Current Report Filing (8-k)

July 26 2021 - 4:18PM

Edgar (US Regulatory)

0001128361false00011283612021-07-222021-07-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

July 22, 2021

Date of Report (Date of earliest event reported)

|

|

|

|

|

HOPE BANCORP INC

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

000-50245

|

95-4849715

|

|

(State of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

3200 Wilshire Boulevard, Suite 1400

Los Angeles, California 90010

(Address of principal executives offices, including zip code)

(213) 639-1700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock

|

,

|

par value $0.001 per share

|

HOPE

|

NASDAQ Global Select Market

|

|

(Title of class)

|

(Trading Symbol)

|

(Name of exchange on which registered)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

Effective July 22, 2021, the Board of Directors for Hope Bancorp, Inc. (the “Company”) approved a stock repurchase program that authorizes the Company to repurchase up to $50 million of its common stock. Stock repurchases may be executed through various means, including, without limitation, open market transactions, privately negotiated transactions or by other means as determined by the Company’s management and in accordance with the regulations of the Securities and Exchange Commission. A copy of the July 26, 2021 press release announcing the stock repurchase program is attached hereto as Exhibit 99.1.

The following risk factor supplements the “Risk Factors” section in our 2020 Form 10-K.

The COVID-19 pandemic has had a material and adverse impact on our business, financial condition and results of operations, and the further impact will depend on future developments that cannot be predicted, including the scope and duration of the pandemic, impact of the different variants of the virus, the economic implications of the same, and the actions taken by governmental authorities in response to the pandemic.

The novel COVID-19 pandemic has substantially and negatively impacted the United States economy, disrupted global supply chains, considerably lowered equity market valuations, created significant volatility and disruption in the financial markets, and materially increased unemployment levels. In addition, certain industries to which the Company has considerable exposure, including hospitality and retail, are expected to require a longer recovery period from the temporary pandemic-related restrictions on business operations. As a result, the demand for our products and services has been and likely will continue to be significantly impacted, which could materially and adversely affect our financial condition and results of operations. Furthermore, the pandemic could result in the recognition of amplified credit losses in our loan portfolios and increases in our allowance for loan losses, particularly if a rise in COVID-19 cases results in a return to business closures and lockdowns. Similarly, because of changing economic and market conditions, we may be required to recognize impairments on goodwill or the securities we hold. Our business operations may also be further disrupted if significant portions of our workforce are unable to work effectively, including because of challenges arising as a result of circumstances related to working from home, illness, quarantines, government actions, or other restrictions in connection with the pandemic. In response to the pandemic, we have also suspended residential property foreclosure sales and evictions, and previously offered payment deferrals and other expanded assistance for credit card, mortgage and small business lending customers, and future governmental actions may require these and other types of customer-related responses. In addition, we may take capital actions in response to the COVID-19 pandemic. The extent to which the COVID-19 pandemic continues to impact our business, results of operations, and financial condition, as well as our regulatory capital and liquidity ratios, will depend on future developments that cannot be predicted, including the scope and duration of the pandemic, impact of the different variants of the virus, the economic implications of the same and actions taken by governmental authorities and other third parties in response to the pandemic.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HOPE BANCORP, INC.

|

|

|

|

|

|

|

Date: July 26, 2021

|

By:

|

/s/ Kevin S. Kim

|

|

|

|

|

Kevin S. Kim

|

|

|

|

|

Chairman, President and Chief Executive Officer

|

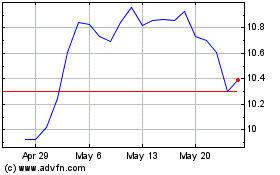

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Jun 2024 to Jul 2024

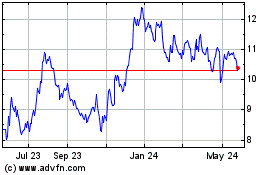

Hope Bancorp (NASDAQ:HOPE)

Historical Stock Chart

From Jul 2023 to Jul 2024