UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION

REQUIRED IN PROXY STATEMENT

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material under §240.14a-12 |

Oncocyte

Corporation

(Name

of Registrant as Specified in Its Charter)

N/A

(Name

of Person(s) Filing Proxy Statement if other than the Registrant)

| Payment

of Filing Fee (Check all boxes that apply): |

| |

|

| ☒ |

No

fee required |

| ☐ |

Fee

paid previously with preliminary materials |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a–6(i)(1) and 0–11 |

July

[10], 2023

Dear

Shareholder:

You

are cordially invited to attend a Special Meeting of Shareholders (the “Meeting”) of Oncocyte Corporation which will be held

virtually on Friday, July 21, 2023, at 10:00 a.m. Pacific Time online through https://web.lumiagm.com/259974801.

The

Notice and Proxy Statement on the following pages contain details concerning the business to come before the Meeting and instructions

on how to gain admission to the Meeting online. Please sign and return your proxy card in the enclosed envelope to ensure that your shares

will be represented and voted at the virtual Meeting even if you cannot attend. You are urged to sign and return the enclosed proxy card

even if you plan to attend the virtual Meeting.

Peter Hong

Secretary

NOTICE

OF SPECIAL MEETING OF SHAREHOLDERS

To

Be Held July 21, 2023

NOTICE

IS HEREBY GIVEN that a Special Meeting of Shareholders of Oncocyte Corporation (the “Meeting”) will be held virtually online

through https://web.lumiagm.com/259974801 for the following purposes:

1.

To approve granting our Board of Directors the authority to exercise its discretion to amend our Articles of Incorporation to effect

a reverse stock split of our outstanding shares of Common Stock, to regain compliance with the Nasdaq Stock Market’s minimum bid

price requirement, at any of the following exchange ratios at any time within one year after shareholder approval is obtained, and once

approved by the shareholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in

the sole discretion of our Board of Directors:

(a)

a one-for-ten reverse stock split;

(b)

a one-for-fifteen reverse stock split;

(c)

a one-for-twenty reverse stock split; or

(d)

a one-for-twenty-five reverse stock split;

2.

To approve granting our Board of Directors the authority to exercise its discretion at any time within one year after shareholder approval

is obtained to amend our Articles of Incorporation to reduce the number of authorized shares of our common stock, no par value (“Common

Stock”), by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved and

implemented;

3.

To approve an amendment to our 2018 Equity Incentive Plan (as amended, the “Incentive Plan”) to eliminate the limitation

on the number of shares of our Common Stock that can be granted to any individual participant under the Incentive Plan during any one

(1)-year period; and

4.

To transact such other business as may properly come before the Meeting or any adjournments of the Meeting.

The

Board of Directors has fixed the close of business on June 28, 2023, as the record date for determining shareholders entitled to receive

notice of and to vote at the Meeting or any postponement or adjournment of the meeting.

We

have made arrangements for our shareholders to attend and participate at the Meeting through an online electronic video screen communication

at https://web.lumiagm.com/259974801. If you wish to attend the Meeting online you will need to gain admission in the manner described

in the Proxy Statement. Although the Meeting will not be held in person, shareholders will, to the extent possible, be afforded the same

rights and opportunities to participate at the virtual meeting similarly to how they would participate at an in-person meeting.

Whether

or not you expect to attend the Meeting online, you are urged to sign and date the enclosed form of proxy and return it promptly so that

your shares may be represented and voted at the Meeting. If you should be present at the virtual Meeting, your proxy will be returned

to you if you so request.

WHETHER

OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE SUBMIT YOUR PROXY PROMPTLY BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD.

Important

Notice Regarding the Availability of Proxy Materials

for

the Special Meeting of Shareholders to be held on July 21, 2023.

The

Letter to Shareholders, Notice of Special Meeting of Shareholders and Proxy Statement

are

available at: https://www.astproxyportal.com/ast/20487

By

Order of the Board of Directors,

Peter

Hong

Secretary

Irvine,

California

July

[10], 2023

SPECIAL

MEETING OF SHAREHOLDERS

To

Be Held on Friday, July 21, 2023

QUESTIONS

AND ANSWERS ABOUT THE PROXY MATERIALS

AND

THE SPECIAL MEETING

Q:

Why have I received this Proxy Statement?

We

are holding a Special Meeting of Shareholders (the “Meeting”) for the purposes stated in the accompanying Notice of Special

Meeting, which include approving of granting our Board of Directors the authority to exercise its discretion at any time within one year

after shareholder approval is obtained to amend our Articles of Incorporation to (1) effect a reverse stock split of our outstanding

shares of Common Stock to regain compliance with the Nasdaq Stock Market’s minimum bid price requirement; and (2) reduce the number

of authorized shares of our Common Stock by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split

proposal is approved and implemented. This Proxy Statement contains information about those matters, relevant information about the Meeting,

and other information that we are required to include in a proxy statement under the Securities and Exchange Commission’s (“SEC”)

regulations.

Q:

Who is soliciting my proxy?

The

accompanying proxy is solicited by the Board of Directors of Oncocyte Corporation (the “Company”), a California corporation,

for use at the Special Meeting of Shareholders to be held virtually via an online electronic video screen communication.

Q:

Who is entitled to vote at the Meeting?

Only

shareholders of record at the close of business on June 28, 2023, which has been designated as the “record date,” are entitled

to notice of and to vote at the Meeting. On that date, there were 164,821,077 shares of our Common Stock issued and outstanding, which

constitutes the only class of Oncocyte voting securities outstanding.

Q:

What percentage of the vote is required to approve the matters that are being presented for a vote by shareholders?

The

affirmative vote of a majority of the shares of Common Stock represented at the Meeting, provided that a quorum is present, is required

to approve each proposal described in this Proxy Statement.

A

quorum consists of a majority of the outstanding shares of Common Stock entitled to vote. Both abstentions and broker non-votes described

in the questions below are counted for the purpose of determining the presence of a quorum. Notwithstanding the foregoing, if a quorum

is not present the Meeting may be adjourned by a vote of a majority of the shares present or represented by proxy.

Q:

How many votes do my shares represent?

Each

share of Oncocyte Common Stock is entitled to one vote in all matters that may be acted upon at the Meeting.

Q:

What are my choices when voting?

For

each proposal described in this Proxy Statement, you may vote for the proposal, vote against the proposal, or abstain from voting on

the proposal. Properly executed proxies in the accompanying form that are received at or before the Meeting will be voted in accordance

with the directions noted on the proxies.

Q:

What if I abstain from voting on a matter?

If

you check the “abstain” box in the proxy form, or if you attend the Meeting without submitting a proxy and you abstain from

voting on a matter, or if your shares are subject to a “broker non-vote” on a matter, it will have the same effect as a vote

against the proposal. Please see “What if I do not specify how I want my shares voted?” below for additional information

about broker non-votes.

Q:

How can I vote at the Meeting?

If

you are a shareholder of record and you attend the Meeting online, you may vote your shares at the Meeting in the manner provided for

internet voting. However, if you are a “street name” holder, you may vote your shares online only if you obtain a signed

proxy from your broker or nominee giving you the right to vote your shares. Please refer to additional information in the “HOW

TO ATTEND THE SPECIAL MEETING” portion of this Proxy Statement.

Even

if you currently plan to attend the Meeting online, we recommend that you also submit your proxy first so that your vote will be counted

if you later decide not to attend the Meeting.

Q:

Can I still attend and vote at the Meeting if I submit a proxy?

You

may attend the Meeting through online participation whether or not you have previously submitted a proxy. If you previously gave a proxy,

your attendance at the Meeting online will not revoke your proxy unless you also vote through internet voting during your online participation

at the Meeting.

Q:

Can I change my vote after I submit my proxy form?

You

may revoke your proxy at any time before it is voted. If you are a shareholder of record and you wish to revoke your proxy you must do

one of the following things:

| |

● |

deliver

to the Secretary of Oncocyte a written revocation; or |

| |

|

|

| |

● |

deliver

to the Secretary of Oncocyte a signed proxy bearing a date subsequent to the date of the proxy being revoked; or |

| |

|

|

| |

● |

attend

the Meeting and vote through internet voting during online participation. |

If

you are a “beneficial owner” of shares “held in street name” you should follow the directions provided by your

broker or other nominee regarding how to revoke your proxy.

Q:

What are the Board of Directors’ recommendations?

The

Board of Directors recommends that our shareholders vote FOR (1) granting the Board of Directors the authority to exercise its

discretion at any time within one year after shareholder approval is obtained to amend our Articles of Incorporation to effect a reverse

stock split of our outstanding shares of Common Stock, to regain compliance with the Nasdaq Stock Market’s minimum bid price requirement,

at any of the stated exchange ratios, and once approved by the shareholders, the timing of the amendment and the specific reverse split

ratio to be effected shall be determined in the sole discretion of the Board of Directors; and (2) granting the Board of Directors the

authority to exercise its discretion at any time within one year after shareholder approval is obtained to amend our Articles of Incorporation

to reduce the number of authorized shares of our Common Stock by a corresponding ratio to the reverse stock split if, and only if, the

reverse stock split proposal is approved and implemented.

Q:

What if I do not specify how I want my shares voted?

Shareholders

of Record. If you are a shareholder of record and you sign and return a proxy form that does not specify how you want your shares

voted on a matter, your shares will be voted FOR (1) granting the Board of Directors the authority to exercise its discretion

at any time within one year after shareholder approval is obtained to amend our Articles of Incorporation to effect a reverse stock split

of our outstanding shares of Common Stock, to regain compliance with the Nasdaq Stock Market’s minimum bid price requirement, at

any of the stated exchange ratios, and once approved by the shareholders, the timing of the amendment and the specific reverse split

ratio to be effected shall be determined in the sole discretion of the Board of Directors; and (2) granting the Board of Directors the

authority to exercise its discretion at any time within one year after shareholder approval is obtained to amend our Articles of Incorporation

to reduce the number of authorized shares of our Common Stock by a corresponding ratio to the reverse stock split if, and only if, the

reverse stock split proposal is approved and implemented.

Beneficial

Owners. If you are a beneficial owner and you do not provide your broker or other nominee with voting instructions, the broker or

other nominee will determine if it has the discretionary authority to vote on the particular matter. Under the rules of the various national

and regional securities exchanges, brokers and other nominees holding your shares cannot vote on any of the proposals described in this

Proxy Statement. If you hold your shares in street name and you do not instruct your broker or other nominee how to vote on those matters

as to which brokers and nominees are not permitted to vote without your instructions, no votes will be cast on your behalf on those matters.

This is generally referred to as a “broker non-vote.”

Q:

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

Shareholder

of Record. You are a shareholder of record if at the close of business on the record date your shares were registered directly in

your name with American Stock Transfer & Trust Company, LLC, our transfer agent.

Beneficial

Owner. You are a beneficial owner if at the close of business on the record date your shares were held in the name of a brokerage

firm or other nominee and not in your name. Being a beneficial owner means that, like most of our shareholders, your shares are held

in “street name.” As the beneficial owner, you have the right to direct your broker or nominee how to vote your shares by

following the voting instructions your broker or other nominee provides. If you do not provide your broker or nominee with instructions

on how to vote your shares, your broker or nominee will be able to vote your shares with respect to some of the proposals, but not all.

Please see “What if I do not specify how I want my shares voted?” above for additional information.

Q:

What if any matters not mentioned in the Notice of Special Meeting or this Proxy Statement come up for vote at the Meeting?

The

Board of Directors does not intend to present any business for a vote at the Meeting other than the matters set forth in the accompanying

Notice of Special Meeting of Shareholders. As of the date of this Proxy Statement, no shareholder has notified us of any other business

that may properly come before the Meeting. If other matters requiring the vote of the shareholders properly come before the Meeting,

then it is the intention of the persons named in the accompanying form of proxy to vote the proxy held by them in accordance with their

judgment on such matters.

The

enclosed proxy confers discretionary authority to vote with respect to any and all of the following matters that may come before the

Meeting: (1) matters that the Board of Directors did not know, a reasonable time before the mailing of the notice of the Meeting, would

be presented at the Meeting; and (2) matters incidental to the conduct of the Meeting.

Q:

Who will bear the cost of soliciting proxies for use at the Meeting?

Oncocyte

will bear all of the costs of the solicitation of proxies for use at the Meeting. In addition to the use of the mails, proxies may be

solicited by a personal interview, telephone, facsimile, via the internet, an overnight delivery service and telegram by a proxy solicitor,

our directors, officers, and employees, who will undertake such activities without additional compensation. Banks, brokerage houses,

and other institutions, nominees, or fiduciaries will be requested to forward the proxy materials to the beneficial owners of the Common

Stock held of record by such persons and entities and will be reimbursed for their reasonable expense incurred in connection with forwarding

such material.

Q:

How can I attend and vote at the Meeting?

If

you plan on attending the Meeting online, please read the “HOW TO ATTEND THE SPECIAL MEETING”

section at the end of this Proxy Statement for information about how to attend and participate in the Meeting online.

This

Proxy Statement and the accompanying form of proxy are first being sent or given to our shareholders on or about July [10], 2023.

ELIMINATING

DUPLICATE MAILINGS

Oncocyte

has adopted a procedure called “householding.” Under this procedure, we may deliver a single copy of this Proxy Statement

to multiple shareholders who share the same address, unless we receive contrary instructions from one or more of the shareholders. This

year, a number of brokers with account holders who are our shareholders will be “householding” our proxy materials. This

procedure reduces the environmental impact of our shareholder meetings and reduces our printing and mailing costs. Shareholders participating

in householding will continue to receive separate proxy cards.

We

will deliver separate copies of Proxy Statement to each shareholder sharing a common address if they notify us that they wish to receive

separate copies. If you wish to receive a separate copy of Proxy Statement, you may contact us by telephone at (949) 409-7600, or by

mail at 15 Cushing, Irvine, California 92618. You may also contact us at the above phone number or address if you are presently receiving

multiple copies of Proxy Statement but would prefer to receive a single copy instead.

PROPOSAL

1: TO APPROVE GRANTING OUR BOARD OF DIRECTORS THE AUTHORITY TO EXERCISE ITS DISCRETION TO AMEND OUR ARTICLES OF INCORPORATION TO EFFECT

A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK, TO REGAIN COMPLIANCE WITH THE NASDAQ STOCK MARKET’S MINIMUM BID

PRICE REQUIREMENT, AT ANY OF THE FOLLOWING EXCHANGE RATIOS AT ANY TIME WITHIN ONE YEAR AFTER SHAREHOLDER APPROVAL IS OBTAINED, AND ONCE

APPROVED BY THE SHAREHOLDERS, THE TIMING OF THE AMENDMENT AND THE SPECIFIC REVERSE SPLIT RATIO TO BE EFFECTED SHALL BE DETERMINED IN

THE SOLE DISCRETION OF OUR BOARD OF DIRECTORS: (A) A ONE-FOR-TEN REVERSE STOCK SPLIT; (B) A ONE-FOR-FIFTEEN REVERSE STOCK SPLIT; (C)

A ONE-FOR-TWENTY REVERSE STOCK SPLIT; OR (D) A ONE-FOR-TWENTY-FIVE REVERSE STOCK SPLIT.

Our

Board of Directors believes it is advisable and in the best interests of the Company and our shareholders to approve granting our Board

of Directors the authority to exercise its discretion to amend our Articles of Incorporation to effect a reverse stock split of our outstanding

shares of Common Stock, to regain compliance with the Nasdaq Stock Market’s minimum bid price requirement, at any of the following

exchange ratios at any time within one year after shareholder approval is obtained, and once approved by the shareholders, the timing

of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion of our Board of Directors:

(A) a one-for-ten reverse stock split; (B) a one-for-fifteen reverse stock split; (C) a one-for-twenty

reverse stock split; or (D) a one-for-twenty-five reverse stock split.

On

June 30, 2023, our Board of Directors approved of the proposed amendment of our Articles of Incorporation,

subject to shareholder approval, that would effect a reverse stock split in which each ten, fifteen, twenty or twenty-five issued and

outstanding shares of our Common Stock would be combined and converted into one share. Although shareholders are being asked to vote

on each of the proposed reverse stock split exchange ratios, only one such proposal will be effected. Upon shareholder approval, our

Board will have the sole discretion to elect, as it determines to be in the best interests of the Company and our shareholders, whether

or not to effect a reverse stock split, and if so, the specific number of shares of our Common Stock between and including ten and twenty-five,

which will be combined into one share, at any time before the first anniversary of this Meeting. The Board of Directors believes that

shareholder approval of an amendment at each of the proposed reverse stock split ratios granting it the discretion to approve the specific

ratio to be effected, rather than approval of only one exchange ratio at this time, provides the Board of Directors with maximum flexibility

to react to then-current market conditions and, therefore, is in the best interests the Company and our shareholders.

The

full text of the form of proposed amendment of the Articles of Incorporation is attached to this Proxy Statement as Annex A. By

approving this Proposal, shareholders will be approving granting our Board of Directors the authority to exercise its discretion to amend

our Articles of Incorporation pursuant to which any whole number of outstanding shares of our Common Stock between and including ten

and twenty-five would be combined into one share, and authorizing the Board of Directors to file only one such amendment, as determined

by the Board of Directors in the manner described herein. The Board of Directors at its discretion may also elect not to implement any

reverse stock split.

If

approved by shareholders and following such approval our Board of Directors determines that effecting a reverse stock split is in the

best interests of the Company and our shareholders, the reverse stock split will become effective upon filing one such amendment with

the Secretary of State of the State of California. The amendment filed thereby will contain the number of shares of our Common Stock

approved by the shareholders and selected by the Board of Directors within the limits set forth in this Proposal to be combined into

one share. Only one such amendment will be filed, if at all, and the other amendments will be abandoned.

Although

we presently intend to effect the reverse stock split to regain compliance with the Nasdaq Stock Market’s minimum bid price requirement,

notwithstanding shareholder approval of the proposed amendment of the Articles of Incorporation at the Meeting, our Board of Directors

may decide it is in the best interests of the Company and its shareholders to withhold approval of any amendments to the Articles of

Incorporation without further action by the shareholders before the amendment of the Articles of Incorporation is filed with the Secretary

of State of the State of California. The Board of Directors may consider a variety of factors in determining whether or not to proceed

with the proposed amendment of the Articles of Incorporation, including overall trends in the stock market, recent changes and anticipated

trends in the per share market price of our Common Stock on the Nasdaq Stock Market, business developments, and our actual and projected

financial performance. If the Board of Directors fails to implement a reverse stock split prior to the one-year anniversary of the Meeting,

shareholder approval again would be required prior to implementing any reverse stock split.

Background

and Reasons for the Reverse Stock Split

Our

primary objective in effectuating the reverse stock split would be to attempt to raise the per share trading price of our Common Stock

in an effort to continue our listing on the Nasdaq Stock Market. To maintain listing, the Nasdaq Stock Market requires, among other things,

that our Common Stock maintain a minimum bid price of $1.00 per share.

Our

Board of Directors is seeking approval for the authority to effectuate the reverse stock split as a means of increasing the share price

of our Common Stock at or above $1.00 per share in order to avoid delisting by the Nasdaq Stock Market. We expect that the reverse stock

split will increase the price per share of our Common Stock above the $1.00 per share minimum bid price, thereby satisfying this listing

requirement. However, there can be no assurance that the reverse stock split will have that effect, initially or in the future, or that

it will enable us to maintain the listing of our Common Stock on the Nasdaq Stock Market.

In

addition, we believe that the low per share market price of our Common Stock impairs its marketability to and acceptance by institutional

investors and other members of the investing public and creates a negative impression of the Company. Theoretically, decreasing the number

of shares of Common Stock outstanding should not, by itself, affect the marketability of the shares, the type of investor who would be

interested in acquiring them, or our reputation in the financial community. In practice, however, many investors, brokerage firms and

market makers consider low-priced stocks as unduly speculative in nature and, as a matter of policy, avoid investment and trading in

such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower

priced stocks. The presence of these factors may be adversely affecting, and may continue to adversely affect, not only the pricing of

our Common Stock but also its trading liquidity. In addition, these factors may affect our ability to raise additional capital through

the sale of stock.

We

further believe that a higher stock price could help us attract and retain employees and other service providers. We believe that some

potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of the

company’s market capitalization. If the reverse stock split successfully increases the per share price of our Common Stock, we

believe this increase will enhance our ability to attract and retain employees and service providers.

We

hope that the decrease in the number of shares of our outstanding Common Stock as a consequence of the reverse stock split, and the anticipated

increase in the price per share, will encourage greater interest in our Common Stock by the financial community and the investing public,

help us attract and retain employees and other service providers, help us raise additional capital through the sale of stock in the future

if needed, and possibly promote greater liquidity for our shareholders with respect to those shares presently held by them. However,

the possibility also exists that liquidity may be adversely affected by the reduced number of shares which would be outstanding if the

reverse stock split is effected, particularly if the price per share of our Common Stock begins a declining trend after the reverse stock

split is effected.

There

can be no assurance that the reverse stock split will achieve any of the desired results. There also can be no assurance that the price

per share of our Common Stock immediately after the reverse stock split will increase proportionately with the reverse stock split, or

that any increase will be sustained for any period of time.

If

shareholders do not approve this Proposal and our stock price does not otherwise increase to greater than $1.00 per share for at least

10 consecutive trading days before our period to regain compliance lapses, we expect our Common Stock to be subject to a delisting action

by Nasdaq. We believe the reverse stock split is the most likely way to assist the stock price in reaching the minimum bid price level

required by Nasdaq, although effecting the reverse stock split cannot guarantee that we will be in compliance with the minimum bid price

requirement even for the minimum 10-day trading period required by Nasdaq. Furthermore, the reverse stock split cannot guarantee we will

maintain compliance with other continued listing criteria required by Nasdaq.

If

our Common Stock were delisted from the Nasdaq Stock Market, trading of our Common Stock would thereafter be conducted on the OTC Bulletin

Board or the “pink sheets”. As a result, an investor may find it more difficult to dispose of, or to obtain accurate quotations

as to the price of, our Common Stock. To relist shares of our Common Stock on the Nasdaq Stock Market, we would be required to meet the

initial listing requirements, which are more stringent than the maintenance requirements.

In

addition, if our Common Stock were delisted from the Nasdaq Stock Market and the price of our Common Stock were below $5.00 at such time,

such stock would come within the definition of “penny stock” as defined in the Securities Exchange Act of 1934, as amended

and would be covered by Rule 15g-9 of the Securities Exchange Act of 1934. That rule imposes additional sales practice requirements on

broker-dealers who sell such securities to persons other than established customers and accredited investors (generally institutions

with assets in excess of $5 million or individuals with net worth in excess of $1 million or annual income exceeding $200,000 or $300,000

jointly with their spouse). For transactions covered by Rule 15g-9, the broker-dealer must make a special suitability determination for

the purchaser and receive the purchaser’s written agreement to the transaction prior to the sale. These additional sales practice

restrictions will make trading in our Common Stock more difficult and the market less efficient.

We

are not aware of any present efforts by anyone to accumulate our Common Stock, and the proposed reverse stock split is not intended to

be an anti-takeover device.

The

Reverse Stock Split May Not Result in an Increase in the Per Share Price of Our Common Stock; There Are Other Risks Associated with the

Reverse Stock Split

We

cannot predict whether the reverse stock split will increase the market price for our Common Stock. The history of similar stock split

combinations for companies in like circumstances is varied. There is no assurance that:

| |

● |

the

market price per share will either exceed or remain in excess of the $1.00 minimum bid price as required by the Nasdaq Stock Market; |

| |

● |

we

will otherwise continue to meet the requirements of the Nasdaq Stock Market for continued listing; |

| |

● |

the

market price per share after the reverse stock split will rise in proportion to the reduction in the number of shares outstanding

before the reverse stock split; |

| |

● |

the

reverse stock split will result in a per share price that will attract brokers and investors who do not trade in lower priced stocks;

or |

| |

● |

the

reverse stock split will result in a per share price that will increase our ability to attract and retain employees and other service

providers. |

If

the reverse stock split is effected and the market price of our Common Stock declines, the percentage decline as an absolute number and

as a percentage of our overall market capitalization may be greater than would occur in the absence of a reverse stock split. In some

cases, the total market value of a company following a reverse stock split is lower, and may be substantially lower, than the total market

value before the reverse stock split. In addition, the fewer number of shares that will be available to trade could possibly cause the

trading market of our Common Stock to become less liquid, which could have an adverse effect on the price of our Common Stock. The market

price of our Common Stock is based on our performance and other factors, including trading dynamics and substantial volatility, which

are likely unrelated to the number of our shares outstanding. In addition, there can be no assurance that the reverse stock split will

result in a per share price that will attract brokers and investors who do not trade in lower priced stock.

Principal

Effects of Reverse Stock Split on Market for Common Stock

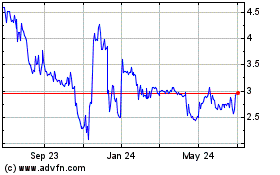

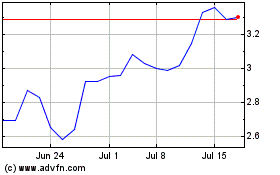

On

June 28, 2023, the closing bid price for our Common Stock on the Nasdaq Stock Market was $0.211per share. By decreasing the number of

shares of Common Stock outstanding without altering the aggregate economic interest represented by the shares, we believe the market

price will be increased. The greater the market price rises above $1.00 per share, the less risk there will be that we will fail to meet

the requirements for maintaining the listing of our Common Stock on the Nasdaq Stock Market. However, there can be no assurance that

the market price of the Common Stock will rise to or maintain any particular level or that we will at all times be able to meet the requirements

for maintaining the listing of our Common Stock on the Nasdaq Stock Market.

Principal

Effects of Reverse Stock Split on Common Stock; No Fractional Shares

If

shareholders approve granting the Board of Directors the authority to exercise its discretion to amend our Articles of Incorporation

to effect a reverse stock split, and if the Board of Directors decides to effectuate such amendment and reverse stock split, the principal

effect of the reverse stock split will be to reduce the number of issued and outstanding shares of our Common Stock, in accordance with

an exchange ratio approved by the shareholders and determined by the Board of Directors as set forth in this Proposal, from approximately

164,821,077 shares of Common Stock to between and including approximately 16,482,108 and 6,592,843 shares, depending on which reverse

stock ratio is effectuated by the Board of Directors and based upon the number of shares outstanding at the time such reverse stock split

is effectuated. The reverse stock split will not affect the Series A Convertible Preferred Stock. The total number of shares of Common

Stock each shareholder holds will be reclassified automatically into the number of shares of Common Stock equal to the number of shares

of Common Stock each shareholder held immediately before the reverse stock split divided by the exchange ratio approved by the shareholders

and determined by the Board of Directors as set forth in this Proposal.

If

the number of shares of Common Stock a shareholder holds is not evenly divisible by such exchange ratio, that shareholder will not receive

a fractional share but instead will receive, upon surrender of stock certificates representing such shares of Common Stock, cash in an

amount equal to the fraction of a share that shareholder otherwise would have been entitled to receive multiplied by the last sale price

(as adjusted to reflect the reverse stock split) of the Common Stock as last reported on the Nasdaq Stock Market on the trading day before

the reverse stock split takes effect. The ownership of a fractional interest will not give the holder thereof any voting, dividend or

other rights except to receive payment therefor as described herein. Shareholders should be aware that, under the escheat laws of the

various jurisdictions where shareholders reside, where we are domiciled and where the funds will be deposited, sums due for fractional

interests that are not timely claimed after the effective time may be required to be paid to the designated agent for each such jurisdiction.

Thereafter, shareholders otherwise entitled to receive such funds may have to seek to obtain them directly from the state to which they

were paid.

The

reverse stock split will affect all of our shareholders uniformly and will not affect any shareholder’s percentage ownership interests,

except to the extent that the reverse stock split results in any shareholders owning a fractional share. As described above, shareholders

holding fractional shares will be entitled to cash payments in lieu of such fractional shares. Such cash payments will reduce the number

of post-split shareholders to the extent there are shareholders presently holding fewer shares than between and including ten

and twenty-five shares, depending on the exchange ratio selected by the Board of Directors. This, however, is not the purpose

for which we are proposing to effect the reverse stock split and we are not aware that cashing out fractional shares would result in

the cancellation of more than ten percent of the outstanding shares of Common Stock. Common stock issued pursuant to the reverse stock

split will remain fully paid and non-assessable. We will continue to be subject to the periodic reporting requirements of the Securities

Exchange Act of 1934.

Principal

Effects of Reverse Stock Split on Outstanding Options and Warrants

As

of the record date, we had outstanding (i) stock options to purchase an aggregate of 9,127,843 shares of Common Stock with a weighted

average exercise price of $2.03 per share under our Incentive Plan and our 2010 Stock Option Plan, (ii) share-based payment awards under

our Incentive Plan, and (iii) outstanding warrants to purchase 16,395,343 shares of Common Stock exercisable at prices ranging from $1.53

to $5.46 per share. When the reverse stock split becomes effective, the number of shares of Common Stock covered by each of the foregoing

securities will be reduced to between and including one-tenth and one-twenty-fifth the number

currently covered and the exercise price per share will be increased by between and including ten

and twenty-five times the current exercise price, resulting in the same aggregate price being required to be paid upon exercise

of such securities as was required immediately preceding the reverse stock split.

Principal

Effects of Reverse Stock Split on Equity Incentive Plans

As

of the record date, we had 21,000,000 shares of Common Stock reserved under our Incentive Plan. Pursuant to the terms of our Incentive

Plan, the Compensation Committee of our Board of Directors (our “Compensation Committee”) will reduce the number of shares

of Common Stock reserved under our Incentive Plan to between and including one-tenth and one-twenty-fifth

of the number of shares currently included in such plan. Furthermore, the number of shares available for future grant under our

Incentive Plan will be similarly adjusted. Because our 2010 Stock Option Plan was replaced by our Incentive Plan, no action will need

to be taken with respect to the share reserve under the 2010 Stock Option Plan.

Principal

Effects of Reverse Stock Split on Legal Ability to Pay Dividends

Our

Board has not in the past declared, nor does it have any plans to declare in the foreseeable future, any distributions of cash, dividends

or other property, and we are not in arrears on any dividends. Therefore, we do not believe that the reverse stock split will have any

effect with respect to future distributions, if any, to our holders of Common Stock.

Accounting

Matters

The

reverse stock split will not affect the par value of our Common Stock because our Common Stock has no par value. The shareholders’

equity, in the aggregate, will remain unchanged. In addition, the per share net income or loss and net book value of our Common Stock

will be increased because there will be fewer shares of Common Stock outstanding in both the basic and fully diluted calculations.

Potential

Anti-Takeover Effect

The

increased proportion of unissued authorized shares to issued shares could, under certain circumstances, be construed as having an anti-takeover

effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition

of our Board of Directors or contemplating a tender offer or other transaction for the combination of the Company with another company).

Although not designed or intended for such purposes, the effect of the proposed reverse stock split might be to render more difficult

or to discourage a merger, tender offer, proxy contest or change in control of the Company and the removal of management, which shareholders

might otherwise deem favorable. For example, the authority of our Board of Directors to issue Common Stock might be used to create voting

impediments or to frustrate an attempt by another person or entity to effect a takeover or otherwise gain control of us because the issuance

of additional Common Stock would dilute the voting power of the Common Stock and Preferred Stock then outstanding. Our Common Stock could

also be issued to purchasers who would support our Board of Directors in opposing a takeover bid, which our Board of Directors determines

not to be in the best interests of the Company and our shareholders. Our Board of Directors is not presently aware of any attempt, or

contemplated attempt, to acquire control of the Company and the reverse stock split proposal is not part of any plan by our Board of

Directors to recommend or implement a series of anti-takeover measures.

Procedure

for Effecting Reverse Stock Split; Exchange of Stock Certificates; Treatment of Fractional Shares

If

shareholders approve granting our Board of Directors the authority to exercise its discretion to effectuate the reverse stock split and

if our Board of Directors determines to effectuate the reverse stock split, we will file the proposed amendment to the Articles of Incorporation

with the Secretary of State of the State of California. The reverse stock split will become effective at the time specified in the amendment,

which will most likely be the date of the filing of the amendment and which we refer to as the “effective time.” Beginning

at the effective time, each certificate representing outstanding pre-reverse stock split shares of Common Stock will be deemed for all

corporate purposes to evidence ownership of post-reverse stock split shares of Common Stock.

We

will appoint American Stock Transfer & Trust Company LLC, 6201 15th Avenue, Brooklyn, NY 11219, (800) 937-5449, to act as exchange

agent for holders of Common Stock in connection with the reverse stock split. Neither the Company nor American Stock Transfer & Trust

Company LLC will distribute fractional shares of Common Stock. We will deposit with the exchange agent, as soon as practicable after

the effective time, cash in an amount equal to the value of the estimated aggregate number of fractional shares that will result from

the reverse stock split. The funds required to purchase the fractional share interests are available and will be paid from our current

cash reserves. Our shareholder list shows that some of our outstanding Common Stock is registered in the names of clearing agencies and

broker nominees. Because we do not know the numbers of shares held by each beneficial owner for whom the clearing agencies and broker

nominees are record holders, we cannot predict with certainty the number of fractional shares that will result from the reverse stock

split or the total amount we will be required to pay for fractional share interests. However, we do not expect that amount will be material.

As

of the record date, we had approximately 310 holders of record of Common Stock (although we had significantly more beneficial holders).

We do not expect the reverse stock split to result in a significant reduction in the number of record holders. We presently do not intend

to seek any change in our status as a reporting company for federal securities law purposes, either before or after the reverse stock

split.

Effect

on Beneficial Holders of Common Stock (i.e., shareholders who hold in “street name”): Upon the effectiveness of

the reverse stock split, we intend to treat shares of Common Stock held by shareholders in “street name,” through a bank,

broker or other nominee, in the same manner as registered shareholders whose shares of Common Stock are registered in their names. Banks,

brokers or other nominees will be instructed to effect the reverse stock split for their beneficial holders holding the Common Stock

in “street name.” However, these banks, brokers or other nominees may have different procedures than registered shareholders

for processing the reverse stock split. If a shareholder holds shares of Common Stock with a bank, broker or other nominee and has any

questions in this regard, shareholders are encouraged to contact their bank, broker or other nominee.

Effect

on Registered “Book-Entry” Holders of Common Stock (i.e., shareholders that are registered on the transfer agent’s

books and records): All of our registered holders of Common Stock hold their shares electronically in book-entry form with our transfer

agent. They are provided with a statement reflecting the number of shares registered in their accounts.

If

a shareholder holds registered shares in book-entry form with the transfer agent, no action needs to be taken to receive post-reverse

stock split shares. If a shareholder is entitled to post-reverse stock split shares, a transaction statement will automatically be sent

to the shareholder’s address of record indicating the number of shares of Common Stock held following the reverse stock split.

Shareholders

will not have to pay any service charges in connection with the exchange of their certificates or the payment of cash in lieu of fractional

shares.

Even

if shareholders approve the reverse stock split, our Board of Directors reserves the right to not effect the reverse stock split if in

our Board of Directors’ opinion it would not be in the best interests of the Company or our shareholders to effect such reverse

stock split.

No

Dissenters’ or Appraisal Rights

Under

the California Corporations Code, shareholders are not entitled to any dissenter’s or appraisal rights with respect to the reverse

stock split, and we will not independently provide shareholders with any such right.

Interest

of Certain Persons in Matters to Be Acted Upon

No

officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the reverse stock split that

is not shared by all of our other shareholders.

Material

U.S. Federal Income Tax Consequences

The

following is a general discussion of the material U.S. federal income tax consequences of the reverse stock split. This discussion does

not provide a complete analysis of all potential U.S. federal income tax considerations relating thereto. This description is based on

the U.S. Internal Revenue Code of 1986, as amended (the “Code”) and existing and proposed U.S. Treasury regulations promulgated

thereunder, administrative pronouncements, judicial decisions, and interpretations of the foregoing, all as of the date hereof and all

of which are subject to change, possibly with retroactive effect.

This

discussion addresses only Common Stock held as capital assets within the meaning of Section 1221 of the Code (generally for investment)

by U.S. holders (defined below).

Moreover,

this discussion is for general information only and does not address all of the tax consequences that may be relevant to you in light

of your particular circumstances, including the alternative minimum tax, the Medicare tax on certain investment income or any state,

local or foreign tax laws or any U.S. federal tax laws other than U.S. federal income tax laws, nor does it discuss special tax provisions,

which may apply to you if you are subject to special treatment under U.S. federal income tax laws, such as for:

| |

● |

certain

financial institutions or financial services entities, |

| |

● |

insurance

companies, |

| |

● |

tax-exempt

entities, |

| |

● |

tax-qualified

retirement plans, |

| |

● |

dealers

in securities or currencies, |

| |

● |

entities

that are treated as partnerships or other pass-through entities for U.S. federal income tax purposes (and partners or beneficial

owners therein), |

| |

● |

foreign

branches, |

| |

● |

corporations

that accumulate earnings to avoid U.S. federal income tax, |

| |

● |

regulated

investment companies, |

| |

● |

real

estate investment trusts, |

| |

● |

persons

deemed to sell Common Stock under the constructive sale provisions of the Code, and |

| |

● |

persons

that hold Common Stock as part of a straddle, hedge, conversion transaction, or other integrated investment. |

You

are urged to consult your own tax advisor concerning the U.S. federal income tax consequences of the reverse stock split, as well as

the application of any state, local, foreign income and other tax laws.

As

used in this discussion, a “U.S. holder” is a beneficial owner of Common Stock that is, for U.S. federal income tax purposes:

| |

● |

an

individual who is a citizen or resident of the United States; |

| |

● |

a

corporation (or other entity taxable as a corporation for U.S. federal income tax purposes) that is created or organized in or under

the laws of the United States, any state thereof or the District of Columbia; |

| |

● |

an

estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

| |

● |

a

trust if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one

or more U.S. persons have the authority to control all substantial decisions of the trust or (ii) it has a valid election in effect

under applicable U.S. Treasury regulations to be treated as a domestic trust. |

If

a partnership or other entity or arrangement treated as a pass-through entity for U.S. federal income tax purposes is a beneficial owner

of Common Stock, the tax treatment of a partner in the partnership or an owner of the other pass-through entity or arrangement generally

will depend upon the status of the partner or owner and the activities of the partnership or other pass-through entity or arrangement.

Any partnership, partner in such a partnership or owner of another pass-through entity or arrangement holding Common Stock should consult

its own tax advisor as to the particular U.S. federal income tax consequences applicable to it.

SHAREHOLDERS

ARE URGED TO CONSULT THEIR OWN TAX ADVISORS REGARDING THE APPLICATION OF U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS

AND THE CONSEQUENCES OF OTHER FEDERAL, STATE, LOCAL AND FOREIGN TAX LAWS, AND APPLICABLE TAX TREATIES, IN PARTICULAR, SHAREHOLDERS WHO

RECEIVE CASH IN LIEU OF FRACTIONAL SHARES RESULTING FROM THE REVERSE STOCK SPLIT AND WITH RESPECT TO ALLOCATING TAX BASIS AND HOLDING

PERIOD AMONG THEIR POST-REVERSE STOCK SPLIT SHARES.

No

gain or loss should be recognized by U.S. holders as a result of the reverse stock split, except for cash payments received in lieu of

fractional shares, the tax consequences of which are described below. The aggregate tax basis of the new Common Stock received by U.S.

holders (including any fraction of new Common Stock deemed to have been received) will be the same as their aggregate adjusted tax basis

in their existing Common Stock. The holding period of the new Common Stock received as a result of the reverse stock split will include

the period during which a U.S. holder held the Common Stock surrendered in the reverse stock split.

U.S.

holders who receive cash in lieu of fractional shares of the new Common Stock in the reverse stock split will be treated as having sold

such fractional shares for cash, and will generally recognize capital gain or loss in an amount equal to the difference between the amount

of cash received and their tax basis in their fractional share. The gain or loss will be long-term capital gain or loss if a U.S. holder’s

holding period for his or her new Common Stock exceeds 12 months.

The

reverse stock split will be treated as a tax-free recapitalization of the Company under the Code. Consequently, the Company will not

recognize any gain or loss as a result of the reverse stock split.

THE

PRECEDING DISCUSSION OF U.S. FEDERAL INCOME TAX CONSEQUENCES IS FOR GENERAL INFORMATION ONLY. IT IS NOT TAX ADVICE. EACH SHAREHOLDER

IS URGED TO CONSULT ITS OWN TAX ADVISOR REGARDING THE PARTICULAR U.S. FEDERAL, STATE, LOCAL AND FOREIGN TAX CONSEQUENCES OF THE REVERSE

STOCK SPLIT, INCLUDING THE CONSEQUENCES OF ANY PROPOSED CHANGE IN APPLICABLE LAWS AND TREATIES, IN PARTICULAR, SHAREHOLDERS WHO RECEIVE

CASH IN LIEU OF FRACTIONAL SHARES RESULTING FROM THE REVERSE STOCK SPLIT AND WITH RESPECT TO ALLOCATING TAX BASIS AND HOLDING PERIOD

AMONG THEIR POST-REVERSE STOCK SPLIT SHARES.

Required

Vote

The

affirmative vote of a majority of the outstanding shares entitled to vote, provided that a quorum is present, is required to approve

granting our Board of Directors the authority to exercise its discretion to amend our Articles of Incorporation to effect a reverse stock

split of our outstanding shares of Common Stock, to regain compliance with the Nasdaq Stock Market’s minimum bid price requirement,

at any of the following exchange ratios at any time within one year after shareholder approval is obtained, and once approved by the

shareholders, the timing of the amendment and the specific reverse split ratio to be effected shall be determined in the sole discretion

of our Board of Directors: (A) a one-for-ten reverse stock split; (B) a one-for-fifteen reverse

stock split; (C) a one-for-twenty reverse stock split; or (D) a one-for-twenty-five reverse stock split. Unless otherwise directed

by the shareholders, proxies will be voted FOR approval of this Proposal.

The

Board of Directors Recommends a Vote “FOR” granting our Board of Directors the authority to exercise its discretion to amend

our Articles of Incorporation to effect a reverse stock split of our outstanding shares of Common Stock, to regain compliance with the

Nasdaq Stock Market’s minimum bid price requirement, at any of the following exchange ratios at any time within one year after

shareholder approval is obtained, and once approved by the shareholders, the timing of the amendment and the specific reverse split ratio

to be effected shall be determined in the sole discretion of our Board of Directors: (A) a one-for-ten reverse stock split; (B) a one-for-fifteen

reverse stock split; (C) a one-for-twenty reverse stock split; or (D) a one-for-twenty-five reverse stock split.

PROPOSAL

2: TO APPROVE GRANTING OUR BOARD OF DIRECTORS THE AUTHORITY TO EXERCISE ITS DISCRETION AT ANY TIME WITHIN ONE YEAR AFTER SHAREHOLDER

APPROVAL IS OBTAINED TO AMEND OUR ARTICLES OF INCORPORATION TO REDUCE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK BY A CORRESPONDING

RATIO TO THE REVERSE STOCK SPLIT IF, AND ONLY IF, THE REVERSE STOCK SPLIT PROPOSAL IS APPROVED AND IMPLEMENTED.

Our

Board of Directors believes it is advisable and in the best interests of the Company and our shareholders to approve granting our Board

of Directors the authority to exercise its discretion at any time within one year after shareholder approval is obtained to amend our

Articles of Incorporation to reduce the number of authorized shares of our Common Stock by a corresponding ratio to the reverse stock

split if, and only if, the reverse stock split proposal is approved and implemented. On June 30, 2023, our Board of Directors

approved of the proposed amendment of our Articles of Incorporation, subject to shareholder approval, that would reduce the number of

authorized shares of our Common Stock by a corresponding ratio to the reverse stock split. Although shareholders are being asked to vote

on each of the proposed ratios, only the one proposal that corresponds to the approved and implemented reverse stock split ratio would

be effected.

The

full text of the form of proposed amendment of the Articles of Incorporation is attached to this proxy statement as Appendix A.

By approving this Proposal, shareholders will be approving granting our Board of Directors the authority to exercise its discretion at

any time within one year after shareholder approval is obtained to amend our Articles of Incorporation to reduce the number of authorized

shares of our Common Stock by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved

and implemented.

If

approved by shareholders and following such approval our Board of Directors determines that effecting a reverse stock split and an authorized

shares reduction is in the best interests of the Company and our shareholders, the authorized shares reduction will become effective

upon filing one such amendment with the Secretary of State of the State of California. The amendment filed thereby will contain the number

of authorized shares of our Common Stock approved by the shareholders and selected by the Board of Directors within the limits set forth

in this Proposal. Only one such amendment will be filed, if at all, and the other amendments will be abandoned.

The

implementation of this Proposal 2 is expressly conditioned upon the approval and implementation of Proposal 1; if Proposal 1 is not approved

and implemented, then this Proposal 2 will not be implemented. Accordingly, if we do not receive the required shareholder approval for

Proposal 1 or the reverse stock split is not otherwise implemented, then we will not implement the authorized shares reduction. If we

receive the required shareholder approval for Proposal 1 but do not receive the required shareholder approval for Proposal 2, then our

Board of Directors will nonetheless retain the ability to implement the reverse stock split and, if so effected, the total number of

authorized shares of our Common Stock would not be reduced. Notwithstanding shareholder approval of the proposed amendment of the Articles

of Incorporation at the Meeting, our Board of Directors may decide it is in the best interests of the Company and its shareholders to

withhold approval from any amendments to the Articles of Incorporation without further action by the shareholders before the amendment

of the Articles of Incorporation is filed with the Secretary of State of the State of California.

Background

and Reasons for the Authorized Shares Reduction

As

a matter of California law, the implementation of the reverse stock split does not require a reduction in the total number of authorized

shares of our stock. However, if Proposals 1 and 2 are approved by our shareholders and the reverse stock split is implemented, our Board

of Directors has the discretion to reduce the authorized number of shares of our Common Stock by a corresponding ratio. The reason for

the authorized shares reduction is so that we do not have what some shareholders might view as an unreasonably high number of authorized

shares of Common Stock that are unissued relative to the number of shares outstanding following the reverse stock split.

Risks

Associated with the Authorized Shares Reduction

If

both Proposals 1 and 2 are approved and the reverse stock split and authorized shares reduction are implemented, then there will be fewer

authorized shares of Common Stock available to issue or reserve for issuance. If we require additional authorized shares in the future,

we would be forced to seek and obtain the approval of our shareholders to effect an increase to the authorized shares of Common Stock.

Any such increase to the authorized shares would require us to solicit proxies and hold a vote at an annual or special meeting of the

shareholders. The shareholder meeting process can be costly and time-consuming and is subject to a variety of SEC rules that implement

waiting periods throughout the process, which could prevent us from obtaining any increase to our authorized shares in a timely manner.

Moreover, our shareholders may not approve any proposal to increase our authorized shares. Either of these outcomes could force us to

forego opportunities that we believe to be valuable or prevent us from using equity for raising capital, strategic transactions, compensation

or other corporate purposes, which could limit our flexibility and prospects and strain our cash resources.

If

this Proposal 2 is not approved, but Proposal 1 is approved and the reverse stock split is implemented, then the authorized number of

shares of our Common Stock would remain unchanged following the reverse stock split. As a result, a reverse stock split, without an authorized

shares reduction, will have the effect of increasing the number of authorized but unissued shares of Common Stock available for future

issuance, which might be construed as having an anti-takeover effect by permitting the issuance of shares to purchasers who might oppose

a hostile takeover bid or oppose any efforts to amend or repeal certain provisions of our Articles of Incorporation or Bylaws. If the

authorized number of shares of our Common Stock remains unchanged following the reverse stock split, some shareholders also might view

us as having an unreasonably high number of authorized shares of Common Stock that are unissued relative to the number of shares outstanding

following the reverse stock split, the future issuance of which could be more dilutive to shareholders than if the authorized shares

had been reduced in connection with the reverse stock split.

Principal

Effects of the Authorized Shares Reduction

Because

the authorized shares reduction is contingent upon the implementation of the reverse stock split, the principal effect of the authorized

shares reduction will be that the number of authorized shares of our Common Stock will be reduced by the same ratio as the reverse stock

split. The authorized shares reduction would not have any effect on the rights of existing shareholders, participants in our equity incentive

plans, or holders of any of our other equity securities, and the Common Stock would continue to have no par value.

Procedure

for Effecting the Authorized Shares Reduction

If

shareholders approve granting our Board of Directors the authority to exercise its discretion to effectuate the authorized shares reduction

and if our Board of Directors determines to effectuate the authorized shares reduction, we will file the proposed amendment to the Articles

of Incorporation with the Secretary of State of the State of California. The authorized shares reduction will become effective at the

time specified in the amendment, which will most likely be the date of the filing of the amendment and which we refer to as the “effective

time.”

No

Dissenters’ or Appraisal Rights

Under

the California Corporations Code, shareholders are not entitled to any dissenter’s or appraisal rights with respect to the authorized

shares reduction, and we will not independently provide shareholders with any such right.

Interest

of Certain Persons in Matters to Be Acted Upon

No

officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the authorized shares reduction

that is not shared by all of our other shareholders.

Required

Vote

The

affirmative vote of a majority of the outstanding shares entitled to vote, provided that a quorum is present, is required to approve

granting our Board of Directors the authority to exercise its discretion at any time within one year after shareholder approval is obtained

to amend our Articles of Incorporation to reduce the number of authorized shares of our Common Stock by a corresponding ratio to the

reverse stock split if, and only if, the reverse stock split proposal is approved and implemented. Unless otherwise directed by the shareholders,

proxies will be voted FOR approval of this Proposal.

The

Board of Directors Recommends a Vote “FOR” granting our Board of Directors the authority to exercise its discretion at any

time within one year after shareholder approval is obtained to amend our Articles of Incorporation to reduce the number of authorized

shares of our Common Stock by a corresponding ratio to the reverse stock split if, and only if, the reverse stock split proposal is approved

and implemented.

PROPOSAL

3: To approve an amendment to the Incentive Plan to eliminate the limitation on the number of

shares of our Common Stock that can be granted to any individual participant under the Incentive Plan during any one (1)-year period.

On

June 30, 2023, our Board of Directors adopted and approved an amendment to our Incentive Plan to eliminate

the limitation on the number of shares of our Common Stock that can be granted to any individual participant under the Incentive Plan

during any one (1)-year period (the “Plan Amendment”), subject to approval by our shareholders at the Meeting.

The

Incentive Plan currently provides that no individual participant shall be granted, during any one (1) year period, options to purchase

and/or stock appreciation rights with respect to more than 1,000,000 shares of Common Stock in the aggregate, or any other awards with

respect to more than 500,000 shares of Common Stock in the aggregate (the “Individual Award Limit”). The Individual Award

Limit is set forth in Section 4.2 of the Incentive Plan, which provides as follows:

“4.2

Subject to adjustment in accordance with Section 11, no Participant shall be granted, during any one (1) year period, Options to purchase

Common Stock and Stock Appreciation Rights with respect to more than 1,000,000 shares of Common Stock in the aggregate or any other Awards

with respect to more than 500,000 shares of Common Stock in the aggregate. If an Award is to be settled in cash, the number of shares

of Common Stock on which the Award is based shall not count toward the individual share limit set forth in this Section 4.”

If

the Plan Amendment is approved, Section 4.2 of the current Incentive Plan would be amended and restated to read in full as follows:

“4.2

[Reserved.]”

Accordingly,

the Plan Amendment would eliminate the Individual Award Limit, such that our Compensation Committee and Board of Directors would have

increased discretion to determine the number of shares of Common Stock subject to Awards that may be granted to participants under the

Incentive Plan during any one (1)-year period or otherwise, subject to the other terms and conditions thereof.

A

copy of the Plan Amendment is set forth in this Proxy Statement as Appendix B.

Reasons

for the Elimination of the Individual Award Limit

Our

Board of Directors believes that our success is largely dependent on our ability to attract and retain highly-qualified employees and

non-employee directors, and that offering them the opportunity to acquire or increase their interest in our company will enhance our

ability to attract and retain such persons. Accordingly, the ability of our Board of Directors to grant meaningful quantities of stock

options and other equity-based award is an important part of employee and director compensation packages.

When

the Incentive Plan was approved, we established limits on the number of shares of Common Stock that can be granted to any individual

participant under the Incentive Plan during any one (1)-year period. However, due to the recent declines in the market price of our Common

Stock and other factors, we have determined that, the established limits are no longer necessary or appropriate, and should be eliminated

in order to give our Board of Directors and Compensation Committee increased discretionary authority to determine the number of shares

of our Common Stock subject to Awards under the Incentive Plan.

We

believe that our Board of Directors and Compensation Committee should have the ability to grant Awards under the Incentive Plan in such

quantities as they may determine appropriate, in light of the circumstances, and without regard to the Individual Award Limit. Further,

the increased authority contemplated by the Plan Amendment is critical to the furtherance of our compensation programs and vital to the

growth and success of our business, as it will allow us to preserve cash and increase our ability to attract, retain and motivate persons

who make important contributions to our business.

Summary

of the Incentive Plan (as proposed to be amended by the Plan Amendment)

The

following summary of the Incentive Plan, as proposed to be amended by the Plan Amendment, is a summary only and does not purport to include

all of the terms of the Incentive Plan or the Plan Amendment, and is qualified in full by the terms of the Incentive Plan and the Plan

Amendment.

We

have adopted the Incentive Plan that permits us to grant awards (“Awards”), consisting of stock options, the grant or sale

of restricted stock (“Restricted Stock”), the grant of stock appreciation rights (“SARs”), and the grant of hypothetical

units issued with reference to our Common Stock (“Restricted Stock Units” or “RSUs”), for up to 21,000,000 shares

of our Common Stock. The Incentive Plan also permits Oncocyte to issue such other securities as our Board of Directors or our Compensation

Committee administering the Incentive Plan may determine. Awards of stock options, Restricted Stock, SARs, and RSUs may be granted under

the Incentive Plan to our employees, directors, and consultants.

Awards

may vest and thereby become exercisable or have restrictions on forfeiture lapse on the date of grant or in periodic installments or

upon the attainment of performance goals, or upon the occurrence of specified events. Awards may not vest, in whole or in part, earlier

than one year from the date of grant. Vesting of an Award after the date of grant may be accelerated only in the limited circumstances

specified in the Incentive Plan. In the case of the acceleration of vesting of any performance-based Award, acceleration of vesting shall

be limited to actual performance achieved, pro rata achievement of the performance goal(s) on the basis for the elapsed portion of the

performance period, or a combination of actual and pro rata achievement of performance goals.

No

Awards may be granted under the Incentive Plan more than ten years after the date upon which the Incentive Plan was adopted by the Board,

and no options or SARs granted under the Incentive Plan may be exercised after the expiration of ten years from the date of grant.

As

of June 28, 2023, an aggregate of 9,127,843 shares of our Common Stock were issuable upon the exercise of outstanding Awards under our

Incentive Plan and 8,491,111 shares of our Common Stock remained available for future issuance under our Incentive Plan.

Stock

Options

Options

granted under the Incentive Plan may be either “incentive stock options” within the meaning of Section 422(b) of the Code

or “non-qualified” stock options that do not qualify incentive stock options. Incentive stock options may be granted only

to our employees and employees of our subsidiaries. The exercise price of stock options granted under the Incentive Plan must be equal

to the fair market of our Common Stock on the date the option is granted. In the case of an optionee who, at the time of grant, owns

more than 10% of the combined voting power of all classes of our capital stock, the exercise price of any incentive stock option must

be at least 110% of the fair market value of our Common Stock on the grant date, and the term of the option may be no longer than five

years. The aggregate fair market value of our Common Stock (determined as of the grant date of the option) with respect to which incentive

stock options become exercisable for the first time by an optionee in any calendar year may not exceed $100,000.

The

exercise price of an option may be payable in cash or in shares of our Common Stock having a fair market value equal to the exercise

price, or in a combination of cash and Common Stock, or other legal consideration for the issuance of stock as our Board of Directors

or our Compensation Committee may approve.

Generally,

options will be exercisable only while the optionee remains an employee, director or consultant, or during a specific period thereafter,

but in the case of the termination of an employee, director, or consultant’s services due to death or disability, the period for

exercising a vested option shall be extended to the earlier of 12 months after termination or the expiration date of the option.

Restricted

Stock and Restricted Stock Units

In

lieu of granting options, we may enter into purchase agreements with employees under which they may purchase or otherwise acquire RSUs

subject to such vesting, transfer, and repurchase terms, and other restrictions. The price at which Restricted Stock may be issued or

sold will be not less than 100% of fair market value. Employees or consultants, but not executive officers or directors, who purchase

Restricted Stock may be permitted to pay for their shares by delivering a promissory note or an installment payment agreement that may

be secured by a pledge of their Restricted Stock. Restricted Stock may also be issued for services actually performed by the recipient

prior to the issuance of the Restricted Stock. Unvested Restricted Stock for which we have not received payment may be forfeited, or

we may have the right to repurchase unvested shares upon the occurrence of specified events, such as termination of employment.

Subject

to the restrictions set with respect to the particular Award, a recipient of Restricted Stock generally shall have the rights and privileges

of a shareholder, including the right to vote the Restricted Stock and the right to receive dividends; provided that, any cash dividends

and stock dividends with respect to the Restricted Stock shall be withheld for the recipient’s account, and interest may be credited

on the amount of the cash dividends withheld. The cash dividends or stock dividends so withheld and attributable to any particular share

of Restricted Stock (and earnings thereon, if applicable) shall be distributed to the recipient in cash or, at the discretion of our

Board of Directors or our Compensation Committee, in shares of Common Stock having a fair market value equal to the amount of such dividends,

if applicable, upon the release of restrictions on the Restricted Stock and, if the Restricted Stock is forfeited, the recipient shall

have no right to the dividends.

The

terms and conditions of a grant of RSUs shall be determined by our Board of Directors or our Compensation Committee. No shares of Common

Stock shall be issued at the time a RSU is granted. A recipient of Restricted Stock Units shall have no voting rights with respect to

the RSUs. Upon the expiration of the restrictions applicable to a RSU, we will either issue to the recipient, without charge, one share

of Common Stock per RSU or cash in an amount equal to the fair market value of one share of Common Stock.

At