Current Report Filing (8-k)

November 15 2022 - 4:56PM

Edgar (US Regulatory)

0001606757false6/3000016067572022-11-112022-11-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 11, 2022

KIMBALL ELECTRONICS, INC.

________________________________________________________________________________________________________

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Indiana | | 001-36454 | | 35-2047713 |

| (State or other jurisdiction of | | (Commission File | | (IRS Employer Identification No.) |

| incorporation) | | Number) | | |

| | | | | | | | |

| | | |

1205 Kimball Boulevard, Jasper, Indiana | | 47546 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code (812) 634-4000

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each Class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, no par value | KE | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year

On November 11, 2022, the Board of Directors (the “Board”) of Kimball Electronics, Inc. (the “Company”) approved a resolution, effective immediately, to amend the Amended and Restated By-Laws of the Company (as amended, the “Amended By-Laws”) to (a) add language to amend our advance notice provisions to address the adoption by the Securities and Exchange Commission of universal proxy rules; (b) remove references to the Board’s now-former Compensation and Governance Committee; and (c) update the Article referring to the Board’s authority to appoint committees:

Section 2.6 of Article II, Notice of Shareholder Nominations: This Section was amended to indicate that Share Owners who intend to solicit proxies in support of director nominees other than our nominees must also comply with the SEC’s universal proxy rules in addition to the specific requirements and procedures set forth in our Amended By-Laws. Specifically, the Amended By-Laws state that such Share Owners must provide timely notice that sets forth the information required by Rule 14a-19 under the Exchange Act. The Company continues to reserve the right to reject, rule out of order, or to take other appropriate action with respect to any proposal or nomination that does not comply with these and other applicable requirements.

Section 2.14 of Article II, Director Resignation Policy: This Section was amended to replace the reference to the now-former Compensation and Governance Committee with a reference to the Board or one of its Committees.

Article IV, Committees: This Article was amended to remove Sections 4.1 and 4.2, which had referred to two specific standing committees (the Audit Committee and the former Compensation and Governance Committee) and to renumber the remaining sections, including Section 4.3 (now Section 4.1), which refers to the Board’s authority to appoint committees. The Board also updated this Section to clarify that a Board-created committee shall have at least two members.

The foregoing summary does not purport to be complete and is qualified in its entirety by reference to the Amended By-Laws, which are attached hereto as Exhibit 3.2 are incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders

At the Annual Meeting of Share Owners of the Company held on November 11, 2022, the Share Owners voted on the following items:

1. The Board is divided into three classes with approximately one-third of the directors up for election each year, with Class II standing for election at this meeting. Director nominees are elected by a majority of the votes cast by the shares entitled to vote in the election at the meeting. The Share Owners voted to reelect each of the Class II nominees for director as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class II Nominees for Directors to serve a three-year term | | Votes For | | Votes

Withheld | | Broker

Non-Votes | | Percentage of Votes Cast in Favor |

| Michele A. M. Holcomb | | 19,018,805 | | | 230,206 | | | 2,137,408 | | | 99 | % |

| Holly A. Van Deursen | | 18,730,903 | | | 518,108 | | | 2,137,408 | | | 97 | % |

| Tom G. Vadaketh | | 19,039,377 | | | 209,634 | | | 2,137,408 | | | 99 | % |

2. The Share Owners voted to ratify the selection of Deloitte & Touche, LLP as the Company’s independent registered public accounting firm for fiscal year 2023 as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Votes For | | Votes Against | | Votes Abstaining | | Percentage of Votes Cast in Favor | | |

| | 20,685,017 | | | 686,364 | | | 15,038 | | | 96.8 | % | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

3. The Share Owners approved, on a non-binding, advisory basis, the compensation paid to the Company’s Named Executive Officers as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Votes For | | Votes Against | | Votes Abstaining | | Broker

Non-Votes | | Percentage of Votes Cast in Favor |

| | 18,741,052 | | | 185,528 | | | 322,431 | | | 2,137,408 | | | 99 | % |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Item 8.01 Other Events

On November 11, 2022, the Board, at its regular meeting held after the annual Share Owners’ meeting, made changes to and expanded its standing committees, effectively immediately. First, the Board formed the Nominating and ESG Committee. This new Board committee will assist the Board in its ongoing oversight and monitoring of the Company’s goals, policies, procedures, initiatives, and disclosures related to sustainability and environmental, social, and governance (ESG) matters. Among other specific duties, the Nominating and ESG Committee will provide oversight of the Company’s policies and operational controls of environmental, health and safety, and social risks.

Second, the Board reformulated its former Compensation and Governance Committee as the Talent, Culture, and Compensation Committee. This Committee will assist the Board in the oversight and monitoring of strategies, policies, and key metrics related to the Company’s talent and culture, including matters such as pay equity, diversity, inclusion, belonging, retention, leadership development and succession, and the alignment with and advancement of the Company’s Guiding Principles; assisting the Board in discharging its responsibilities relating to the fair and competitive compensation of the Chief Executive Officer and other executive officers; and reviewing, approving, and overseeing the Company’s compensation policies, plans, goals, and objectives for executive officers and non-employee directors. The Committee assures that such policies, plans, goals, and objectives are implemented according to the Company’s Guiding Principles and the compensation philosophy established by the Committee.

The Board appointed Directors to serve on the Talent, Culture, Compensation Committee, the Audit Committee, and the Nominating and ESG Committee, and it also appointed Chairpersons for those Committees, all effective immediately. The current compositions of the Board’s Committees are listed in the table below:

| | | | | | | | | | | | | | | | | | | | |

| Director | | Audit Committee | | Nominating and ESG Committee | | Talent, Culture, Compensation Committee |

| Michele A. M. Holcomb | | | | Chair | | |

| Gregory J. Lampert | | X | | | | |

| Robert J. Phillippy | | | | X | | |

| Colleen C. Repplier | | | | X | | X |

| Gregory A. Thaxton | | Chair | | | | X |

| Tom G. Vadaketh | | X | | | | |

| Holly A. Van Deursen | | | | | | Chair |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Each of the three Committees reports directly to the Board and is comprised entirely of independent Directors.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are filed as part of this report:

| | | | | | | | |

| Exhibit | | |

| Number | | Description |

| 3.2 | | |

| 104 | | Cover Page Interactive Data File (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | |

| | KIMBALL ELECTRONICS, INC. |

| | |

| By: | /s/ Douglas A. Hass |

| | DOUGLAS A. HASS

Chief Legal & Compliance Officer, Secretary |

Date: November 15, 2022

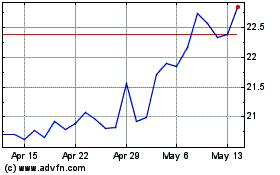

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From May 2024 to Jun 2024

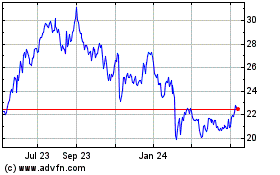

Kimball Electronics (NASDAQ:KE)

Historical Stock Chart

From Jun 2023 to Jun 2024