false12-3100015762633545 CRAY COURTNASDAQ00015762632024-01-232024-01-23

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 23, 2024

MIRATI THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-35921

|

46-2693615

|

|

(State of incorporation)

|

(Commission File No.)

|

(IRS Employer Identification No.)

|

3545 Cray Court, San Diego, California 92121

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (858) 332-3410

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule

14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol

|

Name of Each Exchange on Which Registered

|

|

Common Stock

|

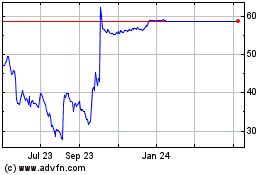

MRTX

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously reported in the Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on October 10, 2023,

Mirati Therapeutics, Inc., a Delaware corporation (the “Company”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), dated October 8,

2023, with Bristol-Myers Squibb Company, a Delaware corporation (“BMS”), and Vineyard Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of BMS (“Merger Sub”), providing for the merger of Merger Sub with and into the Company (the “Merger”), with the Company surviving the Merger as a wholly owned subsidiary of BMS. All capitalized terms used herein and not otherwise defined

have the meanings given to such terms in the Merger Agreement.

On January 23, 2024 (the “Closing Date”), Merger Sub completed its Merger with and into the Company, pursuant to the terms of the Merger Agreement. Mirati was

the surviving corporation in the Merger (the “Surviving Corporation”) and, as a result, is now a wholly owned subsidiary of BMS.

At the effective time of the Merger (the “Effective Time”), each share of common stock, par value $0.001 per share, of the Company (“Company

common stock”) issued and outstanding immediately prior to the Effective Time (other than Excluded Shares and any Dissenting Shares) was automatically converted into the right to receive (i) cash in an amount equal to $58.00, without interest and

subject to any applicable tax withholding (the “Closing Consideration”) and (ii) one contingent value right (a “CVR”) representing the right to receive $12.00 in cash, without interest and subject to any applicable tax withholding (the “Milestone

Payment”), if a specified milestone is achieved, pursuant to the CVR Agreement (as defined and further described below) (the consideration contemplated by (i) and (ii), together, the “Merger Consideration”).

Pursuant to the Merger Agreement, at the Effective Time:

|

• |

Each option to acquire shares of Company common stock (each, a “Company Option”) then outstanding and unexercised, whether or not vested, which had a per share exercise

price less than the Closing Consideration (each, an “In the Money Option”) was cancelled and converted into the right to receive the sum of (A) a cash payment, without interest, equal to (x) the excess of (1) the Closing Consideration over

(2) the per share exercise price of such In the Money Option, multiplied by (y) the total number of shares of Company common stock subject to such In the Money Option immediately prior to the Effective Time (without regard to vesting) plus

(B) one CVR for each share of Company common stock subject to such In the Money Option immediately prior to the Effective Time (without regard to vesting).

|

|

• |

Each then outstanding and unexercised Company Option, whether or not vested, which had a per share exercise price that equals or exceeds the Closing Consideration, but

is less than the sum of the Closing Consideration and the maximum amount payable with respect to one CVR (each, an “Eligible Option”) was cancelled and converted into the right to receive a cash payment equal to (A) the amount by which (x)

the sum of the Closing Consideration and the Milestone Payment with respect to one CVR, if any, exceeds (y) the per share exercise price of such Eligible Option, multiplied by (B) the total number of shares of Company common stock subject to

such Eligible Option immediately prior to the Effective Time (without regard to vesting). Such payment will be made if, and only if, a

Milestone Payment is made in respect of a CVR and will be made at the same time the Milestone Payment is made to holders of CVRs. If the CVR

is terminated or expires without payment, no payment will be made with respect to any Eligible Option.

|

|

• |

Each then outstanding and unexercised Company Option that is not an In the Money Option or an Eligible Option, whether or not vested, was cancelled for no

consideration.

|

|

• |

Each then outstanding restricted stock unit with respect to shares of Company common stock (each, a “Company RSU”), other than the 2024 Awards (as defined and further

described below) and performance-vesting Company RSUs that did not vest in connection with the Merger in accordance with their terms, was cancelled and the holder thereof became entitled to receive the Merger Consideration in respect of each

such Company RSU. Each performance-vesting Company RSU that did not vest in connection with the Merger in accordance with its terms was cancelled and forfeited for no consideration.

|

|

• |

Each award of time-based vesting Company RSUs granted to certain employees of the Company on or after December 29, 2023 (each, a “2024 Award”) that was outstanding as

of immediately prior to the Effective Time was cancelled and converted into the right to receive a cash award equal to the product of the number of

Company RSUs subject to such 2024 Award immediately prior to the Effective Time and the last trading price of a share of Company common stock before the Effective Time as reported by Nasdaq (each, a “Converted Cash Award”). Each Converted

Cash Award is subject to the same terms and conditions (including vesting) applicable to such 2024 Award to which it relates. No 2024 Awards are eligible to receive any CVRs.

|

|

• |

By virtue of the Merger, each then unexpired and unexercised issued and outstanding warrant to purchase shares of Company common stock issued by or on behalf of the

Company (each, a “Company Warrant”) that was outstanding as of immediately prior to the Effective Time was converted into the right to receive, upon exercise of such Company Warrant, the same Merger Consideration as the holder would have been

entitled to receive following the Effective Time if such holder had been, immediately prior to the Effective Time, the holder of the number of shares of Company common stock then issuable upon exercise in full of such Company Warrant without

regard to any limitations on exercise contained therein.

|

The foregoing description of the Merger Agreement is not complete and is qualified in its entirety by reference to the full text of Merger Agreement, a copy

of which is attached as Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 10, 2023 and incorporated herein by reference.

Item 1.02. Termination of a Material Definitive Agreement.

Effective as of the close of business on the day immediately preceding the Closing Date, the Company terminated the Mirati Therapeutics, Inc. 401(k) Plan. At

the Effective Time, the Company also terminated the 2022 Equity Incentive Plan, the Inducement Plan and the 2013 Employee Stock Purchase Plan.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The disclosures under the Introductory Note, Item 3.01, Item 5.01 and Item 8.01are incorporated herein by reference.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

The disclosures under the Introductory Note are incorporated herein by reference.

On January 23, 2024, the Company (i) notified the Nasdaq Stock Market LLC (“Nasdaq”) of the consummation of the Merger and its intent to remove all shares of Company common stock from The Nasdaq Global

Select Market and (ii) requested that Nasdaq (A) suspend trading of the shares of Company common stock effective before the opening of trading on January 23, 2024, and (B) file with the SEC a Form 25 Notification of Removal from Listing and/or

Registration to delist and deregister the shares of Company common stock under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). As a result, shares of Company common stock will no longer be listed on The Nasdaq Global Select Market following the close of trading on

January 23, 2024. The Company intends to file with the SEC a Certification and Notice of Termination of Registration on Form 15 under the Exchange Act, requesting the termination of registration of the Company common stock under Section 12(g) of the

Exchange Act and the suspension of the Company’s reporting obligations under Sections 13 and 15(d) of the Exchange Act.

Item 3.03 Material Modification to Rights of Security Holders.

The disclosures under the Introductory Note, Item 3.01, Item 5.01, Item 5.03 and Item 8.01 are incorporated herein by reference.

Item 5.01 Changes in Control of Registrant.

The disclosures under the Introductory Note, Item 3.01, Item 5.02 and Item 5.03 are incorporated herein by reference.

As a result of the consummation of the Merger, there was a change in control of the Company, and BMS, as the direct parent of Merger Sub, acquired control of

the Company. The aggregate purchase price paid by BMS in the acquisition of the Company was approximately $4.8 billion in equity value, which was fully funded by BMS through a combination of cash on hand and debt proceeds.

To the knowledge of the Company, there are no arrangements which may at a subsequent date result in a further change in control of the Company.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

In connection with the consummation of the Merger and as contemplated by the Merger Agreement, as of the Effective Time, each of the directors of the Company

(Faheem Hasnain; Charles Baum, M.D., Ph.D.; Bruce Carter, Ph.D.; Julie Cherrington, Ph.D.; Aaron Davis; Carol Gallagher, Pharm.D.; Craig Johnson; Maya Martinez-Davis; and Shalini Sharp) resigned and ceased to be directors of the Company and members

of any committee of the Company’s board of directors. These resignations were not a result of any disagreement between the Company and the directors on any matter relating to the Company’s operations, policies or practices.

As of the Effective Time, the directors of Merger Sub immediately prior to the Effective Time became the directors of the Surviving Corporation. The directors

of Merger Sub immediately prior to the Effective Time were Konstantina Katcheves, Sandra Ramos-Alves, and Kimberly M. Jablonski.

Immediately following the Effective Time, all executive officers of the Company immediately prior to the Effective Time were removed from their respective

positions as the executive officers of the Surviving Corporation. Concurrently with such officers’ removal, Sandra Ramos-Alves was appointed to serve as President and Treasurer of the Company, Sophia Park was appointed to serve as a Vice President of

the Company, Scott Matarese was appointed to serve as a Vice President of the Company and Kimberly M. Jablonski was appointed to serve as a Vice President and Secretary of the Company.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change of Fiscal Year.

Pursuant to the terms of the Merger Agreement, as of the

Effective Time, the Company’s certificate of incorporation, as in effect immediately prior to the Effective Time, was amended and restated in its entirety (the “Amended and Restated Certificate of Incorporation”). In addition, pursuant to the terms

of the Merger Agreement, as of the Effective Time, the Company’s bylaws, as in effect immediately prior to the Effective Time, were amended and restated in their entirety (the “Amended and Restated Bylaws”) to conform to the bylaws of Merger Sub as

in effect immediately prior to the Effective Time.

Copies of the Amended and Restated Certificate of

Incorporation and the Amended and Restated Bylaws are filed as Exhibits 3.1 and 3.2, respectively, to this Current Report on Form 8-K, and are incorporated herein by reference.

Item 8.01 Other Events.

At or immediately prior to the Effective Time, in connection with the Merger, BMS and Equiniti Trust Company, LLC, as rights agent, entered into a Contingent

Value Rights Agreement (the “CVR Agreement”) governing the terms of the CVRs. The CVRs are contractual rights only and are not transferable except under certain limited circumstances, are not evidenced by a certificate or other instrument and are not

(and will not be) registered with the SEC or listed for trading. The CVRs do not have any voting or dividend rights and will not represent any equity or ownership interest in BMS, any constituent corporation party to the Merger Agreement or any of

their respective affiliates or subsidiaries.

Each CVR represents a non-tradeable contractual contingent right to receive the Milestone Payment, upon (i) the submission of a New Drug Application (as

defined in the CVR Agreement) to the Food and Drug Administration (the “FDA”) for the approval of MRTX1719 for the treatment of either locally advanced or metastatic non-small cell lung cancer that is indicated for use in patients who have received

no more than two prior lines of systemic therapy (i.e., indicated for use in the first, second and/or third line settings) and (ii) the FDA’s confirmation of acceptance of the filing of such New Drug Application ((i) and (ii), together, the “CVR

Product Milestone”), in each case, prior to January 23, 2031 (the “CVR Product Milestone Achievement Outside Date”).

There can be no assurance that the CVR Product Milestone will be achieved by the CVR Product Milestone Achievement Outside Date or that BMS will be required

to make the Milestone Payment to holders of CVRs.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

|

Description

|

| |

|

|

|

|

|

Agreement and Plan of Merger, dated October 8, 2023, by and among Bristol-Myers Squibb Company, Vineyard Merger Sub Inc., and Mirati Therapeutics,

Inc. (incorporated by reference to Exhibit 2.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 10, 2023).*

|

| |

|

|

|

|

|

Amended and Restated Certificate of Incorporation of Mirati Therapeutics, Inc., dated January 23, 2024.

|

| |

|

|

|

|

|

Amended and Restated Bylaws of Mirati Therapeutics, Inc., dated January 23, 2024.

|

| |

|

|

|

|

|

Contingent Value Rights Agreement, dated January 23, 2024, by and between BMS and Equiniti Trust Company, LLC.

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

|

*

|

Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes to furnish supplemental copies of any of the omitted schedules upon request by the U.S. Securities and Exchange Commission;

provided, that the Company may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any schedules so furnished.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

MIRATI THERAPEUTICS, INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Kimberly M. Jablonski

|

|

| |

Name:

|

Kimberly M. Jablonski

|

|

| |

Title:

|

Vice President and Secretary

|

|

| |

|

|

|

Dated: January 23, 2024

Exhibit 3.1

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF MIRATI THERAPEUTICS, INC.

ARTICLE ONE

The name of the corporation is Mirati Therapeutics, Inc. (hereinafter called the “Corporation”).

ARTICLE TWO

The address of the Corporation’s registered office in the State of Delaware is 1209 Orange Street, Wilmington, County of New Castle, 19801. The

name of its registered agent at that address is The Corporation Trust Company.

ARTICLE THREE

The purpose of the Corporation is to engage in any lawful act or activity for which corporations may be organized under the General Corporation

Law of Delaware.

ARTICLE FOUR

The total number of shares which the Corporation shall have the authority to issue is One Thousand (1,000) shares, all of which shall be shares of

Common Stock, with a par value of $0.01 per share.

ARTICLE FIVE

The directors shall have the power to adopt, amend or repeal By-Laws, except as may be otherwise be provided in the By-Laws.

ARTICLE SIX

The Corporation expressly elects not to be governed by Section 203 of the General Corporation Law of the State of Delaware.

ARTICLE SEVEN

Subject to the provisions of the General Corporation Law of the State of Delaware, no director of the Corporation shall be personally liable to

the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, subsequent to the adoption of this ARTICLE SEVEN, except to the extent that such liability arises (i) from a breach of the director’s duty of loyalty

to the corporation or its stockholders, (ii) as a result of acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 of the Delaware General Corporation Law relating to the

unlawful payment of dividends or unlawful stock purchase or redemption or (iv) any transaction from which the director derived an improper personal benefit. Neither the amendment nor repeal of this ARTICLE SEVEN, nor the adoption of any provision of

the Certificate of Incorporation, the Bylaws or of any statute inconsistent with this ARTICLE SEVEN, shall eliminate or reduce the effect of this ARTICLE SEVEN, in respect of any acts or omissions occurring prior to such amendment, repeal or adoption

of an inconsistent provision.

Exhibit 3.1

To the fullest extent permitted by applicable law, the Corporation is authorized to provide indemnification of (and advance expense to) directors

and officers of the Corporation through Bylaws provisions, agreements with such persons, a vote of stockholders or disinterested directors or otherwise in excess of the indemnification and advancement otherwise permitted by such applicable law. If

applicable law is amended after approval by the stockholders of this ARTICLE SEVEN to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director to the Corporation shall be

eliminated or limited to the fullest extent permitted by applicable law as so amended.

Any repeal or modification of this ARTICLE SEVEN shall only be prospective and shall not affect the rights or protections or increase the

liability of any director under this ARTICLE SEVEN in effect at the time of the alleged occurrence of any act or omission to act giving rise to liability or indemnification.

ARTICLE EIGHT

The Corporation reserves the right to amend or repeal any provisions contained in this Second Amended and Restated Certificate of Incorporation

from time to time and at any time in the manner now or hereafter prescribed by the laws of the State of Delaware, and all rights conferred upon stockholders and directors are granted subject to such reservation.

2

Exhibit 3.2

AMENDED AND RESTATED

BYLAWS

OF

MIRATI THERAPEUTICS, INC.

A Delaware Corporation

ARTICLE I

OFFICES

Section 1.1

Registered Office.

The registered office of the corporation in the State of Delaware shall be located at 251 Little Falls Drive, Wilmington, Delaware 19808, in the County of New Castle. The name of the corporation’s registered agent at such address shall be Corporation

Service Company. The registered office and/or registered agent of the corporation may be changed from time to time by action of the board of directors.

Section 1.2

Other Offices.

The corporation may also have offices at such other places, both within and without the State of Delaware, as the board of directors may from time to time determine or the business of the corporation may require.

ARTICLE II

MEETINGS OF STOCKHOLDERS

Section 2.1

Place and Time of

Meetings. An annual meeting of the stockholders shall be held each year for the purpose of electing directors and conducting such other proper business as may come before the meeting. The date, time and place of the annual meeting

may be determined by resolution of the board of directors or as set by the chief executive officer of the corporation.

Section 2.2

Special Meetings.

Special meetings of stockholders may be called for any purpose (including, without limitation, the filling of board vacancies and newly created directorships), and may be held at such time and place, within or without the State of Delaware, as

shall be stated in a notice of meeting or in a duly executed waiver of notice thereof. Such meetings may be called at any time by two or more members of the board of directors or the chief executive officer and shall be called by the chief

executive officer upon the written request of holders of shares entitled to cast not less than fifty percent (50%) of the outstanding shares of any series or class of the corporation’s capital stock.

Section 2.3

Place of Meetings.

The board of directors may designate any place, either within or without the State of Delaware, as the place of meeting for any annual meeting or for any special meeting called by the board of directors. If no designation is made, or if a special

meeting be otherwise called, the place of meeting shall be the principal executive office of the corporation.

Section 2.4

Notice.

Whenever stockholders are required or permitted to take action at a meeting, written or printed notice stating the place, date, time, and, in the case of special meetings, the purpose or purposes, of such meeting, shall be given to each stockholder

entitled to vote at such meeting not less than 10 nor more than 60 days before the date of the meeting. All such notices shall be delivered, either personally or by mail, by or at the direction of the board of directors, the chief executive officer

or the secretary, and if mailed, such notice shall be deemed to be delivered when deposited in the United States mail, postage prepaid, addressed to the stockholder at his, her or its address as the same appears on the records of the corporation.

Attendance of a person at a meeting shall constitute a waiver of notice of such meeting, except when the person attends for the express purpose of objecting at the beginning of the meeting to the transaction of any business because the meeting is

not lawfully called or convened.

Section 2.5

Stockholders List.

The officer having charge of the stock ledger of the corporation shall make, at least 10 days before every meeting of the stockholders, a complete list of the stockholders entitled to vote at such meeting arranged in alphabetical order, showing the

address of each stockholder and the number of shares registered in the name of each stockholder. Such list shall be open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, for a period of

at least 10 days prior to the meeting, either at a place within the city where the meeting is to be held, which place shall be specified in the notice of the meeting or, if not so specified, at the place where the meeting is to be held. The list

shall also be produced and kept at the time and place of the meeting during the whole time thereof, and may be inspected by any stockholder who is present.

Section 2.6

Quorum.

Except as otherwise provided by applicable law or by the certificate of incorporation of the corporation (as may be amended from time to time, the “Certificate of Incorporation”), a majority of the outstanding shares of the corporation entitled to

vote, represented in person or by proxy, shall constitute a quorum at a meeting of stockholders. If less than a majority of the outstanding shares are represented at a meeting, a majority of the shares so represented may adjourn the meeting from

time to time in accordance with Section 7 of this Article Two, until a quorum shall be present or represented.

Section 2.7

Adjourned Meetings.

When a meeting is adjourned to another time and place, notice need not be given of the adjourned meeting if the time and place thereof are announced at the meeting at which the adjournment is taken. At the adjourned meeting the corporation may

transact any business which might have been transacted at the original meeting. If the adjournment is for more than thirty days, or if after the adjournment a new record date is fixed for the adjourned meeting, a notice of the adjourned meeting

shall be given to each stockholder of record entitled to vote at the meeting.

Section 2.8

Vote Required.

When a quorum is present, the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on the subject matter shall be the act of the stockholders, unless the question is one upon which

by express provisions of an applicable law or of the Certificate of Incorporation a different vote is required, in which case such express provision shall govern and control the decision of such question. Where a separate vote by class is required,

the affirmative vote of the majority of shares of such class present in person or represented by proxy at the meeting shall be the act of such class.

Section 2.9

Voting Rights.

Except as otherwise provided by the General Corporation Law of the State of Delaware or by the Certificate of Incorporation or any amendments thereto and subject to Section 4 of Article VI, every stockholder shall at every meeting of the

stockholders be entitled to one vote in person or by proxy for each share of common stock held by such stockholder.

Section 2.10 Proxies. Each stockholder entitled to vote at a meeting of stockholders or to express consent or dissent to corporate action in writing without a meeting may

authorize another person or persons to act for him, her or it by proxy. Every proxy must be signed by the stockholder granting the proxy or by his, her or its attorney-in-fact. No proxy shall be voted or acted upon after three years from its date,

unless the proxy provides for a longer period. A duly executed proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A proxy may

be made irrevocable regardless of whether the interest with which it is coupled is an interest in the stock itself or an interest in the corporation generally.

Section 2.11

Action by Written

Consent. Unless otherwise provided in the Certificate of Incorporation, any action required to be taken at any annual or special meeting of stockholders of the corporation, or any action which may be taken at any annual or special

meeting of such stockholders, may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action so taken and bearing the dates of signature of the stockholders who signed the

consent or consents, shall be signed by the holders of outstanding stock having not less than a majority of the shares entitled to vote, or, if greater, not less than the minimum number of votes that would be necessary to authorize or take such

action at a meeting at which all shares entitled to vote thereon were present and voted and shall be delivered to the corporation by delivery to its registered office in the State of Delaware, or the corporation’s principal place of business, or an

officer or agent of the corporation having custody of the book or books in which proceedings of meetings of the stockholders are recorded. Delivery made to the corporation’s registered office shall be by hand or by certified or registered mail,

return receipt requested provided, however, that no consent or consents delivered by certified or registered mail shall be deemed delivered until such consent or consents are actually received at the registered office. All consents properly

delivered in accordance with this section shall be deemed to be recorded when so delivered. No written consent shall be effective to take the corporate action referred to therein unless, within sixty days of the earliest dated consent delivered to

the corporation as required by this section, written consents signed by the holders of a sufficient number of shares to take such corporate action are so recorded. Prompt notice of the taking of the corporate action without a meeting by less than

unanimous written consent shall be given to those stockholders who have not consented in writing. Any action taken pursuant to such written consent or consents of the stockholders shall have the same force and effect as if taken by the stockholders

at a meeting thereof.

ARTICLE III

DIRECTORS

Section 3.1

General Powers.

The business and affairs of the corporation shall be managed by or under the direction of the board of directors.

Section 3.2

Number, Election

and Term of Office. The initial number of directors which shall constitute the board as of the effective date of these Bylaws shall be THREE (3). Thereafter, the number of directors may be increased or decreased from time to time by

resolution of the board (subject to a required minimum of TWO (2) directors on the board at any given time). The directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and

entitled to vote in the election of directors. The directors shall be elected in this manner at the annual meeting of the stockholders, except as provided in Section 4 of this Article III. Each director elected shall hold office until a successor

is duly elected and qualified or until his or her earlier death, resignation or removal as hereinafter provided.

Section 3.3

Removal and

Resignation. Any director or the entire board of directors may be removed at any time, with or without cause, by the holders of a majority of the shares then entitled to vote at an election of directors. Whenever the holders of any

class or series are entitled to elect one or more directors by the provisions of the Certificate of Incorporation, the provisions of this section shall apply, in respect of the removal without cause of a director or directors so elected, to the

vote of the holders of the outstanding shares of that class or series and not to the vote of the outstanding shares as a whole. Any director may resign at any time upon written notice to the corporation.

Section 3.4

Vacancies.

Except as otherwise provided by the Certificate of Incorporation or any amendments thereto, vacancies and newly created directorships resulting from any increase in the authorized number of directors may be filled by a majority vote of the holders

of the corporation’s outstanding stock entitled to vote thereon or by a majority of the members of the board of directors. Each director so chosen shall hold office until a successor is duly elected and qualified or until his or her earlier death,

resignation or removal as herein provided.

Section 3.5

Annual Meetings.

The annual meeting of each newly elected board of directors shall be held, without other notice than this by-law, immediately after, and at the same place as, the annual meeting of stockholders.

Section 3.6

Other Meetings and

Notice. Regular meetings, other than the annual meeting, of the board of directors may be held without notice at such time and at such place as shall from time to time be determined by resolution of the board. Special meetings of the

board of directors may be called by or at the request of the chief executive officer or president on at least 24 hours’ notice to each director, either personally, by telephone, by mail, or by telegraph; the chief executive officer must call, in

like manner and on like notice, a special meeting at the written request of at least a majority of the directors.

Section 3.7

Quorum, Required

Vote and Adjournment. A majority of the total number of directors then in office (without regard to any then vacancies on the board) shall constitute a quorum for the transaction of business. The vote of a majority of directors

present at a meeting at which a quorum is present shall be the act of the board of directors. If a quorum shall not be present at any meeting of the board of directors, the directors present thereat may adjourn the meeting from time to time,

without notice other than announcement at the meeting, until a quorum shall be present.

Section 3.8

Committees.

The board of directors may, by resolution passed by a majority of the whole board, designate one or more committees, each committee to consist of one or more of the directors of the corporation, which, to the extent provided in such resolution or

these Bylaws shall have and may exercise the powers of the board of directors in the management and affairs of the corporation except as otherwise limited by law. The board of directors may designate one or more directors as alternate members of

any committee, who may replace any absent or disqualified member at any meeting of the committee. Such committee or committees shall have such name or names as may be determined from time to time by resolution adopted by the board of directors.

Each committee shall keep regular minutes of its meetings and report the same to the board of directors when required.

Section 3.9

Committee Rules.

Each committee of the board of directors may fix its own rules of procedure and shall hold its meetings as provided by such rules, except as may otherwise be provided by a resolution of the board of directors designating such committee. Unless

otherwise provided in such a resolution, the presence of at least a majority of the members of the committee shall be necessary to constitute a quorum. In the event that a member and that member’s alternate, if alternates are designated by the

board of directors as provided in Section 8 of this Article III, of such committee is or are absent or disqualified, the member or members thereof present at any meeting and not disqualified from voting, whether or not such member or members

constitute a quorum, may unanimously appoint another member of the board of directors to act at the meeting in place of any such absent or disqualified member.

Section 3.10

Communications

Equipment. Members of the board of directors or any committee thereof may participate in and act at any meeting of such board or committee through the use of a conference telephone or other communications equipment by means of which

all persons participating in the meeting can hear each other, and participation in the meeting pursuant to this section shall constitute presence in person at the meeting.

Section 3.11

Waiver of Notice

and Presumption of Assent. Any member of the board of directors or any committee thereof who is present at a meeting shall be conclusively presumed to have waived notice of such meeting except when such member attends for the express

purpose of objecting at the beginning of the meeting to the transaction of any business because the meeting is not lawfully called or convened. Such member shall be conclusively presumed to have assented to any action taken unless his or her

dissent shall be entered in the minutes of the meeting or unless his or her written dissent to such action shall be filed with the person acting as the secretary of the meeting before the adjournment thereof or shall be forwarded by registered mail

to the secretary of the corporation immediately after the adjournment of the meeting. Such right to dissent shall not apply to any member who voted in favor of such action.

Section 3.12

Action by Written

Consent. Unless otherwise restricted by the Certificate of Incorporation, any action required or permitted to be taken at any meeting of the board of directors, or of any committee thereof, may be taken without a meeting if all the

then members of the board or committee, as the case may be, consent thereto in writing, and the writing or writings are filed with the minutes of proceedings of the board or committee.

ARTICLE IV

OFFICERS

Section 4.1

Number.

The officers of the corporation shall be elected by the board of directors and may consist of a chairman, a chief executive officer, a president, one or more vice presidents, a secretary, a treasurer, and such other officers and assistant officers

as may be deemed necessary or desirable by the board of directors. Any number of offices may be held by the same person. In its discretion, the board of directors may choose not to fill any office for any period as it may deem advisable.

Section 4.2

Election and Term

of Office. The officers of the corporation shall be elected annually by the board of directors at its first meeting held after each annual meeting of stockholders or as soon thereafter as conveniently may be. Vacancies may be filled

or new offices created and filled at any meeting of the board of directors. Each officer shall hold office until a successor is duly elected and qualified or until his or her earlier death, resignation or removal as hereinafter provided.

Section 4.3

Removal.

Any officer or agent elected by the board of directors may be removed by the board of directors whenever in its judgment the best interests of the corporation would be served thereby, but such removal shall be without prejudice to the contract

rights, if any, of the person so removed.

Section 4.4

Vacancies.

Any vacancy occurring in any office because of death, resignation, removal, disqualification or otherwise, may be filled by the board of directors for the unexpired portion of the term by the board of directors then in office.

Section 4.5

Compensation.

Compensation of all officers shall be fixed by the board of directors, and no officer shall be prevented from receiving such compensation by virtue of his or her also being a director of the corporation.

Section 4.6

The Chairman of

the Board. The Chairman of the Board, if one shall have been elected, shall be a member of the board of directors, may be an officer of the corporation, and, if present, shall preside at each meeting of the board of directors or

stockholders. He shall advise the chief executive officer and, in the chief executive officer’s absence, the other officers of the corporation, and shall perform such other duties as may from time to time be assigned to him by the board of

directors.

Section 4.7

The Chief

Executive Officer. In the absence of the Chairman of the Board or if a Chairman of the Board shall have not been elected, the chief executive officer shall (i) preside at all meetings of the stockholders and board of directors at

which he or she is present, (ii) subject to the powers of the board of directors, have general charge of the business, affairs and property of the corporation, and control over its officers, agents and employees, and (iii) see that all orders and

resolutions of the board of directors are carried into effect. The chief executive officer shall have such other powers and perform such other duties as may be prescribed by the board of directors or as may be provided in these Bylaws.

Section 4.8

President; Vice

Presidents. The president shall, in the absence or disability of the chief executive officer, act with all of the powers and be subject to all of the restrictions of the chief executive officer. The president shall also perform such

other duties and have such other powers as the board of directors, the chief executive officer or these Bylaws may, from time to time, prescribe. The vice-president, if any, or if there shall be more than one, the vice-presidents in the order

determined by the board of directors shall, in the absence or disability of the president, act with all of the powers and be subject to all the restrictions of the president. The vice-presidents shall also perform such other duties and have such

other powers as the board of directors, the president or these Bylaws may, from time to time, prescribe.

Section 4.9

The Secretary and

Assistant Secretaries. The secretary shall attend all meetings of the board of directors, all meetings of the committees thereof and all meetings of the stockholders and record all the proceedings of the meetings in a book or books

to be kept for that purpose. Under the chief executive officer’s supervision, the secretary shall (i) give, or cause to be given, all notices required to be given by these Bylaws or by law, (ii) have such powers and perform such duties as the board

of directors, the chief executive officer or these Bylaws may, from time to time, prescribe, and (iii) have custody of the corporate seal of the corporation. The secretary, or an assistant secretary, shall have authority to affix the corporate seal

to any instrument requiring it and when so affixed, it may be attested by his or her signature or by the signature of such assistant secretary. The board of directors may give general authority to any other officer to affix the seal of the

corporation and to attest the affixing by his or her signature. The assistant secretary, or if there be more than one, the assistant secretaries in the order determined by the board of directors, shall, in the absence or disability of the

secretary, perform the duties and exercise the powers of the secretary and shall perform such other duties and have such other powers as the board of directors, the chief executive officer, or secretary may, from time to time, prescribe.

Section 4.10

The Treasurer and

Assistant Treasurer. The treasurer shall (i) have the custody of the corporate funds and securities, (ii) keep full and accurate accounts of receipts and disbursements in books belonging to the corporation, (iii) deposit all monies

and other valuable effects in the name and to the credit of the corporation as may be ordered by the board of directors, cause the funds of the corporation to be disbursed when such disbursements have been duly authorized, taking proper vouchers

for such disbursements, (v) render to the chief executive officer and the board of directors, at its regular meeting or when the board of directors so requires, an account of the corporation, and (vi) have such powers and perform such duties as the

board of directors, the chief executive officer or these Bylaws may, from time to time, prescribe. If required by the board of directors, the treasurer shall give the corporation a bond (which shall be rendered every six years) in such sums and

with such surety or sureties as shall be satisfactory to the board of directors for the faithful performance of the duties of the office of treasurer and for the restoration to the corporation, in case of death, resignation, retirement, or removal

from office, of all books, papers, vouchers, money, and other property of whatever kind in the possession or under the control of the treasurer belonging to the corporation. The assistant treasurer, or if there shall be more than one, the assistant

treasurers in the order determined by the board of directors, shall in the absence or disability of the treasurer, perform the duties and exercise the powers of the treasurer. The assistant treasurers shall perform such other duties and have such

other powers as the board of directors, the chief executive officer, the president or treasurer may, from time to time, prescribe.

Section 4.11

Other Officers,

Assistant Officers and Agents. Officers, assistant officers and agents, if any, which officers may include officers of any division of the corporation, other than those whose duties are provided for in these Bylaws, shall have such

authority and perform such duties as may from time to time be prescribed by resolution of the board of directors.

Section 4.12

Absence or

Disability of Officers. In the case of the absence or disability of any officer of the corporation and of any person hereby authorized to act in such officer’s place during such officer’s absence or disability, the board of directors

may by resolution delegate the powers and duties of such officer to any other officer or to any director, or to any other person whom it may select.

ARTICLE V

INDEMNIFICATION OF OFFICERS, DIRECTORS AND OTHERS

Section 5.1

Definitions.

As used herein, the term “director” shall include each present and former director of the corporation and the term “officer” shall include each present and former officer of the corporation as such, and the terms “director” and “officer” shall also

include each employee of the corporation, who, at the corporation’s request, is serving or may have served as a director or officer of another entity in which the corporation owns directly or indirectly, securities or of which it is a creditor. The

term “expenses” shall include, but not be limited to, reasonable amounts for attorney’s fees, costs, disbursements and other expenses and the amount or amounts of judgments, fines, penalties and other liabilities.

Section 5.2

Indemnification.

Each director and officer shall be and hereby is indemnified by the corporation, to the full extent permitted by law, against:

(a) expenses incurred or paid

by the director or officer in connection with any claim made against such director or officer, or any actual or threatened action, suit or proceeding (whether civil, criminal, administrative, investigative or other, including appeals and whether or

not relating to a date prior to the adoption of this bylaw) in which such director or officer may be involved as a party or otherwise, by reason of being or having been a director or officer of the corporation, or of serving or having served at the

request of the corporation as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust or other enterprise, or by reason of any action taken or not taken by such director or officer in such capacity, and

(b) the amount or amounts paid

by the director or officer in settlement of any such claim, action, suit or proceeding or any judgment or order entered therein, however, notwithstanding anything to the contrary herein, except as otherwise provided in Section 3(e) of this Article V,

where a director or officer seeks indemnification in connection with a claim, action, suit or proceeding (or part thereof) voluntarily initiated by such director or officer, the right to indemnification granted hereunder shall be limited to

proceedings where such director or officer has been wholly successful on the merits. Notwithstanding the preceding sentence, except as otherwise provided in Section 3(e) of this Article V, the corporation shall be required to indemnify a director or

officer in connection with a proceeding (or part thereof) commenced by such director or officer only if the commencement of such proceeding (or part thereof) by the director or officer was authorized in the specific case by the board of directors of

the corporation.

Section 5.3

Miscellaneous.

(a)

Expenses incurred in defending any claim, action, suit or proceeding of the character described in Section 2(a) of this

Article V above shall be advanced by the corporation prior to the final disposition thereof upon receipt of an undertaking by or on behalf of the recipient to repay such amounts if it shall ultimately be determined that such person is not entitled

to be indemnified by the corporation as authorized in this Article V.

(b)

The rights of indemnification and advancement of expenses herein provided for shall be severable, shall not be exclusive

of other rights to which any director or officer now or hereafter may be entitled under the Certificate of Incorporation, any agreement, vote of stockholders or disinterested directors or otherwise and shall continue as to a person who has ceased

to be a director or officer and shall inure to the benefit of the heirs, executors, and administrators of such a person.

(c)

The obligations of the corporation under the provisions of this Bylaw to indemnify and advance expenses to a director or

officer shall be deemed to be a contract between the corporation and each director or officer who serves in such capacity, and no modification or repeal of any provision of this bylaw shall affect, to the detriment of such person, such obligations

of the corporation in connection with a claim based on any act or failure to act occurring before such modification or repeal.

(d)

The board of directors shall have power on behalf of the corporation to grant indemnification to any person other than a

director or officer to such extent as the board of directors in its discretion may from time to time determine.

(e)

If a claim for indemnification or advancement of expenses under this Bylaw is not paid in full within sixty days after a

written claim therefor by the director or officer has been received by the corporation, the director or officer may file suit to recover the unpaid amount of such claim and, if successful in whole or in part, shall be entitled to be paid the expense

of prosecuting such claim, to the fullest extent permitted by applicable law.

(f)

The corporation’s obligation, if any, to indemnify or advance expenses to any director or officer who was or is serving

at its request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise shall be reduced by any amount such person may collect as indemnification or advancement from such other

corporation, partnership, joint venture, trust or other enterprise.

ARTICLE VI

CERTIFICATES OF STOCK

Section 6.1

Form.

Every holder of stock in the corporation shall be entitled to have a certificate, signed by, or in the name of the corporation by the chairman of the board, the chief executive officer, the president or a vice president and the secretary or an

assistant secretary of the corporation, certifying the number of shares owned by such holder in the corporation; provided, however, that the board of directors may provide by resolution or resolutions that some or all of any classes or series of its

stock shall be uncertificated shares. If such a certificate is countersigned (i) by a transfer agent or an assistant transfer agent other than the corporation or its employee or (ii) by a registrar, other than the corporation or its employee, the

signature of any such chairman of the board, chief executive officer, president, vice-president, secretary, or assistant secretary may be facsimiles. In case any officer or officers who have signed, or whose facsimile signature or signatures have

been used on, any such certificate or certificates shall cease to be such officer or officers of the corporation whether because of death, resignation or otherwise before such certificate or certificates have been delivered by the corporation, such

certificate or certificates may nevertheless be issued and delivered as though the person or persons who signed such certificate or certificates or whose facsimile signature or signatures have been used thereon had not ceased to be such officer or

officers of the corporation. All certificates for shares shall be consecutively numbered or otherwise identified. The name of the person to whom the shares represented thereby are issued, with the number of shares and date of issue, shall be entered

on the books of the corporation. Shares of stock of the corporation shall only be transferred on the books of the corporation by the holder of record thereof or by such holder’s attorney duly authorized in writing, upon surrender to the corporation

of the certificate or certificates for such shares endorsed by the appropriate person or persons, with such evidence of the authenticity of such endorsement, transfer, authorization, and other matters as the corporation may reasonably require, and

accompanied by all necessary stock transfer stamps. In that event, it shall be the duty of the corporation to issue a new certificate to the person entitled thereto, cancel the old certificate or certificates, and record the transaction on its books.

The board of directors may appoint a bank or trust company organized under the laws of the United States or any state thereof to act as its transfer agent or registrar, or both in connection with the transfer of any class or series of securities of

the corporation.

Section 6.2

Lost Certificates.

The board of directors may direct a new certificate or certificates to be issued in place of any certificate or certificates previously issued by the corporation alleged to have been lost, stolen, or destroyed, upon the making of an affidavit of

that fact by the person claiming the certificate of stock to be lost, stolen, or destroyed. When authorizing such issue of a new certificate or certificates, the board of directors may, in its discretion and as a condition precedent to the issuance

thereof, require the owner of such lost, stolen, or destroyed certificate or certificates, or his or her legal representative, to give the corporation a bond sufficient to indemnify the corporation against any claim that may be made against the

corporation on account of the loss, theft or destruction of any such certificate or the issuance of such new certificate.

Section 6.3

Fixing a Record

Date for Stockholder Meetings. In order that the corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment thereof, the board of directors may fix a record date,

which record date shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which record date shall not be more than sixty nor less than ten days before the date of such meeting. If no

record date is fixed by the board of directors, the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders shall be the close of business on the next day preceding the day on which notice is given, or

if notice is waived, at the close of business on the day next preceding the day on which the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment of

the meeting; provided, however, that the board of directors may fix a new record date for the adjourned meeting.

Section 6.4

Fixing a Record

Date for Action by Written Consent. In order that the corporation may determine the stockholders entitled to consent to corporate action in writing without a meeting, the board of directors may fix a record date, which record date

shall not precede the date upon which the resolution fixing the record date is adopted by the board of directors, and which date shall not be more than ten days after the date upon which the resolution fixing the record date is adopted by the board

of directors. If no record date has been fixed by the board of directors, the record date for determining stockholders entitled to consent to corporate action in writing without a meeting, when no prior action by the board of directors is required

by statute, shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the corporation by delivery to its registered office in the State of Delaware, its principal place of

business, or an officer or agent of the corporation having custody of the book in which proceedings of meetings of stockholders are recorded. Delivery made to the corporation’s registered office shall be by hand or by certified or registered mail,

return receipt requested. If no record date has been fixed by the board of directors and prior action by the board of directors is required by statute, the record date for determining stockholders entitled to consent to corporate action in writing

without a meeting shall be at the close of business on the day on which the board of directors adopts the resolution taking such prior action.

Section 6.5

Fixing a Record

Date for Other Purposes. In order that the corporation may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment or any rights or the stockholders entitled to exercise any rights in

respect of any change, conversion or exchange of stock, or for the purposes of any other lawful action, the board of directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is

adopted, and which record date shall be not more than sixty days prior to such action. If no record date is fixed, the record date for determining stockholders for any such purpose shall be at the close of business on the day on which the board of

directors adopts the resolution relating thereto.

Section 6.6

Subscriptions for

Stock. Unless otherwise provided for in the subscription agreement, subscriptions for shares shall be paid in full at such time, or in such installments and at such times, as shall be determined by the board of directors. Any call

made by the board of directors for payment on subscriptions shall be uniform as to all shares of the same class or as to all shares of the same series. In case of default in the payment of any installment or call when such payment is due, the

corporation may proceed to collect the amount due in the same manner as any debt due the corporation.

ARTICLE VII

GENERAL PROVISIONS

Section 7.1

Dividends.

Dividends upon the capital stock of the corporation, subject to the provisions of the Certificate of Incorporation, if any, may be declared by the board of directors at any regular or special meeting, pursuant to law. Dividends may be paid in cash,

in property, or in shares of the capital stock, subject to the provisions of the Certificate of Incorporation. Before payment of any dividend, there may be set aside out of any funds of the corporation available for dividends such sum or sums as

the directors from time to time, in their absolute discretion, think proper as a reserve or reserves to meet contingencies, or for equalizing dividends, or for repairing or maintaining any property of the corporation, or any other purpose and the

directors may modify or abolish any such reserve in the manner in which it was created.

Section 7.2

Checks, Drafts or

Orders. All checks, drafts, or other orders for the payment of money by or to the corporation and all notes and other evidences of indebtedness issued in the name of the corporation shall be signed by such officer or officers, agent

or agents of the corporation, and in such manner, as shall be determined by resolution of the board of directors or a duly authorized committee thereof.

Section 7.3

Contracts.

The board of directors may authorize any officer or officers, or any agent or agents, of the corporation to enter into any contract or to execute and deliver any instrument in the name of and on behalf of the corporation, and such authority may be

general or confined to specific instances.

Section 7.4

Loans.

The corporation may lend money to, or guarantee any obligation of, or otherwise assist any officer or other employee of the corporation or of its subsidiary, including any officer or employee who is a director of the corporation or its subsidiary,

whenever, in the judgment of the directors, such loan, guaranty or assistance may reasonably be expected to benefit the corporation. The loan, guaranty or other assistance may be with or without interest, and may be unsecured, or secured in such

manner as the board of directors shall approve, including, without limitation, a pledge of shares of stock of the corporation. Nothing in this section contained shall be deemed to deny, limit or restrict the powers of guaranty or warranty of the

corporation at common law or under any statute.

Section 7.5

Fiscal Year.

The fiscal year of the corporation shall be fixed by resolution of the board of directors.

Section 7.6

Corporate Seal.

The board of directors may provide a corporate seal which shall be in the form of a circle and shall have inscribed thereon the name of the corporation and the words “Corporate Seal, Delaware”. The seal may be used by causing it or a facsimile

thereof to be impressed or affixed or reproduced or otherwise.

Section 7.7

Voting Securities

Owned By Corporation. Voting securities in any other corporation held by the corporation shall be voted by the chief executive officer, unless the board of directors specifically confers authority to vote with respect thereto, which

authority may be general or confined to specific instances, upon some other person or officer. Any person authorized to vote securities shall have the power to appoint proxies, with general power of substitution.

Section 7.8

Inspection of

Books and Records. Any stockholder of record, in person or by attorney or other agent, shall, upon written demand under oath stating the purpose thereof, have the right during the usual hours for business to inspect for any proper

purpose the corporation’s stock ledger, a list of its stockholders, and its other books and records, and to make copies or extracts therefrom. A proper purpose shall mean any purpose reasonably related to such person’s interest as a stockholder. In

every instance where an attorney or other agent shall be the person who seeks the right to inspection, the demand under oath shall be accompanied by a power of attorney or such other writing which authorizes the attorney or other agent to so act on

behalf of the stockholder. The demand under oath shall be directed to the corporation at its registered office in the State of Delaware or at its principal place of business.

Section 7.9

Section Headings.

Section headings in these Bylaws are for convenience of reference only and shall not be given any substantive effect in limiting or otherwise construing any provision herein.

Section 7.10

Inconsistent

Provisions. In the event that any provision of these Bylaws is or becomes inconsistent with any provision of the Certificate of Incorporation, the General Corporation Law of the State of Delaware or any other applicable law, the

provision of these Bylaws shall not be given any effect to the extent of such inconsistency but shall otherwise be given full force and effect.

ARTICLE VIII

AMENDMENTS

These Bylaws may be amended, altered, or repealed and new Bylaws adopted at any meeting of the board of directors by a majority vote. The

fact that the power to adopt, amend, alter, or repeal the Bylaws has been conferred upon the board of directors shall not divest the stockholders of the same powers.

13

Exhibit 99.1

CONTINGENT VALUE RIGHTS AGREEMENT

This CONTINGENT VALUE RIGHTS AGREEMENT, dated as of January 23, 2024

(this “Agreement”), is entered into by and between Bristol-Myers Squibb Company, a Delaware corporation (“Parent”) and Equiniti Trust Company, LLC, a New York limited liability trust company, as Rights Agent (as defined

herein). Capitalized terms used but not defined herein shall have the meaning assigned to such terms in the Merger Agreement (as defined herein).

RECITALS

WHEREAS, Parent, Vineyard Merger Sub Inc., a Delaware corporation and

wholly owned subsidiary of Parent (“Merger Sub”) and Mirati Therapeutics, Inc., a Delaware corporation (the “Company”), have entered into an Agreement and Plan of Merger, dated as of October 8, 2023 (as it may be amended

or supplemented from time to time pursuant to the terms thereof, the “Merger Agreement”), pursuant to which, among other things, Merger Sub shall merge with and into the Company (the “Merger”), with the Company continuing

as the surviving corporation in the Merger, whereby (i) each issued and outstanding share of common stock of the Company, par value $0.001 per share (“Company Common Stock”) as of the Effective Time (other than Excluded Shares and

Dissenting Shares) will be converted into the right to receive (A) $58.00 per share, in cash, without interest and (B) one (1) contingent value right (a “CVR”), which shall represent, subject to the terms set forth in this Agreement,

the right to receive the Milestone Payment (as defined below) (clauses (A) and (B), collectively, the “Merger Consideration”), and (ii) the Company shall continue as a wholly-owned subsidiary of Parent; and

WHEREAS, as an integral part of the consideration of the Merger,

pursuant to and subject to the terms and conditions of the Merger Agreement, holders of Company Common Stock (other than Excluded Shares and Dissenting Shares), including holders of Company Warrants, In the Money Options or Eligible Company RSUs will

become entitled (any such holders, the “Initial Holders”) to receive up to one contingent cash payment per CVR, such payment being contingent upon, and subject to, the achievement of the Milestone (as defined below) prior to the earlier

of the Milestone Expiration (as defined below) and the Termination (as defined below), subject to and in accordance with the terms of this Agreement.

NOW, THEREFORE, in consideration of the foregoing and the consummation

of the transactions referred to above, the parties agree, for the equal and proportionate benefit of all Holders (as defined herein), as follows:

Article I

DEFINITIONS; CERTAIN RULES OF CONSTRUCTION

Section 1.1 Definitions. As used in this Agreement, the following terms will have the following meanings:

“Acting Holders” means, at the time of determination,

Holders of not less than fifty percent (50%) of outstanding CVRs as set forth in the CVR Register.

“Agreement” has the meaning set forth in the preamble

hereto.

“Assignee” has the meaning set forth in Section 6.3.

“Change of Control” means (a) a sale or other disposition

of all or substantially all of the assets of Parent on a consolidated basis (other than to any Subsidiary (direct or indirect) of Parent), (b) a merger or consolidation involving Parent in which Parent is not the surviving entity, and (c) any other

transaction involving Parent in which Parent is the surviving or continuing entity but in which the stockholders of Parent immediately prior to such transaction (as stockholders of Parent) own less than fifty percent (50%) of Parent’s voting power

immediately after the transaction.

“Commercially Diligent Efforts” means, with respect to a

particular task, a level of efforts that is consistent with the efforts and resources normally used by a biopharmaceutical company of comparable size and resources as Parent in the exercise of its commercially reasonable business practices relating

to performance of a task for a similar compound or product (including the research and development of a compound or product), as applicable, at a similar stage in its research and development or commercial life as the CVR Product, and of similar

scientific data/validation, and that has commercial and market potential similar to the CVR Product, taking into account issues of intellectual property coverage, safety, tolerability and efficacy, stage of development, product profile, the

competitiveness of other products in development or the marketplace, supply chain management considerations, proprietary position, regulatory exclusivity, the regulatory structure involved, anticipated or approved labeling, present and future market

and commercial potential, the likelihood of receipt of Regulatory Approval, any delays or pauses of programs relating to external factors (including, but not limited to, pandemic, natural disaster, government shutdown, war, terrorist attack and

cyber-attack), profitability (including pricing and reimbursement status achieved or likely to be achieved), amounts payable to licensors of patents or other intellectual property rights, alternative products and programs, and legal issues.

“Company” has the meaning set forth in the Recitals

hereto.

“Company Common Stock” has the meaning set forth in the

Recitals hereto.

“Company Warrants” means, collectively, all issued and

outstanding warrants to purchase shares of Company Common Stock issued by or on behalf of the Company that are unexpired and unexercised as of the Effective Time.

“CVRs” means the rights of Holders hereunder (granted to

Initial Holders as part of the consideration of the Merger pursuant to the terms of the Merger Agreement) to receive contingent cash payments on the terms and subject to the conditions of this Agreement and the Merger Agreement.

“CVR Product” means MRTX1719.

“CVR Product Milestone” means all of the following:

(a) the submission of the CVR Product NDA to the FDA and (b) the FDA’s confirmation of acceptance of the filing of the CVR Product NDA.

“CVR Product Milestone Achievement Outside Date” means

January 23, 2031.

“CVR Product NDA” means a New Drug Application for the

approval of the CVR Product for the treatment of either locally advanced or metastatic non-small cell lung cancer that is indicated for use in patients who have received no more than two prior lines of systemic therapy (i.e., indicated for use in the

first, second and/or third line settings).

“CVR Register” has the meaning set forth in Section 2.3(a)(A).

“Delaware Courts” has the meaning set forth in Section

6.5(a).

“DTC” means The Depository Trust Company or any successor

thereto.

“Eligible Company RSUs” means Company RSUs other than (a)

2024 Awards and/or (b) Company RSUs described in Section 1.8(d)(iii)-(iv) of the Company Disclosure Schedule.

“Equity Award CVR” means a CVR received by an Initial

Holder in respect of an In the Money Option or Eligible Company RSU.

“FDA” means the United States Food and Drug

Administration.

“Funds” has the meaning set forth in Section 2.6.

“Holder” means a Person in whose name a CVR is registered

in the CVR Register as of the applicable date and time of determination.

“Initial Holder” has the meaning set forth in the Recitals

hereto.

“Merger” has the meaning set forth in the Recitals hereto.

“Merger Agreement” has the meaning set forth in the

Recitals hereto.

“Merger Consideration” has the meaning set forth in the

Recitals hereto.

“Merger Sub” has the meaning set forth in the Recitals

hereto.

“Milestone” means the CVR Product Milestone has occurred.

“Milestone Expiration” means if as of the end of the CVR

Product Milestone Achievement Outside Date, the Milestone has not occurred, 12:01 a.m. New York City time on the calendar day following the CVR Product Milestone Achievement Outside Date.

“Milestone Notice” has the meaning set forth in Section 2.4(a).

“Milestone Payment” means twelve dollars ($12.00) per CVR, without interest.

“Milestone Payment Amount” means, for a given Holder, the product of (a) the

Milestone Payment and (b) the number of CVRs held by such Holder as reflected on the CVR Register as of the close of business on the date of the Milestone Notice.

“Milestone Payment Date” has the meaning set forth in Section 2.4(a).

“New Drug Application” means a new drug application

(including any supplemental new drug application) filed with the FDA pursuant to 21 U.S.C. § 355(b) and 21 C.F.R. Part 314 (for clarity, including accelerated approval under 21 C.F.R., Part 314 Subpart H) or a biologics license application (including

any supplemental biologics license application) filed with the FDA pursuant to 42 U.S.C. § 262 and 21 C.F.R. Part 601 (for clarity, including accelerated approval under 21 C.F.R. Part 601 Subpart E).

“Officer’s Certificate” means a certificate signed by an

authorized officer of Parent, in his or her capacity as such an officer, and delivered to the Rights Agent.

“Parent” has the meaning set forth in the preamble hereto.

“Paying Agent” means Equiniti Trust Company, LLC, a New

York limited liability trust company.

“Permitted CVR Transfer” means: a transfer of CVRs (a) by

will or intestacy upon death of a Holder; (b) by instrument to an inter vivos or testamentary trust in which the CVRs are to be passed to beneficiaries upon the death of the settlor; (c) pursuant to a court order; (d) by operation of law (including

by consolidation or merger of the Holder) or if effectuated without consideration in connection with the dissolution, liquidation or termination of any Holder that is a corporation, limited liability company, partnership or other entity; (e) in the

case of CVRs held in book-entry or other similar nominee form, from a nominee to a beneficial owner, and if applicable, through an intermediary; (f) if the Holder is a partnership or limited liability company, a distribution by the transferring

partnership or limited liability company to its partners or members, as applicable (provided that such distribution does not subject the CVRs to a requirement of registration under the Securities Act of 1933, as amended or the Securities

Exchange Act of 1934, as amended); or (g) as provided in Section 2.7.

“Regulatory Approval” means the approval by the FDA of the

CVR Product NDA that is necessary for the commercial marketing and sale of the CVR Product in the United States of America, regardless of any (a) limitations on patient population, (b) obligation to conduct any post-marketing study or (c) other than

with respect to the Milestone, as set forth in the definition thereof, contraindications or limitations on use, or other conditions, restrictions or commitments placed on such approval.

“Rights Agent” means the Rights Agent named in the

preamble of this Agreement, until a successor Rights Agent is appointed pursuant to the applicable provisions of this Agreement, and thereafter “Rights Agent” will mean such successor Rights Agent.

“Termination” has the meaning set forth in Section 6.8.

Section 1.2 Rules of Construction. For purposes of this Agreement, whenever the context requires: the singular number shall include the plural, and vice versa; the masculine gender shall include the feminine

and neuter genders; the feminine gender shall include the masculine and neuter genders; and the neuter gender shall include the masculine and feminine genders. Except as otherwise indicated, all references in this Agreement to “Sections” or