A.M. Best Affirms Ratings of Maiden Holdings, Ltd. and Its Subsidiaries

May 30 2012 - 10:30AM

Business Wire

A.M. Best Co. has affirmed the financial strength rating

(FSR) of A- (Excellent) and issuer credit ratings (ICR) of “a-” of

the property/casualty subsidiaries of Maiden Holdings, Ltd.

(Maiden Holdings) (Hamilton, Bermuda) [NASDAQ: MHLD] also known as

Maiden Group (Maiden). Concurrently, A.M. Best has affirmed

the ICR of “bbb-” of Maiden Holdings.

Additionally, A.M. Best has affirmed the ICR and senior debt

ratings of “bbb-” of Maiden Holdings North America, Ltd.

(Maiden NA) (Delaware), a direct, wholly owned subsidiary of Maiden

Holdings. Maiden NA’s senior notes are fully and unconditionally

guaranteed by Maiden Holdings. At the same time, A.M. Best has

assigned indicative ratings of “bbb-” to senior debt, “bb+” to

subordinated debt, “bb” to junior subordinated debt and “bb” to

preferred stock of the recently filed shelf registration of Maiden

Holdings and Maiden NA. The outlook for all ratings is stable. (See

below for a detailed list of the companies and ratings.)

The ratings of Maiden reflect its consistently profitable

underwriting and operating performance along with its solid

risk-adjusted capitalization, in part due to capital contributions

from Maiden Holdings and the operational benefits that Maiden

derives as a quota share partner with AmTrust Financial

Services, Inc.’s (AFSI) Bermuda reinsurance subsidiary,

AmTrust International Insurance, Ltd., (AII) and American

Capital Acquisition Corporation (ACAC).

Partially offsetting these positive rating factors are the

execution risk faced by Maiden in achieving its business plans and

integrating newer business, as well as the continuing competitive

environment in its core reinsurance markets.

Maiden Holdings’ adjusted debt-to-total capital of 26.9% and

adjusted debt-to-total tangible capital of 29.6% at March 31, 2012,

were within A.M. Best’s guidelines at the company’s current

ratings. In addition, Maiden Holdings’ interest coverage ratio

remains adequate for its ratings.

Key rating factors that may lead to positive rating actions

include the organization producing operating results that exceed

its peers for an extended period of time along with the

strengthening of the group’s risk-adjusted capitalization. However,

factors that may lead to negative rating actions include a trend of

increasingly deteriorating underwriting and operating performance

to a level below its peers or an erosion of surplus to an extent to

cause a significant decline in risk-adjusted capitalization.

The FSR of A- (Excellent) and ICRs of “a-” have been affirmed

for the following property/casualty subsidiaries of Maiden

Holdings, Ltd.:

- Maiden Insurance Company

Ltd.

- Maiden Reinsurance Company

- Maiden Specialty Insurance

Company

The following debt ratings have been affirmed:

Maiden Holdings North America, Ltd.—

-- “bbb-” on $100 million 8.0% senior unsecured notes, due

2042

-- “bbb-” on $107 million 8.25% senior unsecured notes, due

2041

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which

provides a comprehensive explanation of A.M. Best’s rating process

and contains the different rating criteria employed in the rating

process. Key criteria utilized include: “Risk Management and the

Rating Process for Insurance Companies”; “Insurance Holding Company

and Debt Ratings”; “Understanding BCAR for Property/Casualty

Insurers”; “Catastrophe Analysis in A.M. Best Ratings”; “The

Treatment of Terrorism Risk in the Rating Evaluation”; and “Rating

Members of Insurance Groups.” Best’s Credit Rating Methodology can

be found at www.ambest.com/ratings/methodology.

Founded in 1899, A.M. Best Company is the world’s oldest and

most authoritative insurance rating and information source. For

more information, visit www.ambest.com.

Copyright © 2012 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

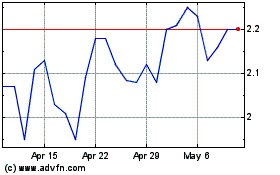

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Jun 2024 to Jul 2024

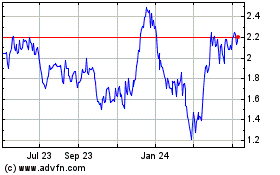

Maiden (NASDAQ:MHLD)

Historical Stock Chart

From Jul 2023 to Jul 2024