SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: May 2024

Commission file number: 001-37600

NANO DIMENSION LTD.

(Translation of registrant’s name into English)

2 Ilan Ramon

Ness Ziona 7403635 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

CONTENTS

Attached hereto and incorporated

herein as Exhibit 99.1 is Nano Dimension Ltd.’s (the “Registrant”) investor

presentation, which was posted on the Registrant’s website on May 13, 2024.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nano Dimension Ltd. |

| |

(Registrant) |

| |

|

|

| Date: May 13, 2024 |

By: |

/s/ Tomer Pinchas |

| |

Name: |

Tomer Pinchas |

| |

Title: |

Chief Financial Officer and Chief Operating Officer |

2

Exhibit

99.1

Nano Dimension Leading Digital Manufacturing into the Future Investor Presentation May 2024

Forward Looking Statements ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 2 This presentation of Nano Dimension Ltd . (the “Company” or “Nano Dimension”) contains “forward - looking statements” within the meaning of the Private Securities Litigation Reform Act and other securities laws . Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and similar expressions or variations of such words are intended to identify forward - looking statements . For example, the Company is using forward - looking statements when it discusses its vision, favorable trends, milestones, pipeline, innovative products and their advantages and benefits, its strategy, size for target markets, expected net cash burn, expected impact of cost reductions, developments driving market penetration and competitive advantage, M&A program and projected growth . Because such statements deal with future events and are based on the Company’s current expectations, they are subject to various risks and uncertainties . Actual results, performance, or achievements of Company’s could differ materially from those described in or implied by the statements in this forward - looking statements are not historical facts, and are based upon management’s current expectations, beliefs and projections, many of which, by their nature, are inherently uncertain . Such expectations, beliefs and projections are expressed in good faith . However, there can be no assurance that management's expectations, beliefs and projections will be achieved, and actual results may differ materially from what is expressed in or indicated by the forward - looking statements . Forward - looking statements are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the forward - looking statements . For a more detailed description of the risks and uncertainties affecting the Company, reference is made to the Company’s reports filed from time to time with the Securities and Exchange Commission (“SEC”), including, but not limited to, the risks detailed in the Company’s annual report for the year ended December 31 , 2023 , filed with the SEC . Forward - looking statements speak only as of the date the statements are made . The Company assumes no obligation to update forward - looking statements to reflect actual results, subsequent events or circumstances, changes in assumptions or changes in other factors affecting forward - looking information except to the extent required by applicable securities laws . If the Company does update one or more forward - looking statements, no inference should be drawn that the Company will make additional updates with respect thereto or with respect to other forward - looking statements .

Our Vision To become the digital manufacturing leader through disruption of electronics & mechanical production by applying environmentally friendly & economically efficient electronics and precision additive manufacturing – resulting in the conversion of digital designs into functioning electronic and mechanical devices – on demand, anytime, anywhere ying Without Permission is Strictly Prohibited. ©2024 Nano Dimension. All Rights Reserved. Distrib ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 3

We Make Advanced Manufacturing Solutions… …that fabricate High - Performance Electrical & Mechanical Applications Multi - Material Additive Manufacturing Systems Robotics Advanced Electronics ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 4 3D Printed Electronics 3D Printed Micro - Polymer 3D Printed Ceramic & Metal

Ushering in a New World Local, Secure, Flexible, and Sustainable All of this Replaced by a few of these ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 5

~$1 billion Cash & Cash Equivalents¹ Investment Highlights Strongly Capitalized with a Multi - Pronged, Synergistic Growth Strategy Multiple R&D Programs Robust GTM Platform Ambitious, Yet Cautious M&A Program Built For Tomorrow’s Challenges Proven Growth Strong Fundamentals Synergistic & Risk Averse Business Development Sustainability Supply Chain Disruptions & Reshoring Custom - made & Precision Manufacturing ~80x Expected Annual Net Cash Burn Rate 2 1. As of December 31 st , 2023; Including cash, cash equivalents, investment in securities and short and long - term unrestricted bank deposits 2. Based on 2023 end - of - year cash, cash equivalents & investment in securities and expected operating loss inclusive of interest earned for FY2024 $3M $56M ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 6 FY20 FY23 155% FY20 – FY23 CAGR Revenue Growth

Strong Secular Tailwinds in High Growth Industries We’re Positioned in a Market With a Compelling Long - Term Opportunity Custom products for many Technology to address environmental impact 23%+ CAGR Favorable Trends Size for Target Markets¹ $110B+ Re - shoring manufacturing IP security 1. IDTechEx - 2022 - 2032 printed electronics; Hubs 3D Printing Trend Report 2023; ResearchAndMarkets 3D Printing Market 2022 - 2030 ~$20B 2023F 2031F ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 7

Innovative Products for True Industry 4.0 Solutions DragonFly Additively Manufactured Electronics Fabrica Micro - AM Admatec Precision - Ceramic and Metal AM Digital Printing Platform Printer control systems and software SMT Suite of Products Surface Mount Technology for Electronics The Critical Pieces to Manufacture High Performance Applications Additive Manufacturing Robotics Conductive and Dielectric Inks Ceramic Metal Polymer Advanced Materials FLIGHT Design - to - Manufacturing, 3D Design, and Print job management DeepCube Deep Learning Based AI Platform Additive Flow Multi - Objective Optimization, and Multi - Physics Simulation Software ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 8

Optical Components Admaflex (AM) PCBA Dispensing, Pick & Place Puma (SMT) Chip Array Socket & Connectors Fabrica 2.0 (Micro AM) Critical Applications for Demanding Technologies Enabling Agile Innovation, Design Freedom, and Weight Reduction ©2 0 2 2 4 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 9 RF Amplifier & System - in - Package DragonFly (AME) Note: Example is illustrative only

Serving Top Customers in Critical Industry Verticals Testimonials Solving Problems in the Most Advanced and Innovative Industries Aerospace/Defense Automotive Electronics & PCB Industrial Medical R&D/Academia “Internal configurations and very complex cores are im - possible to create in the conventional investment casting process. Now that we have the 130 [Admaflex 130] in house, we can do it.” — Jack Ziemba, CEO Aristo - Cast, Inc. “To have high density com - ponents quickly available with reduced effort by means of 3D printing [using AME] gives us a competitive edge in the development process of such high - end electronic systems.” — Thomas Müller, CEO Hensoldt “The DragonFly system enables us to achieve quick results with higher quality performance than traditional manufacturing processes.” — Prof. Massimo De Vittorio CBN - IIT “The ability to manufacture RF systems in - house [using AME] offers an exciting new means for rapid and afford - able prototyping and volume manufacturing.” — Dr. Arthur Paolella Senior Scientist, Space and Intelligence Systems Harris Corporation “Essemtec Spider Dispenser is an extremely efficient high - precision machine. From the first use we could easily double our drops of glue per hour capacity and meet the high - quality requirements of our customers.” — Andrzej Wróblewski Process Engineering Manager LACROIX Electronics “With the DragonFly we will drive forward REHAU’s “Electronics into Polymers” strategy to speed up inhouse electronics development and find new installation spaces and functions for our pro - ducts.” — Dr. Philipp Luchscheider Engineer (3D touch sensor design) REHAU • 10+ Multi $B Defense Manufacturers, Dept./Ministry of Defense, and National Security Agencies Note: Select customers included. Not inclusive of entire customer base ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 10

Driven by Artificial Intelligence Deep Learning - Based AI That Connects Devices Into a Robotic Brain • DeepCube — Nano Dimension’s AI platform • Deep learning - based AI that pushes self - improving capabilities across the product portfolio for: – Better design – Improved yield – Higher throughput DeepCube Deep Learning Based AI Platform ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 11

Leadership in Sustainability Traditional Manufacturing vs. Sustainable AM Solutions¹ Before After ¹ CO 2 (kg/iteration) 94% Less Chemicals (L/iteration) 82% Less Materials (kg/iteration) 98% Less Waste (kg/iteration) 99% Less Water (L/iteration) 100% Less 1. Based on a 2021 study by HSSMI, a UK based sustainability consultant ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 12

2023 - A Year of Innovation Industrial AI from the DeepCube Group ▪ Implementation into DragonFly ® IV ▪ Commercialization of industrial AI for 3 rd parties ▪ Patent filing for large language model analysis of data generated by industrial machines Developments Driving Market Penetration and Competitive Advantage AI - DeepCube Fabrica GIGA series Flight Hub AdditiveFlow Materials, systems, and software ▪ INSU 200 - a breakthrough dielectric material for AME ▪ Fabrica GIGA series – a new Micro - AM system ▪ Admaflex 130 Entry – a new ceramic and metal system ▪ Flight Hub – Improved software AME design to manufacturing capabilities ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 13

Financial Strength Only Increasing Our Sales and Margins Position Us to Deliver to the Bottom Line $10M $44M $56M $0M $20M $40M $60M 2021 2022 2023 Revenue 11% ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 14 32% 45% 0% 20% 40% 60% 2021 2022 2023 Gross Margin ▪ 132% CAGR since 2021 ▪ 29% organic growth from 2022 to 2023 ▪ 34% margin expansion in absolute terms since 2021 ▪ Margin turnaround reflects increased sales of high margin systems and materials

Nano’s Growth Outpaces Peers Revenue Increase Despite Challenges Endured by Comparable Companies Revenue Growth for 2023 vs. 2022 ¹ 1. 2023 vs. 2022 YoY Revenue Increase % / Decrease % ([DDD, DM, MKFG, SSYS] filings and/or preliminary announcements) 2. Peer Group Avg. includes the overall average, non - weighted YoY revenue Increase % / Decrease % (9%) (9%) (7%) (3%) (7%) 29.0% (10%) 0% 10% 20% 30% Peer Group Avg. 2 ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 15

Constantly Focused on Shareholder Value & Governance Reshaping ▪ Reduced $25M - 30M in annual costs; to begin reflecting in Q1/2024 ▪ 2024 cash burn expected to be $12M - $20M; based on Q1/2024 expected run rate ($150 M) ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 16 ($100 M) ($50 M) $0 2022A Net cash burn¹ 2023A 2024F 1. Change in cash and non - restricted deposits net of capital allocation for share repurchase plan Refreshing ▪ Fresh perspective with 4 - Star General (Ret . ) Michael X . Garrett and Major General (Ret . ) Eitan Ben - Eliahu recently joining the Board of Directors o Four directors stepped down and board size reduced to 7 directors Repurchasing ▪ $96M worth of shares repurchased via 1 st buy - back program o Up to $200M 2 nd program is underway Evolving Our Organization, Board, and Capital Allocation

2Q21 4Q21 1Q22 3Q22 3Q23 Building a Digital Manufacturing Platform A Robust M&A Strategy to Be a Market Leader Acq. July ’22 Precision - Additive Manufacturing Systems for Multi - Materials Acq. April ’21 Micro - Additive Manufacturing Systems Acq. November ’21 Robotics for Electronics Assembly Acq. April ’21 Deep Learning - Based AI Acq. Jan ’22 Printing Sub - System Hardware and Software Nano Dimension’s M&A 12.1 % Stake Acq. July ’22 Multi - product / - material Acq. July ’22 Precision Industrial Manufacturer Acq. August ’23 Advanced Digital Solutions for Additive Manufacturing Design and Optimization ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 17

• Raised $ 1 . 5 billion • Demonstrated strong confidence in Nano’s leadership • Capital reserves provided “firepower” for building the business • Expanded from AME into additive electronics and AM • Built GTM platform • Strengthened and leveraged R&D capabilities • Integrated acquisitions and identified technology gaps • Explore transformational acquisition to multiply platform potential • Focus on Industry 4.0 with scaled businesses • Targeting: o Significant revenue o Strong GTM o Established customer base 2020 - 2021 2021 - 2023 2024 ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 18 Phase 2 of Nano’s M&A Program Our Strong Capital Base Enables Us to Lead M&A Phase 1: Capital Raise Building a digital manufacturing platform M&A Phase 2 : Scaling the platform

The Organization to Deliver Human Capital in Close Proximity to Advanced Manufacturing Hubs Israel U.S. Netherlands Germany UK Switzerland • ~450 employees across the globe • ~43% in R&D & application support • ~7% data scientists & algorithm engineers dedicated to AI development ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 19

The People to Do It Experience in the Highest Positions Yoav Stern Chairman & CEO Veteran CEO x5 Nick Geddes Senior CTO Veteran CEO & Founder Zivi Nedivi President Veteran CEO x5 & Founder x2 Neni Rubin VP Human Resources Fortune 500 HR Executive Ziki Peled President, EMEA Veteran CEO x4 Dale Baker President, Americas Veteran CEO x3 & Founder Dr. Eli David CTO Deep Learning Leading AI Expert Tomer Pinchas CFO & COO Veteran CFO & Big Four Executive ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 20 Nir Sade Senior VP Product Veteran 3D Product & R&D Executive Dotan Bar - Natan General Counsel Veteran Public Markets General Counsel

~$1 billion Cash & Cash Equivalents¹ Investment Highlights Strongly Capitalized with a Multi - Pronged, Synergistic Growth Strategy Multiple R&D Programs Robust GTM Platform Ambitious, Yet Cautious M&A Program Built For Tomorrow’s Challenges Proven Growth Strong Fundamentals Synergistic & Risk Averse Business Development Sustainability Supply Chain Disruptions & Reshoring Custom - made & Precision Manufacturing ~80x Expected Annual Net Cash Burn Rate 2 1. As of December 31 st , 2023; Including cash, cash equivalents, investment in securities and short and long - term unrestricted bank deposits 2. Based on 2023 end - of - year cash, cash equivalents & investment in securities and expected operating loss inclusive of interest earned for FY2024 $3M $56M ©2024 Nano Dimension. All Rights Reserved. Distribution, Citation or Copying Without Permission is Strictly Prohibited. 21 FY20 FY23 155% FY20 – FY23 CAGR Revenue Growth

Thank You

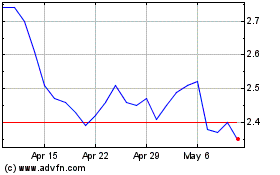

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From Apr 2024 to May 2024

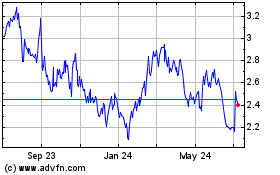

Nano Dimension (NASDAQ:NNDM)

Historical Stock Chart

From May 2023 to May 2024