false

0000087050

0000087050

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 28, 2024

NEONODE INC.

(Exact name of issuer of securities held pursuant

to the plan)

Commission File Number 1-35526

| Delaware |

|

94-1517641 |

(State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

Karlavägen 100, 115 26 Stockholm, Sweden

(Address of Principal Executive Office, including

Zip Code)

+46 (0) 702958519

Registrant’s telephone number, including

area code:

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

NEON |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial

Condition.

On February 28, 2024, Neonode Inc. (the “Company”)

reported its earnings for the fiscal year ended December 31, 2023 (the “Earnings Release”) and posted on the Neonode website

the Fourth Quarter and Full Year 2023 Presentation (the “Presentation”). A copy of the Earnings Release and the Presentation

are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

The information furnished pursuant to this Item

2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, or incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure

As previously announced, the Company will conduct

a conference call today, Wednesday, February 28, 2024 at 10:00 a.m. ET. The presentation slides to be used during the call, attached hereto

as Exhibit 99.2, will be available on the “Investor Relations” section of the Company’s website at www.neonode.com immediately

prior to the call. The information contained in, or that can be accessed through the Company’s website is not a part of this filing.

The information furnished pursuant to this Item

7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject

to the liabilities under that Section, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

| Date: February 28, 2024 |

NEONODE INC. |

| |

|

|

| |

By: |

/s/ Fredrik Nihlén |

| |

Name: |

Fredrik Nihlén |

| |

Title: |

Chief Financial Officer |

2

Exhibit 99.1

Press Release

For Release, 09:10AM ET February 28, 2024

Neonode Reports 2023 Financial Results

STOCKHOLM, SWEDEN, February 28, 2024 — Neonode Inc. (NASDAQ:

NEON) today reported financial results for the fiscal year ended December 31, 2023.

FINANCIAL SUMMARY

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023:

| ● | Revenue

of $4.4 million, a decrease of 21.5% compared to the prior year. |

| ● | Operating

expenses of $10.7 million, an increase of 4.9% compared to the prior year. |

| ● | Net

loss of $10.1 million, or $0.66 per share, compared to $4.9 million, or $0.36 per share,

for the prior year. |

| ● | Cash

used by operations of $6.3 million, compared to $6.8 million for the prior year. |

| ● | Cash

and accounts receivable of $17.1 million as of December 31, 2023 compared to $16.3 million

for the prior year-end. |

THE

CEO’S COMMENTS

“The decrease in our sales revenues 2023 was a disappointment.

In particular, the negative development of our Touch Sensor Module (“TSM”) product business was unsatisfactory and led us

to the decision to sharpen our strategy and focus on licensing going forward, as announced on December 12, 2023. We are currently phasing

out our TSM product business and will close our production unit in Kungsbacka, Sweden, later this year. Existing customers and value-added

resellers are offered to place last-time-buy orders for TSMs for delivery during Q1 and Q2. In parallel, we are offering customers to

license the TSM technology to set up their own TSM production, which several customers have responded positively to,” said Dr. Urban

Forssell, Neonode’s CEO.

“Our licensing revenues were also lower in 2023 than in the previous

year. This is mainly due to our legacy customers’ product sales slowing down in Q3 and Q4, combined with high inventory levels at

some customers. The breakthrough driver monitoring software win with a leading commercial vehicle manufacturer, which we announced on

December 6, 2023, was the result of several years’ dedicated work by our commercial and technical teams and is a stepping stone

for us in our quest to revitalize and grow our licensing business,” continued Dr. Forssell.

“We are pleased to see that our recent driver monitoring software

win has boosted the interest in our driver and in-cabin monitoring solution among other vehicle manufacturers and tier 1 system

suppliers. We are currently working hard to capitalize on this momentum. We also see interesting opportunities with our head-up display

obstruction solution and with our touch and touchless human-machine interaction offerings. In summary, we are optimistic about the future

growth potential for our business. We are also confident that our new, sharpened strategy with a full focus on licensing will help us

increase our efficiency and reach a positive cash flow in shorter time than with our previous strategy that combined licensing with product

sales,” concluded Dr. Forssell.

FINANCIAL OVERVIEW FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

Net revenues for fiscal 2023 were $4.4 million, a 21.5% decrease compared

to 2022. License revenues were $3.8 million, a decrease of 14.9% compared to 2022. The decrease is caused by lower sales volumes for our

customers during 2023.

Revenues from product sales for fiscal 2023 were $0.6 million, a 37.7%

decrease compared to 2022, mainly due to low customer demand.

Revenues from non-recurring engineering for fiscal 2023 were $26,000,

an 87.3% decrease compared to 2022, mainly due to fewer projects.

Gross margin related to products was negative 630.6% for fiscal 2023

compared to 22.0% in 2022. The gross margin for products in 2023 is impacted by one-time costs related to a customer claim, impairment

loss on inventory and a loss on an earlier purchase commitment.

Our operating expenses increased by 4.9% for fiscal 2023 compared to

2022, primarily due to higher marketing costs, professional fees, and payroll and related costs.

Net loss attributable to Neonode for fiscal 2023 was $10.1 million,

or $0.66 per share, compared to a net loss of $4.9 million, or $0.36 per share for 2022. Cash used by operations was $6.3 million in fiscal

2023 compared to $6.8 million for 2022. The decrease is primarily the result of fewer components purchased in 2023.

Cash and accounts receivable totaled $17.7 million and working capital

was $16.8 million as of December 31, 2023, compared to $16.3 million and $19.1 million as of December 31, 2022, respectively.

For more information, please contact:

Chief Financial Officer

Fredrik Nihlén

E-mail: fredrik.nihlen@neonode.com

Phone: +46 703 97 21 09

Chief Executive Officer

Urban Forssell

E-mail: urban.forssell@neonode.com

Phone: +46 734 10 03 59

About Neonode

Neonode Inc. (NASDAQ:NEON) is a publicly traded

company, headquartered in Stockholm, Sweden and established in 2001. The company provides advanced optical sensing solutions for contactless

touch, touch, gesture control, and in-cabin monitoring. Building on experience acquired during years of advanced R&D and technology

licensing, Neonode’s technology is currently deployed in more than 90 million products and the company holds more than 100 patents

worldwide. Neonode’s customer base includes some of the world’s best-known Fortune 500 companies in the consumer electronics,

office equipment, automotive, elevator, and self-service kiosk markets.

NEONODE and the NEONODE logo are trademarks of Neonode Inc. registered

in the United States and other countries.

For further information please visit www.neonode.com

Follow us at:

Cision

LinkedIn

Twitter

Safe Harbor Statement

This press release contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995. These include, but are not limited to, statements

relating to our expectations for growth and the growing demand for our products, future performance or future events. These statements

are based on current assumptions, expectations and information available to Neonode management and involve a number of known and unknown

risks, uncertainties and other factors that may cause Neonode’s actual results, levels of activity, performance or achievements

to be materially different from any expressed or implied by these forward-looking statements.

These risks, uncertainties, and factors include risks related to

our reliance on the ability of our customers to design, manufacture and sell their products with our touch technology, the length of a

customer’s product development cycle, our dependence and our customers’ dependence on suppliers, the global economy generally

and other risks discussed under “Risk Factors” and elsewhere in Neonode’s public filings with the SEC from time to time,

including Neonode’s annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. You are advised

to carefully consider these various risks, uncertainties and other factors. Although Neonode management believes that the forward-looking

statements contained in this press release are reasonable, it can give no assurance that its expectations will be fulfilled. Forward-looking

statements are made as of today’s date, and Neonode undertakes no duty to update or revise them.

NEONODE INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share amounts)

| | |

As of

December 31,

2023 | | |

As of

December 31,

2022 | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 16,155 | | |

$ | 14,816 | |

| Accounts receivable and unbilled revenues, net | |

| 917 | | |

| 1,448 | |

| Inventory | |

| 610 | | |

| 3,827 | |

| Prepaid expenses and other current assets | |

| 938 | | |

| 707 | |

| Total current assets | |

| 18,620 | | |

| 20,798 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 340 | | |

| 282 | |

| Operating lease right-of-use assets, net | |

| 54 | | |

| 118 | |

| Total assets | |

$ | 19,014 | | |

$ | 21,198 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 440 | | |

$ | 334 | |

| Accrued payroll and employee benefits | |

| 941 | | |

| 951 | |

| Accrued expenses | |

| 354 | | |

| 200 | |

| Contract liabilities | |

| 10 | | |

| 36 | |

| Current portion of finance lease obligations | |

| 33 | | |

| 95 | |

| Current portion of operating lease obligations | |

| 54 | | |

| 83 | |

| Total current liabilities | |

| 1,832 | | |

| 1,699 | |

| | |

| | | |

| | |

| Finance lease obligations, net of current portion | |

| 19 | | |

| 46 | |

| Operating lease obligations, net of current portion | |

| - | | |

| 35 | |

| Total liabilities | |

| 1,851 | | |

| 1,780 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common stock, 25,000,000 shares authorized, with par value of $0.001; 15,359,481 and 14,455,765 shares issued and outstanding at December 31, 2023 and 2022, respectively | |

| 15 | | |

| 14 | |

| Additional paid-in capital | |

| 235,158 | | |

| 227,235 | |

| Accumulated other comprehensive loss | |

| (396 | ) | |

| (340 | ) |

| Accumulated deficit | |

| (217,614 | ) | |

| (207,491 | ) |

| Total stockholders’ equity | |

| 17,163 | | |

| 19,418 | |

| Total liabilities and stockholders’ equity | |

$ | 19,014 | | |

$ | 21,198 | |

NEONODE INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share amounts)

| | |

Years Ended | |

| | |

December 31,

2023 | | |

December 31,

2022 | |

| Revenues: | |

| | |

| |

| License fees | |

$ | 3,803 | | |

$ | 4,470 | |

| Products | |

| 620 | | |

| 995 | |

| Non-recurring engineering | |

| 26 | | |

| 205 | |

| Total revenues | |

| 4,449 | | |

| 5,670 | |

| | |

| | | |

| | |

| Cost of revenues: | |

| | | |

| | |

| Products | |

| 4,168 | | |

| 776 | |

| Non-recurring engineering | |

| 12 | | |

| 28 | |

| Loss on purchase commitment | |

| 362 | | |

| - | |

| Total cost of revenues | |

| 4,542 | | |

| 804 | |

| | |

| | | |

| | |

| Total gross (loss) margin | |

| (93 | ) | |

| 4,866 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development | |

| 3,833 | | |

| 3,963 | |

| Sales and marketing | |

| 2,455 | | |

| 2,034 | |

| General and administrative | |

| 4,363 | | |

| 4,155 | |

| | |

| | | |

| | |

| Total operating expenses | |

| 10,651 | | |

| 10,152 | |

| Operating loss | |

| (10,744 | ) | |

| (5,286 | ) |

| | |

| | | |

| | |

| Other income: | |

| | | |

| | |

| Interest income, net | |

| 730 | | |

| 100 | |

| Other income | |

| 6 | | |

| 21 | |

| Total other income | |

| 736 | | |

| 121 | |

| | |

| | | |

| | |

| Loss before provision for income taxes | |

| (10,008 | ) | |

| (5,165 | ) |

| | |

| | | |

| | |

| Provision for income taxes | |

| 115 | | |

| 118 | |

| Net loss including noncontrolling interests | |

| (10,123 | ) | |

| (5,283 | ) |

| Less: net loss attributable to noncontrolling interests | |

| - | | |

| 400 | |

| Net loss attributable to Neonode Inc. | |

| (10,123 | ) | |

| (4,883 | ) |

| | |

| | | |

| | |

| Loss per common share: | |

| | | |

| | |

| Basic and diluted loss per share | |

$ | (0.66 | ) | |

$ | (0.36 | ) |

| Basic and diluted – weighted average number of common shares outstanding | |

| 15,322 | | |

| 13,632 | |

NEONODE INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

| | |

Years Ended | |

| | |

December 31,

2023 | | |

December 31,

2022 | |

| | |

| | |

| |

| Net loss including noncontrolling interests | |

$ | (10,123 | ) | |

$ | (5,283 | ) |

| | |

| | | |

| | |

| Other comprehensive income: | |

| | | |

| | |

| Foreign currency translation adjustments | |

| (56 | ) | |

| 68 | |

| Other comprehensive loss | |

| (10,179 | ) | |

| (5,215 | ) |

| Less: comprehensive loss attributable to noncontrolling interests | |

| - | | |

| 400 | |

| Comprehensive loss attributable to Neonode Inc. | |

$ | (10,179 | ) | |

$ | (4,815 | ) |

NEONODE INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

(In thousands)

| | |

Common

Stock

Shares

Issued | | |

Common

Stock

Amount | | |

Additional

Paid-in

Capital | | |

Accumulated

Other

Comprehensive

Income (Loss) | | |

Accumulated

Deficit | | |

Total

Neonode Inc.

Stockholders’

Equity | | |

Noncontrolling

Interests | | |

Total

Stockholders’

Equity | |

| Balances, January 31, 2022 | |

| 13,576 | | |

| 14 | | |

| 226,880 | | |

| (408 | ) | |

| (202,608 | ) | |

| 23,878 | | |

| (4,041 | ) | |

| 19,837 | |

| Issuance of shares for cash, net of offering costs | |

| 886 | | |

| - | | |

| 4,686 | | |

| - | | |

| - | | |

| 4,686 | | |

| - | | |

| 4,686 | |

| Stock-based compensation | |

| 4 | | |

| - | | |

| 122 | | |

| - | | |

| - | | |

| 122 | | |

| - | | |

| 122 | |

| Repurchase and retirement of stock | |

| (10 | ) | |

| - | | |

| (12 | ) | |

| - | | |

| - | | |

| (12 | ) | |

| - | | |

| (12 | ) |

| Acquisition of remaining shares Pronode | |

| - | | |

| - | | |

| (4,441 | ) | |

| - | | |

| - | | |

| (4,441 | ) | |

| 4,441 | | |

| - | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| 68 | | |

| - | | |

| 68 | | |

| - | | |

| 68 | |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (4,883 | ) | |

| (4,883 | ) | |

| (400 | ) | |

| (5,283 | ) |

| Balances, December 31, 2022 | |

| 14,456 | | |

$ | 14 | | |

$ | 227,235 | | |

$ | (340 | ) | |

$ | (207,491 | ) | |

$ | 19,418 | | |

$ | - | | |

$ | 19,418 | |

| Issuance of shares for cash, net of offering costs | |

| 903 | | |

| 1 | | |

| 7,865 | | |

| - | | |

| - | | |

| 7,866 | | |

| - | | |

| 7,866 | |

| Stock-based compensation | |

| - | | |

| - | | |

| 58 | | |

| - | | |

| - | | |

| 58 | | |

| - | | |

| 58 | |

| Foreign currency translation adjustment | |

| - | | |

| - | | |

| - | | |

| (56 | ) | |

| - | | |

| (56 | ) | |

| - | | |

| (56 | ) |

| Net loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (10,123 | ) | |

| (10,123 | ) | |

| - | | |

| (10,123 | ) |

| Balances, December 31, 2023 | |

| 15,359 | | |

$ | 15 | | |

$ | 235,158 | | |

$ | (396 | ) | |

$ | (217,614 | ) | |

$ | 17,163 | | |

$ | - | | |

$ | 17,163 | |

NEONODE INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

| | |

Years Ended | |

| | |

December 31,

2023 | | |

December 31,

2022 | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | |

| |

| Net loss (including noncontrolling interests) | |

$ | (10,123 | ) | |

$ | (5,283 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Stock-based compensation expense | |

| 58 | | |

| 122 | |

| Depreciation and amortization | |

| 95 | | |

| 120 | |

| Amortization of operating lease right-of-use assets | |

| 65 | | |

| 399 | |

| Inventory impairment loss | |

| 3,572 | | |

| - | |

| Recoveries of bad debt | |

| - | | |

| (46 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable and unbilled revenue, net | |

| 539 | | |

| (136 | ) |

| Inventory | |

| (395 | ) | |

| (1,133 | ) |

| Prepaid expenses and other current assets | |

| (201 | ) | |

| 37 | |

| Accounts payable, accrued payroll and employee benefits, and accrued expenses | |

| 173 | | |

| (460 | ) |

| Contract liabilities | |

| (26 | ) | |

| (65 | ) |

| Operating lease obligations | |

| (65 | ) | |

| (363 | ) |

| Net cash used in operating activities | |

| (6,308 | ) | |

| (6,808 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of property and equipment | |

| (123 | ) | |

| (52 | ) |

| Net cash used in investing activities | |

| (123 | ) | |

| (52 | ) |

| | |

| | | |

| | |

| Cash flow from financing activities: | |

| | | |

| | |

| Proceeds from issuance of common stock, net of offering costs | |

| 7,866 | | |

| 4,686 | |

| Repurchase of common stock | |

| - | | |

| (12 | ) |

| Principal payments on finance lease obligations | |

| (89 | ) | |

| (165 | ) |

| Net cash provided by financing activities | |

| 7,777 | | |

| 4,509 | |

| | |

| | | |

| | |

| Effect of exchange rate changes on cash and cash equivalents | |

| (7 | ) | |

| (216 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash and cash equivalents | |

| 1,339 | | |

| (2,567 | ) |

| Cash and cash equivalents at beginning of year | |

| 14,816 | | |

| 17,383 | |

| Cash and cash equivalents at end of year | |

$ | 16,155 | | |

$ | 14,816 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 9 | | |

$ | 9 | |

| Cash paid for income taxes | |

$ | 115 | | |

$ | 132 | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash investing and financial activities: | |

| | | |

| | |

| Right-of-use asset obtained in exchange for finance lease obligations | |

$ | - | | |

$ | 24 | |

| Acquisition of Pronode shares | |

$ | - | | |

$ | 4,441 | |

7

Exhibit

99.2

2024 - 02 - 27 1 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Neonode Q4 and Full - Year 2023 Earnings Call February 28, 2024

2024 - 02 - 27 2 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Urban Forssell Chief Executive Officer Fredrik Nihlén Chief Financial Officer Presenters

2024 - 02 - 27 3 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Agenda 1. Introduction 2. 2023 Retrospective 3. 2023 Financial Results 4. 2024 Strategy Update 5. Q&A

2024 - 02 - 27 4 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Legal Disclaimer This presentation contains, and related oral and written statements of Neonode Inc. (the “Company”) and its management may contain, forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward - looking statements include information about current expectations, strategy, plans, potential financial performance or future events. Th ey also may include statements about market opportunity and sales growth, financial results, use of cash, product development an d introduction, regulatory matters and sales efforts. Forward - looking statements are based on assumptions, expectations and information available to the Company and its management and involve a number of known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be materially d iff erent from any expressed or implied by these forward - looking statements. These uncertainties and risks include, but are not limited to, our ability to secure financing when needed on acceptable terms, risks related to new product development, our ability to protect ou r intellectual property, our ability to compete, general economic conditions including as a result of geopolitical conflicts su ch as the war in Ukraine, as well as other risks outlined in filings of the Company with the U.S. Securities and Exchange Commission (t he “SEC”) under the Securities Exchange Act of 1934, as amended, including the sections entitled “Risk Factors” and “Management’s Discu ssi on and Analysis of Financial Condition and Results of Operations.” Prospective investors are advised to carefully consider these va rious risks, uncertainties and other factors. Any forward - looking statements included in this presentation are made as of today’s date. The Company and its management undertake no duty to update or revise forward - looking statements. This presentation has been prepared by the Company based on its own information, as well as information from public sources. Certain of the information contained herein may be derived from information provided by industry sources. The Company believe s such information is accurate and that the sources from which it has been obtained are reliable. However, the Company has not independently verified such information and cannot guarantee the accuracy of such information.

2024 - 02 - 27 5 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Agenda 1. Introduction 2. 2023 Retrospective 3. 2023 Financial Results 4. 2024 Strategy Update 5. Q&A

2024 - 02 - 27 6 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open 2023 Retrospective – Business Strategy INTERACTIVE KIOSK ELEVATOR PRINTER AUTOMOTIVE TARGET SECTORS BUSINESS MODELS SALES OF NRE SERVICES + PRODUCT SALES SALES OF NRE SERVICES + TECHNOLOGY LICENSING CUSTOMER OFFERINGS TOUCH SENSOR MODULES (ZFORCE) ZFORCE MULTISENSING

2024 - 02 - 27 7 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open 2023 Retrospective – Outcome In Our Licensing Business: • License revenues from legacy customers stable • Break - through driver monitoring software award • Interesting sales pipeline • License revenues from legacy customers stable Q1 - Q2, but slightly down Q3 - Q4 In Our Products Business: • Weak demand and slow sales for our TSM products Decision to phase out the products business and focus on licensing Printer Automotive Interactive Kiosk, Elevator, Medtech

2024 - 02 - 27 8 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Agenda 1. Introduction 2. 2023 Retrospective 3. 2023 Financial Results 4. 2024 Strategy Update 5. Q&A

2024 - 02 - 27 9 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open 2023 Financial Results – Revenues $ 4 . 4 million Revenue Total 2023 ▼ 22 % YoY $0. 6 million Revenue Products 2023 ▼ 38 % YoY $ 3 . 8 million Revenue License 2023 ▼ 15 % YoY 0 500 1,000 1,500 2,000 2,500 3,000 3,500 AMER APAC EMEA AMER APAC EMEA AMER APAC EMEA AMER APAC EMEA 2020 2021 2022 2023 Thousands Revenues by Revenue Stream and Region License fees Products NRE 0 1,000 2,000 3,000 4,000 5,000 6,000 2020 2021 2022 2023 Thousands Revenues by Revenue Stream License fees Products NRE

2024 - 02 - 27 10 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open 20 23 Financial Results – Operating Expenses $ 10 . 7 million Operating Expenses 2023 ▲ 5 % YoY -12,500 -12,000 -11,500 -11,000 -10,500 -10,000 -9,500 -9,000 2020 2021 2022 2023 Thousands Operating Expenses

2024 - 02 - 27 11 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open 20 23 Financial Results – Profit & Loss $ 10.1 million Net Loss 2023 ▲ 103 % YoY * 2023 impacted by one - time costs of $362,000 related to a loss on purchase commitment and $3.6 million related to inventory write - down . kUSD 2023 2022 2021 2020 Revenues 4 449 5 670 5 836 5 984 Cost of revenues * 4 542 804 955 1 078 Gross margin (93) 4 866 4 881 4 906 Operating expenses 10 651 10 152 11 988 11 097 Operating loss (10 744) (5 286) (7 107) (6 191) Other income (expense) 736 121 (15) (32) Loss before provision for income taxes (10 008) (5 165) (7 122) (6 223) Provision for income taxes 115 118 146 59 Net loss including noncontrolling interests (10 123) (5 283) (7 268) (6 282) Less: net loss attributable to noncontrolling interests - 400 818 677 Net loss attributable to Neonode Inc. (10 123) (4 883) (6 450) (5 605) Preferred dividends - - - (33) Net loss attributable to Neonode Inc. (10 123) (4 883) (6 450) (5 638)

2024 - 02 - 27 12 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open 20 23 Financial Results – Cash Lorem $ 17.1 million Cash and Accounts Receivables Dec . 3 1 , 2023 ▲ 0.8 Million Dec. 31, 2022 $ 6 . 3 million Net Cash Burn Operating Activities 2023 ▼ 7 % YoY -9,000 -8,000 -7,000 -6,000 -5,000 -4,000 -3,000 -2,000 -1,000 0 2020 2021 2022 2023 Thousands Net cash used in operating activities

2024 - 02 - 27 13 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Phase Out of Product Business Inventory P&L effect 2023 • Impairment loss of $3.6 million (no cash flow effect) • Loss on purchase commitment of $0.4 million Plan 2024 • Produc tion and sale of TSMs during H1 • Wind down of production unit in Kungsbacka , Sweden, during H2

2024 - 02 - 27 14 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Agenda 1. Introduction 2. 2023 Retrospective 3. 2023 Financial Results 4. 2024 Strategy Update 5. Q&A

2024 - 02 - 27 15 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Cornerstones of New Sharpened Strategy • Full focus on technology and software licensing ; • Reduced operational complexity • Better market fit • Two application areas: • Human - machine interaction • Machine perception • Two technology platforms : • zForce ® - Optical touch and gesture sensing • MultiSensing ® - Driver and in - cabin monitoring

2024 - 02 - 27 16 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Two Business Areas IT & Industrial • Technology and software licensing • Sales of engineering services • Sales of demonstrators and prototypes • Printer • Interactive Kiosk • Medtech • Industrial Automotive • Technology and software licensing • Sales of engineering services • Sales of demonstrators and prototypes • Automotive CV • Automotive LV • Automotive OH Target Sectors Business Model Target Segments Business Model

2024 - 02 - 27 17 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Touch Features for Printers • Powered by Neonode’s zForce Blocking technology • 50+ million units produced by leading printer manufacturers • Low cost, reliable, high - performance technology IT & Industrial

2024 - 02 - 27 18 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Touch and Touchless Features for Interactive Kiosks • Powered by Neonode’s zForce Reflective technology • Simple, intuitive, and hygienic touchless interaction with • Holographic images • Displays • Keyboards • Buttons • Available for retrofit and new equipment IT & Industrial

2024 - 02 - 27 19 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Touchless Features for Elevators • Powered by Neonode’s zForce Reflective technology • Simple, intuitive and hygienic touchless interaction with • Holographic images • Displays • Buttons • Available for retrofit and new designs IT & Industrial

2024 - 02 - 27 20 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Touch and Touchless Features for Medtech Equipment • Powered by Neonode’s zForce technology • Rugged touch supporting gloved operation • Robust and hygienic touchless interaction with • Holographic images • Displays • Keyboards • Buttons • Avoids cross contamination • Available for retrofit and new equipment IT & Industrial

2024 - 02 - 27 21 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Driver and In - cabin Monitoring • Based on Neonode’s MultiSensing software platform • Driver monitoring : Distraction , drowsiness , gaze direction etc. • In - cabin monitoring : Occupancy , positioning , gaze directions etc. • Custom applications for any need • Unparalleled scalability , efficiency and robustness • Sophisticated software platform including user - friendly development tools for quick iterations and feature development Automotive

2024 - 02 - 27 22 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open HUD Obstruction Detection • Powered by Neonode’s zForce Blocking technology • Safety - enhancing detection of foreign objects • Powered by Neonode’s zForce Blocking technology • Cost effective and extremely reliable • Flexible and compact hardware integration Automotive

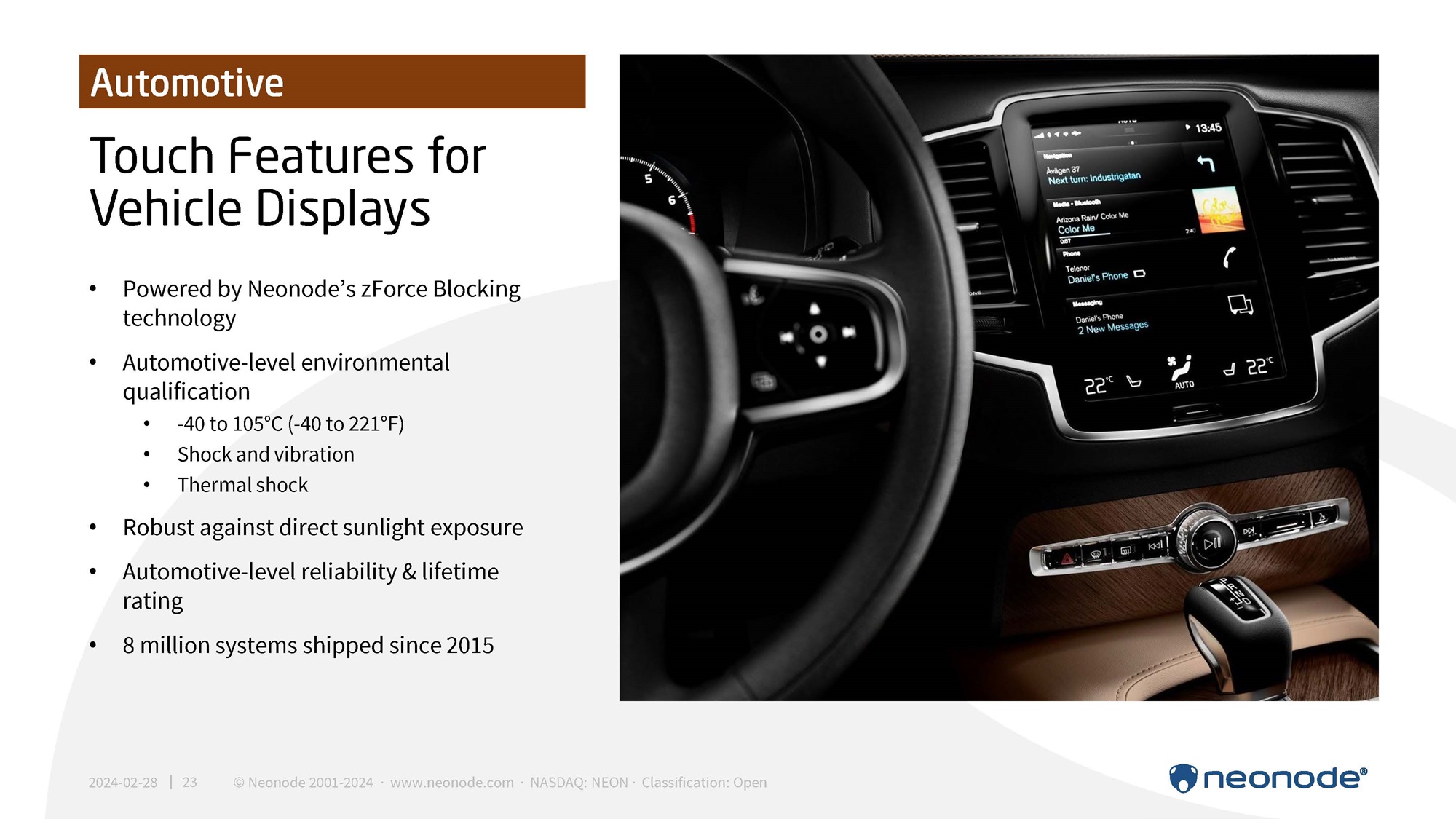

2024 - 02 - 27 23 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Touch Features for Vehicle Displays • Powered by Neonode’s zForce Blocking technology • Automotive - level environmental qualification • - 40 to 105 ° C ( - 40 to 221 ° F) • Shock and vibration • Thermal shock • Robust against direct sunlight exposure • Automotive - level reliability & lifetime rating • 8 million systems shipped since 2015 Automotive

2024 - 02 - 27 24 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open x Well positioned for future growth • Added traction in driver and in - cabin monitoring with break - through commercial vehicle manufacturer award • New and intensified conversations with vehicle manufacturers , tier 1 system suppliers , and technology partners • Strong interest also for our HUD obstruction detection and human - machine interaction solutions x New strategy tapping into our licensing DNA Entering 2024 with Momentum

2024 - 02 - 27 25 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open • Sales and production of TSMs progressing well • Closing of production unit in Kungsbacka, Sweden, prepared • Negotiations of terms and conditions for TSM licensing with several TSM customers and VARs ongoing • Execution of driver and in - cabin monitoring software project with lead commercial vehicle customer • Several discussions re. new driver and in - cabin monitoring projects with other customers ongoing • Continued marketing of HUD obstruction detection solution Status February 2024 Automotive IT & Industrial

2024 - 02 - 27 26 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open Agenda 1. Introduction 2. 2023 Retrospective 3. 2023 Financial Results 4. 2024 Strategy Update 5. Q&A

2024 - 02 - 27 27 © Neonode 2001 - 2024 · www.neonode.com · NASDAQ: NEON · Classification : Open

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neonode (NASDAQ:NEON)

Historical Stock Chart

From Apr 2023 to Apr 2024