets, which are legally available for distribution,

after payments of all debts and other liabilities. All of the outstanding shares of our common stock are fully paid and non-assessable.

The shares of common stock offered by this prospectus will also be fully paid and non-assessable.

Preferred Stock

Our board of directors has the authority, without

further action by our stockholders, to issue up to 10,000,000 shares of preferred stock in one or more classes or series and to fix the

designations, rights, preferences, privileges and restrictions thereof, without further vote or action by the stockholders, net of any

shares of preferred stock that have been previously issued. These rights, preferences and privileges could include dividend rights, conversion

rights, voting rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting, or the

designation of, such class or series, any or all of which may be greater than the rights of common stock. The issuance of our preferred

stock could adversely affect the voting power of holders of common stock and the likelihood that such holders will receive dividend payments

and payments upon our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing

a change in control of the Company or other corporate action.

Anti-Takeover Effects of Delaware law and

Our Certificate of Incorporation and Bylaws

The provisions of Delaware law, our Certificate

of Incorporation and our Bylaws described below may have the effect of delaying, deferring or discouraging another party from acquiring

control of us.

Section 203 of the Delaware General

Corporation Law

We are subject to Section 203 of the Delaware

General Corporation Law, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder

for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

| · | before

such date, the board of directors of the corporation approved either the business combination

or the transaction that resulted in the stockholder becoming an interested stockholder; |

| · | upon

completion of the transaction that resulted in the stockholder becoming an interested stockholder,

the interested stockholder owned at least 85% of the voting stock of the corporation outstanding

at the time the transaction began, excluding for purposes of determining the voting stock

outstanding (but not the outstanding voting stock owned by the interested stockholder) those

shares owned (i) by persons who are directors and also officers and (ii) employee

stock plans in which employee participants do not have the right to determine confidentially

whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| · | on

or after such date, the business combination is approved by the board of directors and authorized

at an annual or special meeting of the stockholders, and not by written consent, by the affirmative

vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested

stockholder. |

In general, Section 203 defines business

combination to include the following:

| · | any

merger or consolidation involving the corporation and the interested stockholder; |

| · | any sale, transfer, pledge

or other disposition of 10% or more of the assets of the corporation involving the interested

stockholder; |

| · | subject to certain exceptions,

any transaction that results in the issuance or transfer by the corporation of any stock

of the corporation to the interested stockholder; |

| · | any transaction involving

the corporation that has the effect of increasing the proportionate share of the stock or

any class or series of the corporation beneficially owned by the interested stockholder;

or |

| · | the receipt by the interested

stockholder of the benefit of any loss, advances, guarantees, pledges or other financial

benefits by or through the corporation. |

In general, Section 203 defines an “interested

stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within

three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock

of the corporation.

Certificate of Incorporation and Bylaws

Our Certificate of Incorporation and Bylaws provide

for:

| · | classifying

our board of directors into three classes; |

| · | authorizing the issuance

of “blank check” preferred stock, the terms of which may be established and shares

of which may be issued without stockholder approval; |

| · | limiting the removal of

directors by the stockholders; |

| · | requiring a supermajority

vote of stockholders to amend our Bylaws or certain provisions our Certificate of Incorporation; |

| · | prohibiting stockholder

action by written consent, thereby requiring all stockholder actions to be taken at a meeting

of our stockholders; |

| · | eliminating the ability

of stockholders to call a special meeting of stockholders; |

| · | establishing advance notice

requirements for nominations for election to the board of directors or for proposing matters

that can be acted upon at stockholder meetings; and |

| · | establishing Delaware as

the exclusive jurisdiction for certain stockholder litigation against us. |

Potential Effects of Authorized but Unissued

Stock

We have shares of common stock and preferred

stock available for future issuance without stockholder approval. We may utilize these additional shares for a variety of corporate purposes,

including future public offerings to raise additional capital, to facilitate corporate acquisitions or payment as a dividend on the capital

stock.

The existence of unissued and unreserved common

stock and preferred stock may enable our board of directors to issue shares to persons friendly to current management or to issue preferred

stock with terms that could render more difficult or discourage a third-party attempt to obtain control of us by means of a merger, tender

offer, proxy contest or otherwise, thereby protecting the continuity of our management. In addition, the board of directors has the discretion

to determine designations, rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights,

redemption privileges and liquidation preferences of each series of preferred stock, all to the fullest extent permissible under the

Delaware General Corporation Law and subject to any limitations set forth in our Certificate of Incorporation. The purpose of authorizing

the board of directors to issue preferred stock and to determine the rights and preferences applicable to such preferred stock is to

eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred stock, while providing desirable

flexibility in connection with possible financings, acquisitions and other corporate purposes, could have the effect of making it more

difficult for a third-party to acquire, or could discourage a third-party from acquiring, a majority of our outstanding voting stock.

Choice of Forum

Unless we consent in writing to the selection

of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and exclusive forum for any stockholder to

bring (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim of breach

of fiduciary duty owed by any director, officer or other employee of the Company or the Company’s stockholders, creditors or constituents,

(iii) any action asserting a claim against the Company or any director or officer of the Company arising pursuant to, or a claim

against the Company or any director or officer of the Company, with respect to the interpretation or application of any provision of,

the DGCL, our Certificate of Incorporation or Bylaws, or (iv) any action asserting a claim governed by the internal affairs doctrine,

except for, in each of the aforementioned actions, any claims to which the Court of Chancery of the State of Delaware determines it lacks

jurisdiction. This provision will not apply to claims arising under the Exchange Act, or for any other federal securities laws which

provide for exclusive federal jurisdiction. However, the exclusive forum provision provides that unless we consent in writing to the

selection of an alternative forum, the federal district courts of the United States of America will be the exclusive forum for the resolution

of any complaint asserting a cause of action arising under the Securities Act. Therefore, this provision could apply to a suit that falls

within one or more of the categories enumerated in the exclusive forum provision and that asserts claims under the Securities Act, inasmuch

as Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce

any duty or liability created by the Securities Act or the rules and regulations thereunder. There is uncertainty as to whether

a court would enforce such an exclusive forum provision with respect to claims under the Securities Act.

We note that there is uncertainty as to whether

a court would enforce the provision and that investors cannot waive compliance with the federal securities laws and the rules and

regulations thereunder. Although we believe this provision benefits us by providing increased consistency in the application of Delaware

law in the types of lawsuits to which it applies, the provision may have the effect of discouraging lawsuits against our directors and

officers.

Listing

Our common stock is listed on the Nasdaq Capital

Market under the trading symbol “PXMD.”

Transfer Agent

Our transfer agent is Computershare Trust N.A.

The transfer agent’s address is 1290 Avenue of the Americas, 9th Floor, New York, NY 1010, and its telephone number is (212) 805-7100.

PLAN OF DISTRIBUTION

The selling stockholder may, from time to time,

sell any or all of their securities covered hereby on the Nasdaq Capital Market or any other stock exchange, market or trading facility

on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders

may use any one or more of the following methods when selling securities:

| · | ordinary brokerage transactions

and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the

broker-dealer will attempt to sell the securities as agent but may position and resell a

portion of the block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer

as principal and resale by the broker-dealer for its account; |

| · | an exchange distribution

in accordance with the rules of the applicable exchange; |

| · | privately negotiated transactions; |

| · | settlement of short sales; |

| · | in transactions through

broker-dealers that agree with the selling stockholder to sell a specified number of such

securities at a stipulated price per security; |

| · | through the writing or settlement

of options or other hedging transactions, whether through an options exchange or otherwise; |

| · | a combination of any such

methods of sale; or |

| · | any other method permitted

pursuant to applicable law. |

The selling stockholder may also sell securities

under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholder

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder

(or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated, but, except

as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission

in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In connection with the sale of the securities

covered hereby, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which

may in turn engage in short sales of the securities in the course of hedging the positions they assume. The selling stockholder may also

sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities to broker-dealers

that in turn may sell these securities. The selling stockholder may also enter into option or other transactions with broker-dealers

or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other

financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may

resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder and any broker-dealers

or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale

of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The selling stockholder

has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute

the securities.

We are required to pay certain fees and expenses

incurred by us incident to the registration of the securities. We have agreed to indemnify the selling stockholder against certain losses,

claims, damages and liabilities, including liabilities under the Securities Act.

We intend to keep this prospectus effective until

the earlier of (i) the date on which the securities may be resold by the selling stockholder without registration and without regard

to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current

public information requirement under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all

of the securities have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar

effect. The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state

securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered

or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is

complied with.

Under applicable rules and regulations under

the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making activities

with respect to our common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution.

In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations

thereunder, including Regulation M, which may limit the timing of purchases and sales of our common stock by the selling stockholder

or any other person. We will make copies of this prospectus available to the selling stockholder and are informing the selling stockholder

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with

Rule 172 under the Securities Act).

Our shares of common stock are listed on the

Nasdaq Capital Market under the trading symbol “PXMD.”

LIND TRANSACTION

On February 2, 2023, the Company entered

into the Purchase Agreement with Lind, which provides for the Company issuing to the Lind a secured, 18-month, interest free convertible

promissory note in the principal amount of $3,680,000 (the “Principal Amount”), the Note, and a common stock purchase warrant

to acquire 800,000 shares of common stock of the Company, the Warrant. The transaction closed on February 6, 2023. In connection

with the issuance of the Note and the Warrant, the Company paid a $112,000 commitment fee to Lind. The proceeds from the sale of the

Note and Warrant are for general working capital. Capitalized terms used in this section but not defined herein shall be given their

respective meanings as set forth in the Purchase Agreement.

Commencing August 6, 2023, the Company shall

pay the outstanding principal amount of the Note in twelve consecutive monthly payments of $306,666.66 each. At the option of the Company,

the monthly payment can be made in cash, shares of the common stock of the Company at a price based on 90% of the 5 lowest VWAPs during

the 20 days prior to the payment date, or a combination of cash and stock, the Repayment Share Price. The shares issued as monthly payments

must either be eligible for immediate resale under Rule 144 or be registered. Any portion of a monthly payment being made in cash

shall include a premium of 5% of such cash amount.

In connection with the issuance of the Note,

the Company granted the Lind a first priority security interest and lien upon all of its assets pursuant to the Security Agreement dated

as February 6, 2023, by and between the Company and Lind.

Following the date that is 60 days following

the date that the registration statement has been declared effective (as discussed in more detail below), the Company may repay all,

but not less than all, of the outstanding principal amount, provided that any such repayment shall include a premium of 5% of the outstanding

principal amount of the Note, and Lind shall have the right to convert up to one-third of the outstanding principal amount of the Note

at the conversion price (as described below).

The Purchase Agreement contains a restriction

whereby there cannot, under any circumstances, be more than 2,405,914 shares of common stock of the Company issued under the Note and

the Warrant combined without first receiving shareholder approval to issue more than 2,405,914 shares of common stock of the Company

thereunder.

The Company agreed to file the Registration Statement

with the Commission no later than 90 days from February 2, 2023, covering the resale of all of the shares of common stock of the

Company issuable to Lind pursuant to the Note and the Warrant. Pursuant to the Purchase Agreement, and in accordance with Nasdaq Listing

Rule 5635(a), the Company obtained shareholder approval to issue in excess of 2,405,914 shares under the Note and Warrant at the

Annual Meeting of the Shareholders that was held on April 26, 2023. In addition, pursuant to the terms of the Purchase Agreement,

Lind has the right to participate in all Subsequent Financings, equal to 10% of the Subsequent Financing on the same terms, conditions

and price provided for in the Subsequent Financing until February 6, 2024, subject to certain exceptions.

The Note is convertible into shares of common

stock of the Company by Lind at any time, provided that no such conversion may be made that would result in the beneficial ownership

by Lind and its affiliates of more than 4.99% of the Company’s outstanding shares of common stock. The conversion price of the

Note is equal to $3.50, subject to customary adjustments, however, if new securities, other than exempted securities, are issued by the

Company at a price less than the conversion price, the conversion price shall be reduced to such price.

If there is a change of control of the Company,

Lind has the right to require the Company to prepay the outstanding principal amount of the Note, plus a 5% premium. A change of control

includes a change in the composition of the Board of Directors of the Company, a shareholder having beneficial ownership of more than

40% or the sale or other disposition of the Company of all or substantially all of the assets.

The Note contains certain negative covenants,

including restricting the Company from certain distributions, loans, issuance or future priced securities and sale of assets.

Upon the occurrence of an event of default as

described in the Note, the Note will become immediately due and payable at a default interest rate of 110% of the then outstanding principal

amount of the Note. Events of default include, but are not limited to, a default in the payment of the Principal Amount or any accrued

and unpaid interest under the Note, failure to observe or perform any other covenant, condition or agreement contained in the Note or

any transaction documents, a change of control, a default in any indebtedness in excess of $250,000, the failure of the Company to instruct

its transfer agent to issue unlegended certificates, the shares no longer publicly being traded, if after August 7, 2023 the shares

are not available for immediate resale under Rule 144 and the Company’s market capitalization is below $10 million for 10

days. Upon an event of default, Lind can demand that all or a portion of the outstanding principal amount be converted into shares of

common stock at the lower of the conversion price and 80% of the average of the three lowest daily VWAPs.

The Warrant entitles Lind to purchase up to 800,000

shares of common stock of the Company until February 6, 2027 at an exercise price of $3.25 per share, subject to customary adjustments.

In addition, the exercise price is subject to adjustment in the event of the issuance of new securities, other than exempted securities,

at an effective price less than the exercise price, then the exercise price shall be reduced to an exercise price equal to the consideration

per share deemed to have been paid for such new securities, subject to compliance with the requirements of the trading market. The Warrant

also provides for cashless exercise.

The foregoing descriptions of the Purchase Agreement,

the Note, the Warrant and the Security Agreement are not complete and are qualified in their entirety by reference to the full text of

the forms of the Purchase Agreement, the Note, the Warrant and the Security Agreement.

LEGAL MATTERS

Dechert LLP will pass upon the validity of the

shares of common stock offered by this prospectus.

EXPERTS

Our balance sheets as of December 31, 2022

and 2021, the related statements of operations, and the statements of stockholders’ deficit and cash flows for the years ended

December 31, 2022 and December 31, 2021 have been audited by Marcum LLP, independent registered public accounting firm, as

stated in their report which is included herein. Such financial statements have been incorporated herein by reference to our Annual

Report on Form 10-K for the year ended December 31, 2022 in reliance upon the report of such firm, which includes an explanatory

paragraph relating to our ability to continue as a going concern, given upon their authority as experts in accounting and auditing.

DISCLOSURE OF COMMISSION

POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to directors, officers or persons controlling us, we have been informed that in the opinion

of the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

WHERE YOU CAN FIND MORE

INFORMATION

We have filed with the Commission a registration

statement on Form S-1 under the Securities Act with respect to the shares of common stock being offered by this prospectus. This

prospectus, which constitutes part of the registration statement, does not include all of the information contained in the registration

statement or the exhibits, schedules and amendments to the registration statement. For further information with respect to us and our

common stock, we refer you to the registration statement, the documents incorporated by reference into the registration statement and

to the exhibits and schedules to the registration statement. Statements contained in this prospectus or in documents incorporated by

reference into this prospectus as to the contents of any contract or any other document referred to are not necessarily complete. If

a contract or other document has been filed as an exhibit to the registration statement, please see the copy of the contract or other

document that has been filed. Each statement in this prospectus relating to a contract or other document filed as an exhibit is qualified

in all respects by the filed exhibit.

We file annual, quarterly and current reports,

proxy statements and other information with the Commission. Our Commission filings are available to the public over the Internet at the

Commission’s website at www.sec.gov and on our website at www.paxmedica.com/investors. Information contained on or accessible through