| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| SCHEDULE 13D |

| |

| Under the Securities Exchange Act of 1934 |

| (Amendment No. )* |

| |

|

Luna Innovations

Incorporated |

| (Name of Issuer) |

| |

|

Common stock, par

value $0.001 per share |

| (Title of Class of Securities) |

| |

|

550351100 |

| (CUSIP Number) |

| |

| David J. Chanley |

| c/o White Hat Capital Partners LP |

| 520 Madison Avenue, 33rd Floor |

| New York, New York 10022 |

| (212) 257-5940 |

| |

| With a copy to: |

| |

| Eleazer Klein, Esq. |

| Schulte Roth & Zabel LLP |

| 919 Third Avenue |

| New York, NY 10022 |

|

(212) 756-2000 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

|

December 21, 2023 |

| (Date of Event Which Requires Filing of This Statement) |

| |

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or

Rule 13d-1(g), check the following box. [ ]

(Page 1 of 21 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information

which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not

be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 550351100 | SCHEDULE 13D | Page 2 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Lightning Opportunity LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

746,267 shares of Common Stock issuable upon conversion of

shares of Series B Convertible Preferred Stock (as defined in Item 4 below) (including 149,253 shares of Common Stock issuable upon conversion

of shares of Seres B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s) (as defined in Item 4))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

746,267 shares of Common Stock issuable upon conversion of

shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of Seres B

Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

746,267 shares of Common Stock issuable upon conversion of

shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of Seres B

Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.1%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

*The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker (as defined in Item 4 below). The number of shares of Common Stock in rows (8), (10) and (11) and the

percentage set forth in row (13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page,

however, the ability to convert such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to

the beneficial ownership of the Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D | Page 3 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

WH Lightning GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

746,267 shares of Common Stock issuable upon conversion of

the Shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

746,267 shares of Common Stock issuable upon conversion of

the Shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

746,267 shares of Common Stock issuable upon conversion of

the Shares of Series B Convertible Preferred Stock (including 149,253 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.1%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

* The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page, however, the ability to convert

such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership of the

Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D | Page 4 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Strategic Partners II LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

1,119,402 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

1,119,402 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,119,402 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.1%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

* The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page, however, the ability to convert

such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership of the

Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D | Page 5 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat SP GP II LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

1,119,402 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

1,119,402 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,119,402 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 223,880 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

3.1%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

* The conversion of the shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker. The number of shares of Common Stock in rows (8), (10) and (11) and the percentage set forth in row

(13) reflect the conversion in full of the Series B Convertible Preferred Stock reported on this cover page, however, the ability to convert

such Series B Convertible Preferred Stock at any given time is subject to the Blocker which applies to the beneficial ownership of the

Reporting Persons in the aggregate.

| CUSIP No. 550351100 | SCHEDULE 13D | Page 6 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Structured Opportunities LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

7,462,686 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

7,462,686 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

7,462,686 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

*The conversion of the shares of Series B Convertible Preferred Stock

reported herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8),

(10) and (11) show the number shares of Common Stock that would be issuable upon the conversion of the shares of Series B

Convertible Preferred Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock

beneficially owned by such Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in

rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D | Page 7 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

WHSO GP LLC |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

7,462,686 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

7,462,686 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

7,462,686 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,492,537 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

OO |

| |

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock

reported herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8),

(10) and (11) show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B

Convertible Preferred Stock in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock

beneficially owned by such Reporting Person, after giving effect to the Blocker, is less than the number of securities reported in

rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D | Page 8 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

White Hat Capital Partners LP |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

State of Delaware |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred Stock

in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such Reporting

Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D | Page 9 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

David J. Chanley |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United Stated of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred Stock

in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such Reporting

Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D | Page 10 of 21 Pages |

| 1 |

NAME OF REPORTING PERSON

Mark R. Quinlan |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ¨

(b) x |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

AF |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH: |

7 |

SOLE VOTING POWER

-0- |

| 8 |

SHARED VOTING POWER

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 9 |

SOLE DISPOSITIVE POWER

-0- |

| 10 |

SHARED DISPOSITIVE POWER

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

9,328,355 shares of Common Stock issuable upon conversion

of shares of Series B Convertible Preferred Stock (including 1,865,670 shares of Common Stock issuable upon conversion of shares of Seres

B Convertible Preferred Stock issuable in one or more Subsequent Issuance(s))* |

| 12 |

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.99%* |

| 14 |

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

*The conversion of shares of Series B Convertible Preferred Stock reported

herein is subject to the Blocker and the percentage set forth in row (13) gives effect to the Blocker. However, rows (8), (10) and (11)

show the number of shares of Common Stock that would be issuable upon the conversion of the shares of Series B Convertible Preferred Stock

in full and does not give effect to the Blocker. Therefore, the actual number of shares of Common Stock beneficially owned by such Reporting

Person, after giving effect to the Blocker, is less than the number of securities reported in rows (8), (10) and (11).

| CUSIP No. 550351100 | SCHEDULE 13D | Page 11 of 21 Pages |

| Item 1. |

SECURITY AND ISSUER |

| |

|

| |

This statement on Schedule 13D (the "Schedule 13D") relates to the common stock, par value $0.001 per share (the "Common Stock") of Luna Innovations Incorporated, a Delaware corporation (the "Issuer"). The Issuer's principal executive offices are located at 301 First Street SW, Suite 200, Roanoke, VA 24011. |

| Item 2. |

IDENTITY AND BACKGROUND |

| |

|

| (a) |

This Statement is filed by each of the entities and persons listed below, all of whom together are referred to herein as the "Reporting Persons": |

| |

(i) |

White Hat Lightning Opportunity LP, a Delaware limited partnership ("WHLO"), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, it; |

| |

|

|

| |

(ii) |

WH Lightning GP LLC, a Delaware limited liability company ("WHLGP"), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, WHLO; |

| |

|

|

| |

(iii)

|

White Hat Strategic Partners II LP, a Delaware limited partnership ("WHSPII"), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, it; |

| |

|

|

| |

(iv) |

White Hat SP GP II LLC, a Delaware limited liability company ("WHSPGPII"), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, WHSPII; |

| |

|

|

| |

(v) |

White Hat Structured Opportunities LP, a Delaware limited partnership ("WHSO" and together with WHLO and WHSPII, the “White Hat Funds”), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, it; |

| |

|

|

| |

(vi) |

WHSO GP LLC, a Delaware limited liability company ("WHSOGP"), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, WHSO; |

| |

|

|

| |

(vii) |

White Hat Capital Partners LP, a Delaware limited partnership (the "Investment Manager"), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, the White Hat Funds; |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 12 of 21 Pages |

| |

(viii) |

Mr. David J. Chanley (“Mr. Chanley”), as co-Managing Member of White Hat Capital Partners GP LLC, a Delaware limited liability company and general partner of the Investment Manager (the “IMGP”), with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, the White Hat Funds; and |

| |

|

|

| |

(ix) |

Mr. Mark R. Quinlan (“Mr. Quinlan”), as co-Managing Member of the IMGP, with respect to the shares of Common Stock issuable upon conversion of the shares of Series B Convertible Preferred Stock held by, and issuable to, the White Hat Funds; |

| |

|

|

| |

|

Any disclosures herein with respect to persons other than the Reporting Persons are made on information and belief after making inquiry to the appropriate party. |

| |

|

|

| |

|

The filing of this statement should not be construed in and of itself as an admission by any Reporting Person as to beneficial ownership of the securities reported herein. |

| (b) |

The address of the principal business office of each of the Reporting Persons is c/o White Capital Partners LP, 520 Madison Avenue, 33rd Floor, New York, New York 10022. |

| |

|

| (c) |

The principal business of each of the White Hat Funds is to invest in securities. The principal business of the Investment Manager is the management of the affairs of the White Hat Funds and other funds under its management. The principal business of Mr. Chanley and Mr. Quinlan is to invest for funds under their management. |

| |

|

| (d) |

None of the Reporting Persons has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| |

|

| (e) |

None of the Reporting Persons has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was, or is subject to, a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, Federal or State securities laws or finding any violation with respect to such laws. |

| |

Schedule A attached hereto sets forth the information required by Instruction C of the instructions to Schedule 13D. |

| |

|

| (f) |

(i) |

WHLO – a Delaware limited partnership |

| |

|

|

| |

(ii) |

WHLGP – a Delaware limited liability company |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 13 of 21 Pages |

| |

(iii) |

WHSPII – a Delaware limited partnership |

| |

|

|

| |

(iv) |

WHSPGPII – a Delaware limited liability company |

| |

|

|

| |

(v) |

WHSO – a Delaware limited partnership |

| |

|

|

| |

(vi) |

WHSOGP- a Delaware limited liability company |

| |

|

|

| |

(vii) |

Investment Manager - a Delaware limited partnership |

| |

|

|

| |

(viii) |

Mr. Chanley – United States |

| |

|

|

| |

(ix) |

Mr. Quinlan – United States |

| Item 3. |

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION |

| |

|

| |

The White Hat Funds used a total of $50.0 million to acquire 52,500 shares of Series B Convertible Preferred Stock reported herein. The White Hat Funds have the option to acquire in one or more additional closing an additional 12,500 shares of Series B Convertible Preferred Stock at $1,000 per share of Series B Convertible Preferred Stock. The source of the funds used to acquire the shares of Series B Convertible Preferred Stock was the working capital of the White Hat Funds. |

| Item 4. |

PURPOSE OF TRANSACTION |

| |

|

| |

On December 21, 2023 (the “Subscription Date”), the White Hat Funds entered into a Subscription Agreement (the “Subscription Agreement”) with the Issuer, relating to the issuance and sale of up to 65,000 shares of a new series of the Issuer’s Series B Convertible Preferred Stock, par value $0.001 per share (the “Series B Convertible Preferred Stock”), for an aggregate purchase price of up to $62.5 million. On December 21, 2023 (the “Initial Closing Date”), pursuant to the terms of the Subscription Agreement, the White Hat Funds purchased an aggregate of 52,500 shares of Series B Convertible Preferred Stock (the “Initial Issuance”) for an aggregate purchase price of $50.0 million. In addition, at any time on or prior to December 21, 2026, each White Hat Fund has the right in one or more additional closings to purchase their pro rata portion of an aggregate of 12,500 additional shares of Series B Convertible Preferred Stock at $1,000 per share, for an aggregate purchase price of up to $12.5 million (each, a “Subsequent Issuance,” and together with the Initial Issuance, the “Issuance”). |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 14 of 21 Pages |

| |

The Series B Convertible Preferred Stock will be convertible into shares of Common Stock at the option of the holders thereof at or following the earlier to occur of (a) the first anniversary of the date of the Initial Issuance and (b) immediately prior to (and conditioned upon) the consummation of a Change of Control (as defined in the Certificate of Designations designating the Series B Convertible Preferred Stock, which was filed by the Issuer with the Secretary of State of the State of Delaware on December 20, 2023 (the “Certificate of Designations”)). The initial conversion price (the “Conversion Price”) for the shares issued in the Initial Issuance and any Subsequent Issuance is $6.70, representing a 10% premium to the 30-day volume-weighted average price of the Common Stock as of the Initial Closing Date. The Conversion Price is subject to certain adjustments set forth in the Certificate of Designations, including by virtue of a weighted-average antidilution adjustment in the event that the Issuer issues equity at a discount to the Conversion Price, subject to customary exceptions. At any time after the first anniversary of the Initial Issuance Date, in the event that the closing price of the Common Stock exceeds 200% of the Conversion Price for 30 consecutive trading days, the Issuer will have the right to mandatorily convert up to an aggregate of 15% of the Convertible Preferred Stock to Common Stock. Unless approved by the stockholders of the Issuer, the maximum aggregate number of shares of Common Stock issuable upon conversion of Series B Preferred Stock shall be limited to 6,935,934 (the “Exchange Cap”), which is 19.99% of the shares of Common Stock that were issued and outstanding on the Subscription Date. |

| |

In addition, each White Hat Fund’s ability to convert the Series B Convertible Preferred Stock shall be subject to a blocker provision (the “Blocker”) that will prohibit any White Hat Fund and any Attribution Parties (as defined in the Certificate of Designations) from beneficially owning more than 9.99% of the outstanding Common Stock at any time, determined in accordance with rules promulgated under the Securities Exchange Act. The Blocker may from time to time be decreased or, upon 61 day notice, increased to a percentage not in excess of 9.99%. |

| |

Any shares of Series B Convertible Preferred Stock that are not converted (i) as a result of the Exchange Cap or (ii) following a conversion in connection with a Change of Control, as a result of the Blocker, shall be settled in cash based on the then trading price of the Common Stock. |

| |

Holders

of the Series B Convertible Preferred Stock are entitled to vote with the holders of the Common Stock on an as-converted basis

subject to a restriction that the aggregate votes of the Series B Convertible Preferred Stock not exceed 19.99% of the voting power

of the Common Stock outstanding on the Initial Issuance Date, unless stockholder approval for the additional voting power is

obtained. Holders of the Series B Convertible Preferred Stock are entitled to a separate class vote with respect to, among other

things, related party transactions, the payment of dividends, repurchases or redemptions of securities of the Issuer in excess of

$100,000 per fiscal year, dispositions of businesses or assets in any transaction or series of transactions having a fair value of

consideration in excess of $30.0 million, the incurrence of indebtedness and certain amendments or extensions of the Issuer’s

existing credit facility, amendments to the Issuer’s organizational documents that have an adverse effect on the Series B

Convertible Preferred Stock and authorizations or issuances of securities of the Issuer, in each case, subject to the specified

exceptions and qualifications set forth in the Certificate of Designations. |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 15 of 21 Pages |

| |

For so long as the White Hat Funds (or their permitted transferees) own beneficially and of record at least 50% of the shares of Series B Convertible Preferred Stock purchased pursuant to the Subscription Agreement (including any shares of Series B Convertible Preferred Stock previously held that were subsequently converted into shares of Common Stock for so long as the White Hat Funds (or their permitted transferees) continue to own beneficially and of record such shares of Common Stock), the White Hat Funds representing at least a majority of the outstanding shares of Series B Convertible Preferred Stock then outstanding will have the right to elect one person to serve on the Board of Directors of the Issuer (the “Board”), with the initial director designee being Mr. Chanley. |

| |

Until the later of (i) six month anniversary of the date that the holders of Series B Convertible Preferred Stock no longer have a right to designate a director and (ii) December 21, 2026, subject to the qualifications set forth in the Subscription Agreement, the White Hat Funds will, subject to certain customary exceptions, be subject to certain standstill restrictions as set forth in the Subscription Agreement. |

| |

The White Hat Funds will be restricted from transferring the Series B Convertible Preferred Stock, subject to certain specified exceptions set forth in the Subscription Agreement. Subject to certain specified exceptions set forth in the Subscription Agreement, the White Hat Funds will generally be restricted from transferring the Common Stock issuable upon conversion of the Series B Convertible Preferred Stock until the one year anniversary of the Initial Closing. |

| |

Also, on December 21, 2023, the Issuer entered into a registration rights agreement (the “Registration Rights Agreement”) with the White Hat Funds, pursuant to which the Issuer agreed to register for resale the shares of Common Stock issuable upon conversion of the Series B Preferred Stock (the “Conversion Shares”). Under the Registration Rights Agreement, the Issuer has agreed to file a registration statement covering the resale by the White Hat Funds of their Conversion Shares (the “Registrable Securities”) . The Issuer has agreed to use reasonable best efforts to cause such registration statement to be declared effective as soon as practicable after the filing thereof, but in any event within twelve (12) months of the Initial Issuance and to keep such registration statement effective until the date the Conversion Shares covered by such registration statement have been sold or cease to be Registrable Securities. The Issuer has agreed to be responsible for all fees and expenses incurred in connection with the registration of the Registrable Securities. The White Hat Funds also have customary “demand” and “piggyback” registration rights as described in the Registration Rights Agreement. |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 16 of 21 Pages |

| |

The White Hat Funds also have the right to demand from the Issuer an underwritten offering to sell Registerable Securities as long as the anticipated gross proceeds of such underwritten offering is not less than $15.0 million (unless the White Hat Funds are proposing to sell all of their remaining Registerable Securities), subject to the limits and conditions contained in the Registration Rights Agreement. The Issuer also agreed, to facilitate underwritten block trades on behalf of the White Hat Funds, subject to certain limits and customary conditions contained in the Registration Rights Agreement. |

| |

The foregoing descriptions of the Subscription Agreement, Certificate of Designations and Registration Rights Agreement do not purport to be complete and are qualified in their entireties by reference to the full texts of the Subscription Agreement, Certificate of Designations and Registration Rights Agreement. For further information regarding the Subscription Agreement, Certificate of Designations and Registration Rights Agreement, reference is made to the texts of the Subscription Agreement, Certificate of Designations and Registration Rights Agreement, which have been filed as Exhibit 99.1 hereto, Exhibit 3.1 to the Issuer’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 27, 2023 and Exhibit 99.2 hereto, respectively, and incorporated by reference herein. |

| |

The Reporting Persons have engaged in, and, subject to the standstill restrictions set forth in the Subscription Agreement, may continue to engage in, discussions with members of management and the board of directors of the Issuer (the “Board”), other shareholders, industry analysts, existing or potential strategic partners or competitors and other third parties regarding a variety of matters relating to the Issuer, which may include, among other things, the Issuer’s business, operations and expenses, strategic alternatives and direction, management, Board and management composition and capital structure and allocation. The Reporting Persons may exchange information with any such persons pursuant to appropriate confidentiality or similar agreements, which may include customary standstill provisions. No Reporting Person has any present plan or proposal which would relate to or result in any of the matters set forth in subparagraphs (a) - (j) of Item 4 of Schedule 13D except as set forth herein or such as would occur upon or in connection with completion of, or following, any of the actions discussed herein. |

| |

The

Reporting Persons intend to review their investment in the Issuer on a continuing basis. Depending on various factors,

including, without limitation, the outcome of any discussions referenced above, the Issuer’s financial position, results and

strategic direction, actions taken by the Issuer’s management and the Board, price levels of the Common Stock, other

investment opportunities available to the Reporting Persons, conditions in the securities market and general economic and industry

conditions, and subject to the standstill restrictions set forth in the Subscription Agreement, the Reporting Persons may in the

future take such actions with respect to their investment in the Issuer as they deem appropriate, including, without limitation;

acquiring additional shares of Common Stock, Series B Convertible Preferred Stock and/or other equity, debt, notes, instruments or

other securities of the Issuer or derivatives related thereto (collectively, the “Securities”) or disposing of

some or all of the Securities beneficially owned by them, in public market or privately negotiated transactions; entering into

financial instruments or other agreements that increase or decrease the Reporting Persons’ economic exposure with respect to

their investment in the Issuer and/or otherwise changing their intention with respect to any and all matters referred to in Item 4

of Schedule 13D. |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 17 of 21 Pages |

| Item 5. |

INTEREST IN SECURITIES OF THE ISSUER |

| |

|

| (a) |

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock and percentages of shares of Common Stock beneficially owned by each of the Reporting Persons. The percentages used in this Schedule 13D are calculated based upon an aggregate of 34,697,019 shares of Common Stock outstanding as of December 20, 2023, as described in the Subscription Agreement, and assumes the conversion of the shares of Series B Convertible Preferred Stock held by the White Hat Funds, subject to the Blocker. |

| |

|

| (b) |

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition. |

| |

|

| (c) |

No transactions in the shares of Common Stock were effected by the Reporting Persons during the past sixty (60) days. |

| (d) |

No person other than the Reporting Persons is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, such shares of Common Stock. |

| |

|

| (e) |

Not applicable. |

| Item 6. |

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER |

| |

|

| |

The Reporting Persons' response to Item 4 is incorporated by reference into this Item 6. |

| |

|

| |

Other than as described in this Schedule 13D and the Joint Filing Agreement attached as Exhibit 99.3 hereto, there are no contracts, arrangements, understandings or similar relationships with respect to the securities of the Issuer between any of the Reporting Persons or Instruction C Persons and any other person or entity. |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 18 of 21 Pages |

| Item 7. |

MATERIAL TO BE FILED AS EXHIBITS |

| |

|

| Exhibit 99.1: |

Subscription Agreement, dated as of December 21, 2023 (incorporated by reference to Exhibit 10.1 to the Issuer's Current Report on Form 8-K filed with the SEC on December 27, 2023). |

| |

|

| Exhibit 99.2 |

Registration Rights Agreement, dated as of December 21, 2023 (incorporated by reference to Exhibit 10.2 of the Issuer's Current Report on Form 8-K filed with the SEC on December 27, 2023). |

| |

|

| Exhibit 99.3 |

Joint Filing Agreement Statement as required by Rule 13d-1(k)(1) under the Act. |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 19 of 21 Pages |

SIGNATURES

After reasonable inquiry and to the best of his

or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and

correct.

| DATE: December 27, 2023 |

/s/ David J. Chanley |

| |

DAVID J. CHANLEY, (i) individually, (ii) as Managing Member of: (a) WH Lightning GP LLC, (x) for itself and (y) as General Partner of White Hat Lightning Opportunity LP, (b) White Hat SP GP II LLC, (x) for itself and (y) as General Partner of White Hat Strategic Partners II LP, (c) WHSO GP LLC, (x) for itself and (y) as General Partner of White Hat Structured Opportunities LP and (d) White Hat Capital Partners GP LLC, as General Partner of White Hat Capital Partners LP. |

| |

/s/ Mark R. Quinlan |

| |

MARK R. Quinlan, individually |

| CUSIP No. 550351100 | SCHEDULE 13D | Page 20 of 21 Pages |

SCHEDULE A

GENERAL PARTNERS, CONTROL PERSONS, DIRECTORS AND EXECUTIVE

OFFICERS OF CERTAIN REPORTING PERSONS

The following sets forth the

name, position, address, principal occupation and citizenship of each general partner, control person, director and/or executive officer

of the applicable Reporting Persons (the "Instruction C Persons"). To the best of the Reporting Persons' knowledge, (i)

none of the Instruction C Persons during the last five years has been convicted in a criminal proceeding (excluding traffic violations

or other similar misdemeanors) or been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and

as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or

mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws and (ii) none of

the Instruction C Persons owns any shares of Common Stock or is party to any contract or agreement as would require disclosure in this

Schedule 13D, except to the extent such Instruction C Person is a Reporting Person in which case such Instruction C Person's beneficial

ownership is as set forth in Item 5 of the Schedule 13D.

REPORTING PERSON: WHITE HAT LIGHTNING GP LLC ("WHLGP")

Mr. Chanley and Mr. Quinlan serve as the managing

members of WHLGP. Mr. Chanley and Mr. Quinlan are Reporting Persons.

REPORTING PERSON: WHITE

HAT SP GP II LLC ("WHSPGPII")

Mr. Chanley and Mr. Quinlan serve as the managing

members of WHSPGPII. Mr. Chanley and Mr. Quinlan are Reporting Persons.

REPORTING PERSON: WHSO GP LLC ("WHSOGP")

Mr. Chanley and Mr. Quinlan serve as the managing members of WHSOGP. Mr.

Chanley and Mr. Quinlan are Reporting Persons.

REPORTING PERSON: WHITE HAT CAPITAL PARTNERS LP (THE "INVESTMENT

MANAGER")

White Hat Capital Partners GP LLC (the "IMGP")

serves as the general partner of the Investment Manager. Its business address is c/o White Capital Partners LP, 520 Madison Avenue, 33rd

Floor, New York, New York 10022. Its principal occupation is serving as the general partner of the Investment Manager. IMGP is a Delaware

limited liability company.

Mr. Chanley and Mr. Quinlan serve as the managing

members of the IMGP. Mr. Chanley and Mr. Quinlan are Reporting Persons.

| CUSIP No. 550351100 | SCHEDULE 13D | Page 21 of 21 Pages |

EXHIBIT 99.3

JOINT FILING AGREEMENT

PURSUANT TO RULE 13d-1(k)

The undersigned acknowledge

and agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments

to this statement on Schedule 13D shall be filed on behalf of each of the undersigned without the necessity of filing additional joint

filing agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness

and accuracy of the information concerning him or it contained herein and therein, but shall not be responsible for the completeness and

accuracy of the information concerning the others, except to the extent that he or it knows or has reason to believe that such information

is inaccurate.

| DATE: December 27, 2023 |

/s/ David J. Chanley |

| |

DAVID J. CHANLEY, (i) individually, (ii) as Managing Member of: (a) WH Lightning GP LLC, (x) for itself and (y) as General Partner of White Hat Lightning Opportunity LP, (b) White Hat SP GP II LLC, (x) for itself and (y) as General Partner of White Hat Strategic Partners II LP, (c) WHSO GP LLC, (x) for itself and (y) as General Partner of White Hat Structured Opportunities LP and (d) White Hat Capital Partners GP LLC, as General Partner of White Hat Capital Partners LP. |

| |

/s/ Mark R. Quinlan |

| |

MARK R. Quinlan, individually |

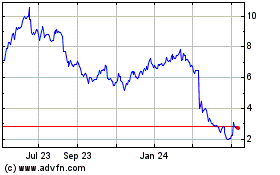

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

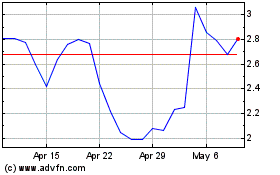

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Apr 2023 to Apr 2024