Consolidated Water Co. Ltd. (NASDAQ Global Select Market: CWCO), a

leading developer and operator of advanced water supply and

treatment plants, reported results for the second quarter ended

June 30, 2023. All comparisons are to the same prior year period

unless otherwise noted.

The company will hold a conference call at 11:00 a.m. Eastern

time tomorrow to discuss the results (see dial-in information

below).

Second Quarter 2023 Financial Highlights

- Total revenue increased 110% to

$44.2 million.

- Retail revenue increased 16% to $7.6

million.

- Services revenue increased 377% to

$24.1 million, with recurring services revenue generated from

operation and maintenance contracts up 11% to $3.9 million.

- Manufacturing revenue increased to

$4.1 million.

- Net income from continuing

operations attributable to company stockholders was $7.5 million or

$0.47 per diluted share, up 178% from $2.7 million or $0.18 per

diluted share in the same year-ago period.

- Paid quarterly cash dividend of

$0.085 per share ($0.34 on an annualized basis).

- Cash and cash equivalents totaled

$47.7 million as of June 30, 2023.

Second Quarter 2023 Operational Highlights

- Signed $204 million contract to

design, build, operate and maintain a seawater desalination plant

in Hawaii.

- Volume of water sold in Grand Cayman

retail segment increased 14% primarily due to increased tourist

activity on Grand Cayman, with tourism in 2022 was lower than

historical levels due to the lingering impact of the COVID-19

pandemic.

- Recognized $17.6 million in revenue

from PERC Water’s progress on the construction of a $82 million

advanced water treatment plant in Goodyear, Arizona. The

construction is on track for completion next year.

Management Commentary

“I‘m truly gratified and excited to mark the company’s 50th

anniversary this month by reporting record quarterly and six-month

financial results,” commented Consolidated Water CEO, Rick

McTaggart. “In Q2, our revenue increased by 110% to $44.2 million,

reflecting another strong period of growth across all four of our

business segments. Our retail water segment benefited from a 14%

increase in the volume of water sold in Grand Cayman, which we

attribute to improved tourist activity over last year when tourism

was lower than historical levels due to the lingering impact of the

pandemic.

“Our services revenue grew by $19 million, mostly due to the

progress our PERC Water subsidiary has made on the construction of

an $82 million advanced water treatment plant in Goodyear, Arizona

that we announced in May of last year. Construction is progressing

as planned, and we anticipate generating significant additional

revenue from this project until the plant’s anticipated

commissioning and startup in mid-2024.

“PERC’s continued strong operating performance, revenue growth

and synergies with other areas of our business have significantly

improved our overall top and bottom line. Its strong operational

presence in the Southwestern U.S. — a region that urgently needs

new fresh water sources due to unprecedented drought conditions —

has positioned us for further growth and development in this

important segment of our business.

“In our Caribbean seawater desalination business, the revenue we

recognized from the design and construction of the 2.6 million

gallon per day Red Gate desalination plant for the Water Authority

of the Cayman Islands also contributed to the year-over-year

increase in services revenue. Construction remains on track and is

expected to be completed in early 2024.

“Our new Cayman Water 1 million gallon per day West Bay

desalination plant is replacing a 30-year-old plant and supplements

production capacity for our retail water business in Grand Cayman.

The plant is expected to go online next month in time to meet the

higher retail water demand we typically experience from

mid-December through April in Grand Cayman.

“In July, we entered the U.S. desalination market for the first

time with a $204 million contract to design, build, operate and

maintain a seawater desalination plant in Hawaii. We believe

winning this contract was due to our proven ability in designing,

building and operating some of the world’s most energy-efficient

seawater desalination plants, as well as the exceptional project

track record that our team was able to demonstrate to our new

client, the Board of Water Supply of Honolulu. We also believe this

entrance into the U.S. desalination plant market positions us well

for the additional opportunities we are pursuing in the Western

U.S.

“We will be commemorating our 50th year of operating with the

ringing of the Nasdaq opening bell on Monday. From our humble

beginnings, Consolidated Water has pursued a mission to provide

state-of-the-art water services to areas of the world where the

supply of potable water is scarce. Our dedicated team of engineers,

builders and operators have long recognized that fresh water is the

most precious resource in the world. Today, we produce more than 25

million gallons of potable water daily from our 11 seawater

desalination plants in the Caribbean, and operate 27 water and

wastewater treatment facilities in the Western U.S.

“We remain very optimistic about our further growth for numerous

reasons. This includes the recovery of tourism in Grand Cayman and

our ongoing construction projects underway there and in the U.S.,

as well as the increased project bidding activity we are seeing in

the U.S. We also anticipate that the more than $350 million in

major multi-year projects that we secured over the last 18 months

will have an increasing positive impact on our earnings in future

quarters.

“We believe these activities and achievements, combined with the

current positive trends in our markets, represent strong drivers

for continued growth, increased profitability, and further

strengthening of shareholder value.”

Second Quarter 2023 Financial Summary

Revenue for the second quarter of 2023 totaled $44.2 million, up

110% compared to $21.1 million in the same year-ago period. The

increase was driven by increases of $1.0 million in the retail

segment, $59,000 in the bulk segment, $19.0 million in the services

segment and $3.0 million in the manufacturing segment.

Retail revenue increased primarily due to a 14% increase in the

volume of water sold, as well as the result of higher energy costs

that increased the energy pass-through component of the company’s

water rates and a more favorable rate mix.

The increase in services segment revenue was due to an increase

in plant design and construction revenue. The company recognized

approximately $17.6 million in revenue in the second quarter of

2023 for the construction of a water treatment plant in Goodyear,

Arizona. Revenue generated under operations and maintenance

contracts totaled $3.9 million in the second quarter of 2023, up

11% as compared to $3.5 million in the same year-ago period.

The increase in manufacturing segment revenue was due to

increased production activity.

Gross profit for the second quarter of 2023 was $15.5 million or

35.0% of total revenue, up 107% from $7.5 million or 35.5% of total

revenue for the same year-ago period.

Net income from continuing operations attributable to

stockholders for the second quarter of 2023 was $7.5 million or

$0.47 per diluted share, compared to net income of $2.7 million or

$0.18 per diluted share for the same year-ago period.

Net income attributable to Consolidated Water stockholders for

the second quarter of 2023, which includes the results of

discontinued operations, was $7.3 million or $0.46 per fully

diluted share, up from a net income of $2.3 million or $0.15 per

basic and fully diluted share for the same year-ago period.

Cash and cash equivalents totaled $47.7 million as of June 30,

2023, as compared to $51.1 million as of March 31, 2023, with

working capital at $75.5 million, debt of $0.3 million, and

stockholders’ equity totaling $170.3 million.First Half

2023 Financial Summary

Revenue for the first half of 2023 was $77.1 million, up 90%

compared to $40.6 million in the same year-ago period. The increase

was primarily driven by increases of $2.5 million in the retail

segment, $1.7 million in the bulk segment, $27.0 million in the

services segment and $5.2 million in the manufacturing segment.

Retail revenue increased primarily due to a 17% increase in the

volume of water sold. The volume of water sold in the Cayman Water

license area increased by 15% and the remaining 2% increase in the

volume of water sold was due to water sales made by Cayman Water

directly to the WAC in January and February of 2023.

The retail revenue increased also as a result of higher energy

costs that increased the energy pass-through component of the

company’s retail water rates, as well as a more favorable rate

mix.

The increase in bulk segment revenue was due to an increase in

energy costs for CW-Bahamas, which increased the energy

pass-through component of CW-Bahamas’ rates and, to a lesser

extent, an increase of 9% in the volume of water sold by

CW-Bahamas.

The increase in services segment revenue was due to an increase

in plant design and construction revenue. The company recognized

approximately $24.1 million in revenue for the construction of a

water treatment plant in Goodyear, Arizona in the first half of

2023. Revenue generated under operations and maintenance contracts

totaled $7.5 million in the first half of 2023, up 5% as compared

to $7.1 million in the same year-ago period.

The increase in manufacturing segment revenue was due to higher

project activity.

Gross profit for the first half of 2023 was $26.0 million or

33.7% of total revenue, up 78% from $14.6 million or 36.0% of total

revenue in the same year-ago period.

Net income from continuing operations attributable to

stockholders for the first half of 2023 was $11.6 million or $0.73

per diluted share, compared to net income of $5.0 million or $0.33

per diluted share in the same year-ago period.

Net income attributable to Consolidated Water stockholders for

the half of 2023, which includes the results of discontinued

operations, was $11.1 million or $0.70 per fully diluted share, up

from net income of $4.0 million or $0.26 per fully diluted share in

the same year-ago period.

Second Quarter Segment Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, 2023 |

| |

|

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

|

$ |

7,573,329 |

|

|

$ |

8,482,495 |

|

$ |

24,093,963 |

|

$ |

4,087,476 |

|

$ |

44,237,263 |

|

| Cost of

revenue |

|

|

3,433,132 |

|

|

|

5,931,735 |

|

|

16,248,141 |

|

|

3,160,706 |

|

|

28,773,714 |

|

| Gross

profit |

|

|

4,140,197 |

|

|

|

2,550,760 |

|

|

7,845,822 |

|

|

926,770 |

|

|

15,463,549 |

|

| General

and administrative expenses |

|

|

4,265,535 |

|

|

|

379,900 |

|

|

904,560 |

|

|

434,920 |

|

|

5,984,915 |

|

| Gain on

asset dispositions and impairments, net |

|

|

— |

|

|

|

1,000 |

|

|

— |

|

|

— |

|

|

1,000 |

|

| Income

(loss) from operations |

|

$ |

(125,338 |

) |

|

$ |

2,171,860 |

|

$ |

6,941,262 |

|

$ |

491,850 |

|

|

9,479,634 |

|

| Other

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

129,131 |

|

| Income

before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,608,765 |

|

|

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,940,067 |

|

| Net income from continuing

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,668,698 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

137,226 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7,531,472 |

|

| Net loss

from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(207,701 |

) |

| Net income attributable to

Consolidated Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

7,323,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, 2022 |

| |

|

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

|

$ |

6,526,803 |

|

$ |

8,423,749 |

|

$ |

5,055,483 |

|

$ |

1,061,092 |

|

|

$ |

21,067,127 |

|

| Cost of

revenue |

|

|

3,118,411 |

|

|

5,647,583 |

|

|

3,865,867 |

|

|

959,769 |

|

|

|

13,591,630 |

|

| Gross

profit |

|

|

3,408,392 |

|

|

2,776,166 |

|

|

1,189,616 |

|

|

101,323 |

|

|

|

7,475,497 |

|

| General

and administrative expenses |

|

|

3,345,109 |

|

|

404,072 |

|

|

838,040 |

|

|

339,470 |

|

|

|

4,926,691 |

|

| Gain on

asset dispositions and impairments, net |

|

|

1,200 |

|

|

— |

|

|

4,080 |

|

|

— |

|

|

|

5,280 |

|

| Income

(loss) from operations |

|

$ |

64,483 |

|

$ |

2,372,094 |

|

$ |

355,656 |

|

$ |

(238,147 |

) |

|

|

2,554,086 |

|

| Other

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

397,982 |

|

| Income

before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,952,068 |

|

|

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,152 |

|

| Net

income from continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,941,916 |

|

| Income

attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

232,197 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,709,719 |

|

| Net loss

from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(419,833 |

) |

| Net

income attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2,289,886 |

|

First Half Segment Results

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2023 |

| |

|

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

|

$ |

15,344,424 |

|

|

$ |

17,486,868 |

|

$ |

36,815,664 |

|

$ |

7,459,297 |

|

$ |

77,106,253 |

|

| Cost of revenue |

|

|

6,983,926 |

|

|

|

12,174,881 |

|

|

26,292,219 |

|

|

5,632,596 |

|

|

51,083,622 |

|

| Gross profit |

|

|

8,360,498 |

|

|

|

5,311,987 |

|

|

10,523,445 |

|

|

1,826,701 |

|

|

26,022,631 |

|

| General and administrative

expenses |

|

|

8,442,642 |

|

|

|

732,875 |

|

|

1,993,232 |

|

|

852,828 |

|

|

12,021,577 |

|

| Gain (loss) on asset

dispositions and impairments, net |

|

|

(7,287 |

) |

|

|

12,270 |

|

|

— |

|

|

1,933 |

|

|

6,916 |

|

| Income (loss) from

operations |

|

$ |

(89,431 |

) |

|

$ |

4,591,382 |

|

$ |

8,530,213 |

|

$ |

975,806 |

|

|

14,007,970 |

|

| Other income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

286,190 |

|

| Income before income

taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14,294,160 |

|

| Provision for income

taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,389,552 |

|

| Net income from continuing

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,904,608 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

300,347 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,604,261 |

|

| Net loss

from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(466,864 |

) |

| Net income attributable to

Consolidated Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

11,137,397 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2022 |

| |

|

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

|

$ |

12,840,003 |

|

|

$ |

15,774,393 |

|

$ |

9,799,303 |

|

$ |

2,211,333 |

|

|

$ |

40,625,032 |

|

| Cost of

revenue |

|

|

6,172,151 |

|

|

|

10,334,702 |

|

|

7,515,047 |

|

|

1,981,871 |

|

|

|

26,003,771 |

|

| Gross

profit |

|

|

6,667,852 |

|

|

|

5,439,691 |

|

|

2,284,256 |

|

|

229,462 |

|

|

|

14,621,261 |

|

| General

and administrative expenses |

|

|

6,795,515 |

|

|

|

714,375 |

|

|

1,618,014 |

|

|

664,904 |

|

|

|

9,792,808 |

|

| Gain on

asset dispositions and impairments, net |

|

|

1,200 |

|

|

|

— |

|

|

16,538 |

|

|

— |

|

|

|

17,738 |

|

| Income

(loss) from operations |

|

$ |

(126,463 |

) |

|

$ |

4,725,316 |

|

$ |

682,780 |

|

$ |

(435,442 |

) |

|

|

4,846,191 |

|

| Other

income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

717,709 |

|

| Income

before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,563,900 |

|

| Benefit

from income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

56,425 |

|

| Net

income from continuing operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,507,475 |

|

| Income

from continuing operations attributable to non-controlling

interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

473,627 |

|

| Net

income from continuing operations attributable to Consolidated

Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,033,848 |

|

| Net loss

from discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,027,147 |

) |

| Net

income attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

4,006,701 |

|

Conference CallConsolidated Water management

will host a conference call tomorrow to discuss these results,

which will include a question-and-answer period.

Date: Friday, August 11, 2023Time: 11:00 a.m. Eastern time (8:00

a.m. Pacific time)Toll-free dial-in number:

1-844-875-6913International dial-in number:

1-412-317-6709Conference ID: 5868888

Please call the conference telephone number five minutes prior

to the start time. An operator will register your name and

organization. If you require any assistance connecting with the

call, please contact CMA at 1-949-432-7566.

A replay of the call will be available after 1:00 p.m. Eastern

time on the same day through August 18, 2023, as well as available

for replay via the Investors section of the Consolidated Water

website at www.cwco.com.

Toll-free replay number: 1-877-344-7529International replay

number: 1-412-317-0088Replay ID: 5868888

About Consolidated Water Co. Ltd.Consolidated

Water Co. Ltd. develops and operates advanced water supply and

treatment plants and water distribution systems. The company

designs, builds and operates seawater desalination facilities in

the Cayman Islands, The Bahamas and the British Virgin Islands, and

designs, builds and operates water treatment and reuse facilities

in the United States. The company recently entered the U.S.

desalination market with a contract to design, build, operate and

maintain a seawater desalination plant in Hawaii.The company also

manufactures and services a wide range of products and provides

design, engineering, management, operating and other services

applicable to commercial and municipal water production, supply and

treatment, and industrial water and wastewater treatment. For more

information, visit www.cwco.com.

Cautionary Note Regarding Forward-Looking

StatementsThis press release includes statements that may

constitute "forward-looking" statements, usually containing the

words "believe", "estimate", "project", "intend", "expect",

"should", "will" or similar expressions. These statements are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements

inherently involve risks and uncertainties that could cause actual

results to differ materially from the forward-looking statements.

Factors that would cause or contribute to such differences include,

but are not limited to (i) continued acceptance of the company's

products and services in the marketplace; (ii) changes in its

relationships with the governments of the jurisdictions in which it

operates; (iii) the outcome of its negotiations with the Cayman

government regarding a new retail license agreement; (iv) the

collection of its delinquent accounts receivable in the Bahamas;

and (v) various other risks, as detailed in the company's periodic

report filings with the Securities and Exchange Commission (“SEC”).

For more information about risks and uncertainties associated with

the company’s business, please refer to the “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” and “Risk Factors” sections of the company’s SEC

filings, including, but not limited to, its annual report on Form

10-K and quarterly reports on Form 10-Q, copies of which may be

obtained by contacting the company’s Secretary at the company’s

executive offices or at the “Investors – SEC Filings” page of the

company’s website at http://ir.cwco.com/docs. Except as otherwise

required by law, the company undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.Company

Contact:David W. SasnettExecutive Vice President and

CFOTel (954) 509-8200Email ContactInvestor Relations

ContactRon Both or Grant StudeCMA Investor RelationsTel

(949) 432-7566Email ContactMedia Contact:Tim

RandallCMA Media RelationsTel (949) 432-7572Email Contact

CONSOLIDATED WATER

CO. LTD.CONDENSED CONSOLIDATED BALANCE

SHEETS

|

|

|

|

|

|

|

|

|

| |

|

|

June 30, |

|

|

December 31, |

|

| |

|

|

2023 |

|

|

2022 |

|

| |

|

(Unaudited) |

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

47,691,699 |

|

$ |

50,711,751 |

|

|

Accounts receivable, net |

|

|

30,302,638 |

|

|

27,046,182 |

|

|

Inventory |

|

|

9,844,600 |

|

|

5,727,842 |

|

|

Prepaid expenses and other current assets |

|

|

6,873,183 |

|

|

5,643,279 |

|

|

Contract assets |

|

|

8,192,770 |

|

|

2,913,722 |

|

|

Current assets of discontinued operations |

|

|

320,427 |

|

|

531,480 |

|

| Total current

assets |

|

|

103,225,317 |

|

|

92,574,256 |

|

| Property, plant and equipment,

net |

|

|

50,733,041 |

|

|

52,529,545 |

|

| Construction in progress |

|

|

5,890,363 |

|

|

3,705,681 |

|

| Inventory, noncurrent |

|

|

5,004,956 |

|

|

4,550,987 |

|

| Investment in OC-BVI |

|

|

1,339,585 |

|

|

1,545,430 |

|

| Goodwill |

|

|

10,425,013 |

|

|

10,425,013 |

|

| Intangible assets, net |

|

|

2,545,556 |

|

|

2,818,888 |

|

| Operating lease right-of-use

assets |

|

|

1,785,865 |

|

|

2,058,384 |

|

| Other assets |

|

|

3,001,292 |

|

|

1,669,377 |

|

| Long-term assets of

discontinued operations |

|

|

21,129,288 |

|

|

21,129,288 |

|

| Total

assets |

|

$ |

205,080,276 |

|

$ |

193,006,849 |

|

| |

|

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

|

$ |

10,156,003 |

|

$ |

8,438,315 |

|

|

Accounts payable - related parties |

|

|

— |

|

|

403,839 |

|

|

Accrued compensation |

|

|

1,869,351 |

|

|

2,267,583 |

|

|

Dividends payable |

|

|

1,411,753 |

|

|

1,375,403 |

|

|

Current maturities of operating leases |

|

|

547,297 |

|

|

546,851 |

|

|

Current portion of long-term debt |

|

|

114,964 |

|

|

114,964 |

|

|

Contract liabilities |

|

|

12,928,490 |

|

|

8,803,921 |

|

|

Deferred revenue |

|

|

409,670 |

|

|

315,825 |

|

|

Current liabilities of discontinued operations |

|

|

280,695 |

|

|

389,884 |

|

| Total current

liabilities |

|

|

27,718,223 |

|

|

22,656,585 |

|

| Long-term debt,

noncurrent |

|

|

161,409 |

|

|

216,117 |

|

| Deferred tax liabilities |

|

|

485,008 |

|

|

560,306 |

|

| Noncurrent operating

leases |

|

|

1,552,708 |

|

|

1,590,542 |

|

| Other liabilities |

|

|

153,000 |

|

|

219,110 |

|

| Total

liabilities |

|

|

30,070,348 |

|

|

25,242,660 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

| Consolidated Water Co. Ltd.

stockholders' equity |

|

|

|

|

|

|

|

|

Redeemable preferred stock, $0.60 par value. Authorized 200,000

shares; issued and outstanding 48,088 and 34,383 shares,

respectively |

|

|

28,853 |

|

|

20,630 |

|

|

Class A common stock, $0.60 par value. Authorized 24,655,000

shares; issued and outstanding 15,736,041 and 15,322,875 shares,

respectively |

|

|

9,441,625 |

|

|

9,193,725 |

|

|

Class B common stock, $0.60 par value. Authorized 145,000 shares;

none issued |

|

|

— |

|

|

— |

|

|

Additional paid-in capital |

|

|

91,107,323 |

|

|

89,205,159 |

|

|

Retained earnings |

|

|

69,702,109 |

|

|

61,247,699 |

|

| Total Consolidated Water Co.

Ltd. stockholders' equity |

|

|

170,279,910 |

|

|

159,667,213 |

|

| Non-controlling interests |

|

|

4,730,018 |

|

|

8,096,976 |

|

| Total

equity |

|

|

175,009,928 |

|

|

167,764,189 |

|

| Total liabilities and

equity |

|

$ |

205,080,276 |

|

$ |

193,006,849 |

|

CONSOLIDATED WATER

CO. LTD.CONDENSED CONSOLIDATED STATEMENTS OF

INCOME (UNAUDITED)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Revenue |

|

$ |

44,237,263 |

|

|

$ |

21,067,127 |

|

|

$ |

77,106,253 |

|

|

$ |

40,625,032 |

|

| Cost of

revenue(including related party expenses of $0 and

$640,937 for the three months ended, and $0 and $1,480,369 for the

six months ended, June 30, 2023 and 2022, respectively) |

|

|

28,773,714 |

|

|

|

13,591,630 |

|

|

|

51,083,622 |

|

|

|

26,003,771 |

|

| Gross

profit |

|

|

15,463,549 |

|

|

|

7,475,497 |

|

|

|

26,022,631 |

|

|

|

14,621,261 |

|

| General and administrative

expenses (including related party expenses of $0 and $24,231 for

the three months ended, and $0 and $48,462 for the six months

ended, June 30, 2023 and 2022, respectively) |

|

|

5,984,915 |

|

|

|

4,926,691 |

|

|

|

12,021,577 |

|

|

|

9,792,808 |

|

| Gain on asset dispositions and

impairments, net |

|

|

1,000 |

|

|

|

5,280 |

|

|

|

6,916 |

|

|

|

17,738 |

|

| Income from

operations |

|

|

9,479,634 |

|

|

|

2,554,086 |

|

|

|

14,007,970 |

|

|

|

4,846,191 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

86,137 |

|

|

|

110,916 |

|

|

|

199,781 |

|

|

|

291,603 |

|

|

Interest expense |

|

|

(36,247 |

) |

|

|

(2,724 |

) |

|

|

(74,091 |

) |

|

|

(6,805 |

) |

|

Profit-sharing income from OC-BVI |

|

|

12,150 |

|

|

|

8,100 |

|

|

|

26,325 |

|

|

|

18,225 |

|

|

Equity in the earnings of OC-BVI |

|

|

35,272 |

|

|

|

19,551 |

|

|

|

70,830 |

|

|

|

51,317 |

|

|

Net gain on put/call options |

|

|

— |

|

|

|

201,000 |

|

|

|

— |

|

|

|

276,000 |

|

|

Other |

|

|

31,819 |

|

|

|

61,139 |

|

|

|

63,345 |

|

|

|

87,369 |

|

| Other income,

net |

|

|

129,131 |

|

|

|

397,982 |

|

|

|

286,190 |

|

|

|

717,709 |

|

| Income before income

taxes |

|

|

9,608,765 |

|

|

|

2,952,068 |

|

|

|

14,294,160 |

|

|

|

5,563,900 |

|

| Provision for income

taxes |

|

|

1,940,067 |

|

|

|

10,152 |

|

|

|

2,389,552 |

|

|

|

56,425 |

|

| Net income from

continuing operations |

|

|

7,668,698 |

|

|

|

2,941,916 |

|

|

|

11,904,608 |

|

|

|

5,507,475 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

|

137,226 |

|

|

|

232,197 |

|

|

|

300,347 |

|

|

|

473,627 |

|

| Net income from

continuing operations attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

7,531,472 |

|

|

|

2,709,719 |

|

|

|

11,604,261 |

|

|

|

5,033,848 |

|

| Total loss from

discontinued operations |

|

|

(207,701 |

) |

|

|

(419,833 |

) |

|

|

(466,864 |

) |

|

|

(1,027,147 |

) |

| Net income

attributable to Consolidated Water Co. Ltd.

stockholders |

|

$ |

7,323,771 |

|

|

$ |

2,289,886 |

|

|

$ |

11,137,397 |

|

|

$ |

4,006,701 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings (loss)

per common share attributable to Consolidated Water Co. Ltd. common

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing

operations |

|

$ |

0.48 |

|

|

$ |

0.18 |

|

|

$ |

0.74 |

|

|

$ |

0.33 |

|

| Discontinued

operations |

|

|

(0.01 |

) |

|

|

(0.03 |

) |

|

|

(0.03 |

) |

|

|

(0.07 |

) |

| Basic earnings per

share |

|

$ |

0.47 |

|

|

$ |

0.15 |

|

|

$ |

0.71 |

|

|

$ |

0.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings

(loss) per common share attributable to Consolidated Water Co. Ltd.

common stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing

operations |

|

$ |

0.47 |

|

|

$ |

0.18 |

|

|

$ |

0.73 |

|

|

$ |

0.33 |

|

| Discontinued

operations |

|

|

(0.01 |

) |

|

|

(0.03 |

) |

|

|

(0.03 |

) |

|

|

(0.07 |

) |

| Diluted earnings per

share |

|

$ |

0.46 |

|

|

$ |

0.15 |

|

|

$ |

0.70 |

|

|

$ |

0.26 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends declared per

common and redeemable preferred shares |

|

$ |

0.085 |

|

|

$ |

0.085 |

|

|

$ |

0.17 |

|

|

$ |

0.17 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of common shares used in the determination of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

|

15,736,041 |

|

|

|

15,285,523 |

|

|

|

15,729,852 |

|

|

|

15,285,523 |

|

|

Diluted earnings per share |

|

|

15,907,440 |

|

|

|

15,436,421 |

|

|

|

15,899,923 |

|

|

|

15,435,956 |

|

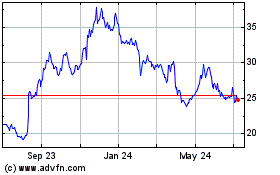

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From Apr 2024 to May 2024

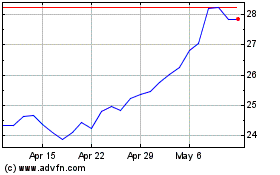

Consolidated Water (NASDAQ:CWCO)

Historical Stock Chart

From May 2023 to May 2024