First National Corporation (the “Company” or “First National”)

(NASDAQ: FXNC), the bank holding company of First Bank (the

“Bank”), reported unaudited consolidated net income of $2.2

million, or $0.46 per diluted share, for the second quarter of

2020, which resulted in a return on average assets of 1.00% and a

return on average equity of 11.30%. This compares to net income of

$2.1 million, or $0.42 per diluted share, and a return on average

assets of 1.08% and a return on average equity of 11.76% for the

second quarter of 2019. Provision for loan losses of $800 thousand

and $200 thousand was included in net income for the three-month

periods ending June 30, 2020 and 2019, respectively.

For the six months ending June 30, 2020, net income totaled $3.9

million, or $0.81 per diluted share, which resulted in a return on

average assets of 0.93% and a return on average equity of 10.01%.

This compares to net income of $4.3 million, or $0.88 per diluted

share, and a return on average assets of 1.14% and a return on

average equity of 12.60% for the same period of 2019. Provision for

loan losses of $1.7 million and $200 thousand was included in net

income for the six-month periods ending June 30, 2020 and 2019,

respectively.

Highlights for the second quarter of 2020:

- Return on assets of 1.00% and return on equity of 11.30%

- Provision for loan losses totaled $800 thousand compared to

$200 thousand in Q2 2019

- Originated $76.2 million of Payroll Protection Program

loans

- Nonperforming assets at 0.16% of assets

- Loans in the Bank’s deferred payment program totaled $182.6

million

- Subordinated debt issuance of $5.0 million further strengthened

holding company liquidity

- Tangible book value increased 14% to $16.63 per share compared

to $14.60 one year ago

“Our team of associates continued to demonstrate an incredible

commitment to their customers, their communities, and one another

throughout the second quarter,” said Scott Harvard, president and

chief executive officer of First National. Harvard continued, “Our

teammates worked overtime to deliver over $76 million of payroll

protection funds to small businesses and provided access to deposit

accounts via the drive throughs at branches, through First Bank’s

mobile and internet banking platforms, and with in-person meetings

by appointment. On July 1st, we were pleased to re-open branch

lobbies for in-person transactions to serve our customers and

communities, while taking precautions to help keep our customers

and employees healthy.”

“We were pleased once again with the financial performance of

the Company in the second quarter. Expenses decreased, while net

interest income improved over the second quarter of 2019. We

continued to earn new business customers from our commitment to

serving small businesses by participating in the payroll protection

program and by offering programs designed to provide financial

relief to customers. We still expect significant pressure on loans

to borrowers in several sectors, including the hospitality and

health care industries, which have been impacted by government

orders and the public’s adoption of social distancing. The

Company’s liquidity position continues to be very strong and

capital levels exceed all regulatory thresholds to be considered

well-capitalized.”

COVID-19 PANDEMIC UPDATE

Operations

During the second quarter, the Bank continued to follow its

Pandemic Plan that strives to protect the health of its employees

and customers, while continuing to deliver essential banking

services. This was accomplished by limiting access to banking

offices and delivering a majority of its services through branch

drive throughs, ATMs, and mobile and internet banking platforms. On

July 1, 2020, the Bank entered phase two of its Pandemic Plan by

re-opening branch lobbies with limited hours for in-person

transactions without appointments.

Paycheck Protection Program

The Bank participated as a lender in the U.S. Small Business

Administration’s (“SBA”) Paycheck Protection Program (“PPP”) to

support local small businesses and non-profit organizations. During

the second quarter of 2020, the Bank originated $76.2 million of

PPP loans, received $2.5 million of loan fees, and incurred $520

thousand of loan origination costs. The loan fees are being

accreted into earnings evenly over the life of the loans, net of

the loan costs, through interest and fees on loans. Approximately

99% of the PPP loan balances mature in 24 months. At June 30, 2020,

PPP loan balances totaled $73.3 million and customers had not yet

requested debt forgiveness from the SBA on PPP loans.

Loan Payment Deferral Program

In response to the unknown impact of the pandemic on the economy

and customers, the Bank created and implemented a loan payment

deferral program for individual and business customers in the first

quarter of 2020. Customers with favorable risk ratings and payment

histories were given the opportunity to defer monthly payments for

90 days. Loans participating in the program totaled $182.6 million,

or 28% of the Bank’s loan balances at June 30, 2020. Interest

income continued to accrue to the Bank during the deferral

periods.

Asset Quality Impact

The pandemic is expected to have an unfavorable impact on the

financial condition of the Bank’s loan customers, and as a result,

the Bank has continued the process of identifying credit risk with

the goal of mitigating the risk and minimizing future loan

charge-offs. Several sectors of the loan portfolio, including

hospitality, retail shopping and health care are expected to

experience significant financial pressure. Those sectors comprise

approximately 9%, 5% and 4% of the loan portfolio, respectively,

excluding PPP loans. The magnitude of the potential decline in the

Bank’s loan quality will likely depend on the duration of the

pandemic and the extent that the Bank’s customers experience

business interruptions from the pandemic. The Bank considered the

impact of the pandemic on the loan portfolio while determining an

appropriate allowance for loan losses, and as a result, recorded a

provision for loan losses of $800 thousand for the second quarter

of 2020, compared to a $200 thousand provision for loan losses in

the second quarter of 2019.

Capital

The stock repurchase plan remained suspended during the second

quarter. The Company updated its enterprise risk assessment and

capital plans during the quarter, and as a result, the Company

issued $5.0 million of subordinated debt in June 2020. The purpose

of the issuance was primarily to further strengthen holding company

liquidity and remain a source of strength for the Bank during a

severe economic downturn. The Company may also use the proceeds of

the issuance for general corporate purposes, including the

potential repayment of the Company’s existing subordinated debt,

which becomes callable in January 2021. The quarterly cash dividend

to common shareholders was not reduced or eliminated during the

second quarter as the Company declared and paid an $0.11 per share

dividend that was unchanged from the dividend paid in the first

quarter of 2020.

BALANCE SHEET

Total assets of First National increased $163.7 million, or 21%,

to $942.1 million at June 30, 2020, compared to $778.4 million at

June 30, 2019. Total securities increased $1.2 million, or 1%, and

loans, net of the allowance for loan losses, increased $75.3

million, or 13%. Loans, net of the allowance for loan losses, would

have increased $2.0 million comparing the same periods, excluding

$73.3 million of PPP loans.

Total liabilities increased $155.7 million, or 22%, to $861.3

million at June 30, 2020, compared to $705.6 million one year ago.

The increase in liabilities was primarily attributable to

significant growth in deposits. Total deposits increased $149.2

million, or 22%, to $839.0 million and subordinated debt increased

by $5.0 million to $10.0 million at June 30, 2020.

Noninterest-bearing demand deposits increased $67.4 million, or

36%, savings and interest-bearing demand deposits increased $85.4

million, or 22%, while time deposits decreased $3.6 million, or

3%.

Although proceeds from PPP loan originations during the second

quarter contributed to the increase in deposits, the Bank also

experienced a significant amount of deposit growth that was not

related to PPP loan proceeds during the quarter. Total deposits

increased $118.4 million, or 16%, during the three-month period

ended June 30, 2020, while PPP loans totaled $73.3 million at June

30, 2020.

Subordinated debt increased to $10.0 million during the quarter

from a $5.0 million issuance on June 29, 2020. The Company issued

the debt at a 5.50% fixed-to-floating rate subordinated note due

2030 to an institutional investor. The Note was structured to

qualify as Tier 2 capital under bank regulatory guidelines, and the

proceeds from the sale of the Note may be utilized to support

capital levels at the Bank in a severe economic downturn or for

general corporate purposes, including the potential repayment of

the Company’s existing subordinated debt, which becomes callable in

January 2021.

Shareholders’ equity increased $8.0 million, or 11%, to $80.8

million at June 30, 2020, compared to one year ago, from a $7.2

million increase in retained earnings and a $2.5 million increase

in accumulated other comprehensive income. These increases were

partially offset by $1.7 million decrease in common stock and

surplus, which resulted from stock repurchases in the first quarter

of 2020 under the Company’s stock repurchase plan.

The Company’s stock repurchase plan was suspended near the end

of the first quarter of 2020 due to the potential impact of the

pandemic on the economy and the Bank’s customers and remained

suspended during the second quarter. The Company paid a cash

dividend to common shareholders during the second quarter of $0.11

per share, which was unchanged from the first quarter. The Bank was

considered well-capitalized at June 30, 2020.

ANALYSIS OF THE THREE-MONTH PERIOD

Net interest income increased $446 thousand, or 6%, to $7.4

million for the second quarter of 2020, compared to the same period

of 2019. The increase resulted from a 15% increase in average

earning assets, which was partially offset by a 29 basis point

decrease in the net interest margin from 3.88% to 3.59%. Growth in

average earning assets was led by a $69.6 million increase in

average loans, followed by a $38.9 million increase in average

interest-bearing deposits in banks. The decrease in the net

interest margin resulted from a 58 basis point decrease in the

yield on average earning assets, which was partially offset by a 29

basis point decrease in interest expense as a percent of average

earning assets.

The 58 basis point decrease in the yield on average earning

assets was attributable to a 41 basis point decrease in the yield

on loans, a 24 basis point decrease on securities, and an 218 basis

point decrease on interest-bearing deposits in banks, which were

all impacted by lower market rates. The total loan yield was also

impacted by the origination of over $76.2 million of PPP loans at a

1.00% interest rate during the second quarter of 2020. The mix of

earning assets also had an unfavorable impact on the yield on

average earning assets as lower yielding interest-bearing deposits

in banks increased from 3% to 7% of average earning assets.

The 29 basis point decrease in interest expense as a percentage

of average earning assets was primarily attributable to lower

interest rates paid on deposits, which were also impacted by lower

market rates. The decrease in the cost of interest-bearing checking

accounts and money market accounts totaled 57 basis points and 77

basis points, respectively.

Noninterest income decreased $262 thousand, or 13%, to $1.8

million, compared to the same period of 2019. The decrease was

primarily attributable to a $367 thousand, or 51%, decrease in

service charges on deposit accounts from lower deposit overdraft

fees. This decrease was partially offset by a $54 thousand increase

in wealth management fees and an $84 thousand increase in fees for

other customer services. The increase in fees for other customer

services was a result of fee income from brokered mortgage loans to

the secondary market. The increases in wealth management fees

resulted primarily from higher balances of assets under management

during the second quarter of 2020 compared to the same period one

year ago. Assets under management increased as a result of new

business relationships and from growth in the market values of

existing accounts.

Noninterest expense decreased $617 thousand, or 10%, to $5.6

million, compared to the same period one year ago. The decrease was

primarily attributable to a $353 thousand, or 10%, decrease in

salaries and employee benefits, a $165 thousand, or 69%, decrease

in marketing expense, and a $145 thousand, or 19%, decrease in

other operating expense. The decrease in salaries and employee

benefits resulted from the $520 thousand deferral of salary costs

to originate PPP loans during the second quarter of 2020. Marketing

expense decreased from a combination of reduced spending on public

relations events in the second quarter of 2020 and elevated

expenses in the second quarter of 2019 from the timing of marketing

initiatives in the prior year. Other operating expense decreased

from lower education and training costs, registration and licensing

fees, and travel costs.

ANALYSIS OF THE SIX-MONTH PERIOD

Net interest income increased $573 thousand, or 4%, to $14.4

million for the six months ending June 30, 2020, compared to the

same period of 2019. The increase resulted from a 11% increase in

average earning assets, which was partially offset by a 26 basis

point decrease in the net interest margin from 3.93% to 3.67%.

Growth in average earning assets was led by a $49.8 million

increase in average loans, followed by a $27.5 million increase in

average interest-bearing deposits in banks. The decrease in the net

interest margin resulted from a 42 basis point decrease in the

yield on average earning assets, which was partially offset by a 17

basis point decrease in interest expense as a percent of average

earning assets.

The 42 basis point decrease in the yield on average earning

assets was attributable to a 30 basis point decrease in the yield

on loans, a 23 basis point decrease on securities, and a 169 basis

point decrease on interest-bearing deposits in banks, which were

all impacted by lower market rates. The total loan yield was also

impacted by the origination of over $76.2 million of PPP loans at a

1.00% interest rate during the second quarter of 2020. The mix of

earning assets also had an unfavorable impact on the yield on

average earning assets as lower yielding interest-bearing deposits

in banks increased from 3% to 6% of average earning assets.

The 17 basis point decrease in interest expense as a percentage

of average earning assets was primarily attributable to lower

interest rates paid on deposits, which were also impacted by lower

market rates. The decrease in the cost of interest-bearing checking

accounts and money market accounts totaled 43 basis points and 45

basis points, respectively.

Noninterest income decreased $148 thousand, or 4%, to $3.9

million, compared to the same period of 2019. The decrease was

primarily attributable to a $387 thousand, or 27%, decrease in

service charges on deposit accounts from lower deposit overdraft

fees. This decrease was partially offset by a $142 thousand

increase in wealth management fees and a $116 thousand increase in

fees for other customer services. The increase in fees for other

customer services was a result of fee income from brokered mortgage

loans to the secondary market. The increase in wealth management

fees resulted primarily from higher balances of assets under

management during the six months ended June 30, 2020 compared to

the same period one year ago. Assets under management increased as

a result of new business relationships and from growth in the

market values of existing accounts.

Noninterest expense decreased $571 thousand, or 5%, to $11.8

million, compared to the same period one year ago. The decrease was

primarily attributable to a $207 thousand, or 3%, decrease in

salaries and employee benefits, a $200 thousand, or 53%, decrease

in marketing expense, and a $195 thousand, or 14%, decrease in

other operating expense. The decrease in salaries and employee

benefits resulted from the deferral of $520 thousand of salary

costs to originate PPP loans during the second quarter of 2020.

Marketing expense decreased from a combination of reduced spending

on public relations events during the six months ending June 30,

2020 and elevated marketing expenses during the same period of 2019

from the timing of marketing initiatives in the prior year. Other

operating expense decreased from lower education and training,

registration and licensing fees, and travel costs.

ASSET QUALITY/LOAN LOSS PROVISION

Provision for loan losses totaled $800 thousand for the second

quarter of 2020, compared to $200 thousand for the same period of

2019. The higher provision for loan losses was primarily

attributable to an increase in the general reserve component of the

allowance for loan losses. The general reserve component of the

allowance for loan losses increased primarily as a result of

adjustments to qualitative factors from risks associated with loans

participating in the Bank’s loan payment deferral program and an

increase in substandard loans. Net charge offs totaled $88 thousand

for the second quarter of 2020, compared to $151 thousand for the

second quarter of 2019.

Loans participating in the Bank’s loan payment deferral program

totaled $182.6 million, or 28% of the Bank’s loan balances at June

30, 2020. Interest income continued to accrue to the Bank during

the deferral periods.

Loans that were 30 to 89 days past due totaled $1.1 million, or

0.17% of total loans at June 30, 2020 compared to $792 thousand, or

0.14% of total loans one year ago. Classified assets, which

were comprised of substandard loans, totaled $10.1 million, or

1.07% of total assets, at June 30, 2020 compared to $4.6 million,

or 0.59% of total assets one year ago.

Nonperforming assets totaled $1.5 million, or 0.16% of total

assets at June 30, 2020, compared to $1.8 million, or 0.23% of

total assets, one year ago. The allowance for loan losses totaled

$6.3 million, or 0.97% of total loans at June 30, 2020, compared to

$5.0 million, or 0.87% of total loans at June 30, 2019.

FORWARD-LOOKING STATEMENTS

Certain information contained in this discussion may include

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements relate to the Company’s future operations and are

generally identified by phrases such as “the Company expects,” “the

Company believes” or words of similar import. Although the Company

believes that its expectations with respect to the forward-looking

statements are based upon reliable assumptions within the bounds of

its knowledge of its business and operations, there can be no

assurance that actual results, performance or achievements of the

Company will not differ materially from any future results,

performance or achievements expressed or implied by such

forward-looking statements. Forward-looking statements involve a

number of risks and uncertainties, including the rapidly changing

uncertainties related to the COVID-19 pandemic and its potential

adverse effect on the economy, our employees and customers, and our

financial performance. For details on other factors that could

affect expectations, see the risk factors and other cautionary

language included in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2019, and other filings with the

Securities and Exchange Commission.

ABOUT FIRST NATIONAL CORPORATION

First National Corporation (NASDAQ: FXNC) is the parent company

and bank holding company of First Bank, a community bank that first

opened for business in 1907 in Strasburg, Virginia. The Bank offers

loan and deposit products and services through its website,

www.fbvirginia.com, its mobile banking platform, a network of ATMs

located throughout its market area, one loan production office, a

customer service center in a retirement community, and 14 bank

branch office locations located throughout the Shenandoah Valley,

the central regions of Virginia and in the city of Richmond. In

addition to providing traditional banking services, the Bank

operates a wealth management division under the name First Bank

Wealth Management. First Bank also owns First Bank Financial

Services, Inc., which invests in entities that provide investment

services and title insurance.

CONTACTS

| Scott C. Harvard |

|

M. Shane Bell |

| President and CEO |

|

Executive Vice President and

CFO |

| (540) 465-9121 |

|

(540) 465-9121 |

| shavard@fbvirginia.com |

|

sbell@fbvirginia.com |

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

June

30, |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

| |

|

2020 |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

| Income Statement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

7,416 |

|

|

$ |

7,203 |

|

|

$ |

7,333 |

|

|

$ |

7,429 |

|

|

$ |

7,200 |

|

|

Interest on deposits in banks |

|

|

16 |

|

|

|

118 |

|

|

|

163 |

|

|

|

97 |

|

|

|

133 |

|

|

Interest on securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable interest |

|

|

636 |

|

|

|

670 |

|

|

|

627 |

|

|

|

645 |

|

|

|

696 |

|

|

Tax-exempt interest |

|

|

151 |

|

|

|

151 |

|

|

|

156 |

|

|

|

157 |

|

|

|

159 |

|

|

Dividends |

|

|

26 |

|

|

|

26 |

|

|

|

27 |

|

|

|

26 |

|

|

|

26 |

|

| Total interest income |

|

$ |

8,245 |

|

|

$ |

8,168 |

|

|

$ |

8,306 |

|

|

$ |

8,354 |

|

|

$ |

8,214 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

$ |

676 |

|

|

$ |

962 |

|

|

$ |

1,042 |

|

|

$ |

1,089 |

|

|

$ |

1,051 |

|

|

Interest on federal funds purchased |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

Interest on subordinated debt |

|

|

91 |

|

|

|

90 |

|

|

|

91 |

|

|

|

90 |

|

|

|

90 |

|

|

Interest on junior subordinated debt |

|

|

67 |

|

|

|

90 |

|

|

|

98 |

|

|

|

103 |

|

|

|

108 |

|

| Total interest expense |

|

$ |

834 |

|

|

$ |

1,142 |

|

|

$ |

1,231 |

|

|

$ |

1,283 |

|

|

$ |

1,249 |

|

| Net interest income |

|

$ |

7,411 |

|

|

$ |

7,026 |

|

|

$ |

7,075 |

|

|

$ |

7,071 |

|

|

$ |

6,965 |

|

| Provision for loan losses |

|

|

800 |

|

|

|

900 |

|

|

|

250 |

|

|

|

— |

|

|

|

200 |

|

| Net interest income after provision for loan losses |

|

$ |

6,611 |

|

|

$ |

6,126 |

|

|

$ |

6,825 |

|

|

$ |

7,071 |

|

|

$ |

6,765 |

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

$ |

348 |

|

|

$ |

681 |

|

|

$ |

753 |

|

|

$ |

757 |

|

|

$ |

715 |

|

|

ATM and check card fees |

|

|

550 |

|

|

|

519 |

|

|

|

654 |

|

|

|

586 |

|

|

|

573 |

|

|

Wealth management fees |

|

|

512 |

|

|

|

525 |

|

|

|

496 |

|

|

|

477 |

|

|

|

458 |

|

|

Fees for other customer services |

|

|

237 |

|

|

|

207 |

|

|

|

181 |

|

|

|

177 |

|

|

|

153 |

|

|

Income from bank owned life insurance |

|

|

99 |

|

|

|

115 |

|

|

|

123 |

|

|

|

131 |

|

|

|

99 |

|

|

Net gains (losses) on securities |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

Net gains on sale of loans |

|

|

26 |

|

|

|

31 |

|

|

|

89 |

|

|

|

34 |

|

|

|

25 |

|

|

Other operating income |

|

|

1 |

|

|

|

21 |

|

|

|

44 |

|

|

|

29 |

|

|

|

12 |

|

| Total noninterest income |

|

$ |

1,773 |

|

|

$ |

2,099 |

|

|

$ |

2,341 |

|

|

$ |

2,191 |

|

|

$ |

2,035 |

|

| Noninterest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

$ |

3,022 |

|

|

$ |

3,589 |

|

|

$ |

3,193 |

|

|

$ |

3,556 |

|

|

$ |

3,375 |

|

|

Occupancy |

|

|

409 |

|

|

|

402 |

|

|

|

415 |

|

|

|

398 |

|

|

|

401 |

|

|

Equipment |

|

|

418 |

|

|

|

410 |

|

|

|

406 |

|

|

|

410 |

|

|

|

409 |

|

|

Marketing |

|

|

74 |

|

|

|

106 |

|

|

|

128 |

|

|

|

143 |

|

|

|

239 |

|

|

Supplies |

|

|

103 |

|

|

|

89 |

|

|

|

88 |

|

|

|

86 |

|

|

|

91 |

|

|

Legal and professional fees |

|

|

301 |

|

|

|

279 |

|

|

|

311 |

|

|

|

231 |

|

|

|

303 |

|

|

ATM and check card expense |

|

|

223 |

|

|

|

245 |

|

|

|

231 |

|

|

|

225 |

|

|

|

225 |

|

|

FDIC assessment |

|

|

60 |

|

|

|

30 |

|

|

|

(53 |

) |

|

|

(6 |

) |

|

|

35 |

|

|

Bank franchise tax |

|

|

161 |

|

|

|

153 |

|

|

|

136 |

|

|

|

136 |

|

|

|

136 |

|

|

Data processing expense |

|

|

188 |

|

|

|

184 |

|

|

|

179 |

|

|

|

174 |

|

|

|

179 |

|

|

Amortization expense |

|

|

42 |

|

|

|

52 |

|

|

|

61 |

|

|

|

71 |

|

|

|

80 |

|

|

Other real estate owned expense (income), net |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

Net losses (gains) on disposal of premises and equipment |

|

|

— |

|

|

|

(9 |

) |

|

|

14 |

|

|

|

— |

|

|

|

— |

|

|

Other operating expense |

|

|

612 |

|

|

|

614 |

|

|

|

694 |

|

|

|

762 |

|

|

|

757 |

|

| Total noninterest expense |

|

$ |

5,613 |

|

|

$ |

6,144 |

|

|

$ |

5,804 |

|

|

$ |

6,186 |

|

|

$ |

6,230 |

|

| Income before income taxes |

|

$ |

2,771 |

|

|

$ |

2,081 |

|

|

$ |

3,362 |

|

|

$ |

3,076 |

|

|

$ |

2,570 |

|

| Income tax expense |

|

|

528 |

|

|

|

376 |

|

|

|

646 |

|

|

|

583 |

|

|

|

484 |

|

| Net income |

|

$ |

2,243 |

|

|

$ |

1,705 |

|

|

$ |

2,716 |

|

|

$ |

2,493 |

|

|

$ |

2,086 |

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

June

30, |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

| |

|

2020 |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

| Common Share and Per Common Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income, basic |

|

$ |

0.46 |

|

|

$ |

0.34 |

|

|

$ |

0.55 |

|

|

$ |

0.50 |

|

|

$ |

0.42 |

|

| Weighted average shares, basic |

|

|

4,849,719 |

|

|

|

4,950,887 |

|

|

|

4,968,574 |

|

|

|

4,966,641 |

|

|

|

4,963,737 |

|

| Net income, diluted |

|

$ |

0.46 |

|

|

$ |

0.34 |

|

|

$ |

0.55 |

|

|

$ |

0.50 |

|

|

$ |

0.42 |

|

| Weighted average shares, diluted |

|

|

4,849,719 |

|

|

|

4,955,970 |

|

|

|

4,972,535 |

|

|

|

4,969,126 |

|

|

|

4,965,822 |

|

| Shares outstanding at period end |

|

|

4,852,187 |

|

|

|

4,849,692 |

|

|

|

4,969,716 |

|

|

|

4,968,277 |

|

|

|

4,964,824 |

|

| Tangible book value at period end |

|

$ |

16.63 |

|

|

$ |

16.17 |

|

|

$ |

15.50 |

|

|

$ |

15.11 |

|

|

$ |

14.60 |

|

| Cash dividends |

|

$ |

0.11 |

|

|

$ |

0.11 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.09 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Performance Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

1.00 |

% |

|

|

0.85 |

% |

|

|

1.36 |

% |

|

|

1.27 |

% |

|

|

1.08 |

% |

| Return on average equity |

|

|

11.30 |

% |

|

|

8.72 |

% |

|

|

14.10 |

% |

|

|

13.31 |

% |

|

|

11.76 |

% |

| Net interest margin |

|

|

3.59 |

% |

|

|

3.77 |

% |

|

|

3.79 |

% |

|

|

3.87 |

% |

|

|

3.88 |

% |

| Efficiency ratio (1) |

|

|

60.34 |

% |

|

|

66.50 |

% |

|

|

60.50 |

% |

|

|

65.65 |

% |

|

|

67.94 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average Balances |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

899,301 |

|

|

$ |

806,609 |

|

|

$ |

795,391 |

|

|

$ |

780,376 |

|

|

$ |

773,574 |

|

| Average earning assets |

|

|

836,741 |

|

|

|

755,173 |

|

|

|

745,721 |

|

|

|

730,865 |

|

|

|

724,909 |

|

| Average shareholders’ equity |

|

|

79,845 |

|

|

|

78,659 |

|

|

|

76,424 |

|

|

|

74,291 |

|

|

|

71,124 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan charge-offs |

|

$ |

176 |

|

|

$ |

328 |

|

|

$ |

281 |

|

|

$ |

156 |

|

|

$ |

219 |

|

| Loan recoveries |

|

|

88 |

|

|

|

78 |

|

|

|

53 |

|

|

|

73 |

|

|

|

68 |

|

| Net charge-offs |

|

|

88 |

|

|

|

250 |

|

|

|

228 |

|

|

|

83 |

|

|

|

151 |

|

| Non-accrual loans |

|

|

1,480 |

|

|

|

1,522 |

|

|

|

1,459 |

|

|

|

1,566 |

|

|

|

1,775 |

|

| Other real estate owned, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Nonperforming assets |

|

|

1,480 |

|

|

|

1,522 |

|

|

|

1,459 |

|

|

|

1,566 |

|

|

|

1,775 |

|

| Loans 30 to 89 days past due, accruing |

|

|

1,094 |

|

|

|

2,901 |

|

|

|

2,372 |

|

|

|

902 |

|

|

|

792 |

|

| Loans over 90 days past due, accruing |

|

|

1 |

|

|

|

86 |

|

|

|

97 |

|

|

|

113 |

|

|

|

19 |

|

| Troubled debt restructurings, accruing |

|

|

4,313 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Special mention loans |

|

|

2,034 |

|

|

|

6,058 |

|

|

|

6,069 |

|

|

|

1,458 |

|

|

|

2,610 |

|

| Substandard loans, accruing |

|

|

8,616 |

|

|

|

4,368 |

|

|

|

3,410 |

|

|

|

3,758 |

|

|

|

2,825 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Ratios (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capital |

|

$ |

88,109 |

|

|

$ |

86,849 |

|

|

$ |

85,439 |

|

|

$ |

83,591 |

|

|

$ |

82,078 |

|

| Tier 1 capital |

|

|

81,813 |

|

|

|

81,265 |

|

|

|

80,505 |

|

|

|

78,679 |

|

|

|

77,083 |

|

| Common equity tier 1 capital |

|

|

81,813 |

|

|

|

81,265 |

|

|

|

80,505 |

|

|

|

78,679 |

|

|

|

77,083 |

|

| Total capital to risk-weighted assets |

|

|

15.20 |

% |

|

|

14.98 |

% |

|

|

14.84 |

% |

|

|

14.57 |

% |

|

|

14.24 |

% |

| Tier 1 capital to risk-weighted assets |

|

|

14.11 |

% |

|

|

14.02 |

% |

|

|

13.99 |

% |

|

|

13.71 |

% |

|

|

13.37 |

% |

| Common equity tier 1 capital to risk-weighted assets |

|

|

14.11 |

% |

|

|

14.02 |

% |

|

|

13.99 |

% |

|

|

13.71 |

% |

|

|

13.37 |

% |

| Leverage ratio |

|

|

9.08 |

% |

|

|

10.08 |

% |

|

|

10.13 |

% |

|

|

10.09 |

% |

|

|

9.96 |

% |

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

June

30, |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

| |

|

2020 |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

| Balance Sheet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and due from banks |

|

$ |

17,717 |

|

|

$ |

30,551 |

|

|

$ |

9,675 |

|

|

$ |

11,885 |

|

|

$ |

12,354 |

|

| Interest-bearing deposits in banks |

|

|

90,562 |

|

|

|

17,539 |

|

|

|

36,110 |

|

|

|

18,488 |

|

|

|

10,716 |

|

| Securities available for sale, at fair value |

|

|

123,193 |

|

|

|

128,660 |

|

|

|

120,983 |

|

|

|

114,568 |

|

|

|

119,510 |

|

| Securities held to maturity, at amortized cost |

|

|

16,211 |

|

|

|

17,086 |

|

|

|

17,627 |

|

|

|

18,222 |

|

|

|

18,828 |

|

| Restricted securities, at cost |

|

|

1,848 |

|

|

|

1,848 |

|

|

|

1,806 |

|

|

|

1,806 |

|

|

|

1,701 |

|

| Loans held for sale |

|

|

170 |

|

|

|

621 |

|

|

|

167 |

|

|

|

1,098 |

|

|

|

675 |

|

| Loans, net of allowance for loan losses |

|

|

645,220 |

|

|

|

576,283 |

|

|

|

569,412 |

|

|

|

566,341 |

|

|

|

569,959 |

|

| Premises and equipment, net |

|

|

19,792 |

|

|

|

19,619 |

|

|

|

19,747 |

|

|

|

19,946 |

|

|

|

20,182 |

|

| Accrued interest receivable |

|

|

3,863 |

|

|

|

2,124 |

|

|

|

2,065 |

|

|

|

2,053 |

|

|

|

2,163 |

|

| Bank owned life insurance |

|

|

17,661 |

|

|

|

17,562 |

|

|

|

17,447 |

|

|

|

17,324 |

|

|

|

17,193 |

|

| Core deposit intangibles, net |

|

|

76 |

|

|

|

118 |

|

|

|

170 |

|

|

|

231 |

|

|

|

302 |

|

| Other assets |

|

|

5,777 |

|

|

|

4,401 |

|

|

|

4,839 |

|

|

|

5,231 |

|

|

|

4,801 |

|

| Total assets |

|

$ |

942,090 |

|

|

$ |

816,412 |

|

|

$ |

800,048 |

|

|

$ |

777,193 |

|

|

$ |

778,384 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest-bearing demand deposits |

|

$ |

253,974 |

|

|

$ |

197,662 |

|

|

$ |

189,623 |

|

|

$ |

189,797 |

|

|

$ |

186,553 |

|

| Savings and interest-bearing demand deposits |

|

|

470,764 |

|

|

|

407,555 |

|

|

|

399,255 |

|

|

|

376,047 |

|

|

|

385,399 |

|

| Time deposits |

|

|

114,277 |

|

|

|

115,410 |

|

|

|

117,564 |

|

|

|

119,777 |

|

|

|

117,863 |

|

| Total deposits |

|

$ |

839,015 |

|

|

$ |

720,627 |

|

|

$ |

706,442 |

|

|

$ |

685,621 |

|

|

$ |

689,815 |

|

| Subordinated debt |

|

|

9,982 |

|

|

|

4,987 |

|

|

|

4,983 |

|

|

|

4,978 |

|

|

|

4,974 |

|

| Junior subordinated debt |

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

|

|

9,279 |

|

| Accrued interest payable and other liabilities |

|

|

3,026 |

|

|

|

3,001 |

|

|

|

2,125 |

|

|

|

1,999 |

|

|

|

1,507 |

|

| Total liabilities |

|

$ |

861,302 |

|

|

$ |

737,894 |

|

|

$ |

722,829 |

|

|

$ |

701,877 |

|

|

$ |

705,575 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Preferred stock |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| Common stock |

|

|

6,065 |

|

|

|

6,062 |

|

|

|

6,212 |

|

|

|

6,210 |

|

|

|

6,206 |

|

| Surplus |

|

|

5,967 |

|

|

|

5,899 |

|

|

|

7,700 |

|

|

|

7,648 |

|

|

|

7,566 |

|

| Retained earnings |

|

|

65,451 |

|

|

|

63,741 |

|

|

|

62,583 |

|

|

|

60,314 |

|

|

|

58,268 |

|

| Accumulated other comprehensive income (loss), net |

|

|

3,305 |

|

|

|

2,816 |

|

|

|

724 |

|

|

|

1,144 |

|

|

|

769 |

|

| Total shareholders’ equity |

|

$ |

80,788 |

|

|

$ |

78,518 |

|

|

$ |

77,219 |

|

|

$ |

75,316 |

|

|

$ |

72,809 |

|

| Total liabilities and shareholders’ equity |

|

$ |

942,090 |

|

|

$ |

816,412 |

|

|

$ |

800,048 |

|

|

$ |

777,193 |

|

|

$ |

778,384 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loan Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans on real estate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction and land development |

|

$ |

31,981 |

|

|

$ |

40,279 |

|

|

$ |

43,164 |

|

|

$ |

45,193 |

|

|

$ |

46,281 |

|

|

Secured by farmland |

|

|

872 |

|

|

|

888 |

|

|

|

900 |

|

|

|

916 |

|

|

|

855 |

|

|

Secured by 1-4 family residential |

|

|

234,188 |

|

|

|

230,980 |

|

|

|

229,438 |

|

|

|

226,828 |

|

|

|

225,820 |

|

|

Other real estate loans |

|

|

247,623 |

|

|

|

240,486 |

|

|

|

235,655 |

|

|

|

232,151 |

|

|

|

236,515 |

|

| Loans to farmers (except those secured by real estate) |

|

|

711 |

|

|

|

1,221 |

|

|

|

1,423 |

|

|

|

1,461 |

|

|

|

1,006 |

|

| Commercial and industrial loans (except those secured by real

estate) |

|

|

123,995 |

|

|

|

54,287 |

|

|

|

48,730 |

|

|

|

49,096 |

|

|

|

48,347 |

|

| Consumer installment loans |

|

|

8,401 |

|

|

|

9,505 |

|

|

|

10,400 |

|

|

|

11,040 |

|

|

|

11,572 |

|

| Deposit overdrafts |

|

|

170 |

|

|

|

238 |

|

|

|

374 |

|

|

|

263 |

|

|

|

208 |

|

| All other loans |

|

|

3,575 |

|

|

|

3,983 |

|

|

|

4,262 |

|

|

|

4,305 |

|

|

|

4,350 |

|

| Total loans |

|

$ |

651,516 |

|

|

$ |

581,867 |

|

|

$ |

574,346 |

|

|

$ |

571,253 |

|

|

$ |

574,954 |

|

| Allowance for loan losses |

|

|

(6,296 |

) |

|

|

(5,584 |

) |

|

|

(4,934 |

) |

|

|

(4,912 |

) |

|

|

(4,995 |

) |

| Loans, net |

|

$ |

645,220 |

|

|

$ |

576,283 |

|

|

$ |

569,412 |

|

|

$ |

566,341 |

|

|

$ |

569,959 |

|

FIRST NATIONAL CORPORATIONQuarterly

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

| |

|

For the Quarter Ended |

| |

|

June

30, |

|

March

31, |

|

December

31, |

|

September

30, |

|

June

30, |

| |

|

2020 |

|

2020 |

|

2019 |

|

2019 |

|

2019 |

| Reconciliation of Tax-Equivalent Net Interest

Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income – loans |

|

$ |

7,416 |

|

|

$ |

7,203 |

|

|

$ |

7,333 |

|

|

$ |

7,429 |

|

|

$ |

7,200 |

|

|

Interest income – investments and other |

|

|

829 |

|

|

|

965 |

|

|

|

973 |

|

|

|

925 |

|

|

|

1,014 |

|

|

Interest expense – deposits |

|

|

(676 |

) |

|

|

(962 |

) |

|

|

(1,042 |

) |

|

|

(1,089 |

) |

|

|

(1,051 |

) |

|

Interest expense – federal funds purchased |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

Interest expense – subordinated debt |

|

|

(91 |

) |

|

|

(90 |

) |

|

|

(91 |

) |

|

|

(90 |

) |

|

|

(90 |

) |

|

Interest expense – junior subordinated debt |

|

|

(67 |

) |

|

|

(90 |

) |

|

|

(98 |

) |

|

|

(103 |

) |

|

|

(108 |

) |

| Total net interest income |

|

$ |

7,411 |

|

|

$ |

7,026 |

|

|

$ |

7,075 |

|

|

$ |

7,071 |

|

|

$ |

6,965 |

|

| Non-GAAP measures: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax benefit realized on non-taxable interest income – loans |

|

$ |

8 |

|

|

$ |

10 |

|

|

$ |

10 |

|

|

$ |

9 |

|

|

$ |

10 |

|

|

Tax benefit realized on non-taxable interest income – municipal

securities |

|

|

40 |

|

|

|

40 |

|

|

|

41 |

|

|

|

43 |

|

|

|

42 |

|

| Total tax benefit realized on non-taxable interest income |

|

$ |

48 |

|

|

$ |

50 |

|

|

$ |

51 |

|

|

$ |

52 |

|

|

$ |

52 |

|

| Total tax-equivalent net interest income |

|

$ |

7,459 |

|

|

$ |

7,076 |

|

|

$ |

7,126 |

|

|

$ |

7,123 |

|

|

$ |

7,017 |

|

FIRST NATIONAL CORPORATIONYear-to-Date

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Six Months Ended |

|

| |

|

June

30, |

|

|

June

30, |

|

| |

|

2020 |

|

|

2019 |

|

| Income Statement |

|

|

|

|

|

|

|

|

| Interest income |

|

|

|

|

|

|

|

|

|

Interest and fees on loans |

|

$ |

14,619 |

|

|

$ |

14,196 |

|

|

Interest on deposits in banks |

|

|

134 |

|

|

|

243 |

|

|

Interest on securities |

|

|

|

|

|

|

|

|

|

Taxable interest |

|

|

1,306 |

|

|

|

1,433 |

|

|

Tax-exempt interest |

|

|

302 |

|

|

|

315 |

|

|

Dividends |

|

|

52 |

|

|

|

50 |

|

| Total interest income |

|

$ |

16,413 |

|

|

$ |

16,237 |

|

| Interest expense |

|

|

|

|

|

|

|

|

|

Interest on deposits |

|

$ |

1,638 |

|

|

$ |

1,973 |

|

|

Interest on subordinated debt |

|

|

181 |

|

|

|

179 |

|

|

Interest on junior subordinated debt |

|

|

157 |

|

|

|

219 |

|

|

Interest on other borrowings |

|

|

— |

|

|

|

2 |

|

| Total interest expense |

|

$ |

1,976 |

|

|

$ |

2,373 |

|

| Net interest income |

|

$ |

14,437 |

|

|

$ |

13,864 |

|

| Provision for loan losses |

|

|

1,700 |

|

|

|

200 |

|

| Net interest income after provision for loan losses |

|

$ |

12,737 |

|

|

$ |

13,664 |

|

| Noninterest income |

|

|

|

|

|

|

|

|

|

Service charges on deposit accounts |

|

$ |

1,029 |

|

|

$ |

1,416 |

|

|

ATM and check card fees |

|

|

1,069 |

|

|

|

1,090 |

|

|

Wealth management fees |

|

|

1,037 |

|

|

|

895 |

|

|

Fees for other customer services |

|

|

444 |

|

|

|

328 |

|

|

Income from bank owned life insurance |

|

|

214 |

|

|

|

202 |

|

|

Net gains on sale of loans |

|

|

57 |

|

|

|

47 |

|

|

Other operating income |

|

|

22 |

|

|

|

42 |

|

| Total noninterest income |

|

$ |

3,872 |

|

|

$ |

4,020 |

|

| Noninterest expense |

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

$ |

6,611 |

|

|

$ |

6,818 |

|

|

Occupancy |

|

|

811 |

|

|

|

839 |

|

|

Equipment |

|

|

828 |

|

|

|

829 |

|

|

Marketing |

|

|

180 |

|

|

|

380 |

|

|

Supplies |

|

|

192 |

|

|

|

164 |

|

|

Legal and professional fees |

|

|

580 |

|

|

|

544 |

|

|

ATM and check card expense |

|

|

468 |

|

|

|

441 |

|

|

FDIC assessment |

|

|

90 |

|

|

|

104 |

|

|

Bank franchise tax |

|

|

314 |

|

|

|

266 |

|

|

Data processing expense |

|

|

372 |

|

|

|

352 |

|

|

Amortization expense |

|

|

94 |

|

|

|

170 |

|

|

Net losses (gains) on disposal of premises and equipment |

|

|

(9 |

) |

|

|

— |

|

|

Other operating expense |

|

|

1,226 |

|

|

|

1,421 |

|

| Total noninterest expense |

|

$ |

11,757 |

|

|

$ |

12,328 |

|

| Income before income taxes |

|

$ |

4,852 |

|

|

$ |

5,356 |

|

| Income tax expense |

|

|

904 |

|

|

|

1,009 |

|

| Net income |

|

$ |

3,948 |

|

|

$ |

4,347 |

|

FIRST NATIONAL CORPORATIONYear-to-Date

Performance Summary(in thousands, except share and per

share data)

| |

|

(unaudited) |

|

| |

|

For the Six Months Ended |

|

| |

|

June

30, |

|

|

June

30, |

|

| |

|

2020 |

|

|

2019 |

|

| Common Share and Per Common Share Data |

|

|

|

|

|

|

|

|

| Net income, basic |

|

$ |

0.81 |

|

|

$ |

0.88 |

|

| Weighted average shares, basic |

|

|

4,900,303 |

|

|

|

4,962,010 |

|

| Net income, diluted |

|

$ |

0.81 |

|

|

$ |

0.88 |

|

| Weighted average shares, diluted |

|

|

4,902,845 |

|

|

|

4,964,988 |

|

| Shares outstanding at period end |

|

|

4,852,187 |

|

|

|

4,964,824 |

|

| Tangible book value at period end |

|

$ |

16.63 |

|

|

$ |

14.60 |

|

| Cash dividends |

|

$ |

0.22 |

|

|

$ |

0.18 |

|

| |

|

|

|

|

|

|

|

|

| Key Performance Ratios |

|

|

|

|

|

|

|

|

| Return on average assets |

|

|

0.93 |

% |

|

|

1.14 |

% |

| Return on average equity |

|

|

10.01 |

% |

|

|

12.60 |

% |

| Net interest margin |

|

|

3.67 |

% |

|

|

3.93 |

% |

| Efficiency ratio (1) |

|

|

63.41 |

% |

|

|

67.59 |

% |

| |

|

|

|

|

|

|

|

|

| Average Balances |

|

|

|

|

|

|

|

|

| Average assets |

|

$ |

852,866 |

|

|

$ |

766,054 |

|

| Average earning assets |

|

|

795,957 |

|

|

|

717,341 |

|

| Average shareholders’ equity |

|

|

79,356 |

|

|

|

69,589 |

|

| |

|

|

|

|

|

|

|

|

| Asset Quality |

|

|

|

|

|

|

|

|

| Loan charge-offs |

|

$ |

504 |

|

|

$ |

447 |

|

| Loan recoveries |

|

|

166 |

|

|

|

233 |

|

| Net charge-offs |

|

|

338 |

|

|

|

214 |

|

| |

|

|

|

|

|

|

|

|

| Reconciliation of Tax-Equivalent Net Interest

Income |

|

|

|

|

|

|

|

|

| GAAP measures: |

|

|

|

|

|

|

|

|

|

Interest income – loans |

|

$ |

14,619 |

|

|

$ |

14,196 |

|

|

Interest income – investments and other |

|

|

1,794 |

|

|

|

2,041 |

|

|

Interest expense – deposits |

|

|

(1,638 |

) |

|

|

(1,973 |

) |

|

Interest expense – subordinated debt |

|

|

(181 |

) |

|

|

(179 |

) |

|

Interest expense – junior subordinated debt |

|

|

(157 |

) |

|

|

(219 |

) |

|

Interest expense – other borrowings |

|

|

— |

|

|

|

(2 |

) |

| Total net interest income |

|

$ |

14,437 |

|

|

$ |

13,864 |

|

| Non-GAAP measures: |

|

|

|

|

|

|

|

|

|

Tax benefit realized on non-taxable interest income – loans |

|

$ |

18 |

|

|

$ |

21 |

|

|

Tax benefit realized on non-taxable interest income – municipal

securities |

|

|

80 |

|

|

|

83 |

|

| Total tax benefit realized on non-taxable interest income |

|

$ |

98 |

|

|

$ |

104 |

|

| Total tax-equivalent net interest income |

|

$ |

14,535 |

|

|

$ |

13,968 |

|

(1) The efficiency ratio is computed by dividing

noninterest expense excluding other real estate owned

income/expense, amortization of intangibles, and gains and losses

on disposal of premises and equipment by the sum of net interest

income on a tax-equivalent basis and noninterest income, excluding

gains and losses on sales of securities. Tax-equivalent net

interest income is calculated by adding the tax benefit realized

from interest income that is nontaxable to total interest income

then subtracting total interest expense. The tax rate utilized in

calculating the tax benefit is 21%. See the tables above for

tax-equivalent net interest income and reconciliations of net

interest income to tax-equivalent net interest income. The

efficiency ratio is a non-GAAP financial measure that management

believes provides investors with important information regarding

operational efficiency. Such information is not prepared in

accordance with U.S. generally accepted accounting principles

(GAAP) and should not be construed as such. Management

believes; however, such financial information is meaningful to the

reader in understanding operational performance, but cautions that

such information not be viewed as a substitute for GAAP.

(2) All capital ratios reported are for First Bank.

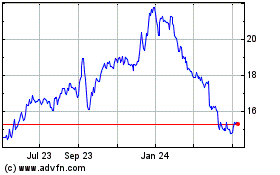

First National (NASDAQ:FXNC)

Historical Stock Chart

From Aug 2024 to Sep 2024

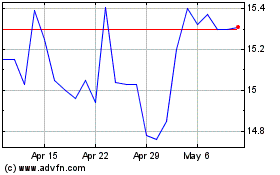

First National (NASDAQ:FXNC)

Historical Stock Chart

From Sep 2023 to Sep 2024