Form 8-K - Current report

January 17 2024 - 7:00AM

Edgar (US Regulatory)

0001101680false00011016802024-01-172024-01-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 17, 2024

DZS INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 000-32743 | 22-3509099 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

5700 Tennyson Parkway, Suite 400

Plano, TX 75024

(Address of Principal Executive Offices, Including Zip Code)

(469) 327-1531

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | DZSI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

On January 17, 2024, DZS Inc. (the “Company”) plans to make a presentation at the 26th Annual Needham Growth Conference. The Company has prepared presentation materials (the “Presentation Materials”) to be used in such presentation. The Presentation Materials are furnished as Exhibit 99.1 to this Current Report on Form 8-K and are incorporated herein by reference.

The information contained in the Presentation Materials is summary information that should be considered within the context of the Company’s filings with the Securities and Exchange Commission and other public announcements that the Company may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K, and the Company specifically disclaims any obligation to update the Presentation Materials.

The information furnished in Item 7.01 of this Form 8-K, including the exhibit attached, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: January 17, 2024 | DZS Inc. |

| | | |

| By: | /s/ Misty Kawecki |

| | Misty Kawecki |

| | Chief Financial Officer |

© 2024 DZS – Proprietary and Confidential January 2024 Investor Presentation 1 NASDAQ: DZSI

© 2024 DZS – Proprietary and Confidential This presentation contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate, and reflect the beliefs and assumptions of our management as of the date hereof. We use words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions to identify forward-looking statements. Such statements include, but are not limited to, statements about the consummation and timing of the Asia business divestiture, the anticipated benefits of, and opportunities from, the divestiture, including the impact to the Company’s balance sheet, operations and financial results. In addition, statements that refer to projections of earnings, revenue, costs or other financial items in future periods; anticipated growth and trends in our business, industry or key markets; cost synergies, growth opportunities and other potential financial and operating benefits of our acquisitions; future growth and revenues from our products; our plans and our ability to refinance or repay our existing indebtedness prior to the applicable maturity dates; our ability to access capital to fund our future operations; future economic conditions and performance; the impact of the global outbreak of COVID-19, also known as the coronavirus; the impact of interest rate and foreign currency fluctuations; anticipated performance of products or services; competition; plans, objectives and strategies for future operations, including our pursuit or strategic acquisitions and our continued investment in research and development; other characterizations of future events or circumstances; and all other statements that are not statements of historical fact, are forward-looking statements within the meaning of the Securities Act and the Exchange Act. Although we believe that the assumptions underlying the forward- looking statements are reasonable, we can give no assurance that our expectations will be attained. Readers are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date on which they are made. Except as required by law, the Company undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise. Factors which could have a material adverse effect on our operations and future prospects or which could cause actual results to differ materially from our expectations include those risk factors contained in the Company’s SEC filings available at www.sec.gov, including without limitation, the Company’s annual report on form 10-K, quarterly reports on Form 10-Q and subsequent filings. 2 Forward-Looking Statements

© 2024 DZS – Proprietary and Confidential Growth Differentiated Products Acquisitions Gross Margins Competitive Landscape Double digit growth across North America and EMEA over the next 3-5 years based on pipeline and trial activity Why We Are Divesting Asia* North America and EMEA adopting open, standards-based software defined networking Asia represents unfavorable headwind to current and future gross margins. North America and EMEA focus provides a path to exceed 40% gross margins. Focused on markets aligned with CSPs that are adopting technology and 5G and FTTX solutions from suppliers that do not pose security risk Acquisitions aligns with North America and EMEA: • Optelian (Saber), • Assia (Network Assurance and WiFi Management) • RIFT (automation and orchestration) * On Jan. 5, 2024, DZS signed a definitive agreement to sell its Asia operations to Korea-based DASAN Networks Inc. (DNI). The information provided in this presentation reflects the DZS business and operations after giving effect to this sale; however, the transaction has not been consummated. It is expected to close in February 2024, subject to regulatory approvals and other customary closing conditions.

© 2024 DZS – Proprietary and Confidential © 2024 DZS – Proprietary and Confidential Supply chain normalizing post-pandemic Spending anticipated to resume during the 2H24 following temporary supply chain management $100B in global government stimulus $42B U.S. BEAD program anticipated to begin 2H24 Access and Subscriber 17% CAGR 2023-2026 (Omdia) Optical Edge 8% CAGR 2023-2026 (Omdia) Cloud Edge 32% CAGR 2023-2026 (Omdia) Market Environment

© 2024 DZS – Proprietary and Confidential A broadband networking and AI cloud focused pure-play focused on the Americas, EMEA, and New Zealand and Australia Focused Aligned AgileThe New DZS Middle East & Africa Post Closing of DNS Asia – New DZS Australia & New Zealand Central America/Latin America North America Europe

© 2024 DZS – Proprietary and Confidential A global leader in access, optical and cloud-controlled software defined solutions The New DZS Agile Open Cloud Native Future-ready Headquarters Dallas, TexasDZSI Founded 1999 250+ CUSTOMERS 50+ COUNTRIES 50+ Million CLOUD CONNECTED HOMES/ BUSINESS Our Product Portfolio We Give Our Customers Our Mission Transforming today’s communications service providers to tomorrow’s experience providers

© 2024 DZS – Proprietary and Confidential Management Team Raghu Marthi Chief Operations Officer Misty Kawecki Chief Financial Officer Justin Ferguson Chief Legal Officer Laura Larson Chief People Officer Gunter Reiss Chief Customer Officer Miguel Alonso Chief Product Officer Charlie Vogt President & CEO

© 2024 DZS – Proprietary and Confidential Customer Footprint 25 of the Top 50 Telecoms Globally Are Customers

© 2024 DZS – Proprietary and Confidential Vision Disruptor in Access, Optical, and Cloud-controlled SDN solutions A focus on the Network Edge Standards-based End-to-End visibility and assurance Future-ready Environmentally hardened Strategy A broadband networking and AI cloud pure-play focused on the Americas, EMEA, and New Zealand & Australia Agile Solutions-focused Customer-first Leverage common architectures Partner-aligned BABA-ready

© 2024 DZS – Proprietary and Confidential Growth Pillars Broadband FTTx Upgrade Cycle North America & EMEA Expansion Chinese Replacement Cloud Software Open RAN 5-7 year duration Differentiated products: Customers returning to normal order patterns in 2024+ Expect high margin regions to exceed revenue growth DZS 2020-2022 Revenue CAGR North America 44% EMEA 10% Geo security conners resulting in cap and grow opportunity Cross selling to contribute margin expansion potential A growing market with high interest from CSPs Saber 4400 and M4000 are category defining

© 2024 DZS – Proprietary and Confidential 11 Market Opportunity Rural Environments Urban Environments IoT connected devices expected to grow to 75B by 2025 Source: Statista Mobile data traffic expected to grow 55%/yr by 2030 Source: Cisco Emerging apps to require 10-500 Gbps per instance/stream Source: Cisco AI software revenue expected to double over next 3 years driven by operations/experience Source: Infopulse PON expected to grow at 17% CAGR from 2023-2026 Source: Omdia Projected bandwidth per home exceeds multi-gig by 2028 Source: RVA LLC $150+ billion of government stimulus & private investment to close digital gap Source: DZS Analysis High speed internet & 5G growth amplifying demand for optical edge Source: Omdia

© 2024 DZS – Proprietary and Confidential Serviceable Addressable Market $0 $5 $10 $15 $20 $25 $30 2023 2026 (B illi on s) Sources: DZS analysis and the following Omdia reports, (1) Fiber and Copper Access Equipment Forecast – 2023-2028, March 2023, (2) Optical Networks Forecast 2022-2027, “Metro WDM”, December 2022, (3) Macrocell Mobile Backhaul Equipment Market Tracker 2H20, December 2020, (4) NFV Tracker – 2H22 Data Half-Year Update, “NFV MANO”, September 2022 (5) Carrier SDN Tracker – 1H 2022 Annual Forecast, May 2022, (6) Mobile Fronthaul Equipment Market Report – 2020, July 2020, (7) Telco Network and Service Automation Market Database – 2022. “Market Forecast”, December 2022. Results not an endorsement of DZS. Any reliance on these results is at the third-party’s own risk. 17% CAGR

© 2024 DZS – Proprietary and Confidential The DZS Edge Easy Integration Lower CAPEX and OPEX Futureproof Better Business Outcomes Trusted Advice Vendor Agnostic E2E Network Automation Performance at Scale Flexible Form Factors and Pricing Technical Support

© 2024 DZS – Proprietary and Confidential 14 A New Network EDGE Architecture Subscriber DevicesCloud EDGECore Network Network Open and Standard Scalable Distributed Intelligence Software Service Agility And Convergence Network Convergence Performance Optimization Optical EDGE Access EDGE Subscriber EDGE

© 2024 DZS – Proprietary and Confidential Disruptive Access, Optical, SDN Innovation Access/Subscriber EDGE Optical EDGE Automation, Assurance, WiFi Experience Mgmt. Containerized OS Netconf/Yang

© 2024 DZS – Proprietary and Confidential Custom Hardware & Software with Standards-based Data, Control and Management Interfaces Access SDN Controller with NetConf provisioning Network Orchestrator OLT Vendor SDN-C Vendor Orchestration Vendor Standard YANG Models Enables 3rd party IOP Standard API Enables 3rd party IOP 3rd Party Unprecedented Network Agility

© 2024 DZS – Proprietary and Confidential Access Orchestration Capabilities 17 Manage device configurations across access domain and vendors Service design UI and intent-driven flow-through activation Single-Pane of Glass for service health and performance Single, stable, standards-compliant APIs regardless of service or supplier OLT ONT RG BNG

© 2024 DZS – Proprietary and Confidential AI-driven Cloud EDGE Software Multi-Vendor SDN Orchestration & Automation WiFi Experience Management Network & Service Assurance

© 2024 DZS – Proprietary and Confidential 19 Managing Experience for 50M+ Subscribers

© 2024 DZS – Proprietary and Confidential Thank You 20

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

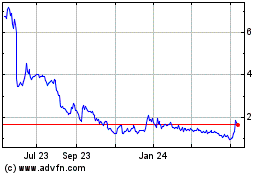

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

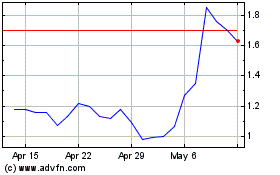

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Apr 2023 to Apr 2024