0001101680false00011016802023-12-292023-12-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 29, 2023

DZS INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 000-32743 | 22-3509099 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

5700 Tennyson Parkway, Suite 400

Plano, TX 75024

(Address of Principal Executive Offices, Including Zip Code)

(469) 327-1531

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.001 par value | DZSI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

Loan Agreement

On December 29, 2023, DZS Inc., as borrower (the “Company”), entered into a Loan Agreement (the “Loan Agreement”) with EdgeCo, LLC (“EdgeCo”), as lender. Pursuant to the Loan Agreement, the Company received a three-year term loan in an aggregate principal amount equal to $15,000,000 (the “Loan”). The principal amount of the Loan is payable on December 29, 2026 and bears interest at a fixed rate of 13.0% per annum. Interest is payable monthly in arrears. If the Loan is prepaid prior to the 18-month anniversary of funding, the Company will owe a prepayment fee equal to 18 months’ interest minus the amount of interest actually paid prior to such prepayment. The Loan is secured by certain assets of the Company.

The Loan Agreement contains various covenants that limit the ability of the Company (and in certain cases, certain of its subsidiaries) to, among other things, enter into any merger or consolidation, incur indebtedness, incur liens, make dividends or stock repurchases, and acquire any businesses (other than a similar business to that of the Company).

The Loan Agreement contains events of default that are customary for loans of this type. If an event of default occurs under the Loan Agreement, EdgeCo will be entitled to accelerate and call the unpaid principal balance of the Loan and all accrued interest and to take various actions against the collateral, including by exercising its right to acquire or sell the collateral to satisfy any obligations under the outstanding indebtedness.

The Loan Agreement also (i) includes preemptive rights that allow EdgeCo to exercise a right of first refusal in the event the Company decides to seek additional debt financing of up to $15 million for additional operating capital or to offer for sale additional unregistered shares of its common stock, par value $0.001 per share (the “Common Stock”), before December 31, 2026 and (ii) in connection with the Warrant Agreement (as defined below), provides EdgeCo with the right to designate a member of the Company’s Board of Directors, in each case subject to certain limitations and exceptions. In particular, EdgeCo’s designation right will terminate upon (x) the payment in full of the loan obligations and (y) its ownership of the Company’s Common Stock being less than 4.9% of the total outstanding Common Stock.

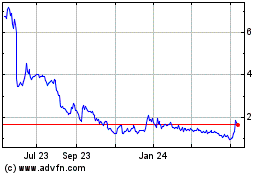

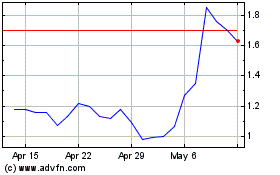

In connection with the Loan Agreement, the Company also entered into (i) a Warrant Agreement (the “Warrant Agreement”), dated as of December 29, 2023, by and between the Company and EdgeCo that issued a warrant to EdgeCo to subscribe for 6,100,000 shares of Common Stock at an exercise price of $1.84 per share, which represents the closing price of the Common Stock on NASDAQ on the trading day immediately preceding the date of the Warrant Agreement, and (ii) a Registration Rights Agreement (the “EdgeCo Registration Rights Agreement”), dated as of December 29, 2023, by and between the Company and EdgeCo that provides EdgeCo customary demand and piggyback registration rights for the 6,100,000 shares of Common Stock underlying the warrant, in the event the warrant is exercised. The warrant was not registered under the Securities Act of 1933, as amended (the “Securities Act”), and was issued pursuant to the private placement exemption from registration thereunder provided by Section 4(a)(2) of the Securities Act.

The foregoing description of each of the Loan Agreement, the Warrant Agreement and the EdgeCo Registration Rights Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Loan Agreement, the Warrant Agreement and the EdgeCo Registration Rights Agreement, which agreements are filed as Exhibits 10.1, 10.2 and 10.3, respectively, to this Current Report on Form 8-K (this “Current Report”) and are each incorporated herein by reference.

Private Placement

On December 29, 2023, the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with IV Global Fund No. 4, a Korean limited partnership (“IV Global Fund”). The general partner of IV Global Fund, Invites Ventures Co., Ltd., and its limited partners are affiliates of DASAN Networks, Inc., a significant stockholder of the Company (“DNI”). Pursuant to the Securities Purchase Agreement, the Company agreed to issue 5,434,783 shares (the “Private Placement Shares”) of Common Stock to IV Global Fund, at a purchase price of $1.84 per share, which represents the closing price of the Common Stock on NASDAQ on the trading day immediately preceding the date of the Securities Purchase Agreement, for an aggregate purchase price of approximately $10,000,000. The issuance and sale of the Private Placement Shares was consummated on January 3, 2024. The Private Placement Shares were not registered under the Securities Act and were issued pursuant to the private placement exemption from registration thereunder provided by Section 4(a)(2) of the Securities Act. Pursuant to the Securities Purchase Agreement, (i) IV Global Fund is not permitted to offer, sell or otherwise transfer the Private Placement Shares for a period of six months from the closing of the transaction under the Securities Purchase Agreement and (ii) IV Global Fund is entitled to designate a member of the Company’s Board of Directors, in each case subject to certain limitations and exceptions, including in the case of the designation right, that IV Global Fund owns 4.9% or more of the total outstanding Common Stock of the Company.

The Securities Purchase Agreement contains customary representations, warranties and agreements by the Company and IV Global Fund, and customary indemnification obligations of the Company and IV Global Fund. The representations, warranties and covenants contained in the Securities Purchase Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement and may be subject to limitations agreed upon by the contracting parties.

In connection with the closing of the transaction contemplated by the Securities Purchase Agreement, the Company, IV Global Fund and DNI entered into an Amended and Restated Registration Rights Agreement (the “Amended and Restated Registration Rights Agreement”), which amends and restates the existing Registration Rights Agreement, dated as of December 9, 2016, by and between the Company and DNI, to, among other things, (i) add IV Global Fund as a party, (ii) include the Private Placement Shares as Registrable Securities (as defined in the Amended and Restated Registration Rights Agreement) thereunder and (iii) provide that the demand registration rights shall not apply until the Company is eligible to register the Common Stock on Form S-3 under the Securities Act. The Amended and Restated Registration Rights Agreement includes customary demand and piggyback registration rights.

The foregoing description of each of the Securities Purchase Agreement and the Amended and Restated Registration Rights Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Securities Purchase Agreement and the Amended and Restated Registration Rights Agreement, which agreements are filed as Exhibits 10.4 and 10.5, respectively, to this Current Report and are each incorporated herein by reference.

Sale of Asia-Pacific Business

On January 5, 2024, the Company and DZS California Inc. (“DZS California”), a wholly owned subsidiary of the Company, entered into a Stock Purchase Agreement (the “Stock Purchase Agreement”) with DNI. Pursuant to the Stock Purchase Agreement, DZS California will, subject to customary closing conditions, sell to DNI all of the equity interests in DASAN Network Solutions, Inc., a Korean company (“DNS”), D-Mobile Limited, a Chinese company, DZS Vietnam Company Limited, a Vietnamese company, Dasan India Private Limited, an Indian company, and DZS Japan, Inc., a Japanese company (collectively, the “Target Companies”), for a purchase price of approximately $48,000,000, consisting of $5,000,000 in cash, subject to certain adjustments, the elimination of approximately $34,000,000 in debt owed to DNI and the retention at DNS of approximately $9,000,000 in debt owed to DNI (the “Asia Sale”). The closing of the Asia Sale is expected to occur in February 2024, subject to the satisfaction or waiver of a number of conditions set forth in the Stock Purchase Agreement, including, among others, certain regulatory approvals in one or more non-U.S. jurisdictions.

The Stock Purchase Agreement contains representations, warranties and covenants of the parties customary for a transaction of this nature. In addition, the Company and DZS California, on the one hand, and DNI, on the other hand, have agreed to indemnify each other and their respective affiliates, shareholders, members, officers, directors, employees and other representatives for certain losses, including, among other things, breaches of representations, warranties and covenants, subject to certain negotiated limitations, deductibles, thresholds and survival periods set forth in the Stock Purchase Agreement.

The foregoing description of the Stock Purchase Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Stock Purchase Agreement, which agreement is filed as Exhibit 2.1 to this Current Report and is incorporated herein by reference. This summary of the principal terms of the Stock Purchase Agreement and the copy of the Stock Purchase Agreement filed as Exhibit 2.1 have been included to provide investors with information regarding its terms. It is not intended to provide any other factual information about the Company, DZS California, the Target Companies, DNI or any of their respective subsidiaries or affiliates. In particular, the assertions embodied in the representations and warranties contained in the Stock Purchase Agreement are qualified by information in confidential disclosure schedules provided by the parties in connection with the signing of the Stock Purchase Agreement. These confidential disclosure schedules contain information that modifies, qualifies and creates exceptions to the representations and warranties and certain covenants set forth in the Stock Purchase Agreement. Moreover, the representations, warranties and covenants in the Stock Purchase Agreement were made as of specific dates, were made solely for the Stock Purchase Agreement and for the purposes of allocating risk between the parties to the Stock Purchase Agreement, rather than establishing matters as facts, are solely for the benefit of such parties, may be subject to qualifications or limitations agreed upon by such parties and may be subject to standards of materiality applicable to such parties that differ from those generally applicable to investors and reports and documents filed with the Securities and Exchange Commission (the “SEC”). Accordingly, investors are not third-party beneficiaries under the Stock Purchase Agreement and the representations, warranties and covenants in the Stock Purchase Agreement, and any descriptions thereof, should not be relied on as characterizations of the actual state of facts or circumstances of the Company, DZS California, the Target Companies, DNI or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of such representations, warranties and covenants may change after the date of the Stock Purchase Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Current Report contains forward-looking statements regarding future events and the Company’s future results that are subject to the safe harbors created under the Private Securities Litigation Reform Act of 1995. These statements reflect the beliefs and assumptions of the Company’s management as of the date hereof. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions are intended to identify forward-looking statements. Such statements include, but are not limited to, statements about the consummation and timing of the Asia Sale. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. The Company’s actual results could differ materially and adversely from those expressed in or contemplated by the forward-looking statements. Factors that could cause actual results to differ include, but are not limited to, those risk factors contained in the Company’s SEC filings available at www.sec.gov, including without limitation, the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q and subsequent filings. In addition, additional or unforeseen affects from the COVID-19 pandemic and the global economic climate may give rise to or amplify many of these risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. The Company undertakes no obligation to update or revise any forward-looking statements for any reason.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report regarding the Loan Agreement is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information provided in Item 1.01 of this Current Report regarding the Warrant Agreement and the Securities Purchase Agreement is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

The Company issued a press release on January 5, 2024 disclosing the transactions described above. A copy of that press release is attached as Exhibit 99.1 hereto and incorporated by reference herein.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 7.01, including Exhibit 99.1, are deemed to be “furnished” and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 2.1* | | |

| 10.1* | | |

| 10.2 | | |

| 10.3 | | |

| 10.4* | | |

| 10.5 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Schedules and similar attachments to this Exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the U.S. Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: January 5, 2024 | DZS Inc. |

| | | |

| By: | /s/ Misty Kawecki |

| | Misty Kawecki |

| | Chief Financial Officer |

주식매매계약서

STOCK PURCHASE AGREEMENT

본 주식매매계약서(이하 “본 계약”)는 델라웨어 주 법에 따라 설립된 DZS INC.(이하 “DZS”), DZS의 완전자회사로 캘리포니아 주 법에 따라 설립된 DZS CALIFORNIA, INC.(이하 “매도인”)와 대한민국법에 따라 설립된 주식회사 다산네트웍스(이하 “매수인”) 사이에서 2024. 1. 5. 체결되었다. 본 계약의 일방 당사자를 말할 때에는 “당사자” 라 하고, 당사자 모두를 말할 때에는 “당사자들” 이라 한다.

THIS STOCK PURCHASE AGREEMENT, dated as of January 5, 2024 (this “Agreement”), is by and among DZS Inc., a company incorporated under the laws of the State of Delaware (“DZS”), DZS CALIFORNIA INC., a company incorporated under the laws of the State of California and a wholly owned subsidiary of DZS (the “Seller”), and DASAN NETWORKS, INC., a company incorporated under the laws of Korea (the “Purchaser”). Each party to this Agreement shall be referred to as a “Party” and shall collectively be referred to as “Parties”.

전 문

RECITALS

DZS는 매도인이 발행한 주식 전부를 소유하고 있고, 매도인은 주식회사 다산네트웍솔루션즈, D-Mobile Limited(중국어 상호 “大山網路”), DZS Vietnam Company Limited, Dasan India Private Limited, DZS Japan, Inc.(이하 통칭하여 “본건 대상 회사들”)에 관하여 별첨 목록 1에 기재된 것과 같은 주식 또는 지분권(이하 “본건 매매대상 주식”)을 보유하고 있다.

WHEREAS, DZS owns all stocks issued by the Seller, and the Seller owns such stocks or equity interests issued by DASAN Network Solutions, Inc., D-Mobile Limited(“大山網路” in Chinese language), DZS Vietnam Company Limited, Dasan India Private Limited and DZS Japan, Inc. (collectively the “Companies”) as are stipulated in the Schedule 1 (the “Stocks”);

DZS, 매도인 및 매수인의 각 이사회는 매도인이 본건 매매대상 주식을 매수인에게 매도함이 각자의 영업 및 주주이익을 위하여 최선이라는 결론에 이르렀다.

WHEREAS, the respective Boards of Directors of DZS, the Seller and the Purchaser have determined that the sale and purchase of the Stocks between the Seller and the Purchaser is in furtherance of and consistent with their respective business strategies and is in the best interest of their respective stockholders;

(i) DZS의 전략위원회 및 이어서 DZS의 이사회는 본 계약과 본 계약에 따른 거래가 공정하며, 권고되고, DZS와 (매수인 및 그 관계사를 제외한)DZS의 주주들의 최선의 이익을 위한다고 결정하였으며, (ii) 매도인 및 매수인의 각 이사회는 본 계약에 따라 매도인이 본건 매매대상 주식을 매수인에게 매도하는 거래를 승인하고 의결하였다.

WHEREAS, (i) the Strategy Committee of the Board of Directors of DZS and, subsequently, the Board of Directors of DZS have determined that this Agreement and the transactions contemplated hereby are fair to, advisable and in the best interest of DZS and the stockholders of DZS other than Purchaser and its affiliates, and approved this Agreement, and (ii) the respective Boards of Directors of the Seller and the Purchaser have approved and declared the acquisition by the Purchaser of the Stocks from the Seller upon the terms and subject to the conditions of this Agreement; and

매도인은 본 계약에서 정해지는 조건과 내용에 따라 본건 매매대상 주식 전부를 매수인에게 매도하고자 하고, 매수인은 이를 매수하고자 한다.

WHEREAS, the Seller desires to sell to the Purchaser, and the Purchaser desires to purchase from the Seller, all of the Stocks subject to the terms and conditions set forth in this Agreement.

이에 당사자들은 각자의 진술과 보장, 의무이행사항 등을 규정하고 구속력을 부여하기 위하여 아래와 같이 약정한다.

NOW THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this Agreement and intending to be legally bound hereby, the Parties agree as follows:

제1조 [주식의 매매]

ARTICLE I [STOCK PURCHASE]

① 본 계약에 따라 매도인이 매도하고 매수인이 매수하는 본건 매매대상 주식은 별첨 목록 1에 기재된 것과 같다.

The Stocks to be sold by the Seller and to be purchased by the Purchaser subject to the terms and conditions of this Agreement are as set forth in the Schule 1.

② 본건 매매대상 주식에 대한 매매대금은 미화38,733,969.16달러로 하고(이하 “본건 매매대금”), 그 중 미화3,784,178.75달러는 현금으로 지급하고(이하 “본건 현금지급 부분”), 본건 매매대금의 잔여분은 별첨 목록 2, Part B에 보다 상세히 기재된 다산네트웍솔루션즈가 매수인으로부터 차입한 차입금에 대한 매수인의 채권(이하 “본건 차입급채권”)을 매수인이 매도인에게 양도함으로써 지급한다. 오해의 소지가 없도록 부언하면, 본건 매매대금의 최종적인 금액은 거래종결일을 기준으로 아래와 같이 결정되고 확정된다.

본건 매매대금의 최종적인 금액 = 본건 현금지급 부분 + 본건 차입급채권 – 제1조 제3항에 따라 차감되는 금액 + 제1조 제4항에 따라 가산되는 금액

The purchase price to be paid by the Purchaser for the Stocks shall be US$38,733,969.16 (the “Purchase Price”). US$3,784,178.75 of the Purchase Price shall be paid in cash (the “Cash Payment”) and the balance of the Purchase Price shall be paid by the Purchaser’s transfer to the Seller of those certain loan receivables owed to the Purchaser by DASAN Network Solutions, Inc., which are more particularly described on Part B of Schedule 2 (the “Loan Receivables”). For avoidance of doubt or misunderstanding, the definitive sum of the Purchase Price shall be decided and fixed as of the Closing Date as follows:

The definitive sum of the Purchase Price = Cash Payment + Loan Receivables – the sum to be deducted pursuant to Section 1.3 + the sum to be added pursuant to Section 1.4

③ 본건 대상 회사들이 DZS와 매수인 간 체결된 2023. 12. 13.자 의향서 (이하 “본건 의향서”)의 체결일부터 거래종결일까지의 사이에, DZS 또는 본건 대상 회사들을 제외한 DZS의 특수관계인(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)에게 보낸 일체의 금전은 본건 매매대금에서 차감된다. 본건 대상 회사들을 제외한 DZS의 특수관계인 전부 및 DZS를 통칭하여 “본건 비대상 회사들” 이라 한다. 오해의 소지가 없도록 부언하면, 주식회사 다산네트웍솔루션즈가 2023. 12. 13. DZS에게 보낸 미화1,215,821.25달러는 이미 제1조 제2항에 기재된 본건 현금지급 부분 금액에 반영되었고, 본건 현금지급 부분에서 차감되지 않는다.

Any cash payment made by any of the Companies to DZS or any of its Affiliates (defined in Section 10.12, same meaning in other parts of this Agreement) other than the Companies from the date of the letter of the intent dated December 13, 2023 by and between DZS and the Purchaser (the “LOI”) until the Closing Date, shall be deducted with respect to the payment of the Purchase Price. DZS and all of its Affiliates other than the Companies shall be referred to collectively as the “Non-Acquired Entities”. For avoidance of doubt or misunderstanding, US$1,215,821.25 sent to DZS by DASAN Network Solutions, Inc. on the date of December 13, 2023, has been already reflected on the sum of the Purchase Price stated in Section 1.2, and shall not be deducted with respect to the payment of the Purchase Price.

④ 본건 비대상 회사들이 본건 의향서의 체결일부터 거래종결일까지의 사이에, 본건 대상 회사들에게 보낸 일체의 금전은 본건 매매대금에 가산된다.

Any cash payment made by any of Non-Acquired Entities to any of the Companies from the date of the LOI entered into by DZS and the Purchaser until the Closing Date, shall be added with respect to the payment of the Purchase Price.

제2조 [본건 매매대금의 지급 및 본건 매매대상 주식의 이전 등]

ARTICLE II [CLOSING]

① 본건 매매대상 주식의 매매 및 이전의 종결(이하 “거래종결”)은 (1) 2024. 2. 1. (단, 해당 일자에 제6조에서 정한 거래종결을 위한 선행조건들이 모두 충족 또는 면제되었어야 함)과 (2) 제6조에서 정한 거래종결을 위한 선행조건들이 모두 충족 또는 면제된 날로부터 3 영업일이 되는 날 중 먼저 도래하는 날짜에 이루어진다. 이하 거래종결이 이루어지는 날을 “거래종결일” 이라 한다.

Subject to the terms and conditions set out in this Agreement, the closing of the sale, purchase and transfer of the Stocks (the “Closing”) shall take place on the earlier of: (i) February 1, 2024, provided that all of the conditions precedent for the Closing set forth in Article VI have been satisfied or waived as of such date; or (ii) the third business day after the date on which all of the conditions precedent for the Closing set forth in Article VI have been satisfied or waived. The date of the Closing shall be referred to as the “Closing Date”.

② 매수인은 거래종결일에 매도인이 본 조 제3항 기재 의무를 이행함과 동시에 다음 각 호의 사항을 이행해야 한다.

Concurrently upon performance by the Seller of its obligations under Section 2.3, the Purchaser shall perform each of the following obligations:

(1)매수인은 거래종결일에 매도인이 서면으로 지정한 계좌로 제1조 제3항에 따라 차감되고 제1조 제4항에 따라 가산된 본건 현금지급 부분을 송금한다. 다만, 매수인은 본건 매매대금 지급과 관련하여 [한미조세협약(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)을 포함한] 대한민국의 법령 (제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)에 따라 차감이나 지급보류가 필요한 경우에는 본건 현금지급 부분에서 필요한 만큼의 금액을 차감하거나 지급보류할 수 있다. 단, 거래종결 이전 매도인이 매수인에게 매도인이 한미조세협약에 따라 어떠한 세액을 면제받을 수 있다는 점을 입증하는 문서를 교부하는 경우, 해당 세액은 차감되거나 지급보류할 수 없다. 이와 같이 지급보류되는 금액은 정부기관(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)에 지급되는 한 매도인에게 완전하게 지급된 것으로 간주한다.

On the Closing Date, the Purchaser shall pay the Cash Payment, which is decreased according to Section 1.3 and increased according to Section 1.4, by wire transfer in immediately available funds at Closing to an account designated by the Seller in writing; provided however, that the Purchaser shall be entitled to deduct and withhold from the Cash Payment such amounts as are required to be deducted and withheld with respect to the payment of the Purchase Price under the Laws of the Republic of Korea, including the Korea-US Tax Treaty (defined in Section 10.12, same meaning in other parts of this Agreement),except that the amount of any taxes, with respect to which the Seller has furnished to the Purchaser documentation evidencing the Seller’s entitlement to exemption under the Korea-U.S. Tax Treaty prior to the Closing, shall not be deducted or withheld from the Purchase Price. To the extent that amounts are so withheld and paid over to the appropriate Governmental Entity (defined in Section 10.12, same meaning in other parts of this Agreement), such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the Seller.

(2)매수인이 제2조 제2항 제(1)호에 따라 본건 현금지급 부분을 지급함과 동시에, 본건 차입금 채권이 매도인에게 양도된 것으로 간주한다.

Concurrently upon payment of the Cash Payment by the Purchaser in accordance with Section 2.2(1) above, the Loan Receivables shall be deemed transferred to the Seller.

③ DZS 및 매도인은 매수인이 본 조 제2항 기재 의무를 이행함과 동시에 다음 각 호의 사항을 이행해야 한다.

Concurrently upon performance by the Purchaser of its obligations under Section 2.2, DZS and the Seller shall perform each of the following obligations:

(1)매수인은 별첨 목록 1 기재 주식들 중 주식회사 다산네트웍솔루션즈가 발행한 주식의 주권(이하 “본건 주권”)을 매수인에게 인도한다. 단, 당사자들은 본 계약 체결

일 현재 매수인이 본건 주권을 점유하고 있다는 점을 인정하며, 거래종결과 동시에 본건 주권에 대한 점유와, 이에 대한 모든 소유권 및 권리가 매도인으로부터 매수인에게로 이전된다는 것에 동의한다.

The Seller shall deliver to the Purchaser the share certificate representing the shares issued by DASAN Network Solutions, Inc. and owned by the Seller as set forth in the Schedule 1 (the “Share Certificates”); provided that the Parties acknowledge the Share Certificates are already in the possession of the Purchaser as of the date of this Agreement, and the Parties agree that the possession thereof, and all title, right and interest therein and thereto, shall have been transferred from the Seller to the Purchaser concurrently upon Closing.

(2)주식회사 다산네트웍솔루션즈로 하여금 거래종결일 현재 매수인이 본건 매매대상 주식에 관한 주주로 명의개서된 본건 대상 회사들의 대표이사의 원본대조필 확인이 있는 주주명부를 교부하도록 한다.

DZS and the Seller shall cause DASAN Network Solutions, Inc. to deliver to the Purchaser a copy of the shareholders registry of DASAN Network Solutions, Inc. certified as true and correct by the chief executive officer of it, evidencing the Purchaser’s ownership of the Stocks.

(3)주식회사 다산네트웍솔루션즈로 하여금 (i) 제2조 제2항 제2호에 따른 본건 차입금채권의 양도, (ii) 별첨 목록 2, Part A에 기재된 DZS가 다산네트웍솔루션즈에 부담하는 차입급채무(이하 “본건 차입금채무”)를 매도인이 승계하는 것 및 (iii) 제2조 제3항 제4호에 따라 거래종결과 동시에 본건 차입금채권과 차입금채무가 서로 상계하여 취소하는 것에 대한 동의서를 제출하도록 한다.

DZS and the Seller shall cause DASAN Network Solutions, Inc. to deliver to the Purchaser its written consent to: (i) the transfer of the Loan Receivables under Section 2.2(2); (ii) the assumption by the Seller of that certain loan payable by DZS owed to DASAN Network Solutions, Inc. as specified in Part A of Schedule 2 (the “Loan Payable”); and (iii) the mutual setting-off and cancellation of the Loan Receivable and the Loan Payable in accordance with Section 2.2.(4).

(4)거래종결시 매도인은 본건 차입금채권과 본건 차입금채무를 상호 상계하고 취소하여, 본건 차입금채권과 본건 차입금채무는 소멸한다. At Closing, the Seller shall set off and cancel the Loan Receivables and the Loan Payable against each other, and the Loan Receivables and the Loan Payable shall be terminated accordingly.

④ 거래종결 시 본건 매매대상 주식에 관한 모든 권리는 매수인에게 자동적으로 이전된다. DZS 및 매도인은 제2조 제3항 기재 의무의 이행 등 본건 매매대상 주식에 관한 모든 권리가 매도인으로부터 매수인에게 이전됨과 관련하여 필요한 모든 절차가 이루어질 수 있도록 협조한다.

All titles to the Stocks shall be transferred automatically from the Seller to the Purchaser upon Closing. DZS and the Seller shall cooperate with the Purchaser to complete all procedures required in relation to the transfer of the Stocks, including without limitation, the obligations set forth in Section 2.3.

⑤ DZS와 본건 대상 회사들 사이의 채권채무 전부는 거래종결일에 상계와 면제로 소멸한다.

All of intercompany receivables and payables between DZS and any of the Companies shall be terminated by net and writing off as of the Closing Date.

제3조 [DZS 및 매도인의 진술과 보장]

ARTICLE III [REPRESENTATIONS AND WARRANTIES OF DZS AND THE SELLER]

① 본 계약 체결일 현재 DZS가 미국 증권거래위원회에 신고하거나 제출한 보고서, 목록, 서식, 진술서, 인증서 또는 기타 문서 (이에 대한 별첨, 개정 및 보완을 포함함)에 기재된 바와 별첨 목록 3(이하 “공개 목록”)에 기재되어 있는 것을 제외하고는, DZS 및 매도인은 매수인에 대하여 본 계약 체결일 및 거래종결일 현재 아래 제2항 내지 제14항과 같은 사항들이 진실함을 보장한다.

Except as set forth in any report, schedule, form, statement, certification or other document (including exhibits, amendments, and supplements thereto) furnished or filed by DZS with the U.S. Securities and Exchange Commission as of the date hereof and as disclosed in the Schedule 3 (the “Disclosure Schedule”), which identifies exceptions by specific Section references, the Seller represents and warrants to the Purchaser the following Section 3.2 through Section 3.14 to be true, accurate, complete and not misleading in all respects as of the date of this Agreement and as of the Closing.

② 매도인은 본건 매매대상 주식의 주주로서 본건 매매대상 주식을 매도할 적법한 권한을 가지고 있고, 본 계약을 체결하고 이행할 수 있는 법적 권한을 가지고 있다. 본 계약 체결일까지 본건 매매대상 주식과 관련하여 제3자로부터 제기된 분쟁이 없다.

The Seller has all requisite legal power and authority to sell the Stocks, to execute and deliver this Agreement, and to carry out and perform its obligations under the terms of this Agreement. There has been no dispute initiated by or against a third party concerning the Stocks.

본건 매매대상 주식에는 질권 기타 어떠한 종류의 제한물권이나 부담(담보대출, 신탁증서, 저당, 담보계약, 담보선취특권 또는 그 밖에 일체의 부담)이 설정되어 있지 않고, 본건 매매대상 주식에 대한 압류, 가압류, 가처분 기타 어떠한 처분제한도 없으며, 본건 매매대상 주식에 대한 우선매수권, 환매권 기타 제3자를 위하여 설정된 아무런 채권적 권리도 존재하지 아니한다.

The Seller owns of record and beneficially the Stocks free and clear of any liens (any mortgage, deed of trust, pledge, hypothecation, encumbrance security interest or other lien of any kind) and any restrictions which prohibit the transfer or disposition. There is no outstanding contractual obligation of the Seller to grant any preemptive or similar right with respect to the Stocks.

DZS 및 매도인은 본 계약의 체결, 교부 및 이행을 위하여 필요한 내부의 모든 절차를 거쳤고, DZS 및 매도인의 본 계약 체결 및 이행은 관련 법령이나 DZS 및 매도인의 설립 관련 서류 및 기타 모든 내부규정에 위반되지 않으며, DZS 또는 매도인이 당사자인 어떠한 계약의 위반도 초래하지 않는다. 단, 관련 법령의 위반 또는 해당 계약의 위반 또는 해당 계약상 이익의 상실이, 개별적으로 또는 종합적으로, 중대한 부정적 영향을 끼치지 않을 것으로 예상되는 경우는 제외한다.

The execution and delivery of this Agreement by DZS and the Seller, the performance by DZS and the Seller of its obligations hereunder and the consummation by DZS and the Seller of the transactions contemplated hereby have been duly and validly authorized and approved by all necessary corporate actions. The execution and delivery of this Agreement by DZS and the Seller do not, and the performance of this Agreement by DZS and the Seller will not violate any provision of or result in the breach of, any applicable Law, conflict with or violate any provision of the Organizational Documents and other corporate regulations of DZS and the Seller, and result in any breach of or any loss of any benefit under any contract to which DZS or the Seller is a party, except in the case of a breach of applicable Law or any breach of or loss of any benefit under any such contract that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

③ DZS, 본건 대상회사들 또는 DZS 이사회의 감사 위원회, 독립적인 회계법인 또는 전술한 주체의 기타 대표자가 본건 회계장부 재작성(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)과 관련하여 인정하였거나 향후 인정하는 바를 제외하고, (1) DZS, 매수인 또는 본건 대상회사들 중 어느 회사가 매수인에게 제공한 본건 대상회사들의 2021년 12월 31일 및 2022년 12월 31일을 기말일로 하는 회계연도에 대한 재무제표 및 2023년 9월 30일을 기말일로 하는 9개월 기간에 대한 재무제표는 모두 기업회계기준에 따라 작성되었으며, (ii) 이러한 재무제표는 각 대상회사의 장부를 따르며, 모든 중대한 사항에서 해당 일자 기준 각 본건 대상회사의 재무상태 및 관련 기간내 각 본건 대상회사의 영업 결과를 공정하게 나타낸다. ,

Except as has been identified or may be identified by DZS, the Companies, the Audit Committee of DZS’ Board of Directors or the independent accounting firm or other representatives of any of the foregoing in connection with the Restatement (defined in Section 10.12, same meaning in other parts of this Agreement), (i) the financial statements of each of the Companies for each of the fiscal years ended December 31, 2021 and 2022, and for the nine months ended September 30, 2023, which have been provided to the Purchaser by DZS, the Seller or any of the Companies, have been prepared in accordance with business accounting standards; and (ii) such financial statements are in accordance with the books and records of each of the Companies, and present fairly in all material respects the

financial position of each of the Companies as of the applicable date and the results of operations of the each of the Companies for the applicable period.

④ 본건 대상 회사들은 각자에게 적용되는 법령에 따라 적법하게 설립되어 존속 중인 법인이다. 본건 대상 회사들은 모두 현재 영위하고 있는 영업 수행과 자산의 소유·임대차·가동에 필요한 모든 권한과 정부승인을 가지고 있다. 본건 대상 회사들은 모두 영업에 필요한 모든 권한·라이센스를 가지고 있다. 다만 해당 인허가·라이센스가 없더라도 중대한 부정적 영향이 발생하지 않는 경우에는 예외로 한다.

Each of the Companies is a company duly organized, validly existing and in good standing under the Laws of its jurisdiction. Each of the Company has the requisite power and authority and all necessary governmental approvals to own, lease and operate its properties and to carry on its business as it is now being conducted. Each of the Company is duly qualified or licensed to do business, except for such failures to be so qualified, licensed or in good standing that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

⑤ 본건 대상 회사들의 주식 및 지분권(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)은 적법하고 유효하게 발행되었고, 납입이 완료되었으며, 그 발행으로 다른 어떤 우선권 기타 이와 유사한 권리를 침해하지 아니하였다.

All issued and outstanding stocks or Equity Interests (defined in Section 10.12, same meaning in other parts of this Agreement) of each of the Companies are duly authorized, validly issued, fully paid and nonassessable and have not been issued in violation of any preemptive or similar rights.

본건 대상 회사들의 기발행·미발행 주식이나 지분권과 관련된 내용이거나, 위와 같은 주식이나 지분권으로 전환·교환될 수 있거나 또는 본건 대상 회사들로 하여금 주식이나 지분권을 발행·매도하도록 강제하는 증권과 관련된 내용이거나, 본건 대상 회사들의 주식이나 지분권으로 전환·교환될 수 있는 증권과 관련된 내용으로, 본건 대상 회사들이 체결하였거나 본건 대상 회사들에게 의무이행을 강제하는 어떠한 종류의 선택권, 인수권, 기타 권리, 계약, 약정, 약속도 존재하지 않는다.

There are no options, warrants or other rights, agreements, arrangements or commitments of any character to which any of the Companies is a party or by which any of the Companies is bound relating to the issued or unissued capital stock or other Equity Interests, or securities convertible into or exchangeable for such capital stock or other Equity Interests, or obligating any of the Companies to issue or sell any shares of its capital stock or other Equity Interests, or securities convertible into or exchangeable for such capital stock of, or other Equity Interests in, any of the Companies.

본건 대상 회사들의 주식이나 기타 지분권과 관련하여, 이를 환매하는 내용이거나, 주금환급 또는 다른 방식으로 매수하여 주는 내용이거나, 이전·처분을 제한하는 내용이거나, 우선권이나 기타 이와 유사한 권리를 인정하여 주는 내용의, 본건 대상 회사들의 계약상 의무는 존재하지 않는다. 본건 대상 회사들의 주식이나 지분권의 의결권 또는 등록과 관련된 내용의 주주간 계약, 의결권 약정, 기타 어떠한 약정도 존재하지 않는다.

There are no outstanding contractual obligations of any of the Companies to repurchase, redeem or otherwise acquire, restricting the transfer or disposition of, or granting any preemptive or similar right with respect to, any capital stock or other Equity Interests of any of the Companies. There are no shareholder agreements, voting trusts or other agreements or understandings to which any of the Companies is a party or by which it is bound relating to the voting or registration of any shares of capital stock or other Equity Interests of any of the Companies.

⑥ 본건 대상 회사들은 보수 관련 계약, 근로계약서나 임금 관련 규정에 명시된 것 이외에는 임직원들에게 추가로 금전지급의무를 부담하지 아니하며, 관련 법령에 따라 임직원들에게 지급하여야 할 보수, 임금, 상여금, 수당, 기타 금원을 모두 적정하게 지급하였고, 노동이나 고용 관련 법령 전부를 준수하고 있다.

Other than as expressly set out in any executive remuneration agreements, employment agreements or the work regulations to which any of the Companies is a party, none of the Companies owes any liabilities to provide additional compensation or other benefits to its executives and employees. Each of the Companies has paid to its executives and employees, in a timely manner in accordance with the requirements of the applicable laws and regulations, all executive remuneration, salary, bonuses, allowances, severance and any other monetary obligations relating to the engagement of executive and

employment that may accrued and be payable to those personnel. Each of the Companies is in compliance with all applicable Laws and regulations respecting labor and employment.

본건 대상 회사들의 종업원들에게 적용되는 모든 종업원급부제도(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)는 해당 국가의 관련 법령을 준수하고 있고, 금원이 출연되거나 장부에 기재되어야 하는 제도들은 모두 적정하게 금원이 출연되거나 장부에 기재되었으며, 위와 같은 종업원급부제도와 관련하여 현재 진행중이거나 장래 발생할 수 있는 중요한 소송은 존재하지 않는다.

All Company Benefit Plans(defined in Section 10.12, same meaning in other parts of this Agreement) that are maintained primarily for the benefit of employees of each of the companies comply with applicable local Law of its respective jurisdiction, all such plans that are intended to be funded and/or book-reserved are funded and/or book reserved, as appropriate, based upon reasonable actuarial assumptions, and there is no pending or threatened material litigation relating to any of such Company Benefit Plans.

⑦ 본건 대상 회사들이 체결한 중요한 계약들은 모두 유효하고 해당 계약의 각 당사자에게 구속력이 있다. 본건 대상 회사들은 각 계약에 따른 중요한 의무를 이행하였고, 본건 대상 회사들은 계약을 중대히 위반하였다거나 계약상 의무를 중대히 불이행하였다는 통지를 받은 사실이 없다.

All material contracts to which any of the Companies is a party, is valid and binding upon on such company and each other party thereto, and in full force and effect. Each of the Companies has performed all material obligations required to be performed by it to the date hereof. Any of the Companies has not received any notice of any material violation or default under any contract to which such company is a party.

⑧ 중대한 부정적 영향(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)을 야기하지 않는 사유를 제외하고, 본건 대상 회사들은 모든 환경 관련 법령(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)을 준수하였고, 환경 관련 법령에서 요구되는 모든 인허가 등을 획득하거나 신고하였으며, 환경 관련 법령을 위반하였다고 정부기관이나 제3자로부터 통지받은 사실이 없다.

Except as would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect(defined in Section 10.12, same meaning in other parts of this Agreement), each of the Companies has complied with all applicable Environmental Laws(defined in Section 10.12, same meaning in other parts of this Agreement) and has obtained all licenses, permits and authorizations and filed all notices which are required to be obtained or filed by it for the operation of its business under all applicable laws and regulations. Any of the Companies has not received any communication, whether from a governmental authority or other third party, which alleges that it is not in compliance with any of the Environmental Laws.

⑨ 본건 대상 회사들은 본 계약 체결일 현재 영업을 영위하는 방식 그대로의 영업에 사용되는 모든 중대한 지식재산(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)에 관하여 적법ㆍ유효한 소유권 또는 사용권을 가지고 있다. 별첨 목록 4A 는 거래종결일 기준 본건 대상 회사들이 보유하는 지식재산(제품 브랜드, 특허 및 상표권을 포함하지만 이에 한정되지 않음)을 기재하고 있다. 오해의 소지가 없도록 부언하자면, 별첨 목록 4B에 기재된 지식재산, 제품, 제품 브랜드, 특허 및 상표를 포함하여, 별첨 목록 4A에 기재되지 않은 모든 지식재산, 제품, 제품 브랜드, 특허 및 상표는 매도인, DZS 또는 그 각 자회사가 지속해서 보유한다. 단, 별첨 목록 4C에 기재된 소프트웨어 및 이와 관련한 지식재산은 본 계약의 체결일 및 거래종결일 현재 DZS 및 다산네트웍솔루션즈가 공동으로 보유하고 있으며, 향후에도 이들이 공동으로 보유하고, 그 각자는 소스코드에 대한 권리 또한 보유한다.

Each of the Companies owns or has the right to use all of the material Intellectual Property (defined in Section 10.12, same meaning in other parts of this Agreement) used in the businesses of such company in substantially the same manner as such businesses are conducted on the date hereof. Schedule 4A sets out all of the material Intellectual Property, including but not limited to, products, product brands, patents and trademarks, that are owned by the respective Companies. For the avoidance of doubt, any such Intellectual Property, products, product brands, patents and trademarks not listed on Schedule 4A, including any Intellectual Property, products, product brands, patents and trademarks set forth on Schedule 4B, shall remain with the Seller, DZS or their respective Affiliates, except for the software set out in Schedule 4C, and Intellectual Property related thereto, which are, of

the date hereof and as of the Closing Date, and shall continue to be jointly owned by DZS and DASAN Network Solution, Inc., with each of them having rights to the source code.

제3자가 본건 대상 회사들을 상대로 지식재산의 소유권 또는 사용권, 이러한 권리의 유효성 또는 실행가능성을 다투는 서면 클레임을 제기한 사실이 없고, 본건 대상 회사들이 보유한 지식재산과 관련하여 현재 진행중이거나, 매도인이 알고 있는 바(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)에 따르면, 장래 진행될 수 있는 조치·소송·클레임·조사·중재·절차는 존재하지 아니하다.

No written claim challenging the ownership or license in and to any Intellectual Property or the validity or enforceability of such right of any of the Companies has been made by a third party and no Intellectual Property owner by any of the Companies is currently the subject of any pending or, to the Knowledge of the Seller (defined in Section 10.12, same meaning in other parts of this Agreement), threatened action, suit, claim, investigation, arbitration or other proceeding.

본건 대상 회사들은 제3자로부터 특허권·상표권·서비스권·상호·저작권·디자인권을 침해하였다거나, 영업비밀·기밀정보·노하우를 부적절하게 사용하거나 공개하였다는 내용의 서면 통지를 받은 사실이 없다.

None of the Companies has received any written notice from any third parties that such Company has infringed any domestic or foreign patent, trademark, service mark, trade name, or copyright or design right, or misappropriated or improperly used or disclosed any trade secret, confidential information or know-how.

본 계약의 체결·이행 및 거래종결은 본건 대상 회사들이 보유하거나 사용하고 있는 지식재산 관련 본건 대상회사들 각자가 당사자인 계약에 어떤 중대한 관점에서도 위반·상충되는 것이 아니고, 이러한 지식재산 관련 계약을 해지시키지 않을 것이며, 본건 대상 회사들이 이러한 지식재산 관련 계약에 따라 보유하는 어떠한 권리도 실효시키지 않는다.

The execution, delivery and performance of this Agreement by the Seller and the Closing will not breach, violate or conflict, in any material respect, with any instrument or agreement, to which any of the Companies is a party, concerning any Intellectual Property owned or used by such Company and will not cause the termination of, or forfeiture any rights in and to such Intellectual Property owned by such company under, such agreement.

대상회사는 그 영업비밀을 보호하고 제3자의 영업비밀을 침해하지 아니하기 위하여 유사한 규모 및 성격의 사업을 영위하는 다른 회사들이 통상적으로 취하고 있는 필요한 조치를 취하였으며, 매도인이 알고 있는 바에 따르면, 제3자의 영업비밀을 침해하고 있지 아니하며, 대상회사의 영업비밀을 침해하고 있는 제3자는 없다.

Each of the Companies has taken necessary measures commonly adopted by other companies of similar size and nature engaged in comparable businesses to protect its trade secrets and avoid infringing on the trade secrets of third parties. To the Knowledge of the Sellers, each of the Companies is not infringing on the trade secrets of third parties, and there are no third parties infringing on the trade secrets of any of the Companies.

⑩ 본건 대상 회사들은 본 계약 체결일까지 각종 세금과 관련된 모든 보고, 신고 등의 의무를 적시에 적법하게 진실한 내용으로 이행하였다. 신고하거나 과세당국에 의하여 결정된 세금 중 본 계약 체결일까지 납부되어야 하는 세금을 기한내에 모두 납부하였으며, 원천징수하여야 하는 모든 중대한 세금을 원천징수하였고, 신고와 유보 등 원천징수와 관련된 모든 절차를 준수하였다. 본건 대상 회사들은 세무신고를 하지 않았다거나 납부할 세금을 납부하지 않았다는 통지를 받은 사실이 없고, 본건 대상 회사들의 재산에 관하여 진행되는 세금추징 관련 절차는 존재하지 않는다.

All reports and returns relating to, or required to be filed in connection with any tax prior to the date of this Agreement by or on behalf of any of the Companies have been duly filed on a timely basis, and such reports and returns have been prepared in accordance with the requirements of the applicable laws and regulations and are in all respects true, complete and correct. All taxes shown to be payable on such reports and returns or on subsequent assessments with respect thereto by or on behalf of any of the Companies under all applicable laws and regulations have been paid in full on a timely basis. Each of the Companies has withheld all material taxes required to have been withheld prior to the date

of this Agreement, and complied with all information reporting and backup withholding requirements. None of the Companies has received notice that it has not filed a tax report or return or paid taxes required to be filed or paid. None of the Companies is a party to any action or proceeding for collection of taxes against it or any of its assets.

⑪ 본건 대상 회사들은 본 계약 체결일 현재 영업을 영위하는 방식 그대로의 영업에 필요한 책임보험, 재산보험, 특종보험, 기타 다른 형태의 보험을 모두 보유하고 있고, 위 보험증권들(또는 실질적으로 동일한 내용으로 갱신된 보험증권들)은 모두 효력을 유지하고 있으며, 납부기한이 도래한 보험료는 모두 납부되었고, 위 보험증권에 관한 취소·해제 통지를 수령한 사실이 없고, 본건 대상 회사들은 어떤 보험에서도 지급을 거절당하지 아니하였고, 과거 3년간 어떤 보험증권도 철회되거나 취소되지 아니하였다. 어떤 보험사도 본건 대상 회사들에게 보험적용범위를 축소하겠다거나 보험료를 대폭 올리겠다거나(이러한 축소나 인상이 본건 대상회사들에게만 특별히 적용되는 경우에 한하여), 본건 대상 회사들을 상대로 제기된 중대한 클레임 때문에 보험적용이 불가하다는(또는 보험적용여부에 관하여 다툴 예정이라는) 내용을 전달한 사실이 없다.

Each of the Companies has material policies of liability, property, casualty and other forms of insurance required in its businesses in substantially the same manner as such businesses are conducted on the date hereof. All such policies (or substantially equivalent renewal policies) are in full force and effect, all premiums due and payable have been paid, no written notice of cancellation or termination has been received with respect to any such policy and Any of the Companies has not been denied any form of insurance and no policy of insurance has been revoked or rescinded during the past three years. No insurer has advised any of the Companies that it intends to reduce coverage or materially increase any premium under any such policy (to the extent such reduction or increase is applicable specifically to any of the Companies only), or that coverage is not available (or that it will contest coverage) for any material claim made against any of the Companies.

⑫ 본건 대상 회사들이나 본건 대상회사들의 임직원을 상대로 하여(임직원을 상대로 한 경우라 함은 본건 대상회사들이 자신의 임직원의 행위 또는 위반에 대해 공동으로 책임을 부담하는 경우에 한정된다) 진행중이거나 매도인이 알고 있는 바에 따르면 장래 발생이 예상되는 어떠한 종류의 소송이나 분쟁도 존재하지 아니한다. 본건 대상 회사들은 어떠한 정부기관의 명령도 위반하고 있지 않고, 매도인이 알고 있는 바에 따르면 위와 같은 소송, 분쟁, 법원의 판결·결정·명령을 야기할 만한 어떠한 사정도 존재하지 아니한다.

There is no pending or, to the Knowledge of the Seller, threatened lawsuit, action, proceeding or investigation against any of the Companies or any of its directors or employees for whose acts or defaults such company may be collectively liable. Any of the Companies is not in default with respect to any order of any governmental authority by which such company is bound. To the Knowledge of the Seller, there are no circumstances which are likely to give rise to any lawsuit, action, suit, proceeding, investigation, judgement, decree or order of court. To the Knowledge of the Seller, there is no lawsuit, action, proceeding or investigation by any of the Companies currently pending or which such company presently intends to initiate.

⑬ 본건 대상 회사들의 은행계좌들은 모두 그 계좌 명의인에 의하여 적법하게 개설되었고, 어떠한 브로커나 M&A 대상 물색자나 투자은행에 대하여도 본건 대상 회사들에게 중개보수 지급책임을 발생시키는 약정을 체결한 사실이 없다.

All bank accounts of each of the Companies have been duly authorized by the holder thereof. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transaction contemplated in this Agreement based upon arrangements made by or on behalf of any of the Companies for which such company would be liable.

⑭ 본 계약의 다른 내용과 관계 없이, (1) 매수인 또는 그 대표·대리인이 조사를 하였더라도, 본 계약에 따른 DZS 및 매도인의 진술과 보장이나 본건 거래와 관련하여 매수인에게 제공된 문서에 기재된 DZS 및 매도인의 진술과 보장에는 아무런 영향이 없고, (2) 설령 매수인이 위와 같은 DZS 및 매도인의 진술과 보장이 정확하지 않은 것임을 알았거나 알았어야 했다 하더라도, 이로 인하여 DZS 및 매도인의 진술과 보장이 영향을 받거나 이와 관련된 권리가 포기되었다고 간주하지 않는다.

Notwithstanding anything to the contrary in this Agreement, (a) no investigation by the Purchaser or its representatives shall affect the representations and warranties of DZS and the Seller under this Agreement or contained in any other writing to be furnished to the Purchaser in connection with the

transactions contemplated hereunder, and (b) such representations and warranties shall not be affected or deemed waived by reason of the fact that the Purchaser knew or should have known that any of the same is or might be inaccurate in any respect.

제4조 [매수인의 진술과 보장]

ARTICLE IV [REPRESENTATION AND WARRANTIES OF THE PURCHASER]

① 매수인은 매도인에 대하여 본 계약 체결일 및 거래종결일 현재 아래 제2항 내지 제3항과 같은 사항들이 진실함을 보장한다.

The Purchaser represents and warrants to the Seller the following Section 4.2 through Section 4.3 to be true, accurate, complete and not misleading in all respects as of the date of this Agreement and each day up to and including the Closing.

② 매수인은 대한민국 법령에 의거하여 적법·적정하게 설립되어 운영되고 있고, 본 계약을 체결하고 거래를 종결할 수 있는 권한을 갖고 있다.

The Seller is a corporation duly organized and validly exiting under the Laws of Korea, and has the requisite corporate power and authority to enter into this Agreement and consummate the transactions contemplated hereunder.

③ 매수인은 본 계약을 체결하기 위하여 필요한 내부의 모든 절차를 거쳤고, 매수인의 본 계약 체결 및 이행은 관련 법령이나 설립 관련 서류 및 모든 내부규정에 위반되지 않으며, 매수인이 당사자인 어떠한 계약의 위반도 초래하지 않는다. 단, 관련 법령의 위반 또는 해당 계약의 위반 또는 해당 계약상 이익의 상실이, 개별적으로 또는 종합적으로, 중대한 부정적 영향을 끼치지 않을 것으로 예상되는 경우는 제외한다.

The execution and delivery of this Agreement by the Purchaser, the performance by the Purchaser of its obligations hereunder and the consummation by the Purchaser of the transactions contemplated hereby have been duly and validly authorized and approved by all necessary corporate action. The execution and delivery of this Agreement by the Purchaser do not, and the performance of this Agreement by the Purchaser will not violate any provision of or result in the breach of, any applicable Law, conflict with or violate any provision of the Organizational Documents and other corporate regulations of the Purchaser, and result in any breach of or any loss of any benefit under any contract to which the Purchaser is a party, except in the case of a breach of applicable Law or any breach of or loss of any benefit under any such contract that would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

제5조 [의무이행사항]

ARTICLE V [COVENANTS]

① (i) 본 계약 체결일부터 거래종결일까지 본 계약의 다른 규정에서 특별히 허용하거나 (ii) 관련 법령상 요구되거나 또는 (iii) 매수인이 사전에 서면으로 동의한(단, 이러한 동의는 비합리적으로 보류되거나, 지연되거나 또는 조건이 부가될 수 없음) 예외사항을 제외하고는, DZS 및 매도인은 본건 대상 회사들이 이전과 동일하게 일상적인 영업을 계속하게 하여야 한다. 더 나아가, (i) 본 계약 체결일부터 거래종결일까지 본 계약의 다른 규정에서 특별히 허용하거나 (ii) 관련 법령상 요구되거나 또는 (iii) 매수인이 사전에 서면으로 동의한(단, 이러한 동의는 비합리적으로 보류되거나, 지연되거나 또는 조건이 부가될 수 없음) 예외사항을 제외하고는, 매도인은 스스로 또는 본건 대상 회사들로 하여금 아래와 같은 행위들을 하거나 하게 하여서는 안 된다.

Between the date of this Agreement and the Closing Date, except (i) as specifically permitted by any other provision of this Agreement, (ii) as required by applicable Law or (iii) as consented to in prior writing by Purchaser (which consent shall not be unreasonably withheld, delayed, or conditioned), DZS and the Seller will cause each of Companies to conduct its operations only in the ordinary and usual course of business consistent with past practice, Without limiting the foregoing, and as an extension thereof, except (i) as specifically permitted by any other provision of this Agreement, (ii) as required by applicable Law or (iii) as consented to in prior writing by Purchaser (which consent shall not be unreasonably withheld, delayed, or conditioned), the Seller shall not, and shall not permit any of the Companies, directly or indirectly, do, or agree to do, any of the following:

(1) 설립 관련 서류(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)를 수정하거나 변경하는 행위

amend or otherwise change its Organizational Documents (defined in Section 10.12, same meaning in other parts of this Agreement);

(2) 본건 대상 회사들의 주식이나 기타 다른 지분권을 발행하거나, 매도하거나, 처분하거나, 승인하거나, 이전하거나, 그 발행·매도·처분·승인·이전 등을 인정하는 행위. 본건 대상 회사들의 주식이나 지분으로 전환되거나 교환될 수 있는 증권이나 옵션, 선택권, 인수권, 기타 권리(계약상 권리 포함)를 부여하는 행위.

issue, sell, pledge, dispose of, grant, transfer, encumber, or authorize the issuance, sale, pledge, disposition, grant, transfer, or encumbrance of any shares of capital stock of, or other Equity Interests in, any of the Companies of any class, or securities convertible or exchangeable or exercisable for any shares of such capital stock or other Equity Interests, or any options, warrants or other rights of any kind to acquire any shares of such capital stock or other Equity Interests or such convertible or exchangeable securities, or any other ownership interest (including, without limitation, any such interest represented by contract right), of any of the Companies;

(3) 본건 대상 회사들의 주요 자산(지식재산 포함)을 매도하거나, 처분하거나, 이전하거나, 임대하거나, 사용권을 허여하거나, 담보로 제공하거나, 이와 같은 매도·처분·이전·임대·사용권허여·담보제공 등을 인정하는 행위(다만 기존에 이미 체결된 약정에 의한 것이거나, 과거부터 해 오던 일상영업에 의한 거래인 경우는 예외로 한다).

sell, pledge, dispose of, transfer, lease, license, guarantee or encumber, or authorize the sale, pledge, disposition, transfer, lease, license, guarantee or encumbrance of, any material property or assets (including Intellectual Property) of any of the Companies, except pursuant to existing contracts or commitments or except for any transactions in the ordinary course of business consistent with past practice;

(4) 과거부터 해 오던 일상영업의 범위를 벗어나는 약정의 체결행위 또는 거래행위

(5) 본건 대상 회사들의 주식에 관하여 배당 기타 분배금 지급(그 형태가 현금배당이든 주식배당이든 현물배당이든 혼합된 형태이든 모두 포함)을 결정하거나 지급하는 행위

declare, set aside, make or pay any dividend or other distribution (whether payable in cash, stock, property or a combination thereof) with respect to any of the Stocks;

(6) 본건 대상 회사들의 주식 의결권에 관한 약정을 체결하는 행위.

enter into any agreement with respect to the voting of any of the Stocks;

(7) 본건 대상 회사들의 주식, 지분권, 기타 다른 증권을 직·간접적으로 재분류, 병합, 분할, 매수, 취득하는 행위

reclassify, combine, split, subdivide or redeem, purchase or otherwise acquire, directly or indirectly, any of the Stocks, other Equity Interests or other securities;

(8) 제3자로부터 지분이나 중대한 자산을 취득하는 행위(흡수합병·신설합병·주식양수도·자산양수도에 의한 취득을 포함하고, 다만 과거부터 해 오던 일상적인 영업에서의 자산 취득은 제외됨)

acquire (including, without limitation, by merger, consolidation, or acquisition of stock or assets) any interest in any person or any division thereof or any material assets, other than acquisitions of assets in the ordinary course of business consistent with past practice;

(9) 제3자를 위하여 금전채무를 부담하거나, 사채권을 발행하거나, 보증이나 배서를 하는 등의 행위(다만 과거부터 해 오던 일상영업의 범위에서 부담하게 되는 채무는 예외로 함)

incur any debt or issue any debt securities or assume, guarantee or endorse, or otherwise as an accommodation become responsible for, the obligations of any person for borrowed money, except for indebtedness for borrowed money incurred in the ordinary course of business consistent with past practice;

(10) 본건 대상 회사들의 주요 계약을 해지하거나, 취소하거나, 주요한 변경을 요구하거나, 주요한 변경에 대하여 동의하는 행위

terminate, cancel or request any material change in, or agree to any material change in, any material contract;

(11) 본 계약 체결일 현재 약정 또는 회사방침에 의하여 지급이 필요하고, 유효하게 존재하는 퇴직금이나 해고수당의 경우를 제외하고: (i) 임원들 또는 종업원들에 대하여 지급하거나 지급하여야 할 보수나 급부를 증액시키는 행위. (ii) 임원들, 종업원들에게 퇴직금·해고수당 관련 권리를 새로이 부여하거나, 새로운 고용계약·퇴직금약정을 체결하거나, 단체교섭·상여금·이익분배·보상·스톡옵션·연금·퇴직·이연보상·고용·해고·퇴직금규정·기타 급부약정에 관하여 새로이 시행·채택·체결·수정하는 행위(다만 관련 법령에 의한 경우는 예외로 한다). (iii) 종업원급부제도를 종업원에게 유리하게 수정·포기하거나 종업원급부제도의 지급시기·지급가능성을 앞당기는 행위.

except as may be required by contractual commitments or corporate policies with respect to severance or termination pay in existence on the date of this Agreement: (i) increase the compensation or benefits payable or to become payable to its directors, officers or employees; (ii) grant any rights to severance or termination pay to, or enter into any employment or severance agreement with, any director, officer or other employee, or establish, adopt, enter into or amend any collective bargaining, bonus, profit sharing, thrift, compensation, stock option, restricted stock, pension, retirement, deferred compensation, employment, termination, severance or other plan, agreement, trust, fund, policy or arrangement for the benefit of any director, officer or employee, except to the extent required by applicable Law; or (iii) take any affirmative action to amend or waive any performance or vesting criteria or accelerate vesting, exercisability or funding under any Company Benefit Plan;

(12) (i) 주요한 클레임·채무·의무에 관하여 지급·변제·이행하는 행위(다만 과거부터 해 오던 일상영업 범위내에서의 약정에 의한 경우는 예외). (ii) 주요한 어음이나 신용거래의 변제받는 시점을 과거부터 해 오던 영업관행에 의한 변제받는 시점보다 앞당기거나 늦추는 행위. (iii) 주요한 신용거래의 지급시점을 약정된 시점이나 과거부터 해 오던 영업관행에 의한 시점보다 늦추거나 앞당기는 행위.

(i) pay, discharge or satisfy any material claims, liabilities or obligations (absolute, accrued, contingent or otherwise), except in the ordinary course of business consistent with past practice and in accordance with their terms, (ii) accelerate or delay collection of any material notes or accounts receivable in advance of or beyond their regular due dates or the dates when the same would have been collected in the ordinary course of business consistent with past practice, or (iii) delay or accelerate payment of any material account payable in advance of its due date or the date such liability would have been paid in the ordinary course of business consistent with past practice;

(13) 과거부터 해 오던 영업관행에 의한 회계정책이나 회계과정을 변경하는 행위. 다만 기업회계기준이나 정부기관의 요구(회계장부 재작성의 경우를 포함한다)에 의한 경우에는 예외로 한다.

make any change in accounting policies or procedures, other than in the ordinary course of business consistent with past practice or except as required by GAAP or by a Governmental Entity, including as related to the Restatement;

(14) 주요한 클레임이나 재판, 중재와 관련하여 권리를 포기하거나, 지급하거나, 양보하거나, 합의하는 등의 행위

waive, release, assign, settle or compromise any material claims, or any material litigation or arbitration;

(15) 관련 법령에 의하여 요구되거나 회계장부 재작성으로부터 기인하는 경우를 제외하고, 주요한 세금 관련 선택을 하거나 변경하는 행위, 주요한 세금 관련 클레임·고지·감사보고·평가에 대하여 양보하거나 합의하는 행위, 세금산정방식을 채택하거나 변경하는 행위, 주요한 세무신고(제10조 제12항에 정의된 것, 본 계약의 다른 부분에서도 동일한 의미로 사용된다)를 하거나 변경하는 행위, 주요한 세금과 관련된 할당약정·공동부담약정·면책약정·종결약정을 체결하는 행위, 주요한 세금환급금과 관련된 불복권한을 포기하는 행위, 주요한 세금 클레임이나 금액산정과 관련된 법정 제한기간 연장이나 포기에 동의하는 행위

except as required by applicable Law or as a result of the Restatement, make or change any material Tax election, settle or compromise any claim, notice, audit report or assessment in

respect of material Taxes, change any annual Tax accounting period; adopt or change any method of Tax accounting, file any amended material Tax Return (defined in Section 10.12 same meaning in other parts of this Agreement), enter into any Tax allocation agreement, Tax sharing agreement, Tax indemnity agreement or closing agreement relating to any material Tax, surrender any right to claim a material Tax refund, or consent to any extension or waiver of the statute of limitations period applicable to any material Tax claim or assessment;

(16) 본건 대상 회사들이 계약당사자인 비밀유지약정과 관련된 주요한 권리나 클레임을 제기할 권리를 수정하거나, 소멸시키거나, 포기하거나, 양도하는 행위

modify, amend or terminate, or waive, release or assign any material rights or claims with respect to any confidentiality or standstill agreement to which any of the Companies is a party;

(18) 이상과 같이 금지되는 행위[위 (1)부터 (17)까지의 행위]를 하기 위한 계약이나 약정을 체결하거나 효력을 부여하는 행위

authorize or enter into any agreement or otherwise make any commitment to do any of the foregoing.

② 각 당사자는 (1) 가능한 신속하게 본 계약에 의한 거래절차를 완료할 수 있도록 관련 법령에 따라 필요한 모든 조치를 취하여야 하고, (2) 본 계약을 이행하기 위하여 정부기관으로부터 취득할 필요가 있거나, 정부기관으로부터의 제재를 피하기 위하여 취득하여야 하는 모든 인허가를 득하여야 하며, (3) 본 계약에 의한 거래절차와 관련하여 필요한 신고 등 절차를 취하여야 한다. 각 당사자는 위와 같은 신고 등 절차와 관련하여 상호 협조하고, 상대방의 요청이 있으면 자신이 제출할 신고서 사본을 상대방 또는 그 조력자에게 교부하며, 상대방의 요청이 있고 상당한 이유가 있으면 자신이 제출할 신고서 내용을 추가, 삭제 또는 변경한다. 각 당사자는 본 계약에 따른 절차와 관련하여 관련 법령에 따른 신청이나 신고를 위하여 필요한 모든 정보를 상대방 당사자에게 제공한다.

Each of the Parties shall use their commercially reasonable efforts to (a) take, or cause to be taken, all appropriate action, and do, or cause to be done, all things necessary, proper or advisable under applicable Law or otherwise to consummate and make effective the transactions contemplated by this Agreement as promptly as practicable, (b) obtain from any Governmental Entity any consents, licenses, permits, waivers, approvals, authorizations or orders required to be obtained or made by each of the Parties or to avoid any action or proceeding by any Governmental Entity, in connection with the authorization, execution and delivery of this Agreement and the consummation of the transactions contemplated hereby, and (c) make all necessary filings, and thereafter make any other required submissions, with respect to this Agreement required under applicable Law; provided, that the Parties shall cooperate with each other in connection with the making of all such filings, including, if requested, by providing copies of all such documents to the non-filing party and its advisors prior to filing and, if requested, accepting all reasonable additions, deletions or changes suggested in connection therewith. The Parties shall furnish to each other all information required for any application or other filing under the rules and regulations of any applicable Law in connection with the transactions contemplated by this Agreement.

③ 각 당사자는 (1) 본 계약에 따른 거래절차를 완료하기 위하여 필요한 경우, (2) 거래종결일 전후를 불문하고 어느 당사자에게라도 악영향이 발생함을 방지하기 위하여 필요한 경우에는 제3자에 대한 통지를 하여야 하고, 제3자의 동의를 얻기 위하여 상당한 주의를 다하여야 한다. 어느 일방 당사자가 위와 같은 제3자의 동의를 얻지 못한 경우, 해당 당사자는 그 동의를 얻지 못함으로 인하여 상대방 당사자에게 발생할 수 있는 피해를 최소화하기 위하여 상당한 주의로 최선을 다하여야 하고, 상대방이 요청하는 상당한 조치를 취하여야 한다.

Each of the Parties shall give any notices to third parties, and use commercially reasonable efforts to obtain any third party consents (i) necessary, proper or advisable to consummate the transactions contemplated in this Agreement, (ii) required to prevent a Material Adverse Effect with respect to any of the Parties from occurring prior to or after the Closing Date. In the event that a Party shall fail to obtain any third party consent described in the first sentence of this Section 5.3, such party shall use commercially reasonable efforts, and shall take any such actions reasonably requested by the other party hereto, to minimize any adverse effect upon the other Party.

④ 본 계약 체결일부터 거래종결일까지, 각 당사자는 상대방에게 다음과 같은 사항들을 지체 없이 통지해야 하는바, (1) 어느 당사자가 본 계약 및 본 계약에 따른 거래를 위하여 이행하여야

하는 의무에 영향을 미치는 사정의 발생 등을 통지하여야 하고, (2) 본 계약에 따라 이행되어야 하는 사항이 이행되지 않거나 충족되어야 하는 조건이 충족되지 않은 사실을 통지하여야 한다. 다만, 본 항(제5조 제4항)에 따른 통지를 하더라도 본 계약 체결 이전에 그러한 사실의 통지를 요구하는 진술과 보장 규정을 위반한 사실이 치유되는 것이 아니고, 상대방의 시정 요구를 제한하는 등의 효력도 없다.

From and after the date of this Agreement until the Closing Date, each Party shall promptly notify the other Party of (i) the occurrence, or non-occurrence, of any event that would be likely to cause any condition to the obligations of any Party to effect the transactions contemplated by this Agreement not to be satisfied, or (ii) the failure of such Party to comply with or satisfy any covenant, condition or agreement to be complied with or satisfied by it pursuant to this Agreement which would reasonably be expected to result in any condition to the obligations of any Party to effect the transactions contemplated by this Agreement not to be satisfied; provided, however, that the delivery of any notice pursuant to this Section 5.4 shall not cure any breach of any representation or warranty requiring disclosure of such matter prior to the date of this Agreement or otherwise limit or affect the remedies available hereunder to the party receiving such notice.

⑤ 각 당사자는 상대방의 사전 동의(상대방의 동의는 부당하게 보류되거나 지연되어서는 안 됨)를 얻기 전에는 본 계약 체결을 공표하지 아니하며, 공표 이전에 상대방과 사전 협의를 해야 한다. 다만 각 당사자는 관련 법령이나 증권거래소와의 상장약정이나 자신이 당사자인 자동호가시스템에서 요구되는 경우, 사전에 최선을 다하였음에도 적시에 상대방과 상의하거나 상대방의 동의를 얻을 수 없었다면, 상대방과의 상의나 사전 동의 없이 공표를 할 수 있다.

Each Party shall not make any press release or public announcement announcing the execution of this Agreement without the prior consent of the other Party (which consent shall not be unreasonably withheld or delayed) and shall consult with the other Party prior to making such any press release or public announcement; provided, that a Party may, without consulting with or obtaining the prior consent of the other Party, issue such press release or make such public statement as may be required by applicable Law or by any listing agreement with a national securities exchange or automated quotation system to which it is a party, if such party has used commercially reasonable efforts to consult with the other party and to obtain such other party’s consent, but has been unable to do so in a timely manner.

⑥ 각 당사자는 본 계약의 체결 및 이행과 관련하여 각 당사자에게 발생한 비용 및 관련 법령에 따라 각 당사자에게 부과되는 조세를 납부할 책임을 부담한다.

Each Party shall be liable for its own costs and expenses in connection with the execution and performance of this Agreement by such Party and any taxes imposed on such Party in connection therewith.

⑦ DZS 및 매도인은 주식회사 다산네트웍솔루션즈로 하여금 매수인으로부터 매도인에게로의 본건 차입금채권 양도를 승인하였음을 증명할 수 있는 이사회의사록과 대표이사 확인서를 매수인에게 전달하도록 하여야 한다.

DZS and the Seller shall cause DASAN Network Solutions, Inc. to provide the Purchaser with the minutes of board of directors and certificate of representative, which shall prove that it has approved the transfer of the Loan Receivables from the Purchaser to the Seller.

⑧ D-Mobile Limited, DZS Vietnam Company Limited, Dasan India Private Limited 또는 DZS Japan의 각 지역에 적용되는 법령에 의하여 본 계약의 이행 및 본 계약에 따른 거래의 완결을 위하여 요구되는 다른 형태의 주식매매계약이나 서류가 있는 경우, 당사자들은 그러한 형태의 주식매매계약이나 서류를 추가로 체결한다. 다만, 해당 주식매매계약이나 서류의 주요한 내용은 전부 본 계약과 일치하여야 한다.

In case that other form of stock purchase agreement or other document shall be required or requested for the purpose of execution and delivery of this Agreement and consummation of the transaction hereunder by Law in each jurisdiction of D-Mobile Limited, DZS Vietnam Company Limited, Dasan India Private Limited or DZS Japan, Inc., the Parties shall enter into such form; provided however, all of material terms and conditions in such form shall be in accordance with this Agreement.

제6조 [거래종결을 위한 선행조건]

ARTICLE VI [CONDITIONS PRECEDENT FOR CLOSING]

① 본 계약에 따른 거래 및 이에 부수되는 거래를 완료하기 위한 각 당사자의 의무는 거래종결일 또는 그 이전에 아래와 같은 조건들이 만족됨을 전제로 한다. 다만 아래와 같은 조건들의 전부 또는 일부는 전체적으로 또는 부분적으로 양 당사자들의 서면 합의에 따라 면제될 수 있다.

The respective obligations of each Party to effect the stock transfer contemplated in this Agreement and the other transactions contemplated hereby are also subject to the following conditions. Any or all of which may be waived in whole or in part, by the mutual agreement of the Parties in writing.

(1) 정부기관·연방법원·주법원·중재원 등으로부터 본건 매매대상 주식 거래나 이에 부수된 거래의 금지·중지를 명하는 일체의 명령·규제·재판·판정 등이 없어야 한다.

No Governmental Entity, nor any federal or state court of competent jurisdiction or arbitrator shall have enacted, issued, promulgated, enforced or entered any statute, rule, regulation, executive order, decree, judgment, injunction or arbitration award or finding or other order (whether temporary, preliminary or permanent), in any case which is in effect and which prevents or prohibits consummation of the Stocks transfer or any other transactions contemplated hereby.

(2) 본건 대상 회사들 중 아래 계약들에 관련된 회사와 DZS는 아래와 같은 계약들 전부를 체결하였어야 한다 (i) R&D Engineering Services Agreement, (ii) Transition Services Agreement, (iii) Intellectual Property License Agreement, (iv) Reseller Agreements, (v) SLA Maintenance Agreements, (vi) Contract Manufacturing Agreement (이하 통칭하여 “본건 부속약정서들”).

The applicable Company and DZS shall have entered into (i) R&D Engineering Services Agreement, (ii) Transition Services Agreement, (iii) Intellectual Property License Agreement and (iv) Reseller Agreements, (v) SLA Maintenance Agreements, (vi) Contract Manufacturing Agreement (collectively the “Ancillary Agreements”).

(3) 각 본건 대상회사가 설립된 관할의 법령에 따라 요구되는 경우, 본 계약의 체결 및 교부 및 거래종결을 위해 필요한 다른 형태의 주식매매계약이나 서류(그 주요 계약조건의 본 계약의 조건과 상당부분 유사해야 함)가 매수인 및 매도인 사이에 체결되었어야 한다.

To the extent required by Law in the jurisdiction where the respective Companies are established, any other form of stock purchase agreement or other document necessary for the purpose of execution and delivery of this Agreement and the Closing, the material terms and conditions of which shall be substantially similar to the those of this Agreement, shall have been executed by the Seller and the Purchaser.

(4) 당사자들간 상호 합의 하에 다음 사항들이 확정되었어야 한다.

(i)DZS로부터 본건 대상회사로 이전되어야 하는 계약 목록

(ii)DZS와 다산네트웍솔루션즈간 체결한 2016. 9. 9.자 Service Agreement의 해지여부

(iii)제2조 제5항에 따라 소명하는 DZS와 본건 대상회사들 사이의 채권채무 세부항목 및 소멸절차.

The following items shall have been determined based on the mutual agreement between the Parties:

(i)a list of contracts that need to be assigned from DZS Inc. to any of the Companies;

(ii)whether the Service Agreement dated September 9, 2016 between DZS and DASAN Network Solutions, Inc. will be be terminated; and

(iii)the details and process of the cancellation of intercompany accounts receivables and payables between DZS and the Companies under Section 2.5.

② 본 계약에 따른 거래 및 이에 부수되는 거래를 완료하기 위한 매수인의 의무는 거래종결일 또는 그 이전에 아래와 같은 조건들이 만족됨을 전제로 한다. 다만 아래와 같은 조건들의 전부 또는 일부는 매수인의 선택에 따라 전체적으로 또는 부분적으로 서면에 의한 방식으로 면제될 수 있다.

The obligations of the Purchaser to effect the stock transfer contemplated in this Agreement and the other transactions contemplated hereby are also subject to the following conditions. Any or all of which may be waived in writing by the Purchaser in whole or in part in its sole discretion.

(1) 본 계약 제3조에 기재된 DZS 및 매도인의 진술과 보장은 본 계약 체결일로부터 거래종결일까지 모든 중요한 부분에서 진실하고 정확하게 (이 경우 “중대한” 또는 이와 유사한 수식어로 표현된 단서 조건을 제한적으로 해석하는 일이 없어야 한다) 유지되어야 한다. 단, 본 계약 제3조 제3항 내지 제14항에 기재된 진술 및 보증이 진실 및 정확하지 못하게 된 경우라도 개별적으로 또는 전체적으로 중대한 부정적 영향을 끼치지 않는 경우에는 예외로 한다.

The representations and warranties of DZS and the Seller contained in Article III of this Agreement shall be true and correct in all material respects (without giving effect to any limitation as to “materiality” or any derivative thereof qualification set forth therein) on and as of the date of this Agreement and the Closing Date with the same effect as if made on and as of such day, except for any failures of representations and warranties set out in Section 3.3 to 3.14 to be so true and correct of that, individually or in the aggregate, have not had or would not have a MAE.

(2) DZS 및 매도인은 거래종결일 및 그 이전에 본 계약에 따라 이행되거나 준수되어야 할 모든 약정이나 이행사항을 모든 중요한 부분에서 이행하였거나 준수하였어야 한다.

DZS and the Seller shall have performed or complied in all material respects with all agreements and covenants required by this Agreement to be performed or complied with by it on or prior to the Closing Date.

(3) DZS 및 매도인은 이사회 의결 등 본 계약에 따른 거래를 이행하기 위한 내부 절차를 모두 완료하고, 위와 같은 거래에 관련된 모든 문서들은 매수인을 합리적으로 만족시키기에 충분하여야 한다.

All corporate and legal proceedings taken by DZS and the Seller in connection with the transactions contemplated by this Agreement (including, without limitation, the passing of necessary board resolutions) and all documents relating to these transactions shall be reasonably satisfactory to the Purchaser.

(4) DZS 및 매도인은 본 계약의 체결과 이행에 필요한 공적 승인이나 보고, 별도의 약정에 의하여 동의가 필요한 다른 주주가 있는 경우에는 해당 주주의 동의 등을 취득하였어야 한다.

All government and other approvals (including reporting to government agencies) and consents (including, if any, consents from other shareholders pursuant to specific contractual rights or otherwise) required by DZS and the Seller in connection with the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby shall have been duly obtained.

(5) 본 계약 체결일 이후, 전체적인 관점에서 본건 대상 회사들에 중대한 부정적 영향을 미치는 사유가 발생하지 않았어야 하며, 본건 회계장부 재작성이 본건 대상회사들에게 중대한 부정적 영향을 초래하지 않았어야 한다(

Since the date of this Agreement, there shall not have occurred any Material Adverse Effect with respect to the Companies, taken as a whole, and the Restatement will not have resulted in a Material Adverse Effect with respect to the Companies (without giving effect to clause (v) of the definition of Material Adverse Effect).

(6) 주식회사 다산네트웍솔루션즈가 매수인으로부터 매도인에게로의 본건 차입금채권 양도를 승인하였음을 증명할 수 있는 이사회의사록과 대표이사 확인서가 매수인에게 전달되었어야 한다.

Minutes of board of directors and a certificate of the Chief Executive Officer of DASAN Network Solutions, Inc., which shall prove that it has approved transfer of the Loan Receivables by the Purchaser to the Seller, have been provided to the Purchaser.

(7) DZS 및 매도인은 각 회사에 관한 제3조 제2항부터 제3조 제14항까지의 사항들이 거래종결일 기준으로(마치 해당 일자에 이러한 확인이 제공되는 것과 동일한 효과를 가지도록 하여) 모든 중대한 관점에서 진실함(이 경우 “중대한” 또는 이와 유사한 수식어로 표현된 단서 조건을 제한적으로 해석하는 일이 없어야 하며, 제3조 제3항부터 제3조 제14항에

기재된 진술 보증이 진실되지 못한 점에 따라, 그 각각 또는 종합하여, 중대한 부정적 영향을 초래하지 않았거나 하지 않을 경우는 제외한다)을 확인한다는 내용으로 작성한 매도인 임원 확인서를 매수인에게 전달하였어야 한다.

DZS and the Seller shall have delivered to the Purchaser, a certificate dated as of the Closing Date, signed by an officer of the Seller, certifying that Section 3.2 through Section 3.14 in relation to each of the Company, are true and correct in all material respects (without giving effect to any limitation as to “materiality” or any derivative thereof qualification set forth therein) as of the Closing Date with the same effect as if made on and as of such day, except for any failures of representations and warranties set out in Section 3.3 to 3.14 to be so true and correct of that, individually or in the aggregate, have not had or would not have a MAE..

③ 본 계약에 따른 거래 및 이에 부수되는 거래를 완료하기 위한 매도인의 의무는 거래종결일 또는 그 이전에 아래와 같은 조건들이 만족됨을 전제로 한다. 다만 아래와 같은 조건들의 전부 또는 일부는 매도인의 선택에 따라 전체적으로 또는 부분적으로 서면에 의한 방식으로 면제될 수 있다.

The obligations of Seller to effect the stock transfer in this Agreement and the other transactions contemplated hereby are also subject to the following conditions. Any or all of which may be waived in writing by the Seller in whole or in part in its sole discretion.

(1) 본 계약 제4조에 기재된 매수인의 진술과 보장은 본 계약 체결일로부터 거래종결일까지 모든 중요한 부분에서 진실하고 정확하게 유지되어야 한다.

The representations and warranties of the Purchaser contained in Article IV of this Agreement shall be true in all material respects on and as of the date of this Agreement and each day up to and including the Closing Date with the same effect as if made on and as of each such day.

(2) 매수인은 거래종결일 및 그 이전에 본 계약에 따라 이행되거나 준수되어야 할 모든 약정이나 이행사항을 모든 중요한 부분에서 이행하였거나 준수하였어야 한다.

The Purchaser shall have performed or complied in all material respects with all agreements and covenants required by this Agreement to be performed or complied with by it on or prior to the Closing Date.

(3) 매수인은 이사회 의결 등 본 계약에 따른 거래를 이행하기 위한 내부 절차를 모두 완료하고, 위와 같은 거래에 관련된 모든 문서들은 DZS 및 매도인을 만족시키기에 충분하여야 한다.

All corporate and legal proceedings taken by the Seller in connection with the transactions contemplated by this Agreement (including, without limitation, the passing of necessary board resolutions) and all documents relating to these transactions shall be satisfactory to DZS and the Seller.

(4) 매수인은 본 계약의 체결과 이행에 필요한 공적 승인이나 보고, 별도의 약정에 의하여 동의가 필요한 다른 주주가 있는 경우에는 해당 주주의 동의 등을 취득하였어야 한다.

All government and other approvals (including reporting to government agencies) and consents (including, if any, consents from other shareholders pursuant to specific contractual rights or otherwise) required by the Purchaser in connection with the execution, delivery and performance of this Agreement and the consummation of the transactions contemplated hereby shall have been duly obtained.

(5) 본 계약 체결일 이후, 매수인 또는 매수인의 본 계약상 거래를 종결하기 위한 능력에 대하여 중대한 부정적 영향을 미치는 사유가 발생하지 않았어야 한다.

Since the date of this Agreement, there shall not have occurred any Material Adverse Effect with respect to the Seller or its ability to consummate the transactions contemplated hereunder.

(6) 한국 세무 기관에 의하여 본건 거래에 따른 매도인의 양도소득에 대해 부과되고 매수인이 원천징수 되었어야 하는 세금이 한미조세협약에 따라 면제되었어야 한다.

Any taxes on the capital gains recognized by the Seller as a result of the Transaction that should have imposed by the Korean tax authority and withheld by the Purchaser shall have been exempted under the Korea-U.S. Treaty.

제7조 [계약의 해제]

ARTICLEVII [TERMINATION]

① 본 계약은 거래종결일 이전에는 언제라도 아래와 같은 경우에 해제될 수 있다.

This Agreement may be terminated and the sale of the Stocks contemplated hereby may be abandoned at any time prior to the Closing Date.

(1) 당사자간 서면 합의가 있는 경우

by mutual written consent of the Parties;

(2) DZS 또는 매도인이 제3조에 기재된 진술과 보장을 위반하거나, 본 계약에 따른 의무를 이행하지 아니하고, 그에 대한 시정 요구를 받고도 받은 날로부터 30일 이내에 시정되지 아니한 경우, 매수인은 본 계약을 해제할 수 있다.

By the Purchaser if DZS or the Seller has breached any of the representations and warranties in Article III herein or materially breaches any of its other representations, warranties and obligations hereunder and such breach cannot be cured or is not remedied within thirty (30) days from the date of receipt of notice of such breach;

(3) 매수인이 제4조에 기재된 진술과 보장을 위반하거나, 본 계약에 따른 의무를 이행하지 아니하고, 그에 대한 시정 요구를 받고도 받은 날로부터 30일 이내에 시정되지 아니한 경우, DZS 및 매도인은 본 계약을 해제할 수 있다.

By DZS and the Seller if the Purchaser has breached any of the representations and warranties in Article IV herein or materially breaches any of its other representations, warranties and obligations hereunder and such breach cannot be cured or is not remedied within thirty (30) days from the date of receipt of notice of such breach;

(4) 제6조 제2항에 기재된 매수인의 의무 이행을 위한 선행조건이 2024. 4. 1.까지 충족되지 아니하거나 면제되지 아니한 경우, 본 계약을 위반하지 아니한 매수인은 2024. 4. 1. 이후 언제라도 본 계약을 해제할 수 있다.