CORRECT: Investor 3Q NAV/Share Slides 18%; Buys SEK1.1 Billion Of Shares

October 18 2011 - 3:34AM

Dow Jones News

Swedish investment firm Investor AB (INVE-B.SK) said Tuesday its

net asset value per share fell 18% at the end of the third quarter

from the second, as a sharp decline in equity markets hit listed

companies, adding that it bought SEK1.1 billion worth of shares in

existing portfolio companies.

MAIN FACTS:

-NAV/share dipped to SEK189 on Sept. 30, from SEK231 on June 30,

and slightly above analysts' expectations of SEK187.

-Listed holdings weighed the most on NAV while financial

investments had a more positive effect.

-The company bought SEK1.1 billion worth of shares in existing

holdings ABB Ltd. (ABB), Atlas Copco AB (ATCO-A.SK), Electrolux AB

(ELUX-B.SK), Husqvarna AB (HUSQ-B.SK) and Nasdaq OMX Group

Inc.(NDAQ).

-Net cash flow from EQT totaled SEK1.6 billion and the

contribution to Investor from Investor Growth Capital amounted to

SEK400 million.

-CEO Borje Ekholm said the current market could offer attractive

long-term investment opportunities and that it was important not to

lose sight of growth in Asia and Latin America.

-The company swung to a net loss of SEK31.62 billion from a

profit of SEK4.86 billion a year ago, following substantial value

changes in mainly listed holdings.

-The company said it was re-building a limited trading operation

about one-tenth the size of its old one, closed earlier this

year.

-Shares closed Monday at SEK125.70.

-By Anna Molin, Dow Jones Newswires; +46 8 545 131 03;

anna.molin@dowjones.com

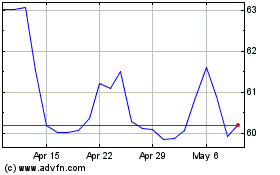

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From May 2024 to Jun 2024

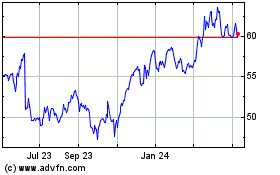

Nasdaq (NASDAQ:NDAQ)

Historical Stock Chart

From Jun 2023 to Jun 2024