Filed by ESGEN Acquisition Corporation pursuant to Rule 425

under the Securities Act of 1933, as amended,

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: ESGEN Acquisition Corporation (File No. 001-40927)

The following presentation was posted on ESGEN’s website on September 21, 2023:

SEPTEMBER 2023 2023 FIRST HALF RESULTS 1

Disclaimer This confidential presentation (this “Presentation”)

is being delivered to you by ESGEN Acquisition Corp. (“SPAC” or “ESGEN”) in connection with its potential business combination (the “Transaction” or “Business Combination”) with Sunergy Renewables, LLC

(“Sunergy” and the combined company formed with SPAC, “Combined Co” or “Newco”). This Presentation is for informational purposes only. Any reproduction or distribution of this Presentation, in whole or in part, or

the disclosure of its contents, without the prior consent of Sunergy or SPAC, is prohibited. By accepting this Presentation, each recipient and its directors, partners, officers, employees, attorneys, agents and representatives (collectively, the

“recipients”) agrees: (i) to maintain the confidentiality of all information that is contained in this Presentation and not already in the public domain; and (ii) to return or destroy all copies of this Presentation or portions thereof

in its possession following the request for the return or destruction of such copies. No Representations and Warranties: This Presentation is for informational purposes only and does not purport to contain all of the information that may be required

to evaluate a possible investment decision with respect to SPAC, Sunergy, Combined Co or the Transaction. The recipient agrees and acknowledges that this Presentation is not intended to form the basis of any investment decision by the recipient and

does not constitute financial investment, tax or legal advice. No representation or warranty, express or implied, is or will be given by SPAC, Sunergy or Combined Co or any of their respective affiliates, directors, officers, employees or advisers

or any other person as to the accuracy or completeness of the information (including as to the accuracy, completeness or reasonableness of statements, estimates, targets, projections, assumptions or judgments) in this Presentation or in any other

written, oral or other communications transmitted or otherwise made available to any party in the course of its evaluation of a possible transaction, and no responsibility or liability whatsoever is accepted for the accuracy or sufficiency thereof

or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. The recipient also acknowledges and agrees that the information contained in this Presentation is preliminary in nature and is subject to change, and any such

changes may be material. Each of SPAC and Sunergy disclaims any duty to update the information contained in this Presentation. Forward-Looking Statements: Certain statements made in this presentation and the oral statements made in connection

herewith are “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Statements regarding the Business Combination and ESGEN’s and Sunergy’s

expectations with respect to future performance growth opportunities and competitive position of Combined Co are “forward-looking statements.” In addition, words such as “estimates,” “projected,”

“expects,” “estimated,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “would,”

“future,” “propose,” “target,” “goal,” “objective,” “outlook” and variations of these words or similar expressions (or the negative versions of such words or expressions) are

intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the control of the parties, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results

or outcomes include (i) ESGEN’s and Sunergy’s ability to complete the Business Combination, including due to the failure to satisfy any conditions to the Closing, (ii) the failure to realize the anticipated benefits of the Business

Combination, which may be affected by, among other things, competition, the ability of Combined Co to grow and manage growth profitably, maintain relationships with customers and suppliers and retain key employees, (iii) delays in obtaining, adverse

conditions contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete the Business Combination, (iv) the outcome of any legal proceedings that may be instituted in connection with the

Business Combination, (v) the occurrence of any event, change or other circumstances that could give rise to the termination of the agreement providing for the Business Combination, (vi) the ability to obtain and/or maintain the listing of the Class

A common stock of Combined Co and warrants entitling holders to purchase Combined Co Class A Common Stock on Nasdaq, and the potential liquidity and trading of such securities, (vii) the amount of redemptions made by public shareholders of ESGEN,

(viii) the projected financial information, anticipated growth rate and market opportunity of Combined Co, (ix) Combined Co’s success in retaining or recruiting principal officers, key employees or directors following the Business Combination,

(x) Combined Co’s directors and officers potentially having conflicts of interest with Combined Co’s business or in approving the Business Combination, as a result of which they would receive compensation, (xi) intense competition and

competitive pressures from electric utilities and other companies in the industry in which Combined Co will operate, (xii) factors relating to the business, operations and financial performance of Sunergy, including market conditions and global and

economic factors beyond Sunergy’s control, (xiii) costs related to the Business Combination, (xiv) the reduction or elimination of government economic incentives to the renewable energy market, (xv) the ability of Combined Co to issue equity

or equity-linked securities or obtain debt financing in connection with the Business Combination or in the future, (xvi) the demand for renewable energy not being sustained or growing in size, (xvii) impacts of climate change, changing weather

patterns and conditions and natural disasters, (xviii) increases in costs of solar energy system components and raw materials, (xix) loss of a supplier or other supply chain disruptions, (xx) problems with the quality or performance of the solar

energy systems that Sunergy sells, (xxi) the effect of legal, tax and regulatory changes and (xxii) other risks and uncertainties, including those to be included under the heading “Risk Factors” in the registration statement on Form S-4

filed by ESGEN with the U.S. Securities and Exchange Commission (“SEC”) (as may be amended from time to time, the “Registration Statement”) and those included under the heading “Risk Factors” in ESGEN’s

Annual Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 31, 2023 (the “Annual Report”) and in its subsequent periodic reports and other filings with the SEC. The forward-looking statements

contained in this presentation are based on current expectations and beliefs concerning future developments and their potential effects on ESGEN and/or Sunergy. There can be no assurance that future developments affecting ESGEN and/or Sunergy will

be those that ESGEN and/or Sunergy have anticipated. These forward- looking statements involve a number of risks, uncertainties (some of which are beyond the control of ESGEN or Sunergy) or other assumptions that may cause actual results or

performance to be materially different from those expressed or implied by these forward-looking statements. Should one or more of these risks or uncertainties materialize, or should any of ESGEN’s assumptions prove incorrect, actual results

may vary in material respects from those described in these forward-looking statements. ESGEN undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as

may be required under applicable securities laws. 2

Disclaimer (cont’d) Industry, Market Data and Partnerships: In this

Presentation, SPAC and Sunergy rely on and refer to certain information and statistics regarding the markets and industries in which Sunergy competes. Such information and statistics are based on management’s estimates and/or obtained from

third-party sources, including reports by market research firms and company filings. Although SPAC and Sunergy believe such third-party information is reliable, there can be no assurance as to the accuracy or completeness of the indicated

information. Neither SPAC nor Sunergy has independently verified the accuracy or completeness of the information provided by the third-party sources. This Presentation contains descriptions of certain key business partnerships of Sunergy. These

descriptions are based on the Sunergy management team’s discussion with such counterparties, certain non-binding written agreements and the latest available information and estimates as of the date of this Presentation. These descriptions are

subject to negotiation and execution of definitive agreements with certain of such counterparties which have not been completed as of the date of this Presentation. No Offer or Solicitation: This presentation relates to proposed Business

Combination. It does not constitute a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination and does not constitute an offer to sell or exchange, or the

solicitation of an offer to buy or exchange, any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, sale or exchange would be unlawful prior to registration or qualification under the securities laws of

any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. Non-GAAP Financial Measures: This Presentation includes certain financial measures not

presented in accordance with generally accepted accounting principles (“GAAP”), including, but not limited to, as earnings (loss) before interest expense, income tax expense (benefit), depreciation and amortization, as adjusted to

exclude merger transaction related expenses (“Adjusted EBITDA” or “Adj EBITDA”) and certain ratios and other metrics derived therefrom. Note that other companies may calculate these non-GAAP financial measures differently,

and, therefore, such financial measures may not be directly comparable to similarly titled measures of other companies. Further, these non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude

items that are significant in understanding and assessing Sunergy’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of

profitability, liquidity or performance under GAAP. You should be aware that SPAC’s and Sunergy’s presentation of these measures may not be comparable to similarly titled measures used by other companies. SPAC and Sunergy believe these

non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Sunergy’s financial condition and results of operations. SPAC and Sunergy believe that

the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends in Sunergy, and in comparing Sunergy’s financial measures with those of other similar companies,

many of which present similar non-GAAP financial measures to investors. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which items of expense and income are

excluded or included in determining these non-GAAP financial measures. Please refer to footnotes where presented on each page of this Presentation or to the tables therein for a reconciliation of these measures to what Sunergy believes are the most

directly comparable measure evaluated in accordance with GAAP. Reconciliation of historical non-GAAP measures to comparable GAAP measures are provided on page 8. Certain monetary amounts, percentages and other figures included in this Presentation

have been subject to rounding adjustments. We expect the variability of these items could have a significant impact on our reported GAAP financial results. Certain other amounts that appear in this Presentation may not sum due to rounding. In

connection with the contemplated filing by SPAC of a preliminary and definitive proxy statement / prospectus included in a registration statement on Form S-4 with respect to the Transaction and in the course of the review by the SEC of such

preliminary proxy statement / prospectus, SPAC may make changes to the information presented in this Presentation, including, without limitation, the description of Sunergy’s business and the financial information and other data included in

this Presentation. Comments by the SEC on information in the preliminary proxy statement / prospectus may require modification or reformulation of the information we present in this Presentation, and any such modification or reformulation could be

significant. In particular, we note that the SEC has adopted certain rules regarding the use of EBITDA and other financial measures that do not comply with GAAP in the United States, which rules will be applicable to the preliminary and definitive

proxy statement / prospectus expected to be filed with respect to the Transaction. Trademarks: This Presentation contains trademarks, service marks, trade names and copyrights of Sunergy and other companies, which are the property of their

respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, © or ® symbols, but SPAC and Sunergy will assert, to the

fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Further, third-party logos included in this Presentation may represent past or present vendors or

suppliers of materials and/or products to Sunergy for use in connection with its business or may be provided simply for illustrative purposes only. Inclusion of such logos does not necessarily imply affiliation with or endorsement by such firms or

businesses. There is no guarantee that SPAC, Sunergy or Combined Co will work, or continue to work, with any of the firms or businesses whose logos are included herein in the future. 3

Disclaimer (cont’d) Important Information and Where to Find It: In

connection with the Business Combination, ESGEN filed the Registration Statement initially on September 18, 2023 that includes a preliminary proxy statement/prospectus of ESGEN, and after the Registration Statement is declared effective, ESGEN will

mail a definitive proxy statement/prospectus relating to the Business Combination to ESGEN’s shareholders. The Registration Statement, including the proxy statement/prospectus contained therein, when declared effective by the SEC, will contain

important information about the Business Combination and the other matters to be voted upon at a meeting of ESGEN’s shareholders to be held to approve the Business Combination. This Current Report does not contain all the information that

should be considered concerning the Business Combination and other matters and is not intended to provide the basis for any investment decision or any other decision in respect of such matters. ESGEN may also file other documents with the SEC

regarding the Business Combination. ESGEN shareholders and other interested persons are advised to read the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus, when available, and other

documents filed in connection with the Business Combination, as these materials will contain important information about ESGEN, Sunergy and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant

materials for the Business Combination will be mailed to ESGEN shareholders as of a record date to be established for voting on the Business Combination. Shareholders will also be able to obtain copies of the preliminary proxy statement/prospectus,

the definitive proxy statement/prospectus and other documents filed or that will be filed with the SEC, free of charge, by ESGEN through the website maintained by the SEC at www.sec.gov, or by directing a request to: ESGEN Acquisition Corporation,

5956 Sherry Lane, Suite 1400, Dallas, TX 75225. Participants in the Solicitation: ESGEN and Sunergy and their respective directors and officers may be deemed to be participants in the solicitation of proxies from ESGEN’s shareholders in

connection with the Business Combination. Information about ESGEN’s directors and executive officers and their ownership of ESGEN’s securities is set forth in ESGEN’s filings with the SEC. To the extent that holdings of

ESGEN’s securities by ESGEN’s directors and executive officers have changed since the amounts printed in ESGEN’s Annual Report, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with

the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed transaction may be obtained by reading the Registration Statement, including the preliminary proxy

statement/prospectus and the definitive proxy statement/prospectus when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph. 4

Strong Operational Growth Driving Record Revenue Commentary Net Revenue ($

in millions) n Net revenue totaled $48.8 million, 261.8% 9.7% 79.5% Growth an 80% increase from $27.2 million in the comparable year-ago period n This increase was primarily due to $97.6 growth in sales dealers and $89.0 partners leading

to higher volume of solar system installations in the period $48.8 “Our rapid sales-to-install cycle and commitment to profitability have helped our sales team continue $27.2 $24.6 outpacing the industry in installs and revenue per sales

pitch, insulating Sunergy from broader U.S. residential solar industry headwinds” (1) - Tim Bridgewater (Sunergy CEO) FY2021A FY2022A Run-Rate 1H2022A 1H2023A FY2023E Source: Public company fillings. 1) Run-Rate FY’2023E for all

financials are annualized numbers using 1H’2023A results. 5

Robust Margin Expansion Propelling Gross Profit (1) Commentary Gross Profit

($ in millions) n Gross profit increased to $9.6 42.7% 20.0% 19.6% 14.3% 19.6% Margin million in the fiscal first half of (1) 2023 n The increase in gross profit was driven by revenue growth, while the increase in gross margin was a $19.1

result of improved integration of $17.8 the combined business a year after the Company’s merger with Sun First Energy, LLC. $10.5 $9.6 “Driven by strength in emerging markets for Sunergy, $3.9 solar system installations grew 65% in the

first half, resulting in record revenue and gross profit” - Tim Bridgewater (Sunergy CEO) (2) FY2021A FY2022A Run-Rate 1H2022A 1H2023A FY2023E Source: Public company fillings. 1) Gross profit is defined as revenue, net loss cost of goods sold

(exclusive of depreciation and amortization expense). 6 2) Run-Rate FY’2023E for all financials are annualized numbers using 1H’2023A results.

Adjusted EBITDA Growth Reflects Operational Efficiency Commentary Adjusted

EBITDA ($ in millions) n Adj. EBITDA increased to $4.5 30.3% 11.6% 9.3% 2.6% 9.3% Margin million in the fiscal first half of 2023 n This increase in Adj. EBITDA was primarily due to the increase in revenue and gross profit, while the

increase in EBITDA margin was a $10.4 reflection of the improvements post integration of the combined $9.1 business a year after the $7.4 Company’s merger with Sun First Energy, LLC. $4.5 “We believe that we’re poised to enter the

public markets at a time when Sunergy’s commitment to $0.7 straightforward growth and sustainable profitability will be well-received and look forward to displaying (1) FY2021A FY2022A Run-Rate 1H2022A 1H2023A our progress over the coming

quarters.” FY2023E - Tim Bridgewater (Sunergy CEO) Source: Public company fillings. 1) Run-Rate FY’2023E for all financials are annualized numbers using 1H’2023A results. 7

Reconciliation of Non-GAAP Metrics Reconciliation of Net Income (Loss) to

Adjusted EBITDA ($) FY2021A FY2022A Run-Rate FY2023E 1H2022A 1H2023A Net income (loss) 7,091,049 8,665,770 4,800,374 (42,947) 2,400,187 Adjustment: Other income, net (28,399) (20,004) 83,424 (52,501) 41,712 Depreciation and amoritzation 379,823

1,706,243 1,844,330 812,109 922,165 Income tax expenses - - - - - M&A expense - - 2,323,528 - 1,161,764 Adjusted EBITDA $7,442,473 $10,352,009 $9,051,656 $716,661 $4,525,828 Source: Public company fillings. 8

For Investors: Cody Slach and Tom Colton Gateway Group 9

sunergy@gatewayir.com

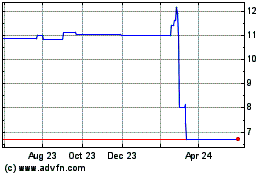

ESGEN Acquisition (NASDAQ:ESACU)

Historical Stock Chart

From Apr 2024 to May 2024

ESGEN Acquisition (NASDAQ:ESACU)

Historical Stock Chart

From May 2023 to May 2024