By Drew FitzGerald

Charlie Ergen has long tried to muscle his way into the U.S.

wireless business. When his rivals had no other choice, the

billionaire behind Dish Network Corp. finally got his way.

John Legere, the chief executive of T-Mobile US Inc., called Mr.

Ergen in late May after it became clear T-Mobile's proposed

takeover of Sprint Corp. was in trouble.

Mr. Ergen had been the most outspoken corporate critic of the

proposed $26 billion deal -- a merger that would leave the U.S.

with three giant cellular companies. But the Colorado maverick also

ran one of the few firms with the airwaves and know-how to create a

new wireless provider that would satisfy the Justice Department's

antitrust concerns.

Two serious attempts to combine T-Mobile and Sprint in the last

five years had already failed. Its third try was already a year

old.

Mr. Legere, a foul-mouthed executive known for tweets poking fun

at his rivals, was all business on the phone. "Justice has said

that we need a fourth carrier. We should talk if you are

interested," Mr. Ergen recalled.

For years, Mr. Ergen had irked telecom rivals and federal

regulators by spending more than $20 billion amassing wireless

licenses but never using them. Time and again Mr. Ergen had

explored various deals, including buying Sprint himself, only to

frustrate the other side. Now, he was the only buyer that could

build a credible fourth nationwide cellphone operator.

"With four, there's always somebody that will be a rabble

rouser," Mr. Ergen said in an interview this week in his office

south of Denver. "Somebody will say I don't have enough market

share. I've only got 9 million subs and want 10 million. That

person is going to be more aggressive. The guy who's got 100

million, he's just going to hope he holds onto them."

Whether Dish can become a formidable force in the mature U.S.

cellphone market will be a key test of the landmark antitrust

agreement announced Friday between the Justice Department and the

companies. The carefully crafted deal gives Dish 9 million of

Sprint's prepaid customers -- its Boost Mobile business and then

some -- plus the right to buy licenses to more airwaves that can

blanket rural areas. It will let Dish operate on T-Mobile's

existing network for seven years while Dish builds its own

nationwide service.

A former professional poker player and card-counting blackjack

whiz who was banned by some Las Vegas casinos, Mr. Ergen co-founded

Dish in 1980 after starting his career as an analyst at Frito Lay

where he calculated how many Doritos should fill a bag. He and his

partners bet their savings, pooling together $60,000 on selling

10-foot-wide satellite dishes from a Denver storefront.

He has said his experience gambling helped hone his business

acumen -- knowing how to "win with bad hands." More than once, Mr.

Ergen has compared his business plans to an "Indiana Jones" movie

in which the hero narrowly dodges a never ending string of lethal

threats.

He switched to hubcap-size dishes and took on cable-TV

monopolies by slashing prices. His service now has 12 million

customers across the country and his controlling stake in Dish is

worth about $9 billion. (He is also the chairman and biggest

shareholder in sister company EchoStar Corp., which operates

satellites.)

The 66-year-old tends to play by his own rules. He has made

executives share hotel rooms on company trips and has done market

research with what he called the "Waffle House poll," visiting

outlets around the country and asking customers how they used their

phones and watched television.

His famously frugal ethos -- he still drives to Dish's

Englewood, Colo., headquarters with lunch in a brown paper bag --

isn't always evident these days. The billionaire often flies in a

private jet and has stopped making employees share hotel rooms on

business trips, according to people familiar with the company.

Mr. Ergen, whose core satellite-TV service has been losing

customers, admits he is starting from behind in the cellphone game.

But he argues that gives him an advantage. "Their legacy is

mishmash. Their networks are plaid," Mr. Ergen said, pointing to

his green-checked dress shirt. "We will be a solid color."

Dish's new network will be dwarfed by the incumbents. Verizon

Communications Inc. has nearly 120 million cellphone customers.

AT&T Inc. and the enlarged T-Mobile will each have more than 90

million. They are among the biggest advertisers in the country.

They are holding onto their subscribers by offering unlimited data

and bundling in free subscriptions to services like HBO and

Netflix. All three are already rolling out faster 5G services.

"How is a company with no track record, no wireless customers

and unused spectrum a more viable competitor?," said Matt Wood,

general counsel at advocacy group Free Press, which publicly

opposed the T-Mobile and Sprint deal.

AT&T, Verizon and T-Mobile have built nationwide networks in

pieces over decades as they acquired rivals or new airwaves

licenses. T-Mobile itself will now spend years integrating Sprint's

network and customers. The incumbents updated the equipment hanging

on cellular towers and the software behind their services as they

moved from 3G connections to faster 4G technology, and now 5G.

Dish plans to lean on T-Mobile while it builds a brand-new,

5G-only network that it can roll out quickly and operate

differently. It also means Dish should be able to roll it out

quickly and operate differently. For example, Mr. Ergen said, Dish

would be able to offer on-demand pricing, such as charging less in

the middle of the night. He also plans to target businesses, such

as automakers, looking for 5G connections.

"We'll get someplace in three years that will take the other

guys 10 years," he said.

The agreement to use T-Mobile's stronger network will allow Dish

to attract customers beyond the cities where Sprint mostly marketed

its Boost service, he said. It also lets Dish build its own network

first in urban areas with many customers and use the T-Mobile

network to reach rural areas that have fewer customers.

Dish will need to add towers in all those less-populated and

less-profitable areas under the deal it reached with the Federal

Communications Commission and the Justice Department. Mr. Ergen

estimates it will cost about $10 billion. But he will be able to

compete for customers and generate cash from his nascent cellular

business before he has to do that.

Mr. Ergen also argues wireless pricing is broken. He says U.S.

carriers have many customers paying for unlimited data plans they

don't need, much as cable companies long forced subscribers to pay

for big bundles of TV channels.

"This is deja vu all over again for us," said Mr. Ergen. In

wireless, he sees an opportunity for Dish to woo customers that use

less data with lower monthly prices and those that are heavy data

users with plans that don't slow their connections.

AT&T CEO Randall Stephenson said this week he wasn't

concerned about the prospect of Dish jumping into the wireless

market. "Our strategy is pretty well baked," he told analysts on

Wednesday. "The strategy is resilient as it relates to changes in

industry structure."

Mr. Ergen has often played the role of disrupter. In 2012, Dish

introduced a DVR that let consumers easily skip commercials,

sparking a legal challenge from broadcasters.

He has often brawled over programming fees with channel owners,

causing blackouts on Dish's service. The company said Friday it

stopped carrying 22 regional sports networks owned by the Walt

Disney Co. over a contract dispute.

Dish has also gone without HBO since November, missing the final

season of "Game of Thrones." Mr. Ergen said HBO's proposal was

unaffordable, calling it "payback" for his company's 2018

opposition to AT&T's purchase of Time Warner. An HBO spokesman

said the terms it offered Dish were consistent with those in place

for large distributors.

Dish launched one of the first live-TV streaming services, Sling

TV, in early 2015. With a small package of channels and lower

price, it made it easy for millions of people to cut their TV bill

- even many of Dish's own satellite customers.

But with cellular service, he has vexed federal authorities and

business partners with what some called broken promises. Critics

said Mr. Ergen was simply hoarding the government-issued licenses

while he waited for a deep-pocketed partner to buy him out. In 2015

he angered FCC officials when he won a large chunk of wireless

licenses at government auction; his bid benefitted from a $3.3

billion discount designed to bring smaller players into the

wireless industry. The FCC later rejected the discount, a decision

that is contested. Last year, FCC officials wrote a letter that

threatened to claw back some Dish licenses if it failed to launch a

cellular service by March 2020.

Mr. Ergen bristles at the notion he has been squatting on

valuable airwaves. He said he simply was outbid by Japan's SoftBank

Group Corp. in 2013 when he tried to buy Sprint. He has been

waiting for a catalyst that would allow him to compete with

entrenched players. The rollout of new 5G networks is just the

technology shift that makes it possible.

"Hoarding is actually a positive for our shareholders and a

positive strategic move because you needed to accumulate spectrum

to go and compete with these guys," he said. "It didn't make any

sense to build a 4G network and tear it all down the next

year."

By early 2019, Dish still had no wireless customers to quell the

government's concerns. The forecast was also darkening for T-Mobile

and Sprint. Their merger effort hit a snag in April, when staff

lawyers at the Justice Department told the companies the deal was

unlikely to earn their approval as it was structured.

The Justice Department pressed the companies to shed enough

pieces of their business to create a new fourth cellphone carrier

that could step into the void left by Sprint, which had been

shedding customers and struggling to turn a profit.

The department met with representatives from potential partners

including Dish and cable operators Altice USA Inc., Charter

Communications Inc. and Comcast Corp., according to people familiar

with the talks. Dish emerged as an early favorite.

Mr. Ergen said his existing airwaves licenses made his pitch to

build a new cellphone carrier more credible. He said he reached a

broad agreement with Mr. Legere and Sprint Chairman Marcelo Claure

in just four weeks of discussions in June.

But the discussions continued for three more weeks as the

Justice Department pressed the merger partners for better terms.

Government lawyers insisted the settlement include no restrictions

on Dish's ability to sell assets, other than to pure competitors,

or find a deep-pocketed partner after the deal.

The Justice Department's antitrust chief, Makan Delharim, was

under the gun as government officials publicly split on the deal.

FCC head Ajit Pai, a fellow Trump administration appointee, had

already endorsed the T-Mobile and Sprint deal while a consortium of

Democratic state attorneys general had filed a lawsuit seeking to

block it, saying it would hurt consumers.

The Justice Department wanted to make sure the final agreement

would stand up in court if challenged by the states. The companies

have agreed to wait to close the deal under a federal court hears

the case later this year.

Mr. Ergen will have to pay $1.4 billion for the Sprint customers

and $3.6 billion in three years for the extra airwaves. T-Mobile

will get the bulk of Sprint's customers and airwaves and also have

the right to buy some Dish spectrum. Sprint's owner SoftBank gets

to cash out after failing to disrupt the U.S. cellular market. The

Justice Department gets to keep a fourth competitor.

"I think three years from now, this transaction will look better

than it does this week," Mr. Ergen said. "They are gonna have real

competition."

--

Sarah Krouse contributed to this article.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

July 27, 2019 00:14 ET (04:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

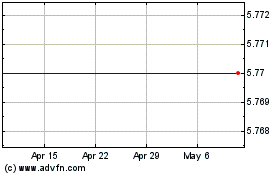

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Aug 2024 to Sep 2024

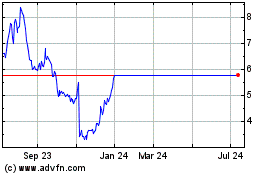

DISH Network (NASDAQ:DISH)

Historical Stock Chart

From Sep 2023 to Sep 2024