0000939767false00009397672023-11-012023-11-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 1, 2023

| | |

|

EXELIXIS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

Delaware | 000-30235 | 04-3257395 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1851 Harbor Bay Parkway

Alameda, California 94502

(Address of principal executive offices) (Zip Code)

(650) 837-7000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock $.001 Par Value per Share | EXEL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On November 1, 2023, Exelixis, Inc. (Exelixis) issued a press release announcing its financial results for the quarter ended September 29, 2023, and providing a corporate update. A copy of such press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this report, including the exhibit hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this report and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Exelixis, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | |

| Exhibit Number | | Exhibit Description | | |

| | | | |

| 99.1 | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| 104 | | Cover Page Interactive Data File | | The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | EXELIXIS, INC. |

| | | |

| November 1, 2023 | | | /s/ Jeffrey J. Hessekiel |

| Date | | | Jeffrey J. Hessekiel |

| | | Executive Vice President, General Counsel

and Secretary |

Contacts:

Chris Senner

Chief Financial Officer

Exelixis, Inc.

650-837-7240

csenner@exelixis.com

Susan Hubbard

EVP, Public Affairs & Investor Relations

Exelixis, Inc.

650-837-8194

shubbard@exelixis.com

Exelixis Announces Third Quarter 2023 Financial Results and Provides Corporate Update

- Total Revenues of $471.9 million, Cabozantinib Franchise U.S. Net Product Revenues of $426.5 million -

- Conference Call and Webcast Today at 5:00 PM Eastern Time -

ALAMEDA, Calif. – November 1, 2023 - Exelixis, Inc. (Nasdaq: EXEL) today reported financial results for the third quarter of 2023 and provided an update on progress toward achieving key corporate objectives, as well as commercial, clinical and pipeline development milestones.

“The third quarter of 2023 was another strong one for the CABOMETYX® commercial franchise, which continues to fuel the buildout of our differentiated pipeline of small molecules and biotherapeutics,” said Michael M. Morrissey, Ph.D., President and Chief Executive Officer, Exelixis. “CABOMETYX maintained its status as the leading tyrosine kinase inhibitor for the treatment of renal cell carcinoma, driven by its use in combination with nivolumab in the first-line setting. On the cabozantinib development front, we reported positive results from the phase 3 CONTACT-02 and CABINET studies in prostate and neuroendocrine tumors, respectively.”

Dr. Morrissey continued: “We welcomed Dr. Amy Peterson as our new Chief Medical Officer in August with a focus on accelerating our clinical pipeline programs, including zanzalintinib, our next-generation tyrosine kinase inhibitor, and XB002, our most advanced antibody-drug conjugate. We’re making progress enrolling key trials for both programs, and we’re excited for the presentation of the clear cell renal cell carcinoma cohort of zanzalintinib’s STELLAR-001 study at the 2023 International Kidney Cancer Symposium later this month. On the business development front, we signed a new agreement with Insilico Medicine to in-license XL309, formerly ISM3091, a potentially best-in-class small molecule inhibitor of USP1, and we are continuing to evaluate external opportunities for potential best-in-class or first-in-class late-stage and commercial assets. We’ll discuss all these updates and more at our R&D Day on Tuesday, December 12th in New York City. I’d like to thank the entire Exelixis team for all their hard work and contributions during the third quarter as we advanced our mission to help cancer patients recover stronger and live longer.”

Third Quarter 2023 Financial Results

Total revenues for the quarter ended September 30, 2023 were $471.9 million, as compared to $411.7 million for the comparable period in 2022.

| | | | | |

Exelixis Third Quarter 2023 Financial Results | Page 2 of 8 |

November 1, 2023 | |

Total revenues for the quarter ended September 30, 2023 included net product revenues of $426.5 million, as compared to $366.5 million for the comparable period in 2022. The increase in net product revenues was primarily due to an increase in sales volume and an increase in average net selling price.

Collaboration revenues, composed of license revenues and collaboration services revenues, were $45.4 million for the quarter ended September 30, 2023, as compared to $45.3 million for the comparable period in 2022. Collaboration revenues primarily consisted of royalty revenues for the sales of cabozantinib outside of the U.S. generated by Exelixis’ collaboration partners, Ipsen Pharma SAS and Takeda Pharmaceutical Company Limited.

Research and development expenses for the quarter ended September 30, 2023 were $332.6 million, as compared to $198.8 million for the comparable period in 2022. The increase in research and development expenses was primarily related to increases in license and other collaboration costs, personnel expenses and manufacturing costs to support Exelixis’ development candidates, partially offset by lower stock-based compensation expense.

Selling, general and administrative expenses for the quarter ended September 30, 2023 were $138.1 million, as compared to $115.0 million for the comparable period in 2022. The increase in selling, general and administrative expenses was primarily related to increases in personnel expenses, stock-based compensation expense and legal and advisory fees.

Provision for income taxes for the quarter ended September 30, 2023 was $4.8 million, as compared to $18.8 million for the comparable period in 2022, primarily due to a decrease in pre-tax income.

GAAP net income for the quarter ended September 30, 2023 was $1.0 million, or $0.00 per share, basic and diluted, as compared to GAAP net income of $73.2 million, or $0.23 per share, basic and diluted, for the comparable period in 2022.

Non-GAAP net income for the quarter ended September 30, 2023 was $32.1 million, or $0.10 per share, basic and diluted, as compared to non-GAAP net income of $102.0 million, or $0.32 per share, basic and $0.31 per share, diluted, for the comparable period in 2022.

Non-GAAP Financial Measures

To supplement Exelixis’ financial results presented in accordance with U.S. Generally Accepted Accounting Principles (GAAP), Exelixis presents non-GAAP net income (and the related per share measures), which excludes from GAAP net income (and the related per share measures) stock-based compensation expense, adjusted for the related income tax effect for all periods presented.

Exelixis believes that the presentation of these non-GAAP financial measures provides useful supplementary information to, and facilitates additional analysis by, investors. In particular, Exelixis believes that these non-GAAP financial measures, when considered together with its financial information prepared in accordance with GAAP, can enhance investors’ and analysts’ ability to meaningfully compare Exelixis’ results from period to period, and to identify operating trends in Exelixis’ business. Exelixis has excluded stock-based compensation expense, adjusted for the related income tax effect, because it is a non-cash item that may vary significantly from period to period as a result of changes not directly or immediately related to the operational performance for the periods presented. Exelixis also regularly uses these non-GAAP financial measures internally to understand, manage and evaluate its business and to make operating decisions.

| | | | | |

Exelixis Third Quarter 2023 Financial Results | Page 3 of 8 |

November 1, 2023 | |

These non-GAAP financial measures are in addition to, not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP. Exelixis encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP financial information and the reconciliation between these presentations, to more fully understand Exelixis’ business. Reconciliations between GAAP and non-GAAP results are presented in the tables of this release.

2023 Financial Guidance

Exelixis is providing the following updated financial guidance for fiscal year 2023:

| | | | | | | | |

| | |

Total revenues | | $1.825 billion - $1.850 billion |

Net product revenues | | $1.625 billion - $1.650 billion |

| Cost of goods sold | | 4.0% - 5.0% of net product revenues |

Research and development expenses (1) | | $1.050 billion - $1.075 billion |

Selling, general and administrative expenses (2) | | $525 million - $550 million |

| Effective tax rate | | 20% - 22% |

____________________

(1) Includes $35 million of non-cash stock-based compensation expense.

(2) Includes $70 million of non-cash stock-based compensation expense.

Cabozantinib Highlights

Cabozantinib Franchise Net Product Revenues and Royalties. Net product revenues generated by the cabozantinib franchise in the U.S. were $426.5 million during the third quarter of 2023, with net product revenues of $422.2 million from CABOMETYX® (cabozantinib) and $4.3 million from COMETRIQ® (cabozantinib). Based upon cabozantinib-related net product revenues generated by Exelixis’ collaboration partners during the quarter ended September 30, 2023, Exelixis earned $37.8 million in royalty revenues.

Positive Results from Phase 3 CONTACT-02 Pivotal Trial Evaluating Cabozantinib in Combination with Atezolizumab in Metastatic Castration-Resistant Prostate Cancer (mCRPC). In August, Exelixis and partner Ipsen announced that the global phase 3 CONTACT-02 pivotal trial met one of two primary endpoints, demonstrating a statistically significant improvement in progression-free survival (PFS) at the primary analysis. CONTACT-02 is evaluating cabozantinib in combination with atezolizumab compared with a second novel hormonal therapy (NHT) in patients with mCRPC and measurable soft-tissue disease who have been previously treated with one NHT. At a prespecified interim analysis for the primary endpoint of overall survival (OS), a trend toward improvement of OS was observed; however, the data were immature and did not meet the threshold for statistical significance. Therefore, the trial will continue to the next analysis of OS as planned. The safety profile of the combination of cabozantinib and atezolizumab was consistent with the known safety profiles for each single medicine, and no new safety signals were identified with the combination. Based on feedback from the U.S. Food and Drug Administration (FDA), Exelixis will discuss a potential regulatory submission when the results of the next OS analysis are available. Detailed findings will be presented at a future medical meeting.

| | | | | |

Exelixis Third Quarter 2023 Financial Results | Page 4 of 8 |

November 1, 2023 | |

Detailed Results from Phase 3 CABINET Pivotal Trial Evaluating Cabozantinib in Advanced Pancreatic and Extra-Pancreatic Neuroendocrine Tumors Presented at the 2023 European Society for Medical Oncology (ESMO) Congress. In October, detailed results were presented from the phase 3 CABINET pivotal trial at the 2023 ESMO Congress. Results of interim analyses in both cohorts demonstrate statistically significant and clinically meaningful improvement in PFS in those patients treated with cabozantinib. Adverse events were consistent with the known safety profile of cabozantinib. CABINET is sponsored by the National Cancer Institute and is led by The Alliance for Clinical Trials in Oncology. Previously, in August, Exelixis announced The Alliance for Clinical Trials in Oncology’s independent Data and Safety Monitoring Board unanimously recommended to unblind and stop the trial early due to a dramatic improvement in efficacy observed at an interim analysis. These findings will be discussed with the FDA.

COSMIC-313 Second Interim Analysis of OS Secondary Endpoint. During the third quarter, a second prespecified interim analysis for the OS secondary endpoint of the phase 3 COSMIC-313 pivotal trial was completed. The data did not meet the threshold for statistical significance. Therefore, the trial will continue to the next planned analysis of OS, anticipated in 2024. The COSMIC-313 study is evaluating the triplet combination of cabozantinib, nivolumab and ipilimumab versus the combination of nivolumab and ipilimumab in previously untreated advanced intermediate- or poor-risk renal cell carcinoma. In July 2022, Exelixis announced that the trial met its primary endpoint, demonstrating significant improvement in blinded independent radiology committee-assessed PFS at the primary analysis.

Corporate Highlights

Settlement of CABOMETYX Patent Litigation with Teva Pharmaceuticals. In July, Exelixis announced that it entered into a Settlement and License Agreement (Agreement) with Teva Pharmaceuticals Development, Inc. and Teva Pharmaceuticals USA, Inc. (collectively “Teva”). This settlement resolves patent litigation brought by Exelixis in response to Teva’s Abbreviated New Drug Application seeking approval to market a generic version of CABOMETYX prior to the expiration of the applicable patents. Pursuant to the terms of the Agreement, Exelixis will grant Teva a license to market its generic version of CABOMETYX in the U.S. beginning on January 1, 2031, if approved by the FDA and subject to conditions and exceptions common to agreements of this type. The U.S. District Court for the District of Delaware dismissed the case without prejudice in September 2023 per the parties’ joint request, effectively terminating all ongoing Hatch-Waxman litigation between Exelixis and Teva regarding CABOMETYX patents.

Appointment of Amy Peterson, M.D., as Executive Vice President, Product Development & Medical Affairs and Chief Medical Officer. In August, Exelixis announced the appointment of Amy Peterson, M.D., as Executive Vice President, Product Development & Medical Affairs and Chief Medical Officer. Dr. Peterson is a veteran oncology drug development leader whose experience includes senior clinical development and operational roles at Genentech, Medivation, BeiGene and CytomX. She received her M.D. from Thomas Jefferson University, completed a residency in internal medicine at Northwestern Memorial Hospital and undertook a hematology/oncology fellowship at the University of Chicago. Dr. Peterson joined Exelixis as the company accelerates development of its product pipeline and builds on the success of its global cabozantinib oncology franchise.

Exelixis and Insilico Medicine (Insilico) Enter into Exclusive Global License Agreement for XL309 (formerly ISM3091), a Potentially Best-in-Class USP1 Inhibitor. In September, Exelixis and Insilico announced that the companies entered into an exclusive license agreement granting Exelixis global rights to develop and commercialize XL309, a potentially best-in-class small molecule inhibitor of USP1, which has emerged as a synthetic lethal target in the context of BRCA-mutated tumors. Under the terms of the agreement, Insilico granted Exelixis an exclusive, worldwide license to develop and commercialize XL309 and other USP1-targeting compounds in exchange for an upfront payment of $80 million and potential future development and commercial milestone payments, as well as tiered royalties on net sales.

| | | | | |

Exelixis Third Quarter 2023 Financial Results | Page 5 of 8 |

November 1, 2023 | |

Share Repurchase Program. As of September 30, 2023, Exelixis has repurchased 16.943 million shares of the company’s common stock for a total of $344.8 million. In March, Exelixis announced that the company’s Board of Directors authorized the repurchase of up to $550 million of the company’s common stock before the end of 2023. Share repurchases under the program may be made from time to time through a variety of methods, which may include open market purchases, in block trades, accelerated share repurchase transactions, exchange transactions, or any combination of such methods. The timing and amount of any share repurchases under the share repurchase program will be based on a variety of factors, including ongoing assessments of the capital needs of the business, alternative investment opportunities, the market price of Exelixis’ common stock and general market conditions.

Basis of Presentation

Exelixis has adopted a 52- or 53-week fiscal year that generally ends on the Friday closest to December 31st. For convenience, references in this press release as of and for the fiscal period ended September 29, 2023 is indicated as being as of and for the period ended September 30, 2023.

Conference Call and Webcast

Exelixis management will discuss the company’s financial results for the third quarter of 2023 and provide a general business update during a conference call beginning at 5:00 p.m. ET / 2:00 p.m. PT today, Wednesday, November 1, 2023.

To access the conference call, please register using this link. Upon registration, a dial-in number and unique PIN will be provided to join the call. To access the live webcast link, log onto www.exelixis.com and proceed to the Event Calendar page under the Investors & News heading. Please connect to the company’s website at least 15 minutes prior to the conference call to ensure adequate time for any software download that may be required to listen to the webcast. A webcast replay of the conference call will also be archived on www.exelixis.com for one year.

About Exelixis

Exelixis is a globally ambitious oncology company innovating next-generation medicines and regimens at the forefront of cancer care. Powered by bi-coastal centers of discovery and development excellence, we are rapidly evolving our product portfolio to target an expanding range of tumor types and indications with our clinically differentiated pipeline of small molecules, antibody-drug conjugates and other biotherapeutics. This comprehensive approach harnesses decades of robust investment in our science and partnerships to advance our investigational programs and extend the impact of our flagship commercial product, CABOMETYX® (cabozantinib). Exelixis is driven by a bold scientific pursuit to create transformational treatments that give more patients hope for the future. For information about the company and its mission to help cancer patients recover stronger and live longer, visit www.exelixis.com, follow @ExelixisInc on X (Twitter), like Exelixis, Inc. on Facebook and follow Exelixis on LinkedIn.

| | | | | |

Exelixis Third Quarter 2023 Financial Results | Page 6 of 8 |

November 1, 2023 | |

Forward-Looking Statements

This press release contains forward-looking statements, including, without limitation, statements related to: Exelixis’ plans to present data from the clear cell renal cell carcinoma cohort of STELLAR-001 at the 2023 International Kidney Cancer Symposium in November 2023, as well as discuss various updates relating to the company’s discovery and development strategy at its R&D Day in December 2023; the potential for XL309 to be a best-in-class small molecule inhibitor of USP1; Exelixis’ updated 2023 financial guidance; Exelixis’ plans to discuss a potential regulatory submission for the combination of cabozantinib and atezolizumab in mCRPC with the FDA when the results of the next OS analysis from CONTACT-02 are available, as well as present detailed findings from CONTACT-02 at a future medical meeting; Exelixis’ plans to discuss findings from CABINET with the FDA; Exelixis’ anticipated timing of 2024 for the next planned OS analysis from COSMIC-313; Exelixis’ future obligations under the Agreement settling the company’s patent litigation with Teva; Exelixis’ immediate and future financial and other obligations under its exclusive license agreement with Insilico; Exelixis’ plans to repurchase up to $550 million of its common stock before the end of 2023; and Exelixis’ scientific pursuit to create transformational treatments that give more patients hope for the future. Any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements and are based upon Exelixis’ current plans, assumptions, beliefs, expectations, estimates and projections. Forward-looking statements involve risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in the forward-looking statements as a result of these risks and uncertainties, which include, without limitation: the degree of market acceptance of CABOMETYX and other Exelixis products in the indications for which they are approved and in the territories where they are approved, and Exelixis’ and its partners’ ability to obtain or maintain coverage and reimbursement for these products; the effectiveness of CABOMETYX and other Exelixis products in comparison to competing products; the level of costs associated with Exelixis’ commercialization, research and development, in-licensing or acquisition of product candidates, and other activities; Exelixis’ ability to maintain and scale adequate sales, marketing, market access and product distribution capabilities for its products or to enter into and maintain agreements with third parties to do so; the availability of data at the referenced times; the potential failure of cabozantinib, zanzalintinib and other Exelixis product candidates, both alone and in combination with other therapies, to demonstrate safety and/or efficacy in clinical testing; uncertainties inherent in the drug discovery and product development process; Exelixis’ dependence on its relationships with its collaboration partners, including their pursuit of regulatory approvals for partnered compounds in new indications, their adherence to their obligations under relevant collaboration agreements and the level of their investment in the resources necessary to complete clinical trials or successfully commercialize partnered compounds in the territories where they are approved; complexities and the unpredictability of the regulatory review and approval processes in the U.S. and elsewhere; Exelixis’ continuing compliance with applicable legal and regulatory requirements; unexpected concerns that may arise as a result of the occurrence of adverse safety events or additional data analyses of clinical trials evaluating cabozantinib and other Exelixis product candidates; Exelixis’ dependence on third-party vendors for the development, manufacture and supply of its products and product candidates; Exelixis’ ability to protect its intellectual property rights; market competition, including the potential for competitors to obtain approval for generic versions of Exelixis’ marketed products; changes in economic and business conditions; and other factors detailed from time to time under the caption “Risk Factors” in Exelixis’ most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, and in Exelixis’ other future filings with the Securities and Exchange Commission. All forward-looking statements in this press release are based on information available to Exelixis as of the date of this press release, and Exelixis undertakes no obligation to update or revise any forward-looking statements contained herein, except as required by law.

Exelixis, the Exelixis logo, CABOMETYX and COMETRIQ are registered trademarks of Exelixis, Inc.

-see attached financial tables-

| | | | | |

Exelixis Third Quarter 2023 Financial Results | Page 7 of 8 |

November 1, 2023 | |

EXELIXIS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Revenues: | | | | | | | | | | | |

| Net product revenues | $ | 426,497 | | | $ | 366,482 | | | $ | 1,199,543 | | | $ | 1,023,824 | | | | | |

| License revenues | 42,367 | | | 34,384 | | | 133,406 | | | 123,977 | | | | | |

| Collaboration services revenues | 3,056 | | | 10,872 | | | 17,607 | | | 39,344 | | | | | |

| Total revenues | 471,920 | | | 411,738 | | | 1,350,556 | | | 1,187,145 | | | | | |

| Operating expenses: | | | | | | | | | | | |

| Cost of goods sold | 18,774 | | | 15,305 | | | 50,794 | | | 41,989 | | | | | |

| Research and development | 332,585 | | | 198,837 | | | 799,401 | | | 554,989 | | | | | |

| Selling, general and administrative | 138,144 | | | 114,983 | | | 411,264 | | | 340,605 | | | | | |

| Total operating expenses | 489,503 | | | 329,125 | | | 1,261,459 | | | 937,583 | | | | | |

| Income (loss) from operations | (17,583) | | | 82,613 | | | 89,097 | | | 249,562 | | | | | |

| Interest income | 23,112 | | | 9,498 | | | 65,155 | | | 16,077 | | | | | |

| Other income (expense), net | 289 | | | (69) | | | 230 | | | 140 | | | | | |

| Income before income taxes | 5,818 | | | 92,042 | | | 154,482 | | | 265,779 | | | | | |

| Provision for income taxes | 4,777 | | | 18,832 | | | 32,235 | | | 53,324 | | | | | |

| Net income | $ | 1,041 | | | $ | 73,210 | | | $ | 122,247 | | | $ | 212,455 | | | | | |

| Net income per share: | | | | | | | | | | | |

Basic | $ | 0.00 | | | $ | 0.23 | | | $ | 0.38 | | | $ | 0.66 | | | | | |

Diluted | $ | 0.00 | | | $ | 0.23 | | | $ | 0.38 | | | $ | 0.65 | | | | | |

| Weighted-average common shares outstanding: | | | | | | | | | | | |

| Basic | 315,496 | | | 322,148 | | | 321,373 | | | 320,949 | | | | | |

| Diluted | 319,247 | | | 325,066 | | | 324,277 | | | 324,420 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | |

Exelixis Third Quarter 2023 Financial Results | Page 8 of 8 |

November 1, 2023 | |

EXELIXIS, INC.

RECONCILIATION OF GAAP NET INCOME TO NON-GAAP NET INCOME

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| GAAP net income | $ | 1,041 | | | $ | 73,210 | | | $ | 122,247 | | | $ | 212,455 | | | | | |

| Adjustments: | | | | | | | | | | | |

Stock-based compensation - research and development expenses (1) | 12,438 | | | 16,438 | | | 25,279 | | | 34,886 | | | | | |

Stock-based compensation - selling, general and administrative expenses (1) | 28,040 | | | 20,899 | | | 56,760 | | | 46,832 | | | | | |

| Income tax effect of the above adjustments | (9,420) | | | (8,506) | | | (19,062) | | | (18,514) | | | | | |

| Non-GAAP net income | $ | 32,099 | | | $ | 102,041 | | | $ | 185,224 | | | $ | 275,659 | | | | | |

| GAAP net income per share: | | | | | | | | | | | |

| Basic | $ | 0.00 | | | $ | 0.23 | | | $ | 0.38 | | | $ | 0.66 | | | | | |

| Diluted | $ | 0.00 | | | $ | 0.23 | | | $ | 0.38 | | | $ | 0.65 | | | | | |

| Non-GAAP net income per share: | | | | | | | | | | | |

| Basic | $ | 0.10 | | | $ | 0.32 | | | $ | 0.58 | | | $ | 0.86 | | | | | |

| Diluted | $ | 0.10 | | | $ | 0.31 | | | $ | 0.57 | | | $ | 0.85 | | | | | |

| Weighted-average common shares outstanding: | | | | | | | | | | | |

| Basic | 315,496 | | | 322,148 | | | 321,373 | | | 320,949 | | | | | |

| Diluted | 319,247 | | | 325,066 | | | 324,277 | | | 324,420 | | | | | |

____________________

(1) Non-cash stock-based compensation expense used for GAAP reporting in accordance with Accounting Standards Codification Topic 718, Compensation—Stock Compensation.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

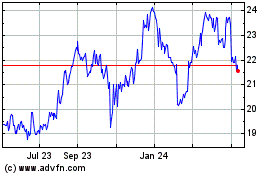

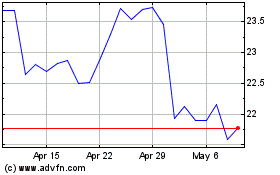

Exelixis (NASDAQ:EXEL)

Historical Stock Chart

From Apr 2024 to May 2024

Exelixis (NASDAQ:EXEL)

Historical Stock Chart

From May 2023 to May 2024