false0001609065PATHFINDER BANCORP, INC.00016090652024-03-042024-03-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 4, 2024

(Exact name of Registrant as specified in its charter)

Commission File Number: 001-36695

|

|

Maryland |

38-3941859 |

(State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

214 West First Street, Oswego, NY 13126

(Address of Principal Executive Office) (Zip Code)

(315) 343-0057

(Issuer's Telephone Number including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.01 par value |

PBHC |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

Attached as Exhibit 99.1 are supplemental materials regarding the recent branch acquisition announced by Pathfinder Bank (the “Bank”), the wholly owned banking subsidiary of Pathfinder Bancorp, Inc. (the “Company”), which certain members of the Company intend to use during discussions regarding the acquisition with investors, analysts, and other interested parties.

The information in this Item 7.01 and Exhibit 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth in such filing.

Item 9.01 Financial Statements and Exhibits

(a) Not Applicable.

(b) Not Applicable.

(c) Not Applicable.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

PATHFINDER BANCORP, INC. |

|

|

|

|

|

Date: |

March 4, 2024 |

|

By: |

/s/ James A. Dowd |

|

|

|

|

James A. Dowd President and Chief Executive Officer |

East Syracuse Branch Acquisition March 4, 2024 Copyright © 2024 Pathfinder Bancorp, Inc.

Copyright © 2024 Pathfinder Bancorp, Inc. 1 Cautionary Note regarding Forward-looking Statements This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements are not historical facts, but instead represent only the beliefs, expectations, or opinions of Pathfinder Bancorp, Inc. (the “Company”), its wholly owned banking subsidiary, Pathfinder Bank (the “Bank”) and the management team regarding future events, many of which, by their nature, are inherently uncertain and beyond the control of the Company and the Bank. Forward-looking statements may be identified by the use of such words as: “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “pro forma,” or words of similar meaning, or future or conditional terms, such as “will,” “would,” “should,” “could,” “may,” “likely,” “probably,” or “possibly.” These forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those set forth in or implied by the forward-looking statements as a result of numerous factors, and depend on the Company’s and the Bank’s ability to close the proposed branch acquisition in a timely manner and to realize the anticipated benefits of the transaction. In addition, the following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the expected growth opportunities or cost savings from the branch acquisition may not be fully realized or may take longer to realize than expected; (2) deposit attrition, operating costs, customer losses and business disruption following the branch acquisition, including adverse effects on relationships with employees and customers, may be greater than expected; (3) the regulatory approvals required for the branch acquisition may not be obtained on the proposed terms or on the anticipated schedule; (4) competitive pressures in the banking industry that may increase significantly; (5) changes in the interest rate environment that may reduce margins and/or the volumes and values of loans made or held as well as the value of other financial assets held; (6) changes in the credit worthiness of customers and the possible impairment of the collectability of loans; (7) general economic conditions, either nationally or regionally, that may be less favorable than expected, resulting in, among other things, a deterioration in credit quality and/or a reduced demand for credit or other services; (8) cybersecurity threats or attacks, the implementation of new technologies, and the ability to develop and maintain reliable electronic systems; (9) competitors may have greater financial resources and develop products that enable them to compete more successfully; (10) changes in business conditions; and (11) changes in the local economy with regard to the branch’s market area. For a discussion of such factors, please see the Company’s most recent reports on Forms 10-K and 10-Q filed with the Securities and Exchange Commission and available on the SEC's website at www.sec.gov. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update any forward-looking statement, whether as a result of new information, future developments or otherwise. Accordingly, you should not place undue reliance on any such forward-looking statements. About Pathfinder Bancorp, Inc. Pathfinder Bank is a New York State chartered commercial bank headquartered in Oswego, whose deposits are insured by the Federal Deposit Insurance Corporation. The Bank is a wholly owned subsidiary of Pathfinder Bancorp, Inc., (NASDAQ SmallCap Market; symbol: PBHC). The Bank has eleven full-service offices located in its market areas consisting of Oswego and Onondaga Counties and one limited purpose office in Oneida County. The Company's common stock trades on the NASDAQ market under the symbol "PBHC." At December 31, 2023, the Company and subsidiaries had total consolidated assets of $1.47 billion, total deposits of $1.12 billion and shareholders' equity of $120.3 million.

Copyright © 2024 Pathfinder Bancorp, Inc. Transaction Overview Pathfinder Bank has entered into an agreement to purchase the East Syracuse Branch from Berkshire Bank Seller: Berkshire Bank Branch Location: 6611 Manlius Center Road, East Syracuse, NY, 13057 Total Deposits: $198 Million1 Cost of Deposits: 1.84%1 # of Accounts: 11,000 +1 Total Loans: $32 Million1 Branch Portfolio Yield: 5.71%1 Branch Size (including administrative space):44,598 Square Feet 1 Data as of January 31, 2024 2

Copyright © 2024 Pathfinder Bancorp, Inc. Transaction Overview Pathfinder Bank has entered into an agreement to purchase the East Syracuse Branch from Berkshire Bank STRATEGIC RATIONALE Continue Pathfinder’s growth strategy to expand into attractive markets Significantly strengthens Pathfinder’s core deposit base Financially compelling Accretive to earnings profile Improves ROA & ROE Exceeds internal rate of return hurdle rates Attractive tangible book value earnback period Helps key strategic initiatives by expanding presence in the attractive Syracuse market, and helps to attract & retain both sales and administrative talent in support of further expansion in that market Liquidity provides flexibility to manage Pathfinder’s balance sheet in the future and pay down wholesale borrowings in the near term Note: Map data provided by S&P Capital IQ Pro 3

Copyright © 2024 Pathfinder Bancorp, Inc. Transaction Overview CORE DEPOSIT PREMIUM 5.8% premium for core deposits1 delivered at closing No premium paid for time deposits delivered at closing TRANSACTION CONSIDERATION ~$7.5 million cash consideration2 LOANS Assuming $32 million in consumer and residential mortgage loans delivered at closing (at 95% of par) PROPERTY Pathfinder to assume the lease of the East Syracuse branch from Berkshire EMPLOYEES Extend employment offer to all existing branch personnel in East Syracuse Branch FINANCIALLY COMPELLING3 Expected to generate a favorable internal rate of return and attractive earnings per share accretion TBV earnback period of less than 2.8 years Pro-forma capital ratios are projected to remain strong and supportive of continued balance sheet growth The addition of nearly $200 million in low-cost deposits will improve Pathfinder’s liquidity profile and balance sheet flexibility Helps improve funding base by reducing loan / deposit ratio below Pathfinder’s current level Excess liquidity received creates opportunity for Pathfinder to pay down higher rate wholesale borrowings DUE DILIGENCE Completed due diligence on loan & deposit portfolio, as well as the facility CLOSING Subject to regulatory approval and satisfaction of certain customary closing conditions Expected to close in the second half of 2024 1 Core deposits defined as total deposits less time deposits, Core deposits were $129 million as of January 31, 2024 2 Based on January 31, 2024 balances. Source: Company Documents 3 Estimated financial impacts of the transaction are presented for illustrative purposes only and are based on management’s assumptions regarding the transaction, including transaction expenses and accounting treatment. 4

Copyright © 2024 Pathfinder Bancorp, Inc. Opportunity for Growth – Syracuse SYRACUSE IS A GROWTH MARKET – MEDIAN HHI 2023 68,883 68,528 80,716 73,503 Onondaga County Syracuse MSA State of New York United States 2029 75,933 74,326 83,550 +10.23% +8.46% +8.26% 87,387 Onondaga County Syracuse MSA State of New York United States 5 Source: rockethomes.com

Copyright © 2024 Pathfinder Bancorp, Inc. Opportunity for Growth – Syracuse MICRON MEGA – COMPLEX In 2022, Micron announced its plans to build the largest semiconductor fabrication facility in the history of the United States. Micron intends to invest up to $100 billion over the next 20-plus years to construct a new megafab in Syracuse, New York The new megafab will increase domestic supply of leading-edge memory, create nearly 50,000 New York jobs and represent the largest private investment in New York state history Micron is a chip manufacturer, based in Boise, Idaho, and currently employs more than 44,000 people worldwide and recorded revenue of $16.2 billion in the last twelve months 6 Source: micron.com

Copyright © 2024 Pathfinder Bancorp, Inc. Opportunity for Growth – Syracuse 467,172 651,613 ATTRACTIVE MARKET DEMOGRAPHICS Population: 651,613 Median Home Sale Price: $171 Thousand Total Bank Deposits: $15.2 Billion Average Bank Branch Deposit: $102.6 Million 336,157,119 19,649,850 Onondaga County Syracuse MSA State of New York United States POPULATION (Actual) 600.2 273.2 417.0 95.1 Onondaga County Syracuse MSA State of New York United States POPULATION DENSITY 2024 (#/sq. mile) 12,194 15,185 1,987,773 15,085,639 Onondaga County Syracuse MSA State of New York United States TOTAL DEPOSITS IN MARKET ($MMs) Source: S&P Capital IQ Pro; census.gov 7

Copyright © 2024 Pathfinder Bancorp, Inc. Loan and Deposit Profiles LOANS 8 1 Data as of December 31, 2023 2 Data as of January 31, 2024 PATHFINDER BANK $897.2 MM EAST SYRACUSE BRANCH $32.3 MM PRO FORMA $929.5 MM - Residential Mtg CRE Home Equity Loans & LOC Commercial Construction Consumer Other 311,737 231,104 23,888 200,336 46,865 78,957 4,330 34.7% 25.8% 2.7% 22.3% 5.2% 8.8% 0.5% Total Loans 897,217 100.0% Portfolio Yield 5.55% Pathfinder Bank % of Total ($000s) (%) Residential Mtg CRE Home Equity Loans & LOC Commercial Construction Consumer Other 9,355 0 17,507 0 0 5,445 0 29.0% 0.0% 54.2% 0.0% 0.0% 16.9% 0.0% Total Loans 32,307 100.0% Portfolio Yield 5.71% East Syracuse Branch % of Total ($000s) (%) Residential Mtg CRE Home Equity Loans & LOC Commercial Construction Consumer Other 321,092 231,104 41,395 200,336 46,865 84,402 4,330 34.5% 24.9% 4.5% 21.6% 5.0% 9.1% 0.5% Total Loans 929,524 100.0% Portfolio Yield 5.56% Pro Forma % of Total ($000s) (%) 1 2

Copyright © 2024 Pathfinder Bancorp, Inc. Loan and Deposit Profiles DEPOSITS 9 1 Data as of December 31, 2023 2 Data as of January 31, 2024 PATHFINDER BANK $1,126.4 MM EAST SYRACUSE BRANCH $198.1 MM PRO FORMA $1,324.5 MM Pathfinder Bank % of Total ($000s) (%) Transaction Accounts (%) 308,123 27.4% MMDA & Savings 345,010 30.6% Retail Time Deposits 377,994 33.6% Jumbo Time Deposits 95,273 8.5% Total Deposits 1,126,400 100.0% Cost of Int-bearing Deposits 3.10% Cost of Deposits 2.78% East Syracuse Branch % of Total ($000s) (%) Transaction Accounts (%) 53,276 26.9% MMDA & Savings 75,915 38.3% Retail Time Deposits 49,452 25.0% Jumbo Time Deposits 19,448 9.8% Total Deposits 198,091 100.0% Cost of Int-bearing Deposits 2.30% Cost of Deposits 1.84% Pro Forma % of Total ($000s) (%) Transaction Accounts (%) 361,399 27.3% MMDA & Savings 420,925 31.8% Retail Time Deposits 427,446 32.3% Jumbo Time Deposits 114,721 8.7% Total Deposits 1,324,491 100.0% Cost of Int-bearing Deposits 2.98% Cost of Deposits 2.64% 1 2

Copyright © 2024 Pathfinder Bancorp, Inc.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

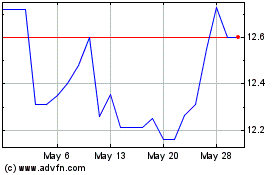

Pathfinder Bancorp (NASDAQ:PBHC)

Historical Stock Chart

From Apr 2024 to May 2024

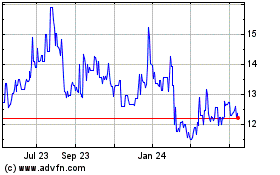

Pathfinder Bancorp (NASDAQ:PBHC)

Historical Stock Chart

From May 2023 to May 2024