UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2019

Commission File Number 000-51138

GRAVITY CO., LTD.

(Translation of registrant’s name into English)

15F, 396 World Cup buk-ro, Mapo-gu, Seoul 121-795, Korea

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☑ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

GRAVITY REPORTS THIRD QUARTER OF 2019 RESULTS AND BUSINESS UPDATES

Seoul, South Korea – November 14, 2019 – GRAVITY Co., Ltd. (NasdaqGM: GRVY) (“Gravity” or “Company”), a developer and publisher of online and mobile games based in South Korea, today announced its unaudited financial results for the third quarter ended September 30, 2019, prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and business updates.

THIRD QUARTER 2019 HIGHLIGHTS

|

|

•

|

Total revenues were KRW 77,566 million (US$ 64,863 thousand), representing a 0.7% decrease from the second quarter ended June 30, 2019 (“QoQ”) and a 75.5% increase from the third quarter ended September 30, 2018 (“YoY”).

|

|

|

•

|

Operating profit was KRW 10,226 million (US$ 8,551 thousand), representing a 21.3% decrease QoQ and a 44.4% increase YoY.

|

|

|

•

|

Profit before income tax expenses was KRW 11,213 million (US$ 9,376 thousand), representing a 20.1% decrease QoQ and a 53.0% increase YoY.

|

|

|

•

|

Net profit attributable to parent company was KRW 8,952 million (US$ 7,485 thousand), representing a 17.6% decrease QoQ and a 41.8% increase YoY.

|

REVIEW OF THIRD QUARTER 2019 FINANCIAL RESULTS

Revenues

Subscription revenues for the third quarter of 2019 were KRW 10,564 million (US$ 8,834 thousand), representing a 56.6 % increase QoQ from KRW 6,746 million and a 75.9% increase YoY from KRW 6,005 million. The increase QoQ was mainly attributable to increased revenues from Ragnarok Online in Taiwan, Brazil, and Ragnarok Prequel 2 in Taiwan. The increase YoY was largely due to increased revenues from Ragnarok Online in Taiwan, Brazil and Ragnarok Prequel 2 in Taiwan. Such increase was partially offset by decreased revenue from Ragnarok Prequel in Taiwan.

Royalty and license fee revenues for the third quarter of 2019 were KRW 2,583 million (US$ 2,160 thousand), representing an 8.8% decrease QoQ from KRW 2,832 million and a 12.8% decrease YoY from KRW 2,961 million. The decrease QoQ was primarily due to decreased revenue from Ragnarok Online in Japan. The decrease YoY resulted mainly from decreased revenues from Ragnarok Online in Brazil and Thailand.

Mobile game and application revenues were KRW 61,238 million (US$ 51,209 thousand) for the third quarter of 2019, representing a 7.9% decrease QoQ from KRW 66,463 million and a 83.4% increase YoY from KRW 33,387 million. The decrease QoQ resulted primarily from decreased revenues from Ragnarok M: Eternal Love in Southeast Asia, North America, South America, Oceania, and Taiwan. Such decrease was partially offset by increased revenues from Ragnarok M: Eternal Love in Japan, Korea and Ragnarok H5 that has launched on September 19, 2019 in Korea. The increase YoY was primarily due to revenues from

Ragnarok M: Eternal Love in Southeast Asia, Japan, North America, South America, Oceania, and Ragnarok H5 launched in September in Korea. This increase was partially offset by decreased revenues from Ragnarok M: Eternal Love in Taiwan and Korea.

Character merchandising and other revenues were KRW 3,181 million (US$ 2,660 thousand) for the third quarter of 2019, representing 52.5% increase QoQ from KRW 2,086 million and a 72.1% increase YoY from KRW 1,848 million.

Cost of Revenue

Cost of revenue was KRW 56,058 million (US$ 46,877 thousand) for the third quarter of 2019, representing a 1.4% decrease QoQ from KRW 56,858 million and a 88.1% increase YoY from KRW 29,806 million. The decrease QoQ was mainly due to decreased commission paid for mobile game services related to Ragnarok M: Eternal love in Southeast Asia, North America, South America, and Oceania. The increase YoY was mostly from increased commission paid for mobile game services related to Ragnarok M: Eternal love in Southeast Asia, North America, South America, Oceania, and Japan.

Operating Expenses

Operating expenses were KRW 11,282 million (US$ 9,435 thousand) for the third quarter of 2019, representing a 36.4% increase QoQ from KRW 8,271 million and a 54.3% increase YoY from KRW 7,311 million. The increase QoQ was mainly attributable to increased advertising expenses for Ragnarok M: Eternal Love in Korea, Ragnarok H5 launched in September in Korea, and re-launched Ragnarok Online in Indonesia. The increase YoY was mostly resulted from increased advertising expenses for Ragnarok M: Eternal Love in Korea, Ragnarok H5 launched in September in Korea, re-launched Ragnarok Online in Indonesia, research and development expenses and salaries.

Profit before income tax expenses

Profit before income tax expenses was KRW 11,213 million (US$ 9,376 thousand) for the third quarter of 2019 compared with profit before income tax expense of KRW 14,037 million for the second quarter of 2019 and profit before income tax expenses of KRW 7,329 million for the third quarter of 2018.

Net Profit

As a result of the foregoing factors, Gravity recorded a net profit attributable to parent company of KRW 8,952 million (US$ 7,485 thousand) for the third quarter of 2019 compared with net profit attributable to parent company of KRW 10,861 million for the second quarter of 2019 and a net profit attributable to parent company of KRW 6,312 million for the third quarter of 2018.

Liquidity

The balance of cash and cash equivalents and short-term financial instruments was KRW 120,259 million (US$ 100,564 thousand) as of September 30, 2019.

Note: For convenience purposes only, the KRW amounts have been expressed in U.S. dollars at the exchange rate of KRW 1,195.85 to US$ 1.00, the noon buying rate in effect on September 30, 2019 as quoted by the Federal Reserve Bank of New York.

GRAVITY BUSINESS UPDATE

Ragnarok Online IP-based Games

|

•

|

Ragnarok Origin, a MMORPG mobile game

|

Ragnarok Origin is scheduled to be launched in Korea in 2020. The game embodies Ragnarok’s game elements to the highest level of graphics on the mobile device.

|

•

|

Ragnarok M: Eternal Love, a MMORPG mobile game

|

Ragnarok M: Eternal Love has launched in Europe (except for some regions) and Russia on October 16, 2019.

|

•

|

Ragnarok Tactics, a SRPG mobile game

|

Ragnarok Tactics has launched in Thailand on November 8, 2019. On the launching day, the game ranked as the first in free download rankings and the second in gross rankings of Apple App Store. The game is scheduled to be launched in Korea in the first half of 2020.

|

•

|

Other Ragnarok Online IP-based games

|

Gravity has launched Ragnarok Click H5, a Click Action RPG game, globally on November 13, 2019.

The company has been preparing to launch Ragnarok H5, an idle RPG game, in Indonesia in the first quarter of 2020.

Other IP games

|

•

|

The Color of Dream Fantasy Latele, a MMORPG mobile game, has launched in Japan on October 16, 2019.

|

Investor Presentation

Gravity issued an investor presentation. The presentation contains the Company’s recent business updates, results of the third quarter in 2019 and Gravity’s business plan. The presentation can be found on the Company’s website under the IR Archives section at http://www.gravity.co.kr/en/ir/pds/list.asp. Korean and Japanese versions of the presentation are also provided on the website.

About GRAVITY Co., Ltd. ---------------------------------------------------

Gravity is a developer and publisher of online and mobile games. Gravity's principal product, Ragnarok Online, is a popular online game in many markets, including Japan and Taiwan, and is currently commercially offered in 83 markets and countries. For more information about Gravity, please visit http://www.gravity.co.kr.

Forward-Looking Statements:

Certain statements in this press release may include, in addition to historical information, “forward-looking statements” within the meaning of the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act 1995. Forward-looking statements can generally be identified by the use of forward-looking terminology, such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe”, “project,” or “continue” or the negative thereof or other similar words, although not all forward-looking statements contain these words. Investors should consider the information contained in our submissions and filings with the United States Securities and Exchange Commission (the “SEC”), including our annual report for the fiscal year ended December 31, 2019 on Form 20-F, together with such other documents that we may submit to or file with the SEC from time to time, on Form 6-K. The forward-looking statements speak only as of this press release and we assume no duty to update them to reflect new, changing or unanticipated events or circumstances.

Contact:

Mr. Heung Gon Kim

Chief Financial Officer

Gravity Co., Ltd.

Email: kheung@gravity.co.kr

Ms. Jin Lee

Ms. Minji Oh

IR Unit

Gravity Co., Ltd.

Email: ir@gravity.co.kr

Telephone: +82-2-2132-7800

# # #

GRAVITY Co., Ltd.

Consolidated Statements of Financial Position

(In millions of KRW and thousands of US$)

|

|

|

As of

|

|

|

|

|

31-Dec-18

|

|

|

30-Sep-19

|

|

|

|

|

KRW

|

|

|

US$

|

|

|

KRW

|

|

|

US$

|

|

|

|

|

(audited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

86,051

|

|

|

|

71,958

|

|

|

|

88,759

|

|

|

|

74,223

|

|

|

Short-term financial instruments

|

|

|

9,500

|

|

|

|

7,944

|

|

|

|

31,500

|

|

|

|

26,341

|

|

|

Accounts receivable, net

|

|

|

60,664

|

|

|

|

50,729

|

|

|

|

39,409

|

|

|

|

32,955

|

|

|

Other receivables, net

|

|

|

255

|

|

|

|

213

|

|

|

|

199

|

|

|

|

166

|

|

|

Prepaid expenses

|

|

|

2,516

|

|

|

|

2,104

|

|

|

|

1,929

|

|

|

|

1,613

|

|

|

Other current assets

|

|

|

1,182

|

|

|

|

988

|

|

|

|

3,749

|

|

|

|

3,135

|

|

|

Total current assets

|

|

|

160,168

|

|

|

|

133,936

|

|

|

|

165,545

|

|

|

|

138,433

|

|

|

Property and equipment, net

|

|

|

1,498

|

|

|

|

1,253

|

|

|

|

6,833

|

|

|

|

5,714

|

|

|

Intangible assets

|

|

|

1,163

|

|

|

|

973

|

|

|

|

1,568

|

|

|

|

1,311

|

|

|

Deferred tax assets

|

|

|

7,413

|

|

|

|

6,199

|

|

|

|

8,866

|

|

|

|

7,414

|

|

|

Other non-current financial assets

|

|

|

1,494

|

|

|

|

1,249

|

|

|

|

1,662

|

|

|

|

1,390

|

|

|

Other non-current assets

|

|

|

1,438

|

|

|

|

1,202

|

|

|

|

1,727

|

|

|

|

1,444

|

|

|

Total assets

|

|

|

173,174

|

|

|

|

144,812

|

|

|

|

186,201

|

|

|

|

155,706

|

|

|

Liabilities and Equity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

|

71,928

|

|

|

|

60,148

|

|

|

|

44,258

|

|

|

|

37,010

|

|

|

Deferred revenue

|

|

|

16,476

|

|

|

|

13,778

|

|

|

|

12,795

|

|

|

|

10,700

|

|

|

Withholdings

|

|

|

2,019

|

|

|

|

1,688

|

|

|

|

2,119

|

|

|

|

1,772

|

|

|

Accrued expense

|

|

|

1,031

|

|

|

|

862

|

|

|

|

1,049

|

|

|

|

878

|

|

|

Income tax payable

|

|

|

1,944

|

|

|

|

1,626

|

|

|

|

3,204

|

|

|

|

2,679

|

|

|

Other current liabilities

|

|

|

123

|

|

|

|

102

|

|

|

|

1,889

|

|

|

|

1,580

|

|

|

Total current liabilities

|

|

|

93,521

|

|

|

|

78,204

|

|

|

|

65,314

|

|

|

|

54,619

|

|

|

Long-term deferred revenue

|

|

|

3,598

|

|

|

|

3,009

|

|

|

|

1,294

|

|

|

|

1,082

|

|

|

Other non-current liabilities

|

|

|

503

|

|

|

|

421

|

|

|

|

3,564

|

|

|

|

2,980

|

|

|

Total liabilities

|

|

|

97,622

|

|

|

|

81,634

|

|

|

|

70,172

|

|

|

|

58,681

|

|

|

Share capital

|

|

|

3,474

|

|

|

|

2,905

|

|

|

|

3,474

|

|

|

|

2,905

|

|

|

Capital surplus

|

|

|

27,141

|

|

|

|

22,695

|

|

|

|

27,128

|

|

|

|

22,685

|

|

|

Other components of equity

|

|

|

138

|

|

|

|

115

|

|

|

|

814

|

|

|

|

680

|

|

|

Retained earnings (Accumulated deficit)

|

|

|

45,405

|

|

|

|

37,970

|

|

|

|

84,978

|

|

|

|

71,061

|

|

|

Equity attributable to owners of the Parent Company

|

|

|

76,158

|

|

|

|

63,685

|

|

|

|

116,394

|

|

|

|

97,331

|

|

|

Non-controlling interest

|

|

|

(606

|

)

|

|

|

(507

|

)

|

|

|

(365

|

)

|

|

|

(306

|

)

|

|

Total equity

|

|

|

75,552

|

|

|

|

63,178

|

|

|

|

116,029

|

|

|

|

97,025

|

|

|

Total liabilities and equity

|

|

|

173,174

|

|

|

|

144,812

|

|

|

|

186,201

|

|

|

|

155,706

|

|

* For convenience purposes only, the KRW amounts are expressed in U.S. dollars at the rate of KRW 1,195.85 to US$ 1.00, the noon buying rate in effect on September 30, 2019 as quoted by the Federal Reserve Bank of New York.

GRAVITY Co., Ltd.

Consolidated Statements of Comprehensive Income

(In millions of KRW and thousands of US$ except for share and ADS data)

|

|

|

Three months ended

|

|

|

Nine months ended

|

|

|

|

|

30-Jun-19

|

|

|

30-Sep-18

|

|

|

30-Sep-19

|

|

|

30-Sep-18

|

|

|

30-Sep-19

|

|

|

|

|

(KRW)

|

|

|

(KRW)

|

|

|

(KRW)

|

|

|

(US$)

|

|

|

(KRW)

|

|

|

(KRW)

|

|

|

(US$)

|

|

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Online games-subscription revenue

|

|

|

6,746

|

|

|

|

6,005

|

|

|

|

10,564

|

|

|

|

8,834

|

|

|

|

21,017

|

|

|

|

23,566

|

|

|

|

19,706

|

|

|

Online games-royalties and license fees

|

|

|

2,832

|

|

|

|

2,961

|

|

|

|

2,583

|

|

|

|

2,160

|

|

|

|

10,788

|

|

|

|

9,135

|

|

|

|

7,639

|

|

|

Mobile games and applications

|

|

|

66,463

|

|

|

|

33,387

|

|

|

|

61,238

|

|

|

|

51,209

|

|

|

|

136,573

|

|

|

|

248,848

|

|

|

|

208,093

|

|

|

Character merchandising and other revenue

|

|

|

2,086

|

|

|

|

1,848

|

|

|

|

3,181

|

|

|

|

2,660

|

|

|

|

5,160

|

|

|

|

7,767

|

|

|

|

6,495

|

|

|

Total net revenue

|

|

|

78,127

|

|

|

|

44,201

|

|

|

|

77,566

|

|

|

|

64,863

|

|

|

|

173,538

|

|

|

|

289,316

|

|

|

|

241,933

|

|

|

Cost of revenue

|

|

|

56,858

|

|

|

|

29,806

|

|

|

|

56,058

|

|

|

|

46,877

|

|

|

|

118,740

|

|

|

|

214,153

|

|

|

|

179,080

|

|

|

Gross profit

|

|

|

21,269

|

|

|

|

14,395

|

|

|

|

21,508

|

|

|

|

17,986

|

|

|

|

54,798

|

|

|

|

75,163

|

|

|

|

62,853

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

5,733

|

|

|

|

5,602

|

|

|

|

8,984

|

|

|

|

7,513

|

|

|

|

28,899

|

|

|

|

21,382

|

|

|

|

17,880

|

|

|

Research and development

|

|

|

2,432

|

|

|

|

1,760

|

|

|

|

2,349

|

|

|

|

1,965

|

|

|

|

5,376

|

|

|

|

6,658

|

|

|

|

5,568

|

|

|

Others, net

|

|

|

106

|

|

|

|

(51

|

)

|

|

|

(51

|

)

|

|

|

(43

|

)

|

|

|

296

|

|

|

|

259

|

|

|

|

217

|

|

|

Total operating expenses

|

|

|

8,271

|

|

|

|

7,311

|

|

|

|

11,282

|

|

|

|

9,435

|

|

|

|

34,571

|

|

|

|

28,299

|

|

|

|

23,665

|

|

|

Operating profit

|

|

|

12,998

|

|

|

|

7,084

|

|

|

|

10,226

|

|

|

|

8,551

|

|

|

|

20,227

|

|

|

|

46,864

|

|

|

|

39,188

|

|

|

Finance income(costs):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income

|

|

|

1,141

|

|

|

|

58

|

|

|

|

1,353

|

|

|

|

1,131

|

|

|

|

1,540

|

|

|

|

3,556

|

|

|

|

2,974

|

|

|

Finance costs

|

|

|

(102

|

)

|

|

|

187

|

|

|

|

(366

|

)

|

|

|

(306

|

)

|

|

|

(679

|

)

|

|

|

(781

|

)

|

|

|

(653

|

)

|

|

Profit before income tax

|

|

|

14,037

|

|

|

|

7,329

|

|

|

|

11,213

|

|

|

|

9,376

|

|

|

|

21,088

|

|

|

|

49,639

|

|

|

|

41,509

|

|

|

Income tax expenses(profits)

|

|

|

3,208

|

|

|

|

1,024

|

|

|

|

2,357

|

|

|

|

1,971

|

|

|

|

4,659

|

|

|

|

10,192

|

|

|

|

8,523

|

|

|

Profit for the period

|

|

|

10,829

|

|

|

|

6,305

|

|

|

|

8,856

|

|

|

|

7,405

|

|

|

|

16,429

|

|

|

|

39,447

|

|

|

|

32,986

|

|

|

Profit attributable to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest

|

|

|

(32

|

)

|

|

|

(7

|

)

|

|

|

(96

|

)

|

|

|

(80

|

)

|

|

|

(47

|

)

|

|

|

(126

|

)

|

|

|

(105

|

)

|

|

Owners of Parent company

|

|

|

10,861

|

|

|

|

6,312

|

|

|

|

8,952

|

|

|

|

7,485

|

|

|

|

16,476

|

|

|

|

39,573

|

|

|

|

33,091

|

|

|

Earning per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted

|

|

|

1,563

|

|

|

|

908

|

|

|

|

1,288

|

|

|

|

1.08

|

|

|

|

2,371

|

|

|

|

5,695

|

|

|

|

4.76

|

|

|

Weighted average number of shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted

|

|

|

6,948,900

|

|

|

|

6,948,900

|

|

|

|

6,948,900

|

|

|

|

6,948,900

|

|

|

|

6,948,900

|

|

|

|

6,948,900

|

|

|

|

6,948,900

|

|

|

Earning per ADS(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic and diluted

|

|

|

1,563

|

|

|

|

908

|

|

|

|

1,288

|

|

|

|

1.08

|

|

|

|

2,371

|

|

|

|

5,695

|

|

|

|

4.76

|

|

* For convenience, the KRW amounts are expressed in U.S. dollars at the rate of KRW 1,195.85 to US$1.00, the noon buying rate in effect on September 30, 2019 as quoted by the Federal Reserve Bank of New York.

(1) Each ADS represents one common share.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

GRAVITY CO., LTD.

|

|

|

|

|

By:

|

/s/ Heung Gon Kim

|

|

Name:

|

Heung Gon Kim

|

|

Title:

|

Chief Financial Officer

|

Date: November 14, 2019

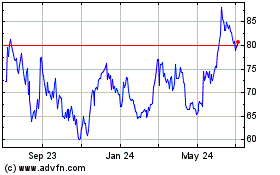

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Mar 2024 to Apr 2024

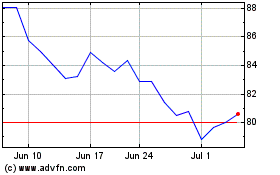

Gravity (NASDAQ:GRVY)

Historical Stock Chart

From Apr 2023 to Apr 2024