German American Bancorp, Inc. (NASDAQ: GABC) reported record

quarterly earnings of $15.3 million, or $0.61 per share, for the

quarter ending on June 30, 2019. This level of quarterly

earnings performance was an increase of 27%, on a per share basis,

compared with the second quarter 2018 net income of $11.1 million,

or $0.48 per share. The current quarter earnings also compared

favorably with the first quarter 2019 net income of $15.1 million,

or $0.60 per share.

These quarterly comparisons are inclusive of the

Company’s 2018 five branch acquisition in the greater Columbus,

Indiana market area on May 18, 2018 and its acquisition of First

Security, Inc. of Owensboro, Kentucky on October 15, 2018.

The Company had also previously announced the completion of its

acquisition of Citizens First Corporation of Bowling Green,

Kentucky as of July 1, 2019. Acquisition-related expenses

from these transactions were included in the expenses in each of

the quarterly period comparisons.

On a linked-quarter basis, the record second

quarter 2019 earnings were attributable to a variety of factors,

including an increased level of net interest income, improved

levels of non-interest income within a majority of the categories

of fee income and additional net gains on the sale of loans and

securities. As compared to the first quarter of 2019, the

Company also benefited from a reduction in the level of provision

for loan loss resulting from an improved level of asset

quality. Additionally, operating expenses were lower in the

current quarter due to reduced levels of salaries and benefits

expense and professional fees during the current quarter.

Other factors offsetting a portion of the

positive quarter-over-quarter comparison, on a linked-quarter

basis, included the recording of $1.4 million in insurance

contingency revenue, $554,000 in bank-owned life insurance

benefits, and a $262,000 gain on the sale of a former branch

facility during the first quarter of 2019.

The Company also recorded strong deposit growth

during the second quarter, as end of period total deposits grew by

approximately $63.7 million, or approximately 8% on a

linked-quarter annualized basis, and total non-maturity transaction

deposits grew by approximately $100.2 million, or 16% on a

linked-quarter annualized basis. Additionally, the Company

experienced a strong level of loan originations during the current

quarter, which was materially offset by a continued elevated level

of loan pay-offs, resulting in a modest increase of $8.3

million, or 1%, on a linked-quarter annualized basis, in end

of period total loans.

Commenting on the Company’s performance, Mark A.

Schroeder, German American’s Chairman & CEO, stated, "We’re

pleased with the extremely strong start we experienced during the

first half of this year, in terms of record earnings, exceptional

deposit growth and the exceptionally strong loan pipelines we

continue to experience throughout our footprint. Even though

the current economic recovery is at a historic length, the economic

strength and vitality in each of the markets we serve continues to

be impressive. Based on these factors, we are encouraged

about our ability to continue the level of exceptional performance

we’ve been able to deliver during the current quarter, year-to-date

and over the course of the past decade.”

The Company also announced its Board of

Directors declared a regular quarterly cash dividend of $0.17 per

share, which will be payable on August 20, 2019 to shareholders of

record as of August 10, 2019.

Balance Sheet Highlights

The Company completed a five-branch acquisition

of locations of First Financial Bancorp (formerly branch locations

of Mainsource Financial Group, Inc. prior to its merger with First

Financial Bancorp) on May 18, 2018. Four of the branches are

located in Columbus, Indiana, and one in Greensburg, Indiana.

In addition, on October 15, 2018, the Company completed its

acquisition of First Security, Inc. ("First Security") and its

subsidiary bank, First Security Bank, Inc. First Security was

based in Owensboro, Kentucky, and operated 11 retail banking

offices in Owensboro, Bowling Green, Franklin and Lexington,

Kentucky and in Evansville and Newburgh, Indiana.

Total assets for the Company totaled $3.971

billion at June 30, 2019, representing an increase of $75.2

million, or 8% on an annualized basis, compared with March 31, 2019

and an increase of $626.2 million, or 19%, compared with June 30,

2018. The increase in total assets as of June 30, 2019

compared to a year ago was driven largely by the acquisition of

First Security and the five-branch network in the Columbus and

Greensburg, Indiana markets, as well as organic loan growth.

June 30, 2019 total loans increased $8.3

million, or 1% on an annualized basis, compared with March 31, 2019

and increased $398.8 million, or 17%, compared with June 30,

2018.

The modest increase during the second quarter of

2019 was driven by a seasonal increase in agricultural loans of

approximately $16.1 million, or 19% on an annualized basis, which

was partially mitigated by a decline in retail loans of $7.7

million, or 5% on an annualized basis, driven primarily by a

decline in residential real estate loans.

| |

|

|

|

|

|

|

| End of Period Loan

Balances |

|

6/30/2019 |

|

3/31/2019 |

|

6/30/2018 |

| (dollars in

thousands) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Commercial & Industrial

Loans |

|

$ |

554,290 |

|

|

$ |

555,967 |

|

|

$ |

518,299 |

|

| Commercial Real Estate

Loans |

|

1,213,579 |

|

|

1,212,090 |

|

|

986,486 |

|

| Agricultural Loans |

|

364,116 |

|

|

347,999 |

|

|

352,308 |

|

| Consumer Loans |

|

280,963 |

|

|

281,724 |

|

|

241,315 |

|

| Residential Mortgage

Loans |

|

307,726 |

|

|

314,634 |

|

|

223,437 |

|

| |

|

$ |

2,720,674 |

|

|

$ |

2,712,414 |

|

|

$ |

2,321,845 |

|

| |

|

|

|

|

|

|

Non-performing assets totaled $12.5 million at

June 30, 2019 compared to $13.1 million at March 31, 2019 and $9.5

million at June 30, 2018. Non-performing assets represented

0.32% of total assets at June 30, 2019, 0.34% at March 31,

2019, and 0.28% at June 30, 2018. Non-performing loans

totaled $11.9 million at June 30, 2019 compared to $12.4 million at

March 31, 2019 and $9.5 million at June 30, 2018.

Non-performing loans represented 0.44% of total loans at June 30,

2019 compared to 0.46% at March 31, 2019 and 0.41% at June 30,

2018.

| |

|

|

|

|

|

| Non-performing

Assets |

|

|

|

|

|

| (dollars in

thousands) |

|

|

|

|

|

| |

6/30/2019 |

|

3/31/2019 |

|

6/30/2018 |

| Non-Accrual Loans |

$ |

10,929 |

|

|

$ |

12,036 |

|

|

$ |

8,953 |

|

| Past Due Loans (90 days or

more) |

959 |

|

|

393 |

|

|

534 |

|

|

Total Non-Performing Loans |

11,888 |

|

|

12,429 |

|

|

9,487 |

|

| Other Real Estate |

635 |

|

|

685 |

|

|

40 |

|

|

Total Non-Performing Assets |

$ |

12,523 |

|

|

$ |

13,114 |

|

|

$ |

9,527 |

|

| |

|

|

|

|

|

| Restructured Loans |

$ |

118 |

|

|

$ |

119 |

|

|

$ |

123 |

|

| |

|

|

|

|

|

The Company’s allowance for loan losses totaled

$16.2 million at June 30, 2019 compared to $16.2 million at March

31, 2019 and $15.6 million at June 30, 2018. The allowance

for loan losses represented 0.60% of period-end loans at June 30,

2019 compared with 0.60% of period-end loans at March 31, 2019 and

0.67% of period-end loans at June 30, 2018. From time to

time, the Company has acquired loans through bank and branch

acquisitions with the most recent (reflected in actual results)

being the First Security acquisition during the fourth quarter of

2018 and a five-branch acquisition in the second quarter of

2018. Under acquisition accounting treatment, loans acquired

are recorded at fair value which includes a credit risk component,

and therefore the allowance on loans acquired is not carried over

from the seller. The Company held a net discount on acquired

loans of $17.1 million at June 30, 2019, $18.2 million at March 31,

2019 and $9.6 million at June 30, 2018.

June 30, 2019 total deposits increased $63.7

million, or 8% on an annualized basis, compared with March 31, 2019

and increased $527.4 million, or 20%, compared with June 30,

2018. The increase in total deposits in the second quarter of

2019, compared with the first quarter of 2019, was largely related

to seasonal increases in public fund operating accounts.

| |

|

|

|

|

|

|

| End of Period Deposit

Balances |

|

6/30/2019 |

|

3/31/2019 |

|

6/30/2018 |

| (dollars in

thousands) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Non-interest-bearing Demand

Deposits |

|

$ |

725,367 |

|

|

$ |

723,995 |

|

|

$ |

629,724 |

|

| IB Demand, Savings, and MMDA

Accounts |

|

1,805,694 |

|

|

1,706,913 |

|

|

1,611,583 |

|

| Time Deposits <

$100,000 |

|

248,744 |

|

|

248,686 |

|

|

190,179 |

|

| Time Deposits >

$100,000 |

|

349,027 |

|

|

385,576 |

|

|

169,954 |

|

| |

|

$ |

3,128,832 |

|

|

$ |

3,065,170 |

|

|

$ |

2,601,440 |

|

| |

|

|

|

|

|

|

Results of Operations Highlights – Quarter ended June

30, 2019

Net income for the quarter ended June 30, 2019

totaled $15,271,000, or $0.61 per share, an increase of 2% on a per

share basis compared with the first quarter 2019 net income of

$15,067,000, or $0.60 per share, and an increase of 27% on a

per share basis compared with the second quarter 2018 net income of

$11,097,000, or $0.48 per share. The change in net income

during the second quarter of 2019, compared with the second quarter

of 2018, was impacted by the completed acquisition activity during

2018. A detailed analysis of the factors impacting second

quarter 2019 income and expenses, as compared to first quarter

2019, is included in the remaining discussion.

Net income for each quarter presented was

impacted by merger and acquisition activity during 2018 and

2019. The second quarter of 2019 results of operations

included acquisition-related expenses of approximately $428,000

($369,000 or $0.01 per share, on an after tax basis), while the

first quarter of 2019 results of operations included

acquisition-related expenses of approximately $544,000 ($432,000 or

$0.02 per share, on an after tax basis) and the second quarter of

2018 included approximately $903,000 ($727,000 or $0.03 per share

on an after tax basis).

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Summary Average

Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Tax-equivalent basis /

dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

| |

|

June 30, 2019 |

|

March 31, 2019 |

|

June 30, 2018 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Principal Balance |

|

Income/ Expense |

|

Yield/ Rate |

|

Principal Balance |

|

Income/ Expense |

|

Yield/ Rate |

|

Principal Balance |

|

Income/ Expense |

|

Yield/ Rate |

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Federal Funds Sold and

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term Investments |

|

$ |

21,257 |

|

|

$ |

85 |

|

|

1.62 |

% |

|

$ |

24,538 |

|

|

$ |

141 |

|

|

2.32 |

% |

|

$ |

12,939 |

|

|

$ |

54 |

|

|

1.68 |

% |

| Securities |

|

842,282 |

|

|

6,529 |

|

|

3.10 |

% |

|

825,625 |

|

|

6,549 |

|

|

3.17 |

% |

|

751,367 |

|

|

5,758 |

|

|

3.07 |

% |

| Loans and Leases |

|

2,721,630 |

|

|

35,135 |

|

|

5.18 |

% |

|

2,718,808 |

|

|

35,207 |

|

|

5.24 |

% |

|

2,229,972 |

|

|

26,394 |

|

|

4.75 |

% |

| Total Interest Earning

Assets |

|

$ |

3,585,169 |

|

|

$ |

41,749 |

|

|

4.67 |

% |

|

$ |

3,568,971 |

|

|

$ |

41,897 |

|

|

4.74 |

% |

|

$ |

2,994,278 |

|

|

$ |

32,206 |

|

|

4.31 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Demand Deposit Accounts |

|

$ |

715,681 |

|

|

|

|

|

|

|

|

|

$ |

691,107 |

|

|

|

|

|

|

|

|

|

$ |

625,158 |

|

|

|

|

|

|

|

|

| IB Demand, Savings, and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MMDA Accounts |

|

$ |

1,797,228 |

|

|

$ |

2,945 |

|

|

0.66 |

% |

|

$ |

1,731,118 |

|

|

$ |

2,695 |

|

|

0.63 |

% |

|

$ |

1,560,838 |

|

|

$ |

1,597 |

|

|

0.41 |

% |

| Time Deposits |

|

631,174 |

|

|

2,814 |

|

|

1.79 |

% |

|

646,726 |

|

|

2,721 |

|

|

1.71 |

% |

|

417,585 |

|

|

1,251 |

|

|

1.20 |

% |

| FHLB Advances and Other

Borrowings |

|

246,229 |

|

|

1,636 |

|

|

2.67 |

% |

|

330,463 |

|

|

2,182 |

|

|

2.68 |

% |

|

238,775 |

|

|

1,216 |

|

|

2.04 |

% |

| Total Interest-Bearing

Liabilities |

|

$ |

2,674,632 |

|

|

$ |

7,395 |

|

|

1.11 |

% |

|

$ |

2,708,307 |

|

|

$ |

7,598 |

|

|

1.14 |

% |

|

$ |

2,217,198 |

|

|

$ |

4,064 |

|

|

0.74 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of Funds |

|

|

|

|

|

0.83 |

% |

|

|

|

|

|

0.86 |

% |

|

|

|

|

|

0.54 |

% |

| Net Interest Income |

|

|

|

$ |

34,354 |

|

|

|

|

|

|

$ |

34,299 |

|

|

|

|

|

|

$ |

28,142 |

|

|

|

| Net Interest Margin |

|

|

|

|

|

3.84 |

% |

|

|

|

|

|

3.88 |

% |

|

|

|

|

|

3.77 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During the quarter ended June 30, 2019, net

interest income totaled $33,641,000, which was relatively flat to

the quarter ended March 31, 2019 net interest income of

$33,591,000. The increased level of net interest income

during the second quarter of 2019 compared with the first quarter

of 2019 was driven primarily by a modestly higher level of average

earning assets combined with an additional day during the second

quarter partially mitigated by a modest decline in the stated tax

equivalent net interest margin.

The tax equivalent net interest margin for the

quarter ended June 30, 2019 was 3.84% compared with 3.88% in the

first quarter of 2019. Accretion of loan discounts on

acquired loans contributed approximately 12 basis points to the net

interest margin on an annualized basis in the second quarter of

2019 and 16 basis points in the first quarter of 2019.

During the quarter ended June 30, 2019, the

Company recorded a provision for loan loss of $250,000 compared

with $675,000 in the first quarter of 2019. The provision

during all periods was done in accordance with the Company's

standard methodology for determining the adequacy of its allowance

for loan loss.

During the quarter ended June 30, 2019,

non-interest income totaled $10,509,000, a decline of $1,149,000,

or 10%, compared with the quarter ended March 31, 2019.

| |

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

| Non-interest

Income |

|

6/30/2019 |

|

3/31/2019 |

|

6/30/2018 |

| (dollars in

thousands) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Trust and Investment Product Fees |

|

$ |

1,913 |

|

|

$ |

1,567 |

|

|

$ |

1,677 |

|

| Service Charges on Deposit

Accounts |

|

2,024 |

|

|

1,900 |

|

|

1,643 |

|

| Insurance Revenues |

|

1,929 |

|

|

3,205 |

|

|

1,696 |

|

| Company Owned Life

Insurance |

|

304 |

|

|

884 |

|

|

260 |

|

| Interchange Fee Income |

|

2,332 |

|

|

2,095 |

|

|

1,714 |

|

| Other Operating Income |

|

461 |

|

|

871 |

|

|

913 |

|

|

Subtotal |

|

8,963 |

|

|

10,522 |

|

|

7,903 |

|

| Net Gains on Loans |

|

1,030 |

|

|

981 |

|

|

905 |

|

| Net Gains on Securities |

|

516 |

|

|

155 |

|

|

74 |

|

| Total Non-interest

Income |

|

$ |

10,509 |

|

|

$ |

11,658 |

|

|

$ |

8,882 |

|

| |

|

|

|

|

|

|

Trust and investment product fees increased

$346,000, or 22%, during the second quarter of 2019 compared with

the first quarter of 2019. The increase during the second

quarter of 2019 was largely attributable to increased assets under

management and increased activity in the Company's wealth

management group.

Insurance revenues declined $1,276,000, or 40%,

during the quarter ended June 30, 2019, compared with the first

quarter of 2019. The decline during the second quarter of

2019 compared with the first quarter of 2019 was primarily due to

contingency revenue. Contingency revenue during the first

quarter of 2019 totaled $1,375,000 compared with no contingency

revenue during the second quarter of 2019. The fluctuation in

contingency revenue is a normal course of business variance and is

reflective of claims and loss experience with insurance carriers

that the Company represents through its property and casualty

insurance agency. Typically, the majority of contingency

revenue is recognized during the first quarter of the year.

Company owned life insurance revenue declined

$580,000, or 66%, during the quarter ended June 30, 2019, compared

with the first quarter of 2019. The increase was largely related to

death benefits of $554,000 received from life insurance policies

during the first quarter of 2019.

Interchange fees increased $237,000, or 11%,

during the second quarter of 2019 compared with the first quarter

of 2019. The increase during the second quarter of 2019

compared with the first quarter of 2019 was largely attributable to

increased card utilization by customers.

Other operating income declined $410,000, or

47%, during the quarter ended June 30, 2019 compared with the first

quarter of 2019. The decline during the second quarter of

2019 compared with the first quarter of 2019 was largely

attributable to a gain realized on the sale of a former branch

facility of $262,000 during the first quarter of 2019.

The Company realized $516,000 in gains on sales of securities

during the second quarter of 2019 compared with $155,000 during the

first quarter of 2019.

During the quarter ended June 30, 2019,

non-interest expense totaled $25,618,000, a decline of $1,141,000,

or 4%, compared with the quarter ended March 31, 2019. The

second quarter of 2019 included acquisition-related expenses of

$428,000 while the first quarter of 2019 included

acquisition-related expenses of approximately $544,000.

| |

|

|

|

|

|

|

| |

|

Quarter Ended |

|

Quarter Ended |

|

Quarter Ended |

| Non-interest

Expense |

|

6/30/2019 |

|

3/31/2019 |

|

6/30/2018 |

| (dollars in

thousands) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Salaries and Employee Benefits |

|

$ |

14,117 |

|

|

$ |

15,044 |

|

|

$ |

12,019 |

|

| Occupancy, Furniture and

Equipment Expense |

|

3,212 |

|

|

3,219 |

|

|

2,527 |

|

| FDIC Premiums |

|

245 |

|

|

288 |

|

|

238 |

|

| Data Processing Fees |

|

1,803 |

|

|

1,583 |

|

|

1,398 |

|

| Professional Fees |

|

1,174 |

|

|

1,327 |

|

|

1,361 |

|

| Advertising and Promotion |

|

936 |

|

|

870 |

|

|

857 |

|

| Intangible Amortization |

|

802 |

|

|

843 |

|

|

306 |

|

| Other Operating Expenses |

|

3,329 |

|

|

3,585 |

|

|

3,002 |

|

| Total Non-interest

Expense |

|

$ |

25,618 |

|

|

$ |

26,759 |

|

|

$ |

21,708 |

|

| |

|

|

|

|

|

|

Salaries and benefits declined $927,000, or 6%,

during the quarter ended June 30, 2019 compared with the first

quarter of 2019. The decline in salaries and benefits during

the second quarter of 2019 compared with the first quarter of 2019

was primarily attributable to a reduced level of incentive

compensation expense and a reduced level of other employee benefit

expense.

Data processing fees increased $220,000, or 14%,

during the second quarter of 2019 compared with the first quarter

of 2019. The increase during the second quarter of 2019

compared with the first quarter of 2019 was driven by

acquisition-related costs which totaled approximately $214,000

during the second quarter of 2019.

Professional fees declined $153,000, or 12%,

during the second quarter of 2019 compared with the first quarter

of 2019. The decline during the second quarter of 2019

compared to the first quarter of 2019 was due in large part to a

decline in professional fees related to merger and acquisition

activity partially offset by an increase in other professional fees

primarily associated with the Company's annual shareholders'

meeting. Merger and acquisition-related professional fees

totaled approximately $205,000 during the second quarter of 2019

compared with $508,000 in the first quarter of 2019.

About German American

German American Bancorp, Inc. is a NASDAQ-traded

(symbol: GABC) bank holding company based in Jasper, Indiana.

German American, through its banking subsidiary German American

Bank, operates 75 banking offices in 20 contiguous southern Indiana

counties, six counties in Kentucky and one county in

Tennessee. The Company also owns an investment brokerage

subsidiary (German American Investment Services, Inc.) and a full

line property and casualty insurance agency (German American

Insurance, Inc.).

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may be

deemed “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Readers are

cautioned that, by their nature, forward-looking statements are

based on assumptions and are subject to risks, uncertainties, and

other factors. Actual results and experience could differ

materially from the anticipated results or other expectations

expressed or implied by these forward-looking statements as a

result of a number of factors, including but not limited to, those

discussed in this press release. Factors that could cause actual

experience to differ from the expectations expressed or implied in

this press release include the unknown future direction of interest

rates and the timing and magnitude of any changes in interest

rates; changes in competitive conditions; the introduction,

withdrawal, success and timing of asset/liability management

strategies or of mergers and acquisitions and other business

initiatives and strategies; changes in customer borrowing,

repayment, investment and deposit practices; changes in fiscal,

monetary and tax policies; changes in financial and capital

markets; potential deterioration in general economic conditions,

either nationally or locally, resulting in, among other things,

credit quality deterioration; capital management activities,

including possible future sales of new securities, or possible

repurchases or redemptions by the Company of outstanding debt or

equity securities; risks of expansion through acquisitions and

mergers, such as unexpected credit quality problems of the acquired

loans or other assets, unexpected attrition of the customer base of

the acquired institution or branches, and difficulties in

integration of the acquired operations; factors driving impairment

charges on investments; the impact, extent and timing of

technological changes; potential cyber-attacks, information

security breaches and other criminal activities; litigation

liabilities, including related costs, expenses, settlements and

judgments, or the outcome of matters before regulatory agencies,

whether pending or commencing in the future; actions of the Federal

Reserve Board; changes in accounting principles and

interpretations; potential increases of federal deposit insurance

premium expense, and possible future special assessments of FDIC

premiums, either industry wide or specific to the Company’s banking

subsidiary; actions of the regulatory authorities under the

Dodd-Frank Wall Street Reform and Consumer Protection Act (the

"Dodd-Frank Act") and the Federal Deposit Insurance Act and other

possible legislative and regulatory actions and reforms; impacts

resulting from possible amendments or revisions to the Dodd-Frank

Act and the regulations promulgated thereunder, or to Consumer

Financial Protection Bureau rules and regulations; the continued

availability of earnings and excess capital sufficient for the

lawful and prudent declaration and payment of cash dividends; and

other risk factors expressly identified in the Company’s filings

with the United States Securities and Exchange Commission. Such

statements reflect our views with respect to future events and are

subject to these and other risks, uncertainties and assumptions

relating to the operations, results of operations, growth strategy

and liquidity of the Company. Readers are cautioned not to place

undue reliance on these forward-looking statements. It is intended

that these forward-looking statements speak only as of the date

they are made. We do not undertake any obligation to release

publicly any revisions to these forward-looking statements to

reflect future events or circumstances or to reflect the occurrence

of unanticipated events.

|

|

|

GERMAN AMERICAN BANCORP, INC. |

|

(unaudited, dollars in thousands except per share

data) |

| |

|

|

|

|

|

|

Consolidated Balance Sheets |

|

|

|

|

|

|

|

| |

June 30, 2019 |

|

March 31, 2019 |

|

June 30, 2018 |

| ASSETS |

|

|

|

|

|

|

Cash and Due from Banks |

$ |

48,634 |

|

|

$ |

45,038 |

|

|

$ |

60,244 |

|

|

Short-term Investments |

41,623 |

|

|

14,740 |

|

|

11,038 |

|

|

Investment Securities |

841,045 |

|

|

824,950 |

|

|

739,834 |

|

|

|

|

|

|

|

|

|

Loans Held-for-Sale |

14,184 |

|

|

8,586 |

|

|

9,552 |

|

|

|

|

|

|

|

|

|

Loans, Net of Unearned Income |

2,717,028 |

|

|

2,708,832 |

|

|

2,318,510 |

|

|

Allowance for Loan Losses |

(16,239 |

) |

|

(16,243 |

) |

|

(15,637 |

) |

|

Net Loans |

2,700,789 |

|

|

2,692,589 |

|

|

2,302,873 |

|

| |

|

|

|

|

|

|

Stock in FHLB and Other Restricted Stock |

13,048 |

|

|

13,048 |

|

|

13,048 |

|

|

Premises and Equipment |

89,413 |

|

|

89,600 |

|

|

66,641 |

|

|

Goodwill and Other Intangible Assets |

113,309 |

|

|

112,920 |

|

|

65,978 |

|

|

Other Assets |

108,694 |

|

|

94,053 |

|

|

75,336 |

|

|

TOTAL ASSETS |

$ |

3,970,739 |

|

|

$ |

3,895,524 |

|

|

$ |

3,344,544 |

|

| |

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Non-interest-bearing Demand Deposits |

$ |

725,367 |

|

|

$ |

723,995 |

|

|

$ |

629,724 |

|

|

Interest-bearing Demand, Savings, and Money Market Accounts |

1,805,694 |

|

|

1,706,913 |

|

|

1,611,583 |

|

|

Time Deposits |

597,771 |

|

|

634,262 |

|

|

360,133 |

|

|

Total Deposits |

3,128,832 |

|

|

3,065,170 |

|

|

2,601,440 |

|

| |

|

|

|

|

|

|

Borrowings |

305,940 |

|

|

317,480 |

|

|

354,803 |

|

|

Other Liabilities |

36,556 |

|

|

33,687 |

|

|

17,761 |

|

|

TOTAL LIABILITIES |

3,471,328 |

|

|

3,416,337 |

|

|

2,974,004 |

|

| |

|

|

|

|

|

| SHAREHOLDERS'

EQUITY |

|

|

|

|

|

|

Common Stock and Surplus |

254,935 |

|

|

254,625 |

|

|

188,885 |

|

|

Retained Earnings |

233,269 |

|

|

222,246 |

|

|

194,994 |

|

|

Accumulated Other Comprehensive Income (Loss) |

11,207 |

|

|

2,316 |

|

|

(13,339 |

) |

| SHAREHOLDERS'

EQUITY |

499,411 |

|

|

479,187 |

|

|

370,540 |

|

| |

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

$ |

3,970,739 |

|

|

$ |

3,895,524 |

|

|

$ |

3,344,544 |

|

| |

|

|

|

|

|

| END OF PERIOD SHARES

OUTSTANDING |

24,992,238 |

|

|

24,992,238 |

|

|

22,967,898 |

|

| |

|

|

|

|

|

| TANGIBLE BOOK VALUE

PER SHARE (1) |

$ |

15.45 |

|

|

$ |

14.66 |

|

|

$ |

13.26 |

|

| |

|

|

|

|

|

| |

| (1) Tangible Book

Value per Share is defined as Total Shareholders' Equity less

Goodwill and Other Intangible Assets divided by End of Period

Shares Outstanding. |

|

|

|

GERMAN AMERICAN BANCORP, INC. |

|

(unaudited, dollars in thousands except per share

data) |

| |

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Income |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, 2019 |

|

March 31, 2019 |

|

June 30, 2018 |

|

June 30, 2019 |

|

June 30, 2018 |

| INTEREST

INCOME |

|

|

|

|

|

|

|

|

|

|

Interest and Fees on Loans |

$ |

35,046 |

|

|

$ |

35,119 |

|

|

$ |

26,308 |

|

|

$ |

70,165 |

|

|

$ |

50,258 |

|

|

Interest on Short-term Investments |

85 |

|

|

141 |

|

|

54 |

|

|

226 |

|

|

110 |

|

|

Interest and Dividends on Investment Securities |

5,905 |

|

|

5,929 |

|

|

5,171 |

|

|

11,834 |

|

|

10,310 |

|

|

TOTAL INTEREST INCOME |

41,036 |

|

|

41,189 |

|

|

31,533 |

|

|

82,225 |

|

|

60,678 |

|

| |

|

|

|

|

|

|

|

|

|

|

| INTEREST

EXPENSE |

|

|

|

|

|

|

|

|

|

|

Interest on Deposits |

5,759 |

|

|

5,416 |

|

|

2,848 |

|

|

11,175 |

|

|

5,131 |

|

|

Interest on Borrowings |

1,636 |

|

|

2,182 |

|

|

1,216 |

|

|

3,818 |

|

|

2,468 |

|

|

TOTAL INTEREST EXPENSE |

7,395 |

|

|

7,598 |

|

|

4,064 |

|

|

14,993 |

|

|

7,599 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

NET INTEREST INCOME |

33,641 |

|

|

33,591 |

|

|

27,469 |

|

|

67,232 |

|

|

53,079 |

|

|

Provision for Loan Losses |

250 |

|

|

675 |

|

|

1,220 |

|

|

925 |

|

|

1,570 |

|

|

NET INTEREST INCOME AFTER PROVISION FOR LOAN

LOSSES |

33,391 |

|

|

32,916 |

|

|

26,249 |

|

|

66,307 |

|

|

51,509 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

NON-INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

Net Gain on Sales of Loans |

1,030 |

|

|

981 |

|

|

905 |

|

|

2,011 |

|

|

1,555 |

|

|

Net Gain on Securities |

516 |

|

|

155 |

|

|

74 |

|

|

671 |

|

|

344 |

|

|

Other Non-interest Income |

8,963 |

|

|

10,522 |

|

|

7,903 |

|

|

19,485 |

|

|

16,475 |

|

|

TOTAL NON-INTEREST INCOME |

10,509 |

|

|

11,658 |

|

|

8,882 |

|

|

22,167 |

|

|

18,374 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

NON-INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

Salaries and Benefits |

14,117 |

|

|

15,044 |

|

|

12,019 |

|

|

29,161 |

|

|

24,145 |

|

|

Other Non-interest Expenses |

11,501 |

|

|

11,715 |

|

|

9,689 |

|

|

23,216 |

|

|

18,018 |

|

|

TOTAL NON-INTEREST EXPENSE |

25,618 |

|

|

26,759 |

|

|

21,708 |

|

|

52,377 |

|

|

42,163 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Income before Income Taxes |

18,282 |

|

|

17,815 |

|

|

13,423 |

|

|

36,097 |

|

|

27,720 |

|

|

Income Tax Expense |

3,011 |

|

|

2,748 |

|

|

2,326 |

|

|

5,759 |

|

|

4,810 |

|

| |

|

|

|

|

|

|

|

|

|

|

| NET

INCOME |

$ |

15,271 |

|

|

$ |

15,067 |

|

|

$ |

11,097 |

|

|

$ |

30,338 |

|

|

$ |

22,910 |

|

| |

|

|

|

|

|

|

|

|

|

|

| BASIC

EARNINGS PER SHARE |

$ |

0.61 |

|

|

$ |

0.60 |

|

|

$ |

0.48 |

|

|

$ |

1.21 |

|

|

$ |

1.00 |

|

| DILUTED

EARNINGS PER SHARE |

$ |

0.61 |

|

|

$ |

0.60 |

|

|

$ |

0.48 |

|

|

$ |

1.21 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

|

|

|

|

|

|

| WEIGHTED

AVERAGE SHARES OUTSTANDING |

24,992,238 |

|

|

24,971,863 |

|

|

22,968,178 |

|

|

24,982,107 |

|

|

22,954,367 |

|

| DILUTED

WEIGHTED AVERAGE SHARES OUTSTANDING |

24,992,238 |

|

|

24,971,863 |

|

|

22,968,178 |

|

|

24,982,107 |

|

|

22,954,367 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

GERMAN AMERICAN BANCORP, INC. |

|

(unaudited, dollars in thousands except per share

data) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Six Months Ended |

| |

|

|

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

| |

|

|

2019 |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| EARNINGS

PERFORMANCE RATIOS |

|

|

|

|

|

|

|

|

|

|

| |

Annualized Return on Average

Assets |

|

1.56 |

% |

|

1.55 |

% |

|

1.38 |

% |

|

1.56 |

% |

|

1.44 |

% |

| |

Annualized Return on Average

Equity |

|

12.60 |

% |

|

12.98 |

% |

|

12.15 |

% |

|

12.78 |

% |

|

12.57 |

% |

| |

Net Interest Margin |

|

3.84 |

% |

|

3.88 |

% |

|

3.77 |

% |

|

3.86 |

% |

|

3.71 |

% |

| |

Efficiency Ratio (1) |

|

57.10 |

% |

|

58.23 |

% |

|

58.63 |

% |

|

57.67 |

% |

|

57.93 |

% |

| |

Net Overhead Expense to

Average Earning Assets (2) |

|

1.69 |

% |

|

1.69 |

% |

|

1.71 |

% |

|

1.69 |

% |

|

1.61 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSET

QUALITY RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Annualized Net Charge-offs to

Average Loans |

|

0.04 |

% |

|

0.04 |

% |

|

0.01 |

% |

|

0.04 |

% |

|

0.15 |

% |

| |

Allowance for Loan Losses to

Period End Loans |

|

0.60 |

% |

|

0.60 |

% |

|

0.67 |

% |

|

|

|

|

| |

Non-performing Assets to

Period End Assets |

|

0.32 |

% |

|

0.34 |

% |

|

0.28 |

% |

|

|

|

|

| |

Non-performing Loans to Period

End Loans |

|

0.44 |

% |

|

0.46 |

% |

|

0.41 |

% |

|

|

|

|

| |

Loans 30-89 Days Past Due to

Period End Loans |

|

0.39 |

% |

|

0.45 |

% |

|

0.52 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELECTED

BALANCE SHEET & OTHER FINANCIAL DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Average Assets |

|

$ |

3,908,669 |

|

|

$ |

3,886,723 |

|

|

$ |

3,226,091 |

|

|

$ |

3,897,757 |

|

|

$ |

3,173,821 |

|

| |

Average Earning Assets |

|

$ |

3,585,169 |

|

|

$ |

3,568,971 |

|

|

$ |

2,994,278 |

|

|

$ |

3,577,115 |

|

|

$ |

2,948,319 |

|

| |

Average Total Loans |

|

$ |

2,721,630 |

|

|

$ |

2,718,808 |

|

|

$ |

2,229,972 |

|

|

$ |

2,720,227 |

|

|

$ |

2,185,087 |

|

| |

Average Demand Deposits |

|

$ |

715,681 |

|

|

$ |

691,107 |

|

|

$ |

625,158 |

|

|

$ |

703,462 |

|

|

$ |

605,405 |

|

| |

Average Interest Bearing

Liabilities |

|

$ |

2,674,632 |

|

|

$ |

2,708,307 |

|

|

$ |

2,217,198 |

|

|

$ |

2,691,376 |

|

|

$ |

2,184,055 |

|

| |

Average Equity |

|

$ |

484,891 |

|

|

$ |

464,234 |

|

|

$ |

365,197 |

|

|

$ |

474,619 |

|

|

$ |

364,392 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Period End Non-performing

Assets (3) |

|

$ |

12,523 |

|

|

$ |

13,114 |

|

|

$ |

9,527 |

|

|

|

|

|

| |

Period End Non-performing

Loans (4) |

|

$ |

11,888 |

|

|

$ |

12,429 |

|

|

$ |

9,487 |

|

|

|

|

|

| |

Period End Loans 30-89 Days

Past Due (5) |

|

$ |

10,605 |

|

|

$ |

12,197 |

|

|

$ |

12,146 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Tax Equivalent Net Interest

Income |

|

$ |

34,354 |

|

|

$ |

34,299 |

|

|

$ |

28,142 |

|

|

$ |

68,653 |

|

|

$ |

54,403 |

|

| |

Net Charge-offs during

Period |

|

$ |

254 |

|

|

$ |

255 |

|

|

$ |

43 |

|

|

$ |

509 |

|

|

$ |

1,627 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

(1) |

Efficiency Ratio

is defined as Non-interest Expense divided by the sum of Net

Interest Income, on a tax equivalent basis, and Non-interest

Income. |

|

|

|

|

|

(2) |

Net Overhead

Expense is defined as Total Non-interest Expense less Total

Non-interest Income. |

|

|

|

|

|

(3) |

Non-performing

assets are defined as Non-accrual Loans, Loans Past Due 90 days or

more, and Other Real Estate Owned. |

|

|

|

|

|

(4) |

Non-performing

loans are defined as Non-accrual Loans and Loans Past Due 90 days

or more. |

|

|

|

|

|

(5) |

Loans 30-89 days past due and

still accruing. |

|

|

|

|

|

|

|

|

|

|

For additional information, contact:Mark

A Schroeder, Chairman & Chief Executive Officer of

German American Bancorp, Inc.Bradley M Rust,

Executive Vice President/CFO of German American Bancorp, Inc.(812)

482-1314

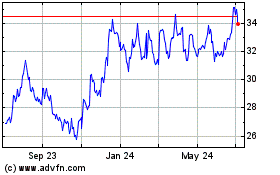

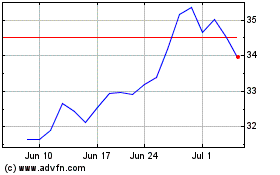

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Mar 2024 to Apr 2024

German American Bancorp (NASDAQ:GABC)

Historical Stock Chart

From Apr 2023 to Apr 2024