Diversified Healthcare Trust Defaults on $450 Million Credit Facility

June 29 2023 - 9:09AM

Dow Jones News

By Dean Seal

Diversified Healthcare Trust disclosed Thursday a nonmonetary

default under its $450 million credit facility due to insufficient

collateral value.

The facility requires the healthcare-focused real estate

investment trust to maintain collateral properties with an

aggregate appraised value of at least $1.09 billion, Diversified

said.

On June 23, an administrative agent notified Diversified that

the reappraised value of properties securing the facility had

fallen to $1.05 billion from $1.34 billion. That's a 22% drop since

they were last appraised in January 2021.

Diversified is negotiating with lenders for a limited waiver of

the default through September 30, which is the outside closing date

of a pending merger with Office Properties Income Trust that would

fully refinance the $450 million facility.

For the time being, Diversified can't issue any new debt or

refinance expiring debt.

Diversified said the best alternative available to it is the

merger with Office Properties.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

June 29, 2023 08:54 ET (12:54 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

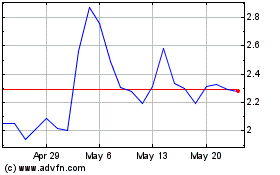

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From Apr 2024 to May 2024

Office Properties Income (NASDAQ:OPI)

Historical Stock Chart

From May 2023 to May 2024