0001101680false00011016802023-02-162023-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 12, 2023

DZS INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 000-32743 | 22-3509099 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

5700 Tennyson Parkway, Suite 400

Plano, TX 75024

(Address of Principal Executive Offices, Including Zip Code)

(469) 327-1531

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.001 par value | DZSI | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

Loan Agreement

On September 12, 2023, DASAN Network Solutions, Inc., a Korea corporation, as borrower (“DNS Korea”), entered into a Loan Agreement (the “Loan Agreement”) with Dasan Networks, Inc., a Korea corporation, as lender (“DNI”), DZS California, Inc., a California corporation, as collateral provider (“DZS California”), and DZS Inc., a Delaware corporation (the “Company”). DNS Korea is an indirect subsidiary of the Company. Pursuant to the Loan Agreement, DNS Korea received a three-year term loan in an aggregate principal amount equal to 32,670,750,000 South Korean Won (“KRW”), the equivalent of $24,500,000 USD (the “DNI Loan”). The DNI Loan matures on September 12, 2026 and bears interest at a fixed rate of 8.0% per annum. Interest is payable on the last day of each calendar quarter.

The net proceeds under the DNI Loan were used to repay a portion of the outstanding obligations under the Credit Agreement, dated as of February 9, 2022 (as amended, the “Credit Agreement”), by and among the Company, as borrower, the other loan parties party thereto, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative Agent”).

The obligations under the Loan Agreement are secured by liens on certain assets of DNS Korea (the “Collateral Assets”) and on 9,999,999 shares of the common stock of DNS Korea held by DZS California (the “Pledged Shares”).

DNS Korea may prepay amounts outstanding under the DNI Loan, in whole or in part, at any time without premium or penalty, upon 30 days’ prior written notice to DNI.

The Loan Agreement contains certain financial covenants, including requiring DNS Korea to maintain (i) a maximum Leverage Ratio (as defined in the Loan Agreement) of (a) 6.00 to 1.00 at the end of each of the second and third quarter of 2024, (b) 5.00 to 1.00 from the fourth quarter of 2024 through the second quarter of 2025 and (c) 4.00 to 1.00 from the third quarter of 2025 until the DNI Loan is repaid in full, (ii) cash of at least 1.3 billion KRW and (iii) a combined total of cash, accounts receivable and inventory of at least 33.0 billion KRW.

In addition, the Loan Agreement contains various covenants that limit the ability of the Company, DNS Korea and DZS California to, among other things, (i) grant liens on the Collateral Assets to any third party, (ii) sell, donate, pledge, provide as collateral or otherwise dispose of the Pledged Shares to any third party, (iii) incur or assume indebtedness, (iv) make loans to affiliates or (v) engage in certain other transactions or make certain other fundamental changes.

The Loan Agreement contains events of default that are customary for loans of this type. If an event of default occurs under the Loan Agreement, all indebtedness under the Loan Agreement will become immediately due and payable and DNI will be entitled to take various actions against the collateral, including by exercising its right to acquire the Pledged Shares or selling the collateral to satisfy any obligations under the outstanding indebtedness.

The foregoing description of the Loan Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the Loan Agreement, an English translation of which is filed as Exhibit 10.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Limited Consent

Also on September 12, 2023, the Company entered into a letter agreement (the “Limited Consent”) with the lenders under the Credit Agreement, which, among other things, permits the incurrence of the DNI Loan and certain other indebtedness of DNS Korea, provided that (i) the proceeds of the DNI Loan and such other indebtedness are immediately used to repay the obligations under the Credit Agreement and (ii) the other conditions set forth in the Limited Consent are satisfied. The Limited Consent does not waive any existing defaults under the Credit Agreement.

As of September 12, 2023, after giving effect to the repayment of the obligations under the Credit Agreement with the proceeds of the DNI Loan, there were $9.4 million in outstanding borrowings and $3.0 million in letters of credit under the Credit Agreement.

The Company is in active discussions with various financing sources to repay in full the remaining obligations under the Credit Agreement and to obtain a replacement credit facility, but there can be no assurance as to the timing or terms of any such incremental financing or replacement working capital facility.

The foregoing description of the Limited Consent is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the Limited Consent, a copy of which is filed as Exhibit 10.2 to this Current Report and is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Current Report is incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with the entry into the Loan Agreement, Mr. Min Woo Nam, the Chairman of the Board of Directors (the “Board”) of the Company and the Chief Executive Officer of DNI, resigned from the Board effective as of September 15, 2023. Mr. Nam’s resignation from the Board was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices.

Item 7.01 Regulation FD Disclosure.

On September 13, 2023, the Company issued a press release announcing the entry into the Loan Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information set forth in this Item 7.01, including Exhibit 99.1, are deemed to be “furnished” and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 10.1* | | Loan Agreement, dated as of September 12, 2023, by and among Dasan Networks, Inc., as Lender, Dasan Network Solutions, Inc., as Borrower, DZS California, Inc., as Collateral Provider, and DZS Inc. (solely for the limited purposes stated therein) (English translation). |

| 10.2 | | Letter Agreement, dated as of September 12, 2023, by and among DZS Inc., as Borrower, the other Loan Parties party thereto, JPMorgan Chase Bank, N.A., as Lender and as Administrative Agent, and Texas Capital Bank, as Lender. |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Schedules and similar attachments to this Exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally a copy of any omitted schedule or exhibit to the U.S. Securities and Exchange Commission upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: September 13, 2023 | DZS Inc. |

| | | |

| By: | /s/ Misty Kawecki |

| | Misty Kawecki |

| | Chief Financial Officer |

Loan Agreement

THIS LOAN AGREEMENT (this “Agreement”) is made and entered into on this 12th day of September 2023 by and among:

1.DASAN NETWORKS, INC., a corporation duly incorporated and existing under the laws of Republic of Korea (“Korea”) with its registered office at 10th floor, DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Republic of Korea as lender (the “Lender”);

2.DASAN NETWORK SOLUTIONS, INC., a corporation duly incorporated and existing under the laws of Korea with its registered office at 9th floor DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea as borrower (the “Borrower”);

3.DZS CALIFORNINA, INC., a corporation duly incorporated and existing under the laws of California USA with its registered head office at 330 N Brand Blvd, Glendale, CA 91203 as collateral provider (the “Collateral Provider”); and

4.DZS INC. a corporation duly incorporated and existing under the laws of Korea with its registered office at 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024(“DZS”);

(Hereinafter, the Lender, the Borrower, the Collateral Provider and DZS, individually, a “Party” and collectively the “Parties”).

SECTION 1. LOAN DATE AND LOAN AMOUNT

The Lender shall advance to the Borrower three hundred twenty-six billion seven thousand seven hundred fifty thousand KRW (₩32,670,750,000), the Korean Won equivalent of twenty-four million five hundred thousand USD ($24,500,000) (“Loan Amount”) on September 12, 2023 as the first loan (“Loan”), and the Borrower shall borrow the Loan Amount.

SECTION 2. PURPOSE OF LOAN

The Borrower shall use the proceeds of the Loan for the sole purpose of financing DZS, and DZS shall use the above mentioned financing solely for the purpose of repaying the loan amount borrowed from J.P. Morgan Chase Bank, N.A. and Texas Capital Bank pursuant to the Credit Agreement, dated as of February 9, 2022, as amended (the “2022 Credit Agreement”).

SECTION 3. CONDITIONS PRECEDENT

The obligations of the Lender to make the Loan Amount available to the Borrower under this Agreement are subject to the satisfaction of each of the following conditions precedent:

1.All representations and warranties made by the Borrower shall be true and correct;

2.No event of default has occurred and no event that may constitute an event of default has occurred or is continuing under this Agreement;

3.All physical collateral that the Lender is entitled to receive under this Agreement have been provided;

4.Each Party shall have obtained the necessary consent and approval from third parties for the execution and performance of this Agreement; and

5.The Borrower shall take actions (such as document submissions) the Lender finds as necessary under the Lender’s reasonable judgment.

SECTION 4. REPAYMENT DATE

1.The Borrower shall repay the above entire Loan Amount by September 12, 2026.

2.The Borrower may prepay the Loan Amount in whole or in part even before the due date of repayment stated in this Section by giving thirty (30) days prior written notice to the Lender. The Borrower shall not incur any separate fees for early repayment.

SECTION 5. INTEREST AND LATE PAYMENT DAMAGES

1.The rate of interest applicable to the Loan Amount shall be at a fixed rate of eight point zero percent (8.0%) per annum.

2.When the Borrower repays the Loan Amount, it shall repay the interest corresponding to the repayment amount along with the principal. In cases where partial repayments of the Loan Amount are made over time, it shall be considered that the interest accrued up to the day prior to the repayment date is paid first and the repayment of the principal of the Loan Amount is made afterwards.

3.If the Borrower delays in repaying the Loan Amount, it shall pay the Lender late payment damages calculated at the rate of fourteen point zero percent (14.0%) per annum on the delayed principal amount.

4.Interests and late payment damages shall be calculated on a daily basis, considering a year as three hundred sixty five (365) days, and based on the actual number of days that have elapsed during the period in which the interest or late payment damages have occurred (including the first day but excluding the last day).

5.The Borrower shall pay the interest calculated in accordance with this Section to the Lender on the last day of each calendar quarter (i.e., March 31st, June 30th, September 30th and December 31st).

SECTION 6. REPAYMENT METHOD

The Borrower shall repay the Loan Amount and the interest accrued thereon in accordance with this Agreement by transferring the funds to a bank account in the name of the Lender, designated by the Lender in advance.

SECTION 7. EVENTS OF DEFAULT

1.If any of the following events occurs, even without separate notice or demand for performance from the Lender, the Borrower shall immediately lose the benefits of this Agreement and must repay the entire loan principal to the Lender in a lump sum.

1)The Borrower applies for bankruptcy, commencement of rehabilitation procedures, or if the applicant for such proceedings of the Borrower fails to withdraw within five (5) business days, or if bankruptcy is declared for the Borrower or rehabilitation procedure is initiated;

2)The Borrower is recognized as an enterprise with insolvency signs under the Corporate Restructuring Promotion Act or management controls by financial institutions are initiated;

3)The circumstances for dissolution as stipulated in the Articles of Incorporation of the Borrower occur, or a court order or judgment for dissolution is issued, or a resolution for dissolution is passed at a shareholders’ meeting;

4)The Borrower suspends or terminates significant business operations, or significant business suspension or cancellation measures are imposed on the Borrower by a supervisory authority (provided, however, temporary suspension due to labor disputes is excluded);

5)The Borrower is determined to be in payment default or suspension including when the Borrower’s bank account transactions are suspended, or trading is suspended by an exchange clearinghouse or when the Borrower applies for inclusion in the defaulting borrower list;

6)The external auditor for the Borrower provides an opinion other than an unqualified opinion on the financial statements in any periodic audit results of the Borrower and the Borrower fails to remedy such opinion within a period of six (6) months from the date on which the relevant audit result is notified to the Borrower;

7)The events of default for other loans of the Borrower besides the Loan under this Agreement occur;

8)The Borrower violates Section 11.1, 11.2, 11.6, 11.8 or 12, of this Agreement;

9)Upon the occurrence of a breach of Section 13 of this Agreement by the Borrower, the Borrower further fails to comply with Lender’s demand to submit any relevant reports and other materials without delay;

10)The Borrower violates Section 11.3, 11.4, 11.5, or 11.7 of this Agreement, and fails to remedy such violation within sixty (60) days from the date the Lender requests for remedy;

11)DZS violates Section 9 of this Agreement; or

12)DZS experiences trading suspension (excluding any temporary and extraordinary trading suspension due to any cause not attributable to DZS or its subsidiaries) or delisting or circumstances equivalent to those described in Clause 1 to 7 of this Paragraph.

2.Each of the Borrower and DZS shall, without delay, provide written notice to the Lender upon becoming aware of the occurrence of any of the circumstances listed in Paragraph 1 and notify the Lender of the occurrence of such circumstances along with relevant facts and actions (or facts or actions that could constitute such circumstances over time).

SECTION 8. COLLATERAL

1.The Borrower shall provide the Lender with following collateral in accordance with the following Clauses:

1)Collateral Provided: Assets owned by the Borrower as specified in Attachment 1 (hereinafter, “Collateral Assets”)

2)Secured Obligations: All guarantee obligations to be borne by the Borrower for past, present, or future liabilities to the Lender including the Loan Amount, interest accrued thereon, late payment damages and indemnification obligations

3)Maximum Amount Secured: sixty three billion one hundred twenty-six million nine hundred thousand KRW (₩63,126,900,000)

4)Form of Collateral: Establishment of the first priority mortgage on the Collateral Assets as of the date of this Agreement (provided, however, if the first priority collateral has already established on some of the Collateral Assets, a subordinate collateral shall be established for those)

5)Collateral Provision (Establishment) Date: Execution Date of this Agreement

6)In the event that the Borrower borrows additional loan amounts from the Lender, the Borrower agrees to increase the maximum amount secured by the collateral established on the Collateral Assets and to make any necessary changes in registration.

2.The Collateral Provider shall establish a first kun-pledge (Collateral Limit: Maximum Amount Secured) in favor of the Lender (hereinafter, “Kun-pledge”) over nine million nine hundred ninety-nine thousand nine hundred ninety-nine (9,999,999) shares of the Borrower’s issued stocks held by the Collateral Provider (hereinafter, “Pledged Shares”), and shall set up the first lien on the Pledged Shares (hereinafter, “Kun-pledge”) and fulfill the necessary conditions required as of the date of this Agreement (provided, however, if a priority lien has already been established on the Pledged Shares, a subordinate lien shall be established). The detailed terms of the Kun-pledge shall be governed in accordance with Attachment 2.

SECTION 9. OBLIGATIONS

1.DZS shall use the Loan Amount received from the Lender solely for the purpose of repaying the amounts borrowed under the 2022 Credit Agreement.

2.DZS shall not provide the Collateral Assets and the Pledged Shares as collateral to any third party.

3.Immediately upon repayment of any part of the loan borrowed under the 2022 Credit Agreement, DZS shall deliver to the Lender all document proofs thereof received from the relevant banks (including, but not limited to, a certificate of repayment and receipt of the repayment amount). In the event DZS repays the full amount of the loan borrowed under the 2022 Credit Agreement, DZS shall immediately terminate and release all collateral provided under the 2022 Credit Agreement and deliver to the Lender all document proofs thereof.

4.DZS shall not pay any dividend or carry out any capital increase with consideration, in connection with any shares provided as a collateral under this Agreement, or dispose any collateral provided under this Agreement.

SECTION 10. REPRESENTATIONS AND WARRANTIES

1. The Borrower represents and warrants as of the Execution Date of this Agreement to the Lender as follows:

1)The Borrower is a corporation duly incorporated and validly existing under the laws of Korea. The Borrower has drafted various documents related to this Agreement, including collateral agreements and other accompanying documents of which the Borrower is the party (hereinafter, “Agreement Documents”) and has taken all the necessary internal procedures, including passing board resolutions to fulfill obligations arising therefrom. The Agreement Documents validly bind the Borrower.

2)The execution of this Agreement, the provision of monetary loans and other contents of this Agreement shall not violate any laws, any content of other contracts that bind the Borrower, any court judgments, administrative decisions, instructions or recommendations.

3)All collateral and pledged assets provided by the Borrower, DZS, and the Collateral Provider are free from any legal defects that would impair the Lender’s security interest, and the Lender’s rights over the collateral and the pledged assets are complete and free from dispute.

4)The act of providing collateral for the Loan Amount does not prejudice and is not intended to prejudice the rights of general lenders of either the Borrower, DZS or the Collateral Provider.

5)Other than the litigations that have been previously disclosed to the Lender, no significant lawsuit, arbitration, or dispute that could have a material adverse effect on the business, property, or financial condition of the Borrower or DZS is currently pending against the Borrower as of the date of this Agreement.

6)No events of default have occurred with respect to the Loan Amount.

7)All information provided by the Borrower, DZS, and the Collateral Provider to the Lender in connection with the Agreement Documents is complete and accurate in all material aspects.

2. As of the Execution Date of this Agreement, the Borrower has disclosed the following information regarding the current financial statements of DZS and the Lender is aware of the following:

1)The current financial statements of DZS (including its subsidiaries) are under restatements, and, as submitted to the Securities and Exchange Commission and publicly disclosed, DZS has received a notice of non-compliance from the Listing Center of NASDAQ.

2)Descriptions regarding the financial restatements and accounting errors are preliminary, unaudited, and subject to potential changes as a result of ongoing review by DZS’s audit committee and the completion of financial restatements.

3)Therefore, neither the Borrower nor DZS can make guarantees concerning the actual impact of financial restatements or regarding the modification of financial statements or additional accounting errors for the periods outside the disclosure period. Furthermore, neither the Borrower nor DZS can provide with certainty regarding the period of which revenues previously recognized within the disclosed period will ultimately be recognized.

SECTION 11. AFFIRMATIVE COVENANTS

The Borrower covenants and agrees the following obligations:

1)The Borrower shall ensure that the representations and warranties made under Section 10 remain true and accurate at all times after the loan date.

2)The Borrower shall faithfully fulfill and comply with all obligations of the Borrower under any contracts executed or to be executed related to this Agreement.

3)The Borrower shall maintain a leverage ratio lower than the ratio specified in Attachment 3.

4)The Borrower shall maintain cash in the amount of at least one billion three hundred million Korean Won (₩1,300,000,000), until all loan principal is repaid after the Borrower borrows the Loan Amount.

5)The Borrower shall maintain a combined total of cash, accounts receivable and inventory (hereinafter, “Collateral Coverage Amount”) of at least thirty-three billion Korean Won (₩33,000,000,000).

6)The Borrower shall use the Loan Amount solely for the purposes stated in Section 2.

7)The Borrower shall take all necessary measures to maintain the collateral as stipulated in this Agreement.

8)The Borrower shall provide the Lender with any documents reasonably requested by the Lender.

SECTION 12. PRIOR WRITTEN CONSENT

The Borrower shall obtain the prior written consent of the Lender for the following matters:

1)Payment of funds to DZS (excluding normal operations including management fees and other shared expenses, e.g., Software licenses); provided, however, that, the payment of any consideration for the management shall require the Lender’s prior written consent.

2)The cumulative total amount of borrowed funds from other third parties in excess of one billion Korean Won (₩1,000,000,000); provided, however, that this excludes the extension of current borrowings or securing additional amounts from other banks in Korea to pay off in full the amounts owed under the 2022 Credit Agreement.

3)Loans to affiliated entities.

4)Other major management matters as specified in Attachment 4.

SECTION 13. REPORTING AND DOCUMENT SUBMISSION

1.The Borrower shall promptly notify the Lender without separate request from the Lender in the following cases or if there is a possibility of their occurrence:

1)If any promissory notes or checks issued, endorsed, and guaranteed by the Borrower are returned or if transactions with banks are suspended;

2)If there is an application for bankruptcy, commencement of rehabilitation proceedings or similar procedures, or if the Borrower is recognized as an enterprise with insolvency signs;

3)If litigation, arbitration, or other disputes involving the Borrower as a party arises;

4)If administrative sanctions are imposed by government or quasi-government agencies;

5)In the event of any change in the major shareholder(s) holding 10% or more of the total shares issued by the Borrower;

6)If events of default or circumstances that may have or are likely to have negative impact on the Borrower’s business or financial status occur under the Borrower’s subjective judgment; or

7)In the event of social concerns or concerns in accounting terms regarding the governance structure and internal transactions with affiliated entities, or if external auditors present opinions other than unqualified opinions on the financial statements, or in case of legal disputes arising from violations of laws or articles of incorporation by the board of directors of the Borrower or due to neglect of the duties of the board or directors of the Borrower.

2.The Borrower shall submit the following matters within the specified deadlines without separate request from the Lender.

1)Changes in accounts receivable and inventory – by the 30th day of the following month (provided, however, if changes in accounts receivable and inventory exceed ten percent (10%) of the holdings, immediate reporting is required)

2)Financial performance and plans of cash balance – weekly (the planning period for cash balance plans shall be thirteen (13) weeks from the reporting date)

3)Annual Reporting – Within ninety (90) days from the start of the next fiscal year (provided, however, that such time period may be delayed without default pending the completion of the restatement and related audit procedures in connection with the restatement described in paragraph 2 of Section 10):

A. Audited financial statements by a certified accounting firm.

B. Annual management report (business plan)

C. Shareholder registry (as of the reporting date)

D. Tax reconciliation statement

4)Quarterly Reporting – Within forty five (45) days from the start of the next quarter (provided, however, that such time period may be delayed without default pending the completion of the restatement and related audit procedures in connection with the restatement described in paragraph 2 of Section 10):

A. Quarterly financial statement

B. Quarterly management report

5)Monthly Reporting – By 30th day of the following month:

A. Monthly financial result (such as sales status)

B. Changes in officers or employee headcount (hiring, resignations, etc.)

6)Other Reporting –Bank Statement confirming financial transactions with financial institutions within thirty (30) days from the due date of each month.

SECTION 14. ASSIGNMENT OF RIGHTS AND OBLIGATIONS

The Borrower, the Collateral Provider, and DZS shall not transfer, assign, or otherwise dispose of any rights acquired or contractual status obtained pursuant to this Agreement to a third party, or provide them as collateral, without a prior written consent of the Lender.

SECTION 15. INTERPRETATION

Matters not specified in this Agreement shall be governed by relevant laws and customary practices. In the event there is a discrepancy in the interpretation of the provisions of this Agreement between the Lender and the Borrower, a comprehensive and reasonable interpretation shall be made, taking into account the form and content of the Agreement, the purpose of the Agreement, the circumstances, and the intentions of the Parties involved.

SECTION 16. AMENDMENT AND TERMINATION

1.In order to amend this Agreement, the unanimous written consent of all the relevant parties shall be obtained to effect such amendment. Provided, however, matters limited to the rights and obligations of some parties may be amended by the written consent of such relevant parties. In such cases, the rights and obligations of other parties must remain unaffected.

2.If either party violates this Agreement, the other party may terminate the Agreement. In such case, the party violating this Agreement shall compensate the other party for any damages incurred upon immediate request.

3.The Borrower shall not terminate this Agreement under any circumstances until the full repayment of the Loan principal and monetary obligations under this Agreement, or without obtaining the written approval of the Lender.

SECTION 17 NOTIFICATION

Notifications, requests, consents, and other communications under this Agreement shall be made in writing, and personally delivered or sent by registered mail, internationally recognized courier service, post, or electronic mail (email) to the following addresses or contacts (or to addresses or contacts designated by one party to the other party for notification), and a notice shall be deemed received on the earlier of the date on which the written notice actually arrives at the following address or contact or five (5) business days after the sending date. In case of a change in the notification address, the respective party shall promptly notify the other party thereof, and in the absence of such notification, the other party shall be deemed to make due notice of the respective party by sending registered mail, facsimile, post, or email to the following address or contact.

1.If to the Lender

To the Lender:

Dasan Networks, Inc.

Address: 10th floor, DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea

Phone: 070-7010-1165

Email: doohwan.yang@dasannetworks.com

2.If to the Borrower

Dasan Network Solutions, Inc.

Address: 9th floor, DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea

Phone: 070-7010-1050

Email: Seongjin.kim@dzsi.com

3.If to the Collateral Provider

DZS California Inc., c/o DZS Inc.

Address: 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024

Phone: 469-327-1531

Email: legal@dzsi.com

4.If to DZS

DZS Inc.

Address: 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024

Phone: 469-327-1531

Email: legal@dzsi.com

SECTION 18. PARTIES’ RESPECTIVE OBLIGATIONS

Each Party agrees and covenants to the other Parties that it shall dully perform this Agreement in good faith. For the avoidance of doubt, DZS shall be liable under this Agreement with respect to its obligations under Section 9 only.

SECTION 19. TAX

Each Party shall bear any taxes and charges imposed on them in connection with this Agreement in accordance with applicable laws.

SECTION 20. JURISDICTION

In the event of a dispute arising from this Agreement, the dispute shall be resolved through arbitration at the Korean Commercial Arbitration Board in accordance with the Expedited Procedures in domestic arbitration rules.

SECTION 21. GOVERNING LAW

This Agreement and the rights and obligations between the Parties under this Agreement shall be interpreted and governed by the laws of Korea.

SECTION 22. LANGUAGE

This Agreement is drafted in both Korean and English languages. In the event of conflicts in interpretation between the two versions, the Korean version shall prevail.

(Intentionally left blank. Signature page follows.)

Each Party, having thoroughly understood the contents of this Agreement, has signed and affixed its seal as follows, and in order to prove the conclusion of this Agreement, four (4) copies of this Agreement have been prepared, with each party keeping one (1) copy.

Date: September 12, 2023

The Lender

DASAN NETWORKS, INC.

Address: DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Republic of Korea

Title: CEO

Name: Nam Min Woo /s/ Nam Min Woo

The Borrower

DASAN NETWORK SOLUTIONS, INC.

Address: DASAN Tower, 49, Daewangpangyo-ro 644 beon-gil, Bundang-gu, Seongnam-si, Gyeonggi-do, Korea

Title: CEO

Name: Won Deok-Yeon /s/ Won Deok-Yeon

The Collateral Provider

DZS CALIFORNIA, INC.,

Address: 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024

Title: CEO

Name: Charlie Vogt /s/ Charlie Vogt

DZS

DZS INC.

Address: 5700 Tennyson Parkway, Suite 400, Plano, Texas 75024

Title: CEO

Name: Charlie Vogt /s/ Charlie Vogt

Attachment 2

DETAILS OF THE KUN-PLEDGE

1.Definition

1)Pledged Shares means 9,999,999 shares of the Borrower’s issued and registered common stocks held by the Collateral Provider.

2)The Secured Obligations means the Loan Amount and all guarantee obligations to be borne by the Borrower pursuant to this Agreement for present, or future liabilities (including interest, late payment damages, indemnification obligations).

2.Scope of Effect of the Kun-Pledge

The effect of the Kun-pledge on the Pledged Shares pursuant to this Agreement shall automatically extends to any funds or shares to be received by the Lender, without separate declaration or other actions of the Lender, in cases such as the distribution of profits or interest, distribution of remaining assets, stock redemption, merger, division, or conversion of shares.

3.Registration of Kun-Pledge

Concurrently upon the advancement of the Loan Amount by the Lender to the Borrower in accordance with Section 1 of this Agreement, the Collateral Provider shall fulfil or satisfy all of the following conditions:

1)Delivery of a certified copy of the shareholder register of the Borrower showing the corporate name and address of the Lender as pledgee to whom the Pledged Shares are provided.

2)Delivery of the original share certificates representing the Pledged Shares and stating the Lender as pledgee to whom such Pledged Shares are provided (or, if provided without such statement, the Lender may set out its status as pledgee thereof by itself).

3)Execution and delivery of the document attached hereto as Exhibit A.

4)Execution and delivery of the document attached hereto as Exhibit B.

4.Obligation to Maintain Pledged Assets

1)The Collateral Provider confirms that, as of the Kun-pledge completion date, no pledge restricting ownership of the Pledged Shares is in place except the collateral provided under the 2022 Credit Agreement.

2)The Collateral Provider shall not, without the prior written approval of the Lender, (i) sell, donate, pledge (excluding pre-existing pledges or pledges under this Agreement), or otherwise dispose of the Pledged Shares to any third party; (ii) engage in any acts that could negatively affect the value of the Pledged Shares; or (iii) undertake any actions that could negatively impact the Lender’s rights and/or the execution of this Agreement.

3)If, the exercise of the Kun-pledge becomes impossible or significantly challenging under the Lender’s reasonable judgment, the Collateral Provider shall provide alternative collateral of equivalent value under the Lender’s reasonable judgment, as requested by the Lender, to account for the decrease in value of the Collateral Shares.

5.Exercise of the Kun-Pledge

1)In the event that the Borrower is required to repay the Laon Amount due to the maturity date or due to the occurrence of the event of default, the Lender may exercise the Kun-pledge under this Agreement.

2)Through means, timing, and pricing that are generally deemed appropriate, the Lender may at its discretion, as one method of exercising the Kun-pledge, dispose of the Pledged Shares, deducting all costs from the proceeds of such disposition and applying the balance to the discharge of the Secured Obligations irrespective of the statutory priority or may acquire the Pledged Shares as an alternative to the discharge of all or a portion of the secured loan. In the latter case, the Lender shall promptly notify the Collateral Provider of acquisition of the pledged assets.

3)The Collateral Provider grants the Lender the authority to supplement the blank transfer certificate provided for the Lender under this Agreement and the Lender approves such authorization. This authorization cannot be canceled or revoked during the period until the complete performance of the Secured Obligations.

4)The Collateral Provider confirms and guarantees that, when the Lender exercises the Kun-pledge pursuant to this clause to directly acquire the Pledged Shares or dispose of them to a third party, there are no provisions or restrictions in the Articles of incorporation or other agreements of the issuer of the Pledged Shares that could affect the exercise of the Kun-pledge.

6.Continuity and Individuality of Collateral

1)The Kun-pledge established under this Agreement shall remain in effect as a continuing security for the Secured Obligations until the complete discharge of the Secured Obligations.

2)If the Collateral Provider has provided separate collateral or guarantees to the Lender with respect to the Secured Obligations, such collateral or guarantees shall not be affected by this Agreement. Such collateral or guarantees shall be distinct from the collateral established under this agreement and may be applied cumulatively alongside the collateral established under this agreement.

7.Termination of the Kun-pledge

Upon full repayment of the Secured Obligations, the Lender shall, as required by the Collateral Provider, take necessary actions to promptly terminate the Kun-pledge established under this Agreement. However, the costs associated with such termination shall be borne by the Collateral Provider.

8.Expenses

The Collateral Provider shall bear the expenses related to the preservation of rights, exercise of rights, and other expenses related to indemnification payments in connection with the Lender’s rights under this Agreement. In the event the Lender has covered such costs, the Collateral Provider shall promptly reimburse them. Expenses incurred in the execution of the Kun-pledge shall be first covered from the proceeds of the pledged assets’ realization.

Exhibit A

WRITTEN CONSENT TO DISPOSITION OF SHARES

To: DASAN NETWORKS, INC.

Reference is made to that certain Loan Agreement dated September 12, 2023 (the “Loan Agreement”) by and between, among others, DZS California, Inc. (the “Collateral Provider”) and Dasan Networks, Inc. (the “Lender”) and other documents and agreements ancillary thereto (together with the Loan Agreement, the “Transaction Documents”). Unless otherwise defined herein, all capitalized terms used herein shall have the respective meanings given to such terms in the Transaction Documents.

The Collateral Provider is the owner of 9,999,999 shares in the ordinary capital of Dasan Network Solutions, Inc. (the “Shares”) and created a kun-pledge over the Shares in favor of the Lender in accordance with the Transaction Documents. The Collateral Provider hereby acknowledges, covenants and agrees that, in the event the Borrower fails to perform any of the Secured Obligations, the Lender may acquire by itself or dispose to any third parties the Shares in accordance with the Transaction Documents, and, in such event, the Collateral Provider shall do any and all acts necessary for and in connection with the acquisition or disposition of the Shares by the Lender, including but limited to, making entry of a change in the holder of the Shares, upon the Lender’s request.

The Collateral Provider further acknowledges and agrees that the right, power and authority granted to the Lender hereunder are irrevocable and cannot be terminated by the Collateral Provider, unless and until the Lender in its discretion determines that the Secured Obligations are fully performed, discharged and released.

Dated as of September 12, 2023

Collateral Provider

DZS California, Inc (seal)

Exhibit B

SHARE TRANSFER DEED

To: Dasan Networks, Inc. (“Transferee”)

DZS California, Inc. (“Transferor”), as owner of 9,999,999 shares in the ordinary capital of Dasan Network Solutions, Inc. (the “Company”), hereby assigns and transfers the entire shares in the Company owned by Transferor (the “Shares”) to the recipient of this Deed.

In furtherance of the foregoing, Transferor hereby grants to Transferee the power and authority to determine and set out the name of the recipient of this Deed. Transferor hereby further acknowledges and agrees that, such power and authority granted to Transferee hereunder shall be irrevocable and may not be terminated by Transferor until the entire secured obligations created under the that certain Loan Agreement dated September 12, 2023 by and between, among others, Transferor and Transferee, and other documents and agreements ancillary thereto (the “Secured Obligations”) is fully discharged and released and such power and authority shall be valid and effective until the full discharge and release of the Secured Obligations.

Transferor hereby covenants and agrees that, in the event Transferee acquires the Shares in accordance with this Deed, such acquisition shall be valid and enforceable against the Company and Transferee shall not make any objection thereto.

Dated as of September 12, 2023

Transferor

DZS California, Inc (seal)

Attachment 3

BORROWER’S LEVERAGE RATIO

1.This obligation to comply with the Leverage Ratio shall be effective from the second quarter of 2024.

2.The Borrower’s Leverage Ratio shall be calculated as follows:

3.For the sole purpose of Leverage Ratio calculation, if EBITDA is less than zero point zero one USD ($0.01), EBITDA shall be deemed as zero point zero one USD ($0.01).

4.The Borrower’s Leverage Ratio shall not exceed the following thresholds at the end of each accounting quarter:

1)The second and third quarters of 2024 – 6.00 : 1.00

2)From the fourth quarter of 2024 to the second quarter of 2025 – 5.00 : 1.00

3)From the third quarter of 2025 until repayment of the principal of the Loan – 4.00 : 1.00

5.For the purpose of this Attachment 3,

1)“EBITDA” means Net Income (Loss) plus or minus (as applicable) (i) interest expense, net, (ii) income tax provision (benefit), and (iii) depreciation and amortization expense;

2)“Adjusted EBITDA” means EBITDA plus or minus (as applicable) (i) stock-based compensation, (ii) other income and expense and (iii) the impact of material transactions or events that are not indicative of the Borrower’s core operating performance, such as acquisition costs, restructuring and other charges, including termination related benefits, headquarters and facilities relocation, executive transition, and bad debt expense primarily related to a large customer in India, and legal costs related to certain litigation, any of which may or may not be recurring in nature; and

3)any regional Adjusted EBITDA shall be calculated consistently by apply the definitions above, prior to any allocations for management fees or shared costs from DZS.

Attachment 4

OTHER MAJOR MANAGEMENT MATTERS

1.Transactions of either purchases and expenses equal to or exceeding twenty billion KRW (₩20,000,000,000) based on a single transaction; provided, however, excluding purchases and expenses related to raw materials or products, or other purchases and expenses, in each case, in the ordinary course of business).

2.Suspension of major business, transfer or disposal of the company’s operations or material assets (including leasing, transfer or providing as collateral)

3.Initiation of dissolution, liquidation, corporate rehabilitation procedure, bankruptcy proceedings, corporate restructuring proceedings, or similar procedures for the company

4.Execution, amendment, termination, or cancellation of material contracts (excluding those in accordance with the ordinary course of business)

5.Filing, withdrawal or settlement of lawsuits or other disputes involving claims equal to or exceeding five hundred million KRW (₩500,000,000)

September 12, 2023

DZS Inc.

5700 Tennyson Parkway, Suite 400

Plano, Texas 75024

Attention: Misty Kawecki

Re: Credit Agreement, dated as of February 9, 2022 (as amended, the “Credit Agreement”), among DZS Inc., a Delaware corporation (the “Borrower”), the other Loan Parties party thereto, the Lenders party thereto, and JPMorgan Chase Bank, N.A., as Administrative Agent (the “Administrative Agent”). Capitalized terms used in this letter agreement (this “Agreement”) and not otherwise defined herein shall have the meanings given to them in the Credit Agreement.

Ladies and Gentlemen:

1.Background. The Borrower has informed the Administrative Agent and the Lenders that certain Events of Default have occurred (a) under clause (d) of Article VII of the Credit Agreement as a result of the failure by the Loan Parties to maintain the minimum Liquidity required by Section 6.12(c)(i) of the Credit Agreement for the fiscal quarter ended June 30, 2023, (b) under clause (d) of Article VII of the Credit Agreement as a result of the failure by the Loan Parties to maintain the minimum Liquidity required by Section 6.12(c)(ii) of the Credit Agreement during the weeks of June 19, 2023 and June 26, 2023, (c) under clause (e) of Article VII of the Credit Agreement as a result of the failure by the Loan Parties and their Subsidiaries to cause Chase to be their principal depository bank as required by Section 5.13 of the Credit Agreement within the time period specified therein, (d) under clause (e) of Article VII of the Credit Agreement as a result of the failure by the Borrower to timely deliver the quarterly financial statements required by Section 5.01(b) of the Credit Agreement for the fiscal quarter ended June 30, 2023 and (e) under clause (d) of Article VII of the Credit Agreement as a result of the failure by the Loan Parties to maintain the minimum EBITDA required by Section 6.12(d) of the Credit Agreement for the fiscal quarter ended June 30, 2023 (the foregoing Events of Default, collectively, the “Specified Defaults”).

2.Requested Consent. The Borrower has requested that, notwithstanding the existence of the Specified Defaults or anything in the Credit Agreement to the contrary, the Administrative Agent and the Required Lenders consent to: (a) the incurrence by Dasan Network Solutions, Inc., a Foreign Subsidiary organized under the laws of South Korea (“DNS”), of term loan Indebtedness in an aggregate Dollar equivalent of up to $24,5000,000 (the “Specified Term Indebtedness”) and to incur other Indebtedness in an aggregate Dollar equivalent of up to $10,500,000 (the “DNI Guaranteed Indebtedness” and, together with the Specified Term Indebtedness, collectively, the “Specified Indebtedness”), (b) the grant of Liens on the assets and Equity Interests of DNS to secure the Specified Term Indebtedness and the release of any Lien on the Equity Interests of DNS held by the Administrative Agent, and (c) the issuance or transfer of one out of the 1,000,000,000 shares of Equity Interests in DNS (such one share, the “Subject Share”) in connection with the incurrence of the DNI Guaranteed Indebtedness and the release of any Lien on the Subject Share held by the Administrative Agent (the foregoing transactions, collectively, the “Specified Transactions”).

3.Representations and Warranties. Each Loan Party represents and warrants to the Administrative Agent and the Lenders that (a) this Agreement is a Loan Document under the Credit Agreement, has been duly executed and delivered by such Person’s duly authorized officer and constitutes the valid and binding obligation of such Person, enforceable against such Person in accordance with its terms, except as enforcement may be limited by applicable bankruptcy, reorganization, insolvency, fraudulent conveyance, moratorium or similar laws affecting the enforcement of creditor’s rights, generally and by general principles of equity (regardless of whether enforcement is considered in a proceeding at law or in equity), (b) the execution, delivery and performance by such Person of this Agreement, and the consummation of the transactions contemplated hereby, are within such Person’s corporate power, have been duly authorized, are not in contravention of any laws applicable to such Person or the terms of such Person’s organizational documents and, except as have been previously obtained or as referred to in Section 3.03 of the Credit Agreement, do not require the consent or approval of any Governmental Authority or any other third party, (c) the representations and warranties set forth in Article III of the Credit Agreement (other than Section 3.04 and the last sentence of Section 3.07) are true and correct in all material respects, after giving effect to this Agreement, as if made on and as of the date of this Agreement (except to the extent such representations and warranties relate solely to an earlier date, in which case, they are true and correct as of such date), and (d) the Credit Agreement, as affected by this Agreement, and the other Loan Documents remain in full force and effect and are hereby reaffirmed.

4.Reservation of Rights.

(a)Each of the Loan Parties acknowledges the existence of the Specified Defaults and agrees that the Administrative Agent and the Lenders: (i) do not and have not waived any of their respective rights and remedies resulting from the Specified Defaults or any other Default or Event of Default that may currently exist, and (ii) may immediately assert, pursue, and/or exercise any and all rights and remedies available to them pursuant to the Loan Documents without further lapse of time, expiration of applicable grace periods, or requirements of notice.

(b)Nothing contained or omitted herein shall, by implication or otherwise, be deemed to limit, impair, be an admission of, or otherwise be a waiver, relinquishment or abandonment of any rights, powers, privileges, prerogatives or remedies under any of the Loan Documents, at law, in equity or otherwise, with respect to the subject matter hereof. All of such rights, powers, privileges, prerogatives and remedies are hereby expressly reserved in all respects. In furtherance of the foregoing, each of the Administrative Agent and the Lenders hereby reserves any all rights, powers, privileges, prerogatives and remedies that may be available to them under the Loan Documents and applicable law with respect to the Specified Defaults or any other existing or future Default or Event of Default.

5.Limited Consent.

(a)Notwithstanding anything in the Credit Agreement to the contrary and subject to the terms and conditions set forth herein and the effectiveness of this Agreement, the Lenders, although they have no obligation to do so, hereby consent to the incurrence of the Specified Indebtedness by DNS and the other Specified Transactions, so long as (i) the proceeds of the Specified Indebtedness are immediately deposited into a bank account of DNS maintained with Chase Parties, (ii) immediately thereafter DNS initiates a wire to repatriate such proceeds to the Borrower to be paid over to the Administrative Agent for application to the Obligations and (iii) the Specified Transactions are consummated on or prior to September 30, 2023. All prepayments required to be made pursuant to this Section 5(a) shall be applied first, to prepay the outstanding amount of the Term Loans and shall be applied to reduce the subsequent scheduled repayments of Term Loans to be made pursuant to Section 2.10 of the Credit Agreement in inverse order of maturity, second to prepay the Revolving Loans (with a corresponding reduction in the Revolving Commitments), and third to cash collateralize outstanding LC Exposure.

(b)Subject to the terms and conditions of this Agreement, the Administrative Agent shall release the Lien on the Subject Share held by the Administrative Agent and upon the Administrative Agent’s receipt of the prepayment and cash collateralization, where applicable, of the Obligations in full in accordance with Section 5(a) with respect to the Specified Indebtedness, the Administrative Agent hereby agrees to, and is hereby authorized by the Lenders to, execute and deliver such documents and instruments as shall be required to release any Liens held by the Administrative Agent on the Equity Interests of DNS.

(c)Nothing contained in this Agreement shall be construed as a waiver of or consent to the deviation from any of the terms or conditions of the Credit Agreement or any other Loan Document, other than those terms or conditions expressly addressed herein (and even in such instance, only to the extent explicitly addressed herein). Nothing contained in this Agreement shall be construed as a waiver of the Specified Defaults or any other Default or Event of Default that may currently exist or a consent to any action or inaction by the Borrower or any other Loan Party, nor shall it be construed as a course of dealing or conduct on the part of the Administrative Agent or any Lender. The limited consent set forth in Section 5(a) above shall be effective only in this specific instance and for the specific purpose for which it is given and shall not entitle the Borrower to, and shall not obligate any Lender to consent to, any further funding or accommodation in any similar or other circumstance. Any failure by the Administrative Agent and the Lenders to exercise available rights and remedies is not intended (i) to operate as a waiver of rights and remedies except as expressly herein provided, or (ii) to indicate any agreement on the part of the Administrative Agent and the Lenders to waive their rights and remedies in the future. The Administrative Agent and the Lenders are not obligated in any way with respect to future dealings between them and the Borrower, except as set forth in the presently existing Loan Documents. All rights and remedies now or hereafter available to the Lender are hereby reserved.

6.Conditions Precedent. This Agreement shall not be effective until the following conditions are satisfied:

(a)the Administrative Agent shall have received counterparts of this Agreement executed by the Borrower, each of the other Loan Parties, and the Lenders;

(b)at the time of and after giving effect to this Agreement, no Default or Event of Default (other than the Specified Defaults) shall exist; and

(c)all fees, expenses and charges owed by the Borrower to the Administrative Agent (including all reasonable and documented fees, charges and disbursements of counsel to the Administrative Agent, to the extent invoiced) and all out-of-pocket expenses of the Lenders (including all reasonable and documented fees, charges and disbursements of counsel to each Lender, to the extent invoiced) in connection with the Agreement, the Credit Agreement and the transactions contemplated hereby shall have been paid by the Borrower.

7.Reference to and Effect on the Credit Agreement. On and after the effective date of this Agreement each reference in the Credit Agreement to “this Agreement,” “hereunder,” “hereof,” “herein” or words of like import shall mean and be a reference to the Credit Agreement as amended by this Agreement, and each reference in the other Loan Documents to “the Credit Agreement,” “thereunder,” “thereof,” “therein” or words of like import referring to the Credit Agreement, shall mean and be a reference to the Credit Agreement as modified by this Agreement. Except as specifically expressed by the terms herein, the Credit Agreement and the other Loan Documents shall remain in full force and effect and are hereby ratified and confirmed. Without limiting the generality of the foregoing, the Security Agreement and all of the Collateral described therein do and shall continue to secure the payment of all Secured Obligations.

8.Counterparts. This Agreement may be executed in any number of counterparts by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute one and the same instrument. Facsimiles or electronic images (e.g. “pdf”) of signatures shall be binding and effective as originals.

9.Governing Law; Binding Effect. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Texas, but giving effect to federal laws applicable to national banks, and shall be binding upon the Borrower, the Lender and their respective successors and assigns.

10.Confirmation; Release. The provisions of the Credit Agreement, as affected by this Agreement, shall remain in full force and effect following the effectiveness of this Agreement. Each of the Loan Parties acknowledges and agrees that on the date hereof all outstanding Obligations are payable in accordance with their terms, and each of the Loan Parties hereby (i) waives any defense, offset, counterclaim or recoupment with respect thereto and (ii) releases and discharges the Administrative Agent, each Lender and their respective Related Parties (collectively, the “Released Parties”) from any and all obligations, indebtedness, liabilities, claims, rights, causes of action or other demands whatsoever, whether known or unknown, suspected or unsuspected, in law or equity, which any Loan Party ever had, now has or claims to have or may have against any Released Party arising prior to the effective date of this Agreement.

11.Final Agreement. THIS AGREEMENT AND THE OTHER LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT BETWEEN THE PARTIES REGARDING THE SUBJECT MATTER HEREIN AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.

[This space is left intentionally blank. Signature pages follow.]

ADMINISTRATIVE AGENT AND LENDERS:

JPMORGAN CHASE BANK, N.A., individually as a Lender and as Administrative Agent

By: /s/ Shiv Kariwala

Name: Shiv Kariwala

Title: Authorized Signatory

TEXAS CAPITAL BANK,

as a Lender

By: /s/ Jeffrey M Parilla

Name: Jeffrey M Parilla

Title: Director

AGREED AND ACKNOWLEDGED:

DZS INC., a Delaware corporation,

as Borrower

By: /s/ Justin Ferguson

Name: Justin Ferguson

Title: Chief Legal Officer and Secretary

DZS CALIFORNIA INC., a California corporation,

as a Loan Party

By: /s/ Justin Ferguson

Name: Justin Ferguson

Title: Chief Legal Officer and Secretary

DZS INTERNATIONAL INC., a Delaware corporation,

as a Loan Party

By: /s/ Justin Ferguson

Name: Justin Ferguson

Title: Chief Legal Officer and Secretary

DZS SERVICES INC., a Delaware corporation,

as a Loan Party

By: /s/ Justin Ferguson

Name: Justin Ferguson

Title: Chief Legal Officer and Secretary

DZS Secures $29.7 Million in Financing

DALLAS, Texas, USA, September 13, 2023 – DZS (Nasdaq: DZSI), a global leader of access, optical and AI-driven cloud software solutions, today announced it has secured $29.7 million in loans, including a $24.5 million 3-year term loan with 29% shareholder DASAN Networks, Inc. (DNI). The 3-year $24.5 million term loan with an annual interest rate of 8% complements approximately $5.2 million of short-term loans with South Korean bank financial partners. The cash will be used to pay off DZS’ existing term debt facility and line of credit.

“As a major shareholder of DZS since 2016, we are inspired by the progress the company has made since the Board of Directors appointed Charlie Vogt as President and CEO of DZS in August 2020,” said Mr. Min Woo Nam, CEO of DNI. “The company’s commitment to innovation spanning fixed and mobile networks has generated exciting interest around the world. DNI is encouraged with the company’s future prospects and remains committed to support DZS. DNI expects DZS to convert many of the active trials across North America and EMEA to new customer logo wins in 2023 and 2024 as well as implementing a disciplined focus on net operating income and free cashflow.”

“The new financing from DNI will ease our financial covenants, lower our interest cost basis and, together with the additional short-term loans secured or in final process, will fully pay off our existing loans,” said Charlie Vogt, President and CEO. “Additionally, we plan to put a new ABL debt facility in place to fuel our growth as we enter 2024. The past three years have been transformational as we continue to execute a bold vision and strategy designed to disrupt the status quo within the broadband access and AI-driven cloud software market. Our mission has been laser focused on differentiated innovation and expanding our footprint in North America, EMEA and India. With technology advancements, the integration of two software acquisitions and IT systems, as well as the outsourcing of two legacy manufacturing facilities complete, we expect to lower our quarterly operating spend by nearly $10 million by the first quarter of 2024 compared with the first quarter of 2023, specifically, $24 million in Q1 2024 versus $34 million in Q1 2023.”

Mr. Vogt continued, “we recently attended Fiber Connect, one of North America’s largest broadband conferences, where we showcased our new ‘Build America, Buy America’ (BABA)- FiberWay turnkey fiber broadband solution. FiberWay is comprised of our next generation access and optical edge systems and complemented by our AI-driven cloud software platform. Customer and prospective customer engagement meetings at this year’s Fiber Connect represented a 50% increase compared with our 2022 Fiber Connect conference.”

DZS has been manufacturing broadband access solutions in the United States for the past two decades. The proposed ‘Buy America’ waiver for the Broadband Equity, Access and Deployment (BEAD) program announced on August 22, 2023 has clarified the guidelines for vendors to participate in the $42.5 billion Federal financial assistance program for broadband infrastructure. Assuming the current Limited General Applicability Nonavailability Waiver of the Buy America Domestic Content Procurement Preference as Applied to Recipients of BEAD Program stands as proposed, DZS is among a short list of technology suppliers meeting the requirements for Optical Line Terminals (OLTs), OLT Line Cards and Optical Network Terminals (ONTs).

Communications service providers can purchase these products consisting of the environmentally hardened Velocity fiber access systems and a wide variety of Helix ONTs directly from DZS or its reseller channel partners today and be compliant with proposed BABA funding guidelines. The new award-winning Saber 4400 coherent optical edge platform, designed for last mile aggregation and middle mile transport is also being manufactured in the United States. Service providers can easily combine these solutions and complement them with the DZS industry-leading AI-driven Cloud software solutions in FiberWay packages optimized for rapid deployment in unserved or underserved communities.

To learn more about DZS, visit https://www.dzsi.com

About DZS

DZS Inc. (Nasdaq: DZSI) is a global leader of access, optical and AI-driven cloud-controlled software defined solutions.

DZS, the DZS logo, and all DZS product names are trademarks of DZS Inc. Other brand and product names are trademarks of their respective holders. Specifications, products, and/or product names are all subject to change.

This press release contains forward-looking statements regarding future events and our future results that are subject to the safe harbors created under the Private Securities Litigation Reform Act of 1995. These statements reflect the beliefs and assumptions of the Company’s management as of the date hereof. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “plan,” “project,” “seek,” “should,” “target,” “will,” “would,” variations of such words, and similar expressions are intended to identify forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties and assumptions that are difficult to predict. The Company’s actual results could differ materially and adversely from those expressed in or contemplated by the forward-looking statements. Factors that could cause actual results to differ include, but are not limited to, those risk factors contained in the Company’s SEC filings available at www.sec.gov, including without limitation, the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q and subsequent filings. In addition, additional or unforeseen affects from the COVID-19 pandemic and the global economic climate may give rise to or amplify many of these risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date on which they are made. DZS undertakes no obligation to update or revise any forward-looking statements for any reason.

For further information see: www.DZSi.com.

DZS on Twitter: https://twitter.com/dzs_innovation

DZS on LinkedIn: https://www.linkedin.com/company/DZSi/

Press Inquiries:

Kenny Vesey, Thatcher+Co.

Phone: +1.973.518.3644

Email: kvesey@thatcherandco.com

Investor Inquiries:

Ted Moreau, Vice President, Investor Relations

Email: IR@dzsi.com

| | |

© DZS www.dzsi.com info@dzsi.com |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

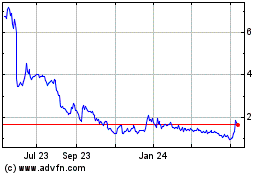

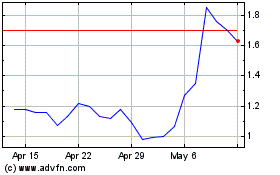

DZS (NASDAQ:DZSI)

Historical Stock Chart

From Apr 2024 to May 2024

DZS (NASDAQ:DZSI)

Historical Stock Chart

From May 2023 to May 2024