Delaware54-1560050000-52008FALSE000123981900012398192022-05-102022-05-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 16, 2023

Luna Innovations Incorporated

(Exact name of registrant as specified in its charter)

301 1st Street SW, Suite 200

Roanoke, VA 24011

(Address of principal executive offices, including zip code)

540-769-8400

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | LUNA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth Company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b‑2 of the Securities Exchange Act of 1934 (§240.12b‑2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| 5.02. | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Resignation of Eugene Nestro as Chief Financial Officer

On October 16, 2023, Eugene Nestro notified the Luna Innovations Incorporated (the “Company”) that he would resign from his position as the Company’s Chief Financial Officer, effective immediately. Mr. Nestro’s separation is not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. In connection with Mr. Nestro’s resignation, the Company and Mr. Nestro entered into a Separation Agreement on October 16, 2023 (the “Separation Agreement”), which includes a general release of claims and provides for (a) severance payments equal to his current base salary for a period of 12 months, (b) a discretionary lump sum bonus payment equal to the target bonus that Mr. Nestro would have been eligible to receive for 2023, (c) if he timely elects and remains eligible for continued coverage under COBRA, the Company will continue paying Mr. Nestro’s COBRA premiums until the earliest of October 16, 2024, the date Mr. Nestro becomes eligible for substantially equivalent insurance in connection with new employment or self-employment, or the date Mr. Nestro ceases to be eligible for COBRA continuation coverage, (d) a payment equal to the value of any unvested 401(k) match amount and (e) the acceleration by a period of 12 months of vesting and exercisability of all time-based outstanding stock options, restricted stock and other equity incentive awards covering the Company’s common stock that are held by Mr. Nestro.

The foregoing description of the Separation Agreement is not complete and is qualified in its entirety by reference to the Separation Agreement, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ending December 31, 2023.

Appointment of George Gomez-Quintero as Chief Financial Officer

On October 17, 2023, the Company announced the appointment of George Gomez-Quintero as the Company’s Chief Financial Officer, effective October 17, 2023. Mr. Gomez-Quintero will serve as the Company’s principal financial officer and principal accounting officer.

There is no arrangement or understanding between Mr. Gomez-Quintero and any other person pursuant to which he was selected as an officer of the Company, and there is no family relationship between Mr. Gomez-Quintero and any of the Company’s other directors or executive officers. Additional information about Mr. Gomez-Quintero is set forth below:

George Gomez-Quintero, age 56, previously served as Senior Vice President of Corporate Finance for Intelsat US LLC, from April 2021 to April 2023. Prior to that, Mr. Gomez-Quintero served as Chief Operating Officer of JSI from February 2019 to December 2020, and the Chief Financial Officer of XFL from December 2017 to January 2019. Mr. Gomez-Quintero served as Vice President of Finance for Time Warner Cable from 2008 to 2016. He received his BBA from Iona University and his MBA from Cornell Johnson Graduate School of Management.

In connection with his appointment, on October 17, 2023, the Company entered into an employment agreement with Mr. Gomez-Quintero. Pursuant to the employment agreement, Mr. Gomez-Quintero will be employed by the Company on an “at-will” basis, meaning either party may terminate the agreement at any time, with or without cause or advanced notice. Mr. Gomez-Quintero’s initial annual base salary will be $400,000 per year, subject to review and adjustment from time to time in the discretion of the Board. Mr. Gomez-Quintero will also be eligible to earn an annual performance cash bonus at a target amount of 70% of his then current base salary and a maximum amount of 140% of his then current base salary, subject to his achievement of annual predetermined objectives to be determined by the Board.

Pursuant to the employment agreement, in the event that Mr. Gomez-Quintero’s employment is terminated by the Company “without cause” or by him for “good reason” not in connection with a “change in control” (each as defined in the employment agreement), subject to him entering into and not revoking a separation agreement that includes, among other terms, a general release of claims in favor of the Company, he will be entitled to receive the following severance benefits:

•payments equal to the then applicable base salary for a period of 12 months paid in installments on the Company’s regular payroll dates;

•if he timely elects and remains eligible for continued coverage under COBRA, continued health insurance premiums until the earliest of (i) 12 months following termination, (ii) the date he becomes eligible for substantially equivalent

insurance in connection with new employment or self-employment, or (iii) the date he ceases to be eligible for COBRA continuation coverage;

•a discretionary lump sum bonus payment equal to 100% of the target bonus that he would have been eligible to receive for the year in which the termination occurs which will be paid when the Company otherwise pays annual bonuses, so long as that date is no later than March 15th the year following the year in which the termination occurs; and

•acceleration of vesting for all outstanding options, restricted stock or other equity incentive awards that have time-based vesting schedules for a period of 12 months.

Further, pursuant to the employment agreement, in lieu of the severance benefits described above, in the event that Messrs. Gomez-Quintero’s employment is terminated by the Company “without cause” or by him for “good reason” within three months prior to or 12 months following a “change in control” transaction, he will be entitled to receive the following severance benefits:

•a payment equal to the then applicable base salary for a period of 15 months paid in a lump sum;

•if he timely elects and remains eligible for continued coverage under COBRA, continued health insurance premiums until the earliest of (i) 18 months following termination, (ii) the date he becomes eligible for substantially equivalent insurance in connection with new employment or self-employment, or (iii) the date he ceases to be eligible for COBRA continuation coverage;

•a discretionary lump sum bonus payment equal to 125% of the target bonus that he would have been eligible to receive for the year in which the termination occurs, which will be paid when the Company otherwise pays annual bonuses, so long as that date is no later than March 15th the year following the year in which the termination occurs; and

•effective as of the later of the effective date of the change in control or the termination date, (i) for all outstanding options, restricted stock or other equity incentive awards that have time-based vesting schedules, acceleration of vesting in full, and (ii) for all outstanding options, restricted stock or other equity incentive awards that have performance-based vesting schedules, acceleration of vesting as if any performance metrics applicable or achievable in the future have been achieved at target levels.

Furthermore, in the event and effective upon a change in control, (i) for all outstanding options, restricted stock or other equity incentive awards that have time-based vesting schedules, the vesting of such awards will be accelerated in full and (ii) for all outstanding options, restricted stock or other equity incentive awards that have performance-based vesting schedules, such awards will be converted to time-based vesting in accordance with the Company's standard time period of vesting.

On October 17, 2023, the Company granted Mr. Gomez-Quintero 100,000 restricted stock units. These restricted stock units will vest on October 17, 2026, subject to Mr. Gomez-Quintero’s continuous service through such vesting date.

The foregoing description of Mr. Gomez-Quintero’s employment agreement is not complete and is qualified in its entirety by reference to the employment agreement, which the Company expects to file with the Company’s Annual Report on Form 10-K for the year ending December 31, 2023.

| | | | | |

| 7.01. | Regulation FD Disclosure. |

October 17, 2023, the Company issued a press release announcing the appointment of Mr. Gomez-Quintero as the Company’s Chief Financial Officer and the resignation of Mr. Nestro. A copy of this press release is furnished herewith as Exhibit 99.1 to this Current Report.

The information in this Item 7.01 of this Current Report on Form 8-K (including Exhibit 99.1) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| | | | | |

| 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Luna Innovations Incorporated |

| | |

| By: | | /s/ Scott A. Graeff |

| | Scott A. Graeff

President and Chief Executive Officer |

Date: October 17, 2023

Luna Innovations Names George Gomez-Quintero as Chief Financial Officer Company reiterates annual guidance (ROANOKE, VA, October 17, 2023) – Luna Innovations Incorporated (NASDAQ: LUNA), a global leader in advanced fiber optic-based technology, announced that George Gomez-Quintero is joining the company as Chief Financial Officer (CFO) today. Mr. Gomez-Quintero will succeed current CFO Gene Nestro, who has agreed to assist the company through mid-2024 to ensure a smooth transition. Mr. Gomez-Quintero will lead Luna’s Finance organization and represent Luna in communications with investors, lenders and rating agencies. As a member of the company’s executive team, he will report to President and CEO Scott A. Graeff. “With the completion of our five-year strategic plan and our continued pursuit of opportunities to further expand our global footprint and elevate our international presence, we’re thrilled to welcome a leader like George with extensive M&A, public market, and operations experience and someone with technical experience at scale,” Graeff said. “George’s deep expertise and his track record of partnering with senior leadership teams to maximize shareholder value and drive transformations that fuel growth are exactly the kinds of skills we need in a CFO as we move forward.” Gomez-Quintero most recently served as Senior Vice President of Corporate Finance at Intelsat, a global satellite communications provider delivering internet connectivity to media companies, mobile network operators, commercial airlines, and the U.S. and foreign governments. In his role, he led a global team of 40 employees spanning five countries accountable for the company’s Financial Planning & Analysis, Investor Relations, Treasury, Procurement, and Credit and Collections functions. Prior to Intelsat, Gomez-Quintero was the Chief Operating Officer at JSI, a leader in broadband solutions and consulting. He previously held senior financial roles at XFL, Time Warner Cable and Cleartel Communications. He holds an M.B.A. from Cornell University and a B.B.A., Finance, from Iona College. (more)

“I’m grateful for this opportunity to join Luna, a company where the potential for growth and value creation is tremendous, given the smart and passionate people, the culture of innovation, and global footprint. I am looking forward to being a strong business partner to the management team and all Luna employees, as we continue the work of scaling for growth and maximizing shareholder value,” Gomez-Quintero said. Graeff and Luna are thankful for Gene Nestro’s four years of service. “Gene is leaving Luna having completed a significant amount of foundational work in our finance department. He was instrumental in implementing financial systems for Luna and helping us strengthen our bench of financial talent,’ Graeff said. “His experience in financial strategic planning was especially helpful as we navigated global acquisitions and expansion. We wish him all the best for the future and thank him for his support of a smooth transition.” Nestro offered, “I’m proud to have been a part of Luna’s progress over these last several years. The company has made exciting advances, and I have every confidence that Luna’s future is bright.” Nestro’s departure is not a result of any disagreement regarding the company’s financial statements or disclosures. Reaffirmation of 2023 Full-Year Outlook: Luna is reaffirming the 2023 outlook provided on its second-quarter fiscal 2023 earnings call: • Total revenues in the range of $125 million to $130 million for full fiscal 2023; and • Adjusted EBITDA in the range of $14 million to $18 million for full fiscal 2023. In addition, Luna expects total revenues in the range of $29 million to $32 million for the third quarter 2023. Luna is not providing an outlook for net income, which is the most directly comparable generally accepted accounting principles ("GAAP") measure to Adjusted EBITDA, because changes in the items that Luna excludes from net income to calculate Adjusted EBITDA, such as share-based compensation, tax expense, and significant non-recurring charges, among other things, can be dependent on future events that are less capable of being controlled or reliably predicted by management and are not part of Luna's routine operating activities. The outlook above does not include any future acquisitions, divestitures, or unanticipated events.

About Luna Luna Innovations Incorporated (www.lunainc.com) is a leader in optical technology, providing unique capabilities in high-performance, fiber optic-based, test products for the telecommunications industry and distributed fiber optic-based sensing for a multitude of industries. Luna’s business model is designed to accelerate the process of bringing new and innovative technologies to market. Forward-Looking Statements The statements in this release that are not historical facts constitute “forward-looking statements” made pursuant to the safe harbor provision of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties. These statements include Luna's expectations regarding strategic growth, management skillsets, corporate culture, global expansion and its projected full year 2023 and third quarter of 2023 financial results and outlook. Management cautions the reader that these forward-looking statements are only predictions and are subject to a number of both known and unknown risks and uncertainties, and actual results, performance, and/or achievements of Luna may differ materially from the future results, performance, and/or achievements expressed or implied by these forward-looking statements as a result of a number of factors. These factors include, without limitation, failure of demand for Luna's products and services to meet expectations, failure of target markets to grow and expand, technological and strategic challenges, uncertainties related to the macroeconomic conditions and those risks and uncertainties set forth in Luna’s Form 10-Q for the quarter ended June 30, 2023, and Luna's other periodic reports and filings with the Securities and Exchange Commission ("SEC"). Such filings are available on the SEC’s website at www.sec.gov and on Luna’s website at www.lunainc.com. The statements made in this release are based on information available to Luna as of the date of this release and Luna undertakes no obligation to update any of the forward-looking statements after the date of this release. Investor Contacts Allison Woody Luna Innovations Incorporated Phone: 540.769.8465 Email: woodya@lunainc.com ###

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

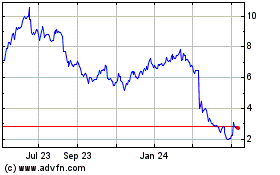

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

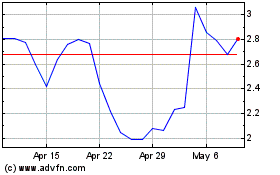

Luna Innovations (NASDAQ:LUNA)

Historical Stock Chart

From Apr 2023 to Apr 2024