CorVel Announces Revenues and Earnings

May 22 2024 - 6:15AM

CorVel Corporation (NASDAQ: CRVL) announced the results for the

quarter and fiscal year ended March 31, 2024. Revenues for the

quarter were $207 million, an increase from $185 million in the

same quarter of the previous year. Earnings per share for the

quarter were $1.12, compared to $1.04 in the same quarter of the

prior year.

Revenues for the fiscal year ended March 31, 2024 were $795

million, compared to $719 million for the fiscal year ended March

31, 2023. Earnings per share for the fiscal year ended March 31,

2024, were $4.40, compared to $3.77 for the fiscal year ended March

31, 2023.

Patient Management services, including revenue from our Third

Party Administration (TPA) customers, increased 11%, significantly

contributing to our overall year-over-year fiscal revenue

growth. CorVel’s third-place ranking in Workers’ Compensation

revenue on Business Insurance’s 2024 TPA Rankings and Directory

highlights the company's ongoing success in providing effective

solutions to the market.

Recent Development Updates

Fiscal year 2024 experienced a solid increase in new bookings

compared to prior years and a net revenue retention of 108%. Both

are a testament to the commitment and engagement of the CorVel team

and the growing reputation for meaningful results the Company has

earned in the market. Feedback from partners is that the service,

communication, transparency, and innovative technological solutions

CorVel provides are unmatched in the industry.

CorVel invested in and implemented Generative AI (GAI)

functionality during the fiscal year, which brought substantive

benefits across the enterprise and a broad foundation from which

additional GAI functionality will be deployed in the future. As a

result of those efforts, the Company has introduced GAI-powered

software as a service (SaaS) platform to the managed care market.

The data and service hub will automate tasks and leverage AI to

increase efficiencies within workflows. The model will also lessen

IT constraints for CorVel’s partners and allow seamless integration

between RMIS systems and other provider platforms.

About CorVel

CorVel Corporation applies technology including artificial

intelligence, machine learning and natural language processing to

enhance the management of episodes of care and the related health

care costs. We partner with employers, third-party administrators,

insurance companies and government agencies in managing workers’

compensation and health, auto and liability services. Our diverse

suite of solutions combines our integrated technologies with a

human touch. CorVel's customized services, delivered locally, are

backed by a national team to support clients as well as their

customers and patients.

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995

All statements included in this press release, other than

statements or characterizations of historical fact, are

forward-looking statements. These forward-looking statements are

based on the Company’s current expectations, estimates and

projections about the Company, management’s beliefs, and certain

assumptions made by the Company, and events beyond the Company’s

control, all of which are subject to change. Such forward-looking

statements include, but are not limited to, statements relating to

our commercial health-focused operation, the ability to deploy

additional GAI functionality, improved productivity resulting from

automation and augmentation across enterprise business systems, the

ability to automate tasks and leverage AI to increase efficiencies

within workflows, and the ability to reduce IT constraints for the

Company’s partners and allow seamless integration between risk

management information systems and other provider platforms.

These forward-looking statements are not guarantees of future

results and are subject to risks, uncertainties and assumptions

that could cause the Company’s actual results to differ materially

and adversely from those expressed in any forward-looking

statement, including the risk that GAI could be prone to errors and

that those errors may cause inefficiencies and could be costly to

mitigate.

The risks and uncertainties referred to above include but are

not limited to factors described in this press release and the

Company’s filings with the Securities and Exchange Commission,

including but not limited to “Risk Factors” in the Company’s Annual

Report on Form 10-K for the year ended March 31, 2023 and the

Company’s Quarterly Report on Form 10-Q for the quarters ended June

30, 2023, September 30, 2023, and December 31, 2023. The

forward-looking statements in this press release speak only as of

the date they are made. The Company undertakes no obligation to

revise or update publicly any forward-looking statement for any

reason.

| CorVel

CorporationQuarterly Results – Income

StatementQuarters and Fiscal Year Ended March 31,

2024 and March 31, 2023 |

| |

| Quarter

Ended |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

Revenues |

|

$ |

207,233,000 |

|

|

$ |

185,443,000 |

|

| Cost of

revenues |

|

|

163,830,000 |

|

|

|

143,492,000 |

|

| Gross

profit |

|

|

43,403,000 |

|

|

|

41,951,000 |

|

| General

and administrative |

|

|

20,806,000 |

|

|

|

19,358,000 |

|

| Income

from operations |

|

|

22,597,000 |

|

|

|

22,593,000 |

|

| Income

tax provision |

|

|

3,143,000 |

|

|

|

4,424,000 |

|

| Net

income |

|

$ |

19,454,000 |

|

|

$ |

18,169,000 |

|

| Earnings

Per Share: |

|

|

|

|

|

|

|

Basic |

|

$ |

1.13 |

|

|

$ |

1.06 |

|

|

Diluted |

|

$ |

1.12 |

|

|

$ |

1.04 |

|

| Weighted

Shares |

|

|

|

|

|

|

|

Basic |

|

|

17,115,000 |

|

|

|

17,176,000 |

|

|

Diluted |

|

|

17,332,000 |

|

|

|

17,429,000 |

|

| Fiscal Year

Ended |

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

Revenues |

|

$ |

795,311,000 |

|

|

$ |

718,562,000 |

|

| Cost of

revenues |

|

|

623,618,000 |

|

|

|

560,303,000 |

|

| Gross

profit |

|

|

171,693,000 |

|

|

|

158,259,000 |

|

| General

and administrative |

|

|

76,592,000 |

|

|

|

73,705,000 |

|

| Income

from operations |

|

|

95,101,000 |

|

|

|

84,554,000 |

|

| Income

tax provision |

|

|

18,849,000 |

|

|

|

18,189,000 |

|

| Net

income |

|

$ |

76,252,000 |

|

|

$ |

66,365,000 |

|

| Earnings

Per Share: |

|

|

|

|

|

|

|

Basic |

|

$ |

4.45 |

|

|

$ |

3.83 |

|

|

Diluted |

|

$ |

4.40 |

|

|

$ |

3.77 |

|

| Weighted

Shares |

|

|

|

|

|

|

|

Basic |

|

|

17,122,000 |

|

|

|

17,328,000 |

|

|

Diluted |

|

|

17,347,000 |

|

|

|

17,592,000 |

|

|

CorVel CorporationQuarterly Results –

Condensed Balance SheetMarch 31, 2024 and March

31, 2023 |

|

|

|

|

|

March 31, 2024 |

|

|

March 31, 2023 |

|

|

Cash |

|

$ |

105,563,000 |

|

|

$ |

71,329,000 |

|

| Customer

deposits |

|

|

88,142,000 |

|

|

|

80,022,000 |

|

| Accounts

receivable, net |

|

|

97,108,000 |

|

|

|

81,034,000 |

|

| Prepaid

taxes and expenses |

|

|

11,418,000 |

|

|

|

11,385,000 |

|

|

Property, net |

|

|

85,892,000 |

|

|

|

82,770,000 |

|

| Goodwill

and other assets |

|

|

42,498,000 |

|

|

|

39,662,000 |

|

|

Right-of-use asset, net |

|

|

24,058,000 |

|

|

|

27,721,000 |

|

|

Total |

|

$ |

454,679,000 |

|

|

$ |

393,923,000 |

|

| Accounts

and taxes payable |

|

$ |

16,631,000 |

|

|

$ |

15,309,000 |

|

| Accrued

liabilities |

|

|

167,868,000 |

|

|

|

152,578,000 |

|

|

Long-term lease liabilities |

|

|

22,533,000 |

|

|

|

23,860,000 |

|

| Paid-in

capital |

|

|

233,632,000 |

|

|

|

218,703,000 |

|

| Treasury

stock |

|

|

(793,905,000 |

) |

|

|

(748,195,000 |

) |

| Retained

earnings |

|

|

807,920,000 |

|

|

|

731,668,000 |

|

|

Total |

|

$ |

454,679,000 |

|

|

$ |

393,923,000 |

|

| |

|

|

|

|

|

|

Contact: Melissa StoranPhone: 949-851-1473www.corvel.com

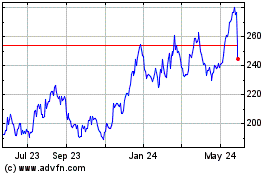

CorVel (NASDAQ:CRVL)

Historical Stock Chart

From May 2024 to Jun 2024

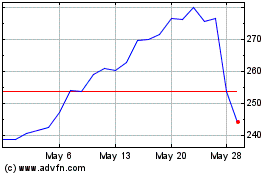

CorVel (NASDAQ:CRVL)

Historical Stock Chart

From Jun 2023 to Jun 2024