0001849548

--12-31

false

0001849548

2023-07-21

2023-07-21

0001849548

ONYX:UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember

2023-07-21

2023-07-21

0001849548

ONYX:ClassOrdinarySharesIncludedAsPartOfUnitsMember

2023-07-21

2023-07-21

0001849548

ONYX:RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2023-07-21

2023-07-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of

Report (Date of earliest event reported): July 21, 2023

ONYX

ACQUISITION CO. I

(Exact name of registrant as

specified in its charter)

| Cayman Islands |

|

001-41003 |

|

98-1584432 |

(State or other jurisdiction of

incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

104 5th Avenue

New York, New York 10011

(Address of principal executive offices, including zip code)

(212) 974-2844

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-half of one redeemable warrant |

|

ONYXU |

|

New York Stock Exchange LLC |

| Class A Ordinary Shares included as part of the units |

|

ONYX |

|

The Nasdaq Stock

Market LLC |

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

ONYXW |

|

The Nasdaq Stock

Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On July 21, 2023, Onyx Acquisition Co. I (the

“Company”) held an extraordinary general meeting of shareholders (the “Meeting”) at

which the Company’s shareholders approved a proposal to amend the Company’s amended and restated memorandum and articles of

association (the “Articles”). The proposal would extend the date by which the Company has to consummate a business

combination from August 7, 2023 to February 7, 2024 (the “Extension Amendment Proposal”). The Extension Amendment

Proposal is described in more detail in the definitive proxy statement of the Company, which was filed with the U.S. Securities and Exchange

Commission (the “SEC”) on June 27, 2023 (the “Proxy Statement”), as supplemented

to date.

The foregoing description is qualified in its

entirety by reference to the amendment to the Company’s Articles, a copy of which is attached as Exhibit 3.1 hereto and is incorporated

by reference herein.

Item

5.07. Submission of Matters to a Vote of Security Holders.

At the Meeting, holders of 9,286,529 Class A ordinary

shares were present in person, virtually over the Internet or by proxy, representing approximately 86% of the voting power of the Company’s

ordinary shares as of June 16, 2023, the record date for the Meeting, and constituting a quorum for the transaction of business. A summary

of the voting results at the Meeting is set forth below:

The shareholders approved the Extension Amendment

Proposal.

The voting results were as follows:

The Extension Amendment Proposal

| For |

|

Against |

|

Abstain |

| 9,286,520 |

|

3 |

|

6 |

As there were sufficient votes to approve the

above proposal, the “Adjournment Proposal” described in the Proxy Statement was not presented to shareholders.

Item 8.01. Other Events.

Redemptions

In connection with the vote to approve the Extension

Amendment Proposal, holders of 2,198,202 Class A ordinary shares exercised their right to redeem their shares for cash at a redemption

price of approximately $10.85 per share, for an aggregate redemption amount of approximately $23.9 million. As a result, approximately

$23,850,492 will be removed from the Trust Account to pay such holders and 2,011,826 Class A ordinary shares and 6,612,500 converted founder shares remain outstanding for a total of 8,624,326 shares outstanding.

Forward-Looking Statements

This Current Report on Form 8-K includes “forward-looking

statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995.

Certain of these forward-looking statements can be identified by the use of words such as “believes,” “expects,”

“intends,” “plans,” “estimates,” “assumes,” “may,” “should,” “will,”

“seeks,” or other similar expressions. Such statements may include, but are not limited to, statements regarding the proposed

Contribution and the conversion of the outstanding founder shares into Class A ordinary shares. These statements are based on current

expectations on the date of this Current Report on Form 8-K and involve a number of risks and uncertainties that may cause actual results

to differ significantly. The Company does not assume any obligation to update or revise any such forward-looking statements, whether as

the result of new developments or otherwise. Readers are cautioned not to put undue reliance on forward-looking statements.

Item

9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are filed with this Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Date: July 21, 2023 |

ONYX ACQUISITION CO. I |

| |

|

| |

By: |

/s/ Michael Stern |

| |

Name: |

Michael Stern |

| |

Title: |

Director, Chairman and Chief Executive Officer |

Exhibit 3.1

Onyx Acquisition Co. I

(the “Company” or “Onyx”)

EXTRACT OF MINUTES OF AN EXTRAORDINARY GENERAL

MEETING OF THE COMPANY HELD VIRTUALLY AND AT THE OFFICES OF KIRKLAND & ELLIS LLP LOCATED AT 609 MAIN STREET, HOUSTON, TEXAS 77002,

UNITED STATES OF AMERICA ON 21 JULY 2023 AT 4:00 PM (EASTERN TIME)

The Chairman noted that the purpose of calling

the Meeting was for the Shareholders to consider and, if thought fit, approve proposals contained in the Notice and which are set out

below.

| 1. | Proposal No. 1 – The Extension Amendment Proposal |

RESOLVED, as a special resolution THAT,

effective immediately, the Memorandum and Articles be amended by:

(a) amending

Article 168(a) by deleting the following introduction of such sub- section:

“In the event that either the Company

does not consummate a Business Combination by August 7, 2023, or such later time as the Members of the Company may approve in accordance

with the Articles or a resolution of the Company’s Members is passed pursuant to the Companies Act to commence the voluntary liquidation

of the Company prior to the consummation of a Business Combination for any reason, the Company shall:”;

and replacing it with the following:

“In the event that either the Company

does not consummate a Business Combination by February 7, 2024, or such later time as the Members of the Company may approve in accordance

with the Articles or a resolution of the Company’s Members is passed pursuant to the Companies Act to commence the voluntary liquidation

of the Company prior to the consummation of a Business Combination for any reason, the Company shall:”; and

(b) amending Article 168(b) by

deleting the words:

“by August 7, 2023”

and replacing them with the words:

“by February 7, 2024”.

| 2.1 | The resolutions referenced above were then put to the meeting. |

| 2.2 | The Chairman declared that the resolutions referenced above were approved. |

Signed as an accurate record of the

proceedings of the Meeting.

| /s/ Benjamin Lerner |

|

| Benjamin Lerner, Secretary of the Meeting |

|

Date: 21 July 2023

v3.23.2

Cover

|

Jul. 21, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 21, 2023

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-41003

|

| Entity Registrant Name |

ONYX

ACQUISITION CO. I

|

| Entity Central Index Key |

0001849548

|

| Entity Tax Identification Number |

98-1584432

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

104 5th Avenue

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10011

|

| City Area Code |

212

|

| Local Phone Number |

974-2844

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A Ordinary Share, $0.0001 par value, and one-half of one redeemable warrant

|

| Trading Symbol |

ONYXU

|

| Security Exchange Name |

NYSE

|

| Class A Ordinary Shares included as part of the units |

|

| Title of 12(b) Security |

Class A Ordinary Shares included as part of the units

|

| Trading Symbol |

ONYX

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants included as part of the units, each whole warrant exercisable for one Class A Ordinary Share at an exercise price of $11.50

|

| Trading Symbol |

ONYXW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ONYX_UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ONYX_ClassOrdinarySharesIncludedAsPartOfUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ONYX_RedeemableWarrantsIncludedAsPartOfUnitsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

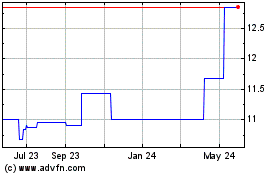

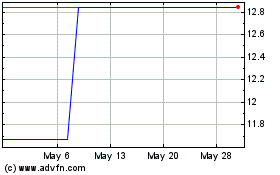

Onyx Acquisition Company I (NASDAQ:ONYXU)

Historical Stock Chart

From Apr 2024 to May 2024

Onyx Acquisition Company I (NASDAQ:ONYXU)

Historical Stock Chart

From May 2023 to May 2024