UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

|

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended March 31, 2020

OR

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period to

Commission File No. 001-38445

HELIUS MEDICAL TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

|

36-4787690

|

|

(State or other jurisdiction of

incorporation or organization)

642 Newtown Yardley Road, Suite 100

Newtown, Pennsylvania

(Address of principal executive offices)

|

|

(I.R.S. Employer

Identification No.)

18940

(Zip Code)

|

(215) 944-6100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.001 par value per share

|

|

HSDT

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days: Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☐

|

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☒

|

|

Smaller reporting company

|

☒

|

|

Emerging growth company

|

☒

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 6, 2020, the registrant had 38,041,666 shares of Class A common stock, $0.001 par value per share, outstanding.

HELIUS MEDICAL TECHNOLOGIES, INC.

INDEX

2

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Balance Sheets

(Except for share data, amounts in thousands)

|

|

|

March 31, 2020

|

|

|

December 31, 2019

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash

|

|

$

|

4,360

|

|

|

$

|

5,459

|

|

|

Accounts receivable, net

|

|

|

110

|

|

|

|

210

|

|

|

Other receivables

|

|

|

124

|

|

|

|

364

|

|

|

Inventory, net of reserve

|

|

|

594

|

|

|

|

598

|

|

|

Prepaid expenses

|

|

|

687

|

|

|

|

610

|

|

|

Total current assets

|

|

|

5,875

|

|

|

|

7,241

|

|

|

Property and equipment, net

|

|

|

678

|

|

|

|

712

|

|

|

Other assets

|

|

|

|

|

|

|

|

|

|

Goodwill

|

|

|

686

|

|

|

|

1,242

|

|

|

Intangible assets, net

|

|

|

687

|

|

|

|

582

|

|

|

Operating lease right-of-use asset, net

|

|

|

517

|

|

|

|

552

|

|

|

Other assets

|

|

|

18

|

|

|

|

18

|

|

|

Total other assets

|

|

|

1,908

|

|

|

|

2,394

|

|

|

TOTAL ASSETS

|

|

$

|

8,461

|

|

|

$

|

10,347

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

1,111

|

|

|

$

|

1,676

|

|

|

Accrued liabilities

|

|

|

1,005

|

|

|

|

1,519

|

|

|

Operating lease liability

|

|

|

180

|

|

|

|

172

|

|

|

Derivative financial instruments

|

|

|

—

|

|

|

|

5

|

|

|

Deferred revenue

|

|

|

321

|

|

|

|

430

|

|

|

Total current liabilities

|

|

|

2,617

|

|

|

|

3,802

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

Operating lease liability

|

|

|

417

|

|

|

|

465

|

|

|

Deferred revenue

|

|

|

218

|

|

|

|

245

|

|

|

TOTAL LIABILITIES

|

|

|

3,252

|

|

|

|

4,512

|

|

|

Commitments and contingencies (Note 6)

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized; no shares issued and outstanding as of March 31, 2020 and December 31, 2019

|

|

|

—

|

|

|

|

—

|

|

|

Class A common stock, $0.001 par value; 150,000,000 shares authorized; 38,041,666 and 30,718,554 shares issued and outstanding as of March 31, 2020 and December 31, 2019, respectively

|

|

|

38

|

|

|

|

31

|

|

|

Additional paid-in capital

|

|

|

114,967

|

|

|

|

111,479

|

|

|

Accumulated other comprehensive loss

|

|

|

(266

|

)

|

|

|

(902

|

)

|

|

Accumulated deficit

|

|

|

(109,530

|

)

|

|

|

(104,773

|

)

|

|

TOTAL STOCKHOLDERS’ EQUITY

|

|

|

5,209

|

|

|

|

5,835

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

$

|

8,461

|

|

|

$

|

10,347

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

3

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income

(Amounts in thousands except shares and per share data)

|

|

|

Three Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

Product sales, net

|

|

$

|

191

|

|

|

$

|

677

|

|

|

Fee revenue

|

|

|

9

|

|

|

|

—

|

|

|

License revenue

|

|

|

7

|

|

|

|

—

|

|

|

Total operating revenue

|

|

|

207

|

|

|

|

677

|

|

|

Cost of sales:

|

|

|

|

|

|

|

|

|

|

Cost of product sales

|

|

|

101

|

|

|

|

236

|

|

|

Gross profit

|

|

|

106

|

|

|

|

441

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,120

|

|

|

|

2,681

|

|

|

Selling, general and administrative

|

|

|

2,862

|

|

|

|

4,581

|

|

|

Amortization expense

|

|

|

126

|

|

|

|

—

|

|

|

Total operating expenses

|

|

|

4,108

|

|

|

|

7,262

|

|

|

Operating loss

|

|

|

(4,002

|

)

|

|

|

(6,821

|

)

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

Other income

|

|

|

6

|

|

|

|

11

|

|

|

Change in fair value of derivative financial instruments

|

|

|

4

|

|

|

|

8,289

|

|

|

Foreign exchange loss

|

|

|

(765

|

)

|

|

|

(155

|

)

|

|

Total other income (expense)

|

|

|

(755

|

)

|

|

|

8,145

|

|

|

Net income (loss)

|

|

|

(4,757

|

)

|

|

|

1,324

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

636

|

|

|

|

(112

|

)

|

|

Comprehensive income (loss)

|

|

$

|

(4,121

|

)

|

|

$

|

1,212

|

|

|

Net income (loss) per share

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

(0.15

|

)

|

|

$

|

0.05

|

|

|

Diluted

|

|

$

|

(0.15

|

)

|

|

$

|

(0.06

|

)

|

|

Weighted average shares outstanding

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

30,972,064

|

|

|

|

25,832,190

|

|

|

Diluted

|

|

|

30,972,064

|

|

|

|

26,785,708

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

4

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Statements of Stockholders’ Equity for the Three Months Ended March 31, 2020 and 2019

(Except share and per share data, amounts in thousands)

|

|

|

Common Stock, $0.001 par value

|

|

|

Additional Paid-In

|

|

|

Accumulated Other Comprehensive

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Loss

|

|

|

Deficit

|

|

|

Total

|

|

|

Balance as of December 31, 2018

|

|

|

25,827,860

|

|

|

$

|

26

|

|

|

$

|

105,411

|

|

|

$

|

(591

|

)

|

|

$

|

(94,992

|

)

|

|

$

|

9,854

|

|

|

Proceeds from exercise of stock options and warrants

|

|

|

16,320

|

|

|

|

—

|

|

|

|

92

|

|

|

|

—

|

|

|

|

—

|

|

|

|

92

|

|

|

Stock-based compensation

|

|

|

—

|

|

|

|

—

|

|

|

|

835

|

|

|

|

—

|

|

|

|

—

|

|

|

|

835

|

|

|

Reclassification of derivative financial instruments from the exercise of warrants

|

|

|

—

|

|

|

|

—

|

|

|

|

25

|

|

|

|

—

|

|

|

|

—

|

|

|

|

25

|

|

|

Foreign currency translation adjustments

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(112

|

)

|

|

|

—

|

|

|

|

(112

|

)

|

|

Net income

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,324

|

|

|

|

1,324

|

|

|

Balance as of March 31, 2019

|

|

|

25,844,180

|

|

|

$

|

26

|

|

|

$

|

106,363

|

|

|

$

|

(703

|

)

|

|

$

|

(93,668

|

)

|

|

$

|

12,018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.001 par value

|

|

|

Additional Paid-In

|

|

|

Accumulated Other Comprehensive

|

|

|

Accumulated

|

|

|

|

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Loss

|

|

|

Deficit

|

|

|

Total

|

|

|

Balance as of December 31, 2019

|

|

|

30,718,554

|

|

|

$

|

31

|

|

|

$

|

111,479

|

|

|

$

|

(902

|

)

|

|

$

|

(104,773

|

)

|

|

$

|

5,835

|

|

|

Proceeds from the issuance of common stock from At-the-Market program

|

|

|

1,065,968

|

|

|

|

1

|

|

|

|

802

|

|

|

|

—

|

|

|

|

—

|

|

|

|

803

|

|

|

Proceeds from issuance of common stock from the March 2020 Offering

|

|

|

6,257,144

|

|

|

|

6

|

|

|

|

1,342

|

|

|

|

—

|

|

|

|

—

|

|

|

|

1,348

|

|

|

Warrant issuance from the March 2020 Offering

|

|

|

—

|

|

|

|

—

|

|

|

|

842

|

|

|

|

|

|

|

|

|

|

|

|

842

|

|

|

Share issuance costs

|

|

|

—

|

|

|

|

—

|

|

|

|

(340

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

(340

|

)

|

|

Stock-based compensation

|

|

|

—

|

|

|

|

—

|

|

|

|

842

|

|

|

|

—

|

|

|

|

—

|

|

|

|

842

|

|

|

Foreign currency translation adjustments

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

636

|

|

|

|

—

|

|

|

|

636

|

|

|

Net loss

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(4,757

|

)

|

|

|

(4,757

|

)

|

|

Balance as of March 31, 2020

|

|

|

38,041,666

|

|

|

$

|

38

|

|

|

$

|

114,967

|

|

|

$

|

(266

|

)

|

|

$

|

(109,530

|

)

|

|

$

|

5,209

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

5

Helius Medical Technologies, Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(Amounts in thousands)

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(4,757

|

)

|

|

$

|

1,324

|

|

|

Adjustments to reconcile net income (loss) to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Change in fair value of derivative financial instruments

|

|

|

(4

|

)

|

|

|

(8,289

|

)

|

|

Stock-based compensation expense

|

|

|

842

|

|

|

|

835

|

|

|

Unrealized foreign exchange loss

|

|

|

738

|

|

|

|

176

|

|

|

Depreciation expense

|

|

|

37

|

|

|

|

22

|

|

|

Amortization expense

|

|

|

126

|

|

|

|

—

|

|

|

Provision for doubtful accounts

|

|

|

139

|

|

|

|

—

|

|

|

Intangible asset impairment

|

|

|

174

|

|

|

|

—

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(39

|

)

|

|

|

(740

|

)

|

|

Other receivables

|

|

|

240

|

|

|

|

(84

|

)

|

|

Inventory

|

|

|

4

|

|

|

|

(339

|

)

|

|

Prepaid expenses

|

|

|

(77

|

)

|

|

|

95

|

|

|

Other current assets

|

|

|

—

|

|

|

|

264

|

|

|

Operating lease liability

|

|

|

(5

|

)

|

|

|

(3

|

)

|

|

Accounts payable

|

|

|

(626

|

)

|

|

|

83

|

|

|

Accrued liabilities

|

|

|

(459

|

)

|

|

|

(144

|

)

|

|

Deferred revenue

|

|

|

(84

|

)

|

|

|

—

|

|

|

Net cash used in operating activities

|

|

|

(3,751

|

)

|

|

|

(6,800

|

)

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment

|

|

|

(3

|

)

|

|

|

(161

|

)

|

|

Internally developed software

|

|

|

(7

|

)

|

|

|

—

|

|

|

Net cash used in investing activities

|

|

|

(10

|

)

|

|

|

(161

|

)

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from the issuances of common stock and warrants

|

|

|

2,992

|

|

|

|

—

|

|

|

Share issuance costs

|

|

|

(340

|

)

|

|

|

(52

|

)

|

|

Proceeds from the exercise of stock options and warrants

|

|

|

—

|

|

|

|

92

|

|

|

Net cash provided by financing activities

|

|

|

2,652

|

|

|

|

40

|

|

|

Effect of foreign exchange rate changes on cash

|

|

|

10

|

|

|

|

(6

|

)

|

|

Net decrease in cash

|

|

|

(1,099

|

)

|

|

|

(6,927

|

)

|

|

Cash at beginning of period

|

|

|

5,459

|

|

|

|

25,583

|

|

|

Cash at end of period

|

|

$

|

4,360

|

|

|

$

|

18,656

|

|

(The accompanying notes are an integral part of the condensed consolidated financial statements.)

6

Helius Medical Technologies, Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

1. DESCRIPTION OF BUSINESS

Helius Medical Technologies, Inc. (“we” or the “Company”), is a neurotech company focused on neurological wellness. The Company’s purpose is to develop, license or acquire unique and non-invasive technologies targeted at reducing symptoms of neurological disease or trauma.

The Company’s first product, known as the Portable Neuromodulation Stimulator (“PoNSTM”), is an authorized class II, non-implantable medical device authorized for sale in Canada. PoNS is intended as a short term treatment (14 weeks) of chronic balance deficit due to mild-to-moderate traumatic brain injury (“mmTBI”) and is to be used in conjunction with physical therapy (“PoNS TreatmentTM”), and is indicated as a short term treatment (14 weeks) of gait deficit due to mild and moderate symptoms from Multiple Sclerosis (“MS”) and is to be used in conjunction with physical therapy. It is an investigational medical device in the United States, the European Union (“EU”), and Australia (“AUS”), and it is currently under review for clearance by the AUS Therapeutic Goods Administration. PoNS Treatment™ is not currently commercially available in the United States, the European Union or Australia.

The Company was incorporated in British Columbia, Canada on March 13, 2014. On May 28, 2014, we were reincorporated from British Columbia to the State of Wyoming, and on July 20, 2018, we were reincorporated from the State of Wyoming to the State of Delaware. We are headquartered in Newtown, Pennsylvania. On December 21, 2018, the Company’s wholly owned subsidiary, NeuroHabilitation Corporation, changed its name to Helius Medical, Inc (“HMI”). On January 31, 2019, the Company formed another wholly owned subsidiary, Helius NeuroRehab, Inc., (“HNR”), a Delaware corporation. On October 10, 2019, the Company formed Helius Canada Acquisition Ltd. (“HCA”), a company incorporated under the federal laws of Canada and a wholly owned subsidiary of Helius Medical Technologies (Canada), Inc. (“HMC”), a company incorporated under the federal laws of Canada, which acquired Heuro Canada, Inc. (“Heuro”) from Health Tech Connex Inc. (“HTC”) on October 30, 2019.

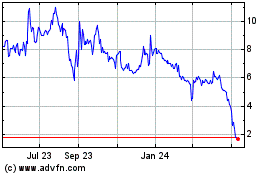

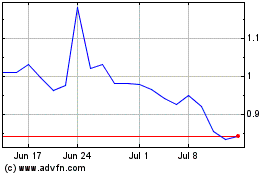

The Company’s Class A common stock, par value $0.001 per share (“common stock”), is listed on the Nasdaq Capital Market (“Nasdaq”) and the Toronto Stock Exchange (the “TSX”). The common stock began trading on the Canadian Securities Exchange on June 23, 2014, under the ticker symbol “HSM” and the trading was subsequently transferred to the TSX on April 18, 2016. On April 11, 2018, the common stock began trading on Nasdaq under the ticker symbol “HSDT” after having traded on the OTCQB in the United States under the ticker symbol “HSDT” since February 10, 2015.

Going Concern Uncertainty

As of March 31, 2020, the Company had cash of $4.4 million. For the three months ended March 31, 2020, the Company had an operating loss of $4.0 million, and as of March 31, 2020, its accumulated deficit was $109.5 million. For the three months ended March 31, 2020, the Company had $0.2 million of revenue from the commercial sale of products or services. The Company expects to continue to incur operating losses and net cash outflows until such time as it generates a level of revenue to support its cost structure. There is no assurance that the Company will achieve profitable operations, and, if achieved, whether it will be sustained on a continued basis. These factors indicate substantial doubt about the Company’s ability to continue as a going concern within one year after the date the financial statements are filed. The Company’s condensed consolidated financial statements have been prepared on the basis of continuity of operations, realization of assets and satisfaction of liabilities in the ordinary course of business.

The Company intends to fund ongoing activities by utilizing its current cash on hand, cash received from the sale of its PoNS™ device in Canada and by raising additional capital through equity or debt financings. There can be no assurance that the Company will be successful in raising that additional capital or that such capital, if available, will be on terms that are acceptable to the Company. If the Company is unable to raise sufficient additional capital, the Company may be compelled to reduce the scope of its operations and planned capital expenditures.

Risks and Uncertainties

The Company’s business, results of operations and financial condition may be adversely impacted by economic conditions, including the global health concerns relating to the coronavirus (“COVID-19”) pandemic. The outbreak and spread of COVID-19 has significantly increased economic uncertainty. Authorities implemented numerous measures to try to contain the virus, such as travel bans and restrictions, quarantines, shelter in place orders, and business shutdowns. The COVID-19 pandemic has led to the closure of PoNS Authorized clinic locations across Canada. Timing for re-opening these clinics is uncertain at this time, and could result in a decrease of our commercial activities, and may have a negative impact on our customer engagement efforts. Moreover, the Company’s ability to conduct its ongoing clinical research may be impaired if trial participants or staff are adversely affected by COVID-19, leading to further delays in the development and approval of the Company’s product candidate. In addition, disruptions in business operations in the United States, Canada and China due to COVID-19 may delay the timing for the submission and approval of the Company’s marketing applications with regulatory agencies or limit the Company’s suppliers’ ability to ship materials that the Company relies upon due to delays or suspension of manufacturing operations. COVID-19 could also disrupt governmental operations or impair the Company’s ability to access the public markets to obtain the necessary capital and continue the Company’s operations. The extent to which the COVID-19 pandemic impacts the Company’s business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted. The Company does not know yet the full extent of the impact of COVID-19 on its business, operations or the global economy as a whole.

7

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The condensed consolidated financial statements have also been prepared on a basis substantially consistent with, and should be read in conjunction with the Company’s audited consolidated financial statements for the year ended December 31, 2019, included in its Annual Report on Form 10-K that was filed with the Securities and Exchange Commission on March 12, 2020. The Company’s reporting currency is the U.S. Dollar (“USD$”).

Use of Estimates

The preparation of the condensed consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and disclosure of contingent assets and liabilities. Significant estimates include the assumptions used in the fair value pricing model for stock-based compensation, derivative financial instruments and deferred income tax asset valuation allowance. Financial statements include estimates which, by their nature, are uncertain. Actual outcomes could differ from these estimates.

Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements reflect the operations of Helius Medical Technologies, Inc. and its wholly owned subsidiaries. The usual condition for a controlling financial interest is ownership of a majority of the voting interests of an entity. However, a controlling financial interest may also exist through arrangements that do not involve controlling voting interests. As such, the Company applies the guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 810 – Consolidation (“ASC 810”), to determine when an entity that is insufficiently capitalized or not controlled through its voting interests, referred to as a variable interest entity should be consolidated. All intercompany balances and transactions have been eliminated. Certain prior period amounts have been reclassified to conform to the current period presentation.

Concentrations of Credit Risk

The Company is subject to credit risk with respect to its cash. Amounts invested in such instruments are limited by credit rating, maturity, industry group, investment type and issuer. The Company is not currently exposed to any significant concentrations of credit risk from these financial instruments. The Company seeks to maintain safety and preservation of principal and diversification of risk, liquidity of investments sufficient to meet cash flow requirements and a competitive after-tax rate of return.

Receivables

Accounts receivables are stated at their net realizable value. In determining the appropriate allowance for doubtful accounts, the Company considers a combination of factors, such as the aging of trade receivables, its customers’ financial strength, and payment history. Changes in these factors, among others, may lead to adjustments in the Company’s allowance for doubtful accounts. The calculation of the required allowance required judgment by Company management. As of March 31, 2020, the Company’s accounts receivable of $0.1 million, is net of an allowance for doubtful accounts of $0.3 million and is the result of revenue from product sales. As of December 31, 2019, the Company’s accounts receivable of $0.4 million, is net of an allowance for doubtful accounts of $0.2 million and is the result of revenue from product sales.

Other receivables as of March 31, 2020 and December 31, 2019 included refunds from research and development (“R&D”) tax credits of $44 thousand and $0.2 million, respectively, and Goods and Services Tax (“GST”) and Quebec Sales Tax (“QST”) refunds of $80 thousand and $0.1 million, respectively, related to the Company’s Canadian expenditures.

Inventory

The Company’s inventory consists of raw materials, work in progress and finished goods of the PoNS device. Inventory is stated at the lower of cost (average cost method) or net realizable value. Adjustments to reduce the cost of inventory to its net realizable value are made if required. The Company calculates provisions for excess inventory based on inventory on hand compared to anticipated sales or usage. Management uses its judgment to forecast sales or usage and to determine what constitutes a reasonable period. There can be no assurance that the amount ultimately realized for inventories will not be materially different than that assumed in the calculation of the reserves. Inventory markdowns to net realizable value of $2 thousand were recorded during the three months ended March 31, 2020. No inventory markdowns to net realizable value were recorded during the three months ended March 31, 2019.

8

As of March 31, 2020 and December 31, 2019, inventory consisted of the following (amounts in thousands):

|

|

|

As of

|

|

|

As of

|

|

|

|

|

March 31, 2020

|

|

|

December 31, 2019

|

|

|

Raw materials

|

|

$

|

151

|

|

|

$

|

144

|

|

|

Work-in-process

|

|

|

466

|

|

|

|

375

|

|

|

Finished goods

|

|

|

29

|

|

|

|

129

|

|

|

Inventory

|

|

$

|

646

|

|

|

$

|

648

|

|

|

Inventory reserve

|

|

|

(52

|

)

|

|

|

(50

|

)

|

|

Total inventory, net of reserve

|

|

$

|

594

|

|

|

$

|

598

|

|

Property and Equipment

Property and equipment are carried at cost, less accumulated depreciation. Depreciation is recognized using the straight-line method over the useful lives of the related asset or the term of the related lease. Expenditures for maintenance and repairs, which do not improve or extend the expected useful life of the assets, are expensed to operations while major repairs are capitalized. The estimated useful life of the Company’s leasehold improvements is over the shorter of its lease term or useful life of 5 years; the estimated useful life for the Company’s furniture and fixtures is 7 years; and equipment has an estimated useful life of 15 years, while computer software and hardware has an estimated useful life of 3 to 5 years.

As of March 31, 2020 and December 31, 2019, property and equipment consisted of the following (amounts in thousands):

|

|

|

As of

|

|

|

As of

|

|

|

|

|

March 31, 2020

|

|

|

December 31, 2019

|

|

|

Leasehold improvement

|

|

$

|

182

|

|

|

$

|

182

|

|

|

Furniture and fixtures

|

|

|

247

|

|

|

|

247

|

|

|

Equipment

|

|

|

289

|

|

|

|

286

|

|

|

Computer software and hardware

|

|

|

182

|

|

|

|

182

|

|

|

Property and equipment

|

|

|

900

|

|

|

|

897

|

|

|

Less accumulated depreciation

|

|

|

(222

|

)

|

|

|

(185

|

)

|

|

Property and equipment, net

|

|

$

|

678

|

|

|

$

|

712

|

|

Depreciation expense of $37 thousand and $22 thousand for the three months ended March 31, 2020 and 2019, respectively.

Business Combinations

Transactions in which the Company obtains control of a business are accounted for according to the acquisition method as described in FASB ASC 805 – Business Combinations. The assets acquired and liabilities assumed are recognized and measured at their fair values as of the date control is obtained. Acquisition related costs in connection with a business combination are expensed as incurred. Contingent consideration is recognized and measured at fair value at the acquisition date and until paid re-measured on a recurring basis. It is classified as a liability based on appropriate GAAP.

On October 30, 2019, the Company and HTC entered into a Share Purchase Agreement (the “SPA”) whereby the Company, through its wholly owned subsidiary, acquired Heuro from HTC. Under the terms of the SPA, total consideration of approximately CAD$2.1 million (USD$1.6 million) was transferred to HTC, which included (1) cash of CAD$0.5 million (USD$0.4 million), (2) delivery of 55 PoNS devices for which the fair value was determined to be CAD$0.5 million (USD$0.4 million), (3) the forgiveness of CAD$750 thousand (USD$0.5 million) receivable from the September 2018 strategic alliance agreement and (4) the exclusivity rights granted to HTC in the Co-Promotion Agreement (as defined below) to provide PoNS Treatment in the Fraser Valley and Vancouver metro regions of British Columbia with a determined fair value of CAD$0.4 million (USD$0.3 million). The transaction has been accounted for as a business combination.

The acquisition related costs were $0.1 million and were accounted for as selling, general and administrative expenses in the consolidated statement of operations and comprehensive loss for the year ended December 31, 2019.

Supplemental proforma financial information has not been presented here because the proforma effects of this acquisition are not material to the Company’s reported results for any period presented.

The following table summarizes the recognized fair values of identifiable assets acquired and liabilities assumed as of October 30, 2019:

9

|

|

|

October 30, 2019

Fair Value

|

|

|

Assets:

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

1

|

|

|

Other receivables

|

|

|

19

|

|

|

Fixed assets

|

|

|

7

|

|

|

Intangibles

|

|

|

1,053

|

|

|

Goodwill

|

|

|

737

|

|

|

Total assets

|

|

$

|

1,817

|

|

|

Liabilities:

|

|

|

|

|

|

Accounts payable

|

|

$

|

186

|

|

|

Other current liabilities

|

|

|

9

|

|

|

Total liabilities

|

|

$

|

195

|

|

|

Net assets acquired

|

|

$

|

1,622

|

|

The fair values assigned to identifiable intangible assets assumed were based on management’s current estimates and assumptions and is considered preliminary. The Company believes that the most recent information available provides a reasonable basis for assigning fair value, but anticipates receiving additional information, and as such, the provisional measurements of fair value are subject to change. The Company recorded measurement adjustments of $0.4 million during the three months ended March 31, 2020. The recorded adjustments related to the recognition of reacquired exclusivity rights. The Company will finalize the amounts recognized as it obtains the information necessary to complete the analysis, but no later than one year from the acquisition date.

Acquired intangibles consisted of customer relationships, proprietary technology and reacquired rights. The remaining useful life at acquisition was 1.25 years, 5 years and 3.87 years, respectively, and the acquired intangibles are amortized using the straight-line method.

Factors considered by the Company in determination of goodwill include synergies, strategic fit and other benefits that do not meet the recognition criteria of acquired identifiable intangible assets. The recognized goodwill of $0.6 million is not expected to be deductible for tax purposes.

The fair value of the 55 PoNS devices in the amount of CAD$0.5 million will be recognized as revenue within the consolidated statements of operations and comprehensive loss once control has been transferred in accordance with ASC 606. As of December 31, 2019, the control had not been transferred resulting in the fair value being recorded as deferred revenue on the condensed consolidated balance sheet. As of March 31, 2020, the control of 11 devices had been transferred resulting in recognition of revenue for these devices. The fair value of the remaining 44 devices is still recorded as deferred revenue on the condensed consolidated balance sheet.

In connection with the SPA, on October 30, 2019, the Company entered into a Clinical Research and Co-Promotion Agreement with HTC (the “Co-Promotion Agreement”), whereby each company will promote the sales of the Company’s PoNS Treatment and HTC’s NeuroCatchTM device throughout Canada. This co-promotion arrangement terminates upon the earlier of the collection of data from 200 patients in Canada and December 31, 2020. Also, subject to certain terms and conditions, Helius granted to HTC the exclusive right to provide the PoNS Treatment in the Fraser Valley and Vancouver metro regions of British Columbia, where HTC has operated a PoNS authorized clinic since February 2019. HTC will purchase the PoNS devices for use in these regions exclusively from the Company and on terms no less favorable than the then-current standard terms and conditions. This exclusivity right has an initial term of ten (10) years, renewable by HTC for one additional ten (10) year term upon sixty (60) days’ written notice to Helius. The Co-Promotion Agreement had a fair value of CAD$360 thousand at the time of acquisition. License revenue will be recognized in connection with the Co-Promotion Agreement ratably over the ten-year term.

Goodwill and Other Intangible Assets

Goodwill represents the excess of purchase price over the fair values underlying net assets acquired in an acquisition. All of the Company’s goodwill as of March 31, 2020 is the result of the Heuro acquisition discussed above. Goodwill is not amortized, but rather will be tested annually for impairment or more frequently if events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable. The Company will test goodwill for impairment annually in the fourth quarter of each year using data as of October 1 of that year.

Goodwill is allocated to and evaluated for impairment at the Company’s one identified reporting unit. Goodwill is tested for impairment by either performing a qualitative evaluation or a quantitative test. The qualitative evaluation is an assessment of factors to determine whether it is more likely than not that a reporting unit’s fair value is less than its carrying amount. The Company may elect not to perform the qualitative assessment for its reporting unit and perform the quantitative impairment test. The quantitative goodwill impairment test requires the Company to compare the carrying value of the reporting unit’s net assets to the estimated fair value of the reporting unit.

10

If the estimated fair value exceeds the carrying value, no further evaluation is required, and no impairment loss is recognized. If the carrying amount of a reporting unit, including goodwill, exceeds the estimated fair value, the excess of the carrying value over the estimated fair value is recorded as an impairment loss, the amount of which is not to exceed the total amount of goodwill allocated to the reporting unit.

The COVID-19 pandemic was a triggering event for testing whether goodwill is impaired. As of March 31, 2020, the Company performed a quantitative assessment and determined that the estimated fair value of the reporting unit exceeded the carrying value of the reporting unit. Therefore, the Company concluded that goodwill was not impaired as of March 31, 2020. The Company will continue to monitor the impacts of the COVID-19 pandemic in future periods.

The following is a summary of the activity for the period ended March 31, 2020 for goodwill:

|

Goodwill

|

|

2020

|

|

|

Carrying amount at beginning of period

|

|

$

|

1,242

|

|

|

Business acquisition fair value allocation adjustment

|

|

|

(454

|

)

|

|

Foreign currency translation

|

|

|

(102

|

)

|

|

Carrying amount at end of period

|

|

$

|

686

|

|

Definite-lived intangibles consist principally of acquired customer relationships, proprietary software and reacquired rights as well as internally developed software. All are amortized straight-line over their estimated useful lives. Amortization expense related to intangible assets was $0.1 million during the three months ended March 31, 2020. No amortization expense related to intangible assets was recorded during the three months ended March 31, 2019. During the three months ended March 31, 2020, the Company incurred an intangible asset impairment loss of $0.2 million related to the customer relationships, which is included in selling, general and administrative expenses in the accompanying consolidated statement of operations.

Intangible assets as of March 31, 2020 and December 31, 2019 consist of the following:

|

|

|

|

|

As of March 31, 2020

|

|

|

As of December 31, 2019

|

|

|

|

|

Useful Life

|

|

Gross Carrying Amount

|

|

|

Accumulated Amortization

|

|

|

Gross Carrying Amount

|

|

|

Accumulated Amortization

|

|

|

Customer relationships

|

|

1.25 years

|

|

$

|

215

|

|

|

$

|

(130

|

)

|

|

$

|

423

|

|

|

$

|

(55

|

)

|

|

Acquired proprietary software

|

|

5 years

|

|

|

136

|

|

|

|

(11

|

)

|

|

|

148

|

|

|

|

(5

|

)

|

|

Reacquired rights

|

|

3.87 years

|

|

|

454

|

|

|

|

(49

|

)

|

|

|

-

|

|

|

|

-

|

|

|

Internally developed software

|

|

3 years

|

|

|

82

|

|

|

|

(10

|

)

|

|

|

75

|

|

|

|

(4

|

)

|

|

Total intangible assets

|

|

|

|

$

|

887

|

|

|

$

|

(200

|

)

|

|

$

|

646

|

|

|

$

|

(64

|

)

|

Amortization expense is anticipated to be as follows in future years:

|

For the Year Ending December 31,

|

|

|

|

|

|

2020 (remaining 9 months)

|

|

$

|

206

|

|

|

2021

|

|

|

180

|

|

|

2022

|

|

|

168

|

|

|

2023

|

|

|

110

|

|

|

2024

|

|

|

23

|

|

|

|

|

$

|

687

|

|

Leases

On January 1, 2019, the Company adopted ASU No. 2016-02, Leases, using the modified retrospective method. The Company elected the package of practical expedients permitted under the transition guidance within the new standard which allowed the Company to carry forward the historical lease classification. Adoption of this standard resulted in the recording of an operating lease right-of-use (“ROU”) asset and corresponding operating lease liabilities of $0.7 million on January 1, 2019.

The Company does not record an operating lease ROU asset and corresponding lease liability for leases with an initial term of twelve months or less and recognizes lease expense for these leases as incurred over the lease term. As of March 31, 2020, the Company had only one operating lease, which was for its headquarters office in Newtown, Pennsylvania upon the adoption date. As of March 31, 2020, the Company has not entered into any additional lease arrangements. Operating lease ROU assets and operating lease liabilities are recognized upon the adoption date based on the present value of lease payments over the lease term. The Company does not have a public credit rating and as such used a corporate yield with a “CCC” rating by S&P Capital IQ with a term commensurate with the term of its lease as its incremental borrowing rate in determining the present value of lease payments. Lease expense is recognized on a straight-line basis over the lease term. The Company’s lease arrangement

11

does not have lease and non-lease components which are to be accounted for separately. As of March 31, 2020, approximately $0.2 million of the Company’s operating lease ROU asset had been amortized (see Note 6).

Foreign Currency

The Company’s functional currency is the U.S. dollar. Monetary assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates in effect at the balance sheet date. Opening balances related to non-monetary assets and liabilities are based on prior period translated amounts, and non-monetary assets acquired, and non-monetary liabilities incurred are translated at the approximate exchange rate prevailing at the date of the transaction. Revenue and expense transactions are translated at the approximate exchange rate in effect at the time of the transaction. Foreign exchange gains and losses are included in the condensed consolidated statement of operations and comprehensive loss as foreign exchange (loss) gain.

The functional currency of HMC and HCA, the Company’s Canadian subsidiaries, is the CAD$ and the functional currency of HMI and HNR is the USD$. Transactions in foreign currencies are recorded into the functional currency of the relevant subsidiary at the exchange rate in effect at the date of the transaction. Any monetary assets and liabilities arising from these transactions are translated into the functional currency at exchange rates in effect at the balance sheet date or on settlement. Revenues, expenses and cash flows are translated at the weighted-average rates of exchanges for the reporting period. The resulting currency translation adjustments are not included in the Company’s condensed consolidated statements of operations and comprehensive loss for the reporting period, but rather are accumulated and gains and losses are recorded in foreign exchange (loss) gain, as a component of comprehensive loss, within the condensed consolidated statements of operations and comprehensive loss.

Stock-Based Compensation

The Company accounts for all stock-based payments and awards under the fair value-based method. The Company recognizes its stock-based compensation expense using the straight-line method.

The Company accounts for the granting of stock options to employees and non-employees using the fair value method whereby all awards are measured at fair value on the date of the grant. The fair value of all employee-related stock options is expensed over the requisite service period with a corresponding increase to additional paid-in capital. Upon exercise of stock options, the consideration paid by the option holder, together with the amount previously recognized in additional paid-in capital is recorded as an increase to common stock, while the par value of the shares received is reclassified from additional paid in capital. Stock options granted to employees are accounted for as liabilities when they contain conditions or other features that are indexed to other than a market, performance or service conditions.

In accordance with ASU 2018-07, Improvements to Nonemployee Share-Based Payment Accounting (“ASU 2018-07”), stock-based payments to non-employees are measured based on the fair value of the equity instrument issued. Compensation expense for non-employee stock awards is recognized over the requisite service period following the measurement of the fair value on the grant date over the vesting period of the award.

The Company uses the Black-Scholes option pricing model to calculate the fair value of stock options. The use of the Black-Scholes option pricing model requires management to make assumptions with respect to the expected term of the option, the expected volatility of the common stock consistent with the expected term of the option, risk-free interest rates, the value of the common stock and expected dividend yield of the common stock. Changes in these assumptions can materially affect the fair value estimate.

Awards of options that provide for an exercise price that is not denominated in: (a) the currency of a market in which a substantial portion of the Company's equity securities trades, (b) the currency in which the employee's pay is denominated, or (c) the Company's functional currency, are required to be classified as liabilities.

Revenue Recognition

In accordance with the FASB’s ASC 606, Revenue from Contracts with Customers (“ASC 606”), the Company recognizes revenue when its customer obtains control of promised goods or services, in an amount that reflects the consideration which the Company expects to be entitled in exchange for those goods or services. To determine revenue recognition for arrangements that the Company determines are within the scope of ASC 606, it performs the following five steps:

|

|

(i)

|

identify the contract(s) with a customer;

|

|

|

(ii)

|

identify the performance obligations in the contract;

|

|

|

(iii)

|

determine the transaction price;

|

|

|

(iv)

|

allocate the transaction price to the performance obligations in the contract; and

|

|

|

(v)

|

recognize revenue when (or as) the entity satisfies a performance obligation.

|

The Company applies the five-step model to contracts when it determines that it is probable it will collect substantially all of the consideration it is entitled to in exchange for the goods or services it transfers to the customer. At contract inception, once the contract is determined to be within the scope of ASC 606, the Company assesses the goods or services promised within each contract and determines those that are performance obligations and assesses whether each promised good or service is distinct. The Company then recognizes as revenue the amount of the

12

transaction price, after consideration of variability and constraints, if any, that is allocated to the respective performance obligation when the performance obligation is satisfied.

Product Sales, net

During the first half of 2019, product sales were derived from the sale of the PoNS device and certain support services including services from the use of the NeuroCatchTM device, which is owned by HTC and assesses electroencephalogram brain waves related to cognition of patients participating in the PoNS Treatment at neuroplasticity clinics in Canada. The Company acted in an agency capacity for services performed using the NeuroCatch device and remitted CAD$600 for each patient assessed with the NeuroCatch device. According to the supply agreement with each of these clinics, the Company’s performance obligation was met when it delivered the PoNS device to the clinic’s facility and the clinic assumed title of the PoNS device upon acceptance. As such, revenue is recognized at a point in time. Shipping and handling costs associated with outbound freight before control of a product has been transferred to a customer is accounted for as a fulfillment cost and are included in cost of sales. Further, according to the Company’s arrangement with HTC and Heuro, the Company shared 50/50 with Heuro in fees from support services excluding the CAD$600 payment for an assessment using the NeuroCatch device. For the three months ended March 31, 2019, the Company recorded $0.7 million in product sales net of $25 thousand for HTC’s portion related to services performed using the NeuroCatch device. As described above, the Company modified its arrangement with HTC on October 30, 2019 and product sales were derived from the sale of the PoNS device alone as the NeuroCatch is sold directly to the neuroplasticity clinics in Canada by HTC. For the three months ended March 31, 2020, the Company recorded $0.2 million in product sales. As of March 31, 2020, the control of 11 of the 55 PoNS devices included as consideration in the Heuro acquisition had been transferred resulting in revenue of $0.1 million being recognized which is included in the aforementioned $0.2 million in product sales. The fair value of the remaining 44 devices is recorded as deferred revenue of $0.3 million on the condensed consolidated balance sheet. The only returns during the three months ended March 31, 2020 were the result of warranty returns for defective products. These returns were insignificant and any future replacements are expected to be immaterial.

Fee Revenue

During the three months ended March 31, 2020, the Company recognized $9 thousand of fee revenue related to engaging new neuroplasticity clinics to provide the PoNS Treatment. During the three months ended March 31, 2019, the Company did not recognize any fee revenue associated with the Company’s agreement with HTC and Heuro that entitled the Company to 50% of the franchise fees collected by Heuro from each executed franchise agreement. As of March 31, 2020 and December 31, 2019, the Company had no contract assets or liabilities on its consolidated balance sheets related to the supply agreements with each clinic.

License Revenue

The Company did not record any license revenue during the first quarter of 2019. As described above, the Company modified its arrangement with HTC on October 30, 2019. License revenue will be recognized ratably over the ten-year term as the performance obligation is met in connection with the Co-Promotion Agreement. During the three months ended March 31, 2020, the Company recognized revenues of $7 thousand in license fees associated with the Co-Promotion Agreement. Revenue not yet recognized of $0.2 million is recorded as deferred revenue on the condensed consolidated balance sheet.

Cost of Sales

Cost of product sales includes the cost to manufacture the PoNS device, royalty expenses, freight charges, customs duties, wages and salaries of employees involved in the management of the supply chain and logistics of fulfilling the Company’s sales orders and certain support services provided by Heuro on the Company’s behalf.

Income Taxes

The Company accounts for income taxes using the asset and liability method. The asset and liability method provide that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized.

The Company has adopted the provisions of ASC 740 Income Taxes regarding accounting for uncertainty in income taxes. The Company initially recognizes tax positions in the condensed consolidated financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. Such tax positions are initially and subsequently measured as the largest amount of the tax benefit that is greater than 50% likely of being realized upon ultimate settlement with the tax authority, assuming full knowledge of the position and all relevant facts. Application requires numerous estimates based on available information. The Company considers many factors when evaluating and estimating its tax positions and tax benefits. These periodic adjustments may have a material impact on the condensed consolidated statements of operations and comprehensive loss. When applicable, the Company classifies penalties and interest associated with uncertain tax positions as a component of income tax expense in its condensed consolidated statements of operations and comprehensive loss.

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”). The CARES Act, among other things, includes provisions relating to refundable payroll tax credits, deferment of employer side social security payments, net

13

operating loss carryback periods, alternative minimum tax credit refunds, modifications to the net interest deduction limitations, increased limitations on qualified charitable contributions, and technical corrections to tax depreciation methods for qualified improvement property. We continue to examine the impact that the CARES Act may have on our business. Currently, we do not believe the CARES Act will have a material impact on our accounting for income taxes.

Research and Development Expenses

Research and development (“R&D”) expenses consist primarily of personnel costs, including salaries, benefits and stock-based compensation, clinical studies performed by contract research organizations, development and manufacturing of clinical trial devices and devices for manufacturing testing and materials and supplies as well as regulatory costs related to post market surveillance, quality assurance complaint handling and adverse event reporting. R&D costs are charged to operations when they are incurred.

Segment Information

Operating segments are defined as components of an enterprise about which separate discrete information is available for evaluation by the chief operating decision maker, or decision-making group, in deciding how to allocate resources and in assessing performance. The Company operates and manages its business within one operating and reportable segment. Accordingly, the Company reports the accompanying condensed consolidated financial statements in the aggregate in one reportable segment.

Derivative Financial Instruments

The Company evaluates its financial instruments and other contracts to determine if those contracts or embedded components of those contracts qualify as derivatives to be separately accounted for in accordance with ASC 815, Derivatives and Hedging. The result of this accounting treatment is that the fair value of the derivative is re-measured at each balance sheet date and recorded as a liability or asset and the change in fair value is recorded in the condensed consolidated statements of operations and comprehensive loss. As of March 31, 2020 and December 31, 2019, the Company’s derivative financial instruments were comprised of warrants issued in connection with both public and/or private securities offerings. Upon settlement of a derivative financial instrument, the instrument is re-measured at the settlement date and the fair value of the underlying instrument is reclassified to equity.

The classification of derivative financial instruments, including whether such instruments should be recorded as liabilities/assets or as equity, is reassessed at the end of each reporting period. Derivative financial instruments that become subject to reclassification are reclassified at the fair value of the instrument on the reclassification date. Derivative financial instruments will be classified in the condensed consolidated balance sheet as current if the right to exercise or settle the derivative financial instrument lies with the holder.

Fair Value Measurements

The Company accounts for financial instruments in accordance with ASC 820, Fair Value Measurements and Disclosures (“ASC 820”). ASC 820 establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy under ASC 820 are described below:

Level 1 – Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly; and

Level 3 – Prices or valuations that require inputs that are both significant to the fair value measurement and unobservable.

The Company’s financial instruments recorded in its condensed consolidated balance sheets consist primarily of cash, accounts receivable, other current receivables, operating lease ROU asset, accounts payable, accrued liabilities, operating lease liability and derivative financial instruments. The book values of these instruments, with the exception of derivative financial instruments, non-current lease liability, operating lease ROU asset and non-current receivables approximate their fair values due to the immediate or short-term nature of these instruments.

14

The Company’s derivative financial instruments are classified as Level 3 within the fair value hierarchy. Unobservable inputs used in the valuation of these financial instruments include volatility of the underlying share price and the expected term. See Note 3 for the inputs used in the Black-Scholes option pricing model as of March 31, 2020 and December 31, 2019 and the roll forward of the Company’s derivative financial instruments. The Company’s derivative financial instruments are comprised of warrants which are classified as liabilities.

The following table summarizes the Company’s recurring fair value measurements for derivative financial instruments and stock-based compensation liability within the fair value hierarchy as of March 31, 2020 and December 31, 2019 (amounts in thousands):

|

|

|

Fair Value

|

|

|

Level 1

|

|

|

Level 2

|

|

|

Level 3

|

|

|

March 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative financial instruments

|

|

$

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

—

|

|

|

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative financial instruments

|

|

$

|

5

|

|

|

|

—

|

|

|

|

—

|

|

|

$

|

5

|

|

There were no transfers between any levels for any of the periods presented.

In addition to assets and liabilities that are recorded at fair value on a recurring basis, the Company's assets and liabilities are also subject to nonrecurring fair value measurements. Generally, assets are recorded at fair value on a nonrecurring basis as a result of impairment charges. Due to the COVID-19 pandemic and the related risks and uncertainties, the Company’s customer relationship intangible asset incurred an impairment loss during the three months ended March 31, 2020 of $0.2 million and has a remaining net book value of $0.1 million as of March 31, 2020. The fair value of this intangible asset was determined based on Level 3 measurements within the fair value hierarchy. Inputs to these fair value measurements included estimates of the amount and timing of the asset’s net future discounted cash flows based on historical data, current trends and market conditions.

Basic and Diluted Loss per Share

Earnings or loss per share (“EPS”) is computed by dividing net income (loss) by the weighted average number of common shares outstanding during the period. Diluted EPS is computed by dividing net income (loss) by the weighted average of all potentially dilutive shares of common stock that were outstanding during the periods presented.

The treasury stock method is used in calculating diluted EPS for potentially dilutive stock options and share purchase warrants, which assumes that any proceeds received from the exercise of in-the-money stock options and share purchase warrants, would be used to purchase common shares at the average market price for the period, unless including the effects of these potentially dilutive securities would be anti-dilutive.

The basic and diluted (loss) income per share for the periods noted below is as follows (amounts in thousands except shares and per share data):

|

|

|

Three Months Ended

|

|

|

|

|

March 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

Basic

|

|

|

|

|

|

|

|

|

|

Numerator:

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

$

|

(4,757

|

)

|

|

$

|

1,324

|

|

|

Denominator:

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

30,972,064

|

|

|

|

25,832,190

|

|

|

Basic net income (loss) per share

|

|

$

|

(0.15

|

)

|

|

$

|

0.05

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

|

|

|

|

|

|

Numerator:

|

|

|

|

|

|

|

|

|

|

Net income (loss), basic

|

|

$

|

(4,757

|

)

|

|

$

|

1,324

|

|

|

Effect of dilutive securities: warrants

|

|

|

—

|

|

|

|

(2,809

|

)

|

|

Net loss, diluted

|

|

$

|

(4,757

|

)

|

|

$

|

(1,485

|

)

|

|

Denominator:

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic

|

|

|

30,972,064

|

|

|

|

25,832,190

|

|

|

Potential common share issuances:

|

|

|

|

|

|

|

|

|

|

Incremental dilutive shares from equity instruments (treasury stock method)

|

|

|

—

|

|

|

|

953,518

|

|

|

Weighted average common shares outstanding

|

|

|

30,972,064

|

|

|

|

26,785,708

|

|

|

Diluted net loss per share

|

|

$

|

(0.15

|

)

|

|

$

|

(0.06

|

)

|

15