Current Report Filing (8-k)

March 31 2020 - 4:38PM

Edgar (US Regulatory)

false

0000800240

0000800240

2020-03-31

2020-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): March 31, 2020

OFFICE DEPOT, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

1-10948

|

59-2663954

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

6600 North Military Trail, Boca Raton, FL

|

|

33496

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(561) 438-4800

(Registrant’s Telephone Number, Including Area Code)

Former Name or Former Address, If Changed Since Last Report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange on which Registered

|

|

Common Stock, par value $0.01 per share

|

|

ODP

|

|

The NASDAQ Stock Market

(NASDAQ Global Select Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1

Item 8.01. Other Events.

On March 31, 2020, Office Depot, Inc. (the “Company”) announced that the Board of Directors of the Company (the “Board”) has, following the completion of its feasibility review previously announced on November 6, 2019, approved the implementation of a holding company reorganization (the “Reorganization”). As previously disclosed, the Reorganization is anticipated to create a new holding company, The ODP Corporation (the “HoldCo”), that will become the new parent company of the Company and will replace the Company as the public company trading on the NASDAQ Stock Market under the Company’s current ticker symbol “ODP.” The Reorganization is intended to be a tax-free transaction for U.S. federal income tax purposes for the Company’s shareholders.

Upon the consummation of the Reorganization, each outstanding share of the Company’s common stock would automatically convert into shares of common stock of HoldCo on a one-for-one basis. Accordingly, each shareholder of the Company will own the same number of shares of HoldCo’s common stock that such shareholder owns of the Company’s common stock immediately prior to the Reorganization. Each share of HoldCo common stock will have the same designations, rights, powers and preferences, and the same qualifications, limitations and restrictions, as the shares of Company common stock immediately prior to the Reorganization. As previously disclosed, the Reorganization will be implemented pursuant to Section 251(g) of the Delaware General Corporation Law, which permits the creation of a holding company through a merger with a direct or indirect wholly-owned subsidiary of the constituent corporation without shareholder approval.

As disclosed in the Company’s definitive proxy statement filed with the Securities and Exchange Commission (“SEC”) on March 26, 2020, if approved by the Company’s shareholders, the Board may decide to implement a reverse stock split substantially concurrently with the consummation of the Reorganization. As further described in the Company’s definitive proxy statement, the reverse stock split is not contingent upon the consummation of the Reorganization, and the consummation of the Reorganization is not a condition to the reverse stock split. Neither the Reorganization nor the reverse stock split is expected to result in a change in the directors, executive officers, management or business of the Company.

Subject to obtaining required approvals or any other intervening developments, the Company expects to consummate the Reorganization on or about the end of the second quarter of 2020.

A copy of the Company’s press release announcing the Board’s approval of the Reorganization is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to a variety of matters, including, without limitation, statements regarding shareholder approval of the reverse stock split and consummation of the Reorganization and reverse stock split. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of the management of the Company and are subject to significant risks and uncertainty. Investors are cautioned not to place undue reliance on any such forward-looking statements. All such forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update or revise these statements, whether as a result of new information, future events or otherwise, except as may be required by law. These forward-looking statements involve many risks and uncertainties that may cause actual results to differ materially from what may be expressed or implied in these forward-looking statements. For example, risks and uncertainties that could affect the forward-looking statements set forth in this Current Report on Form 8-K include: the expected timing of the implementation and consummation of the Reorganization and the reverse stock split; the costs of the Reorganization and the reverse stock split; and factors generally affecting the business, operations, and financial condition of the Company, including the information contained in the Company’s Annual Report on Form 10-K for the year ended December 28, 2019, subsequent Quarterly Reports on Form 10-Q, and other reports and filings with the SEC.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

OFFICE DEPOT, INC.

|

|

|

|

|

|

Date: March 31, 2020

|

|

/s/ N. DAVID BLEISCH

|

|

|

|

Name:

|

N. David Bleisch

|

|

|

|

Title:

|

EVP, Chief Legal & Administrative Officer and Corporate Secretary

|

3

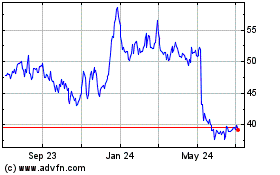

ODP (NASDAQ:ODP)

Historical Stock Chart

From Jun 2024 to Jul 2024

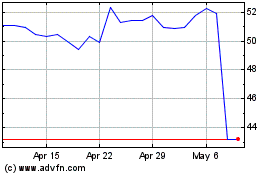

ODP (NASDAQ:ODP)

Historical Stock Chart

From Jul 2023 to Jul 2024