0001101680false00011016802023-09-222023-09-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 22, 2023

DZS INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 000-32743 | 22-3509099 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

5700 Tennyson Parkway, Suite 400

Plano, TX 75024

(Address of Principal Executive Offices, Including Zip Code)

(469) 327-1531

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | DZSI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

Second Loan Agreement

As previously disclosed by DZS Inc., a Delaware corporation (the “Company”), in its Current Report on Form 8-K filed with the Securities and Exchange Commission on September 13, 2023 (the “Prior 8-K”), on September 12, 2023, DASAN Network Solutions, Inc., a Korea corporation and an indirect subsidiary of the Company, as borrower (“DNS Korea”), entered into a Loan Agreement (the “First Loan Agreement”) with Dasan Networks, Inc., a Korea corporation, as lender (“DNI”), DZS California, Inc., a California corporation, as collateral provider (“DZS California”), and the Company. Pursuant to the First Loan Agreement, DNS Korea received a three-year term loan from DNI in an aggregate principal amount equal to 32,670,750,000 South Korean Won (“KRW”), the equivalent of $24,500,000 USD (the “First DNI Loan”).

On September 22, 2023, DNS Korea entered into a Loan Agreement (the “Second Loan Agreement”) with DNI, as lender, DZS California, as collateral provider, and the Company, pursuant to which DNS Korea received an additional three-year term loan from DNI in an aggregate principal amount equal to 6,957,650,000 KRW, the equivalent of $5,234,071 USD (the “Second DNI Loan” and, together with the First DNI Loan, the “DNI Loans”), bringing the total amount loaned by DNI to DNS Korea under the DNI Loans to 39,628,400,000 KRW, or the equivalent of $29,734,071 USD. The Second DNI Loan matures on September 12, 2026 and bears interest at a fixed rate of 8.0% per annum. Interest is payable on the last day of each calendar quarter.

The net proceeds under the Second DNI Loan will be used to repay the remaining amount outstanding under the Credit Agreement, dated as of February 9, 2022, by and among the Company, as borrower, the other loan parties party thereto, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent.

The obligations under the Second Loan Agreement are secured by the same collateral that was pledged under the First Loan Agreement: liens on certain assets of DNS Korea and on 9,999,999 shares of the common stock of DNS Korea held by DZS California.

Other than the amount of the Second DNI Loan, the Second Loan Agreement is substantially the same as the First Loan Agreement, including, without limitation, the collateral provisions, prepayment rights, covenants (including financial covenants) and events of default, in each case, as described in the Prior 8-K, which description is incorporated herein by reference.

The foregoing description of the Second Loan Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the Second Loan Agreement, an English translation of which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1 | | Loan Agreement, dated as of September 22, 2023, by and among Dasan Networks, Inc., as Lender, Dasan Network Solutions, Inc., as Borrower, DZS California, Inc., as Collateral Provider, and DZS Inc. (English translation). |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: September 27, 2023 | DZS Inc. |

| | | |

| By: | /s/ Misty Kawecki |

| | Misty Kawecki |

| | Chief Financial Officer |

Loan Agreement

THIS LOAN AGREEMENT (this “Agreement” or the “2nd Loan Agreement”) is made and entered into on this 22nd day of September 2023 by and among:

1.DASAN NETWORKS, INC., a corporation duly incorporated and existing under the laws of Republic of Korea (“Korea”) with its registered office at 10th floor, DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Republic of Korea as lender (the “Lender”);

2.DASAN NETWORK SOLUTIONS, INC., a corporation duly incorporated and existing under the laws of Korea with its registered office at 9th floor DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea as borrower (the “Borrower”);

3.DZS CALIFORNINA, INC., a corporation duly incorporated and existing under the laws of California USA with its registered head office at 330 N Brand Blvd, Glendale, CA 91203 as collateral provider (the “Collateral Provider”); and

4.DZS INC., a corporation duly incorporated and existing under the laws of Korea with its registered office at 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024 (“DZS”);

(Hereinafter, the Lender, the Borrower, the Collateral Provider and DZS, individually, a “Party” and collectively the “Parties”).

- Recitals -

On September 12, 2023, the Lender and the Borrower entered into an agreement which stipulates that the Lender shall advance to the Borrower thirty-two billion six hundred seventy million seven hundred fifty thousand KRW (₩32,670,750,000), the Korean Won equivalent of twenty-four million five hundred thousand USD ($24,500,000) (the “1st Loan”), and the Borrower shall borrow the 1st Loan (the “1st Loan Agreement”, please refer to the Loan Agreement executed on September 12, 2023) and on the same day, the Lender remitted all of the aforementioned loan to the Borrower.

SECTION 1. LOAN DATE AND LOAN AMOUNT

The Lender shall extend an additional loan to the Borrower in an amount equal to six billion nine hundred fifty seven million six hundred fifty thousand KRW(₩6,957,650,000), the Korean Won equivalent of five million two hundred thirty four thousand seventy one USD ($5,234,071) on

September 22, 2023 as the second loan (the “Loan” or the “2nd Loan”), and the Borrower shall borrow the 2nd Loan.

SECTION 2. INCREASE IN MAXIMUM SECURED AMOUNT

In this Agreement, Section 8 of the 1st Loan Agreement shall be applied mutatis mutandis. Both Parties agree that the maximum secured amount of the collateral provided by the Borrower shall increase from sixty-three billion one hundred twenty-six million nine hundred thousand KRW (₩63,126,900,000) to seventy one billion four hundred seventy six million eighty thousand KRW (₩71,476,080,000).

SECTION 3. RELATIONSHIP TO THE 1st LOAN AGREEMENT

1.All provisions of the 1st Loan Agreement shall remain in full force and effect in this Agreement, except for the additional or revised provisions introduced in this Agreement.

2.In the event that the 1st Loan Agreement is terminated, this Agreement shall also be immediately terminated, and this shall not affect the claim for damages in accordance with the 1st Loan Agreement and the 2nd Loan Agreement.

(Intentionally left blank. Signature page follows.)

Each Party, having thoroughly understood the contents of this Agreement, has signed and affixed its seal as follows, and in order to prove the conclusion of this Agreement, four (4) copies of this Agreement have been prepared, with each party keeping one (1) copy.

Date: September 22, 2023

The Lender

DASAN NETWORKS, INC.

Address: DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Republic of Korea

/s/ Nam Min Woo

Title: CEO

Name: Nam Min Woo

The Borrower

DASAN NETWORK SOLUTIONS, INC.

Address: DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea

/s/ Won Deok-Yeon

Title: CEO

Name: Won Deok-Yeon

The Collateral Provider

DZS CALIFORNIA, INC.,

Address: 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024

/s/ Charlie Vogt

Title: CEO

Name: Charlie Vogt

DZS

DZS INC.

Address: 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024

/s/ Charlie Vogt

Title: CEO

Name: Charlie Vogt

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

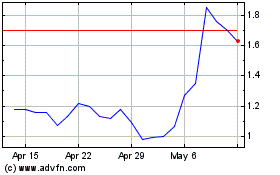

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Apr 2024 to May 2024

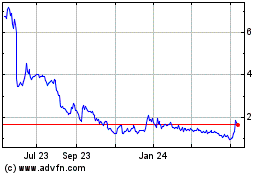

DZS (NASDAQ:DZSI)

Historical Stock Chart

From May 2023 to May 2024