Current Report Filing (8-k)

January 24 2019 - 4:35PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 24, 2019

Mercury Systems, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts

|

|

000-23599

|

|

04-2741391

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

50 Minuteman Road, Andover, Massachusetts

|

|

01810

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (978) 256-1300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 22, 2019, the Board of Directors of Mercury Systems, Inc. (the “Company”) approved an amendment to Section 2(c) of the Company’s 2018 Stock Incentive Plan to permit the Compensation Committee as administrator of the plan to delegate to the Company’s Chief Executive Officer, Chief Financial Officer, General Counsel, and Chief Human Resources Officer the authority to grant equity awards, subject to written guidelines approved by the Compensation Committee, to employees who are not subject to the reporting and other provisions of Section 16 of the Securities Exchange Act of 1934, as amended. The stock plan amendment was effective immediately. The full text of the amendment is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On January 22, 2019, the Company’s Board of Directors approved an amendment to the Company’s By-laws to adopt a forum selection provision providing that the federal and state courts in the Commonwealth of Massachusetts shall be the exclusive forum for (1) any derivative action or proceeding brought on behalf of the Company, (2) any action asserting a claim of breach of a fiduciary duty owed by any current or former director, officer, or other employee of the Company to the Company or its stockholders, (3) any action asserting a claim arising pursuant to any provision of the Massachusetts Business Corporation Act, the Company’s Articles of Organization, or the Company’s By-laws (as either may be amended from time to time), or (4) any action asserting a claim governed by the internal affairs doctrine. The By-law amendment was effective immediately. The full text of the amendment is attached hereto as Exhibit 3.1 and is incorporated herein by reference.

Item 8.01 Other Events.

On January 22, 2019, the Company’s Board of Directors approved an amendment to the Company’s Board Policy to include stock ownership guidelines for executives who report directly to the CEO. Each of the executives who report directly to the CEO is expected to own or control, directly or indirectly, shares of the Company's common stock with a value of at least three times the individual’s base salary. Each such executive is expected to meet this guideline within five years of first becoming a direct report to the CEO, or within five years of January 22, 2019, whichever is later. Each such executive is expected to retain such investment in the Company as long as he or she is a direct report to the CEO. Prior to meeting the three times holding requirement per this guideline, after applicable tax withholding on the vesting of an equity award, the executive is required to retain 50% of the net, after tax award until he or she is in compliance with the stock ownership guideline. Exceptions to this stock ownership guideline may be approved from time to time by the Board of Directors as it deems necessary to address individual circumstances.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Amendment to By-Laws of Mercury Systems, Inc.

|

|

10.1

|

|

2018 Stock Incentive Plan, as amended and restated

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dated: January 24, 2019

|

|

|

|

MERCURY SYSTEMS, INC.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Michael D. Ruppert

|

|

|

|

|

|

|

|

Michael D. Ruppert

|

|

|

|

|

|

|

|

Executive Vice President, Chief Financial Officer, and Treasurer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

|

|

10.1

|

|

|

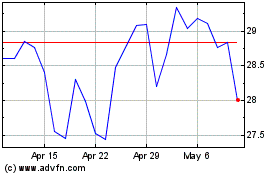

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

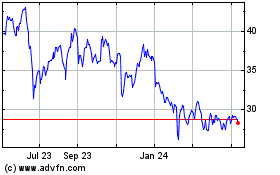

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Apr 2023 to Apr 2024