Crocs, Inc. Raises Second Quarter Guidance

May 25 2006 - 5:47PM

Business Wire

Crocs, Inc. (NASDAQ: CROX) announced today that the Company has

raised its sales and net income per diluted common share guidance

for the second quarter ending June 30, 2006. Based on strong demand

from consumers, which has resulted in faster than anticipated

re-orders from our customers both in the U.S. and overseas, the

Company now expects sales for the second quarter of fiscal 2006 to

be between $62 million and $65 million compared to its previous

sales guidance range of $53 million to $55 million. The Company

also stated that it now anticipates net income per diluted common

share to range from $0.23 to $0.25, versus its previous expectation

of net income per diluted common share of $0.21 to $0.22. The

Company's expected net income per diluted common share for the

second quarter of 2006 includes estimated share-based compensation

expense. About Crocs, Inc. Crocs, Inc. is a rapidly growing

designer, manufacturer and marketer of footwear for men, women and

children under the crocs brand. All of our footwear products

incorporate our proprietary closed-cell resin material, which we

believe represents a substantial innovation in footwear comfort and

functionality. Our proprietary closed-cell resin, which we refer to

as croslite(TM) enables us to produce a soft and lightweight,

non-marking, slip- and odor-resistant shoe. These unique properties

make crocs footwear ideal for casual wear, as well as for

recreational uses such as boating, hiking, fishing and gardening,

and have enabled us to successfully market our products to a broad

range of consumers. Forward Looking Statements This news release

includes forward-looking statements within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, regarding our expectations with respect to

our sales and net income per diluted common share for the second

quarter of fiscal 2006. These statements involve known and unknown

risks, uncertainties and other factors which may cause our actual

results, performance or achievements to be materially different

from any future results, performances or achievements expressed or

implied by the forward-looking statements. These risks and

uncertainties include, but are not limited to, the following: our

limited operating history; our significant recent expansion;

changing fashion trends; our reliance on market acceptance of the

small number of products we sell; our ability to develop and sell

new products; our limited manufacturing capacity and distribution

channels; our reliance on third party manufacturing and logistics

providers for the production and distribution of our products; our

reliance on a single-source supply for certain raw materials; our

management and information systems infrastructure; our ability to

obtain and protect intellectual property rights; the effect of

competition in our industry; the potential effects of seasonality

on our sales; our ability to attract, assimilate and retain

management talent; and other factors described in our annual report

on Form 10-K under the heading "Risk Factors," and our subsequent

filings with the Securities and Exchange Commission. Readers are

encouraged to review that section and all other disclosures

appearing in our filings with the Securities and Exchange

Commission.

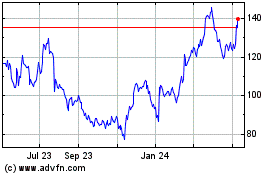

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2024 to Jul 2024

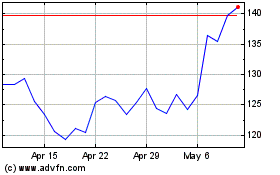

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jul 2023 to Jul 2024