UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x |

Definitive Additional Materials |

| ¨ |

Soliciting Material Pursuant to Section 240.14a-12 |

EXCELFIN ACQUISITION CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee paid previously with preliminary materials |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT

OF 1934

Date of Report (Date of earliest

event reported): October 17, 2023

ExcelFin Acquisition Corp.

(Exact name of registrant as

specified in its charter)

| Delaware |

|

001-40933 |

|

86-2933776 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

100 Kingsley Park Dr

Fort Mill, South Carolina |

|

29715 |

| (Address of principal executive offices) |

|

(Zip Code) |

(917) 209-8581

(Registrant’s telephone

number, including area code)

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Securities Exchange Act of 1934:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Units, each consisting of one share of Class A common stock and one-half of one redeemable warrant |

|

XFINU |

|

The Nasdaq Stock Market |

| Class A common stock, par value $0.0001 per share |

|

XFIN |

|

The Nasdaq Stock Market |

| Redeemable warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 |

|

XFINW |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

On October 17, 2023, ExcelFin Acquisition Corp.,

a Delaware corporation (“we”, “us”, “our”, or the “Company”),

issued a press release announcing that the special meeting of the stockholders of the Company originally scheduled for October 18, 2023

(the “Special Meeting”) is being adjourned to October 20, 2023. At the Special Meeting, Company’s stockholders

will be asked:

| · | to consider and vote upon a proposal to amend the Company’s amended and restated certificate of

incorporation (the “Charter”) pursuant to a second amendment to the Charter (the “Extension Amendment”) to extend

the date by which the Company must effectuate an initial business combination from October 25, 2023 (the “Termination Date”)

to April 25, 2024, comprised of an initial three-month extension and three subsequent one-month extensions, for a total of six months

after the Termination Date (assuming the Company’s initial business combination has not occurred); and |

| · | to consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary,

to (i) permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are

not sufficient votes to approve one or more proposals presented to stockholders for vote or (ii) if stockholders have elected to redeem

an amount of shares in connection with the Extension Amendment such that the Company would not adhere to the continued listing requirements

of The Nasdaq Global Market (“Nasdaq”) (the “Adjournment Proposal”). |

As a result of this change, the Special Meeting

will now be held at 10:00 a.m., Eastern Time, on October 20, 2023, exclusively via live webcast at the following address: https://web.lumiagm.com/276796335.

Also as a result of this change, the date and time by which stockholders seeking to exercise redemption rights must tender their public

shares physically or electronically and submit a request in writing that the Company redeem their public shares for cash to the Company’s

transfer agent, American Stock Transfer & Trust Company, is being extended to 5:00 p.m., Eastern Time, on October 18, 2023.

Investment of Trust Account Funds

There is currently uncertainty concerning the

applicability of the Investment Company Act to SPACs, including a company like ours, that may not complete its initial business combination

within 24 months from the effective date of its IPO Registration Statement. It is possible that a claim could be made that we have been

operating as an unregistered investment company. If we were deemed to be an investment company for purposes of the Investment Company

Act, we might be forced to abandon our efforts to complete an initial business combination and instead be required to liquidate the Company.

The funds in the Trust Account are currently held

only in U.S. government treasury obligations with a maturity of 185 days or less or in money market funds investing solely in U.S. government

treasury obligations and meeting certain conditions under Rule 2a-7 under the Investment Company Act. However, to mitigate the risk of

us being deemed to have been operating as an unregistered investment company (including under the subjective test of Section 3(a)(1)(A)

of the Investment Company Act of 1940, as amended), prior to the 24-month anniversary of the effective date of the registration statement

relating to our initial public offering, will instruct American Stock Transfer & Trust Company, the trustee with respect to the Trust

Account, to liquidate the U.S. government treasury obligations or money market funds held in the Trust Account and to hold all funds in

the Trust Account in cash in an interest bearing account until the earlier of consummation of our initial business combination or liquidation.

A new 1% U.S. federal excise tax could be imposed

on us in connection with redemptions by us of our shares.

On August 16, 2022, the Inflation Reduction

Act of 2022 (the “IR Act”) was signed into federal law. The IR Act provides for, among other things, a new U.S. federal

1% excise tax on certain repurchases (including redemptions) of stock by publicly traded domestic (i.e., U.S.) corporations and

certain domestic subsidiaries of publicly traded foreign corporations. The excise tax is imposed on the repurchasing corporation

itself, not its stockholders from which shares are repurchased. The amount of the excise tax is generally 1% of the fair market

value of the shares repurchased at the time of the repurchase.

If the deadline for us to complete a business

combination (currently October 25, 2023) is extended, our public stockholders will have the right to require us to redeem their public

shares. Any redemption or other repurchase in connection with a business combination or otherwise may be subject to the excise tax. Whether

and to what extent we would be subject to the excise tax in connection with a business combination would depend on a number of factors.

The Company hereby confirms that it will not utilize any funds from its Trust Account to pay any potential excise taxes that may become

due pursuant to the IR Act upon a redemption of the public shares, including, but not limited to, in connection with a liquidation of

the Company if it does not effect a business combination prior to its termination date.

About ExcelFin Acquisition Corp.

ExcelFin Acquisition Corp. is blank check company

formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business

combination with one or more businesses.

On June 26, 2026, we entered into a Business Combination

Agreement (“Business Combination Agreement”) with Betters Medical Investment Holdings Limited, a Cayman Islands exempted company

(“Baird Medical”), Tycoon Choice Global Limited, a business company limited by shares incorporated under the laws of the British

Virgin Islands and a wholly owned subsidiary of Baird Medical (“Tycoon”), Baird Medical Investment Holdings Limited, a Cayman

Islands exempted company and a wholly owned subsidiary of Baird Medical (“PubCo”), Betters Medical Merger Sub, Inc., a Delaware

corporation and wholly owned subsidiary of PubCo (“Merger Sub”) (as it may be amended from time to time, the “Business

Combination Agreement”). The transactions contemplated by the Business Combination Agreement we refer to herein as the “Business

Combination.”

We are not asking you to vote on the Business

Combination at the Special Meeting. The Business Combination will be submitted to stockholders of the Company for their consideration.

On August 21, 2023, PubCo filed a Registration Statement on Form F-4 with the Securities and Exchange Commission (“SEC”),

which includes preliminary proxy statement and a definitive proxy statement, to be distributed to the Company’s stockholders in

connection with the Company’s solicitation for proxies for the vote by the Company’s shareholders in connection with the Business

Combination and other matters as described in the definitive proxy statement. After the Registration Statement on Form F-4 has been declared

effective, the Company will mail a definitive proxy statement and other relevant documents to its stockholders as of the record date established

for voting on the Business Combination. The Company’s stockholders and other interested persons are advised to read the preliminary

proxy statement and any amendments thereto and, once available, the definitive proxy statement, in connection with the Company’s

solicitation of proxies for its special meeting of stockholders to be held to approve, among other things, the Business Combination, because

these documents will contain important information about the Company and the Business Combination. Stockholders may also obtain a copy

of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the Business

Combination and other documents filed with the SEC by the Company, without charge, at the SEC’s website located at www.sec.gov.

Additional Information and Where to Find It

The definitive proxy statement for the

extension of the initial business combination deadline has been mailed to the Company’s stockholders. INVESTORS AND SECURITY

HOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE COMPANY. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC

at the SEC’s web site at www.sec.gov. In addition, the documents filed by the Company with the SEC may be obtained free of

charge by contacting Company at 100 Kingsley Park Dr., Fort Mill, South Carolina 29715. If you have questions about the proposals or

if you need additional copies of the Proxy Statement you should contact our proxy solicitor:

Morrow Sodali LLC

333 Ludlow Street, 5th Floor, South Tower

Stamford, Connecticut 06902

Stockholders may call toll-free: (800) 662-5200

Banks and Brokerage Firms, please call: (203)

658-9400

Email: xfin.info@investor.morrowsodali.com

Participants in the Solicitation

The Company and its sponsor, officers and

directors may be deemed to be participants in the solicitation of proxies from Company stockholders. Information about

Company’s sponsor, officers and directors and their ownership of Company common stock is set forth in the proxy statement for

Company’s Special Meeting of Stockholders, which was filed with the SEC on September 26, 2023, and in Company’s Annual

Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 30, 2023. Investors and security

holders may obtain more detailed information regarding the direct and indirect interests of the participants in the solicitation of

proxies in connection with the transaction by reading the preliminary and definitive proxy statements regarding the transaction,

which were filed by the Company with the SEC.

Non-Solicitation

This Current Report on Form 8-K is not a proxy

statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Special Meeting shall

not constitute an offer to sell or a solicitation of an offer to buy the securities of the Company, nor shall there be any sale of any

such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification

under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the Securities Act of 1933, as amended.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ExcelFin Acquisition Corp. |

| |

|

|

| Date: October 17, 2023 |

By: |

/s/ Joe Ragan |

| |

Name: |

Joe Ragan |

| |

Title: |

Chief Executive Officer & Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

ExcelFin Acquisition Corp. Announces Adjournment

of Special Meeting

New York, NY, October 17, 2023– ExcelFin

Acquisition Corp. (“we”, “us”, “our”, or the “Company”), today

announced that the Special Meeting originally scheduled for October 18, 2023 (the “Special Meeting”) is being adjourned

to October 20, 2023. At the Special Meeting, Company’s stockholders will be asked:

| · | to consider and vote upon a proposal to amend the Company’s amended and restated certificate of

incorporation (the “Charter”) pursuant to a second amendment to the Charter (the “Extension Amendment”) to extend

the date by which the Company must effectuate an initial business combination from October 25, 2023 (the “Termination Date”)

to April 25, 2024, comprised of an initial three-month extension and three subsequent one-month extensions, for a total of six months

after the Termination Date (assuming the Company’s initial business combination has not occurred); and |

| · | to consider and vote upon a proposal to adjourn the Special Meeting to a later date or dates, if necessary,

to (i) permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are

not sufficient votes to approve one or more proposals presented to stockholders for vote or (ii) if stockholders have elected to redeem

an amount of shares in connection with the Extension Amendment such that the Company would not adhere to the continued listing requirements

of The Nasdaq Global Market (“Nasdaq”) (the “Adjournment Proposal”). |

As a result of this change, the Special Meeting

will now be held at 10:00 a.m., Eastern Time, on October 22, 2023, exclusively via live webcast at the following address: https://web.lumiagm.com/276796335.

The record date for the stockholders to vote at

the Special Meeting remains the close of business on September 22, 2023 (the “Record Date”). Stockholders who have

previously submitted their proxy or otherwise voted and who do not want to change their vote need not take any action. Stockholders as

of the Record Date can vote, even if they have subsequently sold their shares. In connection with the adjourned date, the Company has

further extended the deadline for holders of the Company’s Class A common stock issued in the Company’s initial public offering

to submit their shares for redemption in connection with the Special Meeting to 5:00 p.m. Eastern Time on October 18, 2023. Stockholders

who wish to withdraw their previously submitted redemption request may do so prior to the rescheduled meeting by requesting that the transfer

agent return such shares.

About ExcelFin Acquisition Corp.

ExcelFin Acquisition Corp. is blank check company

formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business

combination with one or more businesses.

Additional Information and Where to Find It

The definitive proxy statement has been mailed

to the Company’s stockholders. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT

MATERIALS BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY. Investors and security holders may obtain free copies of these

documents and other documents filed with the SEC at the SEC’s web site at www.sec.gov. In addition, the documents filed by Company

with the SEC may be obtained free of charge by contacting Company at 100 Kingsley Park Dr., Fort Mill, South Carolina 29715. If you have

questions about the proposals or if you need additional copies of the Proxy Statement you should contact our proxy solicitor:

Morrow Sodali LLC

333 Ludlow Street, 5th Floor, South Tower

Stamford, Connecticut 06902

Stockholders may call toll-free: (800) 662-5200

Banks and Brokerage Firms, please call: (203)

658-9400

Email: xfin.info@investor.morrowsodali.com

Participants in the Solicitation

Company and its sponsor, officers and directors

may be deemed to be participants in the solicitation of proxies from Company stockholders. Information about Company’s sponsor,

officers and directors and their ownership of Company common stock is set forth in the proxy statement for Company’s Special Meeting

of Stockholders, which was filed with the SEC on September 26, 2023, and in Company’s Annual Report on Form 10-K for the year ended

December 31, 2022, which was filed with the SEC on March 30, 2023. Investors and security holders may obtain more detailed information

regarding the direct and indirect interests of the participants in the solicitation of proxies in connection with the transaction by reading

the preliminary and definitive proxy statements regarding the transaction, which were filed by Company with the SEC.

Non-Solicitation

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Special Meeting shall not constitute

an offer to sell or a solicitation of an offer to buy the securities of the Company, nor shall there be any sale of any such securities

in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under

the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended.

Contacts

Investors

ExcelFin Acquisition Corp.

Joe Ragan

Chief Executive Officer & Chief Financial

Officer

jragan@paperexcellence.com

ExcelFin Acquisition (NASDAQ:XFINU)

Historical Stock Chart

From Apr 2024 to May 2024

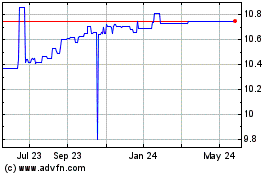

ExcelFin Acquisition (NASDAQ:XFINU)

Historical Stock Chart

From May 2023 to May 2024