false

0001438231

0001438231

2023-11-06

2023-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2023

DIGIMARC CORPORATION

(Exact name of registrant as specified in its charter)

|

Oregon

|

001-34108

|

26-2828185

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File No.)

|

(IRS Employer

Identification No.)

|

8500 SW Creekside Place, Beaverton Oregon 97008

(Address of principal executive offices) (Zip Code)

(503) 469-4800

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.001 Par Value Per Share

|

|

DMRC

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition

|

On November 6, 2023, Digimarc Corporation issued a press release announcing its financial results for the quarter-ended September 30, 2023. The full text of the press release is attached hereto as Exhibit 99.1.

Attached hereto as Exhibit 99.2 is the script from the Company’s conference call on November 6, 2023 announcing its financial results for the quarter-ended September 30, 2023, as posted on the Company’s website at https://www.digimarc.com/investors/quarterly-earnings.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d) Exhibits

|

ExhibitNo.

|

|

Description

|

| |

|

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 6, 2023

| |

|

By:

|

|

/s/ Charles Beck

|

| |

|

|

|

Charles Beck

|

| |

|

|

|

Chief Financial Officer and Treasurer

|

Exhibit 99.1

Digimarc Reports Third Quarter 2023 Financial Results

Annual Recurring Revenue1 Increases 54%

Subscription Gross Profit Margin Expands to 85.5%

Beaverton, Ore. – November 6, 2023 – Digimarc Corporation (NASDAQ: DMRC) reported financial results for the third quarter ended September 30, 2023.

"Q3 was another strong quarter for Digimarc. We delivered a 54% year-over-year increase in our ending Annual Recurring Revenue (ARR) while driving a 1,000 basis point year-over-year increase in subscription gross profit margin,” said Digimarc CEO Riley McCormack. "Our focus on being easy to begin doing business with and excellent at guiding customers along their product digitization journey is paying off, and our recent expansion of Digimarc Validate to the digital domain provides an additional accelerant as it significantly increases our Total Addressable Market (TAM) and meaningfully strengthens our moats -- across all areas of our business. It is becoming clear to many stakeholders that our legacy as the pioneer and widely recognized leader of digital watermarking, coupled with our history of building massive, multinational, multistakeholder and mission critical systems on top of our technology, has ideally positioned us to provide the foundational layer of a safe, fair, trusted and authentic internet, something that was needed before the rise of generative Artificial Intelligence (GenAI), but is absolutely required today."

Third Quarter 2023 Financial Results

Subscription revenue for the third quarter of 2023 increased to $4.8 million compared to $4.1 million for the third quarter of 2022, primarily reflecting higher subscription revenue from new and existing commercial contracts.

Service revenue for the third quarter of 2023 increased to $4.2 million compared to $3.7 million for the third quarter of 2022, primarily reflecting higher service revenue from the Central Banks.

Total revenue for the third quarter of 2023 increased to $9.0 million compared to $7.8 million for the third quarter of 2022.

Gross profit margin for the third quarter of 2023 increased to 58% compared to 53% for the third quarter of 2022. Excluding amortization expense on acquired intangible assets, subscription gross profit margin increased to 85% from 75% while service gross profit margin decreased to 54% from 57% for the third quarter of 2023 compared to the third quarter of 2022.

Non-GAAP gross profit margin for the third quarter of 2023 increased to 76% compared to 72% for the third quarter of 2022.

Operating expenses for the third quarter of 2023 decreased $3.3 million, or 17%, to $16.4 million compared to $19.7 million for the third quarter of 2022, primarily reflecting $1.4 million of lower severance costs incurred for organizational changes, $1.1 million of lower compensation costs due to lower headcount, partially offset by annual compensation adjustments, and $0.6 million of lower contractor and consulting expenses.

Non-GAAP operating expenses for the third quarter of 2023 decreased $2.3 million, or 15%, to $13.2 million compared to $15.5 million for the third quarter of 2022.

Net loss for the third quarter of 2023 was $10.7 million or $(0.53) per share compared to $14.9 million or $(0.76) per share for the third quarter of 2022.

Non-GAAP net loss for the third quarter of 2023 was $5.9 million or $(0.29) per share compared to $9.3 million or $(0.47) per share for the third quarter of 2022.

At September 30, 2023, cash, cash equivalents and marketable securities totaled $33.3 million compared to $34.5 million at June 30, 2023.

1 Annual Recurring Revenue (ARR) is a company performance metric calculated as the aggregation of annualized subscription fees from all of our commercial contracts as of the measurement date.

Conference Call

Digimarc will hold a conference call today (Monday, November 6, 2023) to discuss these financial results and to provide a business update. CEO Riley McCormack, CFO Charles Beck and CLO Joel Meyer will host the call starting at 5:00 p.m. Eastern time (2:00 p.m. Pacific time). A question and answer session will follow management’s prepared remarks.

The conference call will be broadcast live and available for replay here and in the investor section of the company's website. The conference call script will also be posted to the company's website shortly before the call.

For those who wish to call in via telephone to ask a question, please dial the number below at least five minutes before the scheduled start time:

Toll-Free Number: 877-407-0832

International Number: 201-689-8433

Conference ID: 13737195

Company Contact:

Charles Beck

Chief Financial Officer

Charles.Beck@digimarc.com

+1 503-469-4721

###

About Digimarc

Digimarc Corporation (NASDAQ: DMRC) is a global leader in product digitization. A pioneer in digital watermarks, Digimarc connects every physical and digital item to a digital twin that enables the capture of product data, records events and interactions, and supports powerful new automations. Trusted to deter counterfeiting of global currency for more than 20 years, Digimarc is also recognized for ensuring product authenticity, improving plastics recycling, and more, with a commitment to promoting a prosperous, safer, and more sustainable world. In 2023, Digimarc was named to the Fortune 2023 Change the World list and honored as a 2023 Fast Company World Changing Ideas finalist. See more at Digimarc.com.

Forward-Looking Statements

Except for historical information contained in this release, the matters described in this release contain various “forward-looking statements.” These forward-looking statements include statements identified by terminology such as “will,” “should,” “expects,” “estimates,” “predicts” and “continue” or other derivations of these or other comparable terms. These forward-looking statements are statements of management's opinion and are subject to various assumptions, risks, uncertainties and changes in circumstances. Actual results may vary materially from those expressed or implied from the statements in this release as a result of changes in economic, business and regulatory factors. More detailed information about risk factors that may affect actual results are outlined in the company's Form 10-K for the year ended December 31, 2022, and in subsequent periodic reports filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's opinions only as of the date of this release. Except as required by law, Digimarc undertakes no obligation to publicly update or revise any forward-looking statements to reflect events or circumstances that may arise after the date of this release.

Non-GAAP Financial Measures

This release contains the following non-GAAP financial measures: Non-GAAP gross profit, Non-GAAP gross profit margin, Non-GAAP operating expenses, Non-GAAP net loss, and Non-GAAP loss per share (diluted). See below for a reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure. These non-GAAP financial measures are an important measure of our operating performance because they allow management, investors and analysts to evaluate and assess our core operating results from period-to-period after removing non-cash and non-recurring activities that affect comparability. Our management uses these non-GAAP financial measures in evaluating its financial and operational decision making and as a means to evaluate period-to-period comparisons.

Digimarc believes that providing these non-GAAP financial measures, together with the reconciliation to GAAP, helps management and investors make comparisons between us and other companies. In making any comparisons to other companies, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measures and the corresponding GAAP measures provided by each company under applicable SEC rules. These non-GAAP financial measures are not measurements of financial performance or liquidity under GAAP. In order to facilitate a clear understanding of its consolidated historical operating results, investors should examine Digimarc’s non-GAAP financial measures in conjunction with its historical GAAP financial information, and investors should not consider non-GAAP financial measures in isolation or as substitutes for performance measures calculated in accordance with GAAP. Non-GAAP financial measures should be viewed as supplemental to, and should not be considered as alternatives to, GAAP financial measures. Non-GAAP financial measures may not be indicative of the historical operating results of the Company nor are they intended to be predictive of potential future results.

Digimarc Corporation

Consolidated Income Statement Information

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription

|

|

$ |

4,811 |

|

|

$ |

4,086 |

|

|

$ |

13,374 |

|

|

$ |

11,121 |

|

|

Service

|

|

|

4,183 |

|

|

|

3,735 |

|

|

|

12,193 |

|

|

|

11,858 |

|

|

Total revenue

|

|

|

8,994 |

|

|

|

7,821 |

|

|

|

25,567 |

|

|

|

22,979 |

|

|

Cost of revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

698 |

|

|

|

1,006 |

|

|

|

2,264 |

|

|

|

2,934 |

|

|

Service (1)

|

|

|

1,938 |

|

|

|

1,602 |

|

|

|

5,621 |

|

|

|

5,177 |

|

|

Amortization expense on acquired intangible assets

|

|

|

1,135 |

|

|

|

1,048 |

|

|

|

3,346 |

|

|

|

3,362 |

|

|

Total cost of revenue

|

|

|

3,771 |

|

|

|

3,656 |

|

|

|

11,231 |

|

|

|

11,473 |

|

|

Gross profit:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

4,113 |

|

|

|

3,080 |

|

|

|

11,110 |

|

|

|

8,187 |

|

|

Service (1)

|

|

|

2,245 |

|

|

|

2,133 |

|

|

|

6,572 |

|

|

|

6,681 |

|

|

Amortization expense on acquired intangible assets

|

|

|

(1,135 |

) |

|

|

(1,048 |

) |

|

|

(3,346 |

) |

|

|

(3,362 |

) |

|

Total gross profit

|

|

|

5,223 |

|

|

|

4,165 |

|

|

|

14,336 |

|

|

|

11,506 |

|

|

Gross profit margin:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription (1)

|

|

|

85 |

% |

|

|

75 |

% |

|

|

83 |

% |

|

|

74 |

% |

|

Service (1)

|

|

|

54 |

% |

|

|

57 |

% |

|

|

54 |

% |

|

|

56 |

% |

|

Total

|

|

|

58 |

% |

|

|

53 |

% |

|

|

56 |

% |

|

|

50 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

5,366 |

|

|

|

7,684 |

|

|

|

16,770 |

|

|

|

23,702 |

|

|

Research, development and engineering

|

|

|

6,308 |

|

|

|

7,575 |

|

|

|

20,295 |

|

|

|

19,731 |

|

|

General and administrative

|

|

|

4,433 |

|

|

|

4,132 |

|

|

|

13,412 |

|

|

|

15,027 |

|

|

Amortization expense on acquired intangible assets

|

|

|

272 |

|

|

|

301 |

|

|

|

800 |

|

|

|

964 |

|

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

— |

|

|

|

— |

|

|

|

250 |

|

|

|

574 |

|

|

Total operating expenses

|

|

|

16,379 |

|

|

|

19,692 |

|

|

|

51,527 |

|

|

|

59,998 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(11,156 |

) |

|

|

(15,527 |

) |

|

|

(37,191 |

) |

|

|

(48,492 |

) |

|

Other income, net

|

|

|

478 |

|

|

|

623 |

|

|

|

1,870 |

|

|

|

1,214 |

|

|

Loss before income taxes

|

|

|

(10,678 |

) |

|

|

(14,904 |

) |

|

|

(35,321 |

) |

|

|

(47,278 |

) |

|

Provision for income taxes

|

|

|

(45 |

) |

|

|

(26 |

) |

|

|

(65 |

) |

|

|

(72 |

) |

|

Net loss

|

|

$ |

(10,723 |

) |

|

$ |

(14,930 |

) |

|

$ |

(35,386 |

) |

|

$ |

(47,350 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share — basic

|

|

$ |

(0.53 |

) |

|

$ |

(0.76 |

) |

|

$ |

(1.76 |

) |

|

$ |

(2.51 |

) |

|

Loss per share — diluted

|

|

$ |

(0.53 |

) |

|

$ |

(0.76 |

) |

|

$ |

(1.76 |

) |

|

$ |

(2.51 |

) |

|

Weighted average shares outstanding — basic

|

|

|

20,217 |

|

|

|

19,721 |

|

|

|

20,158 |

|

|

|

18,877 |

|

|

Weighted average shares outstanding — diluted

|

|

|

20,217 |

|

|

|

19,721 |

|

|

|

20,158 |

|

|

|

18,877 |

|

(1) Cost of revenue, Gross profit and Gross profit margin for Subscription and Service excludes amortization expense on acquired intangible assets.

Digimarc Corporation

Reconciliation of GAAP to Non-GAAP Financial Measures

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

GAAP gross profit

|

|

$ |

5,223 |

|

|

$ |

4,165 |

|

|

$ |

14,336 |

|

|

$ |

11,506 |

|

|

Amortization of acquired intangible assets

|

|

|

1,135 |

|

|

|

1,048 |

|

|

|

3,346 |

|

|

|

3,362 |

|

|

Amortization and write-off of other intangible assets

|

|

|

143 |

|

|

|

145 |

|

|

|

433 |

|

|

|

430 |

|

|

Stock-based compensation

|

|

|

310 |

|

|

|

270 |

|

|

|

866 |

|

|

|

736 |

|

|

Non-GAAP gross profit

|

|

$ |

6,811 |

|

|

$ |

5,628 |

|

|

$ |

18,981 |

|

|

$ |

16,034 |

|

|

Non-GAAP gross profit margin

|

|

|

76 |

% |

|

|

72 |

% |

|

|

74 |

% |

|

|

70 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP operating expenses

|

|

$ |

16,379 |

|

|

$ |

19,692 |

|

|

$ |

51,527 |

|

|

$ |

59,998 |

|

|

Depreciation and write-off of property and equipment

|

|

|

(223 |

) |

|

|

(316 |

) |

|

|

(911 |

) |

|

|

(1,036 |

) |

|

Amortization of acquired intangible assets

|

|

|

(272 |

) |

|

|

(301 |

) |

|

|

(800 |

) |

|

|

(964 |

) |

|

Amortization and write-off of other intangible assets

|

|

|

(228 |

) |

|

|

(4 |

) |

|

|

(276 |

) |

|

|

(63 |

) |

|

Amortization of lease right of use assets under operating leases

|

|

|

(94 |

) |

|

|

(248 |

) |

|

|

(426 |

) |

|

|

(768 |

) |

|

Stock-based compensation

|

|

|

(2,382 |

) |

|

|

(3,298 |

) |

|

|

(7,280 |

) |

|

|

(8,574 |

) |

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

— |

|

|

|

— |

|

|

|

(250 |

) |

|

|

(574 |

) |

|

Acquisition-related expenses

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(447 |

) |

|

Non-GAAP operating expenses

|

|

$ |

13,180 |

|

|

$ |

15,525 |

|

|

$ |

41,584 |

|

|

$ |

47,572 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss

|

|

$ |

(10,723 |

) |

|

$ |

(14,930 |

) |

|

$ |

(35,386 |

) |

|

$ |

(47,350 |

) |

|

Total adjustments to gross profit

|

|

|

1,588 |

|

|

|

1,463 |

|

|

|

4,645 |

|

|

|

4,528 |

|

|

Total adjustments to operating expenses

|

|

|

3,199 |

|

|

|

4,167 |

|

|

|

9,943 |

|

|

|

12,426 |

|

|

Non-GAAP net loss

|

|

$ |

(5,936 |

) |

|

$ |

(9,300 |

) |

|

$ |

(20,798 |

) |

|

$ |

(30,396 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP loss per share (diluted)

|

|

$ |

(0.53 |

) |

|

$ |

(0.76 |

) |

|

$ |

(1.76 |

) |

|

$ |

(2.51 |

) |

|

Non-GAAP net loss

|

|

$ |

(5,936 |

) |

|

$ |

(9,300 |

) |

|

$ |

(20,798 |

) |

|

$ |

(30,396 |

) |

|

Non-GAAP loss per share (diluted)

|

|

$ |

(0.29 |

) |

|

$ |

(0.47 |

) |

|

$ |

(1.03 |

) |

|

$ |

(1.61 |

) |

Digimarc Corporation

Consolidated Balance Sheet Information

(in thousands)

(Unaudited)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents (1)

|

|

$ |

32,335 |

|

|

$ |

33,598 |

|

|

Marketable securities (1)

|

|

|

996 |

|

|

|

18,944 |

|

|

Trade accounts receivable, net

|

|

|

7,042 |

|

|

|

5,427 |

|

|

Other current assets

|

|

|

4,578 |

|

|

|

6,172 |

|

|

Total current assets

|

|

|

44,951 |

|

|

|

64,141 |

|

|

Property and equipment, net

|

|

|

1,656 |

|

|

|

2,390 |

|

|

Intangibles, net

|

|

|

28,977 |

|

|

|

33,170 |

|

|

Goodwill

|

|

|

8,323 |

|

|

|

8,229 |

|

|

Lease right of use assets

|

|

|

4,108 |

|

|

|

4,720 |

|

|

Other assets

|

|

|

827 |

|

|

|

1,127 |

|

|

Total assets

|

|

$ |

88,842 |

|

|

$ |

113,777 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and other accrued liabilities

|

|

$ |

6,207 |

|

|

$ |

5,989 |

|

|

Deferred revenue

|

|

|

7,315 |

|

|

|

4,145 |

|

|

Total current liabilities

|

|

|

13,522 |

|

|

|

10,134 |

|

|

Long-term lease liabilities

|

|

|

6,170 |

|

|

|

5,977 |

|

|

Other long-term liabilities

|

|

|

267 |

|

|

|

76 |

|

|

Total liabilities

|

|

|

19,959 |

|

|

|

16,187 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

50 |

|

|

|

50 |

|

|

Common stock

|

|

|

20 |

|

|

|

20 |

|

|

Additional paid-in capital

|

|

|

373,844 |

|

|

|

367,692 |

|

|

Accumulated deficit

|

|

|

(301,195 |

) |

|

|

(265,809 |

) |

|

Accumulated other comprehensive loss

|

|

|

(3,836 |

) |

|

|

(4,363 |

) |

|

Total shareholders’ equity

|

|

|

68,883 |

|

|

|

97,590 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity

|

|

$ |

88,842 |

|

|

$ |

113,777 |

|

(1) Aggregate cash, cash equivalents, and marketable securities was $33,331 and $34,542 at September 30, 2023 and June 30, 2023, respectively.

Digimarc Corporation

Consolidated Cash Flow Information

(in thousands)

(Unaudited)

| |

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(35,386 |

) |

|

$ |

(47,350 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and write-off of property and equipment

|

|

|

911 |

|

|

|

1,036 |

|

|

Amortization of acquired intangible assets

|

|

|

4,146 |

|

|

|

4,326 |

|

|

Amortization and write-off of other intangible assets

|

|

|

709 |

|

|

|

493 |

|

|

Amortization of lease right of use assets under operating leases

|

|

|

426 |

|

|

|

768 |

|

|

Stock-based compensation

|

|

|

8,146 |

|

|

|

9,310 |

|

|

Impairment of lease right of use assets and leasehold improvements

|

|

|

250 |

|

|

|

574 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trade accounts receivable

|

|

|

(1,581 |

) |

|

|

(241 |

) |

|

Other current assets

|

|

|

1,688 |

|

|

|

(2,233 |

) |

|

Other assets

|

|

|

279 |

|

|

|

(611 |

) |

|

Accounts payable and other accrued liabilities

|

|

|

299 |

|

|

|

(2,153 |

) |

|

Deferred revenue

|

|

|

3,298 |

|

|

|

233 |

|

|

Lease liability and other long-term liabilities

|

|

|

136 |

|

|

|

(1,040 |

) |

|

Net cash used in operating activities

|

|

|

(16,679 |

) |

|

|

(36,888 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Net cash paid for acquisition

|

|

|

— |

|

|

|

(3,512 |

) |

|

Purchase of property and equipment

|

|

|

(208 |

) |

|

|

(783 |

) |

|

Capitalized patent costs

|

|

|

(295 |

) |

|

|

(404 |

) |

|

Proceeds from maturities of marketable securities

|

|

|

26,696 |

|

|

|

17,498 |

|

|

Purchases of marketable securities

|

|

|

(8,664 |

) |

|

|

(5,873 |

) |

|

Net cash provided by investing activities

|

|

|

17,529 |

|

|

|

6,926 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Issuance of common stock, net of issuance costs

|

|

|

— |

|

|

|

58,220 |

|

|

Purchase of common stock

|

|

|

(2,036 |

) |

|

|

(1,560 |

) |

|

Repayment of loans

|

|

|

(33 |

) |

|

|

(32 |

) |

|

Net cash (used in) provided by financing activities

|

|

|

(2,069 |

) |

|

|

56,628 |

|

|

Effect of exchange rate on cash

|

|

|

(44 |

) |

|

|

(100 |

) |

|

Net (decrease) increase in cash and cash equivalents (2)

|

|

$ |

(1,263 |

) |

|

$ |

26,566 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities at beginning of period

|

|

|

52,542 |

|

|

|

41,618 |

|

|

Cash, cash equivalents and marketable securities at end of period

|

|

|

33,331 |

|

|

|

56,357 |

|

|

(2) Net (decrease) increase in cash, cash equivalents and marketable securities

|

|

$ |

(19,211 |

) |

|

$ |

14,739 |

|

###

Exhibit 99.2

Digimarc Corporation (DMRC) Conference Call

Third Quarter 2023 Financial Results

November 6, 2023

Joel Meyer – Chief Legal Officer

Welcome to our Q3 conference call. Riley McCormack, our CEO, and Charles Beck, our CFO, are with me on the call. On the call today, we will provide a business update and discuss Q3 2023 financial results. This will be followed by a question and answer forum. We have posted our prepared remarks in the investor relations section of our website and will archive this webcast there.

Safe Harbor Statement

Before we begin, let me remind everyone that today's discussion contains forward-looking statements that have risks and uncertainties. Please refer to our press release for more information on the specific risk factors that could cause actual results to differ materially.

Riley will now provide a business update.

Business Update

Thank you Joel, and hello everyone.

Q3 was another strong quarter for Digimarc. While Charles will provide a more detailed discussion on the financial results during his remarks, there are two metrics I want to highlight at the top of the call because their absolute levels -- as well as our expectation they will get even stronger -- are important markers of our progress in building a high quality, high growth, and highly cash flow generative business.

First, we grew our annual recurring revenue, or ARR, 54% year-over-year. As mentioned during the last few earnings calls, first year bookings has become a less relevant metric as our focus is on growing our recurring and high-margin subscription revenue, and signing those customers to multi-year deals. Our decision to begin reporting our quarter-end ARR reflects our desire to provide investors transparency into the results of that focus as well as a greater understanding of our true underlying growth. And while a 54% year-over-year growth rate is objectively high, we believe we are capable of more. In fact, while it is still early in this current quarter, we expect our year-over-year ARR growth in Q4 will be noticeably greater than it was in Q3.

Second, we expanded our subscription gross profit margin to 85.5%, an increase of 1,000 basis points year-over-year and 200 basis points sequentially. On our Q4 2022 call, Charles mentioned our expectation of driving subscription gross profit margin north of 80% in 2023, and three quarters into the year, we have not only exceeded this target in every single quarter, but our gross profit margin is now closer to 90% than 80%.

There is no better predictor of a company’s ultimate level of profitability, nor better proof of the depth and width of its moats, than subscription gross profit margin, and at 85.5% we are near best-in-class, similar to the levels of other high quality and wide-moated SaaS businesses that enjoy the extra gross profit margin tailwinds that come from being much larger than we are today. Like our ARR growth rate, we believe we will improve from these already high levels.

The combination of high and accelerating ARR growth and our significant gross profit margin expansion not only speaks to the quality of the business we are building and the differentiated products we are able to deliver, but acts as a potent cocktail in getting us to cash flow break even, and beyond.

I want to spend the rest of my prepared remarks discussing three specific areas that we know are of interest to investors, but before I do, I want to stress that I am focusing only on these three simply because of time limitations, not because they are the only areas about which we are excited. In

fact, if one were to compare my prepared remarks over the past few quarters to the news we have delivered in the subsequent quarter, you’ll notice little correlation of topics. I view my prepared remarks as a forum to provide updates on areas in which we have received the most questions as well as an opportunity to continue providing transparency into the different parts of our business, not as a sneak preview of upcoming news; we prefer to let the news, i.e., the results, speak for themselves.

Starting with Digimarc Recycle, we recently announced that France will be the first country-wide rollout of this world-changing product. Digimarc Recycle represents a revolution in the sortation, and thus recycling, of plastic waste. It has the power to not just increase the quantity and quality of plastic recyclate, but also uncover never-before-seen data about the post-purchase product journey. According to the Ellen MacArthur Foundation, higher quality plastics recycling is also one of the most impactful things we can do as a planet to reduce carbon emissions and moreover, it comes at a negative financial cost. This means there is an economic return on investment from achieving higher quality plastics recycling in addition to the obvious environmental benefits, something that a recent industry-commissioned study on Digimarc Recycle independently corroborated. It is for all these reasons and more that Fortune recently ranked us 17th on their esteemed 2023 “Change the World” list, despite their stated preference for companies generating over $1 billion of revenue, which we don’t have…yet.

The news regarding the country-wide rollout in France is a major milestone for our company, and a testament to the power of our technology and our team. We are dedicated to working with the initial group of visionaries to help expand adoption in France, and on that front, I am excited to share that we are close to signing a deal with a very large company that was not even listed in our press release from only a few weeks ago.

Beyond France, we are progressing activities in multiple other countries as we pursue the “country by country” avenue for driving Digimarc Recycle adoption. Important to note, two weeks ago the European Commission (EC) voted on amendments to the Packaging and Packaging Waste Regulation (PPWR) as that important law progresses towards finalization. Included in the new amendments, the timeline to implement digital marking was shortened by six months. We applaud the EC’s vision and urgency.

We are also pursuing additional Go-To-Market avenues for Digimarc Recycle in parallel with this “country by country” approach, including partnering directly with global brands and retailers to push adoption in multiple countries at once, working with prospects to open a market via a “closed loop” solution which can then act as the catalyst for wider in-country adoption, and progressing our work in lighting up Deposit Return Scheme (DRS) Value Added Resellers (VARs), which then acts as a profitable wedge to open Digimarc Recycle conversations in those countries.

On this last front, I was recently in-country meeting with our first DRS VAR, and it was exhilarating to see initial production of their DRS logo being applied to real-world products. I believe one of our greatest strengths will always be the awesomeness of our VARs, and I expect when the world sees the tangible results of this VAR’s easy, cost-effective, and quick-to-scale solution, interest in Digimarc’s ability to help improve upon existing DRS solutions will significantly increase.

One last thing to highlight. While historically our focus has been on the application of Digimarc Recycle to the plastic pollution crisis, recently there has been interest by other substrate ecosystems to solve their own end of product life issues. There’s obviously end customer synergies as retailers and brands use multiple different materials in their packaging, and our proven results in plastics objectively lessen the need for Proof-of-Concept work in other substrates. Also worth noting: the PPWR doesn’t restrict the digital marking requirement to just plastic packaging.

Next, I’d like to spend some time on Digimarc Illuminate for Factory Automation. This compelling offering brings the power of the Illuminate product digitization platform into a production, fulfillment, or distribution facility, where the ability to identify specific products in robust, deterministic, and novel ways unlocks important new automations not otherwise possible.

In the specific case of the deal we discussed last quarter, one of the world’s largest CPGs was interested in removing excess packaging from one of their marquee products in an effort to save both money and the planet, but in so doing would have lost the ability to differentiate between different variations of this product, something required for their exacting standards of quality assurance.

Enter Digimarc Illuminate for Factory Automation, and its ability to connect physical products to their digital twins via our unique bridge, Digimarc digital watermarks. This cost- and environment-saving application is something that has sparked the interest of other prospects as well as multiple ecosystem partners who can act as force multipliers in our quest to digitize the world’s products. In fact, one of our partners will be presenting our offering at an important industry event next week.

The potential here is enormous as we have all the necessary ingredients for success: a provable ROI, a wonderful environmental impact, a robust and interested ecosystem of force multipliers, an extremely happy customer, and of course, a unique solution that only the Digimarc Illuminate platform is capable of providing.

Other prospects are exploring using Digimarc Illuminate for Factory Automation to provide novel automations that differ from the maintenance of production line quality control when removing excess packaging. Examples include solving for code occlusion caused by harsh factory conditions and automating workflows that don’t lend themselves to the perfect presentation of a single code.

Recall the multiple characteristics of Digimarc’s digital watermarks: covert, ubiquitous, redundant, and secure. And recall that for use cases that require one, some, or all of these attributes, Digimarc digital watermarks are either the best choice, or the only choice, for connecting physical products to their digital twins.

When it comes to automating factory operations, we are finding there are multiple reasons why one, some, or all of these attributes are required. As the only product digitization platform capable of using digital watermarks as the bridge between a physical object and its digital twin, we believe this sandboxed version of our platform, Digimarc Illuminate for Factory Automation, has a bright future in helping our customers solve some really pressing problems, and in so doing, allowing them to either start or continue along their product digitization journey.

In terms of market size, as I mentioned last quarter, we believe this solution is applicable to 100s if not 1,000s of potential customers, and this single deal we signed in Q2, which covers a single product across two countries, represents mid six figures of ARR.

Finally, moving to Digimarc Validate, it is incredible to look back on the progress we have made since our last call, including the launch of our product just over a month ago. Our legacy of being the pioneer and widely recognized leader in digital watermarking -- the technology that has been universally accepted as having a key role to play in the new world of generative AI (GenAI) -- coupled with our experience in building massive, multinational, multistakeholder and mission critical systems of trust and authenticity upon that technology, has sped our entrée into important conversations across the ecosystem. We are actively engaged with governments, standards bodies, and content creators and technology partners and prospects of all sizes.

GenAI didn’t create the deepfake issue, but it did democratize it, and if the world is to enjoy the benefits of this powerful new technology, action MUST be taken to protect against its risks. This is not a view we are unique in having, and the speed at which all stakeholders are moving is astounding. We believe the result is that the world will look back at GenAI as the catalyst for the delivery of something long-overdue anyway: a safe, fair, trusted, and authentic internet. And Digimarc Validate is ideally positioned to be a foundational element of such a future.

On the government front, we have been engaging with leadership at the highest levels to discuss the need for tools to support the protection and authentication of digital assets in the GenAI era. We have met with senior leaders at the White House, Executive Agencies and Departments, and in Congress, and in these bi-partisan meetings our history, proven technology, and ability to work across images and audio, especially on-device, is helping drive awareness of what’s possible. We have been asked by multiple groups to help educate and inform the conversation, commitments, and coming regulation, and our ideas have been well received. We expect to continue participating in discussions at the highest levels to shape the future of Artificial Intelligence and the broader digital ecosystem and we feel confident that Digimarc Validate has an important role to play in effectively protecting the rights of content creators and owners while also building the foundation of true digital asset authentication.

On the standards body front, we are a member and heavily involved in the Coalition for Content Provenance and Authenticity (C2PA). For those of you not familiar with C2PA, it is a group of industry leaders working to address the prevalence of misleading information online through the development of technical standards for certifying the source and history (or provenance) of media content. We are appreciative of all the hard, smart work this group has been doing and thrilled they understand digital watermarking has a role to play in proving the authenticity of digital content.

I know there have been some questions around C2PA’s Content Credentials and if this is competitive to Validate, and the answer is no. In fact, Digimarc will be supporting Content Credentials as part of our upcoming registry, because while industry standards are necessary, they are not by themselves sufficient. Standards need companies to support them for there to be meaningful adoption, and we recognize we have an important role to play. Content Credentials are an elegant means of organizing and recording metadata, but the risk to metadata is that it can be altered and is removed by common workflows such as editing software and social networks, rendering it useless for the purposes of intellectual property protection and authentication in such scenarios. Just like in the physical world, our digital watermarks will act as a unique, necessary, and immutable bridge between the data and the object, allowing the content owner to control their digital asset’s story.

On top of this governmental and standards body engagement, of course, we are building our Digimarc Validate business. Digimarc Validate provides value to content creators and their consumers as well as owners of detection points running the gamut of GenAI engines, e-commerce sites, network security companies and device vendors.

We are engaging with prospects and partners across the full spectrum of size, and we intend to make it as difficult to counterfeit content and identity in the digital world as we have currency in the real world. In addition to the massive opportunity ahead of us, and the fact we are uniquely qualified and positioned to address it, there are two perhaps non-obvious important points worth highlighting about our entrée into the digital domain.

The first is that our ability to bridge both the physical and digital domains is a key differentiator of our platform, our products, and our digital watermarks, and nowhere is that becoming as obvious as with Digimarc Validate. And secondly, as I know at least a few investors have noticed from visiting our website, the expansion of Digimarc Validate to the digital domain allows us to open a fully digital sales motion. In terms of our mantra of being easy to begin doing business with and excellent at guiding customers along their product digitization journey, this web-based sales motion has opened a new door to “easy.”

Thus, the expansion of Digimarc Validate to the digital domain has not only dramatically increased our overall Total Addressable Market (TAM), it has also increased our opportunities in the physical domain, while adding width and depth to the moats surrounding all our offerings.

I will now turn the call over to Charles to discuss our financial results.

Financial Results

Thank you Riley, and hello everyone.

Before I dig deeper into our Q3 financial results, I wanted to share some financial highlights from the third quarter.

| |

●

|

We ended the quarter with $19.6 million of Annual Recurring Revenue (or ARR), representing 54% growth year-over-year. I will talk more about this important performance metric in a minute.

|

| |

●

|

We achieved 85.5% subscription gross profit margin;

|

| |

●

|

We reduced our operating expenses year-over-year by 17%; and

|

| |

●

|

Our free cash flow usage was only $400 thousand for the quarter.

|

I highlight these areas as they are all critical drivers towards reaching profitability. Now onto the details.

As we mentioned on previous earnings calls, we have been working to select a new reporting metric to replace 1st year commercial bookings that would provide a better indicator of our progress in growing our high-margin commercial subscription business. As Riley already mentioned, we have decided on Annual Recurring Revenue as it’s a key performance metric we are now using to run our business. We intend to report ending ARR each quarter with comparative periods so you can measure our progress. We calculate ARR using the annual recurring fees stated in our sales contracts, thus mirroring the underlying economic value of these contracts. Also, ARR only includes recurring subscription fees from commercial contracts. Government contracts, service fees and non-recurring subscription fees are excluded from our reported ARR. The reason for this is, the most important growth driver we are all focused on is recurring commercial subscription revenue. We have included a table within the earnings script that reports our ARR at the end of each of the last 8 quarters for comparative purposes.

In addition to focusing on growing our high-margin commercial subscription business, we are also focusing on making sure the payment terms in our sales contracts are consistent with traditional SaaS terms, which results in the collection of annual payments up front. I call this out because it is yet another benefit of our transition to becoming a product and platform company and allows our ARR growth to have a more immediate impact on improving cash burn.

|

Quarter

|

12/31/21

|

3/31/22

|

6/30/22

|

9/30/22

|

12/31/22

|

3/31/23

|

6/30/23

|

9/30/23

|

|

ARR1

|

$9.2M |

$9.5M |

$9.8M |

$12.7M |

$13.0M |

$13.0M |

$16.7M |

$19.6M |

| Note: ARR at 12/31/21 includes ARR from EVRYTHNG pre-acquisition for comparative purposes as the acquisition closed 1/03/22. |

Ending ARR for the quarter was $19.6 million representing net ARR growth of $6.9 million or 54% year-over-year.

Total revenue for the quarter was $9.0 million, an increase of $1.2 million or 15% from $7.8 million in Q3 last year.

Subscription revenue, which accounted for 53% of total revenue for the quarter, grew 18% from $4.1 million to $4.8 million. The increase reflects subscription revenue recognized on new customer contracts signed this year as well as upsells this year on existing customer contracts.

Service revenue increased 12% from $3.7 million to $4.2 million. The increase reflects a larger annual budget from the Central Banks for project work in 2023 than 2022, which includes both higher billing rates and project hours.

Subscription gross profit margin2 improved from 75% in Q3 last year to over 85% in Q3 this year. The large increase year-over-year reflects two positive trends we have highlighted previously, both a favorable mix of subscription revenue to our newer products and lower product infrastructure costs. We expect these trends to continue resulting in further expansion over time to our subscription gross profit margins.

Service gross profit margin2 decreased from 57% in Q3 last year to 54% in Q3 this year. The decrease reflects a more favorable labor mix last year than this year. We continue to expect service gross profit margin to be in the mid-50’s on average going forward with some fluctuation quarter to quarter depending on labor mix.

Operating expenses for the quarter were $16.4 million compared to $19.7 million in Q3 last year, a decrease of 17%. The large decrease in operating costs largely reflects lower headcount, partially offset by annual compensation adjustments, and lower contractor and consulting costs. Additionally, Q3 last year included $1.4 million of severance costs for organizational changes.

Non-GAAP operating expenses, which excludes non-cash and non-recurring items, were $13.2 million for the quarter, down 15%, compared to $15.5 million in Q3 last year.

Net loss per share for the quarter was 53 cents versus 76 cents in Q3 last year. Non-GAAP net loss per share was also considerably lower for the quarter at 29 cents versus 47 cents in Q3 last year.

We ended the quarter with $33.3 million in cash and investments.

Free cash flow3 usage was $400 thousand for the quarter, compared to $11.4 million used in Q3 last year. We used an additional $800 thousand of cash in Q3 for share repurchases. Q3 shows the power of my earlier comments about our focus not just on growing our subscription business but also on the payment terms of that business, and while we expect Q4 free cash flow usage to be higher than the $400k we used in Q3, it will be significantly lower than prior quarterly trends. Last quarter, I mentioned we expected our free cash flow usage for the final six months of 2023 to be noticeably less than the $7.9 million we used in Q2 alone. We are reiterating that statement today.

For further discussion of our financial results, and risks and prospects for our business, please see our Form 10-Q that will be filed with the SEC.

I will now turn the call back over to Riley for final remarks.

Final Remarks

Thanks Charles.

We are seeing momentum across all areas of our business, and are hard at work continuing to increase that momentum as we create a market we are uniquely positioned to lead for years to come, a market that at scale has the opportunity to be as large if not larger than the other legs of the digital transformation stool.

With our recent expansion of Digimarc Validate into the digital domain, that opportunity has become significantly larger. And because we are unique in being able to bridge both the physical and digital worlds, not only has our TAM become larger, but our moats have become wider.

As those of you with whom I have spoken with over the years know, I think there’s a really easy way to identify once-in-a-generation investment opportunities before they become obvious to the rest of the world. It’s simply a matter of TAM, moats, and execution.

As just mentioned, our massive TAM has become that much more massive, and our incredibly wide moats have become that much wider. In addition, as our financial results in the last few quarters combined with our comments about Q4 show, we’re executing. We appreciate your interest as we continue to progress this generational opportunity.

Operator, we will now open up the call for questions.

1Annual Recurring Revenue (ARR) is a company performance metric calculated as the aggregation of annualized subscription fees from all of our commercial contracts as of the measurement date.

2Subscription gross profit margin and Service gross profit margin exclude amortization expense on acquired intangible assets.

3Free cash flow includes cash used in operating activities, the purchase of property and equipment and capitalized patent costs.

v3.23.3

Document And Entity Information

|

Nov. 06, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

DIGIMARC CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 06, 2023

|

| Entity, Incorporation, State or Country Code |

OR

|

| Entity, File Number |

001-34108

|

| Entity, Tax Identification Number |

26-2828185

|

| Entity, Address, Address Line One |

8500 SW Creekside Place

|

| Entity, Address, City or Town |

Beaverton

|

| Entity, Address, State or Province |

OR

|

| Entity, Address, Postal Zip Code |

97008

|

| City Area Code |

503

|

| Local Phone Number |

469-4800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

DMRC

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001438231

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

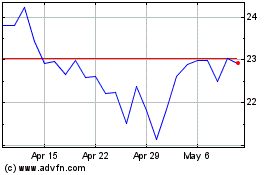

Digimarc (NASDAQ:DMRC)

Historical Stock Chart

From Apr 2024 to May 2024

Digimarc (NASDAQ:DMRC)

Historical Stock Chart

From May 2023 to May 2024