Crocs, Inc. (NASDAQ: CROX): -- Second Quarter Revenues More than

Triple to $85.6 Million vs. $25.8 Million Last Year -- Company

Reports 2Q06 Diluted EPS Including Share-based Compensation of

$0.39 vs. $0.10 Last Year -- Company Issues Third Quarter 2006

Guidance Crocs, Inc. (NASDAQ: CROX) today reported its results of

operations for the second quarter ended June 30, 2006. Revenues for

the second quarter ended June 30, 2006 increased 231.8% to $85.6

million compared to revenues of $25.8 million for the second

quarter ended June 30, 2005. Revenue for the six months ended June

30, 2006 increased 255.6% to $130.5 million compared to revenues of

$36.7 million for the six months ended June 30, 2005. Net income

attributable to common stockholders for the second quarter of

fiscal 2006 was $15.7 million, or $0.39 per diluted share, compared

to net income attributable to common stockholders of $3.3 million,

or $0.10 per diluted share, for the second quarter of fiscal 2005.

Second quarter net income attributable to common stockholders

includes non-cash share-based compensation expense, net of tax

effect, of $1.5 million compared to $685,000 for the comparable

period of 2005. Excluding the non-cash share-based compensation

expense, non-GAAP net income was $17.2 million and non-GAAP net

income per diluted common share was $0.43 for the second quarter

ended June 30, 2006. Net income attributable to common stockholders

for the six months ended June 30, 2006 was $22.1 million, or $0.56

per diluted share, compared to net income attributable to common

stockholders of $5.3 million, or $0.16 per diluted share, for the

six months ended June 30, 2005. -0- *T Three months ended Six

months ended June 30, June 30, ------------------

------------------ (In thousands, except per share data) 2006 2005

2006 2005 --------- -------- --------- -------- Revenues $85,635

$25,769 $130,477 $36,727 GAAP net income attributable to common

stockholders $15,666 $3,282 $22,074 $5,254 Non-GAAP net income,

excluding share-based compensation, net of tax effect $17,198

$3,967 $24,636 $7,415 GAAP net income per diluted common share

$0.39 $0.10 $0.56 $0.16 Non-GAAP net income per diluted common

share, excluding share- based compensation $0.43 $0.12 $0.63 $0.22

*T Ron Snyder, President and Chief Executive Officer of Crocs,

Inc., commented "Our second quarter results were much stronger than

we anticipated due to increased demand for our footwear both

domestically and overseas. Importantly, sales were driven by robust

demand for our core product, as well as positive consumer reaction

to our new styles, such as Athens, Off-Road and Scutes. At the same

time, we drove improvements in operating leverage, which allowed us

to generate a significant improvement in our bottom line." Gross

profit for the three months ended June 30, 2006 was $47.0 million,

or 54.8% of revenues, compared to gross profit of $14.0 million, or

54.2% of revenues for the three months ended June 30, 2005. Gross

profit for the six months ended June 30, 2006 was $70.6 million, or

54.1% of revenues, compared to gross profit of $20.8 million, or

56.7% of revenues for the six months ended June 30, 2005. Selling,

general and administrative expenses for the three months ended June

30, 2006 was $23.3 million, or 27.2% of revenues, compared to $8.6

million, or 33.2% of revenues in the corresponding period a year

ago. Selling, general and administrative expenses for the six

months ended June 30, 2006 was $37.0 million, or 28.4% of revenues,

compared to $13.2 million, or 35.6% of revenues in the

corresponding period a year ago. For the third quarter ending

September 30, 2006, the Company currently anticipates total

revenues to be in the range of $87.0 to $90.0 million and projects

its net income per diluted share to range from $0.38 to $0.40,

including share-based compensation expense. Mr. Snyder concluded,

"The first six months of 2006 have been marked by a number of

important accomplishments for Crocs. Financially, we reported

significant improvements in revenues, net income, and income per

diluted share, as well as completed a very successful initial

public offering. Operationally, we made strategic investments in

our infrastructure, particularly in the areas of manufacturing,

shipping and warehousing in order to better serve our retail

partners and to fully capitalize on the growing demand for our

products. Strategically, we have further diversified our business

with the introduction of new products and the addition of new

channels of distribution. We are very pleased with the progress we

have made across the board and we look forward to building on our

positive momentum going forward." Non-GAAP Disclosures This press

release includes certain non-GAAP financial measures with respect

to net income and diluted earnings per common share, excluding the

impact of share-based compensation expense. The Company's

management uses these measures to monitor and evaluate operating

results and trends and to gain an understanding of the comparative

operating performance of the Company. The Company believes these

measures enable investors to assess the Company's performance on

the same basis applied by management and to ease comparisons of the

Company's operating performance from period to period and among

other companies that separately identify share-based compensation

expenses. Conference Call Information A conference call to discuss

second quarter fiscal 2006 financial results is scheduled for today

(Thursday, August 3) at 4:30 PM Eastern Time. A webcast of the call

will take place simultaneously and can be accessed by clicking the

'Investor Relations' link under the Company section on

www.crocs.com and at www.viavid.net. To listen to the broadcast,

your computer must have Windows Media Player installed. If you do

not have Windows Media Player, go to the latter site prior to the

call, where you can download the software for free. About Crocs,

Inc. Crocs, Inc. is a rapidly growing designer, manufacturer and

marketer of footwear for men, women and children under the crocs

brand. All of our footwear products incorporate our proprietary

closed-cell resin material, which we believe represents a

substantial innovation in footwear comfort and functionality. Our

proprietary closed-cell resin, which we refer to as croslite(TM)

enables us to produce a soft and lightweight, non-marking, slip-

and odor-resistant shoe. These unique properties make crocs

footwear ideal for casual wear, as well as for recreational uses

such as boating, hiking, fishing and gardening, and have enabled us

to successfully market our products to a broad range of consumers.

Forward Looking Statements The matters regarding the future

discussed in this news release include forward-looking statements

as defined in the Private Securities Litigation Reform Act of 1995,

including statements related to our expectations regarding our

total revenues and net income per diluted share for the third

quarter ending September 30, 2006. These statements involve known

and unknown risks, uncertainties and other factors which may cause

our actual results, performance or achievements to be materially

different from any future results, performances or achievements

expressed or implied by the forward-looking statements. These risks

and uncertainties include, but are not limited to, the following:

our limited operating history; our significant recent expansion;

changing fashion trends; our reliance on market acceptance of the

small number of products we sell; our ability to develop and sell

new products; our limited manufacturing capacity and distribution

channels; our reliance on third party manufacturing and logistics

providers for the production and distribution of our products; our

reliance on a single-source supply for certain raw materials; our

management and information systems infrastructure; our ability to

obtain and protect intellectual property rights; the effect of

competition in our industry; the potential effects of seasonality

on our sales; our ability to attract, assimilate and retain

management talent; and other factors described in our annual report

on Form 10-K under the heading "Risk Factors," and our subsequent

filings with the Securities and Exchange Commission. Readers are

encouraged to review that section and all other disclosures

appearing in our filings with the Securities and Exchange

Commission. We do not undertake any obligation to update publicly

any forward looking statement, including, without limitation, any

estimate regarding revenues or earnings, whether as a result of the

receipt of new information, future events, or otherwise. -0- *T

Crocs, Inc. Consolidated Statements of Operations (In thousands,

except share and per share data) (unaudited) THREE MONTHS ENDED SIX

MONTHS ENDED June 30, June 30, 2006 2005 2006 2005(1) Revenues $

85,635 $ 25,769 $ 130,477 $ 36,727 Cost of Sales 38,665 11,800

59,828 15,919 Gross Profit 46,970 13,969 70,649 20,808 Selling,

general and administrative expenses 23,312 8,552 36,978 13,225

Income from operations 23,658 5,417 33,671 7,583 Interest expense

92 165 391 202 Other expense (income), net: (366) 6 (662) 23 Income

before income taxes 23,932 5,246 33,942 7,358 Income tax expense

8,266 1,896 11,835 1,968 Net income 15,666 3,350 22,107 5,390

Dividends on redeemable convertible preferred shares 0 68 33 136

Net income attributable to common stockholders 15,666 3,282 22,074

5,254 Net income per share: Basic $ 0.41 $ 0.13 $ 0.62 $ 0.16

Diluted $ 0.39 $ 0.10 $ 0.56 $ 0.16 Weighted average common shares:

Basic 38,286,877 25,217,641 35,608,875 25,197,004 Diluted

40,427,703 33,497,743 39,351,248 33,289,163 (1) Our Statement of

Operations for the six month period ended June 30, 2005 has been

restated to reflect the effect of adjustments to our share-based

compensation. See the notes to our Form 10-Q filing for the quarter

ended June 30, 2006 for further information, which will be filed by

August 14, 2006. Crocs, Inc. Consolidated Balance Sheets (In

thousands, except share and per share data) (unaudited) June 30,

December 31, 2006 2005 ASSETS Current assets: Cash and cash

equivalents $ 67,017 $ 4,787 Accounts receivable, net 47,252 17,641

Inventories, net 40,839 28,494 Deferred tax assets 1,636 1,939

Prepaid expenses and other current assets 3,345 3,492 Total current

assets 160,089 56,353 Property and equipment, net 19,924 14,765

Goodwill 351 336 Other intangibles, net 7,523 5,311 Deferred tax

assets, net 1,532 1,084 Other assets 777 183 Total assets $190,196

$ 78,032 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable $ 15,466 $ 20,829 Accrued liabilities and other

liabilities 16,101 8,178 Income taxes payable 5,214 8,697 Notes

payable and current installments of long-term debt 864 8,601 Total

current liabilities 37,645 46,305 Long-term debt 1,742 3,422

Deferred tax liability 1,884 1,772 Other liabilities 286 319 Total

liabilities 41,557 51,818 Commitments and contingencies Redeemable

common shares, 8,410,320 shares issued and outstanding at December

31, 2005 - 1,800 Redeemable convertible preferred shares, par value

$0.001 per share; 8,000,000 shares authorized 7,452,492 shares

issued and outstanding in 2005 - preferences in liquidation of

$5,500 - 5,500 Stockholders' equity: Common shares, par value

$0.001 per share; 125,000,000 and 25,000,000 shares authorized,

38,411,687 and 17,449,699 shares issued and outstanding 38 17

Additional paid-in-capital 117,202 13,976 Deferred compensation

(8,186) (12,364) Retained earnings 38,772 16,697 Accumulated other

comprehensive income 813 588 Total stockholders' equity 148,639

18,914 Total liabilities and stockholders' equity $190,196 $ 78,032

Crocs, Inc. Reconciliation of Non-GAAP Financial Results (In

thousands, except share and per share data) (unaudited) THREE

MONTHS ENDED SIX MONTHS ENDED June 30, June 30, 2006 2005 2006

2005(1) GAAP Net income attributable to common stockholders $15,666

$ 3,282 $ 22,074 $ 5,254 Plus: Share-based compensation, net of tax

1,532 685 2,562 2,161 --------- ---------- -------- ---------

Non-GAAP net income 17,198 3,967 24,636 7,415 --------- ----------

-------- --------- Non-GAAP net income per share: Diluted $ 0.43 $

0.12 $ 0.63 $ 0.22 Weighted average common shares: Diluted

40,427,703 33,497,743 39,351,248 33,289,163 (1) Our Statement of

Operations for the six month period ended June 30, 2005 has been

restated to reflect the effect of adjustments to our share-based

compensation. See the notes to our Form 10-Q filing for the quarter

ended June 30, 2006 for further information, which will be filed by

August 14, 2006. *T

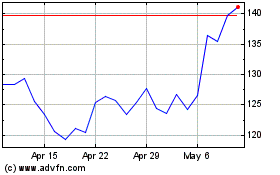

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

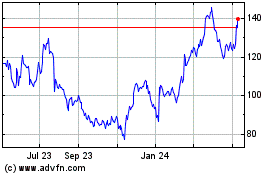

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024