East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, the financial bridge between the U.S. and Asia, today

reported financial results for the second quarter of 2011. For the

second quarter of 2011, net income was $60.5 million or $0.39 per

dilutive share. East West increased second quarter net income $24.2

million or 67% and increased earnings per dilutive share $0.18 or

86% from the prior year period.

“East West is pleased to report solid second quarter earnings of

$60.5 million or $0.39 per share,” stated Dominic Ng, Chairman and

Chief Executive Officer of East West. “Net income increased by

$24.2 million, or 67% from the prior year period and $4.5 million

or 8% from the first quarter of 2011. Fueled by our strong deposit

growth, total assets reached nearly $22 billion, a 10% increase

from the prior year, and a 3% increase from the prior quarter.

Average earning assets grew to $19.4 billion, an increase of 11%

from the prior year period and an increase of 4% from the first

quarter of 2011. This increase in average earning assets was driven

by solid second quarter loan growth of $300.2 million or 2% to

$14.0 billion at June 30, 2011.”

“East West’s solid financial performance for the second quarter

resulted in improvement in almost every key financial ratio. In

comparison to the first quarter of 2011, earning assets expanded

4%, the adjusted net interest margin expanded to 4.03%, fee income

increased and credit quality improved. The nonperforming assets to

total assets ratio is down to 0.83% and net charge-offs decreased

8% from the first quarter.”

Ng concluded, “Although the operating environment for banks

remains challenging, East West continues to grow market share,

increase revenue, and improve profitability. Our second quarter

performance demonstrated that we are on track with all of our

strategic initiatives and are well positioned to grow our franchise

and provide superior and sustainable return to our

shareholders.”

2011 Quarterly Results Summary

For the three months ended, Dollars in

millions, except per share June 30, 2011 March 31,

2011 June 30, 2010 Net income $ 60.5 $ 56.1 $ 36.3

Net income available to common shareholders 58.8 54.4 30.2 Earnings

per share (diluted) 0.39 0.37 0.21 Return on average assets

1.12 % 1.07 % 0.73 % Return on average common equity 11.06 % 10.50

% 6.26 % Tier 1 risk-based capital ratio 15.2 % 15.9 % 18.9

% Total risk-based capital ratio 16.9 % 17.7 % 20.8 %

Second Quarter 2011 Highlights

- Strong Second Quarter Earnings

– For the second quarter 2011, net income was $60.5 million

or $0.39 per share. Earnings per share grew $0.02 or 5% from the

first quarter of 2011 and $0.18 or 86% from the second quarter of

2010.

- Strong C&I Loan Growth of 23%

Quarter to Date – Quarter to date, non-covered commercial and

trade finance loans grew $500.7 million or 23% to $2.7

billion.

- Record Deposit Growth – Total

deposits grew to a record $17.1 billion, a $699.2 million or 4%

increase from March 31, 2011. Core deposits grew to a record $9.4

billion as of June 30, 2011, an increase of $247.7 million or 3%

from March 31, 2011.

- Stable Net Interest Margin of

4.03% – The adjusted net interest margin for the second quarter

totaled 4.03%, an improvement of 9 basis points from the first

quarter of 2011, and an improvement of 8 basis points from the

second quarter of 2010. 1

- Net Charge-offs Down 8% from Q1

2011, Down 43% from Q2 2010 – Net charge-offs declined to $31.6

million, a decrease of $2.6 million or 8% from the prior quarter

and a decrease of $23.6 million or 43% from the second quarter of

2010.

- Nonperforming Assets Down 4% to

0.83% of Total Assets – Nonperforming assets decreased

$7.1 million or 4% during the second quarter of 2011 to $181.2

million, or 0.83% of total assets. This is the seventh consecutive

quarter East West reported a nonperforming assets to total assets

ratio under 1.00%.

Management Guidance

The Company is providing updated guidance for the full year of

2011. Management currently estimates that fully diluted earnings

per share for the full year of 2011 will range from $1.52 to $1.54

per dilutive share or an increase of approximately 83% to 86% from

2010. Also, this updated guidance for the full year 2011 is an

increase of approximately 3% from our previously released guidance.

This updated EPS guidance for the remainder of 2011 is based on the

following assumptions:

- Stable balance sheet

- A stable interest rate environment and

an adjusted net interest margin of approximately 4.00%

- Provision for loan losses of

approximately $45 million for the remainder of the year

- Total noninterest expense of

approximately $97 million to $100 million each quarter, net of

amounts to be reimbursed by the FDIC

- Effective tax rate of approximately

37%

Balance Sheet Summary

Total assets increased 3% to $21.9 billion at June 30, 2011

compared to $21.1 billion at March 31, 2011. Average earning assets

increased 4% to $19.4 billion for the quarter ended June 30, 2011,

compared to $18.7 billion for the quarter ended March 31, 2011. The

increase in total assets and average earning assets was primarily

due to strong total loan growth of $300.2 million or 2% from March

31, 2011 to $14.0 billion at June 30, 2011 and an increase in

investment securities of $275.1 million or 9% from March 31, 2011

to $3.2 billion at June 30, 2011.

Loans receivable totaled $14.0 billion at June 30, 2011 as

compared to $13.7 billion at March 31, 2011. During the second

quarter, non-covered loan balances increased 6% or $543.4 million,

to $9.7 billion at June 30, 2011. The increase in non-covered loans

was primarily driven by significant growth in commercial and trade

finance loans of $500.7 million or 23%. Approximately $243.4

million or 49% of this increase in commercial and trade finance

loans was a result of cross-border trade finance business in Hong

Kong and China. Over 80% of these cross-border trade finance loans

are fully secured by cash and/or standby letters of credit issued

by major financial institutions. The other approximately 51% of the

commercial and trade finance loan growth is attributed to our

expanded lending platform in the U.S. Additionally, during the

second quarter, non-covered single family loan balances grew $84.9

million or 7% and non-covered commercial real estate loan balances

grew $69.0 million or 2% from March 31, 2011.

The growth in non-covered commercial and trade finance,

commercial real estate and single-family loans was partially offset

by decreases in non-covered land, construction, and consumer loans

during the second quarter of 2011. Land and construction loans

declined by $54.7 million or 12% to $420.1 million at June 30,

2011, or only 3% of total loans receivable. The consumer portfolio

declined approximately $81.6 million or 12% during the quarter

primarily as a result of the transfer of certain government

guaranteed student loans to loans held for sale to reflect

management’s intent to sell these loans at a future date. As of

June 30, 2011, we classified $326.8 million of loans as held for

sale, primarily comprised of government guaranteed student loans.

Further, during the quarter, we sold $212.5 million of government

guaranteed student loans at a gain of approximately $5.9

million.

Covered Loans

Covered loans totaled $4.4 billion as of June 30, 2011, a

decrease of $243.2 million during the second quarter. The decrease

in the covered loan portfolio was mainly due to paydowns, payoffs

and charge-off activity.

The covered loan portfolio is comprised of loans acquired from

the FDIC-assisted acquisitions of United Commercial Bank (UCB) and

Washington First International Bank (WFIB) which are covered under

loss share agreements with the FDIC. During the fourth quarter of

2010 we concluded that the credit quality is better than originally

estimated and we lowered the credit discount on the UCB covered

loan portfolio resulting in an increase in interest income over the

life of the loans. Correspondingly, with the lowered credit

discount, the expected reimbursement from the FDIC under the loss

sharing agreement also decreased, resulting in amortization on the

FDIC indemnification asset over the life of the indemnification

asset, which is recorded as a charge to noninterest income. The net

decrease in the FDIC indemnification asset resulting from loan

disposition activity, recoveries and amortization of the

indemnification asset totaled $32.4 million in the second quarter

of 2011.

In total, the net decrease in the FDIC indemnification asset and

receivable recorded in noninterest income (loss) was $(18.8)

million for the second quarter of 2011. The net decrease of $32.4

million discussed above was partially offset by an increase in the

FDIC receivable of $13.6 million due to reimbursable expense

claims. During the second quarter we incurred $17.0 million in

expenses on covered loans and other real estate owned, 80% or $13.6

million of which is reimbursable from the FDIC.

Deposits and Borrowings

The increase in loans and investments was fueled by record

deposit growth. During the quarter, total deposits grew $699.2 or

4% from March 31, 2011 to a record $17.1 billion. Core deposits

increased to a record $9.4 billion at June 30, 2011, or an increase

of $247.7 million or 3% from the first quarter and time deposits

increased to $7.8 billion at June 30, 2011, or an increase of

$451.4 million or 6% from the first quarter. Noninterest-bearing

demand deposits increased by $199.9 million or 7% for the second

quarter of 2011.

As of June 30, 2011, FHLB advances totaled $533.0 million, a

decrease of 33% or $260.7 million from March 31, 2011 due to the

prepayment of FHLB advances during the second quarter. The FHLB

advances prepaid during the second quarter carried an average

effective cost of 1.6%. A prepayment penalty of $4.4 million was

incurred during the second quarter which is included in noninterest

expense. Additionally, during the second quarter, $10.3 million of

10.9% junior subordinated debt securities were called at par. These

actions were taken to better position the balance sheet, reducing

borrowing costs and improving the net interest margin in the coming

quarters.

Second Quarter 2011 Operating Results

Net Interest Income

The core net interest margin, excluding the net impact to

interest income of $32.4 million resulting from covered loan

activity and amortization of the indemnification asset, increased 9

basis points from the first quarter of 2011 to 4.03% for the second

quarter. 1 The improvement in the net interest margin from the

previous quarter is primarily related to an increase in yield on

both investment securities and covered loans, and a stable yield on

noncovered loans. Due to our strong deposit growth during the

quarter, excess liquidity was deployed into investment securities,

which contributed to the improvement of our net interest

margin.

Although our net interest margin remains strong, the extended

low interest rate environment continues to be a challenge for East

West and the rest of the banking industry. East West continues to

look for opportunities to minimize our cost of funds and maximize

our yield through redeployment of excess liquidity into higher

interest-earning assets, while also ensuring prudent interest rate

risk management. Further, in the second quarter of 2011, East West

prepaid $260.7 million of FHLB advances at an average effective

cost of 1.6%. As a result of these actions, we expect our adjusted

net interest margin to remain stable and be approximately 4.00% for

the remainder of 2011.

Noninterest Income

The Company reported total noninterest income for the second

quarter of 2011 of $12.5 million, compared to noninterest income of

$11.0 million in the first quarter of 2011 and noninterest income

of $35.7 million in the second quarter of 2010. Noninterest income

in the second quarter of 2010 included a $19.5 million gain on the

acquisition of WFIB.

Total fees and other operating income increased to $22.1 million

for the second quarter of 2011, an increase from both the first

quarter of 2011 and second quarter of 2010 as detailed below:

Quarter Ended Quarter

Ended Quarter Ended % Change

($ in thousands)

June 30, 2011 March 31,

2011 June 30, 2010 (Yr/Yr) Branch

fees $ 9,078 $ 7,754 $ 8,219 10 % Letters of credit fees and

commissions 3,390 3,044 2,865 18 % Ancillary loan fees 2,055 1,991

2,369

(13)

% Other operating income 7,597 6,197 2,875 164

% Total fees & other operating income $ 22,120 $ 18,986 $

16,328 35 %

In comparison to the first quarter, total fees and other

operating income increased 17% or $3.1 million during the second

quarter, primarily due to an increase in branch fees, letter of

credit fees and commissions, and foreign exchange income. Also

included in noninterest income for the second quarter of 2011 were

gains on sales of student loans of $5.9 million, a net gain on

sales of investment securities of $1.1 million, and gains on the

sales of two bank premises of $2.2 million.

Noninterest Expense

Noninterest expense totaled $117.6 million for the second

quarter of 2011, compared to $106.8 million for the first quarter

of 2011, and $125.3 million for the second quarter of 2010. The

increase in noninterest expense from the first quarter of 2011 was

primarily related to an increase in compensation expense, as well

as an increase in credit cycle costs including legal expenses, loan

related expenses and other real estate owned expenses. Compared to

the prior quarter, compensation expense increased $2.6 million,

other real estate owned expense increased $3.9 million, legal

expenses increased by $2.7 million, and loan related expenses

increased $1.2 million. In addition, included within noninterest

expense for the second quarter of 2011 are prepayment penalties on

FHLB advances of $4.4 million.

The increase in compensation expense for the second quarter of

2011 as compared to the first quarter of 2011 is primarily related

to our continued investments in our commercial lending platform.

The increase in the credit cycle costs as compared to the prior

quarter is primarily related to expenses incurred on covered

assets. In the second quarter, we incurred $17.0 million in

expenses on covered loans and other real estate owned for which we

expect that 80% or $13.6 million will be reimbursed by the FDIC. Of

the $13.6 million of expenses reimbursable by the FDIC, $11.6

million is related to net writedowns and expenses on other real

estate owned and $2.0 million is related to legal and other loan

related expenses. Noninterest expense excluding amounts to be

reimbursed by the FDIC and the prepayment penalty on FHLB advances

totaled $99.6 million for the second quarter of 2011. 1

A summary of the noninterest expenses for the second quarter

2011, compared to the first quarter 2011, is detailed below:

Quarter Ended

Quarter Ended ($ in thousands)

June 30, 2011

March 31, 2011 Total noninterest expense: $

117,597 $ 106,789 Amounts to be reimbursed on covered assets (80%

of actual expense amount) 13,574 9,483 Prepayment penalties for

FHLB Advances 4,433 4,022 Noninterest

expense excluding reimbursement amounts and prepayment penalty on

FHLB Advances $ 99,590 $ 93,284

Management anticipates that in the third quarter of 2011,

noninterest expense will be approximately $97 million to $100

million, net of amounts reimbursable from the FDIC.

The effective tax rate for the second quarter was 36.8% compared

to 35.2% in the prior quarter. The effective tax rate is reduced

from the statutory tax rate primarily due to the utilization of tax

credits related to affordable housing investments.

Credit Quality

All asset quality metrics improved during the second quarter of

2011. Nonperforming assets, excluding covered assets, decreased by

$7.1 million or 4% from the prior quarter to $181.2 million or only

0.83% of total assets at June 30, 2011. The decrease in

nonperforming assets was due to an $8.0 million or 5% decrease in

nonaccrual loans during the second quarter of 2011. In addition,

for the seventh consecutive quarter, net charge-offs declined.

Total net charge-offs decreased to $31.6 million for the second

quarter of 2011, a decrease of 8% from the previous quarter and a

decrease of 43% compared to the prior year quarter.

East West continues to maintain a strong allowance for

non-covered loan losses at $213.8 million or 2.29% of non-covered

loans receivable at June 30, 2011. This compares to an allowance

for non-covered loan losses of $220.4 million or 2.50% of

non-covered loans at March 31, 2011 and $249.5 million or 3.0% of

outstanding loans at June 30, 2010. The provision for loan losses

was $26.5 million for the second quarter of 2011, unchanged from

the prior quarter, and a decrease of 52% as compared to the second

quarter of 2010. Our allowance for loan losses and provision for

loan losses has declined for several quarters as a result of credit

quality improvement, partially offset by increases in the allowance

for loan losses on commercial and trade finance loans, commensurate

with the increases in these portfolios.

Management expects that the provision for loan losses will

decrease in future quarters and total approximately $45 million for

the remainder of 2011.

Capital Strength

(Dollars in millions)

June 30, 2011

Well Capitalized

Regulatory

Requirement

Total Excess Above

Well Capitalized

Requirement

Tier 1 leverage capital ratio 9.3 % 5.00 % $ 902 Tier 1

risk-based capital ratio 15.2 % 6.00 % 1,188 Total risk-based

capital ratio 16.9 % 10.00 % 895

Tangible common equity to tangible assets

ratio

8.1 % N/A N/A Tangible common equity to risk weighted assets ratio

13.4 %

4.00

% *

1,212

_____________________________________________

*As there is no stated regulatory guideline for this ratio, the

SCAP (Supervisory Capital Assessment Program) guideline of 4.00%

tangible common equity has been used.

Our capital ratios remain very strong. As of the end of the

second quarter of 2011, our Tier 1 leverage capital ratio totaled

9.3%, our Tier 1 risk-based capital ratio totaled 15.2% and our

total risk-based capital ratio totaled 16.9%. East West exceeds

well capitalized requirements for all regulatory guidelines by over

$800 million. During the second quarter East West called $10.3

million of 10.9% junior subordinated debt securities at par. The

Company remains focused on active capital management and remains

committed to maintaining strong capital levels that exceed

regulatory requirements, while also supporting balance sheet

growth, and providing a strong return to our shareholders.

Dividend Payout

East West’s Board of Directors has declared third quarter

dividends on the common stock and Series A Preferred Stock. The

common stock cash dividend of $0.05 is payable on or about August

24, 2011 to shareholders of record on August 10, 2011. The dividend

on the Series A Preferred Stock of $20.00 per share is payable on

August 1, 2011 to shareholders of record on July 15, 2011.

Conference Call

East West will host a conference call to discuss second quarter

2011 earnings with the public on Thursday, July 21, 2011 at 8:30

a.m. PDT/ 11:30 a.m. EDT. The public and investment community are

invited to listen as management discusses second quarter results

and operating developments. The following dial-in information is

provided for participation in the conference call: Local call

within the US – (877) 317-6789; Call within Canada – (866)

605-3852; International call – (412) 317-6789. A listen-only live

broadcast of the call also will be available on the investor

relations page of the Company's website at

www.eastwestbank.com.

About East West

East West Bancorp is a publicly owned company with $21.9 billion

in assets and is traded on the Nasdaq Global Select Market under

the symbol “EWBC”. The Company’s wholly owned subsidiary, East West

Bank, is one of the largest independent commercial banks

headquartered in California with over 130 locations worldwide,

including the U.S. markets of California, New York, Georgia,

Massachusetts, Texas and Washington. In Greater China, East West’s

presence includes a full service branch in Hong Kong and

representative offices in Beijing, Shenzhen and Taipei. Through a

wholly-owned subsidiary bank, East West’s presence in Greater China

also includes full service branches in Shanghai and Shantou and a

representative office in Guangzhou. For more information on East

West Bancorp, visit the Company's website at

www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp’s Annual

Report on Form 10-K for the year ended Dec. 31, 2010 (See Item I --

Business, and Item 7 -- Management’s Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC’s ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses; effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state’s Franchise Tax Board regarding the taxation of Registered

Investment Companies; and regional and general economic conditions.

Actual results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank’s expectations of results or any change in event.

1 See reconciliation of the GAAP financial measure to the

non-GAAP financial measure in the tables attached.

EAST WEST BANCORP,

INC. CONDENSED CONSOLIDATED BALANCE SHEETS (In

thousands, except per share amounts) (unaudited)

June 30, 2011 March 31, 2011 June 30, 2010

Assets Cash and cash equivalents $ 1,598,498 $ 1,492,922 $

1,394,851 Short-term investments 85,479 140,585 238,261 Securities

purchased under resale agreements 812,281 768,369 230,000

Investment securities 3,206,108 2,930,976 2,077,011 Loans

receivable, excluding covered loans (net of allowance for loan

losses of $213,825, $220,402 and $249,462) 9,428,015 8,870,177

8,177,966 Covered loans, net 4,356,595

4,599,757 5,275,492 Total loans receivable,

net 13,784,610 13,469,934 13,453,458 Federal Home Loan Bank and

Federal Reserve stock 197,187 203,760 223,395 FDIC indemnification

asset 637,535 717,260 947,011 Other real estate owned, net 16,464

15,580 16,562 Other real estate owned covered, net 123,050 142,416

113,999 Premiums on deposits acquired, net 73,182 76,332 86,106

Goodwill 337,438 337,438 337,438 Other assets 1,000,876

851,454 849,229 Total assets $

21,872,708 $ 21,147,026 $ 19,967,321

Liabilities and Stockholders' Equity Deposits 17,135,753 $

16,436,598 $ 14,918,694 Federal Home Loan Bank advances 532,951

793,643 1,022,011 Securities sold under repurchase agreements

1,052,615 1,081,019 1,051,192 Long-term debt 225,261 235,570

235,570 Other borrowings 29,924 11,090 35,504 Accrued expenses and

other liabilities 666,872 431,189

365,386 Total liabilities 19,643,376 18,989,109

17,628,357 Stockholders' equity 2,229,332

2,157,917 2,338,964 Total liabilities and

stockholders' equity $ 21,872,708 $ 21,147,026 $

19,967,321 Book value per common share $ 14.43 $ 13.96 $

13.31 Number of common shares at period end 148,751 148,638 147,939

Ending Balances June 30, 2011 March 31,

2011 June 30, 2010 Loans receivable Real estate - single

family $ 1,286,235 $ 1,201,311 $ 1,032,915 Real estate -

multifamily 950,981 949,034 985,194 Real estate - commercial

3,408,560 3,339,592 3,499,721 Real estate - land 203,380 220,135

285,864 Real estate - construction 216,689 254,614 351,169

Commercial 2,684,472 2,183,819 1,528,863 Consumer 588,940

670,529 631,258 Total loans

receivable held for investment, excluding covered loans 9,339,257

8,819,034 8,314,984 Loans held for sale 326,841 303,673 159,158

Covered loans, net 4,356,595 4,599,757

5,275,492 Total loans receivable 14,022,693

13,722,464 13,749,634 Unearned fees, premiums and discounts (24,258

) (32,128 ) (46,714 ) Allowance for loan losses on non-covered

loans (213,825 ) (220,402 ) (249,462 ) Net

loans receivable $ 13,784,610 $ 13,469,934 $ 13,453,458

Deposits Noninterest-bearing demand $ 3,151,660 $ 2,951,793 $

2,396,087 Interest-bearing checking 792,330 808,070 685,572 Money

market 4,311,583 4,362,484 4,162,129 Savings 1,099,065

984,552 946,043 Total core

deposits 9,354,638 9,106,899 8,189,831 Time deposits

7,781,115 7,329,699 6,728,863

Total deposits $ 17,135,753 $ 16,436,598 $ 14,918,694

EAST WEST BANCORP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In

thousands, except per share amounts) (unaudited)

Quarter Ended June 30, 2011 March 31,

2011 June 30, 2010 Interest and dividend income $

274,468 $ 254,335 $ 253,533 Interest expense (47,132 )

(45,501 ) (49,910 ) Net interest income before

provision for loan losses 227,336 208,834 203,623 Provision for

loan losses (26,500 ) (26,506 ) (55,256 ) Net

interest income after provision for loan losses 200,836 182,328

148,367 Noninterest income 12,491 11,041 35,685 Noninterest expense

(117,597 ) (106,789 ) (125,318 ) Income before

provision for income taxes 95,730 86,580 58,734 Provision for

income taxes 35,205 30,509

22,386 Net income 60,525 56,071 36,348 Preferred stock

dividend and amortization of preferred stock discount (1,714

) (1,715 ) (6,147 ) Net income available to common

stockholders $ 58,811 $ 54,356 $ 30,201 Net income per share, basic

$ 0.40 $ 0.37 $ 0.21 Net income per share, diluted $ 0.39 $ 0.37 $

0.21 Shares used to compute per share net income: - Basic 147,011

146,837 146,372 - Diluted 153,347 153,334 147,131

Quarter Ended June 30, 2011 March 31,

2011 June 30, 2010 Noninterest income: Branch fees $

9,078 $ 7,754 $ 8,219 Decrease in FDIC indemnification asset and

FDIC receivable (18,806 ) (17,443 ) (9,424 ) Net gain on sales of

loans 5,891 7,410 8,073 Letters of credit fees and commissions

3,390 3,044 2,865 Net gain on sales of investments 1,117 2,515

5,847 Net gain on sale of fixed assets 2,169 37 27 Impairment loss

on investment securities - (464 ) (4,642 ) Ancillary loan fees

2,055 1,991 2,369 Gain on acquisition - - 19,476 Other operating

income 7,597 6,197 2,875

Total noninterest income $ 12,491 $ 11,041 $ 35,685

Noninterest expense: Compensation and employee benefits $ 40,870 $

38,270 $ 41,579 Occupancy and equipment expense 12,175 12,598

13,115 Loan related expenses 4,284 3,099 5,254 Other real estate

owned expense 14,585 10,664 20,983 Deposit insurance premiums and

regulatory assessments 6,833 7,191 4,528 Prepayment penalties for

FHLB advances 4,433 4,022 3,900 Legal expense 6,791 4,101 6,183

Amortization of premiums on deposits acquired 3,151 3,185 3,310

Data processing 2,100 2,603 3,046 Consulting expense 2,378 1,626

1,919 Amortization of investments in affordable housing

partnerships 4,598 4,525 2,638 Other operating expense

15,399 14,905 18,863 Total

noninterest expense $ 117,597 $ 106,789 $ 125,318

EAST WEST BANCORP, INC. CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (In thousands, except per

share amounts) (unaudited) Year To Date

June 30, 2011 June 30, 2010 Interest

and dividend income $ 528,803 $ 572,236 Interest expense

(92,633 ) (106,889 ) Net interest income before provision

for loan losses 436,170 465,347 Provision for loan losses

(53,006 ) (131,677 ) Net interest income after provision for

loan losses 383,164 333,670 Noninterest income 23,532 27,234

Noninterest expense (224,386 ) (264,228 ) Income

before provision for income taxes 182,310 96,676 Provision for

income taxes 65,714 35,412 Net income

116,596 61,264 Preferred stock dividend and amortization of

preferred stock discount (3,429 ) (12,285 ) Net

income available to common stockholders $ 113,167 $ 48,979 Net

income per share, basic $ 0.77 $ 0.40 Net income per share, diluted

$ 0.76 $ 0.34 Shares used to compute per share net income: - Basic

146,937 123,445 - Diluted 153,349 142,143

Year To

Date June 30, 2011 June 30, 2010

Noninterest income: Branch fees $ 16,832 $ 16,977 Decrease in FDIC

indemnification asset and FDIC receivable (36,249 ) (52,996 ) Net

gain on sales of loans 13,301 8,073 Letters of credit fees and

commissions 6,434 5,605 Net gain on sales of investments 3,632

21,958 Net gain on sale of fixed assets 2,206 52 Impairment loss on

investment securities (464 ) (9,441 ) Ancillary loan fees 4,046

4,058 Gain on acquisition - 27,571 Other operating income

13,794 5,377 Total noninterest income $ 23,532

$ 27,234 Noninterest expense: Compensation and employee

benefits $ 79,140 $ 92,358 Occupancy and equipment expense 24,773

25,059 Loan related expenses 7,383 8,251 Other real estate owned

expense 25,249 38,995 Deposit insurance premiums and regulatory

assessments 14,024 16,109 Prepayment penalties for FHLB advances

8,455 13,832 Legal expense 10,892 9,090 Amortization of premiums on

deposits acquired 6,336 6,694 Data processing 4,703 5,528

Consulting expense 4,004 4,060 Amortization of investments in

affordable housing partnerships 9,123 5,675 Other operating expense

30,304 38,577 Total noninterest expense

$ 224,386 $ 264,228

EAST WEST BANCORP, INC. SELECTED FINANCIAL

INFORMATION (In thousands) (unaudited)

Average Balances Quarter Ended June 30,

2011 March 31, 2011 June 30, 2010 Loans

receivable Real estate - single family $ 1,231,774 $ 1,161,336 $

989,744 Real estate - multifamily 950,687 961,770 998,090 Real

estate - commercial 3,393,361 3,379,191 3,530,045 Real estate -

land 217,819 229,901 317,291 Real estate - construction 239,518

278,668 383,846 Commercial 2,450,510 2,056,781 1,492,560 Consumer

935,081 1,055,534 845,104

Total loans receivable, excluding covered loans 9,418,750 9,123,181

8,556,680 Covered loans 4,487,610 4,695,964

5,137,863 Total loans receivable 13,906,360

13,819,145 13,694,543 Investment securities 3,220,795 2,818,703

2,202,676 Earning assets 19,402,968 18,741,052 17,525,796 Total

assets 21,574,103 20,894,782 19,886,269 Deposits

Noninterest-bearing demand $ 2,935,704 $ 2,708,842 $ 2,300,228

Interest-bearing checking 793,349 771,626 663,936 Money market

4,374,404 4,386,100 3,968,293 Savings 1,034,486

971,313 961,374 Total core deposits

9,137,943 8,837,881 7,893,831 Time deposits 7,653,112

7,139,530 6,714,972 Total deposits

16,791,055 15,977,411 14,608,803 Interest-bearing liabilities

15,913,856 15,609,601 14,874,635 Stockholders' equity 2,210,603

2,153,460 2,310,623

Selected Ratios Quarter

Ended June 30, 2011 March 31, 2011 June

30, 2010 For The Period Return on average assets 1.12 % 1.07 %

0.73 % Return on average common equity 11.06 % 10.50 % 6.26 %

Interest rate spread 4.48 % 4.32 % 4.45 % Net interest margin 4.70

% 4.52 % 4.66 % Yield on earning assets 5.67 % 5.50 % 5.80 % Cost

of deposits 0.70 % 0.66 % 0.80 % Cost of funds 1.00 % 1.01 % 1.17 %

Noninterest expense/average assets (1) 1.95 % 1.82 % 2.32 %

Efficiency ratio (2) 43.95 % 43.14 % 51.44 % (1)

Excludes the amortization of intangibles, amortization and

impairment loss of premiums on deposits acquired, amortization of

investments in affordable housing partnerships and prepayment

penalties for FHLB advances. (2) Represents noninterest expense,

excluding the amortization of intangibles, amortization and

impairment loss of premiums on deposits acquired, amortization of

investments in affordable housing partnerships and prepayment

penalties for FHLB advances, divided by the aggregate of net

interest income before provision for loan losses and noninterest

income, excluding items that are non-recurring in nature.

EAST WEST BANCORP, INC. QUARTER TO

DATE AVERAGE BALANCES, YIELDS AND RATES PAID (In thousands)

(unaudited)

Quarter Ended June 30, 2011

June 30, 2010 Average Average

Volume Interest Yield

(1) Volume Interest

Yield (1)

ASSETS

Interest-earning assets: Short-term investments $ 1,006,402

$ 4,500 1.79 % $ 948,361 1,502 0.64 % Securities purchased under

resale agreements 1,068,975 5,109 1.92 % 455,743 2,630 2.31 %

Investment securities available-for-sale 3,220,795 23,253 2.90 %

2,202,676 14,741 2.68 % Loans receivable 9,418,750 119,739 5.10 %

8,556,680 116,916 5.48 % Loans receivable - covered 4,487,610

121,034 10.82 % 5,137,863 116,867 9.12 % Federal Home Loan Bank and

Federal Reserve Bank stock 200,437

833 1.67 % 224,473

877 1.57 % Total

interest-earning assets 19,402,969

274,468 5.67 % 17,525,796

253,533 5.80 %

Noninterest-earning assets: Cash and cash equivalents

270,259 603,907 Allowance for loan losses (228,587 ) (255,904 )

Other assets 2,129,462 2,012,470 Total

assets $ 21,574,103 $ 19,886,269

LIABILITIES AND

STOCKHOLDERS' EQUITY

Interest-bearing liabilities: Checking accounts 793,349 699

0.35 % 663,936 527 0.32 % Money market accounts 4,374,404 5,848

0.54 % 3,968,293 8,336 0.84 % Savings deposits 1,034,486 933 0.36 %

961,374 1,274 0.53 % Time deposits 7,653,112 21,650 1.13 %

6,714,972 18,995 1.13 % Federal Home Loan Bank advances 738,094

3,955 2.15 % 1,238,400 6,175 2.00 % Securities sold under

repurchase agreements 1,064,096 12,116 4.57 % 1,042,305 12,045 4.64

% Long-term debt 235,343 1,788 3.05 % 235,570 1,591 2.71 % Other

borrowings 20,972 143

2.73 % 49,785

967 7.79 % Total interest-bearing liabilities

15,913,856 47,132

1.19 % 14,874,635

49,910 1.35 %

Noninterest-bearing

liabilities: Demand deposits 2,935,704 2,300,228 Other

liabilities 513,940 400,783 Stockholders' equity 2,210,603

2,310,623 Total liabilities and stockholders'

equity $ 21,574,103 $ 19,886,269 Interest rate

spread 4.48 % 4.45 % Net interest income and net interest

margin $ 227,336 4.70 % $ 203,623 4.66 % Net interest income

and net interest margin, adjusted (2) $ 194,955 4.03 % $ 172,460

3.95 % (1) Annualized. (2) Amounts exclude the net impact of

covered loan dispositions of $32.4 million and $31.2 million for

the three months ended June 30, 2011 and 2010, respectively.

EAST WEST BANCORP, INC.

SELECTED FINANCIAL INFORMATION (In thousands)

(unaudited) Average Balances Year To

Date June 30, 2011 June 30, 2010 Loans

receivable Real estate - single family $ 1,196,749 $ 961,800 Real

estate - multifamily 956,198 1,034,830 Real estate - commercial

3,386,315 3,563,975 Real estate - land 223,827 336,990 Real estate

- construction 258,985 416,378 Commercial 2,254,733 1,479,533

Consumer 994,975 788,708 Total loans

receivable, excluding covered loans 9,271,782 8,582,214 Covered

loans 4,591,211 5,256,293 Total loans

receivable 13,862,993 13,838,507 Investment securities 3,020,860

2,194,322 Earning assets 19,067,921 17,733,912 Total assets

21,232,913 20,161,042 Deposits Noninterest-bearing demand $

2,828,933 $ 2,260,847 Interest-bearing checking 782,547 651,655

Money market 4,374,322 3,716,606 Savings 1,003,074

976,695 Total core deposits 8,988,876 7,605,803 Time

deposits 7,397,717 7,013,720 Total

deposits 16,386,593 14,619,523 Interest-bearing liabilities

15,756,651 15,339,588 Stockholders' equity 2,178,624 2,302,208

Selected Ratios Year To Date

June 30, 2011 June 30, 2010 For The Period Return on

average assets 1.10 % 0.61 % Return on average common equity 10.80

% 5.55 % Interest rate spread 4.40 % 5.10 % Net interest margin

4.61 % 5.29 % Yield on earning assets 5.59 % 6.51 % Cost of

deposits 0.68 % 0.86 % Cost of funds 1.01 % 1.22 % Noninterest

expense/average assets (1) 1.89 % 2.36 % Efficiency ratio (2) 43.57

% 50.17 % (1) Excludes the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, amortization of investments in affordable

housing partnerships and prepayment penalties for FHLB advances.

(2) Represents noninterest expense, excluding the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, amortization of investments in affordable

housing partnerships and prepayment penalties for FHLB advances,

divided by the aggregate of net interest income before provision

for loan losses and noninterest income, excluding items that are

non-recurring in nature.

EAST WEST BANCORP,

INC. YEAR TO DATE AVERAGE BALANCES, YIELDS AND RATES

PAID (In thousands) (unaudited)

Year To Date

June 30, 2011 June 30, 2010

Average Average Volume

Interest Yield (1)

Volume Interest Yield

(1)

ASSETS

Interest-earning assets: Short-term investments $ 995,055 $

7,240 1.47 % $ 1,119,912 $ 5,043 0.91 % Securities purchased under

resale agreements 984,020 9,379 1.92 % 358,074 8,893 5.01 %

Investment securities available-for-sale 3,020,860 42,110 2.81 %

2,194,322 34,931 3.21 % Loans receivable 9,271,782 234,650 5.10 %

8,582,214 238,944 5.61 % Loans receivable - covered 4,591,211

233,649 10.26 % 5,256,293 282,783 10.85 % Federal Home Loan Bank

and Federal Reserve Bank stock 204,992

1,775 1.75 % 223,097

1,656 1.50 % Total

interest-earning assets 19,067,920

528,803 5.59 % 17,733,912

572,250 6.51 %

Noninterest-earning assets: Cash and cash equivalents

277,214 485,965 Allowance for loan losses (232,371 ) (254,700 )

Other assets 2,120,150 2,195,865 Total

assets $ 21,232,913 $ 20,161,042

LIABILITIES AND

STOCKHOLDERS' EQUITY

Interest-bearing liabilities: Checking accounts 782,547

1,347 0.35 % 651,655 1,141 0.35 % Money market accounts 4,374,322

11,823 0.55 % 3,716,606 16,302 0.88 % Savings deposits 1,003,074

1,665 0.33 % 976,695 2,416 0.50 % Time deposits 7,397,717 40,277

1.10 % 7,013,720 42,721 1.23 % Federal Home Loan Bank advances

875,290 9,733 2.24 % 1,634,910 15,180 1.87 % Securities sold under

repurchase agreements 1,072,124 24,133 4.54 % 1,035,539 24,586 4.79

% Long-term debt 235,456 3,359 2.88 % 235,570 3,138 2.69 % Other

borrowings 16,122 296

3.70 % 74,893

1,405 3.78 %

Total interest-bearing liabilities

15,756,652 92,633

1.19 % 15,339,588

106,889 1.41 %

Noninterest-bearing

liabilities: Demand deposits 2,828,933 2,260,847 Other

liabilities 468,704 258,399 Stockholders' equity 2,178,624

2,302,208 Total liabilities and stockholders'

equity $ 21,232,913 $ 20,161,042 Interest rate

spread 4.40 % 5.10 % Net interest income and net interest

margin $ 436,170 4.61 % $ 465,361 5.29 % Net interest income

and net interest margin, adjusted (2) $ 376,864 3.99 % $ 371,250

4.22 % (1) Annualized. (2) Amounts exclude the net impact of

covered loan dispositions of $59.3 million and $91.6 million for

the six months ended June 30, 2011 and 2010, respectively, and

repurchase agreement termination gain of $2.5 million for the six

months ended June 30, 2010.

EAST WEST BANCORP, INC. QUARTERLY ALLOWANCE

FOR LOAN LOSSES RECAP (In thousands) (unaudited)

Quarter Ended 6/30/2011

3/31/2011 6/30/2010 LOANS

Allowance balance, beginning of period $ 226,161 $ 234,633 $

250,517 Allowance for unfunded loan commitments and letters of

credit (487 ) (758 ) (1,115 ) Provision for loan losses 26,500

26,506 55,256 Net Charge-offs: Real estate - single family

1,120 928 3,257 Real estate - multifamily 1,081 2,178 7,552 Real

estate - commercial 2,164 4,603 11,836 Real estate - land 1,941

8,931 9,765 Real estate - construction 16,202 7,893 11,634

Commercial 8,844 8,660 10,475 Consumer 266

1,027 677 Total

net charge-offs 31,618 34,220

55,196 Allowance balance, end of

period (3) $ 220,556 $ 226,161

$ 249,462

UNFUNDED LOAN COMMITMENTS AND

LETTERS OF CREDIT: Allowance balance, beginning of period $

10,710 $ 9,952 $ 8,927 Provision for unfunded loan commitments and

letters of credit 487 758

1,115 Allowance balance, end of period

$ 11,197 $ 10,710 $

10,042 GRAND TOTAL, END OF PERIOD $ 231,753

$ 236,871 $ 259,504

Nonperforming assets to total assets (1)

0.83

%

0.89 % 0.98 % Allowance for loan losses on non-covered loans to

total gross non-covered loans held for investment at end of period

2.29

%

2.50 %

3.00

%

Allowance for loan losses on non-covered loans and unfunded loan

commitments to total gross non-covered loans held for investment at

end of period

2.41

%

2.62 %

3.12

%

Allowance on non-covered loans to non-covered nonaccrual

loans at end of period

129.80

%

127.59 % 139.31 % Nonaccrual loans to total loans (2) 1.17 % 1.26 %

1.30 % (1) Nonperforming assets excludes covered loans and covered

REOs. Total assets includes covered assets. (2) Nonaccrual loans

excludes covered loans. Total loans includes covered loans. (3)

Included in the allowance is $6.7 million and $5.8 million related

to covered loans as of June 30, 2011 and March 31, 2011,

respectively.

This allowance is related to drawdowns on

commitments that were in existence as of the acquisition dates and

therefore, are covered under the loss share agreements with the

FDIC. Allowance on these subsequent drawdowns is accounted for as

part of our general allowance.

EAST WEST BANCORP, INC. TOTAL

NON-PERFORMING ASSETS, EXCLUDING COVERED ASSETS (In

thousands) (unaudited) AS OF JUNE 30, 2011

Total Nonaccrual Loans

90+ Days

Delinquent

Under 90+

Days

Delinquent

Total

Nonaccrual

Loans

REO Assets

Total

Non-Performing

Assets

Loan Type Real estate - single family $ 13,326 $ - $ 13,326

$ 1,384 $ 14,710 Real estate - multifamily 11,174 3,708 14,882 833

15,715 Real estate - commercial 38,677 3,432 42,109 4,789 46,898

Real estate - land 19,368 4,782 24,150 8,160 32,310 Real estate -

construction 28,789 16,231 45,020 847 45,867 Commercial 19,078

5,091 24,169 358 24,527 Consumer 1,077 - 1,077

93 1,170

Total $ 131,489

$ 33,244 $ 164,733 $

16,464 $ 181,197 AS OF MARCH 31,

2011 Total Nonaccrual Loans

90+ Days

Delinquent

Under 90+

Days

Delinquent

Total

Nonaccrual

Loans

REO Assets

Total

Non-Performing

Assets

Loan Type Real estate - single family $ 10,585 $ - $ 10,585

$ 441 $ 11,026 Real estate - multifamily 9,101 4,320 13,421 184

13,605 Real estate - commercial 41,494 5,027 46,521 3,966 50,487

Real estate - land 11,053 10,064 21,117 9,856 30,973 Real estate -

construction 24,993 21,390 46,383 867 47,250 Commercial 18,003

14,954 32,957 180 33,137 Consumer 1,755 -

1,755 86 1,841

Total $ 116,984

$ 55,755 $ 172,739 $

15,580 $ 188,319 AS OF JUNE 30,

2010 Total Nonaccrual Loans

90+ Days

Delinquent

Under 90+

Days

Delinquent

Total

Nonaccrual

Loans

REO Assets

Total

Non-Performing

Assets

Loan Type Real estate - single family $ 14,835 $ - $ 14,835

$ 395 $ 15,230 Real estate - multifamily 13,180 5,521 18,701 3,131

21,832 Real estate - commercial 15,778 2,569 18,347 7,047 25,394

Real estate - land 43,775 5,292 49,067 2,541 51,608 Real estate -

construction 24,451 23,819 48,270 3,102 51,372 Commercial 19,310

8,994 28,304 - 28,304 Consumer 1,436 104 1,540

346 1,886

Total $ 132,765

$ 46,299 $ 179,064 $

16,562 $ 195,626 EAST WEST

BANCORP, INC. GAAP TO NON-GAAP RECONCILIATION (In

thousands) (unaudited) The tangible common equity

to risk weighted assets and tangible common equity to tangible

assets ratios is a non-GAAP disclosure. The Company uses certain

non-GAAP financial measures to provide supplemental information

regarding the Company's performance to provide additional

disclosure. As the use of tangible common equity to tangible assets

is more prevalent in the banking industry and with banking

regulators and analysts, we have included the tangible common

equity to risk-weighted assets and tangible common equity to

tangible assets ratios.

As of June 30, 2011

Stockholders' Equity $ 2,229,332 Less: Preferred Equity (83,027 )

Goodwill and other intangible assets (419,133 ) Tangible

common equity $ 1,727,172 Risk-weighted assets

12,880,756 Tangible Common Equity to risk-weighted

assets 13.4 %

As of June 30, 2011 Total

assets $ 21,872,708 Less: Goodwill and other intangible assets

(419,133 ) Tangible assets $ 21,453,575

Tangible common equity to tangible asset ratio 8.1 %

Operating noninterest income is a non-GAAP disclosure. The Company

uses certain non-GAAP financial measures to provide supplemental

information regarding the Company's performance to provide

additional disclosure. There are noninterest income line items that

are non-core in nature. Operating noninterest income excludes such

non-core noninterest income line items. The Company believes that

presenting the operating noninterest income provides more clarity

to the users of financial statements regarding the core noninterest

income amounts.

Quarter Ended June 30, 2011

Noninterest income $ 12,491 Less: Net gain on sales of investments

(1,117 ) Net gain on sales of loans (5,891 ) Net gain on sale of

fixed assets (2,169 ) Decrease in FDIC indemnification asset and

FDIC receivable 18,806 Operating noninterest income

(non-GAAP) $ 22,120

Quarter Ended

June 30, 2010 Noninterest income $ 35,685 Add: Impairment

loss on investment securities 4,642 Less: Net gain on sales of

investments (5,847 ) Net gain on sales of loans (8,073 ) Gain on

acquisition (19,476 ) Net gain on sale of fixed assets (27 )

Decrease in FDIC indemnification asset and FDIC receivable

9,424 Operating noninterest income (non-GAAP) $ 16,328

EAST WEST BANCORP, INC. GAAP TO

NON-GAAP RECONCILIATION (In thousands)

(unaudited) Operating noninterest expense is a

non-GAAP disclosure. The Company uses certain non-GAAP financial

measures to provide supplemental information regarding the

Company's performance to provide additional disclosure. These are

noninterest expense line items that are non-core in nature.

Operating noninterest expense excludes such non-core noninterest

expense line items. The Company believes that presenting the

operating noninterest expense provides more clarity to the users of

financial statements regarding the core noninterest expense

amounts.

Quarter Ended June 30, 2011 Total

noninterest expense: $ 117,597 Amounts to be reimbursed on covered

assets (80% of actual expense amount) 13,574 Prepayment penalties

for FHLB advances 4,433 Noninterest expense excluding

reimbursement amounts and prepayment penalties for FHLB advances $

99,590

Quarter Ended March 31, 2011 Total

noninterest expense: $ 106,789 Amounts to be reimbursed on covered

assets (80% of actual expense amount) 9,483 Prepayment penalties

for FHLB advances 4,022 Noninterest expense excluding

reimbursement amounts and prepayment penalties for FHLB advances $

93,284

EAST WEST

BANCORP, INC. GAAP TO NON-GAAP RECONCILIATION (In

thousands) (unaudited) The Company uses certain

non-GAAP financial measures to provide supplemental information

regarding the Company's performance to provide additional

disclosure. The net interest margin includes amounts that are

non-core in nature. As such, the Company believes that presenting

the net interest income and net interest margin excluding such

non-core items provides additional clarity to the users of

financial statements regarding the core net interest income and net

interest margin, comparability to prior periods and the ongoing

performance of the Company.

Quarter Ended June 30,

2011 Average Volume Interest Yield

(1) Total interest-earning assets $ 19,402,969 $ 274,468 5.67 % Net

interest income and net interest margin $ 227,336 4.70 % Less net

impact of covered loan dispositions and amortization of the FDIC

indemnification asset (32,381 )

Net interest income and net interest

margin, excluding

net impact of covered loan dispositions

and amortization of the FDIC indemnification asset

$ 194,955 4.03 %

Quarter Ended March 31,

2011 Average Volume Interest Yield

(1) Total interest-earning assets $ 18,741,052 $ 254,335 5.50 % Net

interest income and net interest margin $ 208,834 4.52 % Less net

impact of covered loan dispositions and amortization of the FDIC

indemnification asset (26,926 ) Net interest income and net

interest margin, excluding net impact of covered loan

dispositions and amortization of the FDIC indemnification asset $

181,908 3.94 %

Quarter Ended June 30,

2010 Average Volume Interest Yield

(1) Total interest-earning assets $ 17,525,796 $ 253,533 5.80 % Net

interest income and net interest margin $ 203,623 4.66 % Less net

impact of covered loan dispositions (31,163 ) Net interest income

and net interest margin, excluding net impact of covered

loan dispositions $ 172,460 3.95 % (1) Annualized.

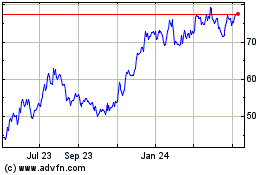

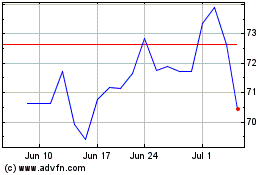

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2024 to Jun 2024

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jun 2023 to Jun 2024