0001101680false00011016802024-01-082024-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 8, 2024

DZS INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 000-32743 | 22-3509099 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

5700 Tennyson Parkway, Suite 400

Plano, TX 75024

(Address of Principal Executive Offices, Including Zip Code)

(469) 327-1531

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | DZSI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 4.01 Changes in Registrant’s Certifying Accountant.

On January 25, 2024, DZS Inc. (the “Company”) was notified by the Company’s independent registered public accounting firm, Ernst & Young LLP (“EY”), of its decision to resign as independent registered public accounting firm of the Company, effective as of that date. The Audit Committee of the Board of Directors of the Company (the “Audit Committee”) accepted EY’s resignation.

The Company and the Audit Committee have initiated discussions with other independent registered public accounting firms to represent the Company for the year ended December 31, 2023, as well as the restatement of the 2022 Annual Financial Statements (as defined below).

During the two most recent fiscal years ended December 31, 2023 and 2022 and the subsequent interim period through the date of this Form 8-K, there were no disagreements (as described in Item 304(a)(1)(iv) of Regulation S-K under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”)) between the Company and EY on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to EY’s satisfaction, would have caused EY to make reference to the subject matter of the disagreement in connection with its reports on the Company’s consolidated financial statements for such periods.

During the two most recent fiscal years ended on December 31, 2023 and 2022 and the subsequent interim periods through the date of this Form 8-K, there were no reportable events (as described in Item 304(a)(1)(v) of Regulation S-K under the Exchange Act), except that (i) as previously disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, management concluded that the Company’s disclosure controls and procedures as of December 31, 2022 were not effective due to a material weakness in internal control over financial reporting relating to the revenue recognition for a significant sales agreement with an existing customer and (ii) as previously reported in the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission (the “SEC”) on November 9, 2023, the Audit Committee, in consultation with the Company’s management, determined that the Company’s previously issued unaudited condensed consolidated financial statements as of and for the three months ended March 31, 2023 (the “Q1 2023 Financial Statements”), the Company’s previously issued audited consolidated financial statements as of and for the year ended December 31, 2022 (the “2022 Annual Financial Statements”), as well as the Company’s previously issued unaudited condensed consolidated financial statements as of and for each of the three months ended March 31, 2022, the three and six months ended June 30, 2022 and the three and nine months ended September 30, 2022 (collectively, the “2022 Interim Financial Statements” and, together with the 2022 Annual Financial Statements, the “2022 Financial Statements” and, together with the Q1 2023 Financial Statements, the “Affected Financial Statements”), should no longer be relied upon and should be restated due to accounting errors in each of the 2022 Financial Statements relating to revenue recognition. Similarly, any previously issued or filed reports, press releases, earnings releases, investor presentations or other communications of the Company describing the Company’s financial results or other financial information relating to the periods covered by the Affected Financial Statements should no longer be relied upon. In addition, the report of EY included in the previously issued 2022 Annual Financial Statements should no longer be relied upon.

As a result of the accounting errors, the Company intends to (a) restate the 2022 Annual Financial Statements and the notes thereto in an amendment to the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “Amended 10-K”) to be filed with the SEC, (b) restate the 2022 Interim Financial Statements and the notes thereto in amendments to each of the Company’s Quarterly Reports on Form 10-Q for the three months ended March 31, 2022, the three and six months ended June 30, 2022 and the three and nine months ended September 30, 2022 (each, a “2022 Amended 10-Q”) to be filed with the SEC, (c) restate the Q1 2023 Financial Statements and the notes thereto in an amendment to the Company’s Quarterly Report on Form 10-Q for the three months ended March 31, 2023 (together with the 2022 Amended 10-Qs, the “Amended 10-Qs”) and (d) amend, among other related disclosures, its Management’s Discussion and Analysis of Financial Condition and Results of Operations for the applicable periods in the Amended 10-K and Amended 10-Qs. The adjustments to such financial statement items will be set forth through expanded disclosure in the financial statements included in the Amended 10-K and Amended 10-Qs, including further describing the restatements and their impact on previously reported amounts.

Although the Company cannot at this time estimate when it will file its restated financial statements, the Amended 10-K or the Amended 10-Qs, it is diligently pursuing completion of the restatements and intends to make such filings as soon as reasonably practicable.

The Company’s management also is assessing the effect of the matters identified to date and the restatements on the Company’s internal control over financial reporting and its disclosure controls and procedures. Although the assessment is not yet complete, the Company anticipates that the review by the Audit Committee described above will result in the disclosure of one or more material weaknesses in the Company’s internal control over financial reporting during the applicable periods, in addition to the Company’s previously identified and reported material weakness for fiscal year 2022.

The Company has provided EY with a copy of the disclosures in this Form 8-K and requested that EY furnish the Company with a letter addressed to the SEC stating whether EY agrees with the disclosures contained herein. A copy of EY’s letter, dated January 30, 2024, is filed as Exhibit 16.1 to this Form 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 8, 2024, the Company promoted Raghu Marthi from Chief Information Officer to Chief Operations Officer. As a result of this promotion, Mr. Marthi will oversee the Company’s sales pipeline, commercial bid desk, order management, master planning, manufacturing, and the underlying information technology systems that align with the Company’s quota to cash value chain.

Raghu Marthi, age 50, joined DZS as Chief Information Officer in September 2021, bringing 25 years of experience in information technology to the Company through leadership of complex company-wide application development, data management, technology infrastructure, data center operations and telecommunication networks worldwide. Prior to DZS, Mr. Marthi was Chief Information Officer at MediaKind from January 2019 to September 2021, where he was responsible for information technology and digital strategy spanning applications, data, cybersecurity and infrastructure. He has also held a variety of management and technical leadership positions at Ericsson, Hewlett Packard, PricewatershouseCoopers, HCL and Dresser Industries. Mr. Marthi holds a Bachelor’s degree in Mathematics and Physics from Nizam College, a Master's degree in Computer Science from Osmania University, and also earned his Master's degree in Business Administration from SC Johnson Graduate School of Management at Cornell University.

On January 19, 2024, Norman Foust departed from the Company, including his position as Senior Vice President of Global Supply Chain of the Company.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 16.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: January 30, 2024 | DZS Inc. |

| | | |

| By: | /s/ Misty Kawecki |

| | Misty Kawecki |

| | Chief Financial Officer |

Exhibit 16.1

| | | | | | | | |

| Ernst & Young LLP 2323 Victory Avenue Suite 2000 Dallas, TX 75219 | Tel: +1-214-969-8000 Fax: +1 214 969 8586 www.ey.com |

January 30, 2024

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Commissioners:

We have read Item 4.01 of Form 8-K dated January 30, 2024 of DZS Inc. and are in agreement with the statements contained in the first, third and fourth paragraphs on the first page therein. We have no basis to agree or disagree with other statements of the registrant contained therein.

/s/ Ernst & Young, LLP

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

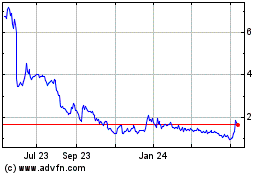

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

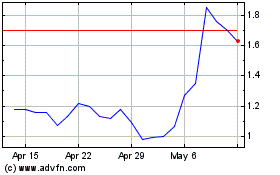

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Apr 2023 to Apr 2024