Registration No. 333-269721

This prospectus relates to the offer and resale by the selling stockholder identified in this prospectus of up to 3,971,000 shares of our common stock issuable to the selling stockholder upon the exercise of a common stock purchase warrant (the “warrant”). The warrant was issued to the selling stockholder in a concurrent private placement transaction in connection with our sale to the selling stockholder of 3,971,000 shares of our common stock in a registered direct offering. All of the shares of common stock issuable upon the exercise of the warrant are being sold by the selling stockholder, or its pledgees, donees, assignees, transferees and successors-in-interest.

The shares of common stock described in this prospectus or in any supplement to this prospectus may be sold from time to time pursuant to this prospectus by the selling stockholder in ordinary brokerage transactions, in transactions in which brokers solicit purchases, in negotiated transactions, or in a combination of such methods of sale, at fixed prices, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at varying prices determined at the time of sale, or at negotiated prices. See “Selling Stockholder” and “Plan of Distribution.” We cannot predict when or in what amounts the selling stockholder may sell any of the shares of common stock offered by this prospectus.

We are not selling any shares of our common stock, and we will not receive any of the proceeds from the sale of shares by the selling stockholder. The selling stockholder will pay all brokerage fees and commissions and similar sale-related expenses. We are only paying expenses relating to the registration of the resale of the shares of our common stock with the Securities and Exchange Commission.

A supplement to this prospectus may add, update or change information contained in this prospectus. You should read this prospectus and any prospectus supplement, together with the documents we incorporate by reference, carefully before you invest.

Our common stock is listed on The Nasdaq Capital Market (“Nasdaq”) under the symbol “ENG.” The last reported sale price of our common stock on Nasdaq on March 7, 2023 was $0.71 per share.

About This Prospectus

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) utilizing a “shelf” registration process. Under this shelf registration process, the selling stockholder named in this prospectus or any supplement to this prospectus may sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities. The selling stockholder is required to provide you with this prospectus and, in certain cases, a prospectus supplement containing specific information about the selling stockholder and the terms upon which the securities are being offered. A prospectus supplement may also add to, update or change the information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any applicable prospectus supplement, you should rely on the information in the applicable prospectus supplement. Please carefully read this prospectus, any applicable prospectus supplement and any free writing prospectus together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.”

We and the selling stockholder have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or incorporated by reference in this prospectus. We and the selling stockholder take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. You should not assume that the information in this prospectus is accurate as of any date other than the date on the cover page of this prospectus or that any information we have incorporated by reference is accurate as of any date other than the date of the documents incorporated by reference. Our business, financial condition, results of operations and prospects may have changed since those dates.

| Prospectus Summary This summary highlights certain information about us, this offering and information appearing elsewhere in this prospectus and in the documents we incorporate by reference. This summary is not complete and does not contain all of the information that you should consider before investing in our securities. To fully understand this offering and its consequences to you, you should read this entire prospectus carefully, including the information referred to under the headings “Risk Factors” in this prospectus on page 3 and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus on page 4, and the financial statements and other information incorporated by reference in this prospectus when making an investment decision. In this prospectus, the terms “we,” “us,” and the “Company” refer to ENGlobal Corporation and its subsidiaries. Our Company We were incorporated in the State of Nevada in June 1994 and are a leading provider of innovative, delivered project solutions primarily to the energy industry. We deliver these solutions to our clients by combining our vertically-integrated engineering and professional project execution services with our automation and systems integration expertise and our fabrication and construction capabilities. We believe our vertically-integrated strategy allows us to differentiate our company from most of our competitors as a full-service provider, thereby reducing our clients’ dependency on and coordination of multiple vendors and improving control over their project cost and schedules. Our strategy and positioning has also allowed us to pursue larger scopes of work centered around many different types of modularized engineered systems. We derive revenues primarily from three sources: (i) business development efforts, (ii) preferred provider or alliance agreements with strategic end user clients, original equipment manufacturers, and technology partners, and (iii) referrals from existing customers and industry members. Our business development professionals are focused on specific market segments within the energy industry. The market segments that we are targeting include Renewables, Automation, Oil, Gas and Petrochemicals and Government Services. This market focus allows us to develop centers of expertise for each of our targeted markets. Within the Renewables group, our focus is to design and build production facilities for hydrogen and associated products, together with converting existing production facilities to produce products from renewable feedstock sources. These projects often utilize technologies that are more fuel efficient, and therefore reduce the associated carbon footprint of the facility. Our scope of work on these projects will typically include front-end development, engineering, procurement, mechanical fabrication, automation and commissioning services, and may be performed in conjunction with a construction partner. Our Automation group designs, integrates and commissions modular systems that include electronic distributed control, on-line process analytical data, continuous emission monitoring, and electric power distribution. Often these packaged systems are housed in a fabricated metal enclosure, modular building or freestanding metal rack, which are commonly included in our scope of work. We provide automation engineering, procurement, fabrication, systems integration, programing and on-site commissioning services to our clients for both new and existing facilities. Our Oil, Gas and Petrochemicals group focuses on providing engineering, procurement, construction and automation services as well as fabricated products to downstream refineries and petrochemical facilities as well as midstream pipeline, storage and other transportation related companies. These services are often applied to small capital improvement and maintenance projects within refineries and petrochemical facilities. For our transportation clients, we work on facilities that include pumping, compression, gas processing, metering, storage terminals, product loading and blending systems. In addition, this group designs, programs and maintains supervisory control and data acquisition (“SCADA”) systems for our transportation clients. This group also provides engineering, fabrication and automation services to clients who have operations in the U.S. oil and gas exploration and development markets. The operations are usually associated with the completion, purification, storage and transmission of the oil and gas from the well head to the terminal or pipeline destination. Our Government Services group provides services related to the engineering, design, installation and maintenance of automated fuel handling and tank gauging systems for the U.S. military across the globe. Our business development professionals focus on building long-term relationships with clients in order to provide solutions throughout the life-cycle of their projects and facilities. Additionally, we seek to capitalize on cross-selling opportunities between our market segments and many of our projects will contain elements from more than one market segment. Sales leads are often jointly developed and pursued by our business development personnel from multiple markets. Products and services are also promoted through trade advertising, participation in industry conferences and on-line internet communication via our corporate home page at www.englobal.com. The ENGlobal website illustrates our Company’s full range of services and capabilities and is updated on a continuous basis. Through the ENGlobal website, we seek to provide visitors and investors with a single point of contact for obtaining information about our company. We are not incorporating the contents of the website into this prospectus. We also develop preferred provider and alliance agreements with clients in order to facilitate repeat business. These preferred provider agreements, also known as master service or umbrella agreements, typically have a duration of three to five years. This allows our clients to release work to us without having to negotiate contract terms for each individual project. With the primary terms of the contract agreed to, add-on projects with these customers are easier to negotiate and can be accepted quickly, without the necessity of a bidding process. Management believes that these agreements can serve to stabilize project-centered operations. |

| Our engineering services are strategically located in offices in cities near our clients while our fabrication and integration facilities are more centrally located. We generally enter into two principal types of contracts with our clients: time-and-material contracts and fixed-price contracts. Our clients typically determine the type of contract to be utilized for a particular engagement, with the specific terms and conditions of a contract being negotiated and typically contained in a multiyear services agreement. Risk Factors An investment in our common stock is very risky. You should consider carefully the risk factors beginning on page 3 of this prospectus before investing in our common stock. Use of Proceeds Although we will incur expenses in connection with the registration of the securities, we will not receive any of the proceeds from the sale of the shares of common stock by the selling stockholder. Corporate Information Our principal executive offices are located at 11740 Katy Fwy – Energy Tower III, 11th Floor, Houston, TX 77079. Our telephone number is (281) 878-1000. |

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the risk factors and all of the other information included in, or incorporated by reference into, this prospectus, including those risk factors included in our Annual Report on Form 10-K for the year ended December 25, 2021, our Quarterly Reports on Form 10-Q for the quarterly periods ended March 26, 2022, June 25, 2022 and September 24, 2022, and our subsequent SEC filings, in evaluating an investment in our securities. If any of these risks were to occur, our business, financial condition or results of operations could be adversely affected. In that case, the trading price of our securities could decline and you could lose all or part of your investment. The risks incorporated by reference in this prospectus are the material risks of which we are currently aware; however, they may not be the only risks that we may face. Additional risks and uncertainties not currently known to us or that we currently view as immaterial may also impair our business operations. Any of these risks could materially and adversely affect our business, financial condition, results of operations and cash flows. In that case, you may lose all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information discussed in this prospectus, our filings with the SEC and our press releases include “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Private Securities Litigation Reform Act of 1995 (the “PSLRA”), or in releases made by the SEC. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. Statements that are not historical fact are forward-looking statements. Forward-looking statements can be identified by, among other things, the use of forward-looking language, such as the words “plan,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “project,” “may,” “will,” “would,” “could,” “should,” “seeks,” or “scheduled to,” or other similar words, or the negative of these terms or other variations of these terms or comparable language, or by discussion of strategy or intentions. These cautionary statements are being made pursuant to the Securities Act, the Exchange Act and the PSLRA with the intention of obtaining the benefits of the “safe harbor” provisions of such laws.

The forward-looking statements contained in or incorporated by reference into this prospectus are largely based on our expectations, which reflect estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions to be reasonable, they are inherently uncertain and involve a number of risks and uncertainties that are beyond our control, including:

| | · | the impact of the COVID-19 pandemic and of the actions taken by governmental authorities, individuals and companies in response to the pandemic on our business, financial condition, and results of operations, including on our revenues and profitability; |

| | · | our ability to increase our backlog, revenue and profitability; |

| | · | our ability to realize revenue projected in our backlog and our ability to collect accounts receivable and process accounts payable in a timely manner; |

| | · | the effect of economic downturns and the volatility and level of oil and natural gas prices, including the severe disruptions in the worldwide economy, including the global demand for oil and natural gas, resulting from the COVID-19 pandemic; |

| | · | our ability to identify, evaluate, and complete any transactions in connection with our review of strategic transactions; |

| | · | the impact of the announcement of our review of strategic transactions on our business, including our financial and operating results, or our employees, suppliers and customers; |

| | · | our ability to realize project awards or contracts on our pending proposals, and the timing, scope and amount of any related awards or contracts; |

| | · | our ability to retain existing customers and attract new customers; |

| | · | our ability to accurately estimate the overall risks, revenue or costs on a contract; |

| | · | the risk of providing services in excess of original project scope without having an approved change order; |

| | · | our ability to execute our expansion into the modular solutions market and to execute our updated business growth strategy to position the Company as a leading provider of engineered modular solutions to its customer base; |

| | · | our ability to attract and retain key professional personnel; |

| | · | our ability to obtain additional financing when needed; |

| | · | our debt obligations may limit our financial flexibility; |

| | · | our dependence on one or a few customers; |

| | · | the risks of internal system failures of our information technology systems, whether caused by the Company, third-party service providers, intruders or hackers, computer viruses, malicious code, cyber-attacks, phishing and other cyber security problems, natural disasters, power shortages or terrorist attacks; |

| | · | the uncertainties related to the U.S. Government’s budgetary process and their effects on our long-term U.S. Government contracts; |

| | · | the risk of unexpected liability claims or poor safety performance; |

| | · | our ability to identify, consummate and integrate potential acquisitions; |

| | · | our reliance on third-party subcontractors and equipment manufacturers; |

| | · | our ability to satisfy the continued listing standards of Nasdaq with respect to our common stock or to cure any continued listing standard deficiency with respect thereto; |

| | · | acts of war or terrorist acts, such as the conflict between Russia and Ukraine, and the governmental or military response thereto; and |

| | · | the effect of changes in laws and regulations, including U.S. tax laws, with which the Company must comply and the associated cost of compliance with such laws and regulations. |

Many of these factors are beyond our ability to control or predict. These factors are not intended to represent a complete list of the general or specific factors that may affect us.

In addition, management’s assumptions about future events may prove to be inaccurate. All readers are cautioned that the forward-looking statements contained in this prospectus and in the documents incorporated by reference herein are not guarantees of future performance, and we cannot assure any reader that such statements will be realized or that the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to factors described in “Risk Factors” included elsewhere in this prospectus and in the documents that we include in or incorporate by reference herein, including our Annual Report on Form 10-K for the fiscal year ended December 25, 2021, our Quarterly Reports on Form 10-Q for the quarterly periods ended March 26, 2022, June 25, 2022 and September 24, 2022, respectively, and our subsequent SEC filings. All forward-looking statements speak only as of the date they are made. We do not intend to update or revise any forward-looking statements as a result of new information, future events or otherwise, except as required by law. These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of any shares of common stock by the selling stockholder under this prospectus. Any proceeds from the sale of shares of common stock under this prospectus will be received by the selling stockholder. We are required to pay certain offering fees and expenses in connection with the registration of the selling stockholder’s securities and to indemnify the selling stockholder against certain liabilities. Please see “Selling Stockholder” for information regarding the person receiving proceeds from the sale of the common stock covered by this prospectus.

SELLING STOCKHOLDER

This prospectus relates to the offer and sale from time to time by the selling stockholder of up to 3,971,000 shares of our common stock, all of which are issuable upon the exercise of a common stock purchase warrant (the “warrant”). The warrant was issued to the selling stockholder on February 1, 2023, in a concurrent private placement transaction in connection with our sale to the selling stockholder of 3,971,000 shares of our common stock in a registered direct offering.

The information contained in the table below in respect of the selling stockholder (including the number of shares of common stock beneficially owned and the number of shares of common stock offered) has been obtained from the selling stockholder and has not been independently verified by us. We may supplement this prospectus from time to time in the future to update or change the information contained in the table below in respect of the selling stockholder.

The registration for resale of the shares of common stock does not necessarily mean that the selling stockholder will sell all or any of these shares. In addition, the selling stockholder may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, shares of common stock in transactions exempt from the registration requirements of the Securities Act, after the date on which it provided the information set forth in the table below.

The following table sets forth the maximum number of shares of our common stock to be sold by the selling stockholder. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to shares of common stock and the right to acquire such voting or investment power within 60 days through the exercise of any option, warrant or other right. Unless otherwise indicated below, to our knowledge, all persons named in the table have sole voting and investment power with respect to the shares of common stock beneficially owned by them. Except as described in the footnotes to the following table, none of the persons named in the table has held any position or office or had any other material relationship with us or our affiliates during the three years prior to the date of this prospectus. The inclusion of any shares of common stock in this table does not constitute an admission of beneficial ownership for the person named below.

| Name of selling stockholder | | Common stock beneficially owned prior to the offering(1) | | | Common | | | Common stock beneficially owned after the offering | |

| | Percentage(2) | | | Number | | | stock to be offered | | | | Number | | | | Percentage(2) |

| Armistice Capital Master Fund Ltd....... | | | 7,942,000 | (3) | | | 18.2 | % | | | 3,971,000 | | | | 3,971,000 | | | | 9.1 | % |

| | (1) | Beneficial ownership is determined in accordance with Rule 13d-3 under the Exchange Act. However, for purposes of this table, we have assumed that the warrant is immediately exercisable and not subject to the beneficial ownership limitation described below. |

| | (2) | Calculated based on 39,771,617 shares of common stock issued and outstanding prior to the exercise of the warrant. As of February 10, 2023, assuming the full exercise of the warrant into 3,971,000 shares of common stock, there would be 43,742,617 shares of common stock issued and outstanding. Because the selling stockholder is not obligated to sell all or any portion of the shares of our common stock shown as offered by it, we cannot estimate the actual number or percentage of shares of our common stock that will be held by the selling stockholder upon completion of this offering. However, for purposes of this table, we have assumed that, after completion of the offering, none of the shares covered by this prospectus will be held by the selling stockholder. |

| | (3) | Consists of 3,971,000 shares of common stock directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”), and 3,971,000 shares of common stock issuable upon exercise of the warrant, which is directly held by the Master Fund. These shares of common stock may be deemed to be indirectly beneficially owned by Armistice Capital, LLC (“Armistice”), as the investment manager of the Master Fund, and Steven Boyd, as the Managing Member of Armistice. Armistice and Steven Boyd disclaim beneficial ownership of the reported securities except to the extent of their respective pecuniary interest therein. The warrant is exercisable at any time on or after August 6, 2023 and on or prior to 5:00 p.m. (New York City time) on August 6, 2028. The warrant is also subject to a 4.99% beneficial ownership limitation (which may be increased to 9.99% at the election of the warrant holder) that prohibits the Master Fund from exercising any portion of it if, following the exercise, the Master Fund’s ownership of our common stock would exceed the ownership limitation. The address of the Master Fund is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

DESCRIPTION OF COMMON STOCK

The following description sets forth certain material terms and provisions of our common stock. This description also summarizes relevant provisions of the Nevada Revised Statutes (“NRS”). The following description is a summary and does not purport to be complete. It is subject to, and qualified in its entirety by reference to, the relevant provisions of the NRS, and to our Restated Articles of Incorporation, dated January 29, 2021 (our “articles of incorporation”), and our Second Amended and Restated Bylaws, dated April 14, 2016 (our “bylaws”), which are filed as Exhibit 3.1 to our Current Report on Form 8-K filed with the SEC on January 29, 2021 and Exhibit 3.1 to our Current Report on Form 8-K filed with the SEC on April 15, 2016, respectively, which are incorporated by reference herein. Please read “Where You Can Find More Information.”

Authorized and Outstanding Capital Stock

The following description of our common stock and provisions of our articles of incorporation and bylaws are summaries and are qualified by reference to our articles of incorporation and bylaws, which have been incorporated by reference herein.

Our authorized capital stock consists of 75,000,000 shares of common stock, par value $0.001 per share, and 2,000,000 shares of undesignated preferred stock, par value $0.001 per share.

As of February 10, 2023, there were 39,771,617 shares of common stock outstanding, and no shares of preferred stock were issued or outstanding.

Description of Common Stock

Voting. Holders of shares of the common stock are entitled to one vote for each share held of record on matters properly submitted to a vote of our stockholders. Stockholders are not entitled to vote cumulatively for the election of directors.

Dividends. Subject to the dividend rights of the holders of any outstanding series of preferred stock, holders of shares of common stock will be entitled to receive ratably such dividends, if any, when, as, and if declared by our Board of Directors out of the Company’s assets or funds legally available for such dividends or distributions.

Liquidation and Distribution. In the event of any liquidation, dissolution, or winding up of the Company’s affairs, holders of the common stock would be entitled to share ratably in the Company’s assets that are legally available for distribution to its stockholders. If the Company has any preferred stock outstanding at such time, holders of the preferred stock may be entitled to distribution preferences, liquidation preferences, or both. In such case, the Company must pay the applicable distributions to the holders of its preferred stock before it may pay distributions to the holders of common stock.

Conversion, Redemption, and Preemptive Rights. Holders of the common stock have no preemptive, subscription, redemption or conversion rights.

Sinking Fund Provisions. There are no sinking fund provisions applicable to the common stock.

Anti-Takeover Effects of Nevada Law; Our Articles of Incorporation and Our Bylaws

General. Certain provisions of our articles of incorporation and bylaws, and certain provisions of the Nevada Revised Statutes, or NRS, could make our acquisition by a third party, a change in our incumbent management, or a similar change of control more difficult. These provisions, which are summarized below, are likely to reduce our vulnerability to an unsolicited proposal for the restructuring or sale of all or substantially all of our assets or an unsolicited takeover attempt. The summary of the provisions set forth below does not purport to be complete and is qualified in its entirety by reference to our articles of incorporation and our bylaws and the relevant provisions of the NRS.

Preferred Stock. The authorization of undesignated preferred stock makes it possible for our Board of Directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to acquire control of the Company.

No Action by Written Consent. Our bylaws provide that no action required or permitted to be taken at a meeting of the stockholders may be taken by written consent.

Advance Notice Requirements. Stockholders wishing to nominate persons for election to our Board of Directors at a meeting or to propose any business to be considered by our stockholders at a meeting must comply with certain advance notice and other requirements set forth in our bylaws.

Special Meetings. Our bylaws provide that special meetings of stockholders may only be called by the President or Secretary, by a majority of the Board of Directors, or by the President at the written request of at least fifty percent (50%) of the number of shares of the Company then outstanding and entitled to vote.

Board Vacancies. Our bylaws provide that any vacancy on our Board of Directors, howsoever resulting, may be filled by a majority vote of the remaining directors.

Removal of Directors. Our bylaws provide that any directors may be removed either with or without cause at any time by the vote of stockholders representing two-thirds of the voting power of the issued and outstanding capital stock entitled to vote.

Nevada Anti-Takeover Statutes. The NRS contains provisions restricting the ability of a Nevada corporation to engage in business combinations with an interested stockholder. Under the NRS, except under certain circumstances, business combinations with interested stockholders are not permitted for a period of two years following the date such stockholder becomes an interested stockholder. The NRS defines an interested stockholder, generally, as a person who is the beneficial owner, directly or indirectly, of 10% of the outstanding shares of a Nevada corporation. In addition, the NRS generally disallows the exercise of voting rights with respect to “control shares” of an “issuing corporation” held by an “acquiring person,” unless such voting rights are conferred by a majority vote of the disinterested stockholders. “Control shares” are those outstanding voting shares of an issuing corporation which an acquiring person and those persons acting in association with an acquiring person (i) acquire or offer to acquire in an acquisition of a controlling interest and (ii) acquire within ninety days immediately preceding the date when the acquiring person became an acquiring person. An “issuing corporation” is a corporation organized in Nevada which has two hundred or more stockholders, at least one hundred of whom are stockholders of record and residents of Nevada, and which does business in Nevada directly or through an affiliated corporation. The NRS also permits directors to resist a change or potential change in control of the corporation if the directors determine that the change or potential change is opposed to or not in the best interest of the corporation.

Amendment of Articles of Incorporation and Bylaws

Our bylaws may be altered, amended or repealed and new bylaws may be adopted at any regular or special meeting of the stockholders owning a majority of the shares and entitled to vote thereon. The bylaws may also be altered, amended or repealed and new bylaws may be adopted at any regular or special meeting of our Board of Directors by a majority vote of directors present at the meeting at which a quorum is present, except that any such amendment may not be inconsistent with or contrary to the provision of an amendment adopted by the stockholders.

Limitation of Liability and Indemnification of Officers and Directors

Our articles of incorporation limits the personal liability of directors and officers for breach of fiduciary duty to the Company or our stockholders. However, this provision does not eliminate or limit the liability of any of our directors and officers:

| | • | for acts or omissions not that involve intentional misconduct, fraud or a knowing violation of law; or |

| | • | The payment of dividends in violation of Section 78.300 of the Nevada Revised Statutes. |

Any repeal or modification of this provision will be prospective only and will not adversely affect any limitation on the personal liability of a director or officer of the Company for acts or omissions prior to such repeal or modification.

Our bylaws provide that the Company shall indemnify any director or officer of the Company against all costs and expenses actually and reasonably incurred by such person or on such person’s behalf, to the extent such director or officer is a party to or a witness in an action, suit or proceeding by reason of its position with the Company.

Authorized but Unissued Shares

Our authorized but unissued shares of common stock and preferred stock are available for future issuance, subject to any limitations imposed by the listing standards of The Nasdaq Capital Market. These additional shares may be used for a variety of corporate finance transactions, acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved common stock and preferred stock could make it more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger or otherwise.

Transfer Agent and Registrar

The transfer agent and registrar for our common stock is Computershare Investor Services, LLC. Its address is P.O. Box 30170, College Station, Texas 77842-3170, and its telephone number is 1-800-662-7232.

Our common stock is listed on The Nasdaq Capital Market under the symbol “ENG.”

PLAN OF DISTRIBUTION

Sale of common stock by the Selling Stockholder

The selling stockholder and any of its pledgees, donees, assignees, transferees and successors-in-interest may, from time to time, sell, separately or together, some or all of the shares of our common stock covered by this prospectus on Nasdaq or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. To the extent the selling stockholder gifts, pledges or otherwise transfers the securities offered hereby, such transferees may offer and sell the securities from time to time under this prospectus, provided that, if required under the Securities Act, and the rules and regulations promulgated thereunder, this prospectus has been amended under Rule 424(b)(3) or other applicable provision of the Securities Act, its includes the name of such transferee in the list of selling stockholders under this prospectus. Subject to compliance with applicable law, the selling stockholder may use any one or more of the following methods when selling shares of common stock:

| | · | ordinary brokerage transactions and transactions in which the broker-dealer solicits the purchaser; |

| | | |

| | · | block trades in which the broker-dealer will attempt to sell the shares of common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| | | |

| | · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| | | |

| | · | an exchange distribution in accordance with the rules of the applicable exchange; |

| | | |

| | · | privately negotiated transactions; |

| | | |

| | · | “at the market” or through market makers or into an existing market for the shares of common stock; |

| | | |

| | · | through one or more underwritten offerings on a firm commitment or best efforts basis; |

| | | |

| | · | settlement of short sales entered into after the date of this prospectus; |

| | | |

| | · | agreements with broker-dealers to sell a specified number of such shares of common stock at a stipulated price per share; |

| | | |

| | · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| | | |

| | · | through the distribution of common stock by the selling stockholder to its partners, members or securityholders; |

| | | |

| | · | a combination of any such methods of sale; or |

| | | |

| | · | any other method permitted pursuant to applicable law. |

To our knowledge, the selling stockholder has not entered into any agreements, understandings or arrangements with any underwriters or broker/dealers regarding the sale of the shares of common stock covered by this prospectus. At any time a particular offer of the shares of common stock covered by this prospectus is made, a revised prospectus or prospectus supplement, if required, will set forth the aggregate amount of shares of common stock covered by this prospectus being offered and the terms of the offering, including the name or names of any underwriters, dealers, brokers or agents. In addition, to the extent required, any discounts, commissions, concessions and other items constituting underwriters’ or agents’ compensation, as well as any discounts, commissions or concessions allowed or reallowed or paid to dealers, will be set forth in such revised prospectus or prospectus supplement. Any such required prospectus supplement, and, if necessary, a post-effective amendment to the registration statement of which this prospectus is a part, will be filed with the SEC to reflect the disclosure of additional information with respect to the distribution of the shares of common stock covered by this prospectus.

To the extent required, any applicable prospectus supplement will set forth whether or not underwriters may over-allot or effect transactions that stabilize, maintain or otherwise affect the market price of the common stock at levels above those that might otherwise prevail in the open market, including, for example, by entering stabilizing bids, effecting syndicate covering transactions or imposing penalty bids.

The selling stockholder may also sell shares of our common stock under Rule 144 under the Securities Act, if available, or in other transactions exempt from registration, rather than under this prospectus. The selling stockholder has the sole and absolute discretion not to accept any purchase offer or make any sale of securities if it deems the purchase price to be unsatisfactory at any particular time.

Broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. If the selling stockholder effects such transactions by selling securities to or through underwriters, broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or commissions from the selling stockholder (and/or, if any broker-dealer acts as agent for the purchaser of shares of common stock, from the purchaser) in amounts to be negotiated.

In connection with the sale of the common stock or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholder may also sell shares of the common stock short after the effective date of the registration statement of which this prospectus is a part and deliver these securities to close out its short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholder may from time to time pledge or grant a security interest in some or all of its shares of common stock to its broker-dealers under the margin provisions of customer agreements or to other parties to secure other obligations. If the selling stockholder defaults on a margin loan or other secured obligation, the broker-dealer or secured party may, from time to time, offer and sell the shares of common stock pledged or secured thereby pursuant to this prospectus. The selling stockholder and any other persons participating in the sale or distribution of the shares of common stock will be subject to applicable provisions of the Securities Act and the Exchange Act, and the rules and regulations thereunder, including, without limitation, Regulation M. These provisions may restrict certain activities of, and limit the timing of purchases and sales of any of the shares of common stock by, the selling stockholder or any other person, which limitations may affect the marketability of the shares of common stock.

The selling stockholder also may transfer the shares of our common stock in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the selling stockholder for purposes of this prospectus.

The selling stockholder may elect to make a pro rata in-kind distribution of shares of common stock to its members, partners or shareholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus. To the extent that such members, partners or shareholders are not affiliates of ours, such members, partners or shareholders would thereby receive freely tradeable shares of common stock pursuant to the distribution through a registration statement.

The selling stockholder and any broker-dealers or agents that are involved in selling the shares of common stock may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares of common stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. To our knowledge, the selling stockholder has not entered into any agreement or understanding, directly or indirectly, with any person to distribute the shares of our common stock.

We are required to pay all fees and expenses incident to the registration of shares of our common stock. We have agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act. We and the selling stockholder may agree to indemnify underwriters, broker-dealers or agents against certain liabilities, including liabilities under the Securities Act, and may also agree to contribute to payments which the underwriters, broker-dealers or agents may be required to make.

There can be no assurance that the selling stockholder will sell any or all of the securities registered pursuant to the registration statement of which this prospectus is a part.

LEGAL MATTERS

The validity of the common stock being offered by this prospectus will be passed on for us by Holland & Hart LLP, Reno, Nevada.

EXPERTS

The consolidated financial statements of ENGlobal Corporation and subsidiaries (the Company) as of December 25, 2021 and December 26, 2020, and for the years then ended, have been incorporated by reference herein, in reliance upon the report of Moss Adams LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The following documents, which have previously been filed by us with the SEC under the Exchange Act, are incorporated herein by reference:

| | · | our Annual Report on Form 10-K for the fiscal year ended December 25, 2021, filed with the SEC on March 11, 2022 (File No. 001-14217); |

| | | |

| | · | our Definitive Proxy Statement on Schedule 14A filed on April 22, 2022 (to the extent incorporated by reference into our Annual Report on Form 10-K); |

| | | |

| | · | our Quarterly Reports on Form 10-Q for the quarters ended March 26, 2022, June 25, 2022 and September 24, 2022, filed with the SEC on May 5, 2022, August 5, 2022, and November 8, 2022, respectively (File No. 001-14217); |

| | | |

| | · | our Current Reports on Form 8-K, filed with the SEC on March 10, 2022, April 19, 2022, May 5, 2022, June 10, 2022, August 4, 2022, November 8, 2022, December 23, 2022, February 3, 2023 and February 14, 2023 (excluding any information furnished pursuant to Item 2.02 or Item 7.01 of any such Current Report on Form 8-K and any corresponding information furnished under Item 9.01 or included as an exhibit); and |

| | | |

| | · | the description of our common stock set forth in our registration statement on Form 8-A, filed with the SEC on December 17, 2007 (File No. 001-14217), including any and all subsequent amendments and reports filed for the purpose of updating that description. |

All documents filed by us pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (excluding any information furnished pursuant to Item 2.02 or Item 7.01 on any Current Report on Form 8-K or Form 8-K/A and any corresponding information furnished under Item 9.01 or included as an exhibit) after the date of this prospectus until the termination of the offering under this prospectus shall be deemed to be incorporated in this prospectus by reference and to be a part hereof from the date of filing of such documents. Any statement contained herein, or in a document incorporated or deemed to be incorporated by reference herein, shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

You may request a free copy of these filings, other than any exhibits, unless the exhibits are specifically incorporated by reference into this prospectus, by writing or telephoning us at the following address:

Darren W. Spriggs

Attention: Chief Financial Officer

11740 Katy Fwy., Suite 1100

Houston, Texas 77079

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Exchange Act and in accordance therewith, file reports, proxy statements and other information with the SEC. The SEC maintains an Internet site at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. We maintain a website at www.englobal.com. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute part of this prospectus. Please note that information contained in our website, whether currently posted or posted in the future, is not a part of this prospectus or the documents incorporated by reference in this prospectus.

3,971,000 Shares of Common Stock

_______________________

Prospectus

_______________________

March 8, 2023

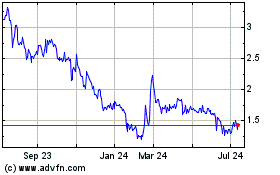

ENGlobal (NASDAQ:ENG)

Historical Stock Chart

From Apr 2024 to May 2024

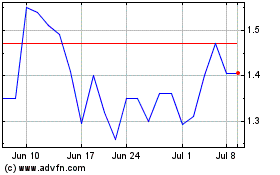

ENGlobal (NASDAQ:ENG)

Historical Stock Chart

From May 2023 to May 2024