Form NT 10-Q - Notification of inability to timely file Form 10-Q or 10-QSB

November 13 2023 - 6:30AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

12b-25

NOTIFICATION

OF LATE FILING

(Check

One): ☐ Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q ☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR

For

Period Ended: September 30, 2023

☐

Transition Report on Form 10-K

☐

Transition Report on Form 20-F

☐

Transition Report on Form 11-K

☐

Transition Report on Form 10-K

☐

Transition Report on Form N-SAR

For

the Transition Period Ended: _____________________________________

Read

Instructions (on back page) Before Preparing Form. Please Print or Type.

NOTHING

IN THIS FORM SHALL BE CONSTRUED TO IMPLY THAT THE COMMISSION HAS VERIFIED ANY INFORMATION CONTAINED HEREIN.

If

the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART

I — REGISTRANT INFORMATION

| Full

name of Registrant: |

Inspired

Entertainment, Inc. |

| |

|

Address

of principal executive office:

City

State and ZIP Code: |

50

West 57th Street, Suite 415

New

York, NY 10107 |

PART

II — RULES 12b-25(b) AND (c)

If

the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b),

the following should be completed (Check box if appropriate)

| |

(a) |

The

reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| ☐ |

(b) |

The

subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-CEN or Form N-CSR, or portion

thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report

or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the

fifth calendar day following the prescribed due date; and |

| |

(c) |

The

accountant’s statement or other exhibit required by Rule 12(b)-25(c) has been attached if applicable. |

PART

III — NARRATIVE

State

below in reasonable detail the reasons why the Form 10-Q could not be filed within the prescribed time period.

Inspired Entertainment, Inc. (the “Company”) has determined that it is unable to file its Quarterly Report on Form 10-Q for

the fiscal quarter ended September 30, 2023 (the “Form 10-Q”) by November 9, 2023, the original due date for such filing,

without unreasonable effort or expense due to the circumstances described below.

As previously reported in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”),

on November 2, 2023, in connection with the preparation of the financial statements to be included in the Form 10-Q, management, in consultation

with the Company’s current independent registered public accounting firm, KPMG LLP, identified certain accounting errors relating

to the compliance with U.S. GAAP relating to the Company’s accounting policies for capitalizing software development costs. The

Company is currently undertaking a review of other financial statement line items and related accounting policies to ensure U.S. GAAP

compliance. It is currently unable to determine whether this review will result in further adjustments being required.

On November 2, 2023, the Audit Committee (the “Audit Committee”) of the Board of Directors, in consultation with the Company’s

management, determined that the Company’s previously issued financial statements included in the Company’s Annual Report on

Form 10-K for the years ended December 31, 2021 and 2022 and associated reports of the Company’s prior independent registered public

accounting firm, Marcum LLP, as well as the Company’s previously issued unaudited condensed consolidated financial statements during

those years, as well as for the first and second quarters of 2023 included in the Company’s Quarterly Reports on Form 10-Q (the

“Subject Periods”) contained accounting errors as set forth above. As a result of these errors, the Audit Committee has determined

that the Company’s consolidated financial statements for the Subject Periods should no longer be relied upon and should be restated.

Similarly, any previously issued or filed auditor or other reports, press releases, earnings releases, investor presentations or other

communications of the Company describing the Company’s financial results or other financial information relating to the Subject

Periods should no longer be relied upon. As a result of the foregoing accounting errors, the Company intends to restate its consolidated

financial statements and the notes thereto with respect to the Subject Periods in an amendment to the Company’s prior Annual Report

on Form 10-K for the years ended December 31, 2021 and 2022 and the Company’s condensed consolidated financial statements during

those years, as well as the first and second quarters of 2023 included in the Company’s prior Quarterly Reports on Form 10-Q for

such periods (the “Amended Reports”) to be filed with the SEC. The adjustments to such financial statement items will be set

forth through expanded disclosure in the financial statements included in the Amended Reports, including further describing the restatement

and its impact on previously reported amounts.

Additionally, the Company’s management has concluded that as a result of the financial statement errors noted above, one or more

additional material weaknesses exist in the Company’s internal control over financial reporting. Also as disclosed in the Company’s

Current Report on Form 8-K filed with the SEC on November 8, 2023, there is a risk that the Company will be unable to obtain, if needed,

any required waivers under its debt indenture with respect to a significant delay in filing periodic reports with the SEC, which could

affect its ability to continue as a going concern.

The Company is diligently pursuing completion of the restatements and intends to make such filings as soon as reasonably practicable.

Due to the time and effort required to complete the preparation of the restatements, the Company was unable, without unreasonable effort

or expense, to complete and file the Form 10-Q within the prescribed time period.

Please refer to Item 4.02 of the Form 8-K for additional details.

PART

IV — OTHER INFORMATION

| (1) | Name

and telephone number of person to contact in regard to this notification: |

| Carys

Damon |

+44(0)7969

537377 |

| Name |

Telephone

Number |

| (2) | Have

all other periodic reports required under Section 13 or 15(d) of the Securities Exchange

Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months

or for such shorter period that the registrant was required to file such report(s) been filed?

If answer is no, identify report(s). |

☒

Yes ☐ No

| (3) | Is

it anticipated that any significant change in results of operations from the corresponding

period for the last fiscal year will be reflected by the earnings statements to be included

in the subject report or portion thereof? |

☒

Yes ☐ No

If

so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why

a reasonable estimate of the results cannot be made.

Due to the forthcoming restatements, the Company is unable to estimate any significant change in results of operations from the corresponding

period for the last fiscal year at this time.

| |

Inspired

Entertainment, Inc. |

|

| |

(Name

of Registrant as Specified in Charter) |

|

has

caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

| Date:

November 13, 2023 |

/s/

Carys Damon |

| |

Carys

Damon |

| |

General

Counsel |

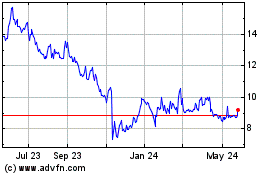

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Apr 2024 to May 2024

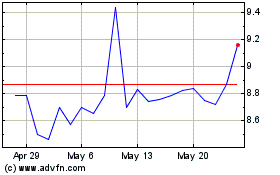

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From May 2023 to May 2024